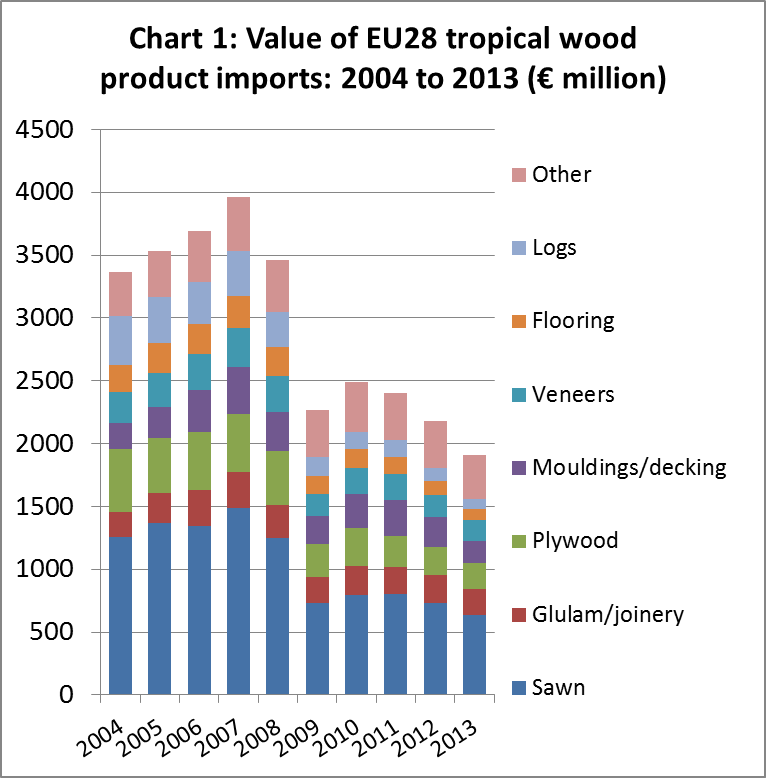

The EU imported tropical wood products with a total value of €1.91 billion in 2013, 12.6% less than the previous year[1]. Between 2012 and 2013, import value declined across all product groups including sawn wood (down 13.2% to €633 million), joinery products (down 8.8% to €208 million), plywood (down 5.6% to €206 million), mouldings and decking (down 26.4% to €177 million), veneers (down 4.9% to €168 million), flooring (down 21.7% to €88 million), logs (down 15.6% to €83 million) and other products (down 8.8% to €347 million). EU tropical wood import value last year was around 50% of the peak achieved in 2007 and is the lowest recorded in recent years (Chart 1).

[1] These figures are based on a new more comprehensive analysis of Eurostat data undertaken by Forest Industries Intelligence Ltd. The data refers to all imports from outside the EU into the EU28 group of countries, which now includes Croatia. Although Croatia only joined the EU in July 2013, EU import data for years before 2013 has been backdated to include Croatia’s wood imports during those years. Included in the definition of “tropical wood products” are all those contained in Chapter 44 of the Harmonised System of trade codes which either: (a) are derived from countries wholly located in the tropical zone or (b) are hardwood products other than eucalyptus from Brazil or (c) are specifically identified as composed of “tropical” species from other parts of the world. The inclusion of imports of “tropical species” from countries outside the tropics and of Croatia in the new data set has led to EU tropical wood imports being revised upwards slightly compared to previous ITTO reports. For example, it was earlier reported that 2012 was the first year that EU imports of sawn tropical hardwood fell below 1 million m3. The new analysis indicates that EU imports of sawn tropical hardwood were slightly in excess of 1 million m3 in 2012 and that 2013 was the first year when imports fell below this threshold.

