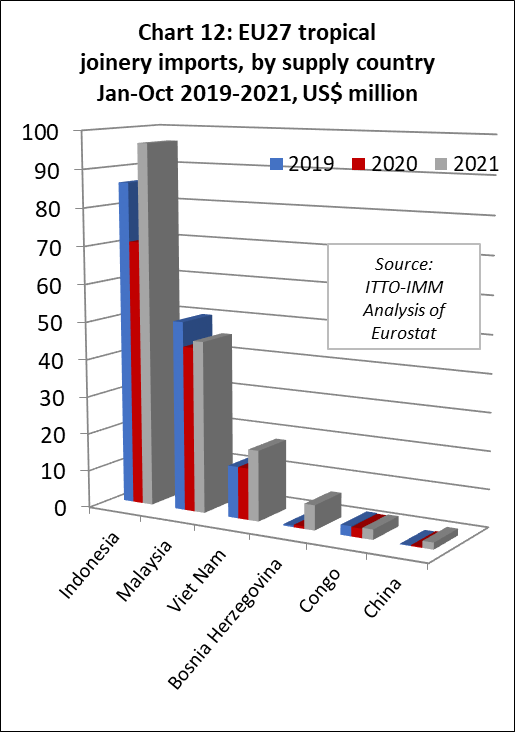

After reaching the highest level for nearly a decade in the first half of 2021, the US dollar value of EU27 imports of wood and wood furniture products from tropical countries declined sharply in July and August. After a brief revival in September, imports fell away again in October (Chart 1).

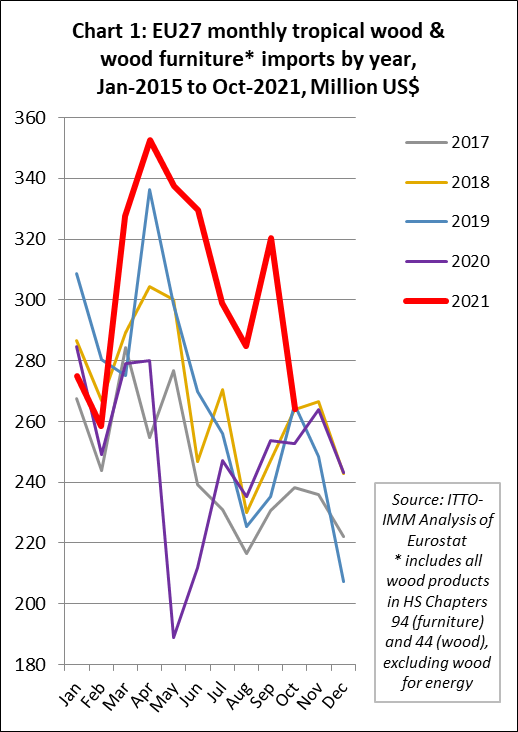

While the value of EU27 imports from the tropics rebounded in 2021, imports from other parts of the world increased at a faster pace so that the long-term decline in market share for tropical countries continued. The decline in share for tropical countries accelerated in the second half of last year (Chart 2).

Total EU27 import value of all wood products and wood furniture in the first ten months of 2021 was US$17.46 billion, 40% more than in the same period in 2020. Import value of all tropical products was US$3.05 billion, 23% more than the same period in 2020. However import value from non-tropical regions was US$14.41 billion, a 44% increase. Imports were up by 39% from China to US$4.55 billion, by 68% from Russia to US$2.80 billion, by 70% from Belarus to US$1.45 billion, and by 58% from Ukraine to US$1.44 billion.

The 40% increase in EU27 import value from the tropics in the first ten months of 2021 was not mirrored by an equivalent increase in import quantity. In quantity terms, imports from tropical countries during the period were 1.46 million tonnes, only 6% more than in 2020 and still 7% down compared to 2019.

A large part of the gain in import value of tropical products was due to a significant rise in prices, partly driven by rising freight rates which were at unprecedented levels in 2021. The Drewry World Container Index shows that global rates for a 40 foot container peaked at over US$10000 in the middle of September 2021 compared to US$2000 in the same month in 2020. At the start of 2022, rates were still at around US$9400 dollars compared to US$5000 at the start of 2021.

