UK imports of hardwood products were rising strongly both in volume and value terms during the second half of 2021 and first half of this year as importers were building stocks on a rising market. However, in the third quarter this year the market has changed dramatically as import prices have fallen and UK importers are sitting on a lot of wood bought earlier at higher prices. This has occurred just at a time when consumption has weakened as the UK heads into recession and the GBP has fallen to the weakest ever level against the USD and is also declining against the EUR.

Reports from UK hardwood importers suggest that trade has slowed dramatically this month with little prospect of any significant improvement for months ahead. A change of economic policy following installation of a new Prime Minister in the first week of September, including dramatic, and largely unfunded, cuts in income tax in a high-risk effort to boost short-term economic growth has done little to boost confidence.

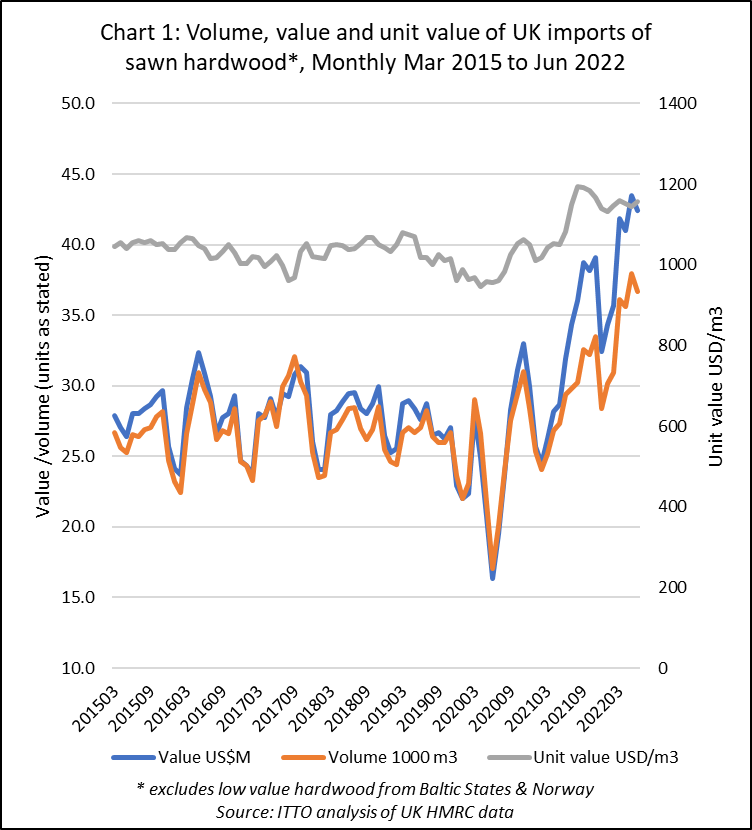

The monthly trend in UK imports of sawn hardwood to the end of June this year is shown in Chart 1. This highlights that both the volume and value of imports increased sharply in the two years following the lows of the first COVID lockdown in June 2020 to reach well above the pre-COVID level in the first half of this year. Monthly import volume of sawn hardwood was averaging over 35,000 cubic meters in the second quarter of this year compared to the long-term pre-COVID average of around 28,000 cubic meters.

In terms of value, the increase in UK sawn hardwood imports in the period to end June this year was even greater, from around US$28 million per month pre-COVID to over US$40 million in the second quarter of this year. Average unit value of sawn hardwood imported into the UK was around US$1150 per cubic meter in the second quarter of this year, compared to around US$1000 per cubic meter pre-COVID. Due to the weakness of the of the GBP, this rise in US$ values is felt even more acutely by UK importers.

