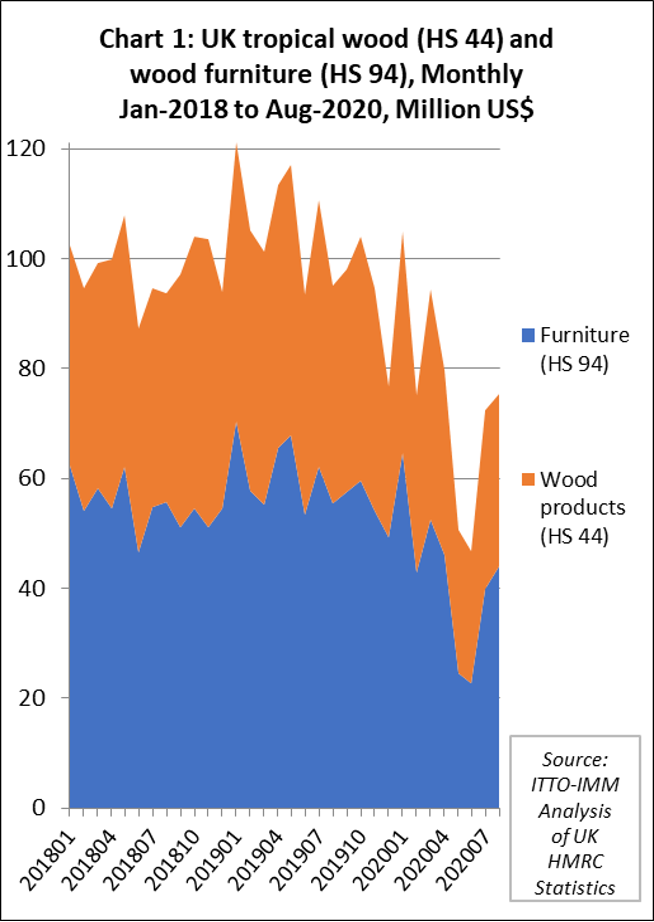

After a sharp fall in UK imports of tropical timber products in May and June in response to the COVID-19 pandemic, imports rebounded strongly in July and made more gains in August. However, even in August, total imports were still down around 15% compared to the same month the previous year (Chart 1).

A strong rebound in construction and other broader economic measures during the summer months gave rise to optimism that the downturn may be short-lived and the recovery would be “V-shaped”. More recent indications, however, are of a “tick mark” recovery, with the sharp fall followed by a longer tail of recovery.

Now new lockdown measures are being imposed in the UK with mounting concern about a second wave of the virus which might yet overwhelm health facilities. The withdrawal of short-term government support measures, notably the furlough scheme designed to keep more people in work during the first lockdown, also raises the prospect of a spike in unemployment during the winter months.

Overall UK imports of tropical wood furniture products to end August this year were US$337 million, 31% less than the same period in 2019. Imports fell to only US$24.5 million in May, 60% down on imports typical for that month in a normal year. However, tropical wood furniture imports recovered to US$40 million in July and US$44 million in August.

