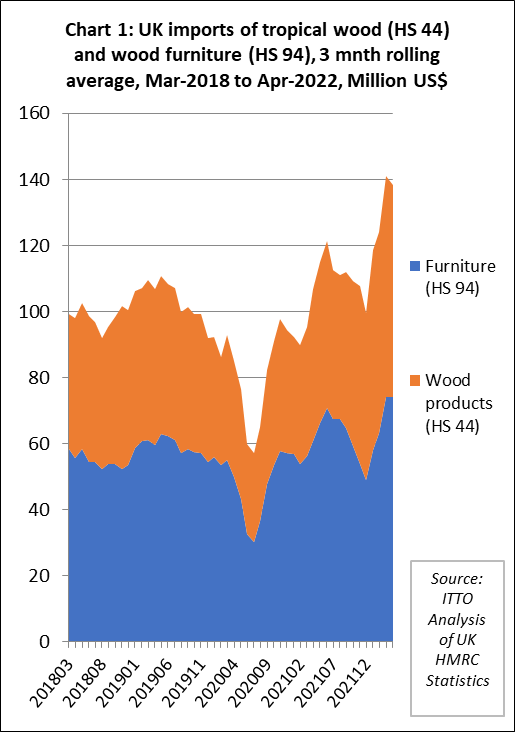

The import value of tropical wood and wood furniture into the UK in the opening four months of this year were at an unprecedented level of USD565 million (Chart 1). That is 36% more than the same period in 2021 when imports were also high following a strong rebound after the downturn during the first COVID lockdown in 2020. In fact, this was by far the strongest start to the year in terms of UK import value of tropical wood and wood furniture products since at least before the 2008 financial crises. It compares to an average import value of less than USD380 million for the January to April period throughout the whole decade prior to the onset of the pandemic in 2019.

The rise in UK import quantity of tropical wood and wood furniture was much less dramatic in the first four months of this year, at 118,000 tonnes, just 10% more than the same period in 2021. This shows that price inflation was the major factor behind the rise in import value. Significant weakening of the value of the GBP on foreign exchange markets since the end of April, combined with the wider geo-political situation, implies that price inflation will remain a key issue for UK importers in the months of ahead. It also indicates that the current boom in UK imports may well be short-lived.

Availability of hardwood and furniture products from the UK’s traditionally largest suppliers in Europe has become even more challenging since Russia’s invasion of Ukraine in the last week of February, encouraging UK importers to look more to tropical products. COVID lockdowns have also seriously disrupted availability of manufactured wood products from China.

Hardwood product prices were declining steadily from the middle of last year to February this year. Even in February prices remained at historically high levels and the downward trend has reversed since Russia’s invasion of Ukraine. UK government figures indicate that average timber prices at point of sale to UK building firms were 30% up in the year to April 2022, compared with a year earlier.

Freight rates also declined from the heights reached in the third quarter of last year but are still at an historically very high level. For example, the cost of a 40ft container from China into the UK was $11,000 at the start of this month, less than its peak of $14,700 in October, but a huge rise from $1,500 in summer 2020.

The war in Ukraine has seriously disrupted all supplies of European and Russian hardwood products, partly because of the direct effects of sanctions against Russia, partly the immediate effects of the war on Ukrainian supply, and partly because of the large numbers of Ukrainians, who contribute a disproportionately large number of truck drivers operating in Europe, who returned home during the conflict. The war has also driven up energy costs, filtering through into rising prices for all European manufactured products, including for wood and furniture.

While higher import prices were the major driver of increased UK import value in the opening months of this year, the trend was partly due to continuing high consumption in the UK, supported by post-COVID government stimulus. Demand during this period was particularly strong in housing repair, maintenance, and improvement, a major source of hardwood demand and the fastest growing part of the UK construction sector following the initial COVID lockdown.