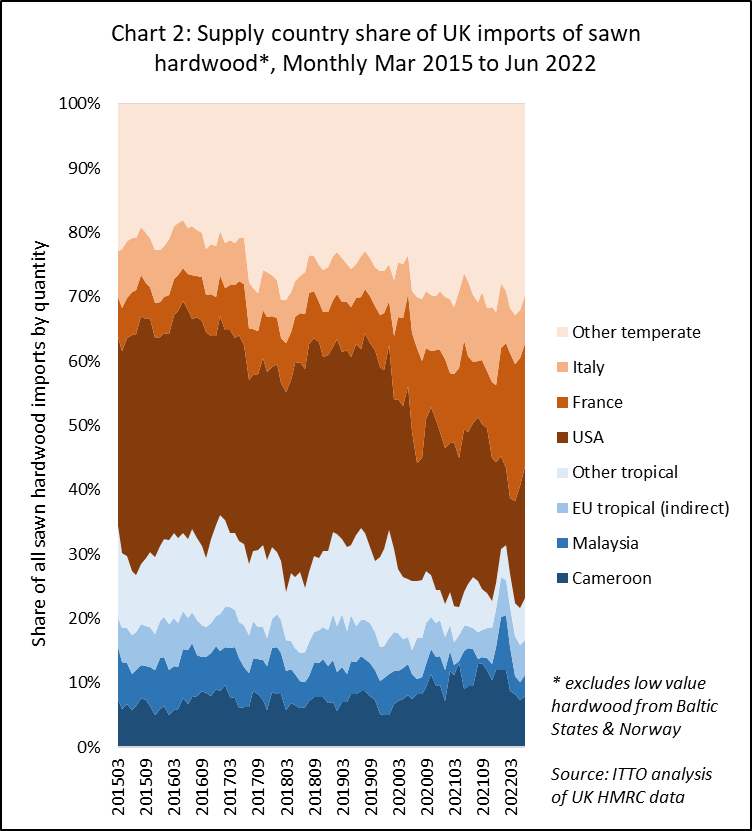

While there was a significant increase in UK imports of tropical sawnwood in the first quarter of this year, particularly from Cameroon and Malaysia, tropical wood’s overall share of UK sawn hardwood imports has been sliding in the last two years. During this period share has principally been lost to European hardwoods imported mainly from France and Italy (Chart 2).

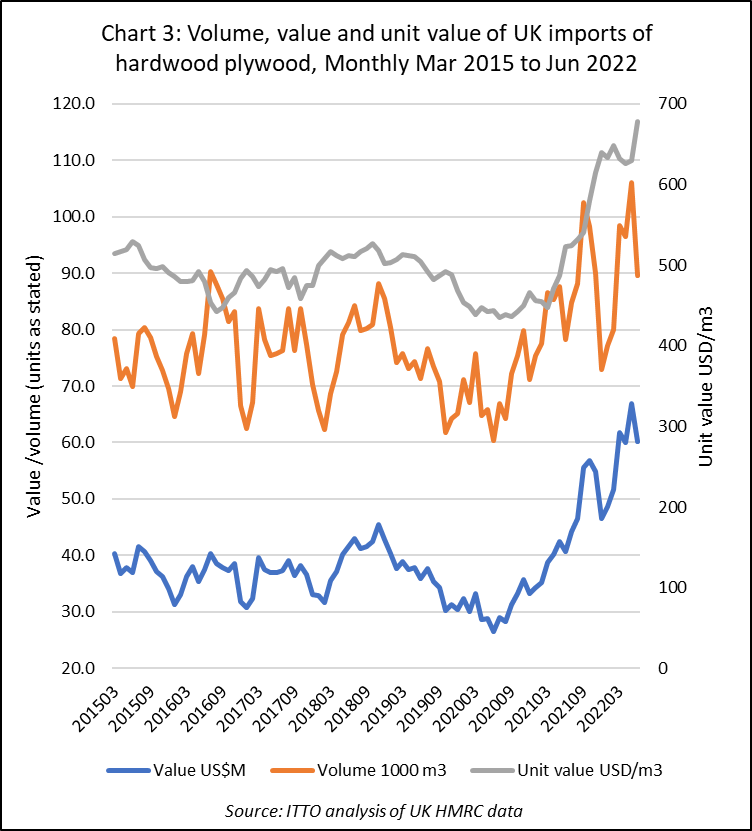

The overall trend in UK imports of hardwood plywood has been similar, with both volume and value rebounding dramatically after June 2020 to well above the pre-COVID level (Chart 3). Monthly import volume of hardwood plywood was averaging around 95,000 cubic meters in the second quarter of this year which compares to the long-term pre-COVID average of around 75,000 cubic meters. The unit value of UK hardwood plywood imports was averaging around US$650 per cubic meter in the second quarter this year, up from around US$500 per cubic meter pre-COVID.

