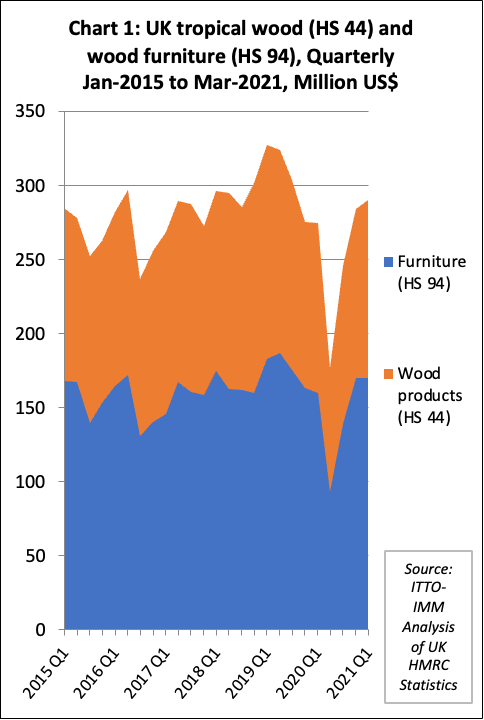

The UK imported tropical wood and wood furniture products with a total value of US$290 million in Q1 2021, a 2% increase compared to the previous quarter and 6% up on Q1 2020 (even before the effects of the COVID pandemic were being felt – Chart 1). The strong performance in the first three months of this year reflect both a robust rise in consumption in the UK, supported by strong government stimulus measures, and the late arrival of delayed shipments from the previous year. The rise occurred despite severe logistical problems that have emerged in shipment of tropical wood products to the UK since the start of the pandemic.

After GDP in the UK fell 10% in 2020, the largest annual decline for around 300 years, the latest economic figures are much more encouraging. In early May, the Bank of England (BOE) upgraded its 2021 growth outlook for the UK to 7.25%, up from 5% as forecast in February.

The brighter economic forecast comes as the country gradually emerges from lockdown and more people are vaccinated against Covid. It follows a drop in first-quarter UK GDP of 1.5% — shallower than expected at a time when the country was again in lockdown — and as restrictions on economic activity ease and Covid infections in the U.K. continue to decline.

Reflecting on these developments, the BOE said second-quarter GDP in the UK would likely “rise sharply,” while economic output was expected to recover to pre-pandemic levels through the remainder of the year. It had previously said the UK economy would recover to pre-pandemic levels in the first quarter of next year.

The forecast of strong economic recovery is bolstered by a very large fiscal stimulus. On 6 May, the BOE’s Monetary Policy Committee voted to hold interest rates steady at an all-time low of 0.1% and maintain its quantitative easing program at existing high levels (targeting asset purchases of £895 billion, equivalent to US$1.2 trillion).

The UK construction sector, the leading driver of timber demand in the country, has recovered particularly strongly.

According to the IHS Markit/CIPS UK Construction Purchasing Managers Index (PMI), construction activity has expanded in ten of the past eleven months, with January 2021 the only exception.

UK construction companies signalled a strong increase in output volumes in April, with continued recoveries seen in civil engineering activity, commercial work and house building. The PMI posted 61.6 in April, down only fractionally from March’s six-and-a-half year peak of 61.7 (any figure above 50.0 indicates an overall expansion of construction output). Workloads in April were boosted by the fastest rise in overall new construction orders since September 2014.

Such is the strength of demand for construction materials in the UK at a time when supply is extremely tight that prices and delivery times are rising rapidly. The PMI shows that the rate of increase in construction sector input costs in April picked up for the seventh month in a row to its highest level since the survey began in 1997. The latest lengthening of suppliers’ delivery times was also the third-greatest since 1997, exceeded only by those seen during the lockdown in April and May last year. Construction firms mostly cited demand and supply imbalances, but some suggested that Brexit issues had led to delays in material arrivals from the EU.

