The European Timber Trade Federation (ETTF) has issued the following information on the EU Deforestation Regulation (EUDR) for suppliers exporting timber and timber products to the EU.

The EU Deforestation Regulation (EUDR) entered into force on 29.06.2023. From 30.12.2024, the EUDR will replace the EU Timber Regulation (EUTR). It obliges all importers of timber or timber products in the EU to apply a due diligence system prior to importing. Importers must collect information and documentation to prove that their wood and wood products has been legally harvested and is deforestation-free, prior to placing these products on the EU market. Deforestation-free means that the wood comes from plots of land where no deforestation or forest degradation as defined in the Regulation has occurred since 31.12.2020.

The EUDR covers a wide range of timber products, including sawn timber, wood-based materials, paper and furniture. The text of the regulation is available here (https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R1115&qid=1687867231461). The scope of the EUDR, including all products covered, can be found in Annex I at the end of the Regulation. Products covered by CITES or FLEGT licenses are also affected by the EUDR.

In future, you will need to provide EU importers (i.e. your customers) with the following information and documentation to enable them to comply with the requirements of the EUDR:

- Tree species (scientific name)

- Country of harvest

- Geo-coordinates of all plots of land where the wood was harvested

- Date or time range of harvest

- Evidence that the wood was legally harvested

- Evidence that the wood is deforestation-free

If the required information and evidence is missing, the goods will not be released for import into the EU by the customs authorities. There is a risk of storage charges at EU borders until the necessary information is provided or the goods have to be returned. Importers may also face legal consequences.

The EUDR applies to all wood and wood products harvested from 29.06.2023 and placed on the EU market from 30.12.2024. It is therefore important that you start gathering the necessary information now. Without this information you will no longer be able to export wood products to the EU from 30.12.2024. A special case applies to wood products harvested from 29.06.2023 and delivered to the EU before 30.12.2024. For these products, importers must apply the EUTR and check that the wood was legally harvested. However, if these products (or wood products made from them) are traded in or exported from the EU after 30.12.2024, importers and their customers will need the information and documentation mentioned above.

The ETTF urges “all exporters to inform their timber suppliers of this new regulation and forward this information to them. This is the only way your suppliers can provide you with the necessary information in time”.

The ETTF provides the following additional notes on the information and documentation that importers in the EU will need in the future to comply with the requirements of the EUDR:

1. Tree species (scientific name)

The scientific names of all tree species (possibly) contained in the product are required. The genus (e.g. Pinus spp. or Eucalyptus spp.) is not sufficient! Both genus and species must be indicated (e.g. Pinus radiata or Eucalyptus globulus).

Please note that the European authorities can verify information on tree species by means of laboratory tests (microscopic analysis, genetic analysis).

2. Country of harvest

The name of the country or countries where the wood was harvested is required. If deforestation or legality risks vary within a country, the region must also be indicated.

Please note that the European authorities can verify information on the country of harvest by means of laboratory tests (genetic analysis, isotope analysis).

3. Geo-coordinates of all plots of land where the wood was harvested.

Exact geo-coordinates of all plots of land where the wood contained in the product was (possibly) harvested are required. For plots of 4 hectares or less, one point is sufficient; for plots of more than 4 hectares, a sufficient number of points is required to describe the perimeter of the plot. Coordinates consist of a latitude and a longitude value, with a minimum of at least six decimal places.

Please note that importers are required to enter the quantity of imported products as well as the coordinates for each individual import into an EU online portal. Through this portal, the EU can detect unrealistic information, for example if suppliers send the same coordinates to multiple importers, even though the wood comes from other areas.

4. Date or time range of harvest Information is required on the date or time range of harvest.

Please note that the European authorities can use satellite imagery to determine whether harvesting took place on the plot land during the specified period.

5. Evidence that the wood was legally harvested

The EUDR requires that the timber has been harvested in accordance with the relevant legislation of the country of production. The following legislation is mentioned in the EUDR:

- Land use rights

- Environmental protection

- Forest-related rules, including forest management and biodiversity conservation, where directly related to wood harvesting

- Third parties’ rights

- Labour rights

- Human rights protected under international law

- The principle of free, prior and informed consent (FPIC), including as set out in the UN Declaration on the Rights of Indigenous Peoples

- Tax, anti-corruption, trade and customs regulations.