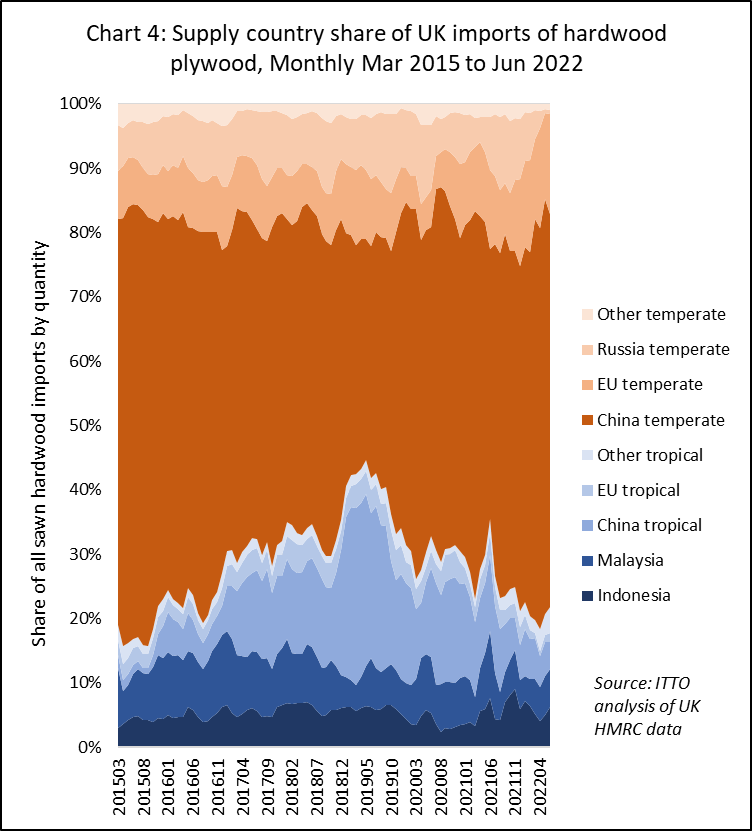

In terms of UK market share, tropical hardwood plywood from Indonesia has made some gains this year, but by far the biggest recent shift in the UK hardwood plywood trade has been a sharp decline in imports of Chinese products faced with tropical hardwoods in favour of Chinese products faced with temperate hardwoods. Chinese temperate hardwood plywood has been the largest beneficiary of UK sanctions against all trade in Russian wood products since the start of the Ukraine conflict (Chart 4).

This raises questions about the origin of the temperate hardwoods used to manufacture some of the plywood products in China’s export mix. There is a chance it contains Russian wood traded via China to bypass the sanctions. Timber Development UK (TDUK – formerly TTF) recently issued an alert to all members warning them of the risk of sanctioned wood from Russia being used to manufacture Chinese plywood products exported to the UK.

Prospects for UK imports of both sawn hardwood and plywood have taken a dramatic turn for the worse in recent weeks. The Bank of England (BOE) Monetary Policy Committee voted to raise its base interest rate to 2.25% from 1.75% at their meeting in September. This is its seventh consecutive rise and takes U.K. interest rates to a level last seen in 2008. Inflation in the UK stood at 9.9% year-on-year in August, well above the bank’s 2% target. In announcing the interest rate rise, the BOE said it believed the UK economy was already in a recession, as it forecast GDP would contract by 0.1% in the third quarter, down from a previous forecast of 0.4% growth. It would follow a 0.1% decline in the second quarter.

In addition to the BOE forecast, numerous analysts along with business association the British Chambers of Commerce have previously said they expect the UK to enter a recession before the end of the year. As well as energy price shocks, the UK faces trade bottlenecks due to COVID and Brexit, declining consumer sentiment, and falling retail sales.

Indicators in sectors particularly relevant to the timber industry are all in the red. UK construction lost 347 firms in July 2022 and 3,841 firms in the last year, the highest since the financial crisis more than a decade ago, according to the Insolvency Service. The S&P Global/CIPS construction Purchasing Managers’ Index (PMI) came in at 49.2 in August, edging up from 48.9 in July but staying below the 50.0 threshold denoting growth.

“Not only did construction activity fall for the second month running, but a range of indicators from the survey pointed to further weakness ahead,” said Andrew Harker, economics director at S&P Global Market Intelligence. He went on to note that “new orders showed the weakest growth since June 2020 and concerns about the sector and the wider economy hit confidence”.

The Builders Merchant Federation’s Building Index (BMBI) latest August report on sales of building materials in the UK, also underscores the impact of price inflation on the sector. Overall sales revenue in Quarter 2 2022 was the highest since the BMBI started in 2015 but, just as in the first quarter of the year, this was largely driven by price inflation rather than volume growth. Comparing Q2 2022 with Q2 2021 shows total builders merchant sales value increased by +4.0%. However, volume sales were 11.3% lower, while prices increased by 17.3%. Considering just timber and joinery, sales value declined 3.0% in the second quarter.

John Newcomb, CEO of the Builders Merchants Federation said that: “the negative effect of rampant inflation is starting to show with escalating input costs across fuel, energy, raw materials and wages impacting production costs and adding to existing material supply issues. It is plain to see that the increase in sales values of building materials during the first half of the year has been driven by price inflation rather than volume growth. Regrettably, this pattern seems set to continue into 2023.”

Mr Newcomb also noted that “The second quarter of this year has amplified some of the global difficulties, with the continued Russian invasion and spiralling cost of living issues at the forefront. Unfortunately, no immediate end is in sight. With UK inflation approaching double digits, the counterbalance between inflation and interest rates is increasingly difficult to control and will be the ultimate test for the next year or so.”