The UK-based TTJ published its annual Tropical Timber supplement in the last week of April, containing a series of articles and expert commentaries on prospects in the UK and wider European market. Major European concerns in relation to tropical timber include: the potential impact of the EU Illegal Timber Law (ITL) – to be fully implemented from 3 March 2012; the impact of rising demand in emerging markets to reduce availability of supply to Europe; the rate of uptake of certification in tropical supply countries; and the extent to which modified softwoods and temperate hardwoods may substitute for tropical hardwoods in the future. While there is clearly uncertainty about future prospects to tropical wood in the European market, there are also encouraging signals that many buyers remain committed to sourcing and marketing genuine tropical hardwoods.

Continue reading “TTJ Celebrates Strong Prospects for Tropical Hardwood – ITTO European Market Report 30th April 2011”Mixed Signals for Tropical Hardwood – ITTO European Market Report 14th April 2011

Overall the year 2010 was a slightly better year for the European trade in tropical hardwood than 2009, although purchasing remained at levels well below those before the recession and there were unsettling signs of declining market share in some sectors.

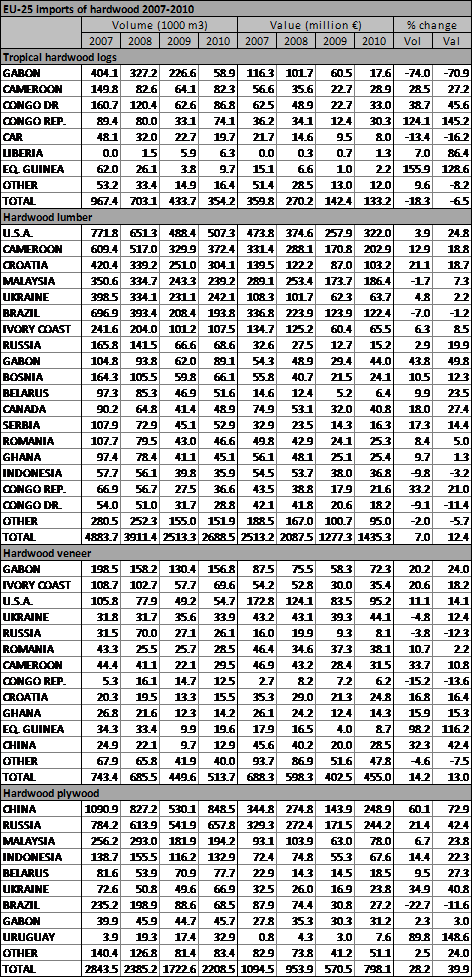

The latest EU-wide trade data (see Table) indicates that imports of tropical hardwood logs into the region reached 354,000 m3 (down 18% on 2009) valued at €133 million (down 7%). The big decline in imports from Gabon following that country’s log export ban imposed from May 2010 onwards was only partially offset by rising imports from other countries in the Congo basin.

Nevertheless, quarterly data (Chart 1) indicates that after reaching an all time low in the third quarter of 2010, the pace of imports of tropical hardwood logs picked up significantly in the closing months of the year. EU-25 imports of tropical hardwood logs during the October to December period reached 108,000 m3, up from only 78,000 m3 in the previous quarter.

Interestingly, EU imports of tropical logs in the last quarter of 2010 were almost exactly the same volume as the same period in 2009, before introduction of Gabon’s log export ban. Three countries are now filling the void created by Gabon’s withdrawal as a supplier – Congo Democratic Republic, Cameroon and the Congo Republic – each now contributing between 25% and 30% of total EU imports.