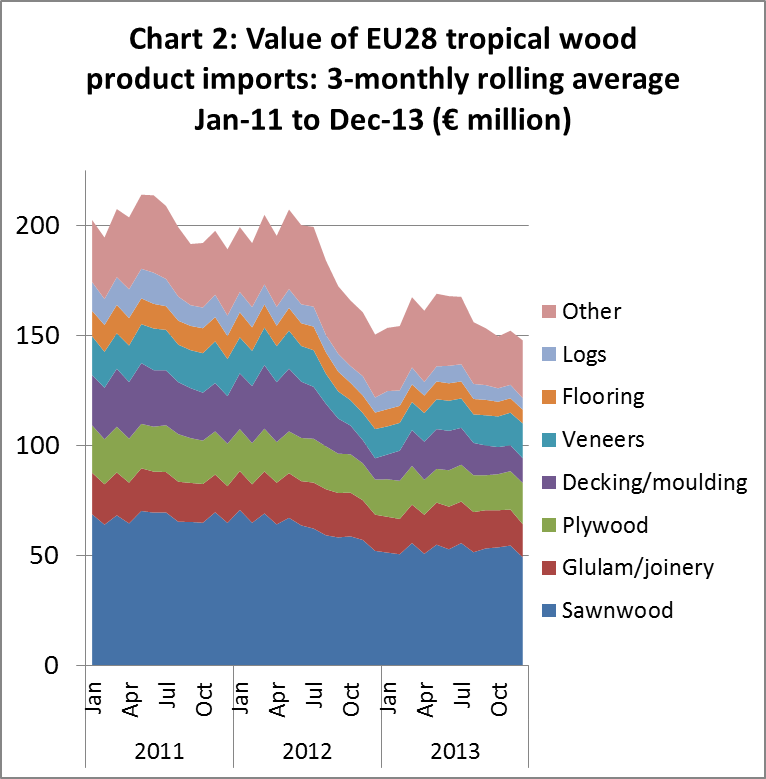

Closer analysis of monthly data indicates that EU tropical wood imports hit a low of €150 million in December 2012 and then staged a brief recovery over the spring and summer period to reach a high of €169 million in May 2013 (Chart 2). However, monthly imports fell back again to only €148 million in December 2013 when there was a particularly sharp downturn in sawn hardwood imports.

The fall in EU imports of tropical wood products in 2013 was part of a wider trend of declining imports across nearly all forest product groups, including sawn softwood, temperate hardwood products, wood furniture and pulp and paper. It is explained by the combined effects of recession in Europe, supply diversion to other more active global markets, and rising share of domestic production in EU consumption.

EU construction rises slightly but remains 20% below pre-crises levels

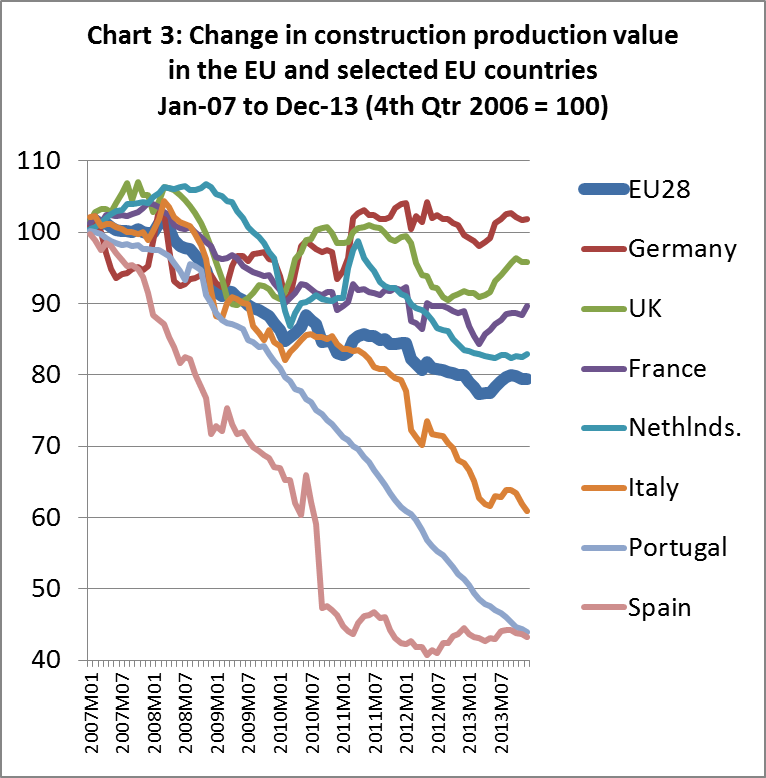

A variety of indicators show that March 2013 was the point at which economic activity across Europe was at its lowest ebb at the end of a long cold winter. This is particularly true of the construction sector, such an important driver of timber demand in Europe. Total construction value across the EU in March 2013 was 23% less than in early 2007 just prior to the financial crises. In the months following March 2013, EU construction activity increased marginally to around 20% below the pre-crises level.

