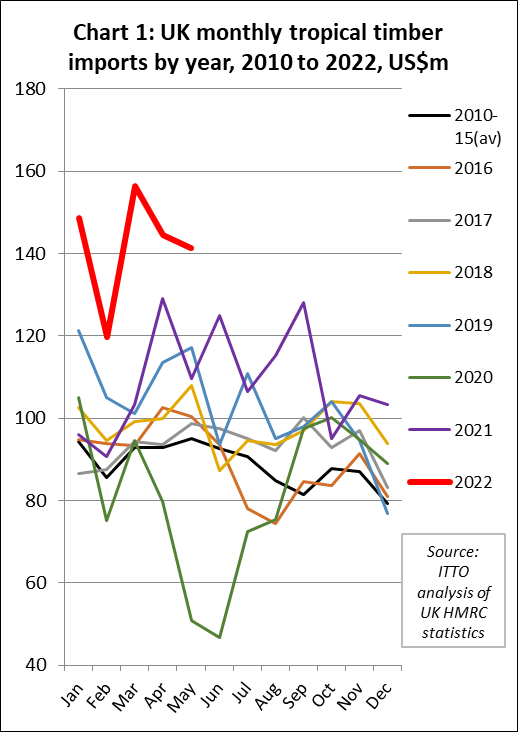

The import value of tropical wood and wood furniture into the UK in the opening five months of this year was USD711 million, 34% more than the same period last year. In fact, this was by far the strongest start to the year in terms of UK import value of tropical wood and wood furniture products since at least before the 2008 financial crises (Chart 1). It compares to an average import value of less than USD500 million for the January to May period throughout the whole decade prior to the onset of the pandemic in 2020.

The rise in UK import quantity of tropical wood and wood furniture was much less dramatic than the rise in import value in the first five months of this year, at 228,000 tonnes just 10% more than the same period in 2021. This shows that price inflation was the major factor behind the rise in import value. Significant weakening of the value of the GBP on foreign exchange markets since the end of April, combined with the wider geo-political situation, implies that price inflation will remain a key issue for UK importers in the months of ahead. It also indicates that the current boom in UK imports may well be short-lived.

Availability of hardwood and furniture products from the UK’s traditionally largest suppliers in Europe has become even more challenging since Russia’s invasion of Ukraine in the last week of February, encouraging UK importers to look more to tropical products. COVID lockdowns have also seriously disrupted availability of manufactured wood products from China.

Tropical wood performs well compared to overall UK market this year

Comparing tropical wood product imports with data for total UK wood imports in the latest market statement from Timber Development UK (TDUK formerly Timber Trade Federation) implies that tropical products have performed better than the overall UK timber market so far this year.

According to TDUK, the total volume of all timber imported into the UK in Q1 2022 was 2.5 million m3, nearly half a million m3 behind the record imports of Q1 2021. This decrease in total timber imports follows on from a downward trend seen towards the back end of Q4 2021. TDUK note that “While this downward trend may have been sparked initially by market saturation for timber products, loss of consumer and business confidence is now the primary cause”.

TDUK highlight that while UK direct timber imports from Russia are relatively low, demand for all timber products in the UK is being impacted by the war in Ukraine through its effects on consumer confidence, along with high energy and material costs. The UK timber industry has responded to the Russia-Ukraine conflict by following sanctions and greatly reducing imports across all the main Russia import categories.

In tonnage terms, comparing the first five months of 2022 with the same period last, UK imports of Russian hardwood plywood were down 42% at 8,500 tonnes, Russian softwood plywood was down 86% to just 250 tonnes, Russian softwood sawnwood was down 82% to 15,800 tonnes, Russian hardwood sawnwood was down 70% to 568 tonnes, and Russian softwood decking was down 51% to 632 tonnes.

The large majority of UK wood product imports from Russia this year arrived between January and March (34,000 tonnes across all product categories). Less than 2,000 tonnes of Russian product were imported into the UK in April and May.

