EU plywood trade is cautious, but Covid recovery is faster than expected. It’s still too early to say for sure, but it’s variously estimated by European plywood importers and distributors that the Covid-19 pandemic will slice 10-20% off their 2020 bottom line. Trade has since seen a bounce back, varying in degree from country to country, but companies don’t expect it to make up for the sales lost when the health crisis first hit.

Looking ahead, the sector is hopeful about continued market recovery, although there’s a wariness about making more than short-term forecasts and concern about the economic fallout as European governments wind down pandemic business support measures. There is some preoccupation too about the potential impacts on the European economy of Brexit if the UK does come to the end of its transition period to depart the EU on January 1 and leaves without a trade deal.

The better news, however, is that, while plywood companies across Europe acknowledge that they’ve taken a significant hit from the pandemic, the general view is that the contraction in trade has not in fact been as severe as expected earlier in the year.

“In normal circumstances, losing a tenth to a fifth of sales would be seen as a bit of a disaster,” said one importer. “But if you’d offered us that when we were at peak lockdown, we’d have grabbed it with both hands. At one point we were trading at between 30 and 35% of normal levels.”

This expressed the general consensus. Some companies closed for a period late March into April. Most kept trading, but report that they were mainly dealing with outstanding orders.

“There was new business coming into the pipeline, but it was significantly down and more hand to mouth,” said an importer/distributor. “Very few customers were committing more than a few weeks ahead. We actually kept all our staff on, but it was as much to keep communications channels open with customers, as to actually do business.”

But the worst of the crisis was, in the words of one company, ‘surprisingly short-lived’. Business was reported to have started recovering as early as May and picked up from there.

“An indicator that things didn’t turn out quite as bad as customers expected was that we got calls in April asking for longer payment terms, then in May they came back to us and said that they no longer needed them,” said an importer distributor.

Some businesses report that they were already back to pre-Covid trade levels by June and that momentum continued to build in July.

“Early on, part of the uptick in activity was due to delayed supply shipments coming in and completing outstanding orders that we’d been able to fulfill before,” said an importer. “But new orders also started to increase.”

Sharp dip in continental European plywood trade in August

Some plywood businesses in continental Europe said that, after trade strengthened through June and July, it dipped again, in some cases sharply, in August.

“This seems to be because people went ahead with vacations, even if they were staycations,” said an importer. “We anticipated once customers got back to business post lockdown and staff returned after furlough or technical leave, they’d work through the summer period. But no. However, trade did slowly get back to recovery in September.”

The exception to this trend was the UK. “We don’t have the continental summer vacation pattern, and we saw sales continuing to accelerate through July and into August,” said a UK importer.

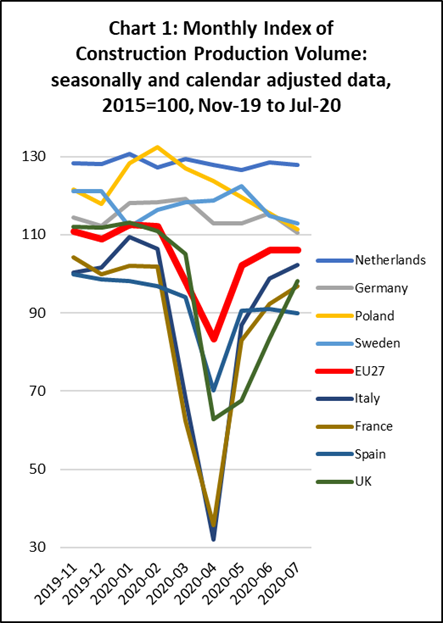

The European construction sector, the main plywood consumer, was severely affected by the pandemic in April but recovered strongly in most countries in the following months. According to Eurostat figures in April EU27 construction output slumped by 15% compared to March but made up much of the lost ground in May and June (Chart 1).

The construction sector was hit hardest in April in Italy, down 53%, France, down 43%, and Spain, down 25%. Construction in the UK also fell rapidly in April, down 40%. Although production rebounded in all these countries in the following months, it was still down on the long-term average in July.

In contrast, construction production in the Netherlands, Germany, Poland and Sweden was less affected during the first wave of the pandemic.

On the basis of current data, Euroconstruct predicts that, after expanding 2.7% in 2019 to €1,700 billion, construction output in its 19 European member countries will contract 11.5% (compared to a GDP decline of 8.8%). This will take revenue down to around €1,500 billion, the lowest level since 2015. Recovery is expected to set in next year, with output rising 6%, followed by 3% growth in 2022. However, the pandemic over the 2020-22 period is forecast to cost construction around €350 billion in lost business.