FOB prices for tropical wood products were also driven up during 2021 in response to the sharp increase in global demand at a time when supplies were scarce and tropical producers continued to operate under extremely challenging conditions during the pandemic. This in turn encouraged EU27 importers to buy larger quantities from more accessible suppliers in the European neighbourhood and a continued loss of market share for tropical suppliers in the EU market.

Wood furniture drives rise in EU27 import value in 2021

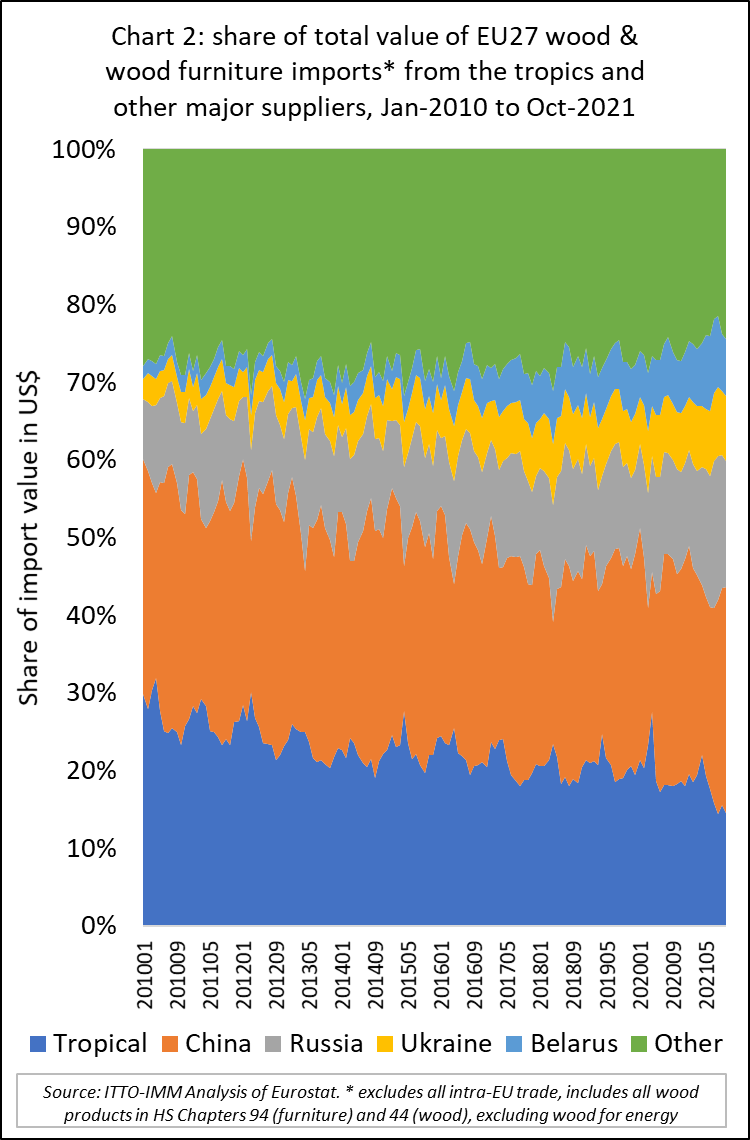

The 2021 increase in the value of EU27 imports from tropical countries was heavily concentrated in wood furniture products. For these products, import value in the first ten months of 2021 was well in excess of imports during the same period in both 2020 and 2019. Although import value of all other wood products from tropical countries was higher in 2021 than in the previous year, for some (including key products like tropical sawnwood and plywood), import value was still below the level prevailing before the COVID pandemic in 2019 (Chart 3).