UK wood furniture imports from Singapore fill supply gaps

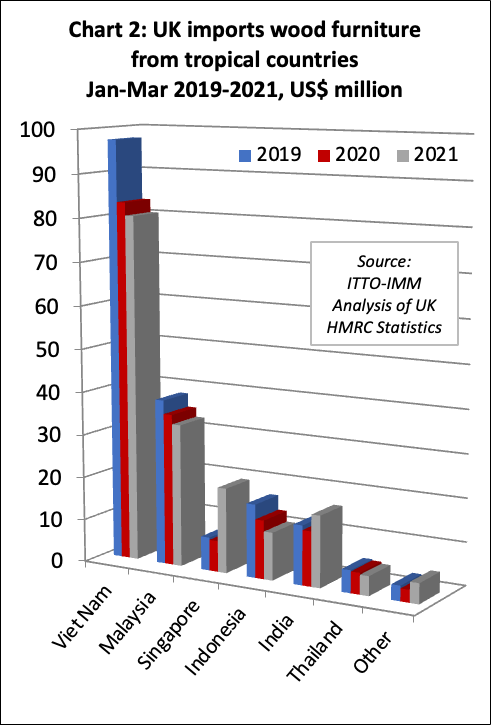

Overall the UK imported USD170 million of tropical wood furniture products in Q1 2021, the same level as the previous quarter but 6% more than Q1 2020. Compared to Q1 2020, imports were down from all three of the leading tropical supply countries to this market; Vietnam (-4% to USD80 million), Malaysia (-6% to USD33 million) and Indonesia (-19% to USD11 million). In contrast, imports from Singapore, at USD20 million, were over three times larger than the same period last year (Chart 2).

The size and direction of UK imports of tropical wood furniture continue to be heavily influenced by lack of freight space. The rise in imports from Singapore is due to there being more container space available from Singapore than elsewhere in South East Asia. Although all countries worldwide have suffered from lack of access to containers, the problem has been particularly severe in the UK where ports have become severely congested following the country’s departure from the EU single market at the start of this year.

The problem is so acute that shipping lines have been trying to drive down demand from British importers by charging a premium for deliveries to the UK or bypassing the country’s ports altogether. A recent report by the BBC notes that one shipping line recently offered freight rates of $12,050 for a 40ft container from China to Southampton but charged just $8,450 for the same container to travel from China to Rotterdam, Hamburg, or Antwerp.

“Most of the carriers just don’t want UK cargo because of the issues when the vessels dock, so mainly they’re favouring European ports and we are having to truck containers over,” said freight forwarder Craig Poole, quoted by the BBC. He said that adds a cost of up to £2,000 per container and takes an extra seven to ten days to reach the delivery point in the UK.

UK tropical wood imports rise 5% in first quarter 2021

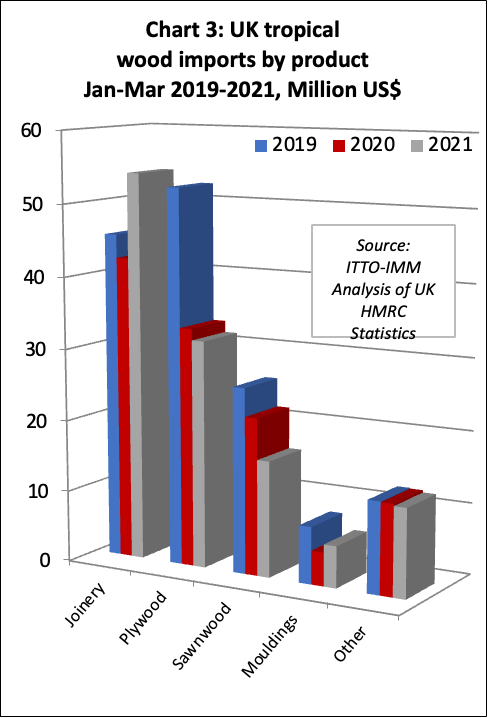

UK imports of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes were USD120 million in Q1 2021, 5% more than both the previous quarter and Q1 2020. Compared to Q1 2020, UK imports of tropical joinery products increased 28% to USD54 million while imports of tropical mouldings/decking increased 24% to USD6 million. These gains offset a 5% decline in tropical plywood imports, to USD32 million, and a 26% decline in tropical sawnwood imports to USD16 million (Chart 3).

