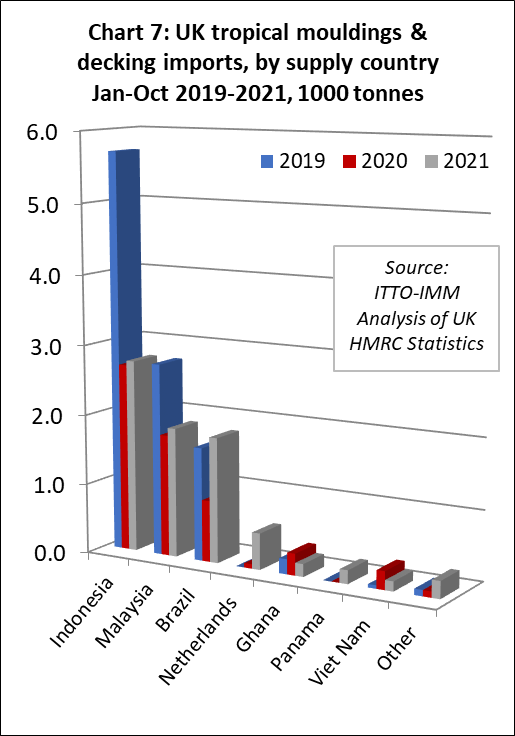

The UK imported tropical wood and wood furniture products with a total value of USD1.1 billion in the first ten months of 2021, a 38% increase compared to the same period in 2021. Import value to end October this year was also 4% more than the same period in 2019 before onset of the COVID pandemic. Following the sharp increase in April this year, when import value was at the highest monthly level since before the financial crises of 2008 – 2009, imports declined only slightly from this peak between May and October (Chart 1).

This year the UK has experienced a very robust rise in construction sector activity and in timber trade and consumption. There has been a welcome rebound from the lows of last year in the value of wood product imports from tropical countries into the UK, and importers are benefiting from strong sales, high prices and larger margins. The main constraints to increased imports this year have been on the supply side.

The latest UK Construction Products Association (CPA) Trade Survey shows construction continued to expand during the third quarter of this year, with private housing and repairs, maintenance and improvement leading the industry. Much of the activity in these sectors has been sustained by government housing policies, an increase in the disposable income across households in the UK, and a homeworking trend that has been driving demand for greater or improved outdoor and office space.

According to the Building Merchants Building Index (BMBI), UK sales of timber were at their highest ever level and performing better than all other building material categories in the third quarter of 2021. Sales were 5% higher than the previous quarter, 44% up on the same quarter the previous year and 49% higher than the same quarter in 2019. According to the UK Timber Trade Federation, longer term prospects for timber demand in the UK are good, but short term logistical issues are putting severe strain on supply.

While UK construction activity remained robust in the third quarter, the latest UK Office of National Statistics data indicates that activity declined by 1.8% in October compared to September, the sharpest fall since the initial COVID lockdown in March 2020. The main reason for the downturn was shortages in the supply and sharp increases in prices of key construction materials, including timber, due to a combination of ongoing COVID restrictions, Brexit delays and shipping hold-ups. The volatile price and supply environment was hindering new business as construction companies revised cost projections and some clients delayed decisions on contract awards.

However, the latest IHS Markit/CIPS UK Construction Purchase Managers Index (PMI) for November suggests that the downturn in October was short-lived. At 55.5 in November, up from 54.6 in October, the PMI signalled a robust and accelerated expansion of overall construction activity in the UK during the month (any number over 50 indicates growth).

According to Tim Moore, director at IHS Markit, “November data highlighted a welcome combination of faster output growth and softer price inflation across the UK construction sector. Commercial building led the way as recovering economic conditions ushered in new projects, which helped compensate for the recent slowdown in house building”.

Tim Moore also noted that “input price inflation remains extremely strong by any measure, but it has started to trend downwards after hitting multi-decade peaks this summer. The latest rise in purchasing costs was the slowest since April, helped by a gradual turnaround in supply chain disruption and a slight slowdown in input buying. Port congestion and severe shortages of haulage capacity were again the most commonly cited reasons for longer lead times for construction products and materials.”

