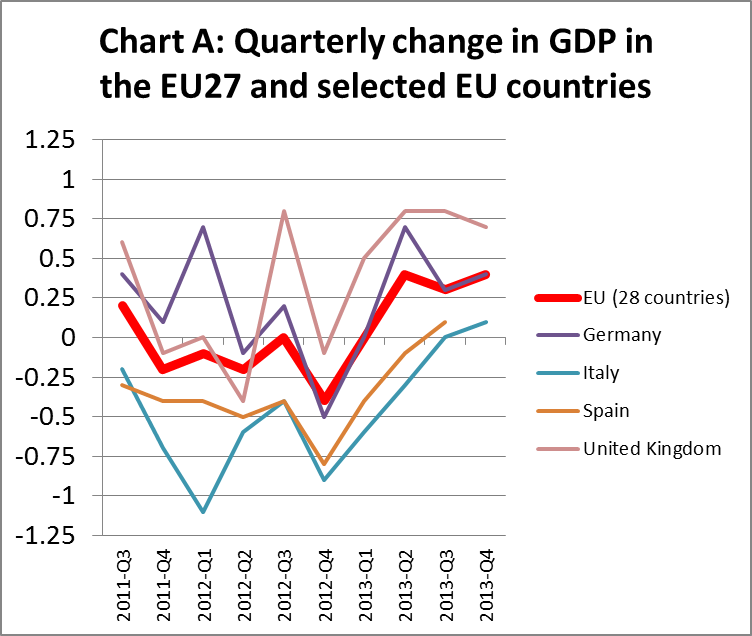

According to a preliminary estimate by Eurostat, GDP rose by 0.1% in the EU28 and fell by 0.4% in the euro area during 2013. Quarterly data shows that the European economy has been recovering slowly since the second quarter of 2013 (Chart A). Of the large EU countries, the UK was the best performing economy in 2013. The UK’s services and manufacturing sectors were the drivers of 0.7% growth in the fourth quarter, taking the annual growth rate to 1.9%, the strongest since 2007. In the euro-zone, 0.4% and 0.3% GDP growth respectively in Germany and France in 2013 helped offset further declines in Italy and Spain. However, all these economies were recovering slowly in the second half of 2013.

Fragile recovery in the euro-zone

The euro zone’s fragile economy improved modestly in the final quarter of 2013. GDP increased 1.1% at an annualized rate during the period. Recent growth is being buoyed by gains in exports and investment which is helping offset sluggish consumer spending. However growth is still well below the pace needed to make a dent in near record-high unemployment or to alleviate debt burdens in Southern Europe.

Nevertheless, with a value of $12.7 trillion, the euro-zone economy remains the second-biggest in the world behind the U.S. Official and private-sector estimates peg growth of around 1% across the region during 2014. This suggests that while the euro-zone won’t be a drag on the global economy this year, it is unlikely to provide much of a lift to its trading partners either.

With the exception of Germany – which is renowned for its export prowess- the outlook for euro-zone growth is insufficient to propel much new investment and hiring. That leaves much of the currency bloc vulnerable to shocks from the global economy, financial markets or renewed political uncertainty.

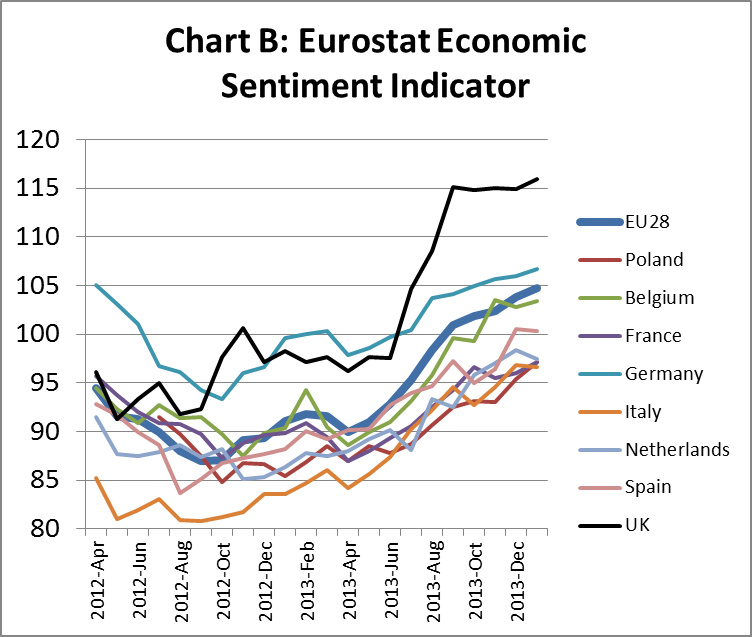

More positively, economic sentiment was improving across the EU during the second half of 2013 (Chart B). For the EU28 as a whole, the Eurostat Economic Sentiment Indicator has exceeded 100 since August 2013. This implies above average sentiment across all five economic sectors (industry, services, retail trade, construction and consumers). Economic sentiment is particularly good in the UK and Germany.

