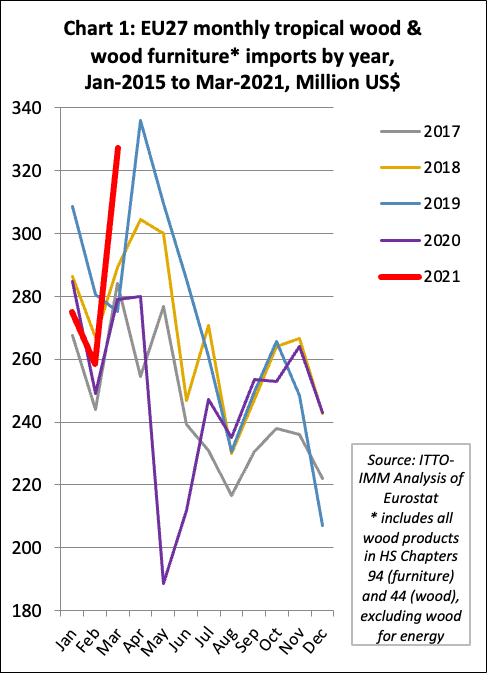

EU27 import value of tropical wood and wood furniture products was US$861 million in the first three months of this year, 6% more than the same period in 2020. After a slow start to the year in January and February, imports surged to US$327 million in March, only the second time since 2012 that monthly imports have exceeded US$325 million (the only other occurrence being in April 2019) (Chart 1).

The high level of EU27 tropical wood product imports in March came at a time when most of the continent was still subject to tight lockdown conditions and probably partly reflects a surge in deliveries delayed in previous months due to shortages of containers and other logistical problems. However, there also encouraging signs that the economic recovery in the EU is gaining momentum, a trend expected to continue as vaccination rates are rising, lockdown measures are eased and the full effects of NextGenerationEU, the EU’s large fiscal stimulus programme, begin to be felt.

EU27 economic forecast revised upwards

According to the EU’s Spring 2021 Economic Forecast published on 12th May, following a 6.1% decline in 2020, the EU economy will expand by 4.2% in 2021 and by 4.4% in 2022. This represents a significant upgrade of the growth outlook compared to the Winter 2021 Economic Forecast which the Commission presented in February. Growth rates will continue to vary across the EU, but all Member States should see their economies return to pre-crisis levels by the end of 2022.

The Forecast notes that the rebound in Europe’s economy that began last summer stalled in the fourth quarter of 2020 and in the first quarter of 2021, as fresh public health measures were introduced to contain the rise in the number of COVID-19 cases. However, the rise in vaccination rates and easing of lockdown restrictions is expected to drive a strong rebound in private consumption and investment.

Growth is expected to be bolstered by rising demand for EU exports from a strengthening global economy. Public investment, as a proportion of GDP, is also set to reach its highest level in more than a decade in 2022 driven by the Recovery and Resilience Facility (RRF), the key instrument at the heart of NextGenerationEU.

While the outlook is more positive, the Forecast emphasises that the risks are high and will remain so as long as the shadow of the COVID-19 pandemic hangs over the economy. Developments in the epidemiological situation and the efficiency and effectiveness of vaccination programmes could turn out better or worse than assumed in the central scenario of this forecast. The forecast may underestimate the propensity of households to spend or it may underestimate consumers’ desire to maintain high levels of precautionary savings. The impact of corporate distress on the labour market and the financial sector could yet prove worse than anticipated.

Forward looking indicators show that economic momentum in the EU27 has picked up since the start of the year, although business and consumer confidence is still quite fragile, particularly in the construction sector, a key driver of timber demand in the region.

The EU’s consumer confidence indicator reached its highest level in one year in March, pushing the quarterly average up to -14.8, 1.9 points above the previous quarter. The EU’s Economic Sentiment Indicator (ESI) continued to recover, edging up to 109.7 in April 2021, markedly above its long-term average and higher than its pre-pandemic level for the first time since the outbreak of COVID-19 on the continent. Similarly, Markit’s Flash Purchasing Managers’ Composite Output Index for the euro area stayed above its no change mark of 50 for a second month in a row in April, after four months of decline. It was up by 0.5 points to 53.7.