Recovery in UK tropical furniture imports continues

Overall the UK imported USD630 million of tropical wood furniture products in the first ten months of this year, 40% more than the same period in 2020, but just 4% more than the same period in 2019. After a slow first quarter this year, when lockdowns once again disrupted trade, imports strengthened considerably in the second quarter to reach monthly highs not seen for over a decade. The pace of imports slowed only a little in the third quarter.

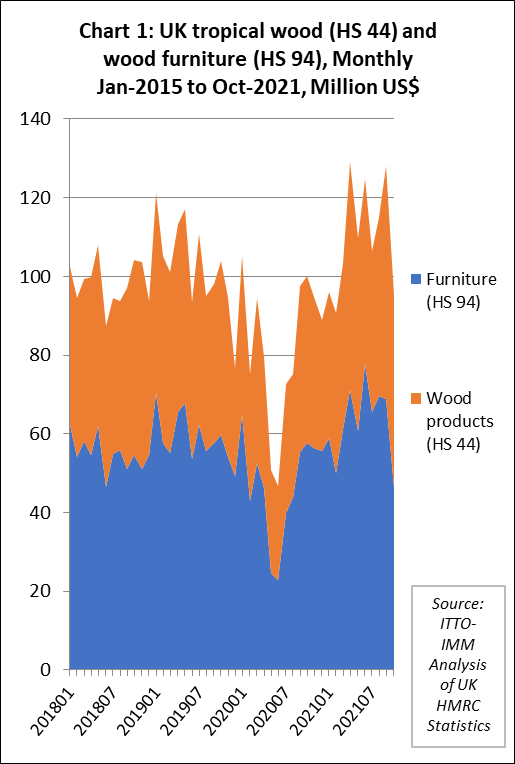

Overall during the first ten months of 2021 compared to the same period last year, UK wood furniture imports were up from all the leading tropical supply countries to this market; Vietnam (+39% to USD300 million), Malaysia (+15% to USD112 million), Singapore (+75% to USD65 million), India (+94% to USD62 million), Indonesia (+53% to USD62 million) and Thailand (+4% to USD15 million).

While gains were made across the board when compared to the depressed levels of 2020, wood furniture import value in the first ten months of 2021 was still trailing the pre-pandemic 2019 level from Vietnam (-5%), Malaysia (-12%), and Thailand (-20%). In contrast, imports were significantly higher than in 2019 from India (+40%), Indonesia (+9%), and Singapore (+148%). Singapore has become more important as a supply hub due to logistical problems elsewhere during the pandemic (Chart 2).

UK tropical joinery imports exceed pre-pandemic level

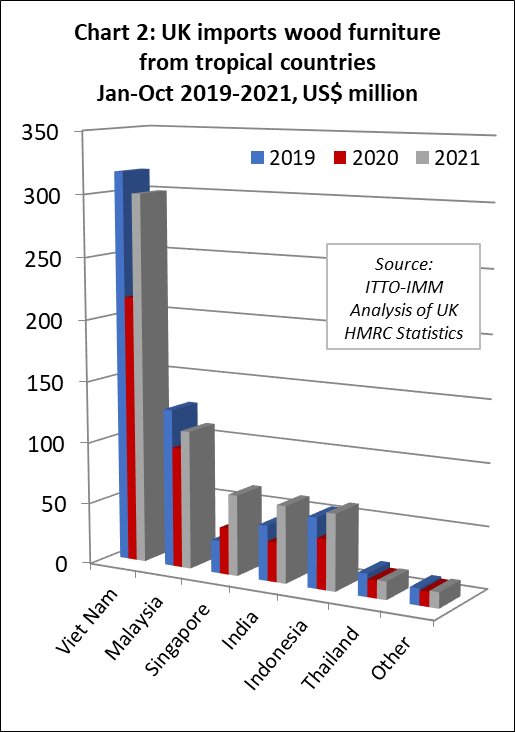

UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes was USD469 million in the first ten months of 2021, 35% more than the same period last year and 3% up on the same period in 2019.

