The last two and half years, marked from the start of 2020 by the Covid-19 pandemic and from February this year by war in Ukraine, have seen unprecedented changes in Europe’s wood furniture sector. The sector has passed through a period characterised by an initial but very short lived fall in demand in the second quarter of 2020, followed by rapid demand escalation at a time when material shortages and other logistical challenges greatly reduced availability. During this relatively short period, major changes have occurred in patterns of supply and demand, trade flows, consumer preferences and working conditions, distribution channels, design, and fashion trends. Companies throughout the sector are having to evolve new strategies in response to a transformed world.

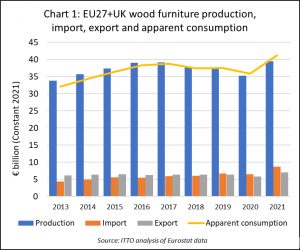

Recent trends in the value of production trade and consumption of wood furniture in the EU27+UK are shown in Chart 1. This highlights that wood furniture production and consumption was weakening in the years before the onset of the pandemic in response to sluggish growth of the EU27+UK economy and intense competition in global markets, particularly from Chinese manufacturers whose sales in the US market were being diverted elsewhere due to the trade dispute. Due to the onset of the pandemic, there was an estimated 5% downturn in the euro value of EU27+UK wood furniture production and 4% decline in consumption. However this was followed in 2021 by an unexpectedly strong 12% and 15% rebound respectively in production and consumption.

According to commentary by CSIL, the Milan based furniture research organisation (www.worldfurnitureonline.com), the last two years of the European furniture sector have been marked by a significant mismatch between supply and demand. A sharp reduction in production of wood and other essential material inputs, severe logistical problems in international trade, rapidly rising freight rates, shortages of key staff, social distancing measures at manufacturing plants, and a big increase in energy prices all placed limits on production and supply.

This meant that, while furniture production and imports rebounded strongly in many European countries, they failed to keep pace with an even sharper increase in demand. The rise in demand was mainly due to a shift in consumer spending away from travel and leisure towards home-related product categories and to cater for new home offices with the rise in remote working. There was also resumption in export market growth in 2021.

The mismatch between demand and supply caused a general increase in furniture prices, initially at the manufacturing stage and partly absorbed by manufacturers, and then progressively transferred to final consumers.

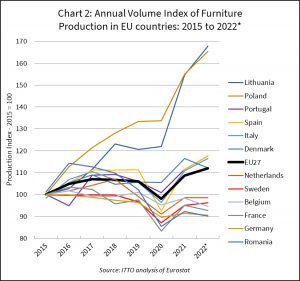

Furniture sector performance varied widely between European countries. Eurostat data shows that while overall EU27 furniture production had rebounded to pre-pandemic levels before the end of 2021, production was still below these levels in many countries including Germany, France, Sweden, and Romania. In contrast production in some countries, notably Poland and Lithuania, remained strong even during the first year of the pandemic in 2020, and continued to rise in 2021 and the first half of 2022 (Chart 2).

Looking forward, CSIL forecast that after the exceptional rebound in European furniture production in 2021, 2022 is expected to be another strong year on the demand side, although the rebound effect will slow compared to last year. This is partly due to reallocation of household spending back towards travel and other leisure activities. High inflation and soaring furniture prices are also expected to have a dampening effect on down. On the other hand purchasing in the commercial sector is expected to remain robust.

Supply chain disruptions are expected to persist, particularly due to rising energy prices, lack of qualified workers, and the fallout from the Russia-Ukraine war. The conflict is increasing material supply difficulties, notably for timber products, and commodity prices are expected to remain elevated at least for the remainder of this year. The outlook for European inflation and wider economic growth is heavily dependent on how the war in Ukraine will unfold, the impact of sanctions and other measures, and how these feed through into energy prices and consumer confidence.

According to CSIL there are several positive factors expected to maintain strong demand for furniture in Europe in the coming months including the continuing roll-out of the EU’s Recovery and Resilience Facility (RRF), some significant national level support measures, such as a fiscal bonus in Italy which was extended into 2022, growth in residential construction in several European countries, and improved export market prospects for European manufacturers, driven both by increased affluence of consumers in some emerging markets, and by continuing efforts in the US to reduce dependence on imports from China.

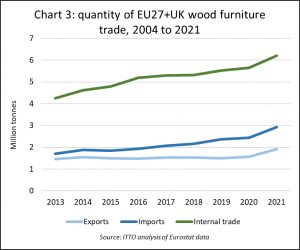

Recent trends in the quantity of European wood furniture trade as revealed by Eurostat trade data are somewhat surprising. The long-term rise in European trade which began in 2013 as the European economy gradually recovered from the 2008-09 global financial crises and subsequent eurozone currency crisis, continued apparently uninterrupted by the pandemic. The most notable recent trend is the upturn in trade in 2021, apparent both in EU27+UK external and internal trade (Chart 3).

