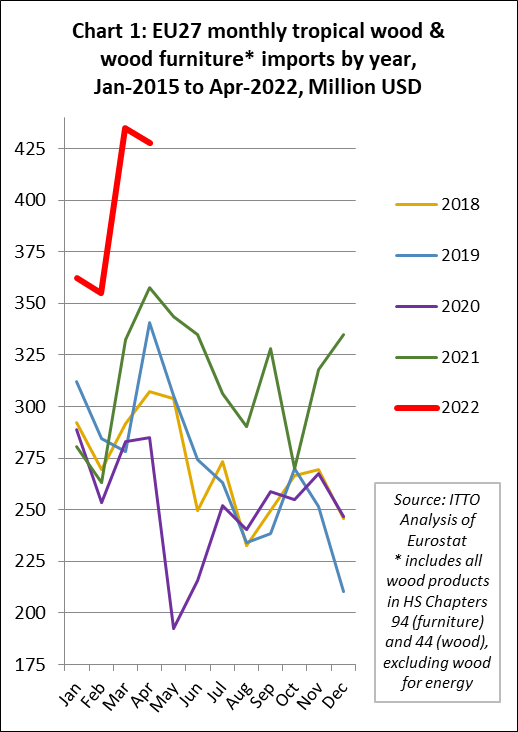

In the first four months of this year, the value of EU imports of tropical wood and wood furniture totalled USD1.23 billion, a gain of 28% compared to the same period last year. In terms of value, this was by far the highest level of trade for the four month period in the last five years (Chart 1). In fact trade value was at a level not seen since before the 2008-2009 financial crises.

Part of the gain in EU27 tropical wood product import value in the first four months of this year reflected a rise in CIF prices, driven both by continuing high freight rates and severe shortages of wood and other materials due to logistical challenges during the global pandemic. In quantity terms, EU imports of tropical wood and wood furniture products in the first four months of this year were, at 669,000 tonnes, up 14% compared to the same period in 2021.

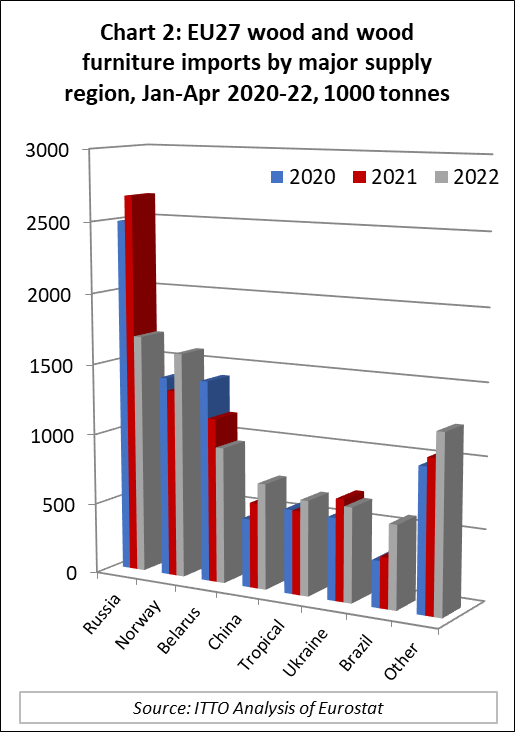

The curtailment of wood supplies from Russia and Belarus due to the sanctions imposed by the EU following the invasion of Ukraine in February is opening up new opportunities in the EU market for some tropical wood products, notably plywood and decking for which Russian birch and larch products have been important substitutes.

In the first four months of this year, tropical products accounted for 8.2% of the quantity of all wood and wood furniture products imported into the EU27, which compares to 6.9% during the same period in 2021. The gain in tropical wood share is due mainly to a 37% and 17% reduction in imports respectively from Russia and Belarus during this period. However, larger beneficiaries of the opening supply gap so far this year have been Norway, China and Brazil (non-tropical products only) (Chart 2).