Comparing UK import value in the first ten months of 2021 with the same period in 2020, tropical joinery was up 46% at USD186 million, tropical plywood was up 38% at USD147 million, tropical sawnwood was up 10% at USD70 million, and tropical mouldings/decking was up 47% at USD21 million.

While import value of tropical joinery in the first ten months of this year was also up 29% on the pre-pandemic level in 2019, UK import value of all other HS 44 tropical wood products was significantly behind the 2019 level, including plywood (-9%), sawnwood (-15%), and mouldings/decking (-9%) (Chart 3).

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in Q2 2020, imports gradually built momentum until March this year and then surged in the second quarter. Imports from Indonesia (mainly wooden doors) continued to rise in the third quarter but imports from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) slowed during this period.

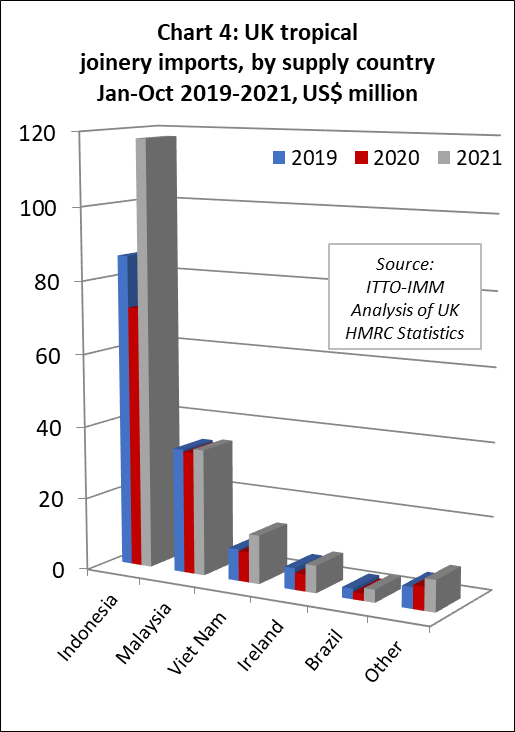

Joinery product imports from Indonesia were USD118 million in the first ten months of 2021, 64% more than the same period last year and 37% up on the same period in 2019. Imports from Malaysia were USD35 million between January and October this year, 3% more than the same period in 2020 and 2% up on the same period in 2019. Joinery product imports of USD13 million from Vietnam were 62% more than in the same period in 2020 and 60% more than the same period in 2019 (Chart 4).

UK tropical plywood imports still at low levels

In contrast to joinery products, UK imports of tropical hardwood plywood have remained at relatively low levels this year. In the first ten months of 2021, the UK imported 250,900 cu.m of tropical hardwood plywood, which is 16% more than the same period in 2020 but still down 18% compared to the same period in 2019.

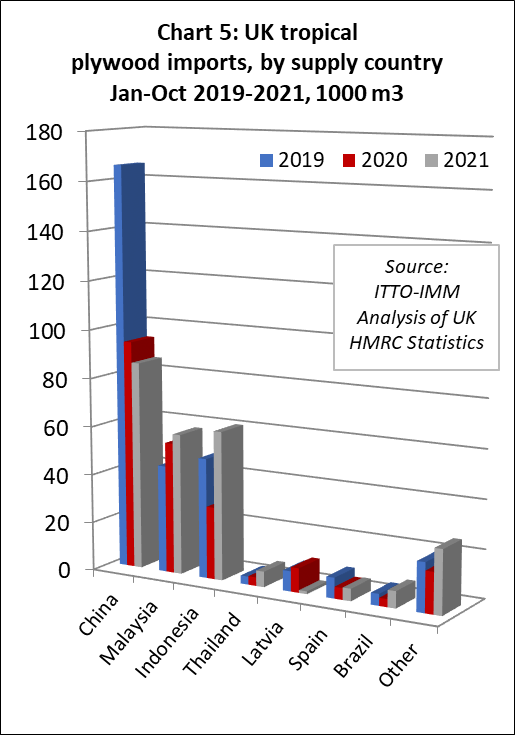

Imports from the UK’s three largest suppliers of tropical hardwood plywood – China, Indonesia and Malaysia – have followed very different trajectories this year (Chart 5). The UK imported 85,800 cu.m of tropical hardwood faced plywood from China in the first ten months of this year, down 9% compared to the same period in 2020 and 48% less than the same period in 2019.