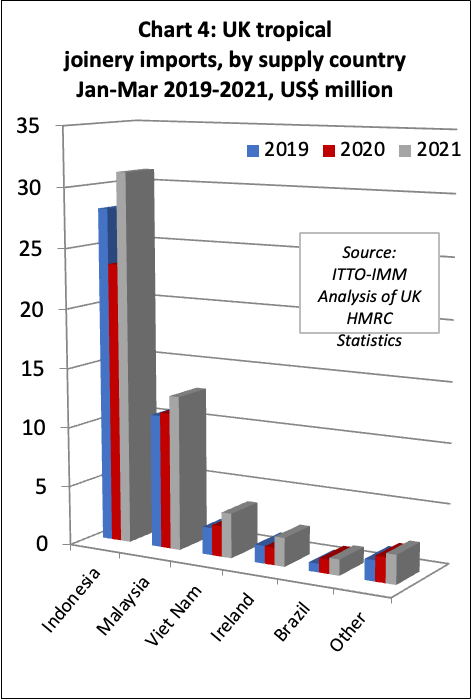

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in Q2 2020, imports have progressively built momentum. Imports from Indonesia, mainly consisting of doors, were USD31 million in Q1 2021, 20% more than the previous quarter and a 33% gain compared to Q1 2020.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) also made strong gains in Q1 2021. Imports from Malaysia were USD13 million in the three month period, 16% more than the previous quarter and 13% up on Q1 2020. Imports of USD4 million from Vietnam were 44% more than the previous quarter and 47% up on Q1 2020 (Chart 4).

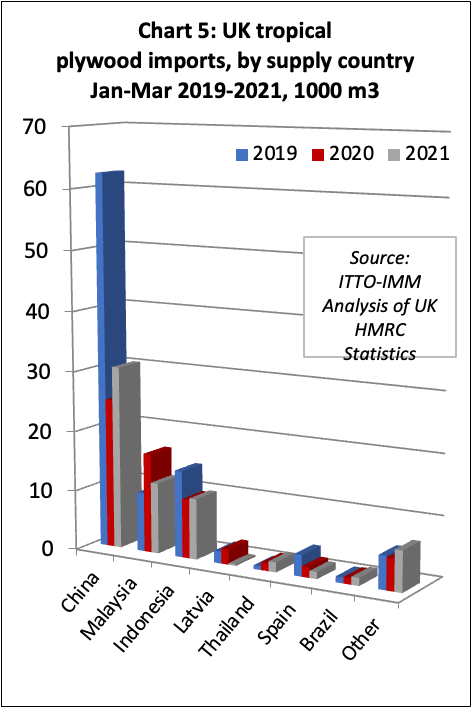

In Q1 2021, the UK imported 64,000 cu.m of tropical hardwood plywood, 7% less than the previous quarter but 1% more than the same period in 2020. Imports from the UK’s three largest suppliers of tropical hardwood plywood – China, Indonesia and Malaysia – have followed very different trajectories this year (Chart 5).

The UK imported 31,000 cu.m of tropical hardwood faced plywood from China in Q1 2021, down 2% compared to Q4 2020 but a gain of 23% compared to Q1 2020. Imports from Indonesia also made gains in Q1 2021, rising 27% against the previous quarter and 3% against the same quarter in 2020 to 10,100 cu.m. In contrast, imports of 11,800 cu.m from Malaysia in Q1 2021 were 27% down on Q4 2020 and 29% less than Q1 2020.

As with other hardwood product groups, UK demand for tropical hardwood plywood has been strong this year, driven by high levels of construction activity and shortages of competing materials, and the main market challenges have been on the supply side.

