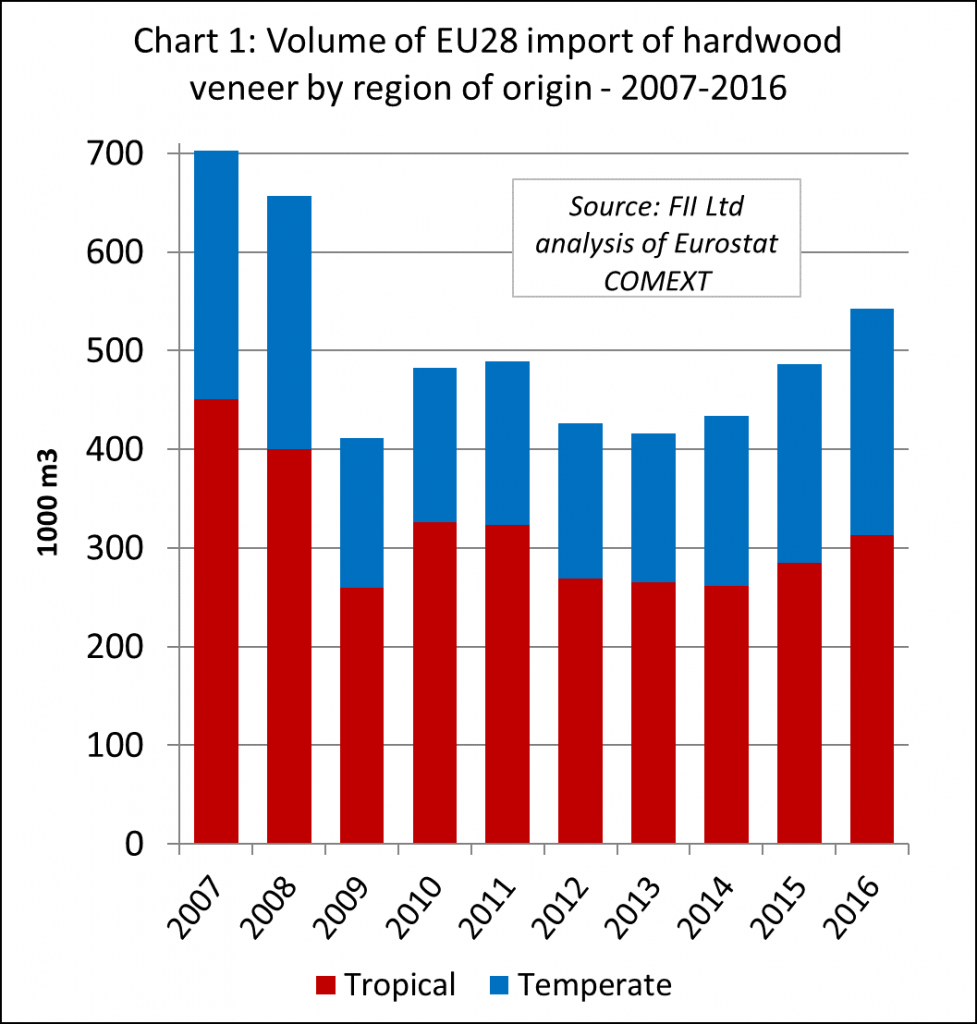

The upturn in EU imports of hardwood veneer which began in 2013 continued last year. The EU imported 542,000 m3 of hardwood veneer from outside the region in 2016, 12% more than in 2015. Imports from the tropics increased 10% to 313,400 m3, exceeding 300,000 m3 for the first time since 2011. However, EU imports of tropical veneer are still well below volumes of over 400,000 m3 per annum prevailing before the financial crises (Chart 1).

EU imports of veneer from temperate countries increased 14% to 228,900 m3 in 2016, almost entirely due to a 39% rise in trade with Ukraine to 81,600 m3 following the country’s decision to implement a log export ban from November 2015 which encouraged increased exports of processed hardwood products from Ukraine in 2016.