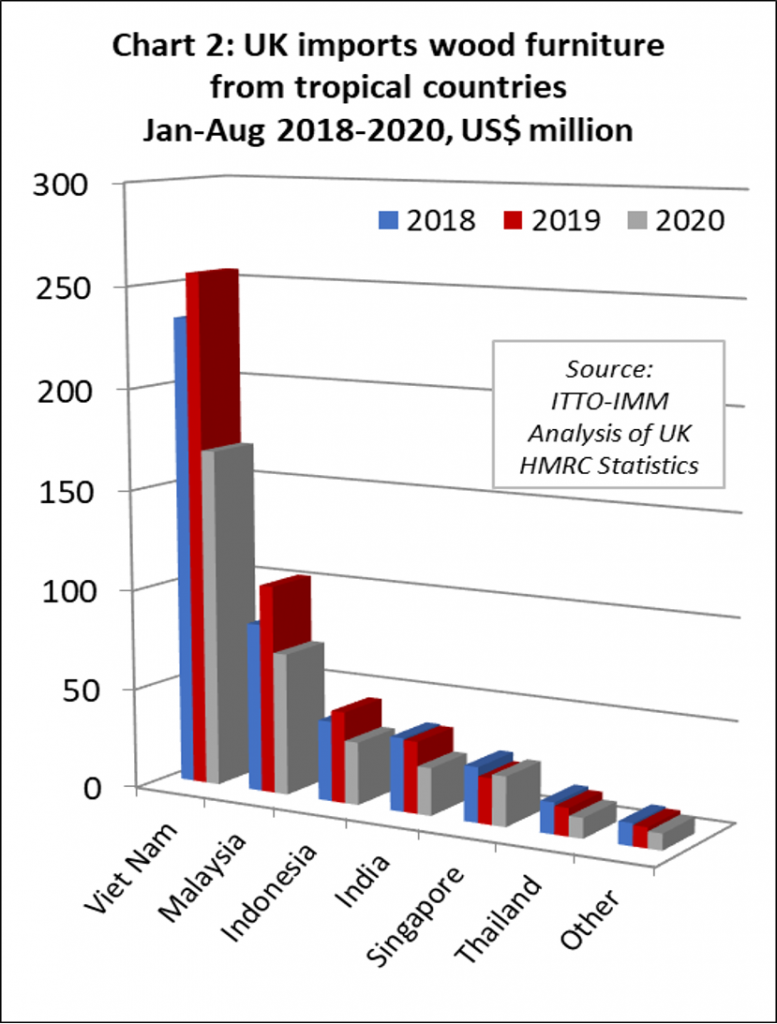

UK imports of wood furniture declined sharply from all the leading tropical supply countries in the first eight months of this year (Chart 2). Imports from Vietnam were down 34% at US$168 million, imports from Malaysia fell 32% to US$71 million, imports from Indonesia declined 31% to US$31 million, and imports from India fell 34% to US$24 million. However, there was an 8% rise in imports from Singapore, to US$25 million.

The total value of UK imports of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes to end August this year was US$262 million, 29% less than the same period in 2019. Imports fell from US$34 million in April to US$26 million in May and continued to slide to US$24 million in June. They then recovered to US$33 million in July before slipping back to US$31 million in August.

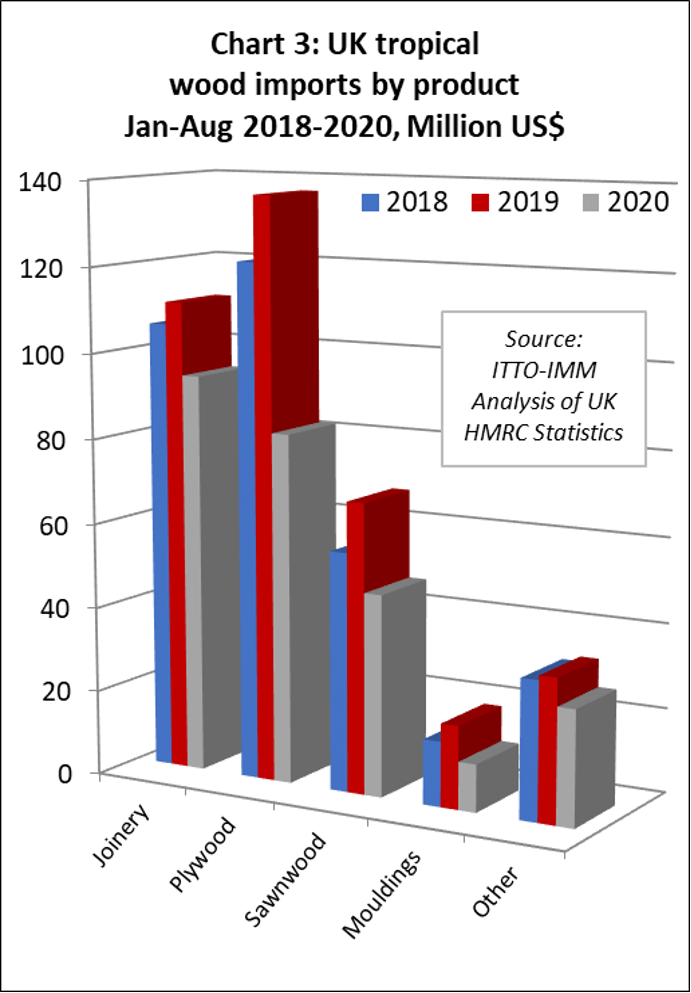

Comparing the first eight months of 2020 with the same period in 2019, total UK import value of tropical joinery products was down 15% at US$94.2 million, tropical plywood was down 40% at US$82.4 million, tropical sawnwood fell 30% to US$47.5 million, and mouldings/decking declined 43% to US$11.2 million (Chart 3).