Chart 3 reveals how the timing and depth of construction industry recession and recovery have varied widely between countries. Construction activity in Germany, the UK and France has been relatively resilient over the last 5 years and was showing signs of revival in the second half of 2013. This is in contrast to Spain, Portugal and Italy where the value of construction is well down on pre-recession levels and has yet to show any signs of recovery.

EU tropical log imports fall another 20%

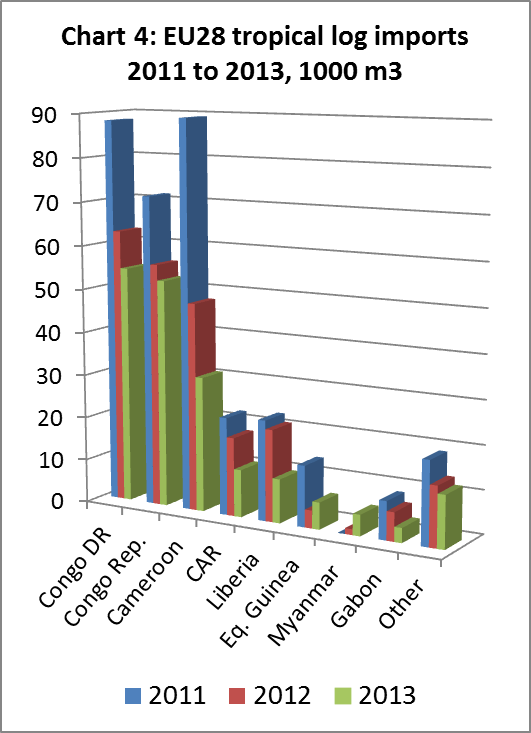

EU imports of tropical hardwood logs were 186,000 m3 in 2013, down 20% compared to the previous year. Imports of this commodity into France, the main destination, were down 20% at 86,350 m3. Imports from all the leading supply countries declined, including Congo (Kinshasa), Congo (Brazzaville), Cameroon, Central African Republic, and Liberia (Chart 4).

The decline is due to the combined effects of weak European demand, supply constraints, and regulatory uncertainty. The European okoume plywood manufacturing sector, formerly a major buyer of logs, has struggled to compete during the recession and capacity is now small, with a significant share of production having relocated to Gabon. Due to supply problems and rising log prices, more central European mills that formerly imported tropical hardwood logs for sawing and slicing have switched to temperate hardwoods this year.

On the supply side, political unrest restricted log availability from Central African Republic in 2013. The Liberian government placed a freeze on all logging activities in January 2013, including on the exportation of logs from the country. Meanwhile, encouraged by the EUTR, environmental groups have focused heavily on finding discrepancies in the legal documentation for log exports from the Congo basin. This has added to the already high level of uncertainty in the EU tropical hardwood log trade.

The only significant upward trend in EU tropical log imports was of teak from Myanmar. This has followed the end of trade sanctions and has also been encouraged by Myanmar’s announcement of a ban on log exports from April 2014. The main European end users in the boat-building sector have been building stocks in advance of the measure.

EU sawn tropical hardwood imports down another 8%

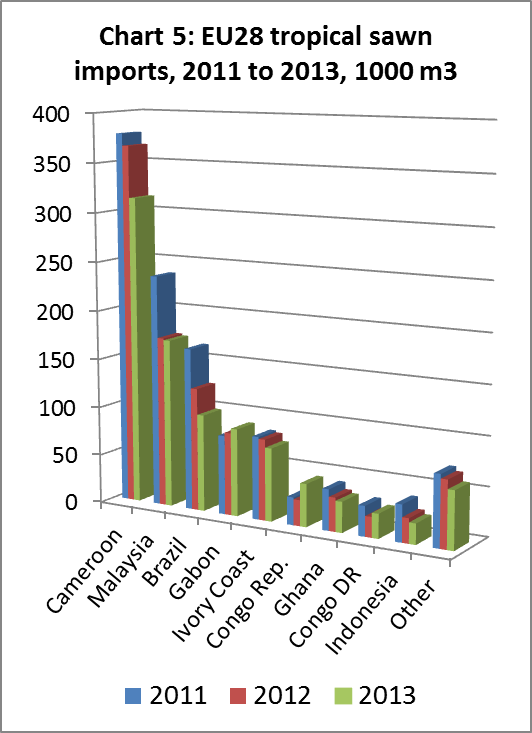

EU28 imports of tropical sawn hardwood in 2013 were 930,000 m3, 8% down on the previous year (Chart 5). Declining imports from Cameroon, Malaysia, Brazil, Ivory Coast, Ghana and Indonesia were only partly offset by rising imports from Gabon and the Congo countries.