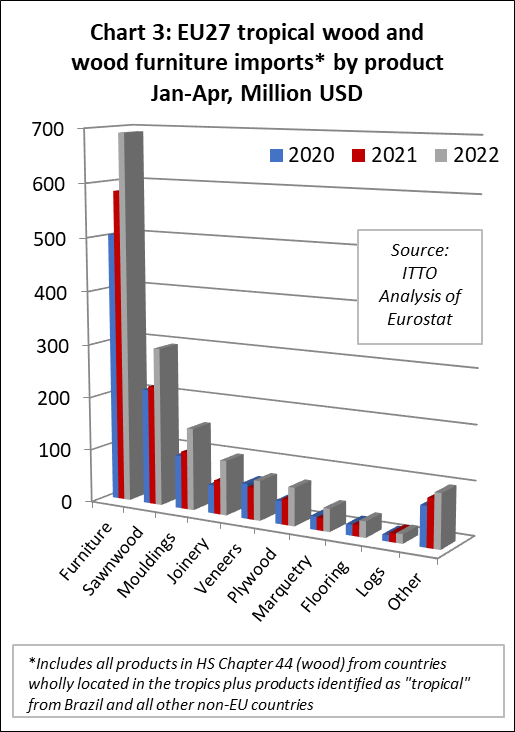

Rise in EU27 import value for nearly all tropical wood product groups

There were significant increases in the value of EU27 imports of most wood product groups from tropical countries in the first four months of this year (Chart 3). For wood furniture, import value of USD691M during the January to April period was 18% more than the same period last year. For tropical sawnwood, import value of USD297M was 33% up on the same period last year. Import value of tropical mouldings/decking was USD154M in the first four months of this year, a gain of 42% compared to the same period in 2021.

There were also large gains in the value of EU27 imports of tropical joinery products (+63% to USD102M), tropical veneer (+24% to USD74M), plywood (+50% to USD71M), marquetry (+88% to USD43M) and flooring (+40% to USD30M) in the first four months of this year. Import value of tropical logs was USD17M between January and April, just 9% more than the same period last year.

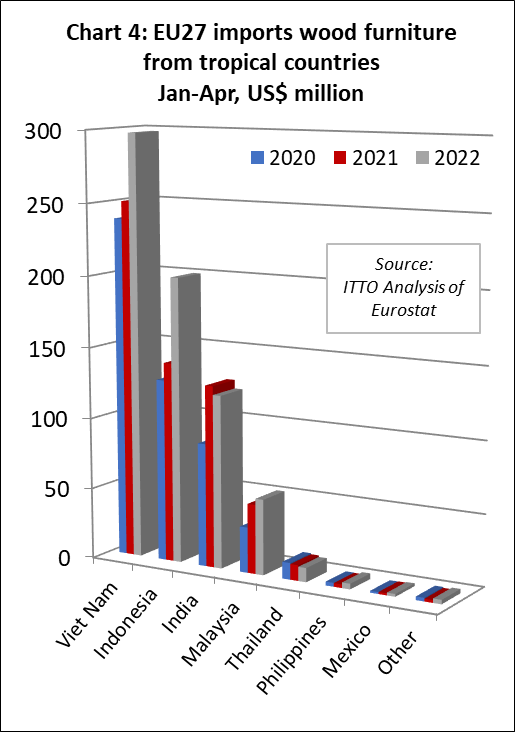

Sharp rise in EU27 wood furniture imports from Vietnam and Indonesia

In the first four months of 2022, EU27 import value of wood furniture from tropical countries was USD691M, 18% higher than the same period in 2021. Import value increased 19% from Vietnam to USD298M, 43% from Indonesia to USD200M, and 9% from Malaysia to USD53M. However imports from India, after increasing sharply last year, were down 5% to USD122M in the first four months of this year. Wood furniture imports from Thailand have continued to slide, down 10% to just USD10M in the first four months of this year. EU27 wood furniture imports from all other tropical countries are negligible (Chart 4).

