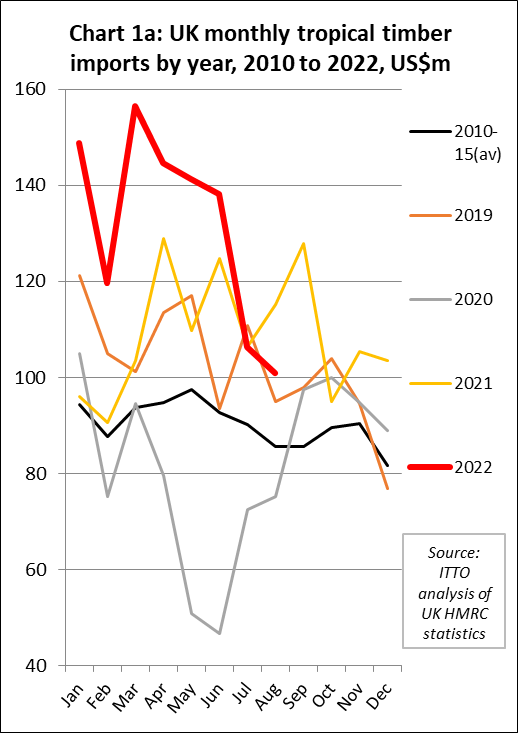

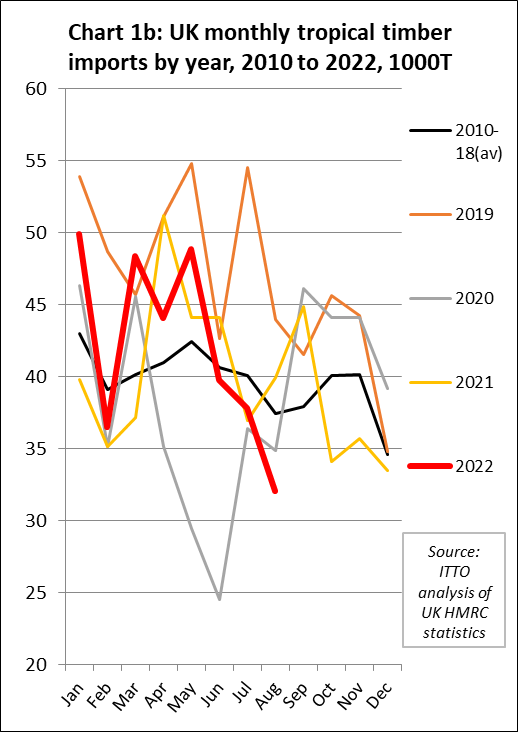

The import value of tropical wood and wood furniture into the UK in the opening eight months of this year was USD1.06B, 21% more than the same period last year. Following the strongest start to the year in terms of UK import value since before the 2008 financial crises, imports fell sharply during July and August (Chart 1).

The trend looks different in quantity terms (Chart 1b). Import quantity of tropical wood and wood furniture into the UK in the opening eight months of this year was 337,000 tonnes, just 3% more than the same period last year and not out of line with previous years during the last decade. This shows that price inflation was the major factor behind the rise in UK import value in the first half of this year, driven both by historically high material and freight prices and extreme weakness of sterling against the USD.

The decline in UK tropical wood product imports over the summer months was particularly dramatic in quantity terms, with imports of only 32,000 tonnes in August being the third lowest monthly total since August 2016. During this six year period, monthly imports were only previously below the August 2022 level in May and June 2020 during the first COVID lockdown.

Dark clouds gather over UK economy

The slowdown in UK imports of tropical wood and wood products in the summer months is unlikely to be reversed anytime soon as market prospects have deteriorated rapidly in the autumn months. The latest official UK government data shows that economic output fell 0.3 per cent in the three months to August compared with the previous quarter during an unprecedented period of political uncertainty and high energy and borrowing costs.

More recent survey data shows that UK economic activity contracted at its fastest pace in almost two years in October, suggesting the country has fallen into a recession. The S&P Global/Cips UK composite Purchasing Managers Index (PMI), a measure of activity in the private sector, dropped to a 21-month low of 47.1 in October from 49.1 in September. October’s PMI was the third consecutive reading under 50, which indicates a majority of businesses reporting a contraction in activity and was below the 48.1 forecast by economists polled by Reuters.