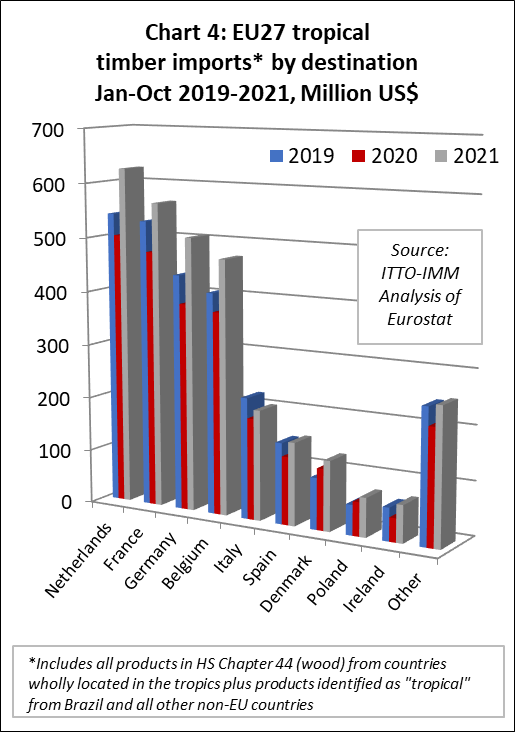

In the first ten months of 2021, import value into all the largest EU27 destinations for tropical wood and wood furniture products was significantly higher than in the same period in 2020. Furthermore, of the largest markets, only in Italy was import value in the first ten months of 2021 less than in the same period in 2019 before the pandemic (Chart 4).

EU recovery expected to continue but significant downside risks are emerging

Longer term market prospects in the EU27 look reasonable as the economic expansion in the region is expected to continue, but there are significant downside risks. According to the EU’s latest Autumn 2021 forecast, the EU economy is expected to have grown by 5% in 2021 and to maintain growth of 4.3% this year before easing to 2.5% in 2023.

While strong domestic demand is expected to continue to fuel economic expansion in the EU, the forecast recovery is heavily dependent on the uncertain evolution of the pandemic, both within and outside the EU. The improving health situation, which allowed the economy to bounce back in 2021, is now being challenged by rising infections linked to the Omicron variant across the EU. For now, hospitalisations and deaths associated with COVID-19 infections remain low compared to previous waves. But they are slowly rising, posing a risk to economic prospects.

Inflation is another source of uncertainty for the European economy. As in other parts of the world, surging prices are hitting customers across the region with soaring food and energy bills. Germany, Europe’s largest economy, saw the biggest price increase for almost 30 years in December, beating forecasts. In Italy, economists have said the recovery could be muted in 2022 by rising prices, especially fuel prices. Poland has also reported a high inflation not seen over the past 20 years.

Supply bottlenecks and combined with rising demand, boosted by government stimulus measures, have caused consumer prices to rise. Rising energy prices and disruptions in global logistics, leading to severe shortages and price increases of key raw and intermediate inputs, is also holding back manufacturing across the EU. While this may be only a temporary phenomenon as supply bottlenecks are widely expected to ease in the course of 2022, an inflation rate of below 2 percent is not expected until 2023.

At the same time, activity in the construction sector in the EU, a key driver of timber demand in the region, remains fragile. The IHS Markit Eurozone Construction Index gradually increased from 49.5 in August last year to 53.3 in November before slipping to 52.9 in December. Overall, the recent trend has been positive but, with 50.0 being the dividing line between contraction and growth, the index implies that sentiment in the sector is very mixed.

The rise in eurozone construction activity in the last quarter of 2021 was led by a marked upturn among Italian companies. French firms recorded a softer rate of growth, while Germany noted a sustained decrease. Overall though, in December last year new orders placed with eurozone construction companies expanded at the fastest pace since February 2019 at the end of 2021. Anecdotal evidence pointed to new projects coming to tender amid sustained government incentives for the sector. Meanwhile, a majority of eurozone construction companies continued to cite higher raw material prices due to widespread supply shortages.

Rising EU27 wood furniture imports from Vietnam, Indonesia, and India

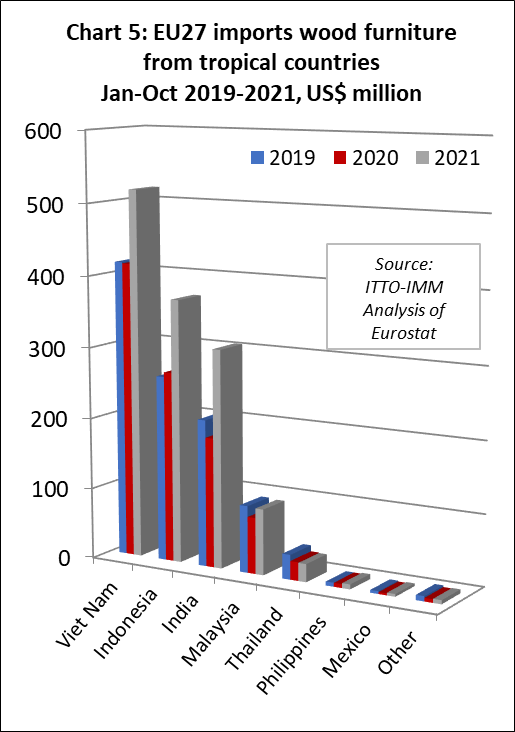

In the first ten months of 2021, EU27 import value of wood furniture from tropical countries was US$1.33 billion, 35% and 29% higher than the same period in 2020 and 2019 respectively. For all three leading tropical supply countries of wood furniture to the EU27 – Vietnam, Indonesia, and India – import value in the first ten months of 2021 was higher even than in 2019 before the pandemic.

