In the first nine months of this year, the EU27 imported 1.53 million tonnes of tropical wood and wood furniture products with a total value of USD3.48B, respectively 15% and 25% more than the same period the previous year. However, imports have been slowing since the summer and, as Europe moves into the winter months there are ominous signs of recession ahead. The war in Ukraine is contributing to huge increases in energy prices, while business and consumer confidence has been hit by expectations of higher interest rates to control inflation.

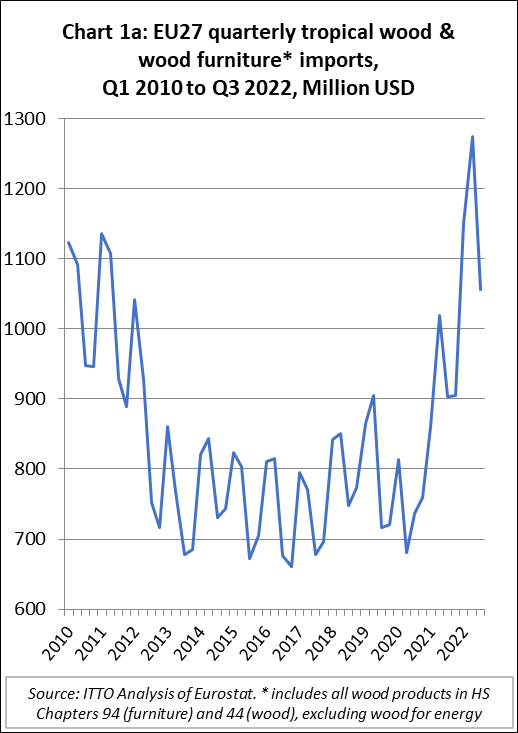

EU27 imports of tropical wood and wood furniture products came off the boil in the third quarter this year after reaching in the previous quarter the highest level in dollar terms since at least before the 2007-2008 financial crisis. Imports of USD1.06B during the third quarter of 2022 were 17% less than the previous quarter. However, they were still at historically high levels in dollar terms during the third quarter and 17% above the third quarter in 2021 (Chart 1a).

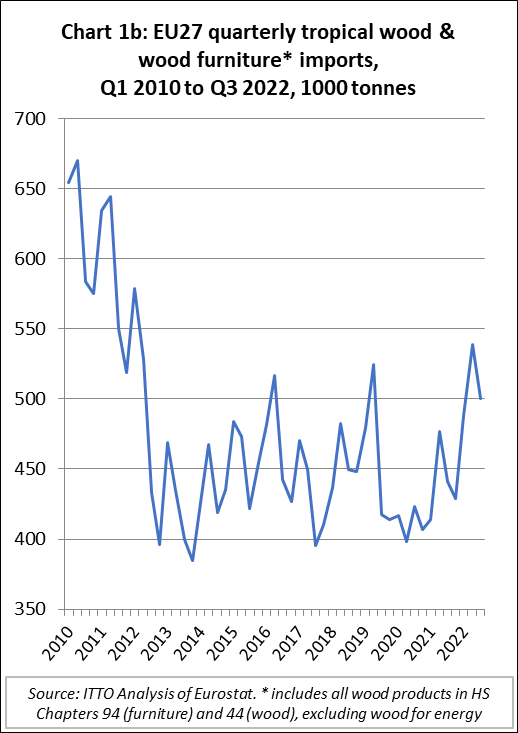

The quarterly trend in EU27 imports of tropical wood and wood furniture looks different in quantity terms (Chart 1b). Imports of 501,000 tonnes in the third quarter this year were 7% down on the previous quarter and 14% more than the same quarter the previous year. In tonnage terms Q2 2022 imports, while high compared to the previous two years, were not significantly greater than similar quarterly peaks in Q2 2019 and Q2 2016 and were well below the level of EU27 tropical wood product imports typical a decade ago (Chart 1b).

This highlights that the volatility and record high levels of EU27 tropical wood and wood furniture imports this year have been driven mainly by changes in CIF prices. These in turn have been due to the combined effects of changing freight rates and supply and exchange rate volatility in the wake of the COVID pandemic. Last year and in the first half of this year, EU importers responded to sharply rising consumption in the European market – boosted particularly by heavy spending on home improvement and public finance to support economic recovery after the pandemic – by buying in larger volumes as CIF prices were rising to record high levels.