EU hardwood imports up 7%

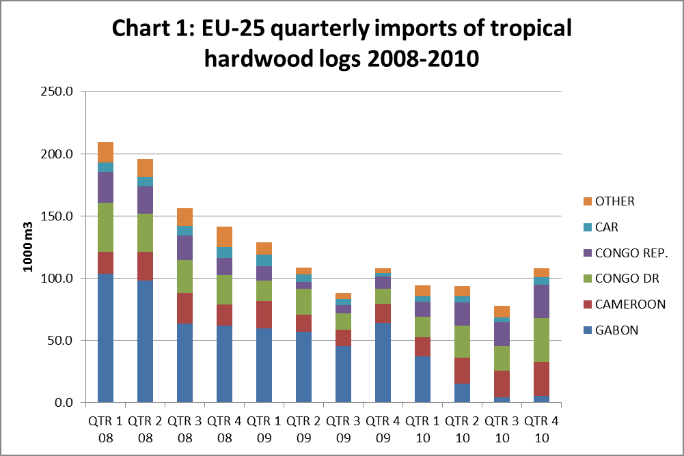

EU imports of hardwood lumber (tropical and temperate) reached 2.69 million m3 valued at €1435 million, up 7% and 12.4% respectively. Despite the gains, imports were still down 42% on levels prevailing before the recession. This is due both to lower consumption and much reduced supply as harvesting levels fell dramatically and large swathes of the hardwood industry were effectively forced to close during 2008 and 2009.

Lack of credit coupled with a desire to keep lower inventories during times of uncertainty has also fed a strong trend towards just-in-time ordering which has tended to favour more readily available hardwoods. Temperate hardwood lumber producers have benefited most from this trend, and last year there was significant growth in EU imports from several Eastern European supply countries, notably Croatia, Bosnia, Serbia and Romania.

Of leading tropical hardwood lumber suppliers to the EU, imports from Malaysia and Brazil fell last year. In contrast, there was a reasonable recovery in the level of EU imports from Cameroon. Lumber exports from Gabon also rose significantly last year, one effect of the log export ban.

Signs of sustained market improvement in the last quarter of 2010

The quarterly hardwood lumber import data (Chart 2) provides some cause for optimism that the recovery in Europe’s sawn hardwood markets will be maintained. There was a robust rebound in the level of EU hardwood lumber imports in the last quarter of 2010. During that period, EU hardwood lumber imports reached 861,000 m3, the highest quarterly figure for over two years. This suggests that the big decline in imports during the third quarter of 2010 was seasonal and due to short-term stocking issues rather than a long-term reversal in underlying consumption trends.

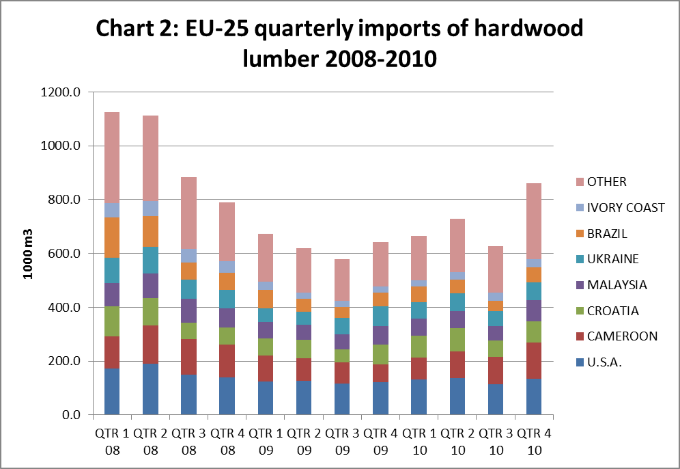

EU imports of hardwood veneer have followed a similar pattern. Overall EU hardwood veneer imports reached 514,000 m3 in 2010 valued at €455 million, up 14% and 13% respectively. This is partly the result of a switch to hardwood rotary veneer imports by European plywood manufacturers in place of logs from Gabon following the log export ban in May. In addition to Gabonese exporters, those in various other African countries are benefiting from this trend including Cameroon, Ghana and Equatorial Guinea. Rising levels of veneer imports from countries better known for supply of sliced veneer – such as Ivory Coast, USA, and Romania – suggests this component of the veneer market has also seen some recovery this year.