The evidence required in each case will depend on the applicable legislation in the country of harvest and the local legality risks. Depending on the situation, some aspects may not be relevant.

If indigenous peoples are present in or around the logging area, it will be necessary to demonstrate that their rights have not been violated.

If there are legal requirements for logging permits in the country of harvest, these permits must be provided. The same applies to official transport documentation. If no permit is required for logging on private land, other evidence of legality must be provided. In addition, internationally recognised certification schemes can help to demonstrate legality.

Proof of the supply chain (delivery notes or invoices) is also required to establish the link between the geo-coordinates provided, the proof of legality and the exported timber product. It is important to ensure that the documentation provided matches the timber exported and is plausible in terms of dates and quantities.

Additional risk mitigation measures are required for timber from countries with high levels of illegal logging or corruption.

Timber imported into the EU with a valid FLEGT licence is considered to have been legally harvested under the EUDR and hence only fulfils a part of the requirements. FLEGT-timber is no longer a “green lane” as it used to be in EUTR.

6. Evidence that the wood is deforestation-free

Importers must demonstrate that their imported products have not contributed to deforestation or forest degradation. The importer can use e.g. satellite images for this purpose. If there is other evidence that the product is deforestation-free, this should also be provided to the importer.

UK import tropical wood import tonnage falls 24% in the first half of 2023

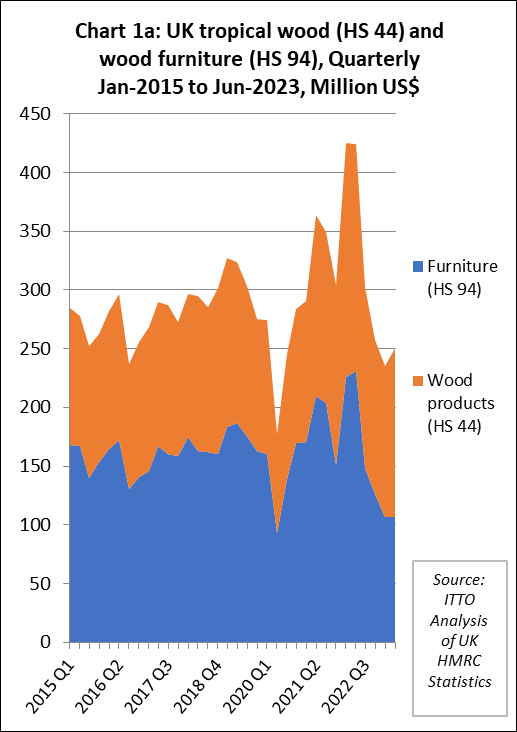

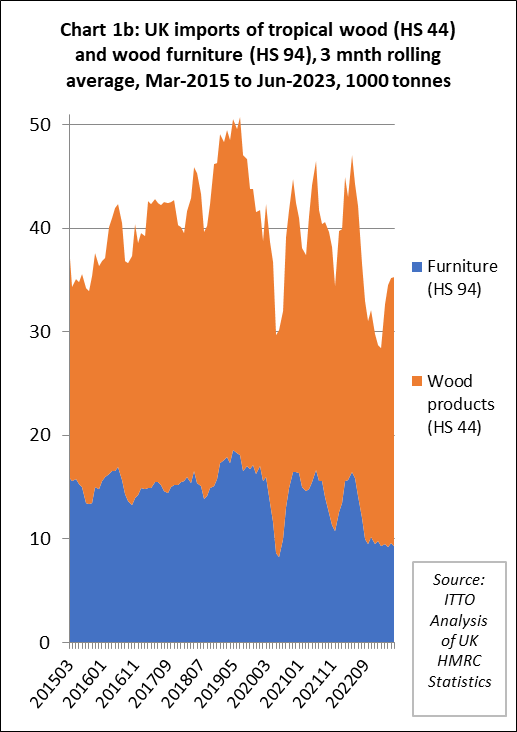

The import value of tropical wood and wood furniture into the UK in the first six months of this year was USD486 million, 43% less than the same period last year. In quantity terms, the UK imported 203,600 tonnes of tropical wood and wood furniture in the January to June period, 24% less than the same period last year. The sharp decline was expected as trade in the opening months of last year was at the highest level (in dollar terms) since before the 2008 financial crises and had already slowed markedly since summer 2022.

