EU27 tropical timber imports are stronger than expected so far in 2020. The total EU27 (i.e. excluding the UK) import value of tropical wood and wood furniture products was US$1.98 billion between January and August this year, 14% less than in 2019. This is a significantly higher level of import than forecast earlier in the year with the “Great Lockdown” having a severe impact on the wider EU27 economy and on the supply side in tropical countries. The fact that EU27 trade in tropical wood timber products was cooling even before the onset of the COVID-19 pandemic makes this performance more remarkable.

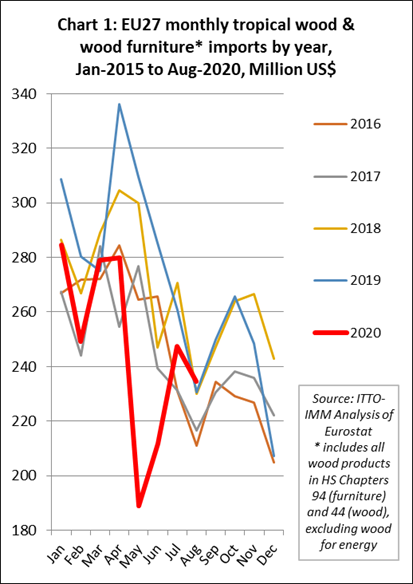

Chart 1, which shows the value of EU27 imports of tropical wood and wood furniture products each month during the last five years, highlights that while imports fell sharply in May this year there was a very strong rebound in June and July. Although imports declined again in August, they were at a five year high for that month (which is typically very slow during the European summer vacation period).

Chart 1: The Value Of EU27 Imports Of Tropical Wood & Wood Furniture Products Each Month During The Last Five Years

The continued relative buoyancy of trade is probably partly due to the strength of the DIY sector in the EU27 during the lockdown with many people taking the opportunity to carry out home improvement work. In some EU27 countries with less stringent lockdowns, such as the Netherlands and Sweden, commercial construction and manufacturing activity also continued, at a slower pace but without interruption throughout the spring and summer months.

With the easing of lockdown measures from May onwards and boosted by the introduction of large government stimulus measures, the economy picked up across the EU27 in the third quarter. Official GDP figures have yet to be published (due early November), but according to projections by Barclays an 11.5% rebound of euro area economic activity is expected in the third quarter, led by Spain (17.9% q/q) and France (16.8% q/q). Barclays projections for third quarter rebounds in Italy (12.5% q/q) and Germany (8.2% q/q) are less dramatic but only because the initial downturn in the second quarter was more muted.

EU27 imports have also been given a boost by the relative strength of the euro on international exchange markets, the euro-dollar rate rising sharply from less than 1.10 to nearly 1.20 between May and August. The dollar’s weakness is due to uncertainty in the run up to the presidential elections and the severity of the pandemic in the United States.

More Serious Challenges Emerging For The EU27 Economy

However, it remains to be seen whether the recovery in EU27 imports will be sustained as there are, once again, serious challenges emerging for the European economy. The relative strength of the euro is already creating a headache for the European Central Bank which is becoming alarmed at the impact on export competitiveness of EU27 manufacturers at a time when other factors are weighing down heavily on demand.

Meanwhile, the second waves of COVID infection across Europe have grown to be larger than the first and have led to renewed lockdowns which now threaten a final quarter economic contraction. Assessing the impact of the new lockdown measures is difficult because, unlike six months ago, they are now more regional, or targeted, sector-specific and time–limited. However, they are adding to an already uncertain economic climate.

Forward looking indicators show that economic momentum in the EU27 is likely to get worse before it gets better. October registered a third consecutive monthly decline in the Euro Area Purchasing Managers Composite Output Index, down 1.1 points to 49.4 and taking it back into contractionary territory (any score below 50 indicates that a majority of those surveyed recorded a decline in purchasing).

The latest PMI data for eurozone construction is also not encouraging. IHS Markit, who undertake the survey, commented in their 6th October report that “The PMI results for September show that the eurozone construction sector remained stuck in contraction as builders struggled to secure new work amid the COVID-19 outbreak. The survey pointed to broad-based declines across housing, infrastructure and commercial projects. In line with increases in coronavirus cases, and the potential for stricter restrictions to be imposed, a rebound in the near-term seems unlikely. In fact, eurozone builders remained pessimistic about growth prospects”.

