In 2016, EU imports of tropical sawn hardwood were 1.04 million m3, unchanged from the previous year. The value of EU imports increased by 2% to €775 million. The average unit value of tropical sawn hardwood imports into the EU in 2016 was €747 per cubic meter, up from €730 per cubic meter the previous year.

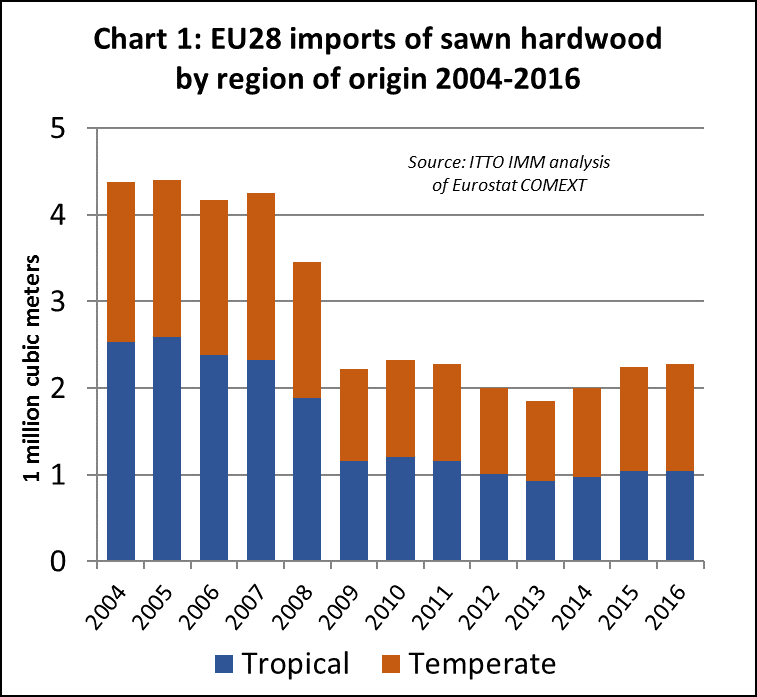

The volume of EU imports of tropical sawn timber remains stalled at historically very low levels. Import volume in 2016 was 12% higher than the all-time low of 930,000 m3 recorded in 2013 but remains 40% below the levels prevailing before the global financial (Chart 1).

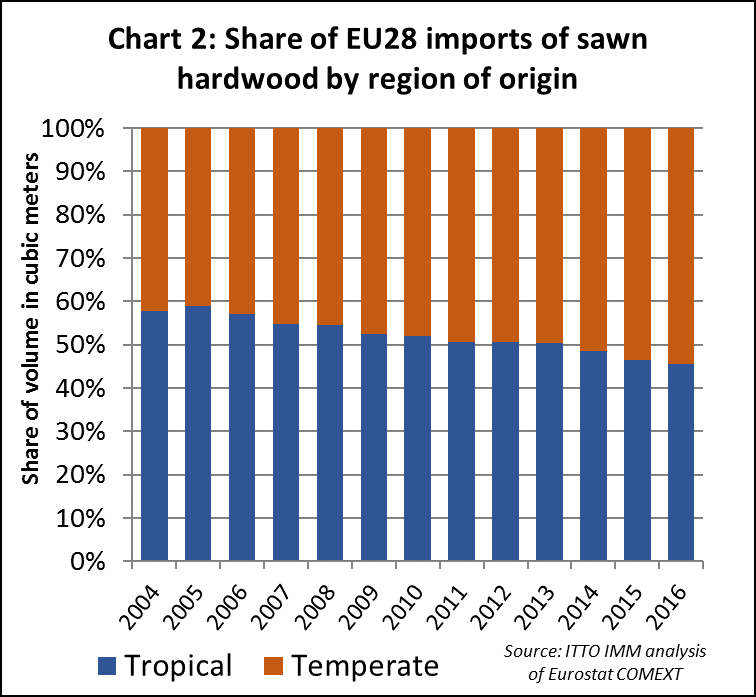

The share of tropical in total EU sawn hardwood imports declined from 46.5% in 2015 to 45.6% in 2016, continuing a long term downward trend (Chart 2). In 2016, EU imports of temperate sawn hardwood increased 3% to 1.24 million m3. This was mainly due to a 13% increase in EU imports of sawn oak from Ukraine in response to tighter controls on log exports from that country and extreme weakness of the Ukrainian currency.