The UK imported 105,700 tonnes of tropical wood and wood furniture with a value of USD251 million in Q2 2023, respectively 20% and 41% less than the same period last year. However, import tonnage and value during the second quarter this year were up 8% and 6% respectively compared to the first quarter. The quarterly increase in imports was all due to a rise in HS44 wood products. UK imports of tropical wood furniture products remained slow in the second quarter of this year (Charts 1a and 1b).

60 percent risk of recession in the UK this year

The latest report from the UK National Institute of Economic and Social Research (NIESR) published on 9 August highlights that the British economy is growing only very slowly, and that this trend is set to continue. At the end of the first quarter this year, UK GDP was still 0.5 per cent below the level of GDP before the pandemic and NIESR forecast that it will not pass this level until the third quarter of 2024.

According to the NIESR, “Despite continuing to expect the United Kingdom to steer clear of a recession in 2023, GDP is projected to grow barely by 0.4 per cent this year and by 0.3 per cent in 2024, with the outlook remaining highly uncertain. There are, in fact, even chances that GDP growth will contract by the end of 2023 and a roughly 60 per cent risk of a recession at the end of 2024”.

The main reasons for this lost wealth and hit to prosperity, according to the NIESR, are the pandemic, Brexit, and Russia’s war against Ukraine. The monetary tightening necessary to bring inflation down has also played a role. These commonly cited reasons are often bunched together, and the reality is that the overlap of these events makes it very difficult to pinpoint specific blame.

NIESR’s outlook is more pessimistic than the Bank of England’s forecasts published a week earlier which came as the Bank raised the base rate for the 14th time in a row. The Bank suggested a recession was unlikely in the coming years but also implied that the economy will effectively flatline all the way through to 2026.

Expectations of a recession in the UK seem to be rising amongst other forecasters. For example, Capital Economics is predicting a recession before the end of the year. The IMF’s most recent updates predict the UK will just about avoid recession, but only on the condition that serious public policy reforms are implemented soon, notably more tax incentives for businesses.

For the hardwood sector, some crumbs of comfort may be derived from sector specific surveys. The latest S&P Global/CIPS UK Construction Purchasing Managers’ Index for July shows an overall return to growth. The index stood at 51.7 in July, up from the previous month’s 48.9 score, and exceeding the 50 mark which indicates positive growth. Robust increases in commercial building (indexed at 54.4) and civil engineering (53.9) did just enough to offset a continuing steep fall in house building (43.0). Significant growth in refurbishment projects during the month is encouraging for hardwoods as these projects tend to use more hardwoods than the new build sector.

Similarly, the latest State of Trade Survey by the UK Construction Products Association (CPA) covering the second quarter of 2023 showed a split in performance in the construction products manufacturing industry. In this case the divide was between manufacturers of “heavy side” materials, which recorded a fourth consecutive quarterly downturn, and of “light side” materials, which added to a run of quarterly growth that began in the third quarter of 2020.

“Heavy side” materials are typically installed early in the construction process and include structural timber products alongside aggregates, cement, ready-mix concrete, and structural steel. “Light side” products are installed later in the construction process and include internal fittings and services such as doors, windows, and kitchen furniture alongside heating and ventilation systems, plumbing, electrical and lighting, and thermal insulation. sector

It is encouraging that applications for hardwoods are more prevalent on the expanding “light side” than the declining “heavy side”. According to the CPA, “strong activity in commercial refurbishment, energy efficiency improvements and fit-out work has driven a three-year run of growth for light side product manufacturers, which contrasts with reticence for new project starts (particularly for private housing, and commercial and factory new builds) that continues to hold back heavy side sales”.