Strong start to the year unlikely to be sustained in the UK

TDUK’s market statement highlights that UK demand for timber was strong in the first quarter of this year, particularly driven by construction output which reached a record high during the period, just surpassing the previous high set in Q1 2019. Drawing on data from the UK Office of National Statistics (ONS), construction output was up by 3.8% when comparing Q1 2021 with Q1 2022. The private repair, maintenance and improvement (RM&I) sector, which is particularly important for hardwoods, was at historically high levels in the first quarter of this year.

However, TDUK note that the high level of demand in unlikely to persist as the overall picture for the economy is overwhelmingly negative across a range of macroeconomic indicators. The following adverse factors are identified by TDUK:

- The stability of the construction sector’s recovery in 2022 has always remained subject to inflationary pressures – which at 9.1% as per the Consumer Price Index in June, is now at its highest rate in 40 years.

- The Russia-Ukraine crisis leading to particularly high energy and material costs.

- Greater barriers to trade and a more complex regulatory environment in the UK since Brexit.

- The British pound has suffered severe depreciation, plunging 10% this year according to Bloomberg.

- There is a “cost of living crisis” with 88% of British adults reporting an increase in their cost of living in May 2022 according to ONS.

- According to the GfK index, consumer confidence in the UK was down 41 points in June 2022, the lowest since the index began in 1974.

- Recent surveys indicate a decline in business confidence.

- IMF now projects that global growth will slow from 6.1% in 2021 to 3.6% in 2022 and 2023.

- Political instability in the UK with Prime Minister Boris Johnson deposed by his party in July 2022.

Overall therefore, prospects for the rest of this year are far from promising. This is reflected in the latest CPA Construction Industry Forecasts released in July 2022 which predict that UK construction output will grow by 2.5% in 2022, a sharp revision down from just six months ago of 4.3% growth. Growth in 2023 has also been revised down to 1.6%, from 2.5%. The private RM&I sector is forecast to decline by 3.0% in 2022 and 4.0% in 2023 as it will be particularly hard hit by inflation and falling consumer confidence.

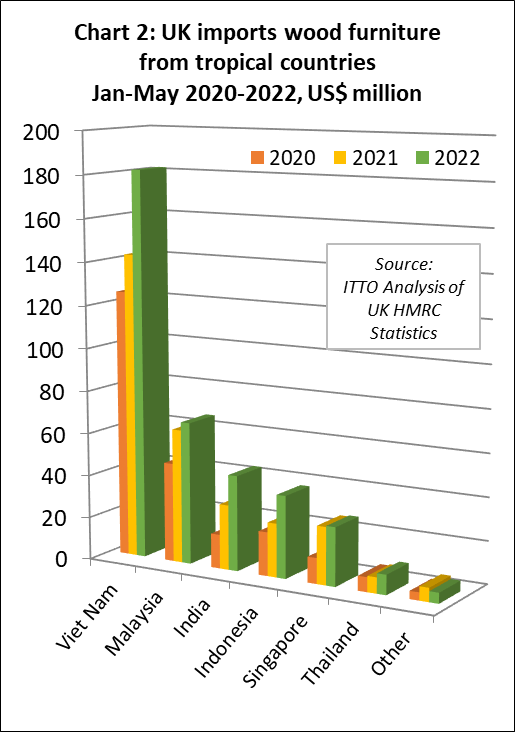

Big increase in UK import value of wood furniture from all main tropical suppliers

The UK imported USD374 million of tropical wood furniture products in the first five months of 2022, which is 28% more than the same period in 2021. In quantity terms, wood furniture imports were 78,000 tonnes during the five month period, 3% more than the same period last year. This indicates that the rise in value was driven more by price inflation than strong demand. Import value increased from all of the leading tropical supply countries to this market in the first five months of this year compared to last including Vietnam (+28% to USD182 million), Malaysia (+6% to USD67 million), India (+47% to USD45 million), Indonesia (+53% to USD39 million), Singapore (+2% to USD27 million), and Thailand (+25% to USD9 million) (Chart 2).