Broad-based recovery in the UK

Prospects look much improved in the UK as economic recovery is now apparent across a wide range of industrial sectors. Britain’s dominant services sector expanded by 0.8% between October and December 2013, while the construction sector increased by 0.2%. British manufacturing increased by 0.9%, with industrial production overall up by 0.7%, while agricultural output increased by 0.5%.

Of particular note for the wood industry, house building in the UK staged a dramatic recovery in 2013. British builders enjoyed their best year since the financial crisis struck. The UK Office for National Statistics reports that new housing construction jumped 10.4% to £22.1 billion in 2013. That is the highest level since 2007. The surge pushed output across the construction sector up 1.3% to £112.6 billion in 2013, 3.9% higher than the low in 2009 but still 12.2% below the 2007 peak of £128.2 billion.

Very slow recovery in construction in other EU countries

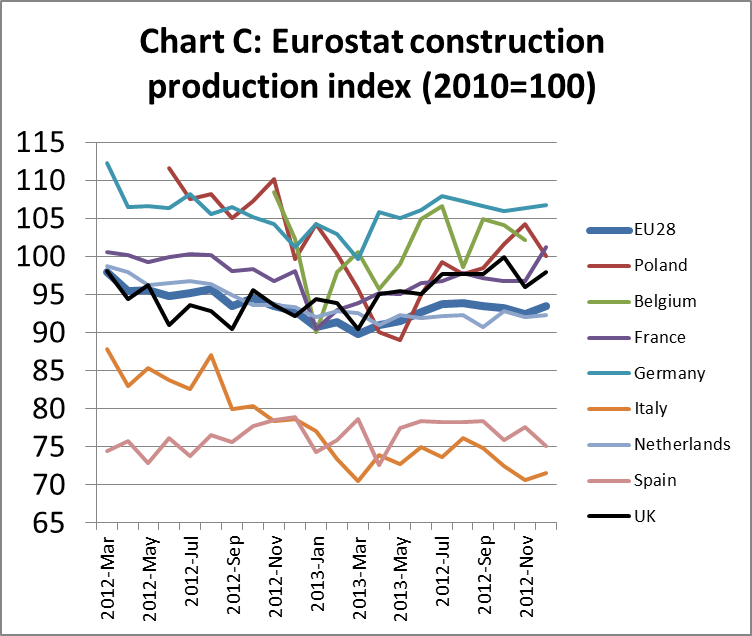

Construction activity throughout the whole of EU is currently running at around 95% of the level in 2010 (Chart C). Activity in Germany maintained a relatively high level throughout 2013. Activity was also showing signs of recovery in Belgium, Poland and France during the second half of 2013. However construction activity remained at a very low level in Italy and Spain throughout the year.