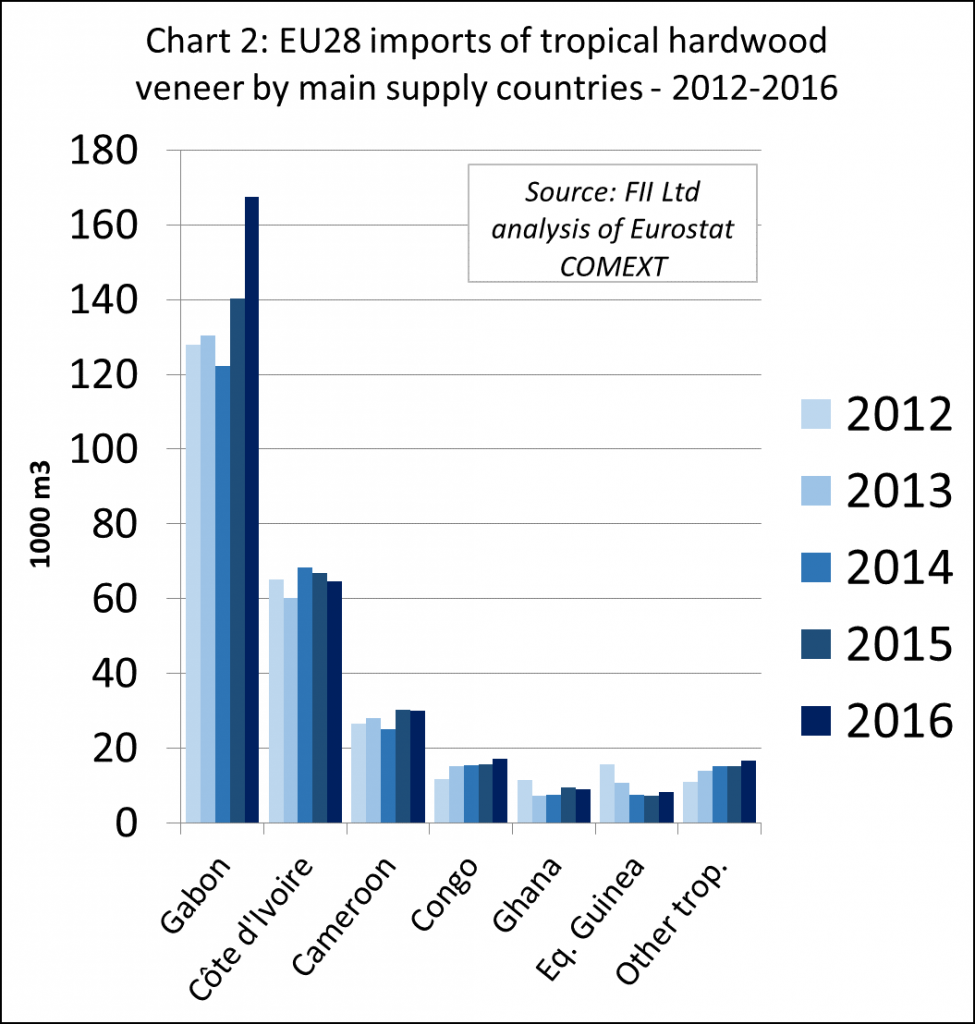

EU imports of hardwood veneer from Gabon, the leading tropical supplier, ended the year 19% up compared to 2015 at 167,600 m3. This is due both to better consumption in the EU and to rising investment in veneer production capacity in Gabon, on-going ever since the country banned log exports in May 2010. Strong growth in EU imports of Gabon veneer in the first half of 2016 was sufficient to offset a slowdown in the second half of the year when trade was disrupted during the dispute over Gabon’s presidential election.