IMF forecasts published in October now suggest that euro area GDP will decline 8.3% this year followed by growth of 5.2% in 2021. Of the largest economies, prospects are strongest in Germany, with a 6% decline forecast for this year to be followed by 4.2% growth next year. The French economy is forecast to fall 9.8% this year followed by 6% growth next year. Italy’s economy is forecast to fall 10.6% this year and to rebound 5.2% next year. Spain’s economy is forecast to fall even more drastically this year, down 12.8%, but to rebound more strongly, by 7.2% in 2021.

Also in October, the European contractors’ federation FIEC published their annual report which forecast an 8.5% fall in EU27 construction activity in 2020. FEIC said the final months of 2020 would be critical for the industry as new projects were expected to decline during the Autumn.

In a sign of the heightened uncertainty, the FIEC report included no forecasts for next year. However, FIEC warned that “The situation might worsen in 2021 if investments in construction, both public and private, do not recover significantly. Moreover, due to losses in equity during the health crisis, companies will find it difficult to embark on new projects.”

EU27 Tropical Wood Imports Value Hold Up Reasonably Well In All Sectors

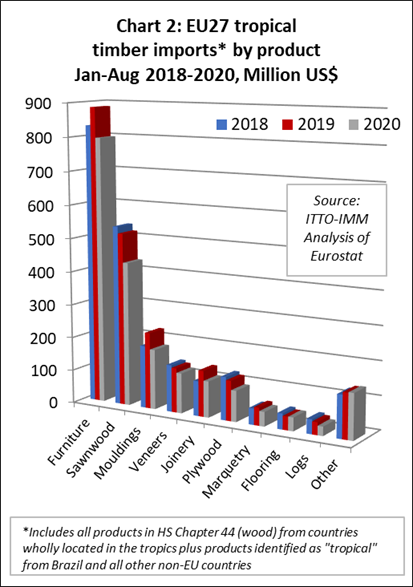

Unsurprisingly, EU27 imports of all the main tropical wood products fell in the first eight months of this year, but in each case the decline was less dramatic than expected earlier in the year when the scale of the pandemic and associated lockdown measures were becoming apparent.

In the year to August, EU27 imports of wood furniture from tropical countries declined 10% to US$797 million, while imports of tropical sawnwood declined 17% to US$432 million, tropical mouldings were down 21% to US$179 million, veneer down 10% to US$120 million, joinery down 21% to US$108 million, plywood down 23% to US$93 million, marquetry and ornaments down 18% to US$43 million, and logs down 26% to US$27 million. Imports of tropical flooring were stable, but at a historically low level of US$40 million (Chart 2).

Chart 2: EU27 Imports Of Tropical Timber By Product

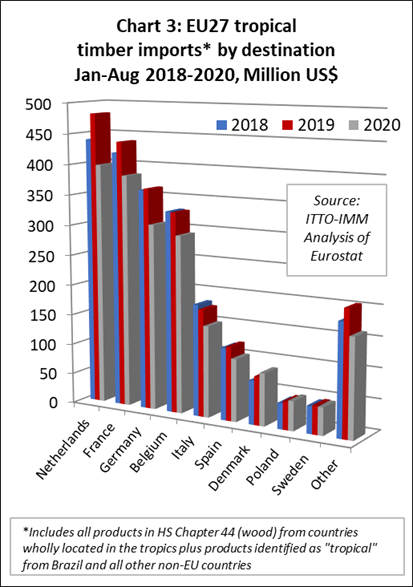

Imports fell into all six of the largest EU27 destinations for tropical wood and wood furniture products in the first eight months of this year. Imports were down 17% to US$398 million in the Netherlands, 12% in France to US$383 million, 16% in Germany to US$306 million, 11% in Belgium to US$292 million, 15% in Italy to US$150 million, and 15% in Spain to US$103 million. However, imports increased in Denmark, by 9% to US$86 million, and in Poland, by 5% to US$48 million. Imports in Sweden fell but only by 2% to US$45.5 million (Chart 3).