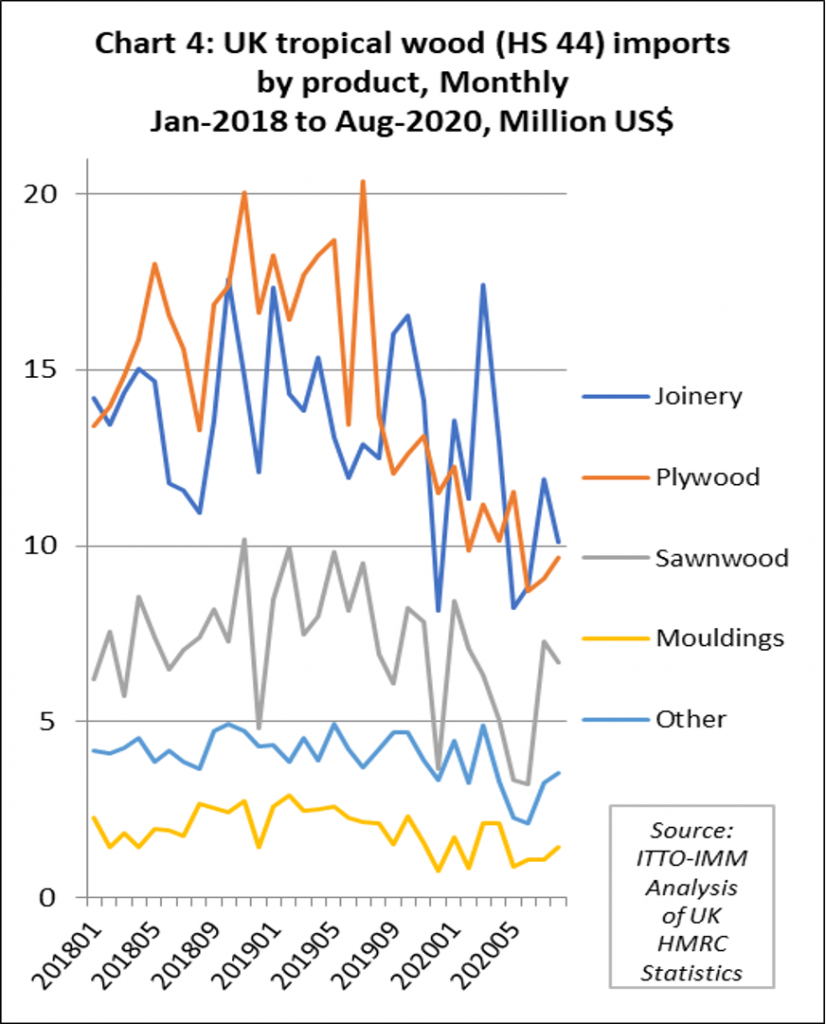

Although UK imports of all HS Chapter 44 wood products from the tropics have fallen sharply this year, the timing of the decline and subsequent recovery has varied by product group (Chart 4). For example, the decline in imports of tropical sawnwood, which were quite buoyant before the COVID lockdown, was short-lived and followed by a strong recovery in July and August. In contrast, UK imports of tropical plywood were sliding even before the lockdown and had barely recovered by the end of August.