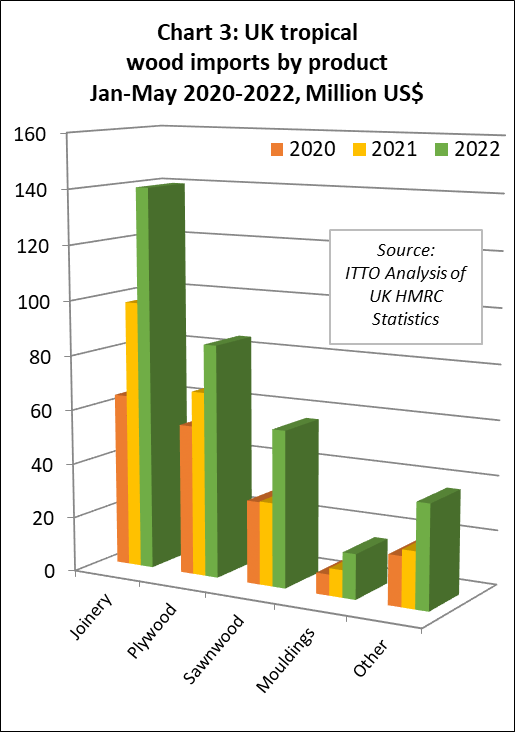

UK tropical wood import value up 49% in the first five months of 2022

Total UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes were USD337 million between January and May this year, 49% more than the same period in 2021. In quantity terms imports increased 14% to 150,000 tonnes during the period. Compared to the first five months last year, UK import value of tropical joinery products increased 43% to USD140 million, import value of tropical plywood was up 26% to USD85 million, import value of tropical sawnwood increased 88% to USD57 million, and import value of tropical mouldings/decking increased 65% to USD16 million (Chart 3).

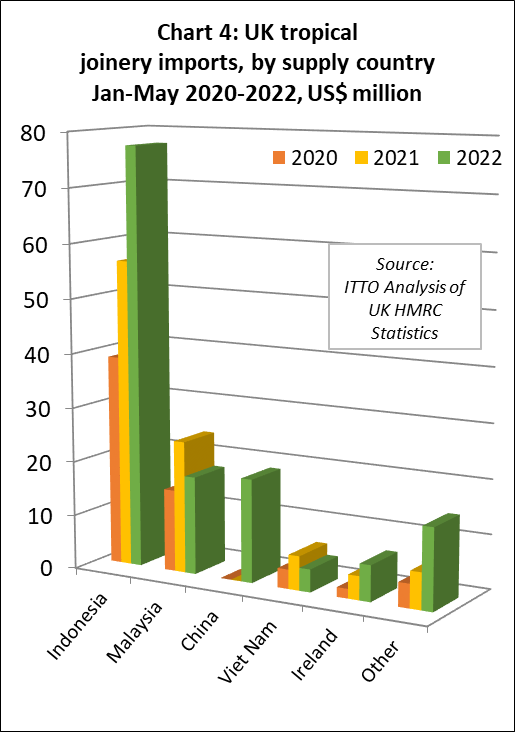

UK imports of wood doors from Indonesia gather momentum

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in the second quarter of 2020, imports of this commodity group have progressively built momentum. This trend is mainly driven by Indonesia for which UK joinery imports, mainly consisting of doors, were USD77 million in the first five months this year, 37% more than the same period in 2021 (Chart 4). In quantity terms, UK joinery imports from Indonesia were 24,500 tonnes in the first five months of this year, 11% more than the same period in 2021.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) started this year more slowly. Import value from Malaysia was USD18 million in the January to May period, 26% less than the same period last year. In quantity terms, imports from Malaysia were 5,800 tonnes, 37% less than the same period in 2021. Joinery imports from Vietnam of 1100 tonnes valued at USD4 million were respectively 39% and 33% less than the same period last year.