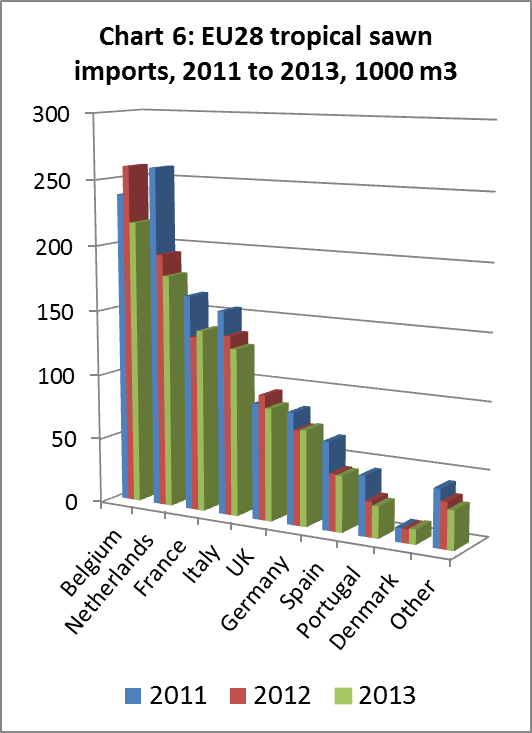

Imports of sawn tropical hardwood declined into Belgium, Netherlands, Italy, UK, Spain, and Portugal. However there was a 4% increase in imports into France and imports into Germany remained level (Chart 6).

EU imported 314,000 m3 of sawn hardwood from Cameroon in 2013, 14% less than the previous year. This was partly due to mounting supply problems in Cameroon which have been particularly pronounced for sapele, the most popular commercial species in Europe. By the end of 2013, lead times for delivery into Europe of new orders of sapele from Cameroon were around 6 months. This resulted in sharply rising prices both on an FOB basis and for landed stock in the EU.

EU imports of sawn wood from Cameroon were low in the first half of 2013 before recovering slightly in the third quarter. However they fell back sharply in December 2013, a short trading month when there was also a strike at Cameroon’s main port of export in Douala.

Gabon was the second largest African supplier of tropical sawn wood into Europe in 2013, supplying 89,000 m3 during the year, a gain of 6% compared to 2012. In the early months of 2013, EU imports of sawn hardwood from Gabon were affected by the economic slowdown in France, the main market, and by harvesting restrictions which led to reduced log supply in the country. However, both problems eased during the course of 2013 which led to a strengthening recovery in EU imports from the country. Some of the large European owned operations in Gabon which have made a strong commitment to delivery of certified wood products may also now be benefitting from the introduction of EUTR in March 2013. This might also partly explain the 65% increase in EU imports of sawn hardwood from the Congo Republic to 44,000 m3 in 2013.

EU imports of tropical hardwood from Cote d’Ivoire fell 10% to 75,000 m3 in 2013. Most of this decline occurred in the early months of the year when EU importers were concerned about possible EUTR conformance issues. However, EU imports from the country recovered in the second half of 2013 as traders grew more confident that the available legal documentation would stand up to EUTR scrutiny. EU imports from Ivory Coast also benefitted from slow recovery in demand for key species like framire and ayous in the UK and Italian markets during the second half of 2013.

EU imported 172,000 m3 of sawn hardwood from Malaysia in 2013, 1% less than the previous year. Imports from Malaysia were particularly weak in the first half of 2013, due to very slow activity in the northern European construction market. Orders picked up towards the end of the year, partly in response to improved demand, particularly in the German and UK construction sectors, together with restocking in advance of the increase in EU import duties on Malaysian products from 3.5% to 7% on 1 January 2014 due to a change in Malaysia’s GSP status.

EU sawn hardwood imports from Brazil fell 21% to 99,000 m3 in 2013, continuing the sharp downward trend which set in at the start of the European recession. The decline from Brazil is due to the combined effects of weak EU demand, exchange rate volatility and rising prices in response to improved US demand and more restricted supply as the Brazilian government has taken steps to curtail illegal logging. The problems of obtaining legality assurance in the complex fragmented supply chains that exist in the Brazilian Amazon may be another contributing factor since implementation of EUTR.