Rishi Sunak was appointed prime minister on 25th October following the resignation of his predecessor Liz Truss who had been in office for only 44 days, the shortest term of any British prime minister in history. Truss resigned when her misfired attempt to radically reorient the government’s economic agenda, by slashing taxes without saying how the decision would be paid for, sent the markets reeling.

The appointment of a new Prime Minister committed to a tighter fiscal policy has somewhat reassured markets and raised confidence at least of a short respite from recent political instability. However, the sharp change of policy also implies slower growth and higher chances of a recession in the near-term. This means the Bank of England is likely to be less aggressive with rate hikes.

Nevertheless, with the annual rate of inflation in excess of 10% in October, markets widely expect the BoE’s Monetary Policy Committee to raise rates by between 75 and 100 basis points when it meets in the first week of November. None of this is particularly positive for Sterling which has been bumping along at close to an all-time low of less than 1.1 to the USD since the last week of September.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said October’s PMI data showed “the pace of economic decline gathering momentum” after recent political and financial market upheaval. The economy “therefore looks certain to fall in the fourth quarter after a likely third-quarter contraction, meaning the UK is in recession”, he added.

The UK PMI survey, based on responses collected between October 12 and 20, showed that new orders had decreased at the sharpest pace since January 2021, with panellists attributing it to the worsening economic outlook. Manufacturers reported a particularly steep fall in new work, with export sales falling at the fastest pace in almost two-and-a-half years. Business confidence also collapsed, sliding to a level rarely seen in 25 years of survey history, with escalating political uncertainty and rising interest rates among the most commonly cited reasons for the downbeat sentiment. The manufacturing sector remained in a downturn for the third consecutive month, while the services sector reported the first contraction in 20 months.

Williamson said that although price pressures had eased because of the economic downturn, the weak pound and high energy costs meant input cost inflation remained higher than at any time in the survey’s pre-pandemic history.

In a downbeat assessment earlier in October, analysts at Deutsche Bank said UK GDP was due to take until 2024 to return to the level of December 2019 before the pandemic struck. The British Chambers of Commerce (BCC) also reported that more than three-quarters of companies in a survey of 5,200 firms had not increased investment in the last three months.

A rare shaft of light in all this gloom comes from the latest S&P Global/CIPS PMI survey for the UK construction sector. At 52.3 in September, up from 49.2 in August, the headline construction PMI registered above the 50.0 no-change value for the first time since June. The latest reading was the highest for three months and signalled a modest overall increase in construction output.

Construction survey respondents commented on a boost to activity from work on previously delayed projects. House building was the best-performing category in September (index at 52.9), with growth reaching a five-month high. Commercial work increased only marginally (51.0), while civil engineering activity (49.6) fell for the third month in a row.

According to S&P Global/CIPS “survey respondents often commented on a strong pipeline of outstanding work, but incoming new orders remained relative scarce in September. Latest data signalled that new business volumes were broadly unchanged overall, which represented the worst month for new orders for almost two-and-a-half years. Construction firms cited slow decision making among clients and greater risk aversion due to inflation concerns, squeezed budgets and worries about the economic outlook”.