UK imports of Chinese tropical joinery products, nearly all comprising doors, were 7,200 tonnes with value of USD19 million in the first five months of 2022, up from negligible levels in previous years. Due to introduction from 1st January 2022 of new product codes in the EU Combined Nomenclature (still mirrored by the UK post-Brexit) it is now possible to identify wood doors and windows manufactured using a wider range of tropical wood species in UK and EU trade statistics. The apparent rise in imports of “tropical” wood joinery from China is very likely due to these products now being identifiable as of tropical species, whereas previously they were classified as “other non-coniferous” in the trade statistics and excluded from the figures for tropical wood imports.

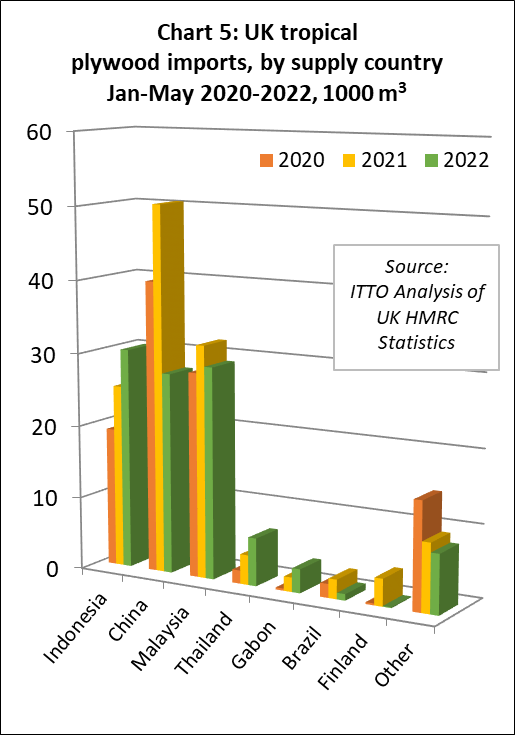

UK tropical hardwood plywood imports switch from China to Indonesia

In the first five months of 2022, the UK imported 106,000 m3 of tropical hardwood plywood, 18% less than the same period last year. Tropical hardwood plywood imports from Indonesia have made gains this year, while imports from China have continued to slide (Chart 5).

The UK imported 30,300 m3 of tropical plywood from Indonesia in the first five months of this year, a gain of 21% compared to the same period last year. Imports from Indonesia, which were quite slow between February and April this year, picked up pace again in May. The UK imported 29,100 m3 of plywood from Malaysia in the first five months of this year, 9% less than the same period last year. Imports from Malaysia also picked up in May to their highest monthly level for over a year.

The UK imported 27,600 m3 of tropical hardwood plywood from China in the first five months of this year, 28% less than the same period in 2021, trade having been affected by COVID lockdowns in China. At the same time, Brexit is impacting on UK imports of tropical hardwood plywood from EU countries which were just 5,200 m3 in the opening five months of this year compared to over 10,000 m3 during the same period in the last two years.