Over this year, only Portugal and Poland among Euroconstruct countries are expected to see building sector growth, while the smallest contractions will be in Switzerland and Finland, down 1-2%. Of the big five, Germany is predicted to fare best, with a 2.5% construction downturn, and the UK worst, with output 33% lower. Building in Spain is forecast to contract 15%, France by 17.8% and Italy 11.4%.

These figures tally with comments from plywood companies in different countries, although a number gave a more upbeat perspective on the rate of recovery in construction, with government investment programmes expected to give the industry a further boost in various countries.

“In two of our leading construction markets, Germany and the Netherlands, we saw activity continuing quite robustly. There was some slowdown, but few sites closed, and from May onwards demand has picked up steadily,” said an importer. “In Germany, in particular we see strong prospects for the industry. After a period of under investment, for which it was criticized by the EU and UN, Germany started a multi-billion euro infrastructure and public construction spending programme about two years ago, and that continues. So we’re expecting good growth in the market.”

While construction suffered worse in France, public investment is also expected to underpin recovery and growth.

“The French government says its recovery investment package will eventually add up to 4% of GDP, the largest percentage spend of any European country,” said another importer. “It maintains that this should get GDP to pre-Covid levels by 2022, and €7 billion is earmarked for building renovation and increased energy efficiency. Additionally, as part of its sustainable development programme, France is introducing a law in 2022 whereby timber will have to make up 50% of construction materials used in new public buildings. In line with this, a significant part of construction for the 2024 Paris Olympics will be in wood.”

The pace of recovery in other European countries was expected to depend on the resources governments have available to boost their economies.

“The deeper their pockets, the sooner they’ll get back on track,” said an importer-distributor.

Signs of good recovery in UK plywood market in the third quarter

While Euroconstruct forecasts the UK building sector to suffer the steepest downturn of its member countries, bar Ireland where contraction is predicted at 38%, a UK importer also reported good signs of recovery from June through August.

“In fact we had one of our best Julys ever, not just for plywood, but also OSB and the range of wood panel products, and construction contributed significantly to that,” they said. “Looking forward, the government has also pledged to increase funding for public building projects and the refrain is that we’re going to build back better and greener, which should hopefully open the door to greater use of timber.”

Of other markets, the DIY and repair maintenance and improvement sectors are both reported to have come through the pandemic relatively strongly, and now to be picking up well.

“It seems consumers turned to DIY projects during lockdown,” said an importer. “In addition, the money they’re not spending on holidays and going out is going into home improvement.”

Of other plywood markets, furniture and joinery manufacture seem to have taken longer to recover, although activity is now said to be on the up. Worst affected are reported to have been packaging, hit especially by the general downturn in manufacturing, and shopfitting, with retail already suffering going into lockdown, in part from continuing growth in online shopping, which the pandemic has further accentuated. The hospitality sector has also been badly affected, as has the trade exhibition industry.

“By July/August our sales into construction, which form the biggest part of our plywood trade, were back to 90% of normal, with furniture and joinery around 50% and increasing,” said an importer. “But shopfitting and packaging were still some way behind. And the exhibition sector, which is a significant panel products market, was just flat and we don’t see it coming back significantly even in the first half of 2021.”

A UK importer distributor, however, did see some signs of revival in shopfitting from August. Sales of wood sheet materials for ‘distancing screening’ in hospitality and healthcare sectors also to some extent made up for business lost elsewhere.

Steady recovery in European plywood deliveries from China

In terms of supply the major concern early on in the pandemic was China. “When they went into lockdown, as far as we were concerned, they just turned off the tap,” said one importer. “We didn’t see deliveries from February, through to early April. We and our customers had to live off inventories.”

However, through April and May, Chinese supply was reported to have recovered steadily, and in the summer to be back to normal. One importer reported a ‘surge of outstanding deliveries in July’.

Increasing freight rates, up in the last couple of months from $1,300/1,400 FEU to $2,000 are now impacting Chinese competitiveness. In addition the strengthening of the CNY against the dollar, plus increased veneer prices due to the effects of bad weather on supply, are reported to be prompting Chinese suppliers to push for 3-5% price increases.

“However, there’s a lot of market resistance and that could lead to some issues with quality, with factories cutting back on standards if they can’t get price rises,” said an importer. “With China, you get what you pay for.”

Some gaps are reported to be opening up in Brazilian supply as demand from the US construction sector continues to grow strongly. Consequently prices are up too.

“While production has continued, Brazilian through the pandemic has been a real roller coaster,” said an importer. “At the start in March the price for standard 20mm C+/C dropped from $230/m3 FOB to $170 due to contraction in international demand, then dipped even lower. Now it’s back to $250-280 and it’s mainly due to an increasingly active US market.”