Flatlining UK imports of tropical wood furniture

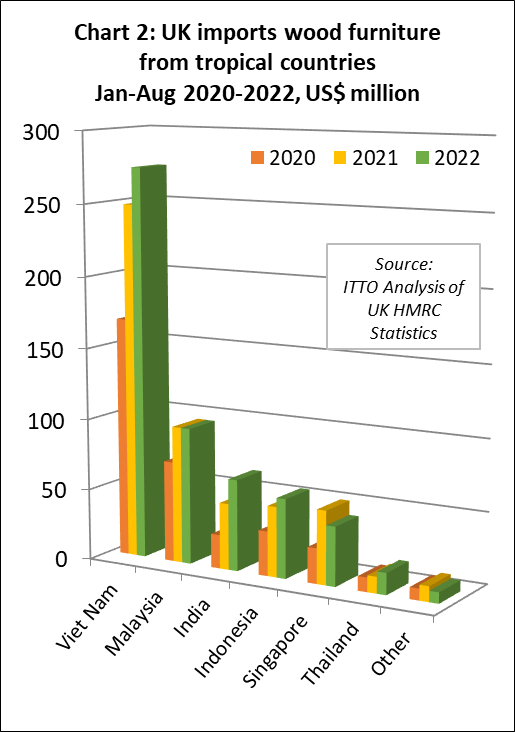

The UK imported USD555 million of tropical wood furniture products in the first eight months of 2022, which is 8% more than the same period in 2021. In quantity terms, wood furniture imports were 114,000 tonnes during the eight month period, 7% less than the same period last year. This indicates that the rise in value was driven more by price inflation than strong demand. Imports between June and August this year were much lower than the same period last year.

In the first eight months of this year compared to last year, UK import value of wood furniture increased 10% from Vietnam to USD274 million, 38% from India to USD64 million, 13% from Indonesia to USD56 million, and 32% from Thailand to USD15 million. Import value of USD96 million from Malaysia was the same level as the previous year, while import value of USD42 million from Singapore was 19% down compared to 2021. (Chart 2).

Gains in UK imports of some tropical wood products in the first eight months of 2022

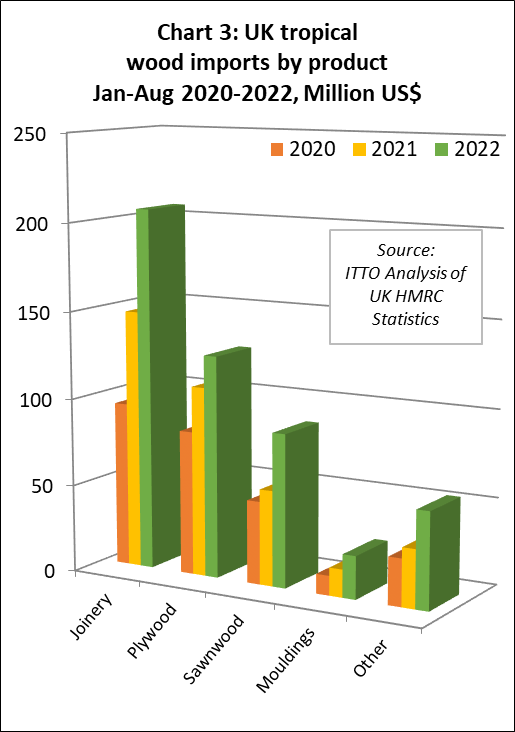

Total UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes was USD501 million between January and August this year, 39% more than the same period in 2021. In quantity terms imports increased 8% to 223,000 tonnes during the period. Compared to the first eight months last year, UK import value of tropical joinery products increased 40% to USD207 million, import value of tropical plywood was up 17% to USD127 million, import value of tropical sawnwood increased 60% to USD88 million, and import value of tropical mouldings/decking increased 55% to USD25 million (Chart 3).