Rising EU dependence on tropical sawn wood from Cameroon

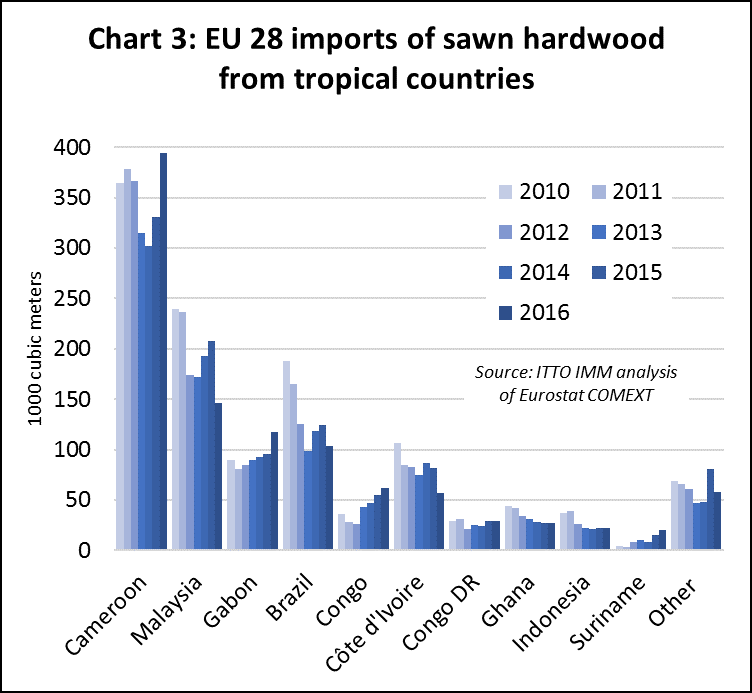

The most notable trend in the supply of tropical sawn timber to the EU in 2016 was the rising dependence on imports from Cameroon. EU imports from Cameroon increased 19% to 395,000 m3 in 2016, growing particularly rapidly into Belgium but with robust increases also into Italy, France, Spain, the UK and the Netherlands (Chart 3).

There was a significant increase in EU imports of sawn tropical wood from two other central African countries during 2016. Imports were up 22% to 117,000 m3 from Gabon and 13% to 62,000 m3 from the Congo Republic. Imports from both countries mainly enter the EU by way of Belgium. However last year there was a particularly large increase in UK imports from Congo Republic, from 6500 m3 in 2015 to 14000 m3 in 2016.

A combination of factors contributed to rising EU imports from Cameroon, Gabon and Congo Republic during 2016 including the relative weakness of the euro against the dollar (which tends to favour African countries where currencies are linked to the euro); continuing efforts to add value prior to export in central Africa; and recent progress to implement forest certification in the Congo region.

In contrast to imports from central Africa, EU imports of sawn hardwood from West Africa were low and declining in 2016. Imports were down 30% to 57,000 m3 from Cote d’Ivoire and 2% to 27,000 m3 from Ghana, a reflection of the limited availability of hardwoods favoured in the European market.

Eurostat import data indicates a big decline in EU imports of Malaysian sawn timber in 2016, with nearly all the fall recorded as occurring into the Netherlands. Unfortunately, Dutch sawn hardwood import data has been unreliable in recent years, indicating a very significant upturn in import volume from Malaysia in 2015 followed by a crash in 2016. Malaysian trade statistics, which appear to be more accurate, confirm that there was a rise in sawn hardwood exports to the Netherlands in 2015 followed by a decline in 2016, but the level of volatility is much less than suggested by Eurostat.

During 2016, Malaysian sawn hardwood imports were relatively low and flat into the other main EU markets for this commodity, including the UK, Germany, France and Belgium. This is due both to the continuing weakness of the euro against the dollar and the reorientation of Malaysian exporters away from European markets for sawn lumber in favour of emerging markets and value-added products such as LVL, doors and other joinery products.

Eurostat data suggests that EU sawn hardwood imports from Brazil fell 16% to only 104,000 m3 in 2016, only just above the all-time low of 99,000 m3 recorded in 2013. Imports from Brazil fell into both the Netherlands and France in 2016, a trend only partly offset by a slight rise in imports into Belgium. As for Malaysia, the Eurostat data is questionable (particularly for Dutch imports) and contradict Brazilian trade statistics which indicate a slight rise in exports of sawn hardwood to the Netherlands and several other EU countries in 2016.