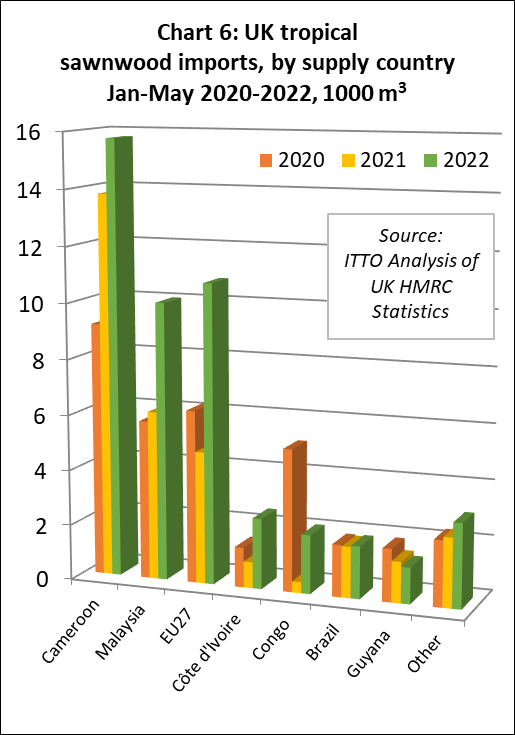

Strong rise in UK imports of tropical sawnwood

UK imports of tropical sawnwood started this year strongly. Imports were 47,500 m3 in the first five months of 2022, 49% more than the same period last year. In addition to making major gains overall, there were big changes in the countries supplying tropical sawnwood to the UK in the opening months of this year (Chart 6). This is indicative of the major shifts in hardwood markets since the start of the pandemic which have led to significant supply shortages and sharply increasing prices in many supply regions and continuing high levels of demand in markets like the UK.

UK imports of tropical sawnwood from Cameroon were 15,700 m3 in the first five months of this year, 14% more than the relatively high level in the same period last year. UK imports from Malaysia, which had fallen to little more than a trickle in recent years, were 10,000 m3 in the first five months of this year, 65% more than in the same period last year.

UK imports of tropical sawnwood from Côte d’Ivoire were 2,500 m3 in the first five months of this year, a 170% increase compared to negligible imports in the same period last year. UK imports of tropical sawnwood from the Republic of Congo (RoC) have also recovered some lost ground this year, with imports of 2,100 m3 in the first five months, a 430% gain compared to the same period last year, although still well down on the pre-pandemic level.

UK imports of tropical sawnwood from Brazil were 1,900 m3 in the first five months of this year, 3% more than the same period last year and still down on the pre-pandemic level.

After losing ground following Brexit and during the pandemic, indirect UK imports of tropical sawnwood from EU countries have been recovering again this year. Total UK imports from EU countries were 10,800 m3 in the first five months of this year, up from just 4,800 m3 in the same period in 2021.

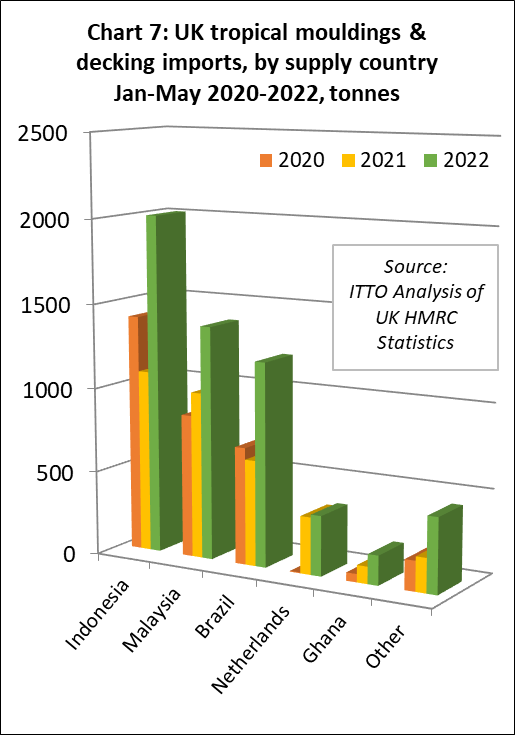

UK imports of tropical hardwood mouldings/decking were relatively high in the opening five months of 2022, at 5,600 tonnes, 67% more than the same period last year. This is another commodity group for which there has been particularly strong demand in the UK, combined with sharply tightening supply since the start of the pandemic. The war in Ukraine and sanctions on Russia are expected to lead to even tighter supplies of non-tropical decking products that directly compete with tropical decking in the short to medium term.

UK imports of decking/mouldings increased sharply from Indonesia, Malaysia and Brazil in the first five months of this year. Imports of 2,000 tonnes from Indonesia were 86% more than the same period last year. Imports of 1,400 tonnes from Malaysia were 40% up on the same period in 2021. Imports from Brazil increased 93% to 1,200 tonnes during the five month period. (Chart 7).