The IHS Markit Eurozone Construction Total Activity Index was unchanged at 50.1 in April, signalling only a fractional expansion in euro area construction activity for the second successive month. Construction firms often linked the slight expansion to a resumption of work on paused projects and were increasingly concerned about the impact that renewed COVID-19 restrictions have had on overall demand in the construction sector.

According to IHS Markit, work undertaken on housing by euro area construction firms increased for a second successive month in April. The rate of growth quickened from March and was the strongest recorded since February 2020. A renewed contraction in home building activity in Germany was offset by a survey record expansion among Italian housebuilders. French firms, meanwhile, reported stable conditions in housebuilding for the second month in a row.

Commercial construction activity contracted again in the latest HIS Markit survey period, extending the current sequence of decline to 14 months. That said, the pace of the reduction eased from March and was the softest in the sequence. A softer fall in commercial activity in France and a stronger rise in Italy contributed to the easing in the rate of decline. However, firms in Germany signalled a further, marked decline in commercial building. The downturn in euro area civil engineering activity continued in April, as work undertaken on infrastructure projects contracted at a modest pace.

The IHS Markit survey shows that the degree of optimism regarding the outlook for construction activity over the coming 12 months eased in April and was the softest recorded for three months. German constructors signalled renewed pessimism regarding the year ahead outlook, with projections at their weakest since December 2020. French firms indicated a lower level of positive sentiment, though Italian firms signalled the strongest projections since August 2001.

Rebound in EU27 tropical wood product imports in first quarter

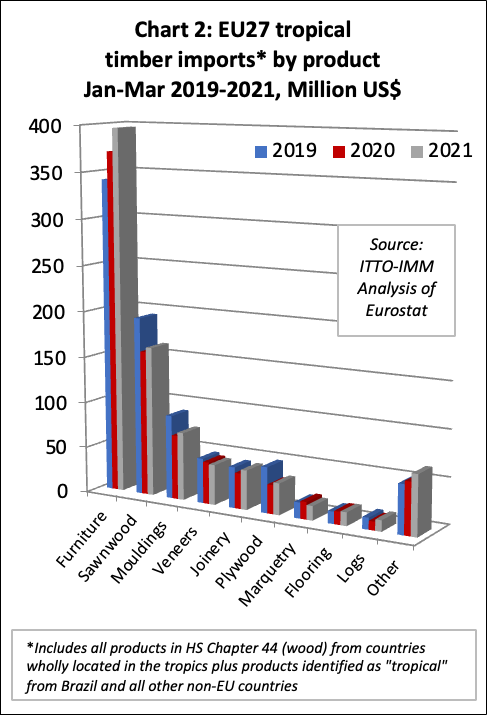

The value of EU27 imports of most tropical wood products increased in the first three months of 2021 compared to the same period in 2020. This is encouraging given that Europe only began to lockdown in the middle of March last year, too late to significantly impact on trade volumes in the first quarter of 2020.

EU27 imports of wood furniture from tropical countries increased 7% to US$396 million in the first quarter this year compared to the same period in 2020, while imports of tropical sawnwood increased 3% to US$163 million, tropical mouldings were up 6% to US$74 million, joinery up 11% to US$43 million, plywood up 10% to US$34 million, flooring up 3% to US$15 million, and logs up 27% to US$12 million. These gains offset a 4% decline in veneer imports to US$44 million, and a 17% fall in marquetry imports to US$16 million (Chart 2).