In 2016, there were also increases in EU veneer imports from Congo (+9% to 17,100 m3), Equatorial Guinea (+17% to 8,400 m3) and the Democratic Republic of Congo (+3% to 4213 m3). These gains offset a slight decline in imports from Côte d’Ivoire (-3% to 64,700 m3), Cameroon (-1% to 29,900 m3) and Ghana (-3.4% to 9,100 m3) (Chart 2).

Nearly all the largest EU markets for tropical veneer imported more in 2016. Imports increased into France (+16% to 135,000 m3), Italy (+2% to 68,500 m3), Spain (+15% to 41,600 m3), Greece (+22% to 20,000 m3), Germany (+3% to 14,500 m3), and Belgium (+62% to 11,300 m3). These gains offset a decline in imports by Romania (-36% to 9,400 m3) and the Netherlands (-1% to 6,800 m3).

EU plywood imports rise to near record levels

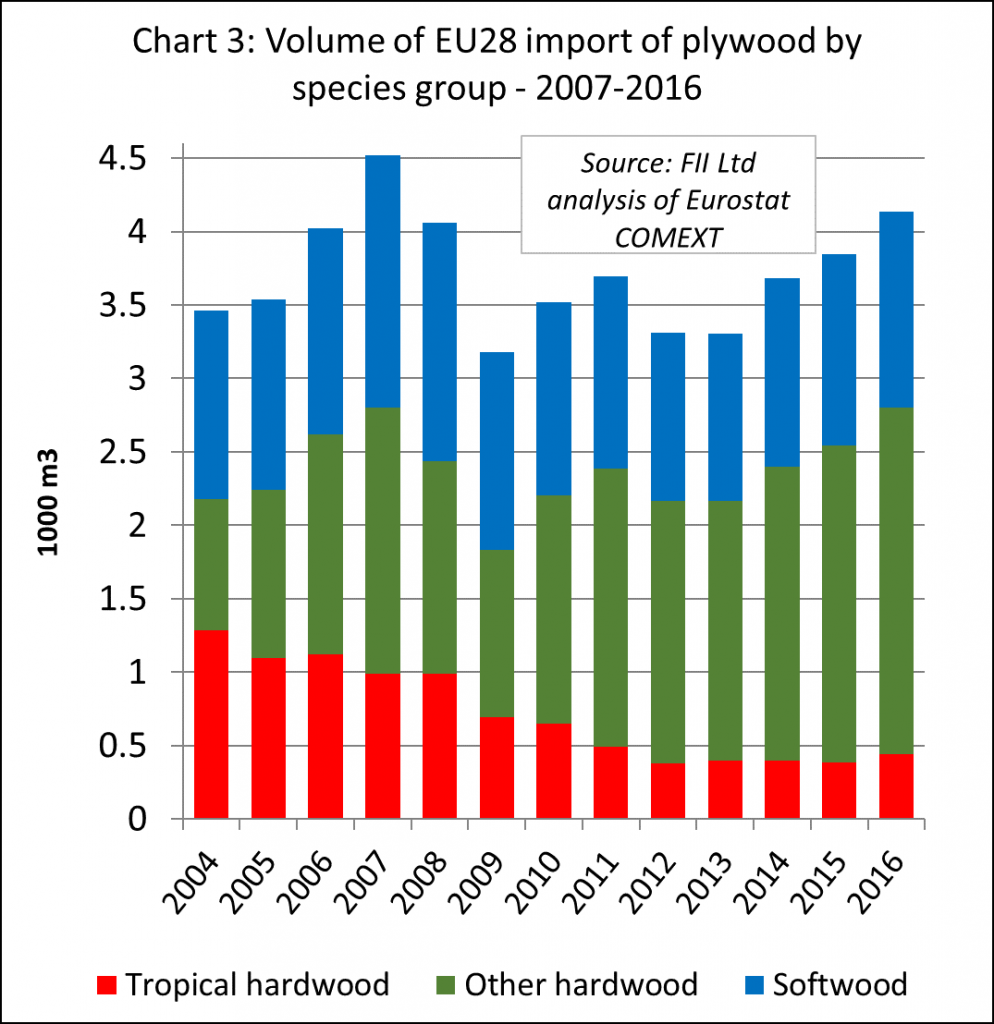

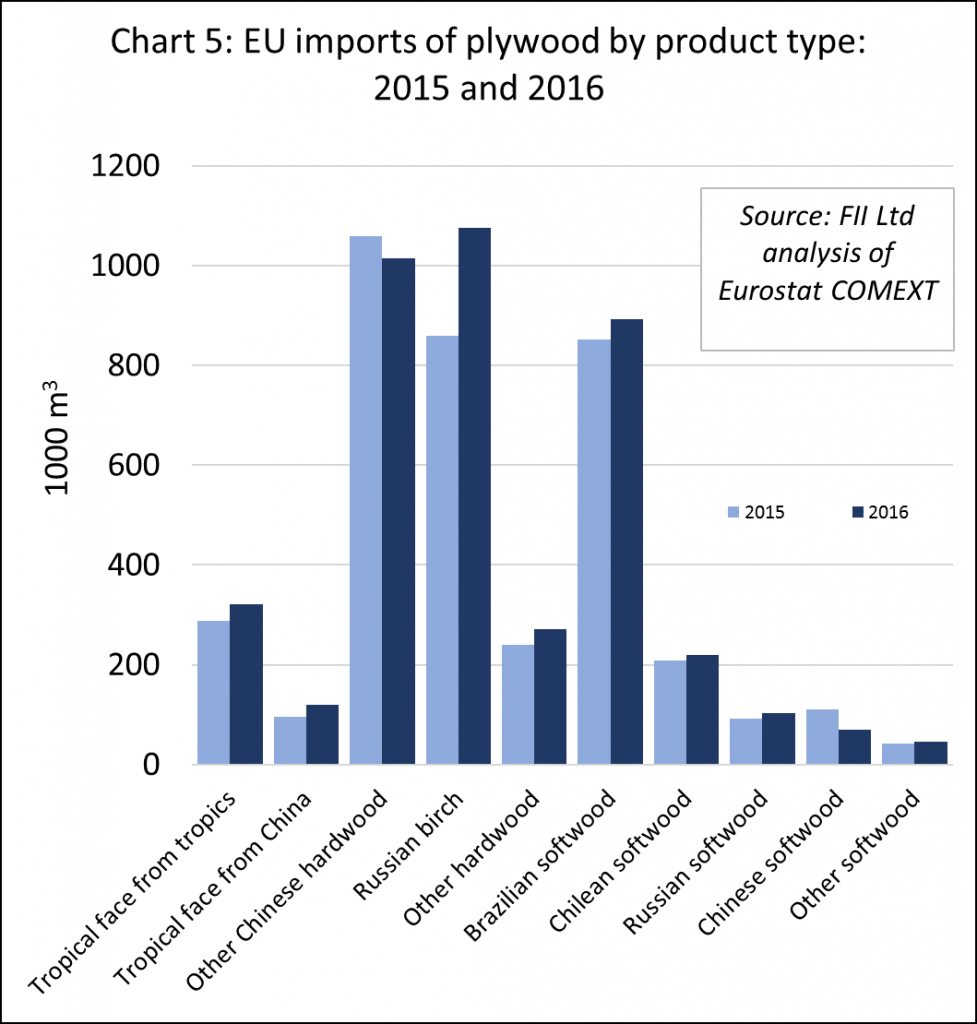

EU imports of plywood increased by 8% to 4.13 million m3 in 2016, the second highest level ever recorded, although some way short of the peak of around 4.50 million m3 in 2007 (Chart 3). Much of the gain in 2016 was due to a sharp increase in imports of birch plywood from Russia encouraged by extreme weakness of the Russian rouble against the euro and other EU currencies. In 2016, EU imports of Russian birch plywood increased 25% to 1.08 million m3, with most destined for Germany, the Baltic States, Poland, the UK and Netherlands.