While Chinese hardwood plywood suppliers are reported to have generally returned to pre-pandemic production levels, some manufacturers in Indonesia and Malaysia are reported to be still struggling. “One of our leading Malaysian suppliers is still only at 50% of normal production due to safe distance work practices and so many staff being in isolation,” said an importer. The severe difficulties of obtaining freight space and increased competition for supplies from buyers in the US, where demand is also extremely strong, is adding to UK supply difficulties out of Asia.

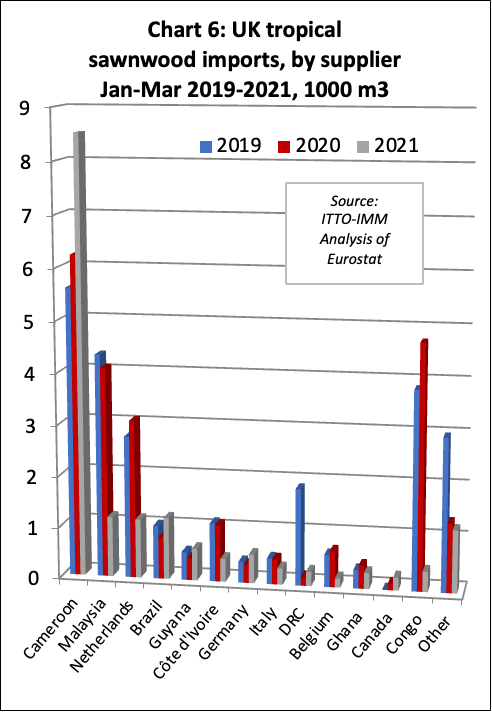

After falling sharply in May and June last year, UK imports of tropical sawnwood strengthened between July and December but the momentum slowed in the first quarter of 2021. UK imports were 16,600 cu.m in Q1 2021, 31% less than the same period in 2020 and 20% less than Q4 2020.

Imports from Cameroon continued to rise in Q1 2021, at 8,500 cu.m 3% more than Q4 2020 and 37% more than Q1 2020. Imports from Brazil were 1,200 cu.m in the first quarter this year, 21% more than the previous quarter and 47% up on Q1 2020. However, these gains were insufficient to offset a big decline in UK imports of tropical sawnwood from elsewhere. Imports from Malaysia were 1,200 cu.m in Q1 2021, 70% less than Q4 2020 and 71% less than Q1 2020. Imports from Côte d’Ivoire were no more than 500 cu.m in the first quarter of this year, 60% less than the same period in 2020 and 33% down on the last quarter of 2020 (Chart 6).

Indirect UK imports of tropical sawnwood from other EU countries also fell dramatically in the opening months of this year, a sign of the immediate detrimental effects of the UK’s departure from the EU single market on 1st January. Total UK imports from EU countries were 2,800 cu.m in Q1 2021, 47% less than Q1 2020 and 40% down on Q4 2020.