Slowing pace of UK imports of wood doors from Indonesia

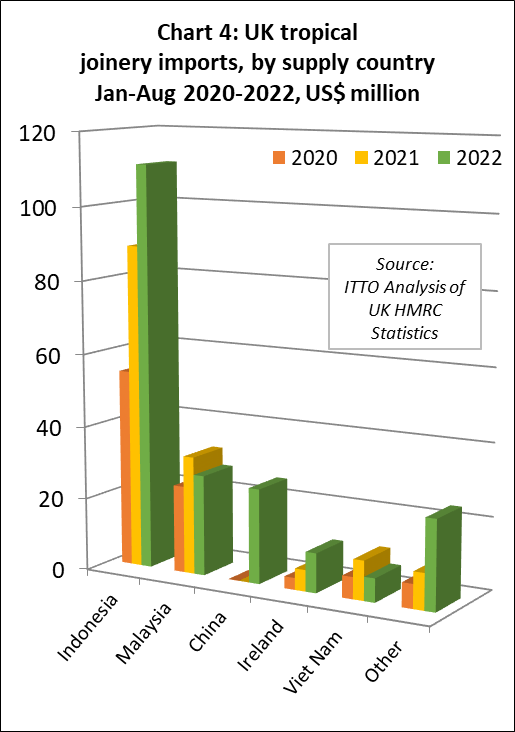

As for other tropical products, the pace of increase in UK import value of tropical joinery products slowed between June and August this year. Nevertheless import value from Indonesia, by far the largest supplier of tropical joinery products to the UK (in this case mainly doors), was at USD111 million still up 25% year-on-year in the first eight months of 2022 (Chart 4). In quantity terms, UK joinery imports from Indonesia were 35,400 tonnes in the first eight months of this year, 6% more than the same period in 2021.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) started the year slowly and weakened further during the summer months. Import value from Malaysia was USD28 million in the January to August period, 15% less than the same period last year. In quantity terms, imports from Malaysia were 8,900 tonnes, 28% less than the same period in 2021. Joinery imports from Vietnam of 1800 tonnes valued at USD7 million were respectively 42% and 40% less than the same period last year.

UK imports of Chinese tropical joinery products, nearly all comprising doors, were 10,400 tonnes with value of USD26 million in the first eight months of 2022, up from negligible levels in previous years. The recorded rise was due to introduction from 1st January 2022 of new product codes which identify wood doors and windows manufactured using a wider range of tropical wood species in UK and EU trade statistics. This may also explain the apparent rise in UK imports of tropical joinery products from Ireland which were 1,200 tonnes with value of USD11 million in the first eight months of 2022, respectively 56% and 85% more than the same period in 2021.

UK tropical hardwood plywood imports switch away from China

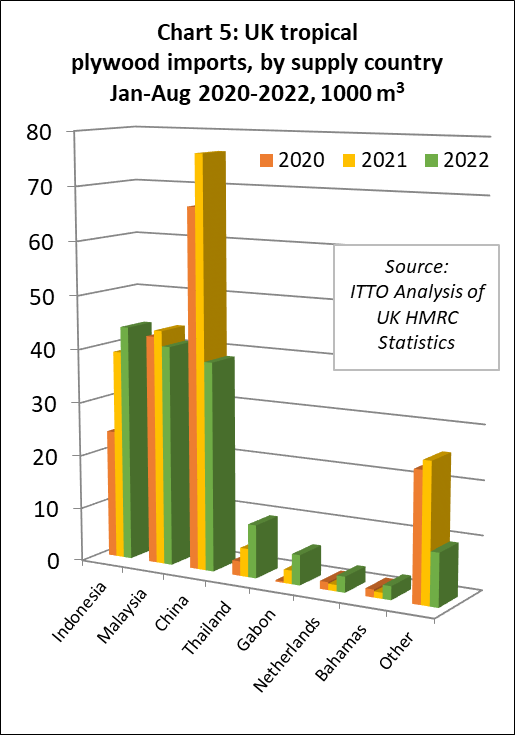

In the first eight months of 2022, the UK imported 154,600 m3 of tropical hardwood plywood, 21% less than the same period last year. Tropical hardwood plywood imports from Indonesia, Thailand and Gabon have made gains this year, while imports from China have fallen dramatically, and imports from Malaysia have also lost ground (Chart 5).

The UK imported 43,900 m3 of tropical plywood from Indonesia in the first eight months of this year, a gain of 12% compared to the same period last year. After picking up pace in May this year, imports from Indonesia slowed again between June and August. The UK imported 41,000 m3 of plywood from Malaysia in the first eight months of this year, 6% less than the same period last year. Imports from Malaysia also picked up in May to their highest monthly level for over a year but were very slow during the summer months.

The UK imported 38,900 m3 of tropical hardwood plywood from China in the first eight months of this year, 49% less than the same period in 2021. Probably the biggest shift in the UK hardwood plywood trade in the last two years has been a rapid decline in imports of Chinese products faced with tropical hardwoods in favour of Chinese products faced with temperate hardwoods. Chinese temperate hardwood plywood has been the largest beneficiary of UK sanctions against all trade in Russian wood products since the start of the Ukraine conflict.

Meanwhile, Brexit is impacting on UK imports of tropical hardwood plywood from EU countries which were just 8,600 m3 in the opening eight months of this year compared to over 18,000 m3 during the same period in the last two years.