After a slow start to the year, the value of EU27 wood furniture imports from Vietnam and Indonesia increased sharply from the second quarter onwards. By the end of the first ten months, import value was up 25% from Vietnam to US$518 million, and up 38% from Indonesia to US$370 million. Imports from India, which were consistently high throughout the first ten months of 2021, totalled US$306 million during this period, 68% greater than the same period in 2020.

In contrast, EU27 imports from Malaysia were very strong in the first half of 2021 but slowed sharply in the second half of the year. Imports from Malaysia in the first ten months of 2021 totalled US$92 million, 17% more than the same period in 2020 but 2% less than the same period in 2019. Imports from Thailand were US$25 million in the first ten months of 2021, 3% less than the same period in 2020 and down 27% compared to 2019 before the pandemic (Chart 5).

EU27 imports of tropical sawnwood still below pre-COVID level

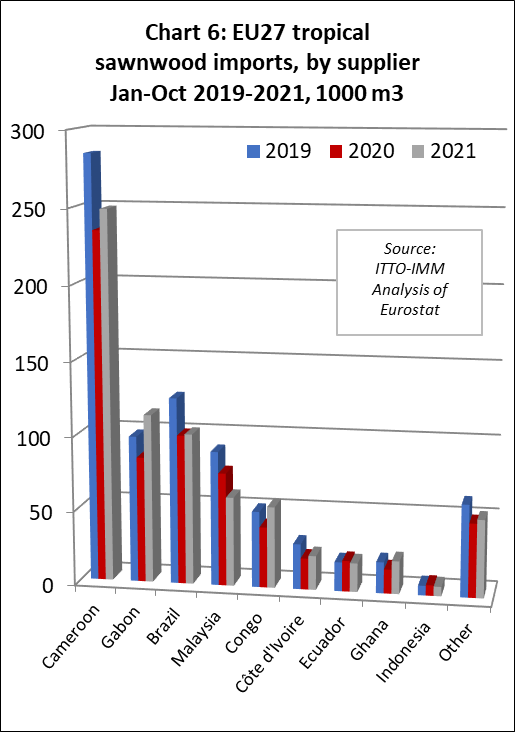

In the first ten months of 2021, EU27 import value of tropical sawnwood was US$602 million, up 10% on 2020 but down 7% compared to 2019. In quantity terms, imports of 700,300 cu.m in the first ten months were 8% higher than the same period in 2020 but still down 11% compared to the same period in 2019 before the pandemic.

Imports of 248,600 cu.m from Cameroon in the first ten months of 2021 were 6% higher than the same period in 2020 but still 13% down compared to 2019. Imports of 101,300 cu.m from Brazil were up 1% compared to 2020 but down 19% compared to 2019.

Sawnwood imports from Gabon and Congo fared better during the first ten months of 2021. Imports from Gabon, at 113,300 cu.m, were up 34% on 2020 and up 15% compared to 2019. For the Congo, imports were 54,600 cu.m in the ten month period, up 34% on 2020 and 7% on 2019.

Imports of sawnwood from Côte d’Ivoire were 22,900 cu.m in the first ten months of 2021, up 9% compared to 2020 but down 25% on 2019. The long term decline in EU27 imports of sawnwood from Malaysia continued in the first ten months of 2021, at 59,800 cu.m 21% less than the same period in 2020 and 34% down on 2019 (Chart 6).