UK import value of tropical wood furniture down more than 50%

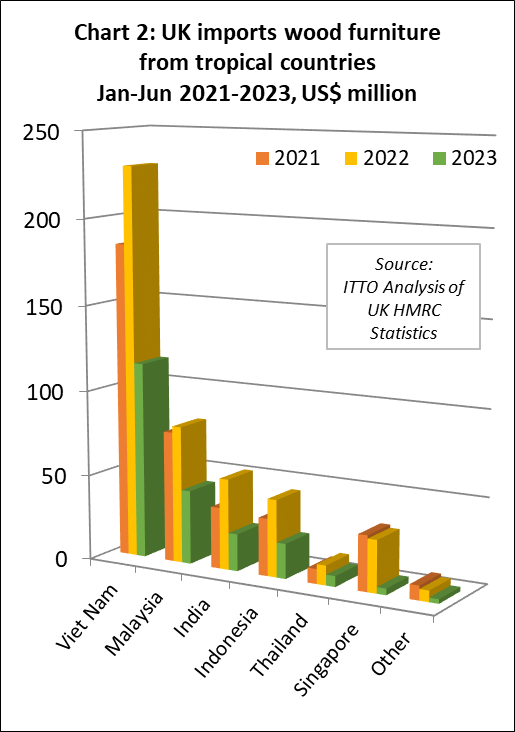

The UK imported USD213 million of tropical wood furniture products in the first six months of 2023, which is 53% less than the same period last year. In quantity terms, wood furniture imports were 56,100 tonnes during the six-month period, 40% less than the same period last year.

In the first six months of 2023 compared to last year, UK import value of wood furniture from Vietnam was down 50% to USD115 million, Malaysia was down 46% to USD43 million, India was down 59% to USD22 million, Indonesia was down 55% to USD20 million, Thailand was down 46% to USD6 million, and Singapore was down 87% to USD4 million. (Chart 2).

Across the board decline in UK import value of all tropical wood products

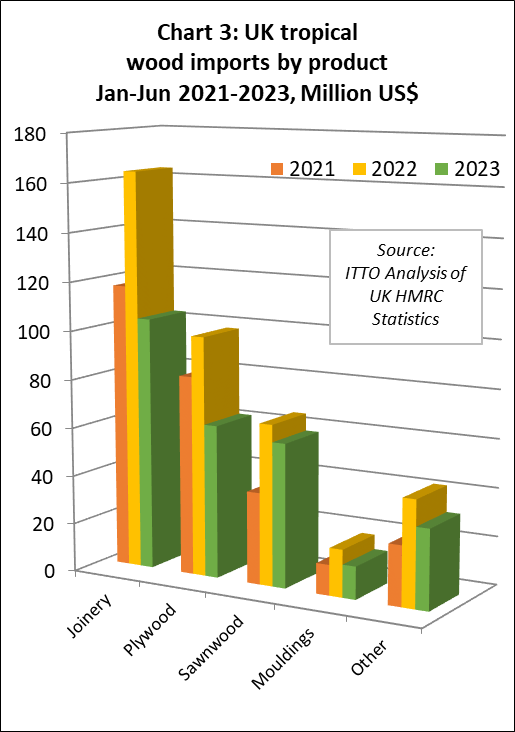

Total UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes was USD273 million between January and June this year, 31% less than the same period in 2022. In quantity terms imports decreased 15% to 147,400 tonnes during the period. Compared to the first six months of 2022, UK import value of tropical joinery products decreased 37% to USD104 million, import value of tropical plywood decreased 36% to USD63 million, import value of tropical sawnwood decreased 11% to USD59 million, and import value of tropical mouldings/decking decreased 31% to USD13 million (Chart 3).