Chart 3: EU27 Imports Of Tropical Timber By Destination Country

EU27 Wood Furniture Imports From Vietnam Close To Last Year’s Level

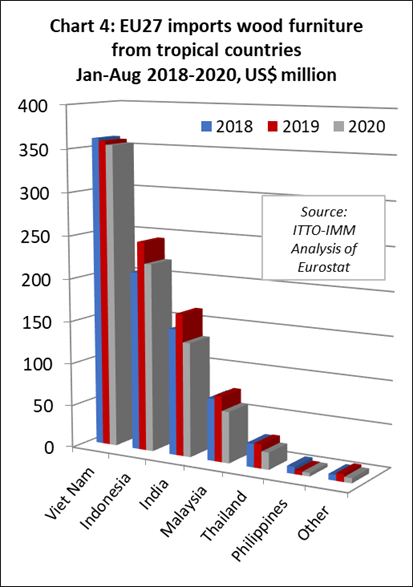

In the furniture sector, EU27 imports from Vietnam almost matched last years’ level in the first eight months, down only 1% to US$354 million. Imports from Indonesia were down 10% to US220 million in the first eight months of this year, although this compares with a relatively strong performance in 2019 and imports this year are still higher than in the same period during 2018 (Chart 4).

Chart 4: EU27 Imports Of Wood Furniture FromTropical Countries

EU27 imports of wood furniture from the other main South East Asian suppliers declined sharply, including Malaysia (down 22% to US$60 million), Thailand (down 29% to US$19 million, and the Philippines (down 9% to US$4 million)

EU27 imports of wood furniture from India were down 20% to US$133 million in the first eight months. Partly due to supply side issues, imports from furniture from India almost came to a complete halt in May this year, but then rebounded very strongly in July and August to record levels for the summer months.

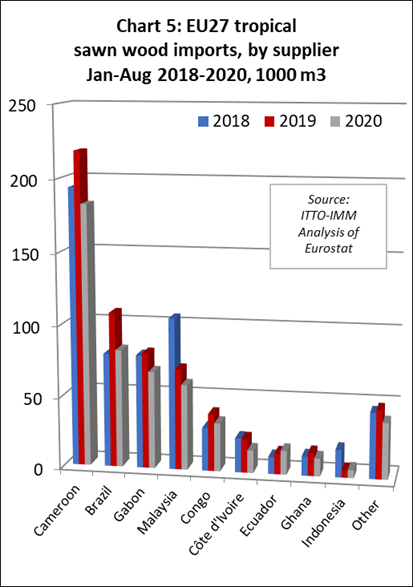

EU27 Tropical Sawnwood Imports Down Sharply From All Major Supply Countries

EU27 imports of tropical sawnwood declined sharply from all major supply countries in the first eight months of 2020; down 17% from Cameroon to 182,500 cu.m, 24% from Brazil to 82,200 cu.m, 16% from Gabon to 67,900 cu.m, 15% from Malaysia to 59,600 cu.m, 16% from Congo to 33,800 cu.m, 33% from Côte d’Ivoire to 15,800 cu.m, and 23% from Ghana to 12,200 cu.m. However Ecuador bucked the downward trend, with EU27 imports from the country rising 15% to 16,600 cu.m, much destined Denmark and likely driven by strong demand for balsa for wind turbines. Imports of sawnwood from Indonesia also increased slightly, by 11% to 5,500 cu.m, but this follows a 74% reduction in 2018 (Chart 5).