EU imports of tropical hardwood plywood also increased last year. Imports of products manufactured in tropical countries increased 11% to 320,000 m3 in 2016, while imports of products faced with tropical hardwood manufactured in China increased 25% to 120,000 m3.

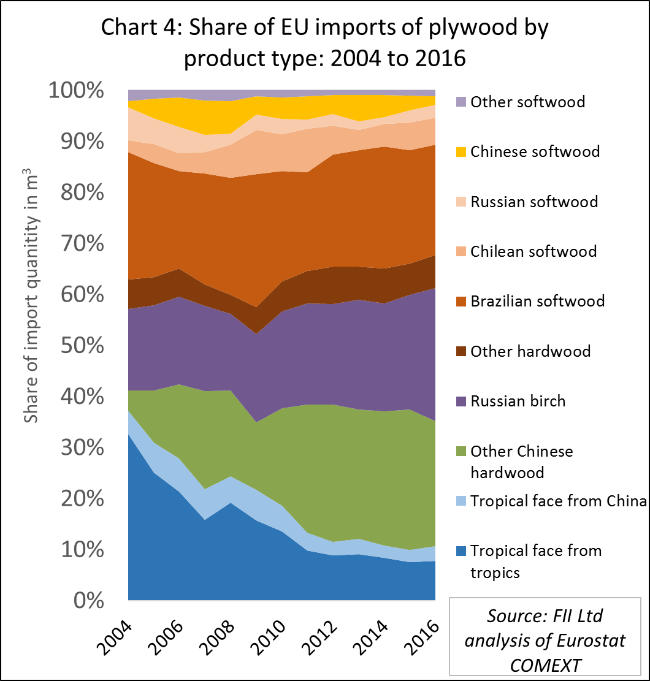

In 2016, the share of tropical countries in total EU plywood imports recovered a little ground, rising to 7.8% after sliding to an all-time low of 7.5% in 2015 (Charts 4 and 5).

However, Russian birch plywood achieved by far the largest increase in share of EU imports last year, rising from 22.4% in 2015 to 26.0% in 2016. This was largely at the expense of Chinese plywood faced with non-tropical hardwoods (including birch plywood, mixed light hardwood made with plantation grown poplar and eucalyptus, and various other forms of combi plywood). Between 2015 and 2016, EU imports of Chinese non-tropical hardwood plywood fell 4% to 1.01 million m3 and share of this commodity in total imports fell from 27.5% to 24.5%.

EU imports of softwood plywood increased by 2% to 1.33 million m3 in 2016, with rising imports from Brazil (+5% to 890,000 m3), Chile (+2% to 220,000 m3) and Russia (+13% to 100,000 m3). These gains offset a 36% fall in EU imports of softwood plywood from China, to 70,000 m3.

The changing composition of EU plywood imports may be partly related to enforcement of EUTR and CE marking requirements which is encouraging a shift from Chinese mixed light hardwood products to plywood containing more clearly identified species of known origin and technical performance. This factor tends to favour Russian birch plywood and Chinese plywood faced with hardwood species of known tropical origin, together with plywood imported directly from tropical countries.