According to the UK Construction Products Association latest survey, nearly half of materials firms in the UK said sales had jumped in the first three months of 2022 compared to the fourth quarter of last year. Increased sales were reported by around 50% of so-called “light side” manufacturers of products like windows, doors and kitchens.

However, prospects for the UK economy for the rest of this year are far from promising. Economists have said it is increasingly likely that the UK will sink into recession this year. In June, the Paris-based OECD cut its UK growth forecast for 2023 to zero, the lowest in the G20. Also in June, the Bank of England raised interest rates to 1.25 per cent to tackle fast rising inflation, which is expected to reach 11% by October.

The latest S&P Global / CIPS UK Construction Purchasing Managers Index (PMI) report for May indicates that the wider economic slowdown is beginning to filter through into declining UK construction sector activity. The report notes that “Though still offering a comfortable margin above the no change mark, the construction sector saw growth ease to a four-month low with the usual suspects taking the heat out of the recovery – elevated inflation, future uncertainty and supply-chain disruption”.

The PMI report goes on to say that “The UK housing sector in particular showed further signs of fragility with the worst performance since May 2020 and moving closer to the danger zone of negative territory. Affordability concerns will be weighing on the mind of potential house buyers grappling with escalating costs for everyday items, resulting in a postponement of big purchases until the UK economy shows more resilience”. Furthermore “”The lack of positive sentiment was also reflected in construction companies’ confidence over the next 12 months, with optimism dropping to the weakest since August 2020”.

The PMI report also suggests that recent strong material purchases in the UK construction sector are partly driven by a desire to beat anticipated price increases in the months ahead as inflation rates are exceedingly high.

Indonesia leads rise in tropical wood furniture imports into the UK

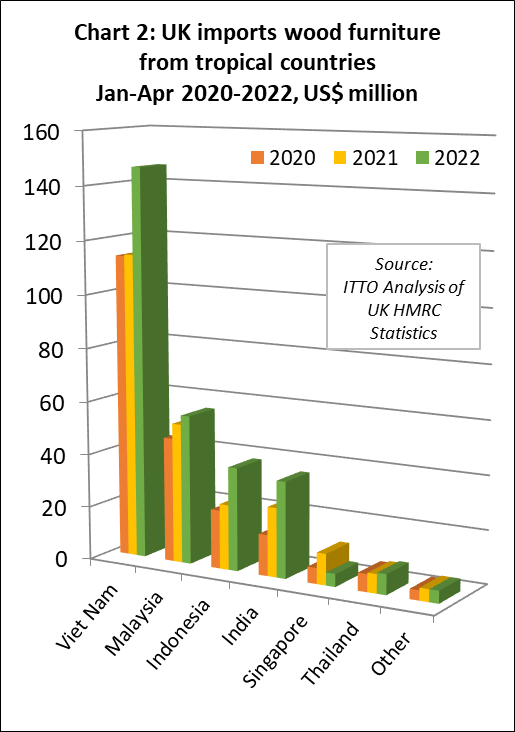

The UK imported USD284 million of tropical wood furniture products in the first four months of 2022, which is 23% more than the same period in 2021. In quantity terms, wood furniture imports were 64,000 tonnes during the four month period, the same level as the previous year. This indicates that the rise in value was driven more by price inflation than strong demand. Import value increased from all four of the leading tropical supply countries to this market in the opening four months of this year compared to last including Vietnam (+28% to USD147 million), Malaysia (+7% to USD56 million), Indonesia (+59% to USD39 million) and India (+39% to USD36 million). Imports from Singapore, which increased sharply last year due to shipping problems elsewhere in Southeast Asia, fell back 59% to more a “normal” level of just USD5 million in the four month period (Chart 2).