Despite these discrepancies, it is clear that Brazilian sawn hardwood exports into the EU are now very low by historical standards and that a large proportion of the relatively limited volume of this commodity that Brazil makes available to international markets is now destined for other countries.

Global Trade Atlas data indicates that Brazil exported 284,000 m3 of sawn hardwood in 2016, of which 39,000 m3 went to China, 39,000 m3 to India, 31,000 m3 to Vietnam and 28,000 m3 to the US. Brazilian exports of sawn hardwood to all EU countries were 94,000 m3 in 2016, up from 81,000 m3 in 2015, but well below levels before the financial crises which were typically in excess of 500,000 m3 per year.

EU tropical wood imports increasingly shipped through Belgium

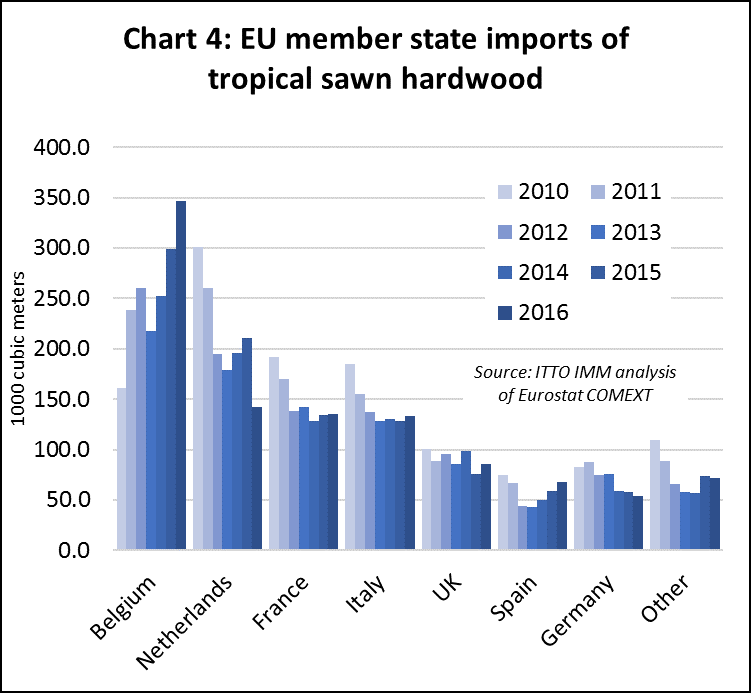

On the demand side, the most notable trend in EU tropical sawn hardwood imports during 2016 was increasing concentration of trade through Belgium (Chart 4). This trend is much more indicative of changes in distribution channels for tropical wood within the EU than of variations in regional demand. For reasons probably associated with differences in transit times or local costs, EU tropical wood importers are currently preferring the Belgian port of Antwerp over the Dutch and French ports. The wood entering by way of Belgium is being distributed throughout North Western Europe.

The focus on Belgium is also linked to the rising dependence on tropical sawn wood from central Africa where kiln drying facilities are restricted. Much of the African wood shipped into Belgium arrives as green lumber and will be kiln dried there, or in Netherlands or northern France, before being distributed into other parts of Europe.

Spain’s tropical wood market recovers some ground

Hardwood consumption in Spain has recovered some ground, but growth remains slow and hardwood products are coming under renewed pressure from substitutes, including other wood non-wood products. More positively for tropical wood, tightening supply and rising prices for European oak and American white oak, is encouraging some importers to focus again on tropical wood.

These were some of the messages that came out of the General Assembly of the Spanish timber trade association AEIM held in Madrid on 10 March. The Assembly was attended by 78 representatives of timber companies including distributors, manufacturers and agents from across Spain, the highest level of attendance ever recorded.

Overall the view was that supply and demand in the tropical hardwood market in Spain is reasonably well balanced, with sufficient supply to match demand which is still limited but rising slowly. The main tropical species imported into Spain are ayous for interior mouldings and iroko for window frames, with small volumes of other species such as sapele, tali, cumaru, and jatoba for various niche applications.