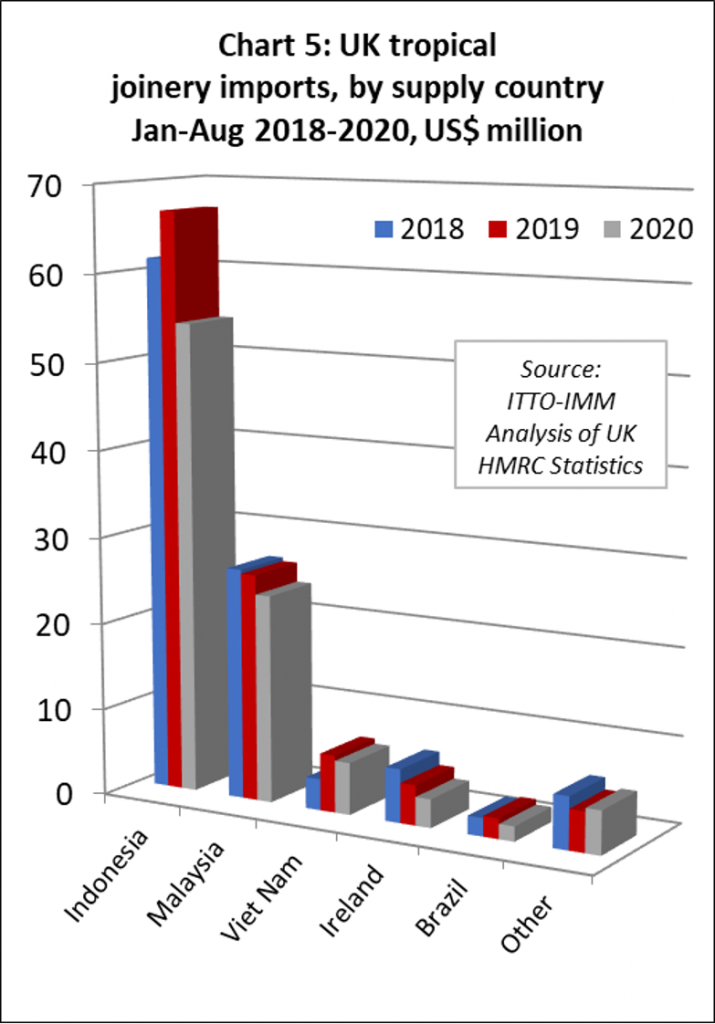

Indonesia loses ground in UK joinery market

After making gains in 2019, UK imports of tropical joinery products from Indonesia, mainly consisting of doors, fell 19% to US$54 million in the first eight months of this year (Chart 5). UK imports of wooden doors from Indonesia were quite strong in March and April but were slow between May and August. It is not unusual for these imports to vary widely each month, even in a normal year, and it is therefore difficult to predict how the trade will develop for the rest of the year.

After a strong start to the year, UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) stalled almost completely in May and recovered only slowly in the following months. Total joinery imports in the first eight months were down 9% to US$24 from Malaysia and down 9% to US$6 million from Vietnam. UK trade in joinery products manufactured from tropical hardwoods in neighbouring Ireland have also fallen dramatically this year, down 29% to US$3.3 million in the first eight months.

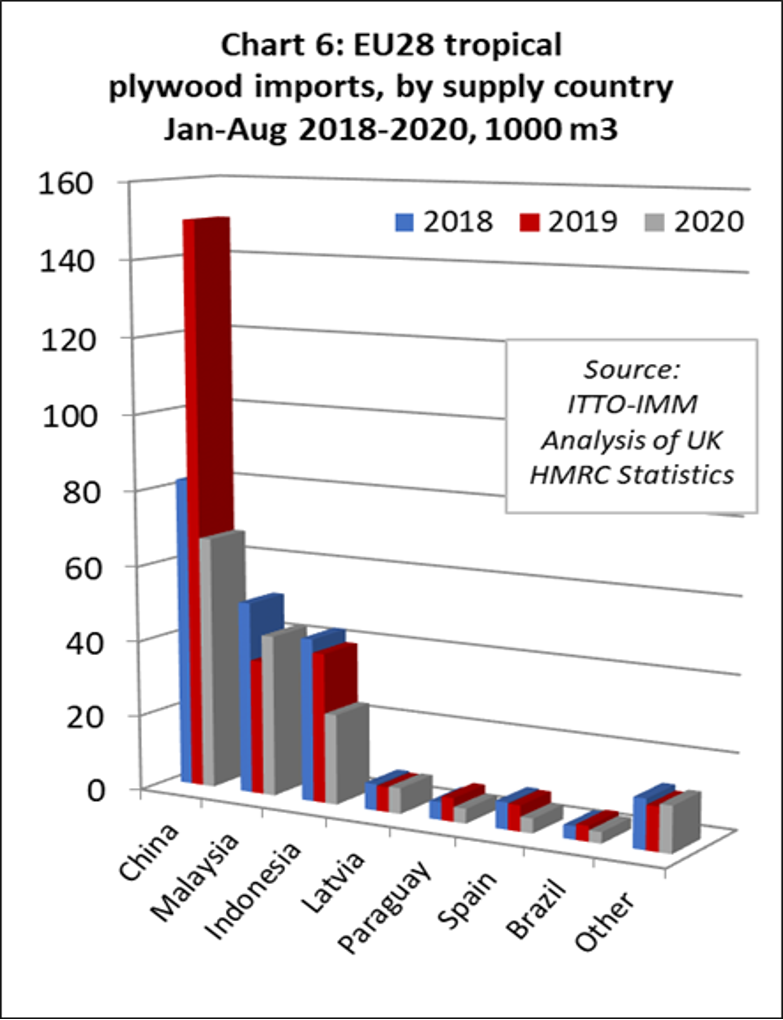

UK imports of tropical hardwood plywood from China recover slowly

The UK imported 66,800 m3 of tropical hardwood faced plywood from China in the first eight months of this year, 55% less than the same period last year (Chart 6). UK imports of plywood from China ground to halt earlier this year when China went into lockdown. There were hardly any deliveries from February through to early April and UK importers were forced to live off inventories.