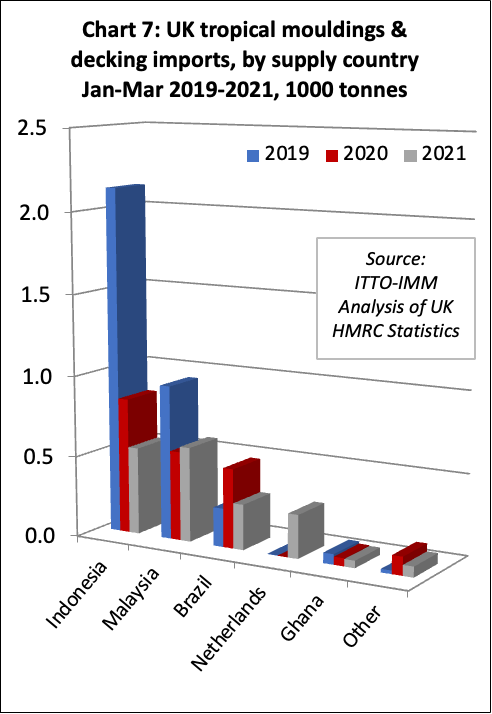

UK imports of tropical hardwood mouldings/decking performed only marginally better than tropical sawnwood in Q1 2021. Total imports of 1,800 tonnes were 7% up on the previous quarter but 13% less than Q1 2020. Imports of 500 cu.m from Indonesia were 36% less than Q1 2020 and 44% down on Q4 2020. Imports of 300 cu.m from Brazil were 41% up on Q4 2020 but 43% down on Q1 2020. However these losses were offset by a rise in imports from Malaysia which, at 600 cu.m were 46% more than Q4 2020 and 6% up on Q1 2020 (Chart 7).

Upward correction in African prices may be here to stay

Market reports presented to the National Hardwood Division of the UK Timber Trade Federation (TTF) on 12 May suggest that recent price increases for African sawn hardwood may represent the “correction that has been expected for some time” and be here to stay.

The reports also highlighted that extreme shortages of container space have led to the first breakbulk shipments of Asian meranti and keruing lumber into the UK for nearly 30 years, while the UK is also experiencing a “massive shortage” in supply of Indonesian bangkirai decking which has led to rising interest in Brazilian hardwood alternatives.

The TTF report on the African hardwood trade noted that relative to rapid and large price hikes for hardwoods sourced from the US, the Far East and Europe since the start of the pandemic, “Africa, as is often the case, had been slow to catch on and had not been subject to the same levels of market volatility”.

The report goes on to note that “lead times between contracting and shipping product from this region is one reason for this. Contracts placed back in 2020 are still shipping and consequently the full reality of new price levels are not yet being felt in the market place and may not be for some time. But rest assured they are coming!”

The report highlights that global demand for species such as Sapele, Sipo and Iroko, accompanied by production delays and logistical difficulties, have been such that many African mills placed a moratorium on taking new orders in late March and throughout April this year.

“Placing new business now that will ship in 2021 is a challenge and late shipments are leading to shortages in some product in the market. The few mills with capacity to take orders which can be produced and shipped relatively quickly are taking advantage with high premiums being requested”, according to the TTF report.

While African process have been slower to respond than elsewhere, “over the course of the last couple of months Africa is now starting to catch up. 10% increases in shipping dry Sapele and Iroko have been felt within the space of this period, which considering the previous 12 months saw a cumulative increase of roughly 5%, is a steep jump. Sipo and other redwoods such as Khaya and Tiama are replicating this trend”.

On other African species, the TTF report notes that “Framire is proving increasingly challenging to source due to a lack of raw material in the forest while even species such as Ayous and Okoume are limited in supply. This is in part due to the fact that consumer markets are seeking new alternatives to their customary products such as Poplar because of lack of supply”.

The TTF report stressed the severe impact of the pandemic on hardwood production costs and volumes in Africa: “it is always a challenge in the region to maintain machinery and obtain spare parts but with the logistical issues and travel restrictions resulting from the Covid Pandemic, this challenge has been exacerbated many times over. Mills that have had breakdowns in key production facilities such as kilns, head saws and boilers have simply not been able to get the replacement parts or the technicians to install them. The result of this is that many mills are not running at anything like full capacity, and this is unlikely to change for some time”.

The TTF report on Africa concludes by suggesting that “while the global timber market is likely to see price corrections in product from other source areas, the recent increases in Africa may well be the correction that has been in the making for some time. Less availability of primary species in the forest, fewer producers to buy from, increased costs and a growing global demand mean that the price increases we have recently seen, and will continue to see this year, are very likely here to stay”.

The TTF report on South East Asian hardwoods highlighted that in the past 5-6 months there was a 4-5 fold increase in container freights from the region which at one stage (during Dec/Jan) virtually halted shipments of South East Asian hardwood products to the UK. Since Chinese New Year, with rates unchanged but relatively stable, many buyers re-negotiated contracts with their South East Asian suppliers to allow goods to be shipped at the new freight rates.