Overall, the signs are that EU wood furniture manufacturers, while still dominant inside the EU single market, accounting for around 80% of total consumption value in the region, have been gradually losing competitiveness in other global markets. Exports by EU27+UK manufacturers to other regions of the world were broadly flat in quantity terms and slightly declining in value terms before 2021. Last year, EU27+UK wood furniture exports to countries outside the region increased sharply, rising 21% to both euro value and quantity terms, but it remains to be seen whether this growth can be sustained.

Meanwhile manufacturers outside the region, notably in neighbouring non-EU countries and China, slowly increased their share of the EU27+UK market in the years before 2022. The share of non-EU suppliers in EU27+UK wood furniture consumption increased to 21% in 2021, up from 18% the previous year and 15% five years earlier.

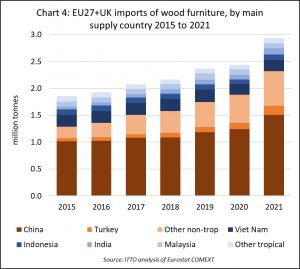

Between 2015 and 2019, EU27+UK imports of wood furniture from outside the region increased fairly consistently at an average rate of 6% per year. In 2020, the onset of the pandemic and related logistical problems led to a slower rate of import growth of only around 3% to 2.44 million tonnes. Last year, import growth accelerated sharply, rising over 20% to 2.93 million tonnes.

In recent years, by far the largest growth in EU27+UK wood furniture imports in quantity terms was from China (Chart 4). In terms of percentage growth rate, the largest growth was from countries neighbouring the EU, notably Turkey, Ukraine, Belarus, Serbia and Russia. EU27+UK wood furniture imports from tropical countries averaged no more than 2.4% per annum between 2015 and 2019, and then fell 10% to 560,000 tonnes in 2020. Last year, imports of tropical wood furniture rebounded 10% to 610,000 tonnes.

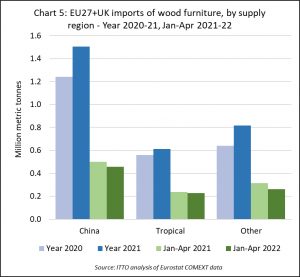

Notwithstanding CSIL’s prediction of continuing good demand for furniture in Europe in 2022, EU27+UK imports of wood furniture were down 10% in quantity terms, to 950,000 tonnes, in the first four months of this year. Import tonnage decreased from all main supply regions during the first four months of 2022; by 8% from China to 460,000 tonnes, by 3% from the tropics to 230,000 tonnes; and by 17% from other countries to 260,000 tonnes (Chart 5). The decline is indicative of severe supply problems caused most notably by the renewed COVID lockdown in parts of China, and the war in Ukraine and associated trade sanctions against Russia and Belarus.

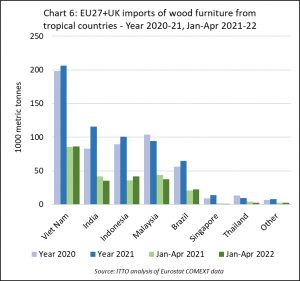

Of tropical countries supplying wood furniture to the EU27+UK, Indonesia recorded the largest gain in this market in the first four months of 2022, rising 18% to 42,000 tonnes. Imports also increased from Brazil, by 8% to 22,000 tonnes. Imports from Vietnam were stable at 82,000 tonnes. Imports from all other leading tropical supply countries declined, including India (-16% to 35,000 tonnes), Malaysia (-15% to 37,000 tonnes), Thailand (-39% to 3,000 tonnes) and Singapore (-53% to 1,000 tonnes) (Chart 6).

Tropical wood furniture import trends varied very widely between EU27+UK countries in the opening months of this year, with no clear pattern emerging (Chart 7). In the first quarter of 2022, a rise in imports was recorded in the UK (+8% to 57,500 tonnes), Germany (+6% to 23,800 tonnes), Belgium (+29% to 12,600 tonnes), Spain (+7% to 7,000 tonnes), Italy (+9% to 4,300 tonnes) and Ireland (+24% to 3,500 tonnes). However imports declined into France (-8% to 25,900 tonnes), Netherlands (-16% to 16,900 tonnes), and Poland (-18% to 3,300 tonnes). Imports into Denmark were stable at 4,400 tonnes during the three month period.