Chart 5: EU27 Tropical Sawnwood Imports By Supplier Country

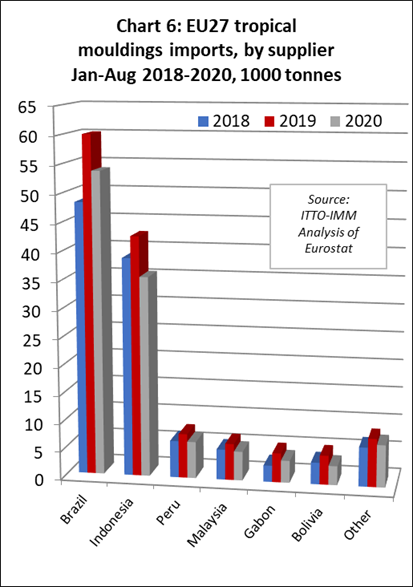

The decline in imports of tropical sawnwood in the first eight months of 2020 was mirrored by a similar decline in EU27 imports of tropical mouldings/decking. Imports of this commodity were down 10% from Brazil to 53,800 tonnes, 17% from Indonesia to 35,500 tonnes, 17% from Peru to 6,500 tonnes, 20% from Malaysia to 5,100 tonnes, 24% from Gabon to 3,900 tonnes, and 35% from Bolivia to 3,400 tonnes (Chart 6).

Chart 6: EU27 Tropical Mouldings Imports By Supplier Country

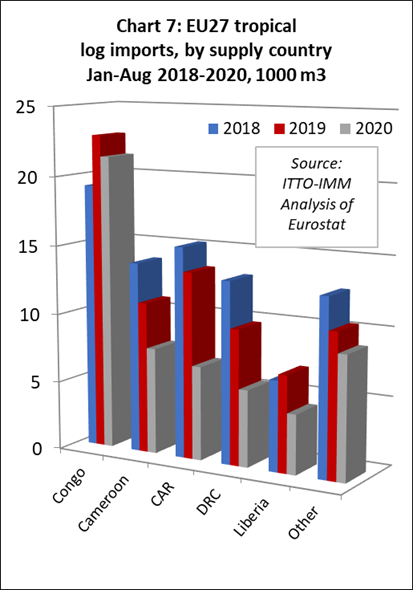

EU27 imports of tropical logs held up reasonably well from the Republic of Congo in the first eight months of the year, down only 7% to 21,400 cu.m, but fell sharply from all other leading cupply countries including Cameroon (-30% to 7,700 cu.m), Central African republic (-50% to 6,800 cu.m), DRC (-43% to 5,600 cu.m), and Liberia (-38% to 4,300 cu.m) (Chart 7).

Chart 7: EU27 Tropical Log Imports By Supplier Country

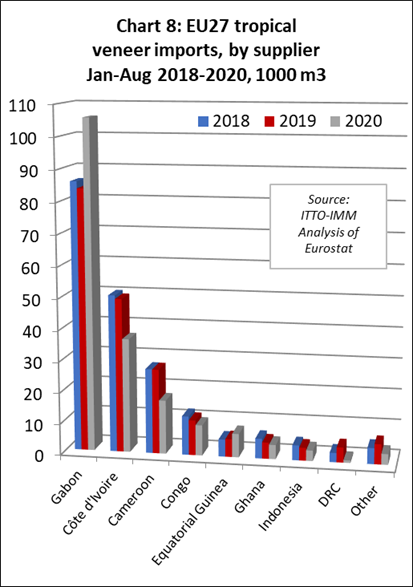

EU27 Tropical Wood Veneer Imports From Gabon On The Rise Despite Pandemic

In the veneer sector, imports from Gabon bucked the wider downward trend in EU27 imports in the first eight months of 2020. The EU27 imported 105,700 cu.m of veneer from Gabon between January and August this year, 26% more than the same period in 2019, mainly destined for France. Veneer imports also increased 32% from a small base to 7,500 cu.m from Equatorial Guinea, in this case destined mainly for Spain and Italy. However, EU27 veneer imports were down 26% from Côte d’Ivoire to 36,600 cu.m, 37% from Cameroon to 17,200 cu.m, 13% from Ghana to 4,600 cu.m, 18% from Indonesia to 3,400 cu.m and 84% from DRC to 800 cu.m (Chart 8).