In contrast, Malaysian plywood has made gains in the UK market this year, imports of 58,000 cu.m in the first ten months being 7% more than the same period in 2020 and 31% up on the same period in 2020. But these gains are being made against historically very low levels after a long period of decline in UK imports of Malaysia plywood in the years before 2019.

This year, UK imports of plywood from Indonesia have also rebounded from the lows of 2020 this year, a trend which gained momentum in the third quarter. Plywood imports of 61,300 cu.m from Indonesia in the first ten months of this year are 106% more than the same period in 2020 and 24% more than the same period in 2019.

As for other hardwood product groups, UK demand for tropical hardwood plywood has been strong this year, driven by high levels of construction activity and shortages of competing materials. The main market challenges have been on the supply side, notably the considerable escalation in freight rates on Asian routes to the UK. A 40ft container from Malaysia or Indonesia as late as last autumn cost $1500 -$2000. By Q2 2021 UK importers were being quoted over $15,000 and rates have remained at these record high levels in the second half of the year.

This has encouraged a partial switch to breakbulk shipments out of Southeast Asia into the UK, although this has proved a challenging option. When the breakbulk vessel Konya arrived into the port of London from Malaysia in summer this year, the first such arrival for 30 years, it took weeks to discharge the cargo, partly as the port was so busy and partly because personnel weren’t used to the work.

Supply issues constrain UK imports of tropical sawnwood

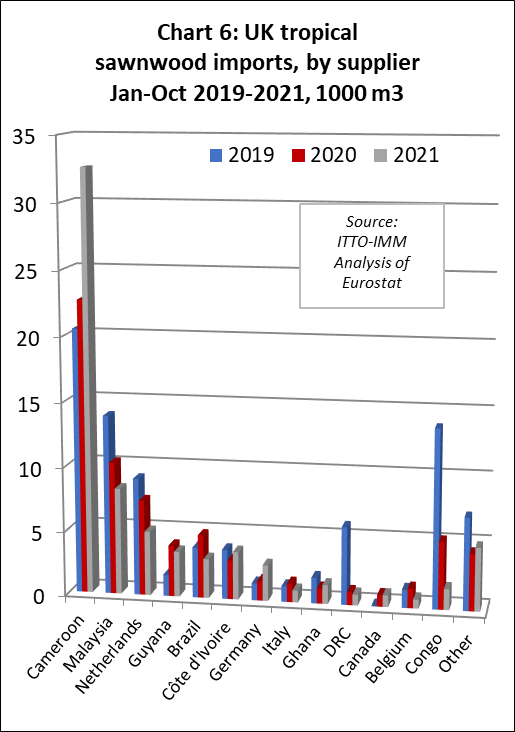

After falling sharply in May and June last year, UK imports of tropical sawnwood slowly increased during the course of the next 12 months, but the pace of increase began to slow again in the third quarter of 2021. Throughout this period, the rebound in UK tropical sawnwood imports has been impaired by significant logistical problems on the supply side. UK imports were 70,100 cu.m in the first ten months of 2021, just 1% more than the same period in 2020 and 18% less than the same period in 2019. Although imports from Cameroon, now by far the leading supplier of tropical sawnwood to the UK, were up 44% on 2021 and up 60% on 2019 during the ten month period, imports from nearly all other leading tropical sawnwood supply countries have remained weak this year (Chart 6).

The large increase in imports of sawnwood from Cameroon this year reflects the long lead time in shipment of contracts placed back in 2020. UK importers report that securing supplies for hardwoods from Cameroon and other African supply countries has continued to be very challenging. While iroko is currently reported by UK importers to be more readily available, utile is described as ‘very scarce’. There are differing views on sapele supply, with some importers reporting they have secured sufficient volume while others have been unable to do so.