Bouyant UK imports of tropical sawnwood during 2022

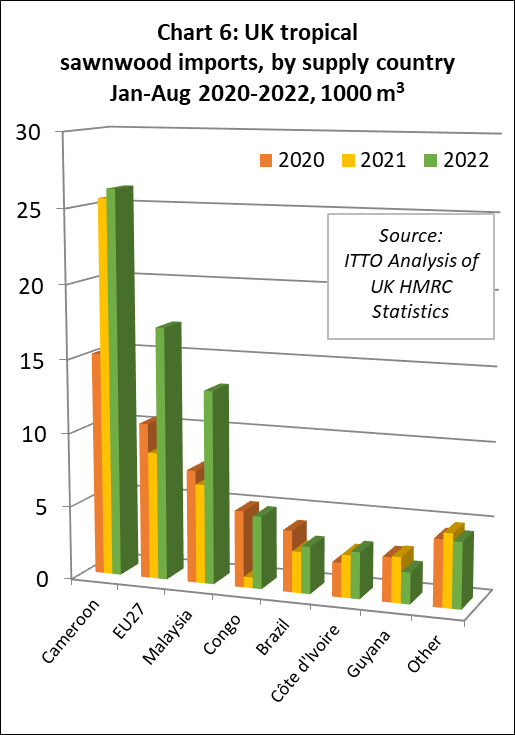

Unlike tropical hardwood plywood, UK imports of tropical sawnwood have been buoyant this year. Total UK imports of tropical sawnwood were 74,500 m3 in the first eight months of 2022, 34% more than the same period last year. In addition to making gains overall, there have been some significant changes in the countries supplying tropical sawnwood to the UK this year (Chart 6).

UK imports of tropical sawnwood from Cameroon were 26,200 m3 in the first eight months of this year, 3% more than the relatively high level in the same period last year. UK imports of tropical sawnwood from the Republic of Congo have recovered lost ground this year, with imports of 4,900 m3 in the first eight months, a 575% gain compared to the same period last year, although still down on the pre-pandemic level. UK imports from Côte d’Ivoire were 3,100 m3 in the first eight months of this year, a 9% increase compared to the same period last year.

UK imports from Malaysia, which had fallen to little more than a trickle in recent years, were 13,000 m3 in the first eight months of this year, 95% more than in the same period last year. UK imports of tropical sawnwood from Brazil were 3,200 m3 in the first eight months of this year, 14% more than the same period last year but still down on the pre-pandemic level. Indirect UK imports of tropical sawnwood via the EU have also recovered ground this year despite the Brexit disruption, increasing 99% to 17,000 m3 in the first eight months of 2022.

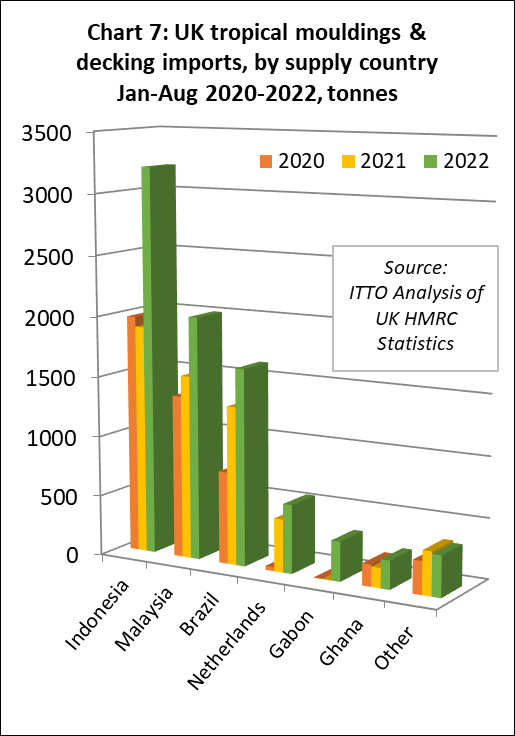

UK imports of tropical hardwood mouldings/decking were relatively high in the first eight months of 2022, at 8,322 tonnes, 46% more than the same period last year. This commodity group has benefited in the UK market from shortages of non-tropical products, particularly since the start of the war in Ukraine and sanctions on Russian decking products that directly compete with tropical decking. Imports of 3,200 tonnes from Indonesia were 69% more than the same period last year. Imports of 2,000 tonnes from Malaysia were 32% up on the same period in 2021. Imports from Brazil increased 24% to 1,600 tonnes during the eight month period. (Chart 7).