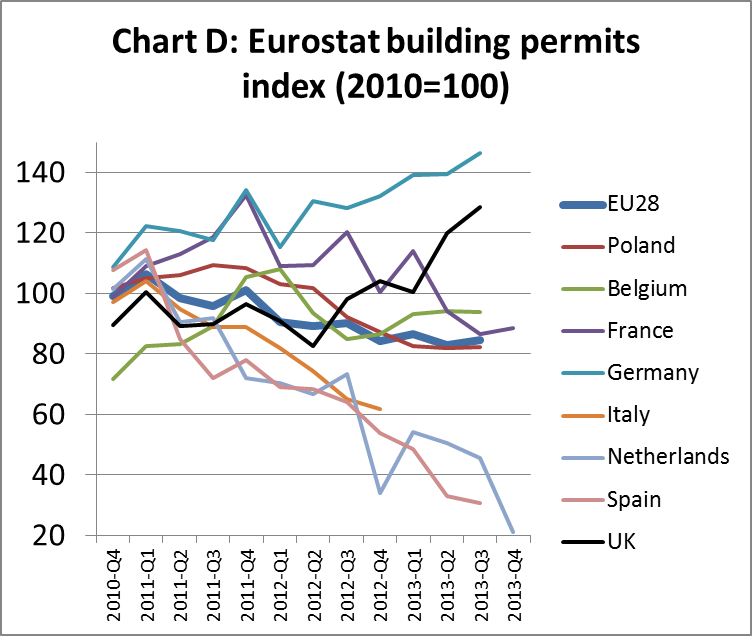

The Eurostat Building Permits Index, an indicator of future activity, suggests only very slow recovery in construction activity in the EU during 2014 (Chart D). Building permits were rising strongly in the UK and Germany in the second half of 2013. However the number of building permits issued in Spain and the Netherlands declined sharply during this period. Overall building permits issued in the 3rd quarter of 2013 were only around 80% of the level prevailing in 2010.

EU wood flooring consumption down 5% in 2013

After a year in which overall European wood flooring consumption fell by 5.9%, first estimates suggest the market contracted another 5% in 2013. This is based on comments received from member country representatives at the FEP (European Federation of the Parquet Industry) meeting held at the DOMOTEX fair in Hannover in January 2014.

As in previous years, the results show some variation between European countries and from quarter to quarter. However, the overall picture is not as diverse as it once was. Indeed, countries which were performing rather well and driving the markets upwards also lost momentum in 2013.

Markets in the south of the EU (e.g. Spain, Italy, and France) still face serious difficulties and probably experienced double digit decline in 2013. The situation is better in northern Europe, but developments are still slightly negative or, in the best case, stable (e.g. in Sweden). Central Europe remains the best performing region, particularly Switzerland with expected growth of 6% in 2013. Consumption in Austria and Germany is estimated to have remained stable between 2012 and 2013.

According to FEP, these figures “have to be seen in the light of the major challenges faced by the sector in 2013 and still faced today, notably the continuously stiff competition, extremely high unemployment rates in some important EU regions and ever uncertain exchange rates, especially the EUR/USD rate”.

However FEP also note that the latest economic forecasts provide some grounds for optimism. FEP stress the conclusions of recent FEP consumer perception studies “which confirm that parquet is a great natural product, very much valued and desired by consumers, who see real wood parquet as an indispensable element of interior decoration of the future.”

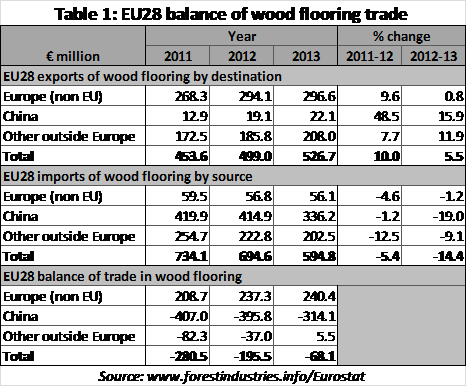

Big fall in EU wood flooring trade deficit

While European wood flooring consumption remains slow, there are signs that EU wood flooring manufacturers have adjusted to the new market situation by significantly boosting competitiveness in international markets. This is suggested by the recent rise EU exports of wood flooring to other regions and by a sharp decline in EU imports of wood flooring. The value of the EU’s trade deficit in wood flooring has fallen from €281 million to only €68 million in only three years (Table 1).