UK tropical wood imports up 72% in the first two months of 2022

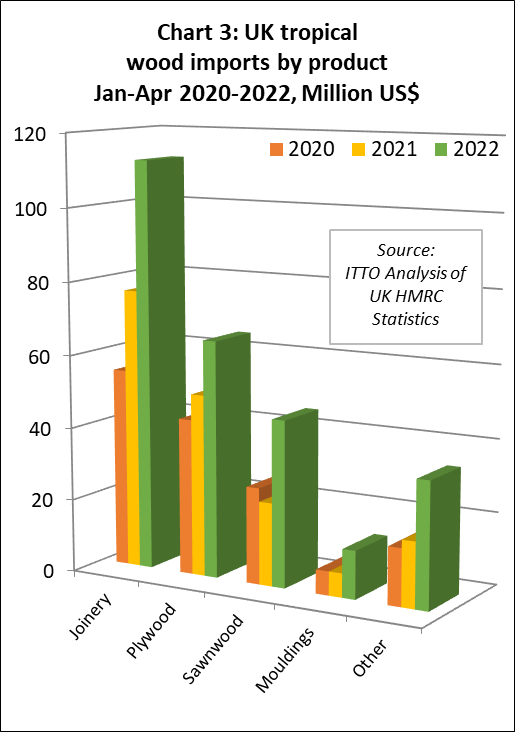

Total UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes were USD271 million between January and April this year, 55% more than the same period in 2022. In quantity terms imports increased 16% to 118,000 tonnes during the period. Compared to the first four months last year, UK import value of tropical joinery products increased 46% to USD112 million, import value of tropical plywood was up 30% to USD65 million, import value of tropical sawnwood increased 100% to USD46 million, and import value of tropical mouldings/decking also increased 100% to USD13 million (Chart 3).

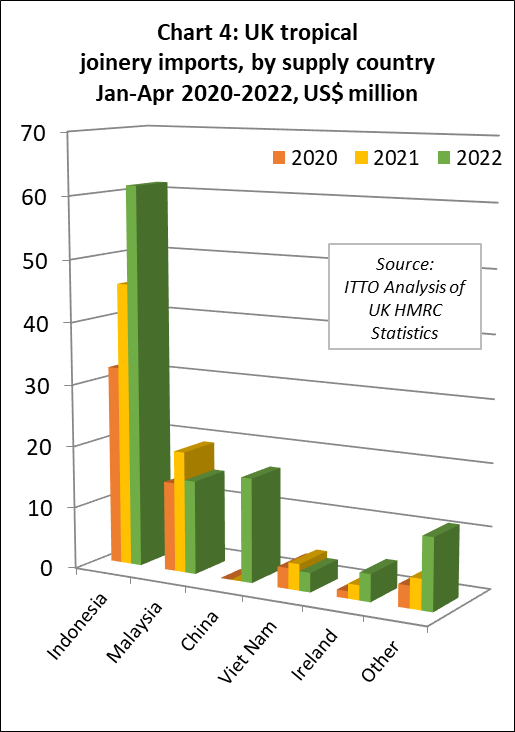

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in the second quarter of 2020, imports of this commodity group have progressively built momentum. This trend is mainly driven by Indonesia for which UK joinery imports, mainly consisting of doors, were USD61 million in the first four months this year, 34% more than the same period in 2021 (Chart 4). In quantity terms, UK joinery imports from Indonesia were 19,000 tonnes in the first four months of this year, 6% more than the same period in 2021.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) started this year more slowly. Import value from Malaysia was USD15 million in the January to April period, 23% less than the same period last year. In quantity terms, imports from Malaysia were 4,800 tonnes, 35% less than the same period in 2021. Joinery imports from Vietnam of 834 tonnes valued at USD3 million were respectively 39% and 26% less than the same period last year.

UK imports of Chinese tropical joinery products, nearly all comprising doors, were 6,200 tonnes with value of USD17 million in the first four months of 2022, up from negligible levels in previous years. Due to introduction from 1st January 2022 of new product codes in the EU Combined Nomenclature (still mirrored by the UK post-Brexit) it is now possible to identify wood doors and windows manufactured using a wider range of tropical wood species in UK and EU trade statistics. The apparent rise in imports of “tropical” wood joinery from China is very likely due to these products now being identifiable as of tropical species, whereas previously they were classified as “other non-coniferous” in the trade statistics and excluded from the figures for tropical wood imports.