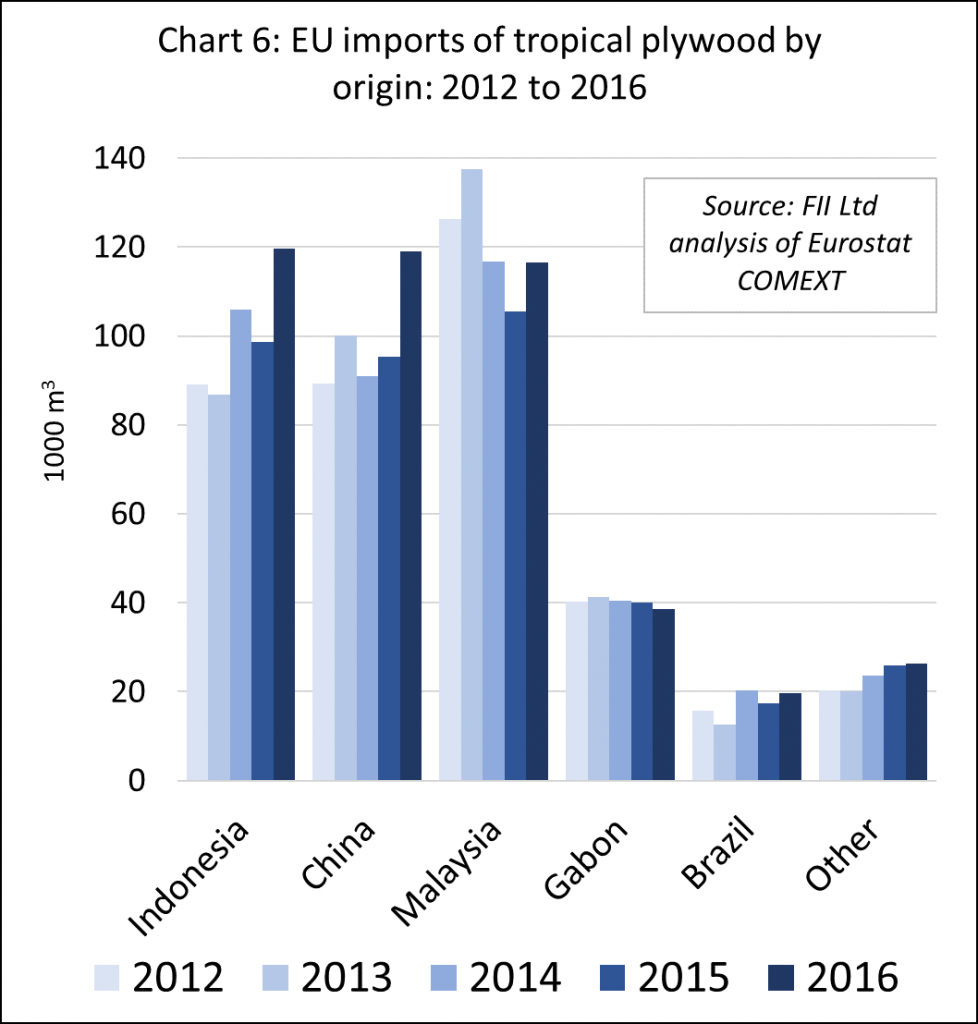

During 2016, EU imports of tropical hardwood plywood increased 21% to 119,000 m3 from Indonesia and 10% to 116,500 m3 from Malaysia. There was also a 13% increase in EU imports of this commodity from Brazil, although at 19,000 m3 in 2016, trade with Brazil is less than one tenth of the level prevailing a decade ago. EU imports of tropical hardwood plywood from Gabon declined by 4% to 38,600 m3 in 2016. (Chart 6).