The TTF report also notes that UK buyers of West Malaysian meranti and keruing lumber and some finished hardwood products recently took advantage of the first breakbulk vessel to load hardwood for the UK in almost 30 years: “that vessel is about 2 weeks off and we will see how well [the UK port of] Tilbury handle what will be a challenging range of timber products packaged in a form the dock workers are not used to”. A second breakbulk vessel destined for the UK is expected to be loaded in Malaysia during June.

According to the TTF report, freight costs of the breakbulk shipments from Malaysia to the UK are about USD150/170 per cu.m compared to container rates currently anywhere between USD280/cu.m and USD 460/cu.m depending on where the goods are loading and what volume can be loaded in a container.

The TTF report notes that “many buyers are buying Meranti and Keruing Lumber on a forward basis and we have seen FOB prices rising, but nothing like the increases we have seen from other supplying regions. It is very likely that DRM [dark red meranti] and keruing volumes will (during 2021) be the same or less than last year. This is in part due to Covid but also due to the Federal Government placing volume extraction restrictions, so time will tell if there is sufficient lumber coming onto the market in the summer”.

The TTF report also highlights the severe lack of bangkirai decking in the UK market which was “initially due to the freight hikes at the beginning of the year but, it seems, in the past 3 months or so, due to suppliers selling UK bound stocks to other markets at a time when the availability of (replacement) logs and lumber suddenly dried up”.

The number of Indonesian mills offering bangkirai for sale to UK importers is now very restricted and the few offers being made are “at prices about 50% higher than where they were back in December which has led to significant interest in cheaper Brazilian Decking species”, according to the TTF report.

TTF ramps up communication on benefits of tropical timber

The UK TTF is ramping up a communications campaign which aims to enhance customer and specifiers awareness to the benefits of FLEGT-licensed tropical timber as a safe, legal, and responsible method of timber use ahead of the rescheduled COP26 UN Climate Change Conference now due to be held in the UK in November.

It has launched “Conversations about Climate Change”, a design competition, exhibition, and event series, showcasing thought-provoking designs using responsibly sourced tropical timber. The virtual exhibition at the London Building Centre can be accessed online (https://www.buildingcentre.co.uk/whats_on/conversations-about-climate-change-the-virtual-exhibition).

According to the TTF, their FLEGT project “works to tackle stereotypes around tropical timber, educating audiences on the benefits of specifying and including FLEGT in procurement policies as a holistic approach to responsible, sustainable timber”.

The TTF notes that engaging with designers, architects, and craftspeople on the benefits of FLEGT-licensing has been really well received. “When it comes to communicating complex conversations, we took the approach that the best mechanism is to start designing with it – to showcase the beauty and unique properties of tropical hardwoods, the encompassing benefits to countries engaging in FLEGT, and to trace the story back from there”.

With further Foreign Commonwealth & Development Office (FCDO) government funding, the TTF FLEGT Project is planning a further design initiative, with an exhibition to coincide with COP26 in November, promoting FLEGT and highlighting the environmental significance of forests and timber.

The TTF has also begun plans for the construction of a timber pavilion at COP26 and the creation of a wider communication programme with other FCDO grantees and is seeking to “bring together all willing VPA FLEGT countries to develop a joint tropical timber manifesto and agenda”. This will focus on “FLEGT and tropical hardwoods and will include advocacy of zero tariffs for FLEGT-licensed products”.

TTF aims to continue FLEGT communications after COP26 to “ensure changes initiated remain on the climate agenda, with enhanced promotion of FLEGT to specifiers in Europe and the UK. Further educational work includes additional e-learning modules for national associations on FLEGT, sustainable forest management and timber legality/sustainability”.

To find out more, email lbedry@ttf.co.uk

PDF of this article:

Copyright ITTO 2021 – All rights reserved