Chart 8: EU27 Tropical Veneer Imports By Supplier Country

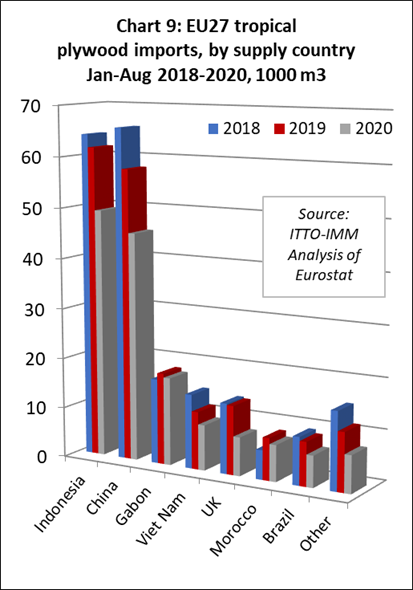

EU27 imports of tropical hardwood faced plywood were down from all the leading supply countries in the first eight months of 2020. Imports fell 20% to 49,400 cu.m from Indonesia, 22% to 45,300 cu.m from China, 4% to 17,400 cu.m from Gabon, 21% to 9,000 cu.m from Vietnam, 14% to 7,200 cu.m from Morocco and 28% to 6,300 cu.m from Brazil. EU27 imports of tropical hardwood faced plywood from the UK – a re-export since the UK has no plywood manufacturing capacity – declined 44% to 7,600 cu.m (Chart 9).

Chart 9: EU27 Tropical Plywood Imports By Supplier

EU27 Tropical Wood Flooring Imports Rise While Other Joinery Imports Decline

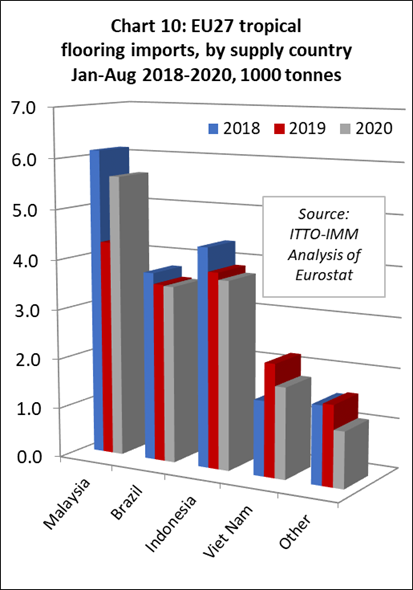

Given the situation in the wider market, one of the least expected trends in EU27 import data is a slight recovery in imports of tropical flooring products in the first eight months of this year after a long and persistent period of decline. Imports were up 2% to 15,900 tonnes, with the gain due to a 31% rise in imports from Malaysia to 5,600 tonnes, mostly destined for Belgium. Imports declined only moderately from Brazil, down 1% to 3,500 tonnes, and Indonesia, down 4% to 3,800 tonnes. Imports from Vietnam fell more rapidly, by 19% to 1,800 cu.m. (Chart 10).

Chart 10: EU27 Tropical Flooring Imports By Suppy Country

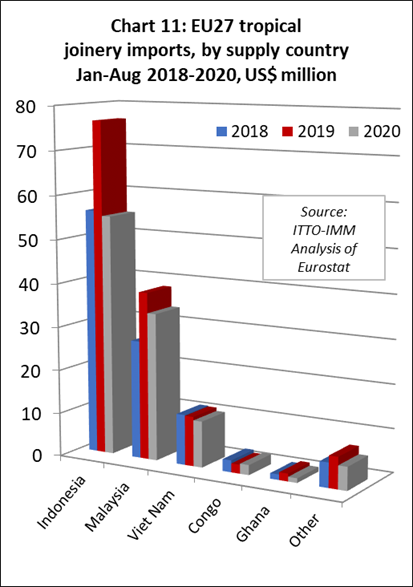

EU27 imports of other joinery products from tropical countries, which mainly comprise laminated window scantlings, kitchen tops and wood doors, declined from all three of the main supply countries in the first eight months of 2020. Imports from Indonesia were down 28% to 55,000 tonnes, 12% from Malaysia to 33,800 tonnes, and 7% from Vietnam to 10,600 tonnes. For African countries, EU27 imports of this commodity increased from the Republic of Congo, by 12% to 2,300 tonnes, but fell from Ghana, by 40% to 1,100 tonnes. (Chart 11).

Chart 11: EU27 Tropical Joinary Imports By Suppy Country

PDF of this article

Copyright ITTO 2020 – All rights reserved.