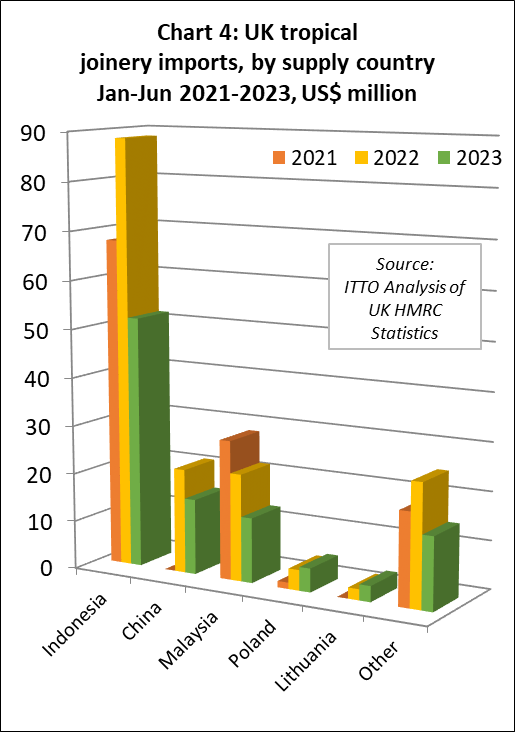

UK import value of joinery products from Indonesia (mainly doors) was USD52 million in the first six months of 2023, down 52% compared to the same period last year. UK import value of joinery products from Malaysia (mainly laminated products for kitchen and window applications) fell 39% to USD13 million during the same period. UK import value of Chinese tropical joinery products, nearly all comprising doors, was USD16 million in the January to June period, 28% less than the same period last year (Chart 4).

UK direct imports of tropical hardwood plywood offset by rise from China

In the first six months of 2023, the UK imported 108,100 m3 of tropical hardwood plywood, 10% less than the same period last year. A significant decline in direct imports of tropical hardwood plywood from tropical countries partly offset by a rise in imports from China (Chart 5).

The UK imported 47,500 m3 of tropical hardwood plywood from China in the first six months of 2023, 48% more than the same period last year. Last year, UK imports of Chinese products faced with tropical hardwoods fell sharply in favour of Chinese products faced with temperate hardwoods. This trend has been reversed in 2023 with China again shipping a larger proportion of tropical hardwood faced plywood to the UK.

UK imports of Indonesian plywood in the first six months this year were, at 26,900 m3, 24% less than the same period last year. The UK imported 21,300 m3 of plywood from Malaysia in the first six months of 2023, 33% less than the same period last year. UK plywood imports from Thailand were down 70% to 2,100 m3 in the first six months this year. However, in the same period there was a large percentage increase from a very small base in tropical hardwood plywood imports from Brazil (+148% to 3,100 m3). Imports from Paraguay also increased 13% to 1,600 m3.

Meanwhile, the combined effects of Brexit, supply shortages and rising energy and other material costs on the European continent continue to impact on UK imports of tropical hardwood plywood from EU countries which were just 4,300 m3 in the first six months of this year, 35% less than the same period last year.