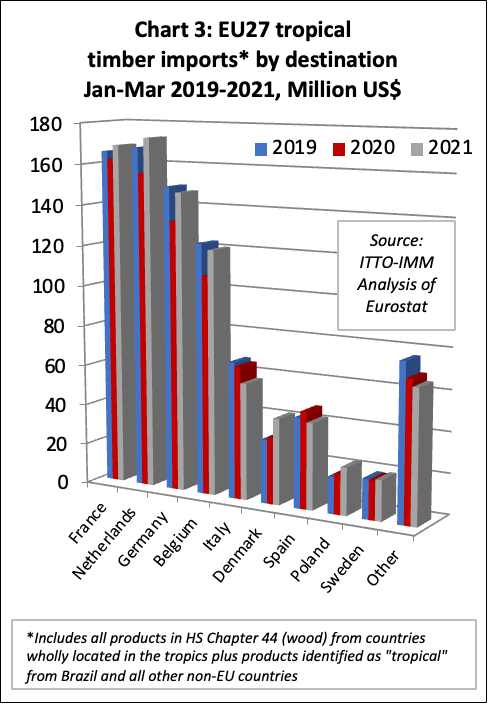

In the first quarter this year, import value increased into all the largest EU27 destinations for tropical wood and wood furniture products with the exception of Italy and Spain. Import value was up 4% to US$169 million in France, 11% in the Netherlands to US$173 million, 11% in Germany to US$147 million, 12% in Belgium to US$120 million, 30% in Denmark to US$42 million, 17% in Poland to US$23 million, and 4% to Sweden to US$20 million. Import value decreased in Italy by 12% to US$58 million and by 11% in Spain to US$42 million (Chart 3).

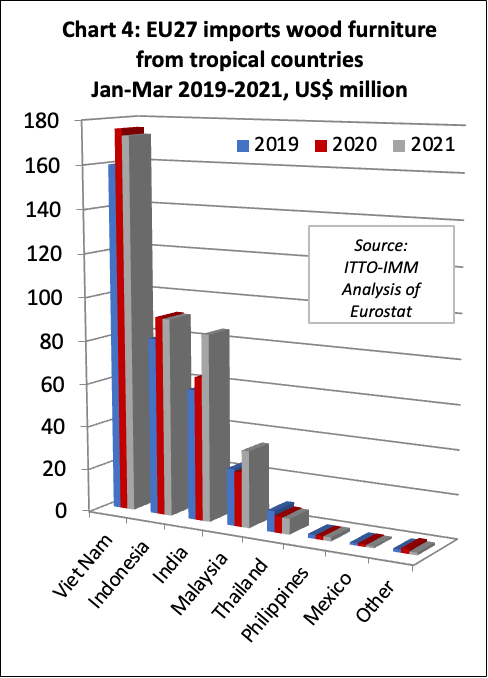

Rising EU27 wood furniture imports from India and Malaysia

In the first three months of 2021 compared to the same period in 2020, EU27 import value of wood furniture increased sharply from India (+30% to US$86 million) and Malaysia (+41% to US$35 million). However import value from the two largest suppliers was marginally down on the previous year’s level, declining 2% from Vietnam to US$173 million and 1% from Indonesia to US$91 million (Chart 4). It is notable that India, until recently only a relatively minor supplier of wood furniture to the EU, is now challenging Indonesia as the second largest tropical supplier of these products into the region.