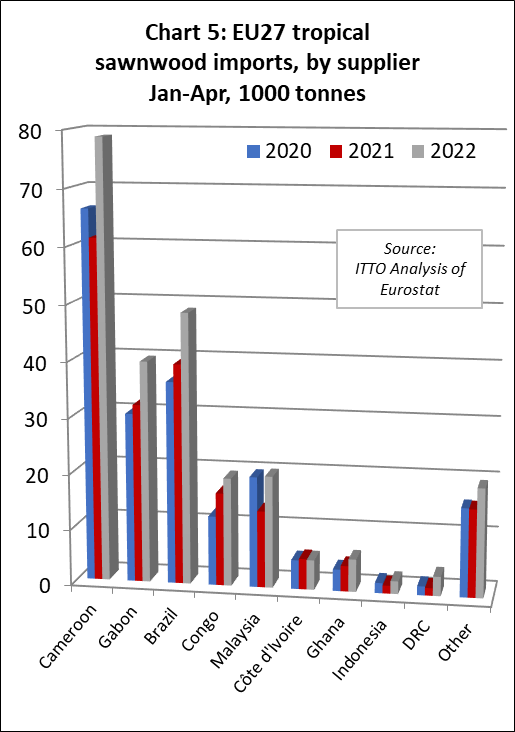

Recovery in EU27 imports of tropical sawnwood

After two slow years during the global pandemic, EU27 imports of tropical sawnwood have shown signs of recovery this year. Imports of 243,000 tonnes in the first four months were 18% higher than the same period in 2021 and 37% more than the same period in 2020.

Sawnwood imports increased sharply in the first four months of this year from all the largest tropical suppliers to the EU27 including Cameroon (+28% to 78,700 tonnes), Gabon (+24% to 39,700 tonnes), Brazil (+23% to 48,500 tonnes), Congo (+16% to 19,400 tonnes) and Malaysia (+46% to 20,000 tonnes). Of smaller supply countries, there was 3% decline from Côte d’Ivoire to 5,300 tonnes but a 27% increase from Ghana to 5,800 tonnes and a 155% increase from DRC to 3,500 tonnes (Chart 5).

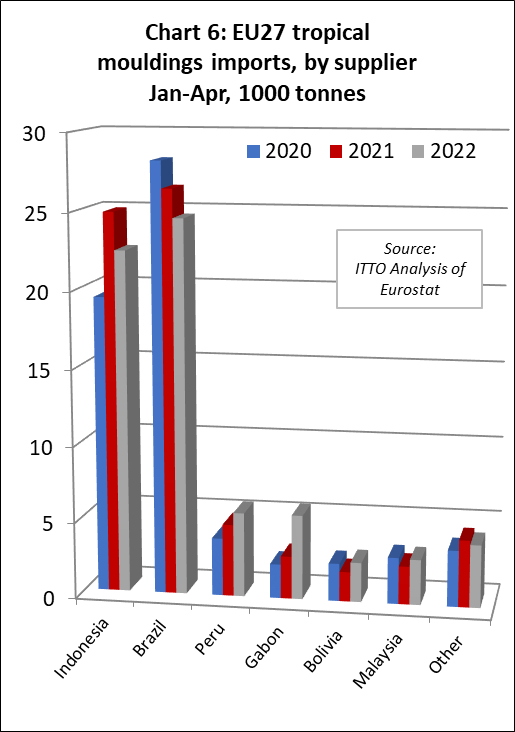

In contrast to sawnwood, EU27 imports of tropical mouldings/decking were quite slow in the first four months of this year, most likely due to supply shortages rather than to limited demand. Imports of 67,700 tonnes between January and April this year were at the same level as the same period last year. Falling imports from the two largest supply countries, Indonesia (-10% to 22,400 tonnes) and Brazil (-7% to 24,500 tonnes), were offset by rising imports from Peru (+17% to 5,500 tonnes), Gabon (+98% to 5,500 tonnes), Bolivia (+33% to 2,600 tonnes), and Malaysia (+19% to 3,000 tonnes) (Chart 6).