However, demand in Europe fell dramatically during the summer months this year with rising economic uncertainty, particularly fuelled by the war in Ukraine and high energy costs. At the same time, global prices for wood materials and freight rates fell dramatically. A big decline in global trade has followed on from sharply rising interest rates in the United States and as China faces a raft of economic problems as the country has struggled to maintain a zero-COVID strategy and China’s property market is in crises. The price of a 40 foot container for delivery into Europe from the Southeast Asia which hit record levels in excess of USD17,000 at the end of 2021, have now fallen to around USD2,500 today.

The combined effect of these trends is that many European timber importers are now sitting on large stocks bought earlier at high prices which they are struggling to shift on to their customers. The value of these landed stocks is being undermined as prices for new orders in the main supply countries are falling. Costs of holding stock and manufacturing wood products are also rising as interest rates are being pushed up and energy costs are soaring. Meanwhile the euro value is still hovering close to parity with the US dollar, 10% down since the start of the year and only just above the lowest level for 20 years. Under these conditions, European imports of all tropical wood products are widely forecast to continue to fall in the months ahead.

One factor which encouraged more EU imports of tropical wood products in the second quarter of this year was the curtailment of wood supplies from Russia and Belarus. This followed on from the sanctions imposed by the EU after Russia’s invasion of Ukraine in February. This provided new opportunities in the EU market for some tropical wood products, notably plywood and decking for which Russian birch and larch products have been important substitutes.

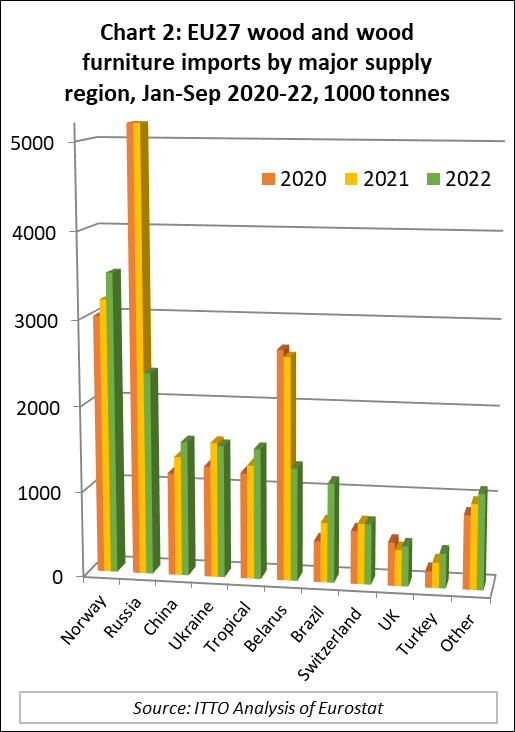

In the first nine months of this year, tropical products accounted for 9.7% of the quantity of all wood and wood furniture products imported into the EU27, which compares to 6.7% during the same period in both 2021 and 2020. The gain in tropical wood share is due mainly to a large reduction in imports from Russia (-65% to 2.36 million tonnes) and Belarus (-49% to 1.32 million tonnes) during this period. After an initial fall in the early months of the war, EU27 imports from Ukraine recovered some ground in the second and third quarters and by the end of the first nine months of this year were, at 1.57 million tonnes, only 2% down on the same period in 2021 (Chart 2).

While tropical wood made gains in the EU market in the first nine months this year, the largest beneficiaries of the opening supply gap due to the fall in imports from Russia and Belarus have been non-tropical wood products from Norway (+10% to 3.5 million tonnes), China (+13% to 1.57 million tonnes), Brazil (+66% to 1.16 million tonnes), Turkey (+36% to 405,000 tonnes), Chile (+63% to 93,000 tonnes), Uruguay (+508% to 67,000 tonnes), and New Zealand (+12% to 44,000 tonnes).