TDUK urges vigilance to ensure birch plywood contains no Russian wood

TDUK has issued a trade alert urging vigilance to ensure no plywood offered by Asian manufacturers to UK importers contains birch originating in Russia. TDUK note that UK sanctions introduced in response to Russia’s invasion of Ukraine prohibit the import, acquisition, supply and delivery of revenue on all wood products coming from Russia. This spans across all wood categories but is particularly relevant to birch plywood as significant volumes were exported to the UK prior to the conflict.

The UK timber industry has responded to the Russia-Ukraine conflict by significantly reducing imports across all the main Russian import categories. However, TDUK note that “a worrying development has emerged in recent weeks as TDUK members have reported increasing offers of birch plywood coming from the far east, particularly China”.

The birch in this plywood is, according to TDUK, almost certainly derived from Russia “given that birch forests are concentrated in Northern Russia” and that “China does not share the same view of the West regarding the Ukraine conflict. This means China has imposed no sanctions on Russia, with trade patterns continuing as they were prior to the conflict”.

TDUK also suggest that “the increasing isolation of the Russian economy has provided a business opportunity for many Chinese timber suppliers, with sanction-stricken products such as Russian birch now becoming widely available for import and processing”.

TDUK warn that “despite the birch plywood being processed in China, any timber originating from Russia is now illegal to import into the UK or the EU. Any [TDUK] member or non-member who imports birch plywood from outside of the EU runs a high risk of being in breach of UK sanctions”.

In response, TDUK are writing directly to manufacturers offering to supply birch plywood from China and other Asian countries making them aware of both UK and EU sanctions. Additionally, TDUK is asking member companies receiving offers of birch plywood to reply with information on the sanctions applying in the UK and EU.

TDUK note that should Russian wood be found in the UK/EU market “the importer and all customers who have purchased these products will be subject to legal action, fines and reputational damage which would also impact their trading partners in the manufacturing country”.

UKCA due to replace CE mark in UK from 1 January 2023

After the UK signalled its intention to leave the EU, the government set out plans to stop recognising the CE mark and to introduce the UK Conformity Assessed (UKCA) mark instead. For construction products this was originally due to take place on 1 January 2022, but the deadline was extended until 1 January 2023 due to the pandemic, and because there was a lack of available UK Approved Conformity Assessment Bodies.

Like the CE mark, the UKCA mark indicates that a product conforms with the applicable product safety requirements for products of its type sold in Great Britain. The UKCA mark shows that a product has been assessed for conformity, with the results of that assessment being summarised in the manufacturer’s Declaration of Performance.

Most construction products that are currently CE marked, or new products covered by a UK Designated Standard, will need to be UKCA marked from 1 January 2023. The marks are required for structural timber and wood-based panels for which there is a harmonised European standard or UK Designated Standard. Wood-based products such as skirting, architraves and other wood trim are not covered by a harmonised standard and therefore do not require CE marking. Wood-based panels specifically designed for furniture are not construction products and therefore do not typically require marks. Other wood products not typically requiring marks are general sawn or machined goods (unless they are Structural or Flooring). Decking also, on the whole, is exempt but may count as Structural if it is used as a balcony or raised up on columns.

While the official deadline for introduction of the UKCA mark requirement is 1 January 2023, the UK Construction Products Association has warned government that unless they take action to make the UKCA marking requirements more flexible, many sectors could be left unable to place products on the market after that date. This could result in tradespeople being unable to purchase essential construction materials, potentially delaying projects and damaging the UK’s economic growth.

It is possible that the deadline will be delayed again following passage of the Building Safety Bill, which gives Ministers the power to alter the date. The new law is expected to be introduced during the next (Autumn 2022) session of the UK parliament.

More information about the UKCA marking regulations is available at: https://www.gov.uk/guidance/using-the-ukca-marking