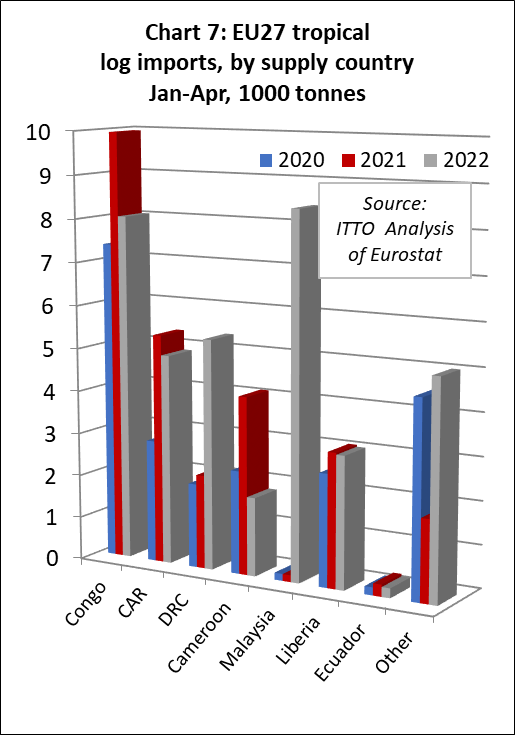

In the first four months of 2022, the EU27 imported 36,900 tonnes of tropical logs, 36% more than the same period in 2021. The most significant trend was a rise in log imports from Malaysia, at negligible levels for many years, to 8,400 tonnes in the first four months of this year (Chart 7). The rise coincides with a limited export program by the Malaysian State of Sabah allowing eligible parties to export unprocessed timber from natural forests which began on 3 January this year.

EU27 log imports from the largest African supply countries declined in the first four months of this year compared to the same period last year; imports were down 19% to 8,000 tonnes from Congo, down 9% from CAR to 4,900 tonnes, and down 56% from Cameroon to 1,800 tonnes. However, imports from DRC increased 145% to 5,400 tonnes. Imports from Liberia were level at 3,100 tonnes during the four month period.

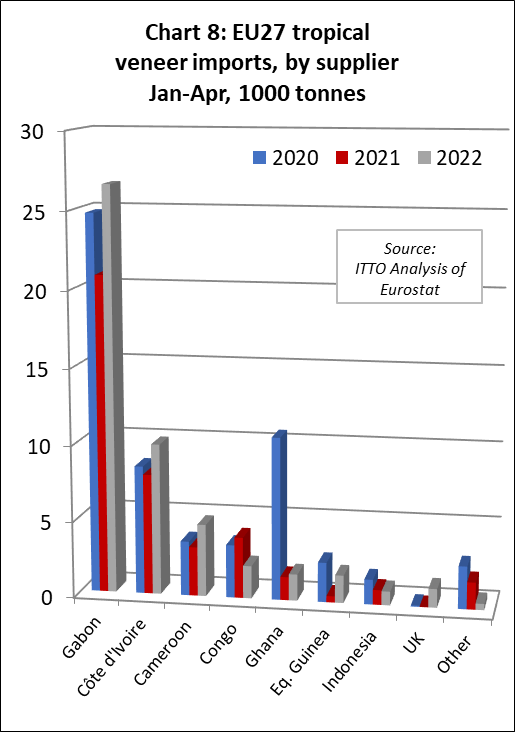

Gabon drives rebound in EU27 imports of tropical veneer and plywood

In the first four months of 2022, the EU27 imported 49,500 tonnes of tropical veneer, 22% more than the same period last year. Imports of tropical veneer from Gabon, by far the largest supplier to the EU27, increased 28% to 26,600 tonnes. There were also large gains in imports from Côte d’Ivoire (+26% to 9,900 tonnes) and Cameroon (+47% to 4,700 tonnes), offsetting a sharp decline in imports from Congo (-46% to 2,100 tonnes) (Chart 8).