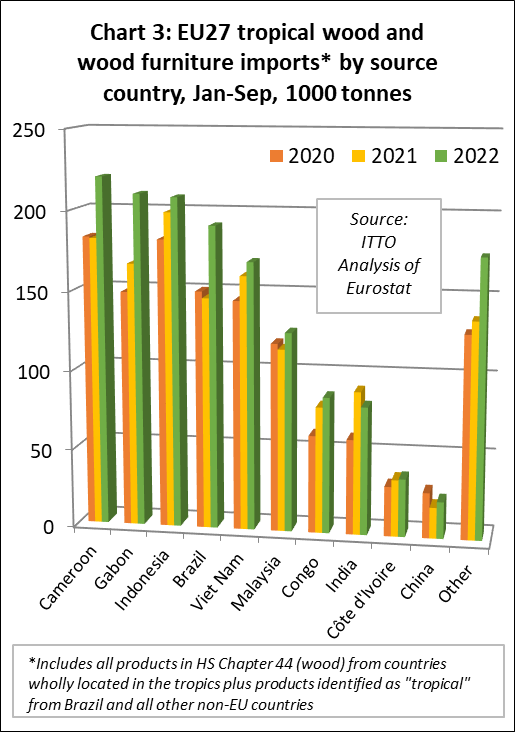

Rise in EU27 imports from all main tropical wood supplying countries

EU27 imports of wood and wood furniture increased in the first nine months this year from all the main tropical supply countries (Chart 3). Both value and volume of imports increased from Cameroon (+19% to USD216M, +21% to 220,200 tonnes), Gabon (+30% to USD235M, +26% to 210,000 tonnes), Indonesia (+27% to USD809M, +5% to 208,200 tonnes), Brazil (+58% to USD285M, +31% to 191,100 tonnes), Vietnam (+20% to USD712M, +5% to 169,200 tonnes), Malaysia (+36% to USD335M, +9% to 125,900 tonnes), Republic of Congo (+3% to USD81M, +8% to 86,200 tonnes), and Cote d’Ivoire (+10% to USD48M, +2% to 36,600 tonnes). Import value from India increased 4% to USD344M but import volume fell 11% to 81,000 tonnes during the nine month period (Chart 3).

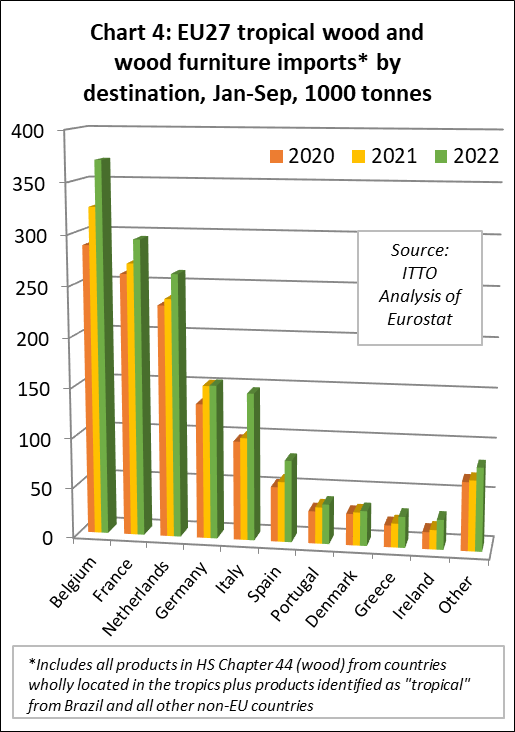

Import value of tropical wood and wood furniture in the first nine months this year also increased into all the leading EU destinations for these products, while import quantity increased into all destinations except Germany (Chart 4). Trends into the main import destinations for tropical wood and wood furniture were: France (+29% to USD670M, +9% to 294,400 tonnes); Netherlands (+14% to USD652M, +10% to 261,700 tonnes); Belgium (+29% to USD552M, +14% to 370,500 tonnes); Germany (+16% to USD533M, no change at 153,000 tonnes); Italy (+46% to USD269M, +43% to 146,900 tonnes); Spain (+36% to USD190M, +36% to 81,600 tonnes); Denmark (+17% to USD142M, +5% to 34,900 tonnes); Ireland (+48% to USD93M, +54% to 29,800 tonnes); Sweden (+29% to USD79M, +26% to 19,200 tonnes); Poland (+17% to USD78M, +21% to 24,300 tonnes); Portugal (+37% to USD48M, +9% to 39,700 tonnes); and Greece (+46% to USD59M, +30% to 30,900 tonnes).