Rising UK imports of tropical sawnwood from the EU this year

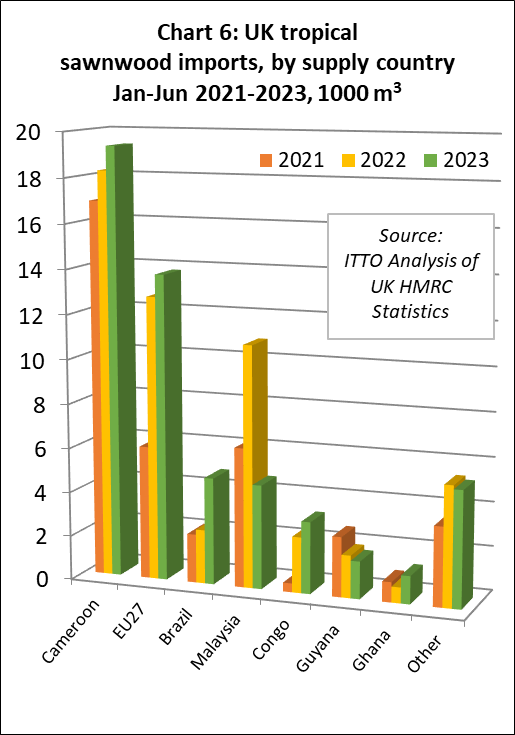

UK imports of tropical sawnwood were 54,000 m3 in the first six months of this year, 2% less than the same period in 2022. Although UK imports of this commodity appear to have held up reasonably well compared to other tropical products this year, a larger share has been sourced indirectly from the EU and not direct from the tropics (Chart 6). Furthermore, a large increase in UK imports of tropical hardwood sawnwood (HS 4407) from Brazil this year is also offset by a significant decline in imports of Brazilian tropical hardwood decking/mouldings (HS4409). Therefore, it may be that reported trends for both commodities are distorted by changes in the way products from Brazil are categorized respectively as “sawnwood” and “mouldings”.

UK imports of tropical sawnwood from Cameroon were 19,300 m3 in the first six months of 2023, 6% less than the relatively high level in the same period in 2022. UK tropical sawnwood imports from Malaysia, which revived to some extent last year after many years of decline, fell by 57% in the first six months of this year to 4,700 m3.

UK imports of tropical sawnwood from Brazil were reported as 4,800 m3 in the first six months of this year, a gain of 98% compared to the same period in 2022. UK tropical sawnwood imports also increased in the first six months this year from Republic of Congo (+29% to 1,600 m3), and Ghana (+78% to 1,300 m3). However imports from Guyana fell 12% to 1,700 m3.

Indirect UK imports of tropical sawnwood via the EU recovered ground despite the Brexit disruption, increasing 8% to 13,800 m3 in the first six months of 2023. To some extent, UK’s continuing dependence on indirect imports of tropical sawnwood from the EU is due to a shortage of kiln drying space in African supply countries combined with lack of any hardwood kiln dying capacity in the UK.

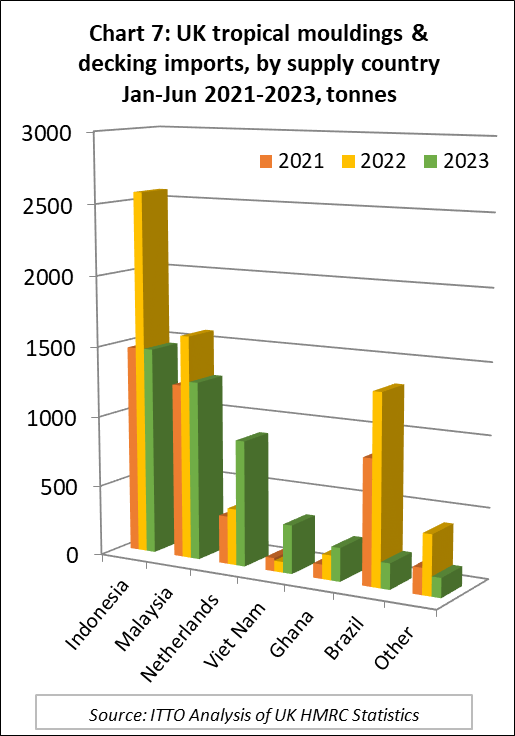

UK imports of tropical hardwood mouldings/decking fell 31% in the first six months of 2023 to 4,500 tonnes. This commodity group benefited in the UK market during 2022 from shortages of non-tropical products, particularly since the start of the war in Ukraine and sanctions on Russian decking products that directly compete with tropical decking.

However, with high stocks built up in the UK last year and much reduced consumption, imports of tropical mouldings/decking have fallen away again this year. Imports of 1,500 tonnes from Indonesia were 43% less than the same period in 2022. Imports from Malaysia totalling 1,300 tonnes were down 20% compared to the same period last year. Imports of this commodity group from Brazil were recorded at less than 200 tonnes in the first six months of this year, 86% less than the same period last year. In contrast, imports increased 123% from the Netherlands to 891 tonnes, while imports from Vietnam increased 3-fold to 350 tonnes from a very small base (Chart 7).