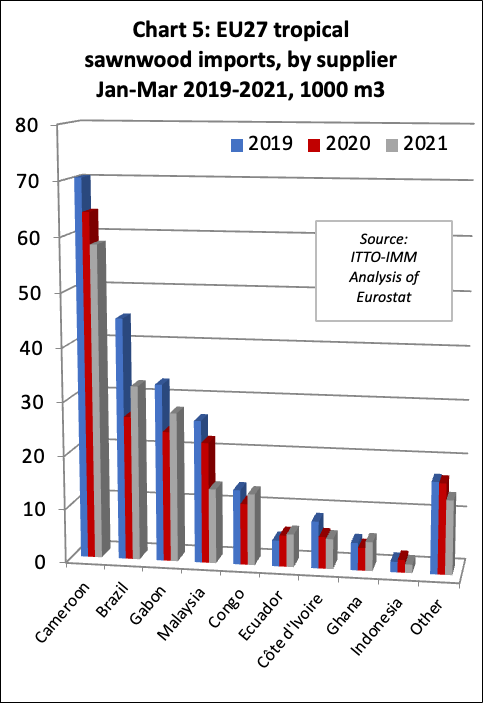

Sharp decline in EU27 imports of sawnwood from Cameroon and Malaysia

The EU27 imported 178,400 cu.m of tropical sawnwood in the first three months of this year, 3% less than the same period in 2020. Imports were sharply down from Cameroon (-9% to 58,300 cu.m) and Malaysia (-38% to 13,900 cu.m), while imports from Côte d’Ivoire continued a steady decline (-6% to 5,600 cu.m). However, there were gains in imports from Brazil (+21% to 32,500 cu.m), Gabon (+15% to 27,800 cu.m), Republic of Congo (+17% to 13,300 cu.m), Ecuador (+5% to 6,100 cu.m), and Ghana (+27% to 5,400 cu.m). Despite the sharp decline in imports from Cameroon this year and last, it is notable that the country still remains very dominant as the lead supplier of tropical sawnwood into the EU27 (Chart 5).

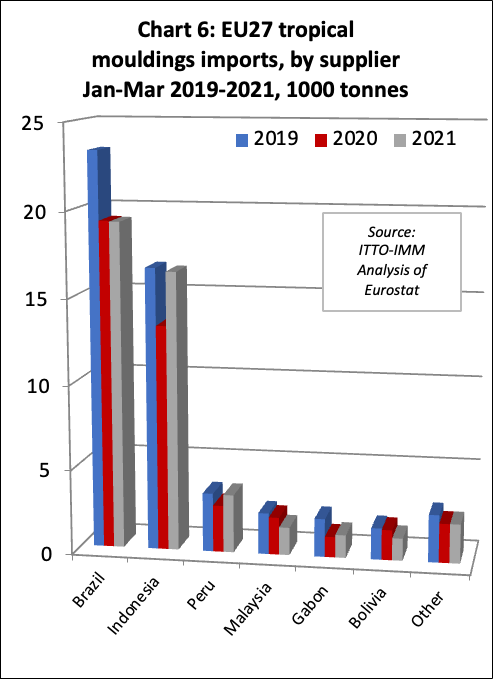

In contrast to sawnwood, EU27 imports of tropical mouldings/decking increased in the first quarter of this year, at 45,700 tonnes 7% more than the same period in 2020. Imports from Brazil, the largest supplier, were level at 19,300 tonnes. Despite widespread reports of supply shortages for Indonesian bangkirai decking, imports of moulding/decking from Indonesia increased 24% to 16,400 tonnes during the three month period. Imports also increased 24% to 3,400 tonnes from Peru and 11% to 1340 tonnes from Gabon. These gains offset a 26% decline in imports from Malaysia to 1600 tonnes, and a 26% fall from Bolivia to 1,300 tonnes (Chart 6).