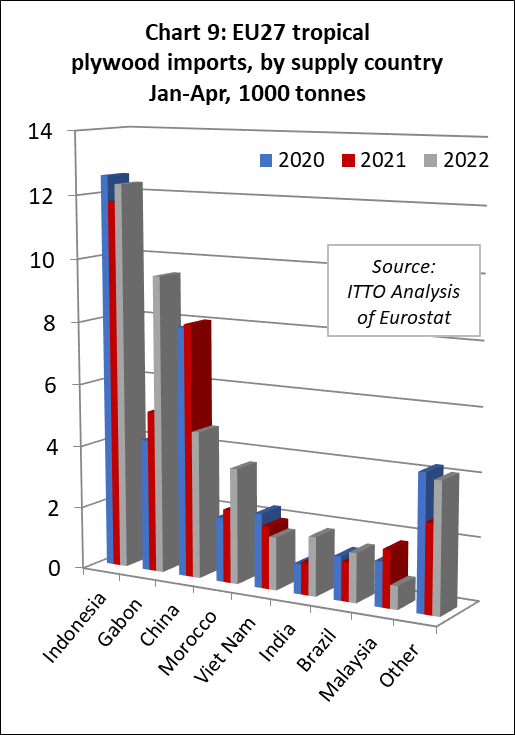

In the first four months of 2022, EU27 tropical plywood imports of 40,200 tonnes were 11% more than the same period the previous year. Imports from Indonesia, at 12,300 tonnes, were up 5% compared to the same period last year. However, the biggest increase was in imports from Gabon, rising 84% to 9,500 tonnes. Imports of tropical plywood also increased 58% to 3,700 tonnes from Morocco. These gains offset a 42% decline in imports of tropical hardwood faced plywood from China to 4,700 tonnes (Chart 9).

Rise in EU27 imports of tropical flooring from Malaysia continues

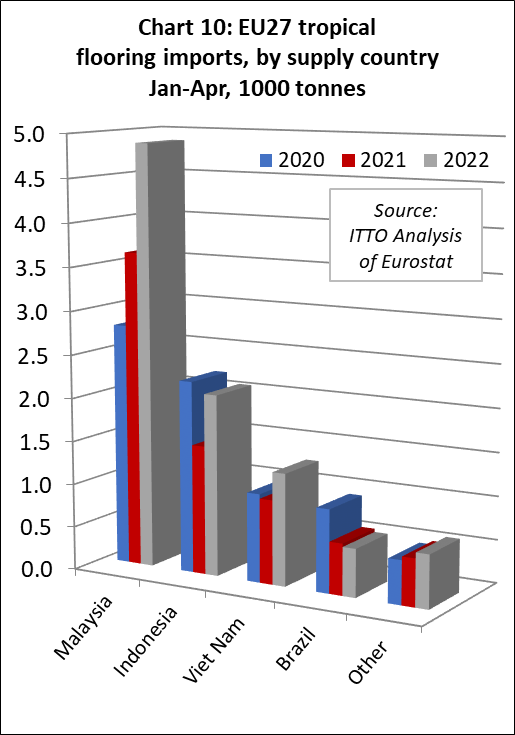

In the first four months of 2022, the EU27 imported 9,400 tonnes of tropical wood flooring, 30% more than the same period in 2021. The rise in EU27 wood flooring imports from Malaysia, that began in 2020, has continued this year. Imports of 4,900 tonnes from Malaysia in the first four months of 2022 were 34% more than the same period in 2021. There were also large gains, from a smaller base, from Indonesia (+41% to 2,100 tonnes) and Vietnam (+33% to 1,300 tonnes). However flooring imports from Brazil have continued to slide this year, at just 600 tonnes in the first four months, 6% down compared to the same period last year (Chart 10).