UK imports of tropical sawnwood from Côte d’Ivoire were 3,700 cu.m in the first ten months of this year, 22% more than the same period in 2020 but still down 4% on the same period in 2019. The UK was previously a significant buyer of framire from Côte d’Ivoire but UK importers report that this species is proving increasingly difficult to source, both due to a lack of raw material in the forest and the challenges of obtaining assurances of legality that satisfy UK Timber Regulation requirements.

Meanwhile, UK imports of tropical sawnwood from both the Republic of Congo and DRC have fallen to a trickle since the start of the pandemic. Imports from the Republic of Congo were just 1,614 cu.m in the first ten months of the year, down 69% and 88% compared to the same period in 2020 and 2019 respectively. Imports from DRC were 836 cu.m during the 10 month period, which is 17% less than in 2020 and 86% down compared to 2019.

After an extremely slow start to the year brought on by pandemic induced production problems and extreme shortages of containers, UK imports of tropical sawnwood from Malaysia picked up a little during the summer with the arrival of breakbulk shipments of Asian meranti and keruing lumber into the UK. UK imports of Malaysian sawnwood were 8,235 cu.m in the first ten months of 2021. That is still 19% less than the same period last year and 41% down on the same period in 2019.

With shortages in supply from other sources, UK importers were turning more to South America in the opening months of this year. Imports from Brazil were quite good in the first quarter but ground to a halt in the second and third quarters. By the end of the first ten months, total UK imports of tropical sawnwood from Brazil were just 3,000 cu.m, 38% less than the same period last year and 22% down compared to 2020. Imports from Guyana have been slightly more robust, at 3,500 cu.m in the first ten months this year, 12% less than the same period in 2020 but double the volume imported in the same period in 2019.

Indirect UK imports of tropical sawnwood from other EU countries have fallen dramatically this year. Total UK imports from EU countries were 11,400 cu.m in the first ten months of 2021, 16% less than the same period last year and 35% down on the same period in 2019.

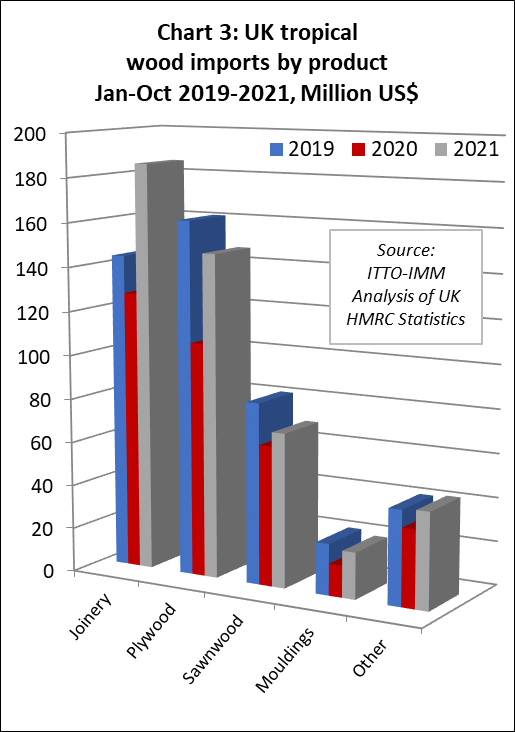

The UK imported 7,700 tonnes of tropical hardwood mouldings/decking in the first ten months of 2021, 28% more than the same period in 2020 but still 26% less than the same period in 2019. The arrival of the first breakbulk shipments into the UK this year boosted imports a little from Indonesia, which at 2,800 tonnes in the first ten months were 3% more than the same period in 2020, but still down 52% compared to 2019. Similarly, imports from Malaysia, at 1,900 tonnes, were 7% more than the same period in 2020 but 33% less than in 2019. Imports of decking products from Brazil have also picked up a little, at 1,800 tonnes in the first ten months, around twice the quantity imported during the same period last year and 11% more than in 2019 (Chart 7).

The UK market is currently suffering from severe lack of availability of tropical hardwood decking, due both to the freight hikes and also to suppliers preferring to sell the limited stocks they have available to other markets. This has encouraged some UK importers to purchase more tropical decking from importers in the Netherlands. The UK imported 520 tonnes of tropical hardwood decking from the Netherlands in the first ten months of this year when previously very little was sourced from there.