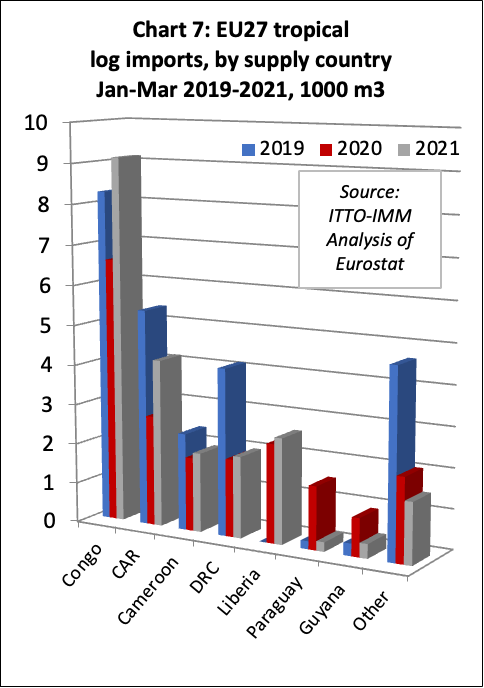

EU27 imports of tropical logs, which have been in long term decline and are now a shadow of their former level, did at least rebound 9% to 22,000 cu.m in the first three months of this year. Imports recovered from the leading African supply countries but imports from South American countries, which had increased sharply last year, fell back to negligible levels. Imports increased 38% to 9,100 cu.m from the Republic of Congo, 52% to 4,200 cu.m from CAR, 8% to 2000 cu.m from Cameroon, 5% to 2,000 cu.m from DRC, and 7% to 2,600 cu.m from Liberia. In contrast, imports from Paraguay fell 85% to just 236 cu.m and from Guyana were down 27% to 360 cu.m (Chart 7).

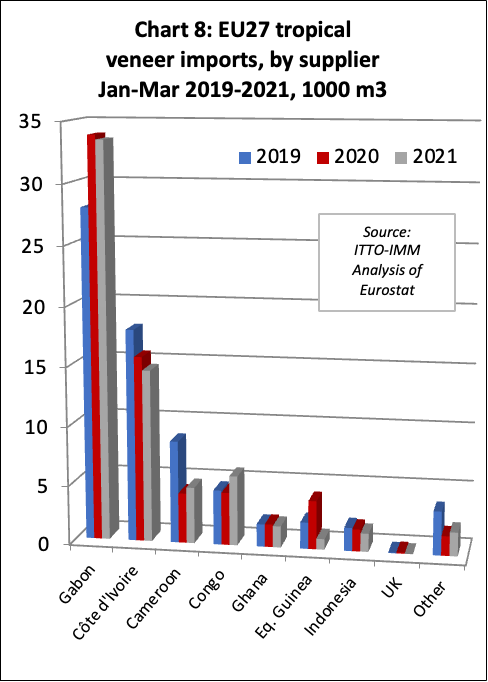

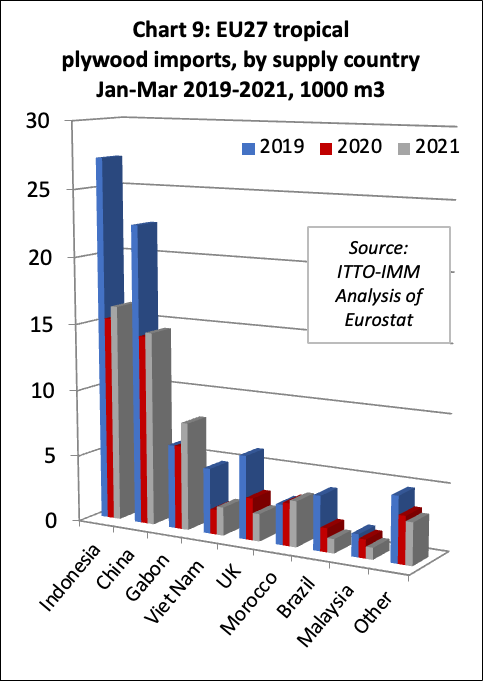

Slow start to the year for EU27 imports of tropical veneer and plywood

EU27 imports of tropical veneer declined 4% to 64,900 cu.m in the first three months of this year. After a rapid rise last year, imports from Gabon declined 1% to 33,500 cu.m. There were larger falls in imports from Côte d’Ivoire (-7% to 14,500 cu.m), Ghana (-7% to 1,800 cu.m), Equatorial Guinea (-78% to 900 cu.m), and Indonesia (-17% to 1,537 cu.m). However, imports increased 13% to 4,700 cu.m from Cameroon and 32% to 5,900 cu.m from the Republic of Congo (Chart 8).