Major structural changes in European furniture distribution

A new CSIL report highlights major structural changes in Europe’s furniture sector. Although some of the trends have been underway now for at least a decade, recent events have brought about accelerating change. According to the report, major trends include:

- An unprecedented increase in online sales that now account for over 10% of the total European furniture market. The pandemic outbreak accelerated a massive change in consumer behaviour shifting from offline stores to e-commerce. Moreover, the e-commerce channel has bolstered international penetration enabling leading furniture retailers to expand into new markets at lower costs (including countries where they may have a limited network of stores).

- A slightly decreasing share of the overall market occupied ‘specialist’ retailers. This trend is mainly due to the increasing role of the online channel that has eroded market share of organized chains specialized in home furniture and of independent stores. The latter particularly suffered in 2020 during the months of lockdown.

- Relative stability of market share of ‘non-specialized’ retailers. During and after the pandemic outbreak, home improvement projects increased particularly benefitting DIY chains. DIY chains were also able to remain open during the months of the lockdowns while other competitors were forced to close.

- Changing behaviour of consumers impacting on distribution of big supermarkets and hypermarkets. Shopping districts in large towns and city centres have become a far more attractive place to purchase. Leading international furniture retail chains, such as IKEA and Maisons du Monde, are developing new store concepts. For more than half a decade, IKEA has been a single-format retailer. However it is now investigating new ways of meeting customer needs. For example by establishing stores in inner-city locations and by balancing the big-box superstore format with smaller format stores that use digital technology to provide access to the full product range.

More details are available the 2022 edition of CSIL report “Furniture Retailing In Europe” which provides analysis of home furniture distribution in 13 European countries (Austria, Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden, Switzerland and the United Kingdom), including trends In home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers. See www.worldfurnitureonline.com

Strong outdoor furniture market in Europe

The outdoor furniture market in Europe is one of the best performers in the furniture sector, according to a new report focused on this sector just published by CSIL. Total annual sales of outdoor furniture in Europe are estimated by CSIL to be around €3.3 billion. Following a slight reduction in 2020 the sector recorded a double-digit rebound in 2021, well above the sector average. The largest outdoor furniture markets within Europe are Germany, the United Kingdom, France, and Italy, accounting for a combined market share of over 50%. According to CSIL, consumption of outdoor furniture in Europe is expected to continue to increase in 2022 and 2023.

During the first part of the pandemic (2020) the drop of the outdoor furniture market was contained. Good retail sales offset a sharp decline in contract sales. However, starting from 2021 most manufacturers also experienced a rebound of the contract sector as many activities put on hold the previous year were restarted.

The hospitality industry is an component of outdoor furniture demand in Europe. Official Eurostat statistics released by Eurostat and reported by CSIL show a significant fall in the number of hotels in Europe in 2020 as a main consequence of Covid-19. However, with some of the world’s most popular tourist destinations, Europe has seen a revival in domestic and inter-regional travel in the past year. International arrivals to Europe increased nearly 75% in 2021. There is now optimism that delayed projects in the hotel and wider tourist sector will soon be completed. According to data from Lodging Econometrics at the end of 2021, Europe’s hotel construction pipeline stood at 1,824 projects and nearly 300,000 rooms. A further 474 new hotels and 70,000 rooms are expected to open in 2022 and 504 new hotels with 75,015 rooms in 2023.

The outdoor sector is much more dependent on imports than other furniture sectors in Europe. Slightly more than half of all outdoor furniture imported by EU countries is from countries outside the EU, with around 60% of non-EU imports derived from China and 30% from tropical countries in Southeast Asia. There has been a long term rising trend in European imports of outdoor furniture from outside the region, although CSIL believes that recent factors, such as the raw materials shortages and high freight rates may lead to a partial reshoring of sourcing activities in the next few years.

CSIL note that the outdoor furniture market is served via a wide variety of channels, both specialist and non-specialist distributors, from large scale retail chains to small independent stores, and from ‘pure’ online players to brick-and-mortar operators. Overall the role of non-specialist retailers is higher in this sector than for most other furniture sectors such as upholstery, kitchen furniture, and office furniture. DIY chains and garden centres are still pivotal sales channels. However, there has been some growth in sales via more specialist retailers in recent years, first as the large-scale furniture chains expanded outdoor collections and more recently as more independent retailers are promoting designer outdoor brands.

The e-commerce channel is also growing rapidly. Both manufacturers and retailers are extending their web marketing activity and upgrading their on-line presence. No longer do they only display product pictures and prices, but also seek to guide and inspire customers with design suggestions and case studies.