Downward trend continues in EU decking and mouldings imports

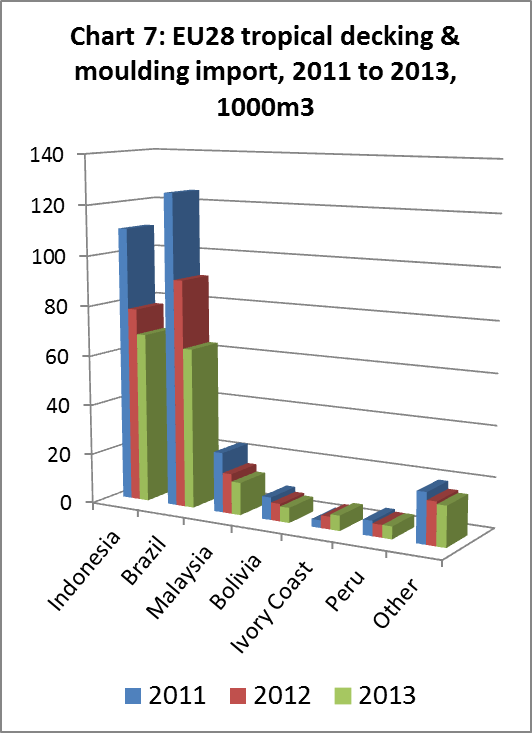

EU imports of “continuously shaped” wood (HS code 4409) from tropical countries fell 19% in 2013 to 178,000 m3 (Chart 7). Imports from Brazil fell particularly heavily, down 30% to 64,000 m3. Imports also fell from Indonesia (-13% to 68,000 m3), Malaysia (-19% to 13,000 m3).

Continuously shaped wood products listed under HS4409 include both decking products and interior decorative products like moulded skirting and beading. The market for tropical hardwood decking timbers in Europe during 2013 was very slow. Imports were impacted by a stock overhang after low levels of consumption in 2012. As prices for Asian bangkirai declined in 2013, Amazonian species like garapa and massaranduba became less competitive so that imports from Brazil fell particularly heavily. Tropical hardwood also suffered a further loss of share in the decking sector both to other wood species and to Wood Plastic Composites.

EU imports of tropical mouldings for interior applications were also declining in 2013 due to falling competitiveness relative to EU domestic production. For example, Brazil’s hardwood industry continues to suffer from high and rising labour and other business costs. Hardwood decorative mouldings of all types are also coming under intense competitive pressure from pine and MDF.

However there were isolated reports in 2013 of some tropical interior mouldings products regaining market share at the expense of temperate hardwoods. For example, in recent years American tulipwood made significant inroads into the European market for painted mouldings. However in 2013 Ghanaian wawa was retaking share as the price of American tulipwood increased. During 2013, lack of log supply and rising US and international demand led to a significant increase in prices across the full range of American hardwood species.

Falling EU imports of engineered wood window scantlings from the tropics

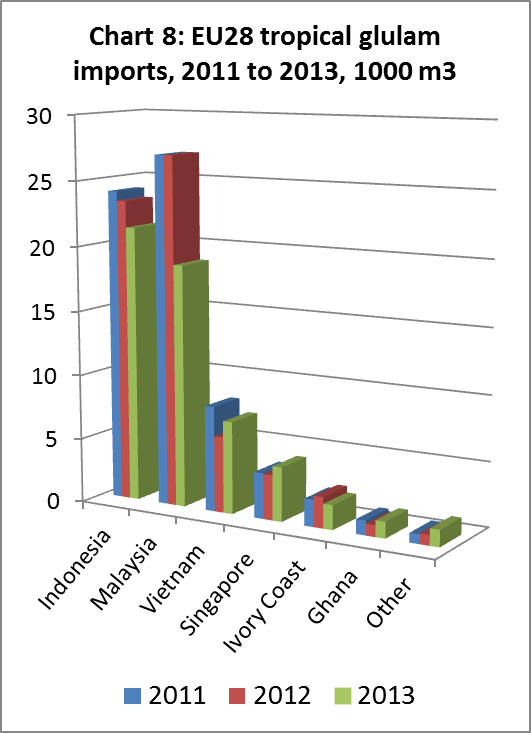

Weak construction sector activity during 2013 led to further declines in EU glulam imports (Chart 8). EU imports of this product, which consist primarily of scantlings for the window sector, were 56,000 m3 in 2013, 12% less than the previous year. EU imported 19,000 m3 of scantlings from Malaysia in 2013, 31% less than the previous year. Imports from Indonesia declined 9% to 21,000 m3 in 2013. However, there was a slight increase in EU imports of glulam products from some smaller suppliers, including Vietnam, Singapore and Ghana.