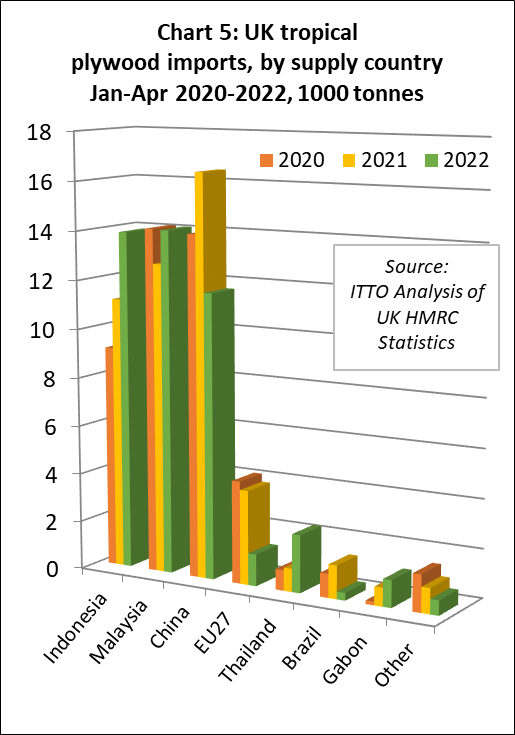

In the first four months of 2022, the UK imported 45,400 tonnes of tropical hardwood plywood, 6% less than the same period last year. Tropical hardwood plywood imports from Indonesia have made gains this year, while imports from China have continued to slide (Chart 5).

The UK imported 13,900 tonnes of tropical plywood from Indonesia in the first four months of this year, a gain of 25% compared to the same period last year. Imports from Indonesia, which increased sharply in the first two months of the year, slowed in March and April. In contrast, UK plywood imports from Malaysia were very slow in the opening two months this year but strengthened in March and April. By the end of the first four months, the UK had imported 14,100 tonnes of plywood from Malaysia, 11% more than the previous year.

The UK imported 11,700 tonnes of tropical hardwood plywood from China in the first four months this year, 29% less than the same period in 2021, trade having been affected by COVID lockdowns in China. At the same time, Brexit is impacting on UK imports of tropical hardwood plywood from EU countries which were just 1,300 tonnes in the opening four months of this year. This compares to around 4,000 tonnes during the same period in the last two years.

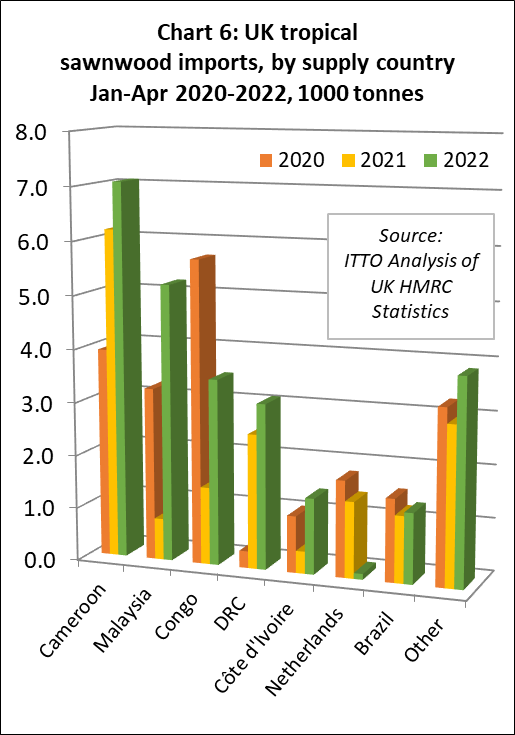

Big shift in countries supplying tropical sawnwood to the UK

UK imports of tropical sawnwood started this year strongly. Imports were 25,600 tonnes in the first four months of 2022, 50% more than the same period last year. In addition to making major gains overall, there were big changes in the countries supplying tropical sawnwood to the UK in the opening months of this year (Chart 6). This is indicative of the major shifts in hardwood markets since the start of the pandemic which have led to significant supply shortages and sharply increasing prices in many supply regions and continuing high levels of demand in markets like the UK.