Russian plywood squeezing out Indonesian suppliers

Indonesian supply is also reported to be back to normal, albeit with freight rates increasing costs. One importer, however, said they were now only buying raw board from the country.

“Thinner Indonesian product is also still doing OK, and they’re strong in overlay and 2.7mm items for the caravan industry, but, for us, they’re pretty much out of the picture in 18-21mm film-faced for construction, where Russian dominates,” they said.

Russian plywood is reported to have become more competitive overall, with the rouble sliding from 77 to the euro in June to over 90 in September.

“At the same time, some Russian mills have been pushing for price rises in certain upper end qualities as they’re facing shortages of logs and quality veneers until the next harvest season starts,” said an importer.

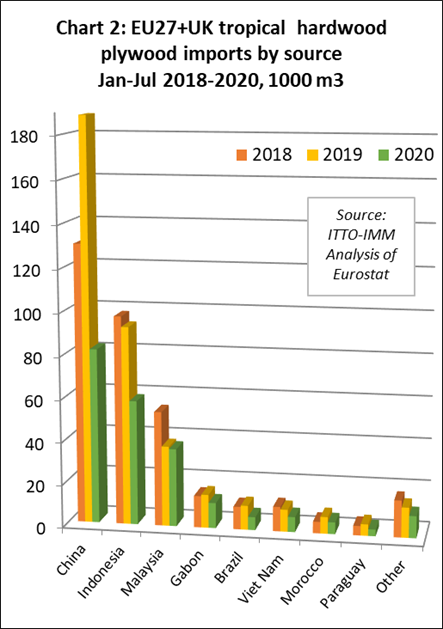

Reflecting the impact of the pandemic, analysis of Eurostat’s Comext figures show total tropical hardwood imports into the EU27+UK, down 42.4% to 221,000 m3 from January to July, compared with the same period in 2019.

Biggest falls came in imports from China, down 56.6% to 82,000 m3. Shipments from Indonesia were 37.1% lower at 58,000 m3, from Malaysia down 2.8% to 36,000 m3, Gabon down 23.8% to 12,000 m3, Brazil down 46% to 6,000 m3 and Vietnam down 31.7% to 7,000 m3 (Chart 2).

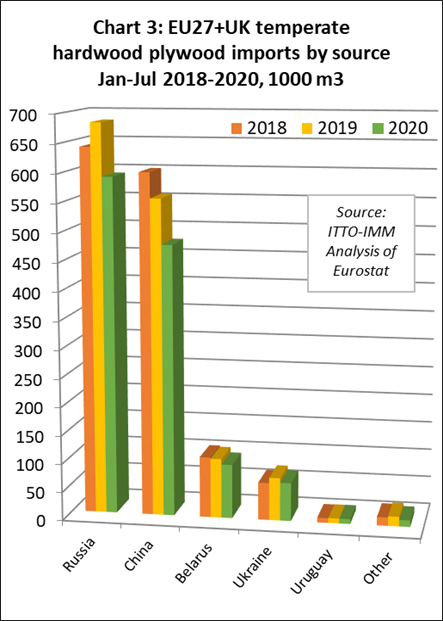

EU27+UK combined temperate hardwood plywood imports for the period fell 13.4% to 1.25 million m3, with Russian imports down 13.5% to 591,000 m3, Chinese down 14.2% to 477,000 m3, Belarusian down 9.1% to 95,000 m3 and Ukrainian down 10.6% to 67,000 m3, while Uruguayan imports were up 0.8% at 9,000 m3 (Chart 3).

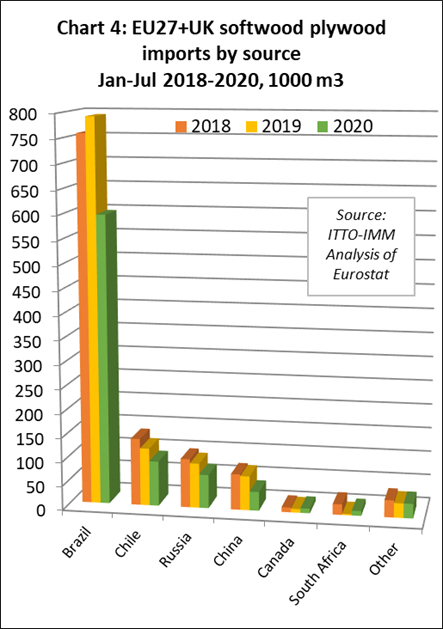

EU27+UK total softwood plywood imports over the same period were 23.9% lower at 847,000 m3, with Brazilian 24.7% lower at 597,000 m3, Chilean down 22.1% at 93,000 m3, Russian down 24.7% at 70,000 m3 and Chinese down 44.9% at 39,000 m3. Imports from Canada rose 26% to 9,500 m3 and South African increased 311.8% to 10,000 m3 (Chart 4).