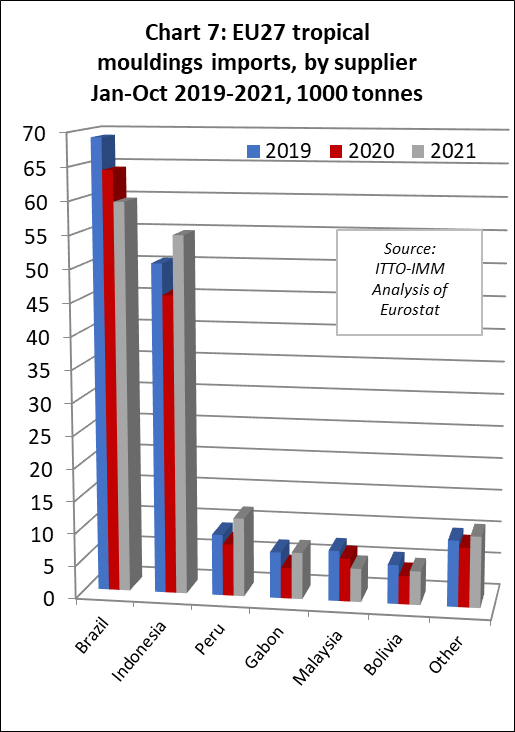

In the first ten months of 2021, EU27 import value of tropical mouldings/decking was US$271 million, up 23% and 1% compared to 2020 and 2019 respectively. In quantity terms, tropical mouldings/decking imports increased 8% to 154,800 tonnes in the first ten months of 2021 compared to the same period the previous year. However import quantity was still down 3% compared to 2019. Imports of 59,600 tonnes from the largest supplier Brazil, were 7% down on the same period in 2020 and 14% less than in 2019.

Despite widespread reports of supply shortages for Indonesian bangkirai decking, imports of mouldings/decking from Indonesia were 54,800 tonnes during the first ten months of 2021, 20% more than the same period in 2020 and 9% more than in 2019. Imports of mouldings/decking from Peru were 12,000 tonnes, 51% more than in 2020 and 28% up on 2019. Sawnwood imports from Gabon were 7,200 tonnes in the first ten months of 2021, 52% more than the same period in 2020 and 1% more than in 2019. Imports from Malaysia were 5,100 tonnes in the first ten months last year, 22% less than in 2020 and 34% down compared to 2019 (Chart 7).

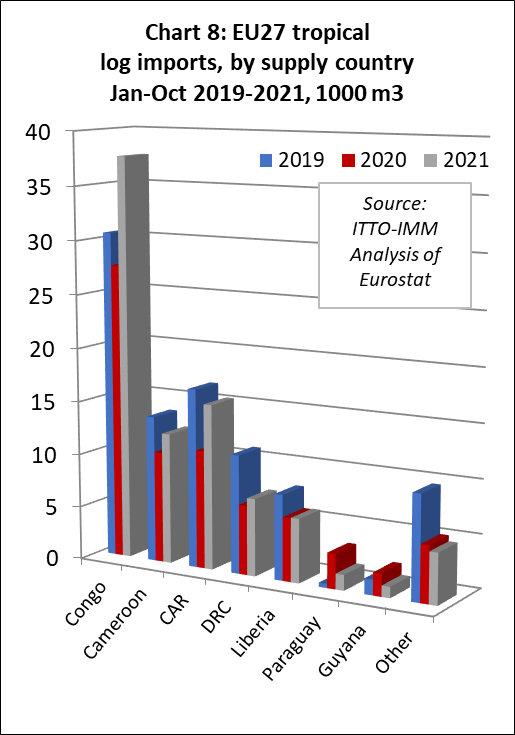

In the first ten months of 2021, EU27 import value of tropical logs was US$47 million, 30% up on 2020 and 3% more than in 2019. In quantity terms, imports of 85,800 cu.m were 19% more than the same period in 2020 but 6% less than the same period in 2019. Imports of 37,700 cu.m from Congo, now by far the largest supplier of tropical logs to the EU, were 37% more than the same period in 2020 and 23% more than the same period in 2019. Imports in the first ten months of 2021 from all other leading supply countries – CAR (15,400 cu.m), Cameroon (12,200 cu.m), DRC (7,200 cu.m), and Liberia (6,000 cu.m) – were all more than the same period in 2020 but still down on the level of 2019 before the pandemic.