After a slow year in 2020, EU27 imports of tropical plywood made only marginal gains in the first quarter of this year. Imports of 51,500 cu.m in the three month period were just 2% more than in the same period in 2019. Imports were up from all four of the largest supply countries including Indonesia (+6% to 16,200 cu.m), China (+2% to 14,500 cu.m), Gabon (+29% to 8,000 cu.m), and Vietnam (+14% to 2,100 cu.m). However, the decline in imports continued from Brazil (-40% to 1,100 cu.m) and Malaysia (-37% to 875 cu.m.). EU27 imports of tropical hardwood plywood from the UK – a re-export since the UK has no plywood manufacturing capacity – fell 35% to 2,000 cu.m (Chart 9).

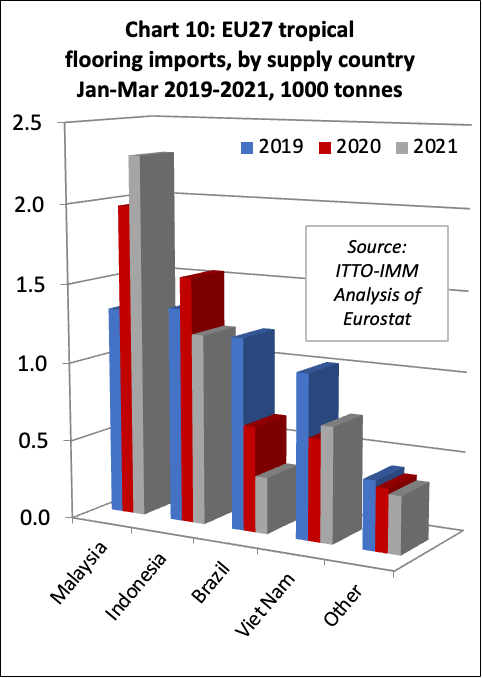

EU27 tropical flooring imports rise while other joinery imports decline

After unexpectedly recovering some lost ground last year, EU27 imports of flooring from tropical countries have weakened again this year. Imports of 4,900 tonnes in the first three months were 6% less than the same period in 2020. Imports from Malaysia continued to rise, up 16% to 2,300 tonnes, while imports from Vietnam recovered by 13% to 730 tonnes. However, these gains were offset by a 23% decline in imports from Indonesia to 1,200 tonnes and a 47% decline in imports from Brazil to just 360 tonnes. (Chart 10).

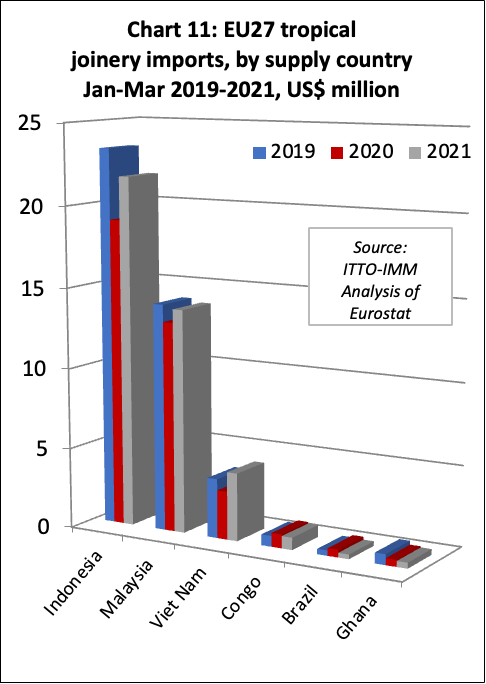

The value of EU27 imports of other joinery products from tropical countries – which mainly comprise laminated window scantlings, kitchen tops and wood doors – increased 11% to US$43 million in the first three months of this year. Imports were up 22% to US$21.7 million from Indonesia, 6% to US$13.8 million from Malaysia, and 41% to US$4.2 million from Vietnam (Chart 11).

EC update on new policy framework for consumption of “forest-risk” commodities

Speaking at a webinar hosted by the EURACTIV news agency on 26th May, Virginijus Sinkevičius, EC Commissioner for Environment, Oceans and Fisheries, provided an update on the state of play in EU deliberations on a new policy framework to ensure EU consumption is not contributing to global deforestation and forest degradation.