UK importers report that through April and May this year Chinese plywood supply recovered steadily. By July, supply was back to normal and significant volumes under delayed contracts began to arrive. It is expected that some of the lost volume from China will be made up later this year. On the other hand, rising freight rates, up in the last couple of months from $1,300/1,400 FEU to $2,000, strengthening of the CNY against the dollar, and higher raw material costs are now impacting China’s competitiveness in the plywood market.

Likely due to supply problems in China, UK imports of plywood from Malaysia, which have been in long term decline, have recovered ground in 2020. Despite significant slowing in May, imports from Malaysia were still up 20% at 42,600 m3 for the first eight months of the year.

In contrast to Malaysian plywood, UK imports of Indonesian plywood fell 40% to 23,900 m3 in the first eight months of the year. In addition to supply problems during the pandemic, Indonesian plywood has come under very intense competitive pressure from Russian birch plywood this year. Russian plywood is reported to have become more competitive overall, with the rouble sliding from 77 to the euro in June to over 90 in September.

Indonesian plywood has lost share particularly in the large market for 18-21mm film-faced for construction where Russian birch now dominates. Although Indonesian supply is now reported to be back to normal, albeit with freight rates increasing costs, UK imports of Indonesian plywood are now focused more on more niche products such as thinner plywood and for overlay and 2.7mm items for the caravan industry,

In recent years, the UK has been importing small volumes of tropical hardwood faced plywood from Latvia and Spain. In the first eight months of 2020, imports increased 4% to 6,800 m3 from Latvia but fell 43% to 3,900 m3 from Spain.

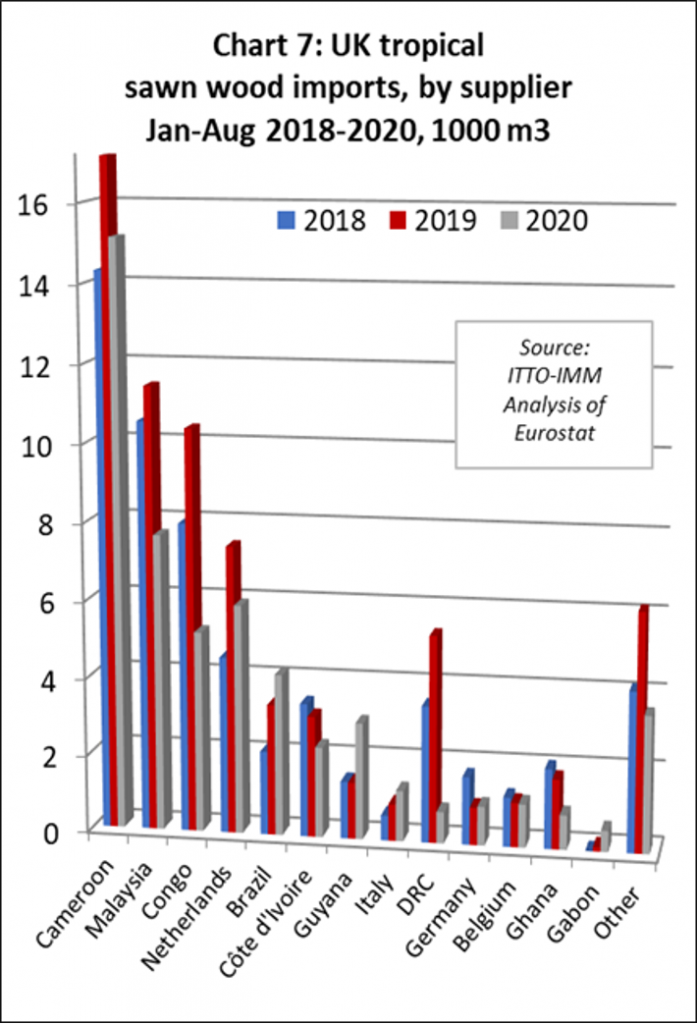

UK tropical sawn hardwood imports rising from Latin America

The UK is now a relatively minor market for tropical sawn hardwood, importing less than 100,000 m3 in each of the last two years, making it only the fifth largest European importer for this commodity (after Belgium, Netherlands, France and Italy). While the UK trade in sawn tropical hardwood fell sharply in May and June this year, there was some recovery in July and August, particularly from Latin America. However imports were still down from most major supply countries by the end of August (Chart 7).