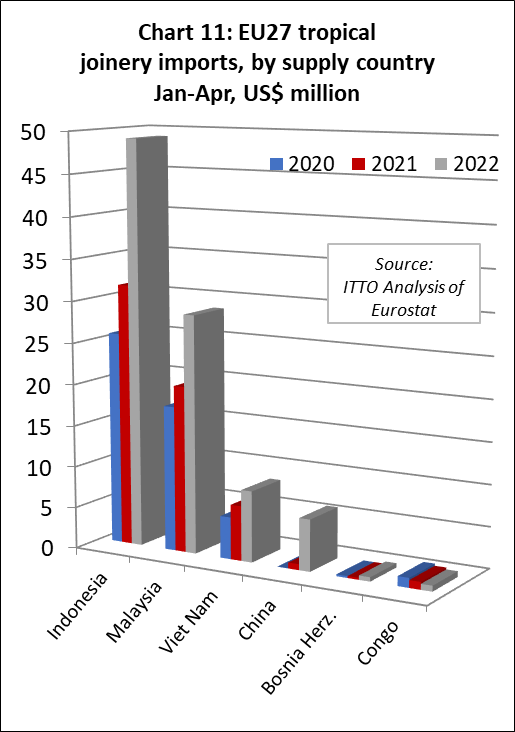

The value of EU27 imports of other joinery products from tropical countries – which mainly comprise laminated window scantlings, kitchen tops and wood doors – increased 63% to USD103M in the first four months of 2022. Imports were up 55% to USD49M million from Indonesia, up 43% to USD29M from Malaysia, and up 30% to USD9M from Vietnam.

The apparent large increase in imports of this commodity group from China, from negligible levels to USD6.2M in the first four months of this year, is due to a change in product codes from the start of this year allowing more joinery products manufactured using tropical hardwood in non-tropical countries to be separately identified (Chart 11).

European Council adopts position on deforestation law

On 28 June, the European Council adopted its negotiating position on a proposal to limit the consumption of products contributing to deforestation or forest degradation. Now that the Council has agreed its position, negotiations with the European Parliament can begin so as to reach an agreement on the final legal text, a process that could be completed before the end of this year.

According to the European Council press release issued following the 28 June meeting, the Council agreed to set mandatory due diligence rules for all operators and traders who place, make available or export the following products from the EU market: palm oil, beef, timber, coffee, cocoa and soy. The rules also apply to a number of derived products such as furniture, leather, and chocolate.

The Council agreed to set up a benchmarking system, which assigns to third and EU countries a level of risk related to deforestation (low, standard or high). The risk category would determine the level of specific obligations for operators and member states’ authorities to carry out inspections and controls. This would mean an enhanced monitoring for high-risk countries and simplified due diligence for low-risk countries.

The Council simplified and clarified the due diligence system, while preserving a strong level of environmental ambition. The general approach avoids duplication of obligations and reduces administrative burden for operators and member states’ authorities. It also adds the possibility for small operators to rely on larger operators to prepare due diligence declarations. However the requirement for operators to provide geolocation of all regulated products placed on the EU market, irrespective of benchmarked risk, was retained.

The Council clarified the control obligations and set quantified objectives of minimum control levels for standard- and high-risk countries. The purpose is to set effective and targeted measures. The Council maintained provisions regarding effective, proportionate and dissuasive penalties and enhanced cooperation with partner countries, as proposed by the Commission.

The Council modified the definition of ‘forest degradation’ to mean structural changes to forest cover, taking the form of the conversion of primary forests into plantation forests or into other wooded land. Lastly, the Council strengthened the human rights aspects of the text, notably by adding several references to the United Nations Declaration on the Rights of Indigenous Peoples.

The legal text agreed by consensus at the Council meeting is available at:

An independent briefing on the revisions agreed by the Council prepared by the law firm HFW which specialises in international commerce is available at:

Views and updates from European based timber trade and industry organisations following the Council’s meeting are available at:

- https://www.atibt.org/en/news/13185/eu-regulation-on-deforestation-general-approach-adopted-by-eu-council

- https://www.cei-bois.org/_files/ugd/5b1bdc_98cebc2c2a1342bc80b0d626faec2ea8.pdf

Press coverage relating to the Council’s agreement includes:

- https://www.politico.eu/article/industry-warn-against-eu-traceability-plan-prevent-deforestation/

- https://www.euractiv.com/section/climate-environment/news/ministers-back-draft-eu-anti-deforestation-law-derided-as-swiss-cheese-by-campaigners/

- https://www.theguardian.com/environment/2022/jul/05/scientists-warn-meps-against-watering-down-eu-deforestation-law

- https://www.foodnavigator.com/Article/2022/07/01/full-of-more-holes-than-swiss-cheese-europe-accused-of-watering-down-its-deforestation-due-diligence-regulation