Strong recovery in veneer imports in October to December period

As in the hardwood lumber trade, the quarterly data indicates strong recovery in EU imports of hardwood veneer in the last quarter of 2010 after a disappointing performance in the June-September period (Chart 3). The sharp downturn in EU veneer imports during the third quarter of 2010 seems to have been due to short term over-stocking of okoume rotary veneer destined for the European okoume plywood trade, a sector which in recent times has been struggling to compete with cheap Chinese substitutes.

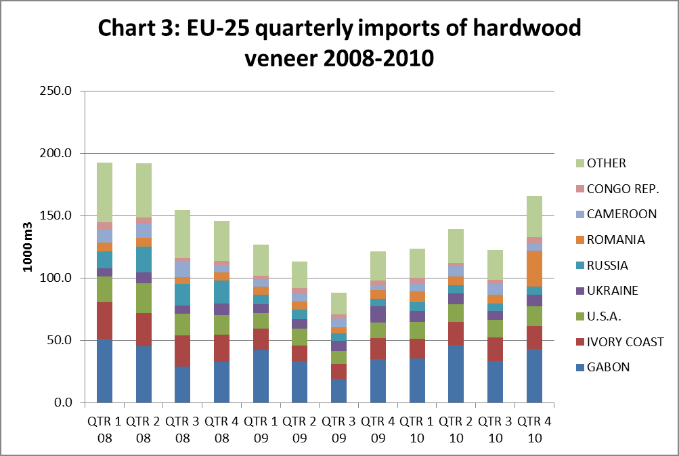

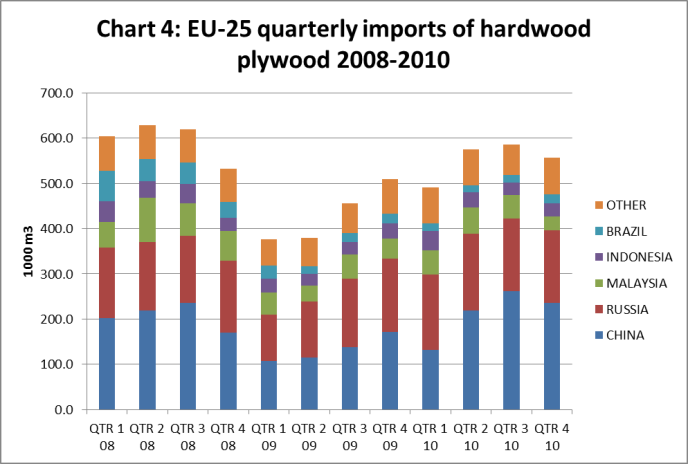

Imports of hardwood plywood into the EU-25 group of countries during 2010 reached 2.21 million m3 valued at €798 million, up 28% and 40% respectively on the previous year. The particularly sharp rise in the unit value of imports must be welcome news for a sector that has had to deal with narrow and ever declining margins over recent years.

However the data doesn’t bode well for all hardwood plywood producers. A notable trend in the EU market during 2010 was growth in the share of China, Russia, Ukraine, and Uruguay, largely at the expense of Malaysia, Brazil and Gabon. Through-and-through tropical hardwood plywood grades continue to be substituted for cheaper more readily available combi-products, plantation-grown eucalypt products, and birch plywood.

The quarterly data is also disappointing, revealing a significant downturn in EU hardwood plywood imports during the October to December period last year (Chart 4). This is in line with market reports indicating a downturn in European demand for raw grades of tropical and Chinese hardwood plywood at the end of last year. Following significant imports of plywood in the second and third quarters of 2010, many importers were carrying excess stocks into 2011 relative to limited demand. Demand for more specialist film-faced products was performing rather better, continuing to benefit from higher prices and low availability of birch plywood due to the forest fires in Russia during 2010 and the Russian export tax on birch logs.

PDF of this article:

Copyright ITTO 2020 – All rights reserved