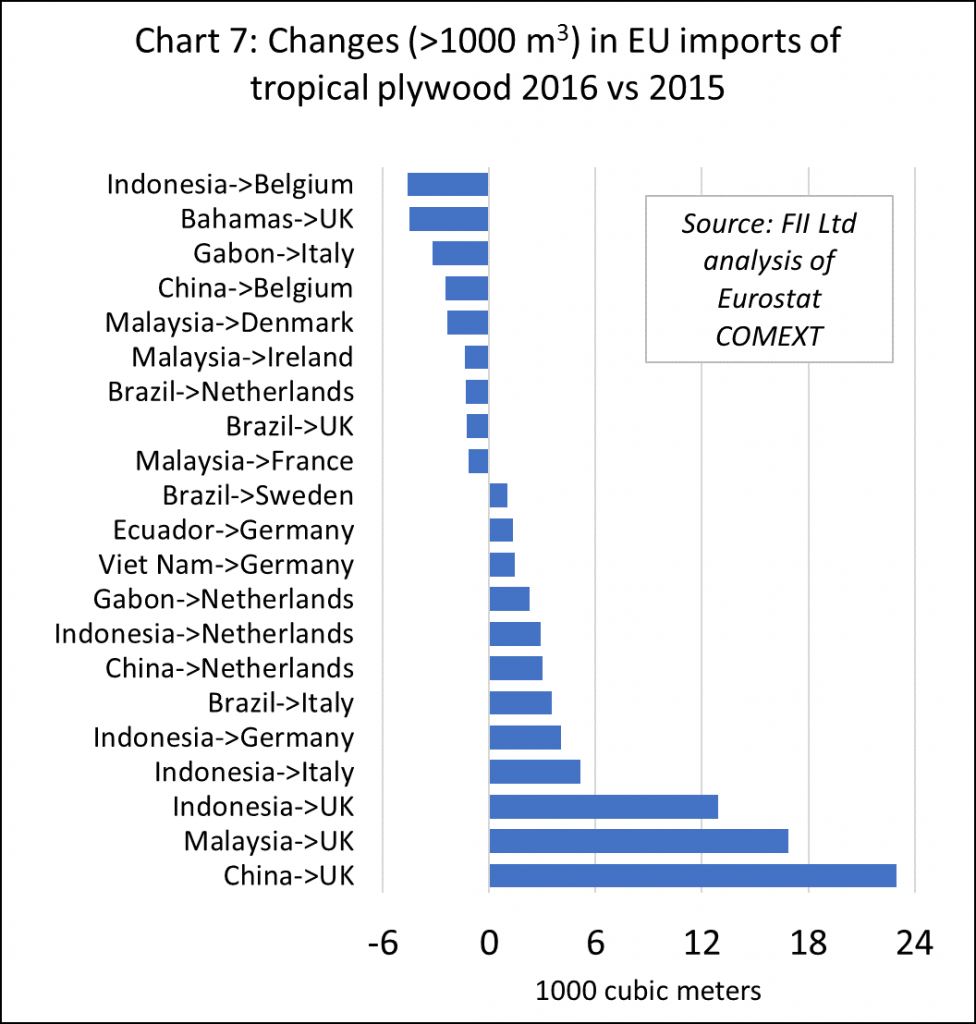

Rise in tropical hardwood plywood imports concentrated in the UK

Last year’s increase in EU imports of tropical hardwood faced plywood manufactured in China was heavily concentrated in the UK (Chart 7).

In recent years, of all EU importing countries, the UK has been most tempted by the low prices and relatively short transit times offered by Chinese plywood suppliers. UK importers have also been under intense pressure to demonstrate conformance to EUTR after the NMO, the UK’s enforcement agency, published a report in February 2015 revealing failures by several UK importers of Chinese plywood to meet regulatory requirements. Specific concerns were raised over the lack of accurate information on species content in Chinese hardwood plywood.

The sharp rise in UK imports of Chinese plywood faced in tropical hardwood may therefore be a result of efforts to ensure more accurate identification of species content. It also suggests that a significant proportion of this material is faced with FSC or PEFC certified tropical hardwood, or at least that Chinese manufacturers are now successfully reassuring customers of the legality of their tropical veneer supplies by other means.

The rise in EU imports of Malaysian plywood in 2016 was destined almost exclusively for the UK. Rising imports from Indonesia were more evenly distributed between the UK, Italy, Germany, and the Netherlands. These gains were sufficient to offset a big fall in imports of Indonesian plywood by Belgium.

For Gabon plywood during 2016, a gain in Dutch imports was offset by a decline in imports by Italy and France. More than 50% of all EU plywood imports from Gabon were destined for the Netherlands during 2016, while 30% were destined for Italy. In 2016, direct imports of Gabon plywood into France, traditionally one of the largest markets for this commodity, were only around 5100 m3, less than half the level of imports typical in the years before 2013.

PDF of this article:

Copyright ITTO 2020 – All rights reserved