Only marginal gains in EU27 imports of tropical veneer and plywood

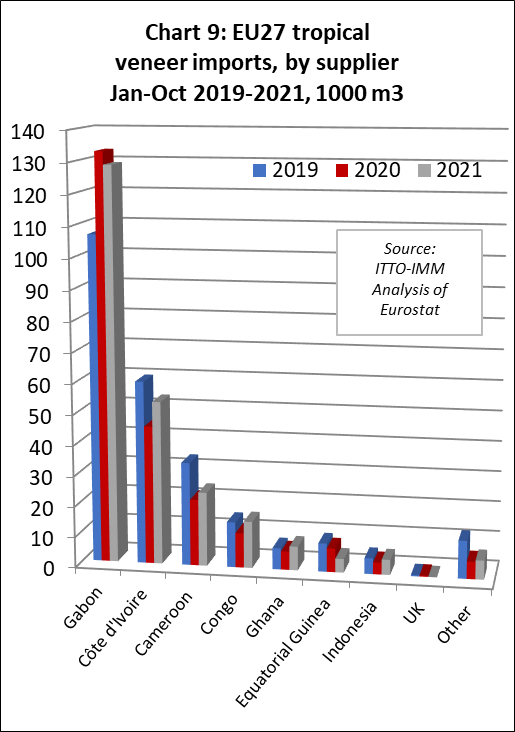

In the first ten months of 2021, EU27 import value of tropical veneer was US$168 million, 11% more than the same period in 2020 and a 1% gain compared to 2019. In quantity terms, imports were 245,200 cu.m in the first ten months of 2021, a gain of 4% compared to 2020 but 2% less than in 2019.

After a rapid rise in 2020, veneer imports from Gabon were 128,800 cu.m in the first ten months of 2021, down 3% compared to 2020 but still 21% more than in 2019. At 53,400 cu.m, veneer imports from Côte d’Ivoire were 18% more than in 2020 but still down 11% compared to 2019. Imports of 24,200 cu.m from Cameroon were 12% more than in 2020 but 28% less than in 2019. Veneer imports from Congo were 15,300 cu.m in the first ten months of 2021, 35% and 3% more than the same period in 2020 and 2019 respectively (Chart 9).

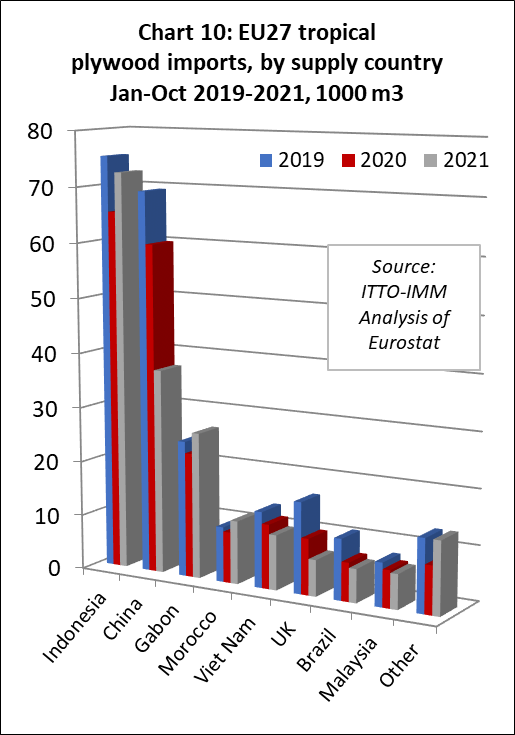

In the first ten months of 2021, EU27 import value of tropical plywood was US$135 million, up 11% compared to 2020 but down 8% on 2019. In volume terms, imports of 190,300 cu.m in the first ten months of 2021 were 6% less than the same period in 2020 and 22% down compared to 2019.

EU27 tropical hardwood plywood imports from Indonesia, the largest supplier, made up some lost ground in the second half of 2021 after a slow start in the first half of the year. Imports from Indonesia were 72,500 cu.m in the first ten months of 2021, 11% more than the same period in 2020 but still 4% down compared to 2019.

There were also positive trends in EU27 imports of tropical hardwood plywood from Gabon and Morocco in the first ten months of 2021. Imports from Gabon were 26,600 cu.m during the period, 17% more than the same period in 2020 and 7% more than in 2019. Imports from Morocco were 11,500 cu.m, 24% and 15% more than the same period in 2020 and 2019 respectively.

In contrast, imports of tropical hardwood faced plywood from China were 37,300 cu.m in the first ten months of 2021, 38% less than the same period in 2020 and 46% down compared to 2019. EU27 imports of tropical hardwood plywood from Vietnam, Malaysia and Brazil, and indirect imports from the UK, all continued to slide in the first ten months of 2021 (Chart 10).