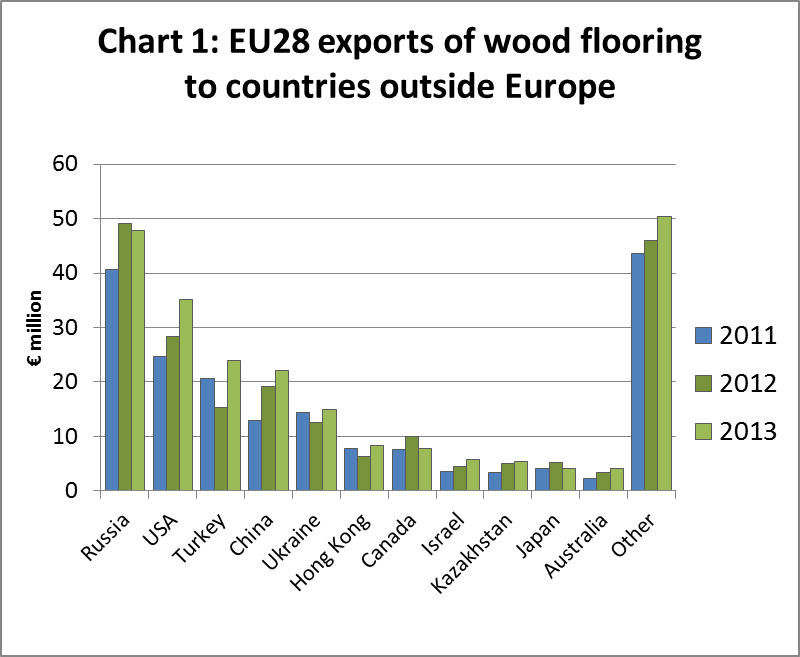

Between 2012 and 2013, the value EU28 wood flooring exports increased by 5.5% to €527m. This followed a 10% increase in export value between 2011 and 2012. Most of the export gains in 2013 were to markets outside the European continent, notably USA, Turkey and China (Chart 1). This is in contrast to 2012 when most of the rise in exports was destined for other European countries (mainly Switzerland and Norway).

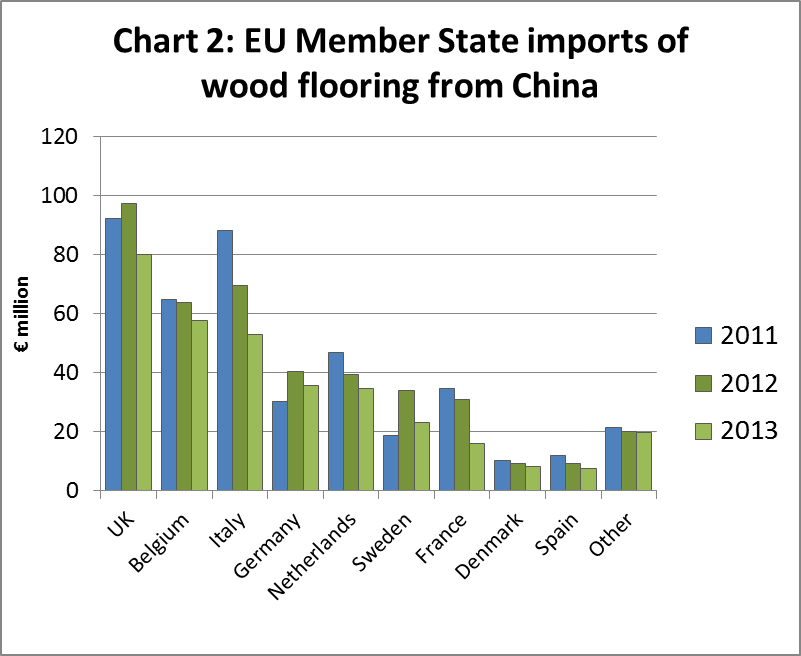

Last year, EU imports of wood flooring from outside the region fell by over 14% to €595 million. Imports from China, by far the largest external supplier to the EU, fell 19% to €336.2 million. All the main EU markets imported less Chinese wood flooring during 2013, including UK, Belgium, Italy, Germany, Netherlands, Sweden and France (Chart 2).