UK imports from Cameroon, the leading supplier, fell 12% to 15,100 m3 in the eight-month period, while imports from the Republic of Congo declined 50% to 5,200 m3. Of other African suppliers, imports were down 25% to 2,300 m3 from Côte d’Ivoire, down 85% to only 810 m3 from DRC and down 51% to 887 m3 from Ghana.

While UK imports of African hardwoods suffered severely during the COVID lockdown this year, there is some optimism that trade will recover well in coming months. Recent market discussions at the London Hardwood Club suggested that trade in the favoured African species (dominated by sapele in the UK) is “now at normal levels”. It was also noted that UK is “well stocked but not overstocked” in African hardwoods. However, sapele is currently being traded at unsustainable price levels, below replacement cost.

UK imports from Malaysia were 7,700 m3 in the first eight months of 2020, 33% less than the same period in 2019. Indirect imports into the UK via the Netherlands were down 20%, at 5,900 m3, after significant growth last year. However imports from Brazil increased 23% to 4,200 m3 in the first eight months of 2020, with particularly good growth during the summer months after lockdown. Imports from Guyana also increased, rising 107% to 3,000 m3 in the first eight months of the year.

Economic forecasts in the UK becoming a little more optimistic

The latest October report of the EY Item Club, a leading UK economic forecasting body, is slightly more optimistic than the previous report in July. According to the Club, the UK economy may have grown by as much as 17% in the three months to the end of September. This compares to their earlier prediction of only 12% growth.

However the Club believes slower growth may follow, with a fall to 1% or less predicted for the final three months of this year. The end of the furlough scheme, under which workers had part of their salary paid by the government, will mean higher unemployment and sluggish growth, said the forecasters.

“The UK economy has done well to recover faster than expected so far,” said Howard Archer, chief economic adviser to the EY Item Club. “Consumer spending has bounced back strongly, while housing sector activity has also seen a pick-up, in part thanks to the stamp duty holiday.”

That said, the UK economy is now predicted to regain its pre-pandemic size in the second half of 2023. Back in July, the EY Item Club did not expect that to happen until late 2024.

However, there is a high level of uncertainty surrounding this forecast. While a vaccine is likely to help the economy, the downside risks are significant. Factors that could weigh down growth include a drop in consumer spending, more lockdown measures, a spike in unemployment and slow Brexit negotiations between the UK and the EU.

On the last point, the Club’s estimates assume a simple free trade agreement with the EU by the end of the year. Without an agreement, growth of 4.8% is forecast in 2021, down from 6%, while growth in 2022 would be cut to 2.6% from 2.9%.

More positive, particularly for having a more direct bearing on timber demand, is that the latest data on purchasing managers sentiment in the construction sector from IHS Markit and UK Chartered Institute of Procurement and Supply (CIPS) signals another sharp increase in UK construction activity at the end of the third quarter.

The expansion came amid the sharpest rise in new UK construction business since before the pandemic-induced lockdown, with firms increasing their purchasing activity at the quickest pace for nearly five years.

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index registered 56.8 in September, up from 54.6 in August. Any figure above 50.0 indicates growth of total construction output. The latest reading pointed to a reacceleration in the rate of activity growth and a sharp increase overall.

Underlying data revealed varied results across the three monitored sub-sectors. The strongest performing category was home building, where firms registered a sharp expansion in activity for the fourth month running. Work undertaken on commercial projects also rose strongly, increasing at quickest pace for over two years. Meanwhile, civil engineering activity fell for the second month running and at the sharpest rate since May.

Looking forward, confidence towards the 12-month business outlook in UK construction was the strongest since February. Optimism was supported by expectations of a sustained rise in new work.

Commenting on the latest PMI data, Duncan Brock, Group Director at CIPS said “UK Construction took off in September, soaring ahead of both the manufacturing and service sectors in terms of output growth and recording the fastest rise in purchasing activity since October 2015. Fuelled by the easing of lockdown measures, new orders rose for the fourth month in a row and at the quickest pace since the beginning of the year before the pandemic struck”.

While Mr Brock was concerned about the potential impact on employment as “government support schemes are winding down” he suggested that “for now, builders are stocking up for Brexit and Covid preparations, so purchasing remains strong in spite of longer delivery times and some shortages”.

PDF of this article:

Copyright ITTO 2020 – All rights reserved