No-deal Brexit threatens European market confidence

Turning to Brexit, there remain fears if the UK leaves the EU without a deal, it could further undermine European market confidence, which is already fragile due to fresh spikes in incidence of Covid-19 in a growing number of countries. But late September, negotiators on both sides were making more conciliatory noises and sounding more positive a deal would be struck.

A leading UK importer added that, while they remained concerned about hold ups at ports and customs as new administrative procedures bed in in the event of a no-deal Brexit, they were not hedging by increasing stocks.

“We always keep a buffer and don’t anticipate we’ll need more than this,” they said. “In addition, all our competitors will be in the same position.”

Another importer said they were cautious about building stock in case the current ‘US demand bubble’ underpinning the global market bursts. “In that case prices would drop,” they said.

UK companies added that they were not ‘overly anxious’ either about having to undertake due diligence on imports from the EU under the new UK Timber Regulation, which succeeds the EUTR in the UK, if a deal is not struck. This includes FLEGT-licensed product imported via EU countries.

“We have the systems in place, and are already subjecting Latvian plywood and OSB to due diligence, for instance, so we don’t see it as a significant additional administrative burden,” said one company.

One complication is the position of Northern Ireland post Brexit. Under the original ‘Withdrawal Agreement’ concluded by the UK and EU, it remains subject to the EUTR, so goods shipped from the rest of the UK to Northern Ireland would have to undergo due diligence and be subject to the same duty as those imported into the province from other non-EU countries. However, under the UK government’s recently proposed Internal Market Bill, goods could be shipped to Northern Ireland without any checks or duty, in which case those exported from Northern Ireland to the Irish Republic would be subject to EUTR due diligence.

“About 10% of our turnover comes from goods exported to the Republic via Northern Ireland, and this uncertainty is not helpful,” said a UK plywood importer. “But we have been assured, we won’t be paying duty twice.”

Brexit deal or no Brexit deal, all UK imports from outside the EU will be subject to the duty rates in the new UK Global Tariff unless:

- the supplier country or region has a trade deal with the UK

- a developing supplier country has Generalised Scheme of Preference status with the UK

- an open Product Quota has been registered with the WTO.

That said, many of the duty rates will be unchanged from those of the EU. Some will be lower.

As for quotas, this includes the EU Coniferous Plywood Quota. According to the UK Timber Trade Federation, if the UK strikes a trade deal with the EU, then it will continue to take its share of this annual quota, as before. If not, plywood from the EU will count as part of its share of the quota.

“Our understanding is that the UK will have its own duty free softwood plywood quota of around 167,000 m3 starting January 1, 2021, which is based on its usage of the [EU] quota over the past five years,” said a TTF spokesperson. “If we do not sign an EU deal then coniferous plywood from Finland, France and Sweden will have access to the quota along with the rest of the world so it is likely to be used up faster than before.”

Also in EU plywood sector news, the Dutch EUTR Competent Authority has ordered the Netherlands company Sakol to stop importing tropical-faced plywood from Chinese supplier Jiangsu High Hope Arser Co. Ltd, which it deems in breach of the Regulation.

The Environmental Investigation Agency NGO says the move sets a precedent for the rest of the EU, and it urges Competent Authorities in France, Belgium, Greece, and the UK, which import similar products from China, to follow the Dutch example.

“This decision is significant as it delivers a blow to the protective cover that these global supply routes have provided for high risk and illegal tropical timber and shows that European authorities are rising to the challenge posed by complex timber supply chains,” said EIA Forest Campaigns Director Lisa Handy. “For the EU to demonstrate it is truly a level playing field, and if the UK does not want to become a back door for illegal tropical timber in the region, the decision taken in the Netherlands should trigger a domino effect across Europe. We look forward to other authorities taking similar actions.”

On the trade outlook, EU plywood companies highlight continued downside risks in the market. These include further increases in new cases of Covid-19 – the so-called pandemic ‘second wave’. Importers are also concerned that unemployment will rise as governments withdraw worker furlough support, with a consequent loss of consumer confidence. Some expressed a worry too about sufficient new construction work coming on stream, despite public investment, once pandemic-delayed projects are completed.

However, the sector is not overly downbeat. “We’re in a better position now than we expected to be six months ago, and at the moment we’re seeing recovery continuing to pick up,” said an importer. “We’re taking things week to week, month to month, as the picture is so uncertain, but we’re cautiously optimistic.”

Copyright ITTO 2020 All rights reserved