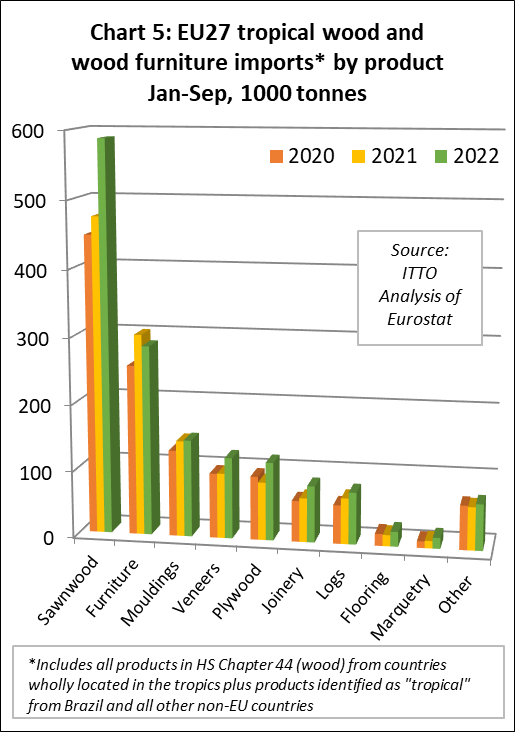

EU27 import value of all the main categories of tropical timber products increased in the first nine months this year. Import quantity also increased for all products except furniture (Chart 5).

After two slow years during the global pandemic, EU27 imports of tropical sawnwood have recovered ground this year. Imports of 785,700 cubic meters with value of USD705M in the first nine months were respectively 24% and 28% higher than the same period in 2021. Sawnwood imports increased sharply in the first nine months of this year from all the largest tropical suppliers to the EU27 including Cameroon (+21% to 272,100 cubic meters), Brazil (+44% to 138,700 cubic meters), Gabon (+16% to 120,400 cubic meters), Malaysia (+25% to 70,700 cubic meters), Congo (+26% to 61,100 cubic meters), and Ghana (+26% to 23,200 cubic meters). However sawnwood imports fell 30% to 14,900 cubic meters from Côte d’Ivoire and were down 24% to 13,700 cubic meters from Ecuador.

In the first nine months of 2022, EU27 import value of wood furniture from tropical countries was USD1.41B, 15% higher than the same period in 2021. The value of EU27 imports of wood furniture increased 18% to USD587M from Vietnam, 28% to USD424M from Indonesia, and 13% to USD101M from Malaysia. However import value of furniture from India was down 2% to USD261M and from Thailand fell 1% to USD23M.

The increase in the total dollar value of EU27 imports of tropical wood furniture this year is entirely due to the rise in freight rates and prices and the weakness of the euro rather than an increase in export quantity. In tonnage terms, imports actually declined 6% to 285,000 tonnes during the nine month period.

EU27 import value of tropical mouldings/decking was USD336M in the first nine months of this year, a gain of 36% compared to the same period in 2021. In tonnage terms, EU27 imports of tropical mouldings/decking were quite slow in the first nine months of this year, most likely due to supply shortages rather than to limited demand. Imports of 145,600 tonnes between January and September this year were just 1% more than the same period last year. Falling imports from Indonesia (-11% to 44,600 tonnes) were offset by rising imports from Brazil (+2% to 57,400 tonnes), Gabon (+68% to 11,500 tonnes), Bolivia (+33% to 6,200 tonnes), and Malaysia (+20% to 5,800 tonnes). Moulding/decking imports of 11,300 tonnes from Peru were at the same level as last year.

In the first nine months of 2022, the EU27 imported 269,800 cubic meters of tropical veneer with a value of USD180M, respectively 25% and 22% more than the same period last year. Imports of tropical veneer from Gabon, by far the largest supplier to the EU27, increased 19% to 136,700 cubic meters. There were also gains in imports of veneers from Côte d’Ivoire (+37% to 63,700 cubic meters), Cameroon (+51% to 30,000 cubic meters), Ghana (+1% to 7,000 cubic meters), and Equatorial Guinea (+76% to 6,200 cubic meters). However veneer imports from Congo fell 9% to 12,500 cubic meters.

In the first nine months this year, EU27 tropical plywood imports of 227,600 cubic meters with value of USD195M were respectively 38% and 63% more than the same period last year. Imports from Indonesia, the largest tropical plywood supplier, were 69,600 cubic meters, a gain of 20% compared to the same period last year. However, there were larger percentage increases from Gabon, rising 118% to 53,300 cubic meters, and Vietnam, up 154% to 20,600 cubic meters. EU27 imports of tropical plywood also increased from Morocco (+56% to 16,600 cubic meters), Brazil (+200% to 12,200 cubic meters), India (+30% to 8,800 cubic meters), and the UK (+5% to 6,500 cubic meters). These gains offset a 30% decline in imports of tropical hardwood faced plywood from China to 24,800 cubic meters, and a 67% fall in imports from Malaysia to just 1,900 cubic meters.