The Commissioner reiterated the EU’s intent to develop new laws to prevent commodities with a high risk of contributing to deforestation being placed on the EU market. The EU is also likely to propose that these new laws be implemented alongside new partnerships with countries supplying “forest risk” commodities to develop procedures to ensure that products are “deforestation free”.

The Commissioner began by emphasising that the whole issue of deforestation is “high on the political agenda, it’s very high on the Commission’s agenda, it’s an important matter for companies, NGOs and of course citizens, and it’s a key topic for everyone on the ground in the producing countries” and noted that “tackling deforestation is an important element in [the] European Green Deal” (which sets out the trajectory for the EU to be climate neutral by 2050).

The Commissioner said that the intention was to build on, and learn from, existing forest policy mechanisms, particularly those implemented as part of the FLEGT Action Plan.

He noted that “part of the process to develop a new legislative proposal is an evaluation of the effectiveness of existing legislation; a fitness check of both the EU Timber Regulation and the FLEGT Regulation with its Voluntary Partnership Agreements”. He also said the EC is “conducting a study on the role and impact of private certification schemes, and the contributions they could make to additional measures”.

Commenting on the role of the EUTR, the Commissioner said that “a mixed picture is emerging; it has been an incentive for operators to focus on keeping their supply chains clean, but the structure and the wording of the legislation has made it difficult to use in practice. The [EUTR] competent authorities found it hard to prove due diligence compliance failures in courts of law. In that area there is definitely room for improvement”.

On the role of the VPAs, the Commissioner said that these “have clearly proved their use in improving stakeholder participation, better forest governance and regulatory reforms in some partner countries, but their actual impact on illegal logging and associated trade has been more limited. We have not found much evidence that these agreements have helped reduce illegal logging or the consumption of illegally harvested wood here in Europe”.

The Commissioner emphasised that this was not intended as a criticism of progress made in any individual VPA but rather the “problem is simply one of scale; the first VPA was concluded with Ghana more than a decade ago, but today when we have 15 different VPAs at various stages of completion, there is only one operating licencing system in place in Indonesia. That means that despite our best efforts, these agreements cover only a very small part of the overall volume of trade. So the total effect on illegal timber is therefore extremely limited”.

The Commissioner went to say that “these conclusions together with the feedback from extensive public consultations, input from the European Parliament, and studies we have carried out, are quite clear. The current system of due diligence needs to be improved and enhanced, but that alone will not be enough”.

According to the Commissioner, this “enhanced” due diligence “will need to be complemented by alternative support methods which help partner countries to comply with the requirements”. He indicated that there would be a more flexible approach to development of forest partnership agreements so that they are “tailored to specific needs and the specific interests of each partner country”.

This implied that the agreements “should retain the elements that have proved effective, while other [elements], like licencing in a trade agreement, should be abandoned.” Perhaps hinting at a shift towards more jurisdictional forms of verification based on analysis of governance and assessment of forest condition at national or regional level, he noted that “we are also creating an EU Observatory which will facilitate information exchange on global deforestation, combining trade data with [satellite] observation”.

In finalising their regulatory proposals, the Commissioner said “we need to be certain that all options comply with our obligations under the World Trade Organisation rules…we started with a long list of 20 options, now we are down to a few ones such as improved due diligence requirements, country benchmarking, mandatory public certification, mandatory labelling, or a deforestation free requirement”.

He also said that the EC identified a “preliminary list of products, the main criteria for choosing them [being] the overall impact of production and harvesting on forests and their level of consumption in the EU, so that list includes for now palm oil, cattle, soy, wood, cocoa and coffee”.

The Commissioner concluded that “we have come a long way since the first commission proposal in its 2019 communication [on Stepping up EU Action to Protect and Restore the World’s Forests]. Under the Green Deal we are advancing steadily and we are advancing with care. We have no choice but of course to get it right. And for that to happen, we need to listen to the views from all sides”.

PFD of this article:

Copyright ITTO 2021 – All rights reserved