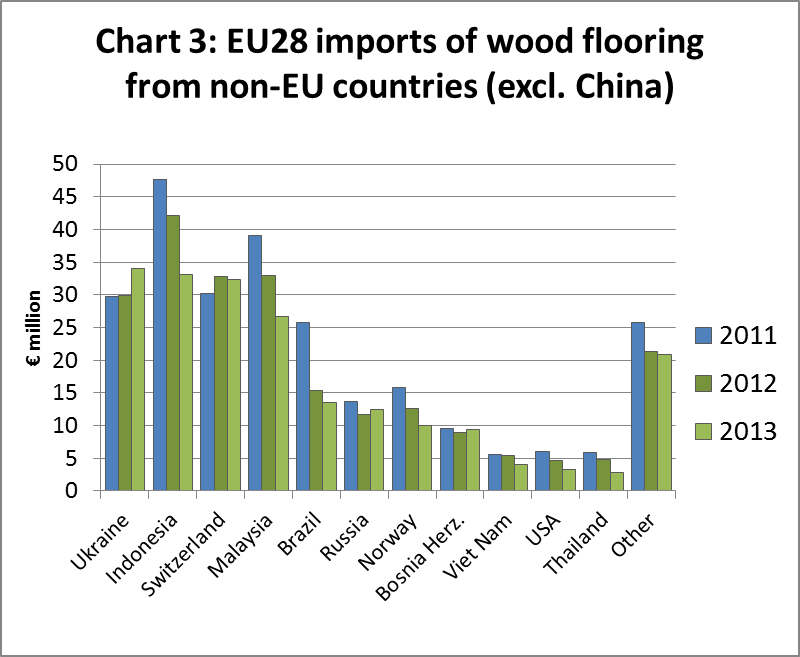

While much of the decline in imports is due to China, EU imports also declined from most tropical producing countries during 2013 (Chart 3). EU import value of wood flooring fell sharply from Indonesia (-22% to €33m), Malaysia (-19% to €26.7m), Brazil (-12% to €13.6m), Viet Nam (-27% to €4m) and Thailand (-41% to €2.9m).

Domotex highlights dominant position of oak in European flooring

Domotex is Europe’s leading flooring sector trade show held each year in Hannover, Germany during January. Every year for the last decade, the wood content of the show has become increasingly dominated by engineered wood flooring faced with oak. In relation to wood species, the only observable trend has been the increasingly wide and creative range of oak finishes. This year was no different with some companies promoting up to 150 finishes of oak. Other species, both tropical and temperate, have been pushed to the side-lines.

From the perspective of overall wood flooring demand, the Domotex show provided reasons for optimism about the future. After an attendance drop in 2013, the show rebounded 11% to 45,000 visitors and attracted 1,350 exhibitors from 57 countries. It was also encouraging that two large halls this year were dedicated to wood and laminate flooring. Some of the bigger brands who also produce laminate and non-wood flooring were showing a wider range of real wood products. Most of the biggest European flooring brands were exhibiting this year. This contrasts with 2013 when some opted instead for the German building show Bau held at the same time. There were quite a few Chinese producers promoting their products to European buyers, but perhaps not as many as in the past. This year there appeared to be more producers from Central Europe including Hungary, Czech Republic, Poland, Croatia and Serbia.

The show highlighted that the rustic antique look remains strong in in the wood flooring sector. This trend is one the producers clearly want to perpetuate as they are able to source cheaper lower grades and small dimension oak lumber, especially from Central and Eastern Europe. Manufacturers were generally confident of continuity of supply and stable prices for this lower grade material. This contrasts with supply of joinery grades of European oak and most grades of U.S. oak which are currently experiencing supply shortages and firming prices.

One indication that the European wood flooring market is recovering is provided in a comment by a US hardwood supplier attending Domotex quoted in the US-based journal Hardwood Floors. He notes that “In comparison to 2013, [European] buyers seem much more focused on availability than price. Most buyers are aware of the tight supply of U.S. hardwoods and are responding more aggressively than this time last year.”

Much of the oak on display appeared to be of European origin, although most large European flooring manufacturers are also buying significant volumes of American white oak. Other species being promoted, although much less prominent than oak, were walnut (almost all American) and ash (European and American). Some brands were marketing a few tropical species but there was no maple or cherry.

Mixed messages for tropical wood at Domotex

The Domotex show sent out mixed messages for tropical hardwoods. In addition to evidence of declining usage, there was the usual negative commentary by suppliers of competing products on the environmental profile of tropical hardwood. MOSO was promoting bamboo flooring on grounds that it offered “an ecological and long-lasting alternative to patio floorboards made of ever scarcer tropical woods”. MOSO claimed that’s patented bamboo treatment process “gives the outdoor floorboards a level of hardness, shape stability and resistance that exceeds that of even the best tropical hardwoods”. MOSO also claimed “carbon-neutrality” for their product based on “an official Life Cycle Assessment following the ISO 14040 and 14044 standard”.

More positively for tropical wood, a press release issued by the Domotex organisers highlights – as a “Hot Topic in 2014” – the availability of VLEGAL certified teak flooring from Indonesia. The press release notes that “under the 2013 EU Timber Regulation, operators placing timber on the EU market must demonstrate that they have not imported illegally harvested wood. Indonesia with its VLEGAL certification and documentation system offers a foundation for legal wood harvesting that is recognized by the EU”.

The press release draws on information supplied to Domotex by the Import Promotion Desk (IPD), a project for trade promotion financed by the German Ministry for Economic Cooperation (BMZ) together with its cooperation partner SIPPO (Swiss Import Promotion Programme). The project helped finance participation by several Indonesian flooring manufacturers at the Domotex show.

PDF of this article:

Copyright ITTO 2020 – All rights reserved