The EU27 imported 88,100 cubic meters of tropical logs with value of USD47M in the first nine months of this year, respectively 18% and 15% more than the same period last year. EU27 log imports increased from all three of the largest African supply countries in the first nine months of this year compared to the same period last year; Congo (+6% to 35,500 cubic meters), CAR (+41% to 18,100 cubic meters), and DRC (+87% to 10,700 cubic meters). Imports also increased sharply from two South American countries; Guyana (+145% to 2,300 cubic meters), and Paraguay (+93% to 2,800 cubic meters). However, log imports were down 23% to 8,100 cubic meters from Cameroon and down 38% to 3,600 cubic meters from Liberia.

In the first nine months of 2022, the EU27 imported 22,200 tonnes of tropical wood flooring with a value of USD69M, respectively 33% and 43% more than the same period in 2021. The rise in EU27 wood flooring imports from Malaysia, that began in 2020, has continued this year. Imports of 10,700 tonnes from Malaysia in the first nine months of 2022 were 46% more than the same period in 2021. EU27 imports of flooring from Indonesia also increased, by 35% to 5,300 tonnes, during the nine month period.

EU27 imports of other joinery products from tropical countries – which mainly comprise laminated window scantlings, kitchen tops and wood doors – increased 39% in value to USD227M and 28% in quantity to 84,700 tonnes in the first nine months of 2022. Import value increased 16% to USD100M million from Indonesia, 60% to USD69M from Malaysia, and 28% to USD23M from Vietnam.

EU economy at a turning point

The European Union Autumn 2022 Economic Forecast was issued on 11 November under the headline “The EU economy at a turning point”. According to the forecast, after a strong first half of the year, the EU economy has now entered a much more challenging phase. The shocks unleashed by Russia’s war against Ukraine are denting global demand and reinforcing global inflationary pressures. The EU is among the most exposed advanced economies, due to its geographical proximity to the war and heavy reliance on gas imports from Russia. The energy crisis is eroding households’ purchasing power and weighing on production. Economic sentiment in the EU has fallen markedly. As a result, although EU growth in 2022 is set to be better than previously forecast, the outlook for 2023 is significantly weaker for growth and higher for inflation compared to the European Commission’s Summer interim Forecast.

The Forecast goes on to note that real GDP growth in the EU surprised on the upside in the first half of 2022 as consumers vigorously resumed spending, particularly on services, following the easing of COVID-19 containment measures. The expansion continued in the third quarter this year, though at a considerably weaker pace. Amid elevated uncertainty, high energy price pressures, erosion of households’ purchasing power, a weaker external environment and tighter financing conditions are expected to tip the EU, the euro area and most Member States into recession in the last quarter of this year. Still, the momentum from 2021 and strong growth in the first half of the year are set to lift real GDP growth in 2022 as a whole to 3.3% in the EU – well above the 2.7% projected in the EU Summer Interim Forecast.

As inflation keeps cutting into households’ disposable incomes, the contraction of economic activity in the EU is set to continue in the first quarter of 2023. However, the Forecast suggests that growth will return to the EU in spring next year, as inflation gradually relaxes its grip on the economy. But with powerful headwinds still holding back demand, economic activity is set to be subdued, with GDP growth reaching 0.3% in 2023 as a whole in both the EU and the euro area.

In a cautionary note, the Forecast states that the EU economic outlook remains surrounded by an exceptional degree of uncertainty as Russia’s war against Ukraine continues and the potential for further economic disruptions is far from exhausted. The largest threat comes from adverse developments on the gas market and the risk of shortages, especially in the winter of 2023-24. Beyond gas supply, the EU remains directly and indirectly exposed to further shocks to other commodity markets reverberating from geopolitical tensions. Longer-lasting inflation and potential disorderly adjustments on global financial markets to the new high interest rate environment also remain important risk factors.

In presenting the forecast, Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People, said that “this is a turning point for the EU economy as we deal with the spillovers of Russia’s unprovoked war against Ukraine and a complex geopolitical environment: high energy prices fuelling inflation, people across Europe struggling with rising living costs, and our companies losing competitiveness. Following relatively strong economic performance this year, the economic outlook for next year has weakened and we expect only 0.3% growth of the EU economy next year. But a strong labour market coupled with reforms and investments in the Recovery and Resilience Facility should help to support the economy”.