Spain imported around 68,000 m3 of tropical sawn hardwood in 2016, a gain of 14% compared to the previous year. Imports from Cameroon, by far the leading supplier, increased sharply, by 24% to 45,000 m3 in 2016. There was also a 4% increase in imports from Brazil to 8500 m3 and a 54% increase in imports from Gabon to 3500 m3. These gains offset a 23% fall in imports from Cote d’Ivoire to 3200 m3 and 60% decrease in imports from Congo Republic to only 1100 m3.

At the AEIM General Assembly concerns were expressed over the increasing problems to source European oak, a situation which has arisen due to restricted harvesting and strong demand for logs from other sectors, notably the barrel stave market, and for overseas export, particularly to China and Vietnam. Prices for American white oak have also been rising on the back of improved domestic US demand and export demand in the Far East.

Spanish importers are struggling to pass on higher white oak prices to consumers. As a result importers have been running down existing stocks and seeking cheaper alternatives. Some are buying in more American red oak, which is currently about 20% cheaper than white oak. Some are also now sourcing more ayous and other African timbers.

As for other wood products, Spanish timber traders at the AEIM General Assembly commented that consumption of structural products, such as laminated beams, and of treated wood for exteriors is now increasing in Spain.

The economic situation in Spain is improving but still uncertain. The headline economic figures are encouraging but the financial crisis and the current political and economic uncertainty in the Eurozone is affecting consumer confidence. Unemployment is still high and consumers are reluctant to spend on what they see as luxury items such as hardwood furniture, kitchens and flooring.

The use of hardwood is restricted to the higher value end of the market although the boom in tourism is still fuelling strong demand for hotel and restaurant renovation especially in coastal regions. There also appears to be a move at the lower, more cost sensitive, end of the market away from solid hardwood towards cheaper substitutes such as veneer boards or non-wood materials like vinyls and ceramics, some of which imitate the look of wood.

Rougier revenues decline 9.3% in 2016

Rougier, the France-based tropical timber company, reports €149.4 million in revenues in 2016, down 9.3% compared to 2015. Fourth-quarter 2016 revenues came to €37.6 million, contracting 11.0% compared to the same quarter in 2015.

Full-year revenues for the Rougier Afrique International branch which covers operations in Gabon, Cameroon and the Congo Republic were down 11.8% compared to 2015. Rougier note that business in Cameroon and Congo was affected by a significant slowdown in demand in the main emerging markets. However this contraction was partially offset by improving business in Gabon, benefiting from buoyant local demand and the upturn in the European market for plywood and veneers.

Full-year revenues for Rougier’s Import-Distribution France branch were up 3.2% in 2016. Rougier note that in a French market that is still quite flat, this growth has been driven by the strengthening of Rougier product ranges and the diversification of its customer base

Rougier’s revenue from log sales declined 14.8% to €37.9 million in 2016 due to the lower level of demand on international markets. Rougier’s revenue from sales of sawn timber and derivatives, was also down by 11.9% during the year at €80.4 million. This sector slowed sharply during the first nine months of 2016, before improving in the fourth quarter (+0.5%). Revenue from plywood and veneer sales increased 12.3% to €30 million over the full year, buoyed by strong demand in Europe.

Rougier’s sales per region reflect the impact of the slowdown in several emerging markets in Asia, the Middle East and North Africa, as well as intense competition on American markets. However, sales in Europe have been more resilient, benefiting from the attractive range of certified products offered by Rougier, while Sub-Saharan Africa has seen growth.

During 2017, Rougier report that the Group is moving forward with a strategic realignment plan for its operations in Africa, focusing on higher value-added production activities and improving its organization. Alongside this, the Group is preparing to start up its first production operations in the Central African Republic during the first half of 2017.

In February, Rougier also announced their signature of a major contract to supply logs for processing units located in Gabon’s Nkok

Special Economic Zone (SEZ). Under the terms of the partnership agreement between Rougier and the Gabon SEZ, Rougier is committed to deliver 110,000 m3 of okoume logs annually for a seven-year period starting from 15 February 2017. The okoume logs supplied by Rougier will enable the industrial operators based in the Nkok SEZ to make progress with the secondary and tertiary processing of timber, particularly for peeling construction materials, doors and windows, and furniture.

PDF of this article:

Copyright ITTO 2020 – All rights reserved