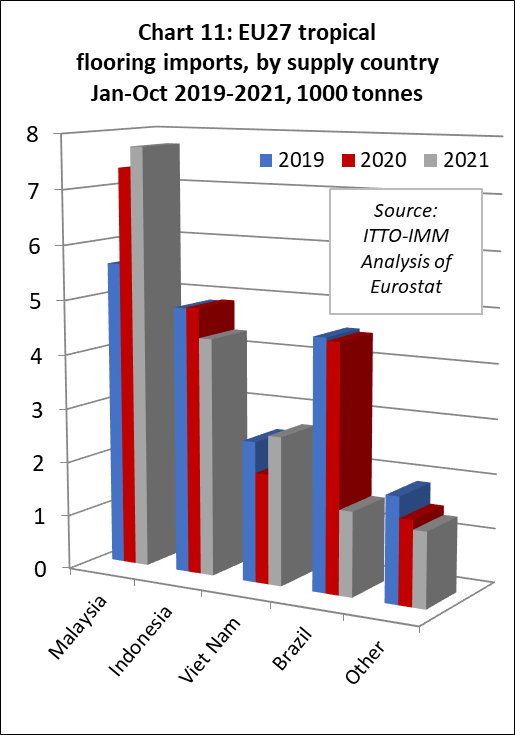

Rise in EU27 imports of tropical flooring from Malaysia continues

In the first ten months of 2021, EU27 import value of tropical flooring products was US$52 million, equivalent to the same period in 2020 and 2% more than in 2019. However in quantity terms, imports of 17,800 tonnes in the first ten months of 2021 were 13% down compared to 2020 and 9% less than in 2019. The rise in EU27 wood flooring imports from Malaysia, that began in 2020, continued into 2021. Imports of 7,750 tonnes from Malaysia in the first ten months of 2021 were 5% more than the same period in 2020 and 38% greater than in 2019. Imports of 2,730 tonnes from Vietnam during the ten month period were also 35% greater than in 2020 and 6% more than in 2019.

In contrast, flooring imports from Indonesia of 4,400 tonnes in the first ten months of 2021 were 11% less than the same period in both 2020 and 2019. Imports from Brazil also continued to slide last year, at just 1,550 tonnes in the first ten months, 66% down compared to both 2020 and 2019 (Chart 11).

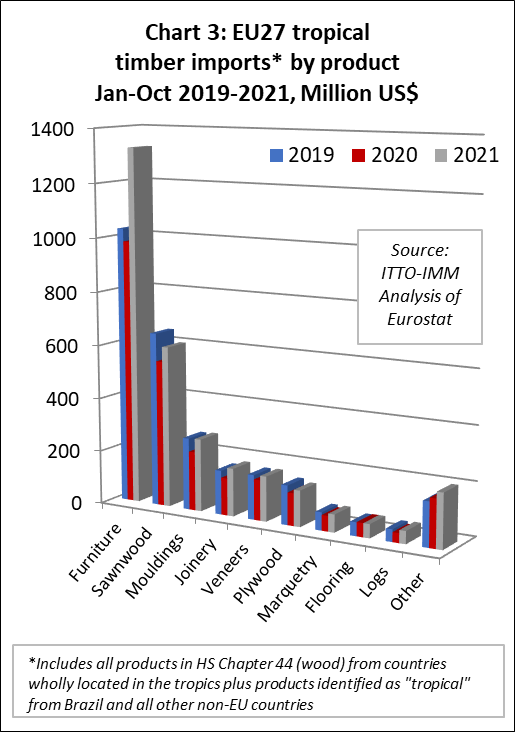

The value of EU27 imports of other joinery products from tropical countries – which mainly comprise laminated window scantlings, kitchen tops and wood doors – increased 28% to US$179 million in the first ten months of 2021. Imports were up 37% to US$97 million from Indonesia, up 4% to US$46 million from Malaysia, and up 37% to US$19 million from Vietnam. In the case of Indonesia and Vietnam, import value of these joinery products also exceeded the pre-pandemic level in 2019.

In 2021, the EU27 has also began to import joinery products manufactured using tropical hardwood from Bosnia. Import value from Bosnia was US$6.6 million in the first ten months of 2021, up from a negligible level the previous year (Chart 12).