UK imports of tropical sawnwood from Cameroon were 7,100 tonnes in the first four months of this year, 14% more than the relatively high level in the same period last year. UK imports from Malaysia, which had fallen to little more than a trickle in recent years, were 5,200 tonnes in the first four months this year, nearly a 6-fold increase compared to the same period last year.

UK imports of tropical sawnwood from the Republic of Congo (RoC) were 3,500 tonnes in the first four months of this year, nearly three times the level of last year but still well down on the pre-pandemic level. Meanwhile there has been a significant rise in UK imports of sawnwood from DRC, which were 3,100 tonnes in the first four months this year, a gain of 23% compared to the same period last year. UK imports from DRC were negligible before the pandemic. UK imports of tropical sawnwood from Côte d’Ivoire were 1,400 tonnes in the first four months this year, a 240% increase compared to negligible imports in the same period last year.

Imports of tropical hardwood sawnwood from Brazil were 1,300 tonnes in the first four months of this year, 6% more than the same period last year but still down on the pre-pandemic level.

Indirect UK imports of tropical sawnwood from EU countries have fallen dramatically since the UK’s departure from the EU single market on 1st January 2021. Total UK imports from EU countries were 1,600 tonnes in the first four months of this year, 48% less than the same period last year.

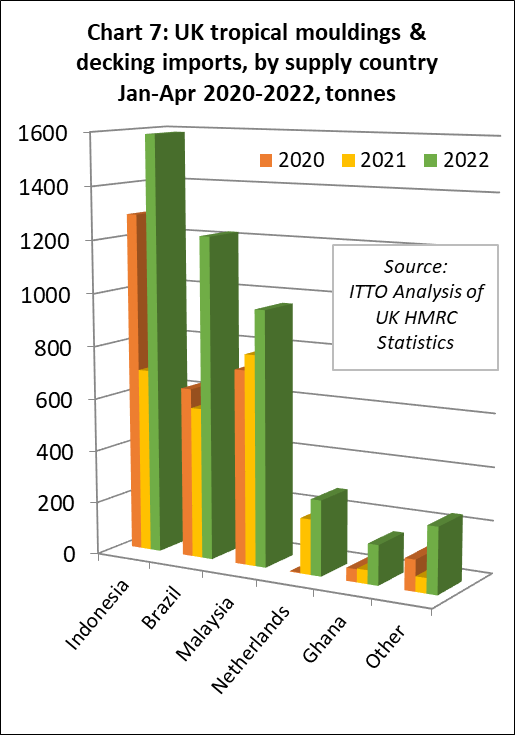

UK imports of tropical hardwood mouldings/decking were relatively high in the opening four months of 2022, at 4,500 tonnes, 87% more than the same period the previous year. This is another commodity group for which there has been particularly strong demand in the UK, combined with sharply tightening supply since the start of the pandemic. The war in Ukraine and sanctions on Russia are expected to lead to even tighter supplies of non-tropical decking products that directly compete with tropical decking in the short to medium term.

UK imports of decking/mouldings increased sharply from Indonesia and Brazil in the first four months of this year. Imports of 1,600 tonnes from Indonesia were 128% more than the same period last year. Imports of 1,200 tonnes from Brazil were 113% up on the same period in 2021. Imports from Malaysia increased 21% to 1,000 tonnes during the four month period. (Chart 7).

