In the first nine months of this year, the EU27 imported 1.53 million tonnes of tropical wood and wood furniture products with a total value of USD3.48B, respectively 15% and 25% more than the same period the previous year. However, imports have been slowing since the summer and, as Europe moves into the winter months there are ominous signs of recession ahead. The war in Ukraine is contributing to huge increases in energy prices, while business and consumer confidence has been hit by expectations of higher interest rates to control inflation.

Tropical hardwood market insights from the UK. ITTO Market Report 15th November 2022

The September meeting of London Hardwood Club included a series of presentations on the hardwood market situation in South America, Africa and Southeast Asia, alongside discussion of European and North American hardwoods.

UK Tropical Wood Product Imports Fall Sharply In July And August. ITTO European Market Report 31st October 2022

The import value of tropical wood and wood furniture into the UK in the opening eight months of this year was USD1.06B, 21% more than the same period last year. Following the strongest start to the year in terms of UK import value since before the 2008 financial crises, imports fell sharply during July and August (Chart 1).

EU27 Tropical Wood Imports Come Off The Boil As Recession Fears Mount. ITTO Market Report 15th October 2022

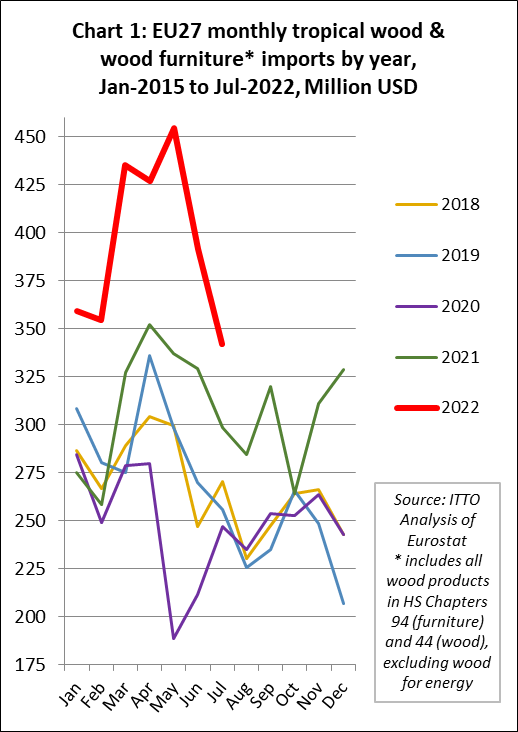

The most recent EU27 trade data to end July this year shows that imports of tropical wood and wood furniture products were still at historically high levels in the early summer months this year. However, imports were slowing from the peak reached in May. Now, as Europe moves into the winter months there are ominous signs of recession ahead, particularly as the war in Ukraine is contributing to huge increases in energy prices and business and consumer confidence is being hit by expectations of higher interest rates to control inflation.

UK Hardwood Imports Slow Dramatically As Recession Looms. ITTO Market Report 30th Sept 2022

UK imports of hardwood products were rising strongly both in volume and value terms during the second half of 2021 and first half of this year as importers were building stocks on a rising market. However, in the third quarter this year the market has changed dramatically as import prices have fallen and UK importers are sitting on a lot of wood bought earlier at higher prices. This has occurred just at a time when consumption has weakened as the UK heads into recession and the GBP has fallen to the weakest ever level against the USD and is also declining against the EUR.

Post-Pandemic Revival In EU Joinery Manufacturing During 2021. ITTO Market Report 15th Sept 2022

After the dislocation caused by the COVID-19 pandemic, the performance of the EU27 wood joinery sector was transformed in 2021. The main long-term trends in previous years were a continuous increase in joinery production in Germany offsetting a large decline in Italy and wood’s loss of share to other materials – particularly plastics – in windows and doors manufacturing. However, 2021 saw a sharp revival in wood joinery activity across the continent. Following three years of stagnation, production value of wood joinery and related products in the EU27 increased 16% to €38.22 billion in 2021. Last year, in value terms, total wood joinery activity across the EU27 was at the highest since before the 2008 financial crises (Chart 1).

EU27 Tropical Wood Import Value At Highest Level Since Financial Crisis. ITTO Market Report 31st August 2022

Between April and June this year, EU27 import value of tropical wood and wood furniture products was, in dollar terms, at the highest quarterly level since at least before the 2007-2008 financial crisis (Chart 1). Imports of USD1.27B during the second quarter of 2022 were 11% more than the previous quarter and 25% more than the same quarter the previous year.

Value Of UK Tropical Wood Product Imports Up 34%. ITTO Market Report 15th August 2022

The import value of tropical wood and wood furniture into the UK in the opening five months of this year was USD711 million, 34% more than the same period last year. In fact, this was by far the strongest start to the year in terms of UK import value of tropical wood and wood furniture products since at least before the 2008 financial crises (Chart 1). It compares to an average import value of less than USD500 million for the January to May period throughout the whole decade prior to the onset of the pandemic in 2020.

Unprecedented period of change in European wood furniture sector. ITTO Market Report July 31st 2022

The last two and half years, marked from the start of 2020 by the Covid-19 pandemic and from February this year by war in Ukraine, have seen unprecedented changes in Europe’s wood furniture sector. The sector has passed through a period characterised by an initial but very short lived fall in demand in the second quarter of 2020, followed by rapid demand escalation at a time when material shortages and other logistical challenges greatly reduced availability. During this relatively short period, major changes have occurred in patterns of supply and demand, trade flows, consumer preferences and working conditions, distribution channels, design, and fashion trends. Companies throughout the sector are having to evolve new strategies in response to a transformed world.

EU27 Tropical Wood Import Value Increases On The Back Of High Prices. ITTO European Market Report 15th July 2022

In the first four months of this year, the value of EU imports of tropical wood and wood furniture totalled USD1.23 billion, a gain of 28% compared to the same period last year. In terms of value, this was by far the highest level of trade for the four month period in the last five years (Chart 1). In fact trade value was at a level not seen since before the 2008-2009 financial crises. Continue reading “EU27 Tropical Wood Import Value Increases On The Back Of High Prices. ITTO European Market Report 15th July 2022”