Short-term prospects for meranti window scantling in the EU market remain poor. Despite limited imports in 2013, importers’ inventories are still quite high relative to slow demand. However longer term prospects appear more promising. More building permits are now being issued in Germany, the leading European market, and there is rising confidence in the German construction sector.

The UK construction sector is also rebounding more strongly than expected this year. The UK has not been a significant market for tropical hardwood glulam in the past, but interest in engineered scantlings is now rising with introduction of tougher quality and energy-efficiency standards for wood windows. These factors, together with limited supply of sapele, the leading African wood used in European joinery, might lead to improving European demand for meranti window scantlings during summer 2014.

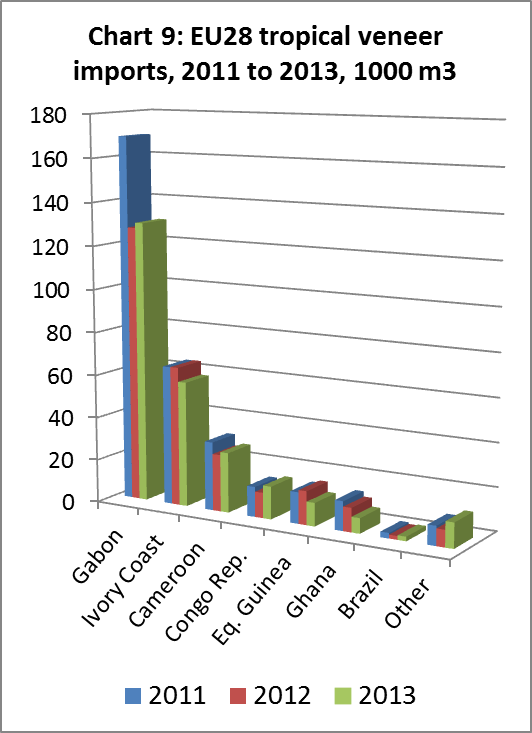

Tropical hardwood veneer imports stabilise at a low level

After significant falls in previous years, EU imports of tropical hardwood veneers stabilised at a low level in 2013 (Chart 9). Imports were 263,000 m3, 1% down compared to the previous year. Imports from Gabon – which fell heavily between 2011 and 2012 – increased 2% to 130,000 m3 in 2013. Imports also increased 5% from Cameroon and 29% from the Congo Republic in 2013. However imports from Ivory Coast fell 10% and imports from Equatorial Guinea were down 31%.

The EU market for hardwood veneers remains very difficult, with producers suffering from declining turnover in the face of lower sales volumes, declining prices and continuing loss of market share to competitors. Prices continue to be under pressure for mass-production grades for the plywood, flooring and furniture, and this pressure also now extends into the market for more specialist grades. Demand and prices are not expected to recover significantly in 2014.

ETTF reports only limited impact of EUTR so far

While it’s possible that some of the recent downturn in EU imports of tropical wood was due to legal uncertainty following implementation of the EUTR, other economic and commercial factors were probably much more significant drivers of trade during 2013. According to a recent analysis of the trade impact of EUTR by the European Timber Trade Federation:

“longer term trends are obscured by the overwhelming effect of the economic downturn and by supply problems due to capacity closures and diversion of wood fibre to other markets over recent years”.

Furthermore, while EUTR has been enforceable since March 2013 in theory, it is still very early days in practice. This is clear from the recent survey of EUTR authorities in EUWID. The German trade journal reports that Competent Authorities are already active in Denmark, UK, Germany, and the Netherlands. However the pace of implementation has been slower in France and southern and eastern Europe. The EC process to formally recognise Monitoring Organisations is also taking time, with only two so far appointed – Conlegno in Italy and Nepcon with EU-wide coverage. Even in countries where Competent Authorities are active, building up the necessary capacity and knowledge required to provide advice and pursue successful prosecutions remains a challenge.

The real impact of EUTR will only become clearer as the EU economic recovery gathers pace and as more progress is made to develop enforcement capacity and impose sanctions.

PDF of this article:

Copyright ITTO 2020 – All rights reserved