Leading media outlets highlight mounting concern over European wood supply

The extent of concern surrounding disruption to wood supplies in Europe due to the war in Ukraine is highlighted by this issue now being the focus of reports by mainstream media outlets in the region.

On 19 June, the London-based Financial Times (FT) published an article under the headline “Ukraine war hits global timber trade and adds to risks for forest” (https://www.ft.com/content/d6388b32-757b-4484-95ff-720b4b2319f3). The articles notes that “The war in Ukraine has caused serious disruption to the global timber trade and increased concerns over forest destruction as exports are interrupted, environmental protections are lifted and Kyiv redirects manpower away from fighting wildfires to the front line”.

The FT reports that international sanctions imposed over Moscow’s invasion of Ukraine have curbed supplies from Russia, the world’s largest exporter of softwood timber, and Belarus, while the conflict has severely hampered production in Ukraine. It is noted that “the three countries accounted for a quarter of the worldwide timber trade last year, according to industry figures. They exported 8.5mn cubic metres of softwood to Europe last year, just under 10 per cent of the region’s demand. Russia, the world’s largest exporter of softwood, alone produces about 40mn cubic metres a year”.

“Timber producing and exporting nations are taking steps to make up the shortfall, including loosening some environmental protections to increase production”, according to the FT. In Ukraine itself, the FT notes that “Soon after February’s invasion, Kyiv lifted a regulation that prohibits logging in protected forests during spring and early summer, as part of a bill to increase the country’s defence capabilities during martial law, partly by boosting export earnings”.

The FT quotes Ukraine’s environmental protection ministry as stating earlier this year that “the sanctions offered the country the chance to increase its share of the European timber market in Russia’s place and boost financing of postwar reconstruction efforts”.

The FT goes on to suggest that “Other exporters including Estonia, Finland and the US are also seeking to increase logging volumes. In the US, the House Committee on Natural Resources in April introduced the No Timber From Tyrants bill, which would ban imports of wood products from Russia and Belarus and authorise an equivalent amount of domestic harvesting in 2021 to make up for lost imports”.

According to the FT, “Earlier this month Estonia announced a relaxation of logging restrictions on state-owned land, which is home to about half of the country’s forests. As a result, the area of land logged will increase by almost a quarter to 2,400 hectares” and “Finland is expected to boost harvesting volumes by 3 per cent for each of the next two years”.

Another recent mainstream media article – this one in Dezeen published 17 June, one of the world’s most influential architecture, interiors and design magazines (https://www.dezeen.com/2022/06/17/timber-shortage-ukraine-war-news/) states that “architects and designers are struggling to source wood for their projects as Russia’s invasion of Ukraine has brought imports from the region to a standstill, threatening stocks and driving up prices across the continent”.

According to Dezeen, studios in Europe are “reporting that costs for solid oak and birch plywood have doubled in the last few months, while others have seen the price of structural timber go up by around 20 per cent”. The article quotes Sean Sutcliffe, co-founder of British furniture maker Benchmark: “Everyone is really worried about their supply chains. We have projects where it would now cost me more to buy the wood that I’m charging for the whole thing.” Birch plywood is “just not available anymore”, Sutcliffe said.

In another quote, Signe Bindslev Henriksen of Danish design studio Space Copenhagen is reported as saying that solid oak “is almost like gold at the moment. Everybody is using up all their stock. Suppliers and manufacturers can deliver right now but in just a few months’ time, it’ll be all gone.”

Dezeen notes that while most European wood imports from Russia, Belarus and Ukraine go to the Baltic states, Germany and Finland, “architects and designers say the knock-on effects are being felt across Europe.” Sean Sutcliffe is reported as saying that “we didn’t actually buy any Ukrainian or Russian wood. But of course, all the people that did are now crowded into Western Europe, which is where our supply chain comes from.” Due to svere shortages of European oak, Benchmark are reported to be making all new products presented at Clerkenwell Design Week last month from local British ash and American red oak.