After record lows in 2012, the latest EU trade data indicates that imports of hardwood products from tropical countries fell even further during 2013. In the first 11 months of 2013, EU28 imports of sawn hardwood from tropical countries were 870,200m3, 8.2% less than the same period in 2012. Imports of tropical hardwood logs were only 170,900m3 between January and November 2013, 23.6% less than the same period in 2012. Direct imports of hardwood plywood from tropical countries (i.e. excluding imports from China) declined 4.8% to 1.14 million m3 during this period. Tropical hardwood veneer imports fell 7% to 251,500m3.

These numbers for the whole of the EU are indicative of the slow pace of recovery in the European economy, particularly in the construction and furniture sectors which are so important for hardwood consumption. They are also the result of on-going supply problems. Unlike in previous years when Europe was the dominant market, European buyers now have much less leverage to encourage more rapid delivery or prevent diversion to larger buyers in other parts of the world.

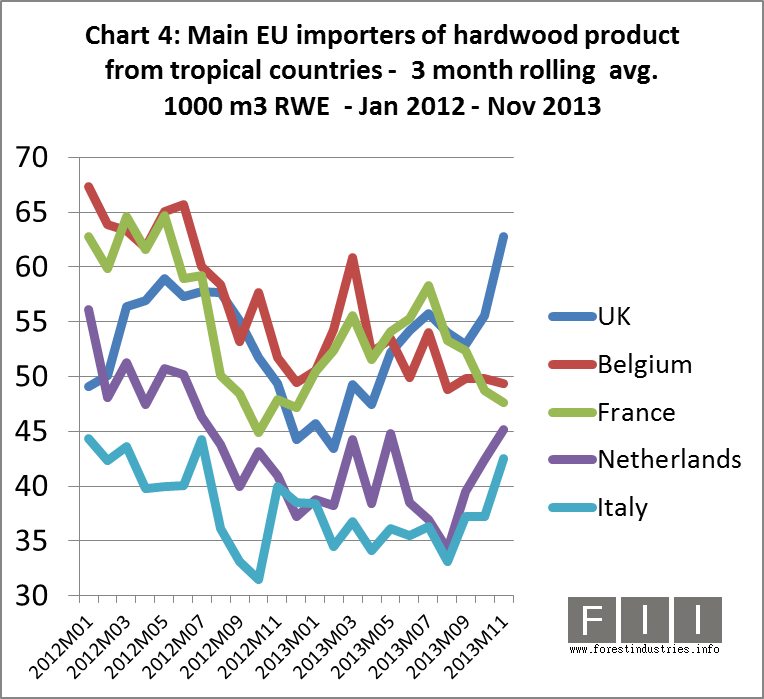

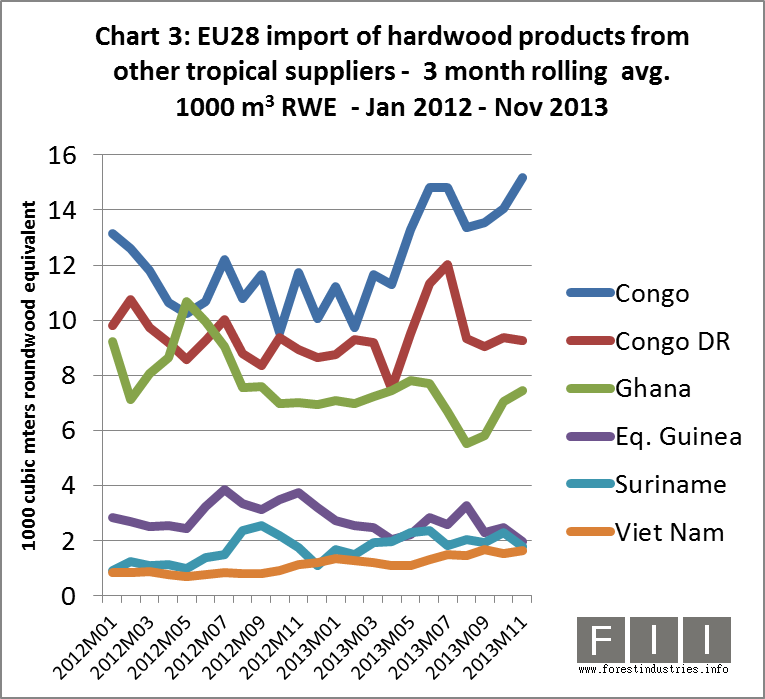

The total numbers for the whole of the EU during 2013 hide significant variations in market conditions between countries and at different times of the year. Some of these more subtle variations are apparent in the following series of charts (Chart 1 to 5).

The charts show the 3-month rolling average roundwood equivalent (RWE) volume in cubic meters of EU imports of hardwood products from tropical countries to end November 2013. RWE is used so that data for all products may be aggregated and also to provide a rough measure of the “forest footprint” of EU trade[1]. The moving average is used to smooth out short-term fluctuations, which are strongly influenced by factors like vacations or shipping delays, so that the longer-term trend becomes clearer. Imports from China are omitted from all the charts to focus attention on direct trade with tropical countries and to avoid distortion of data by the large share of non-tropical hardwood (poplar and eucalyptus) in Chinese products.

[1] RWE can only ever provide a “rough measure” because of the numerous assumptions made on conversion efficiency and waste utilisation. For the sake of transparency, the RWE figures here have been calculated based on the following assumed conversion rates: logs (100%), rough sawn (47.5%), planed/sanded sawn (45%), veneer (55%), plywood (43.5%), and joinery products (33%). It’s also simplistically assumed that no waste material (e.g. offcuts and saw dust) is used for manufacture of other wood products (which in practice would mean some of the RWE volume should be allocated to these other products).

Chart 1 highlights that in terms of RWE volume well over half of EU imports of tropical hardwood products now arrive in the form of sawn wood, with much of the remainder consisting of veneer and plywood. The volume of log imports has diminished to negligible levels. Despite the recent policy focus on value added in tropical countries in recent years, in practice only a small proportion of finished joinery products are imported into the EU.

The 3 month rolling average of EU imports of hardwood products from tropical countries fell to a low of 266,000m3/month RWE in December 2012 and staged a slow and hesitant recovery during the course of 2013. By November 2013, the 3 month rolling average had risen to 304,000m33/month RWE, mainly due to improving imports of sawn wood and plywood.

Supply problems contribute to declining EU imports from Cameroon

Chart 2 shows how the fortunes of major suppliers of tropical hardwood to the EU changed throughout the course of 2013. Imports from Cameroon, the largest single tropical hardwood supplier to the EU (mainly of sawn wood), fell sharply in the nine months prior to February 2013 and remained at the relatively low average of around 65,000m3/month RWE during the rest of 2013. This trend coincides with mounting supply problems in Cameroon, particularly of sapele, the most popular commercial species in Europe.

Reports from traders suggest that harvesting in Cameroon in 2013 was largely restricted to less accessible areas leading to rising log transports distances. Logging in the last quarter of the year was further curtailed by a severe rainy season. The main port at Douala has suffered a series of problems leading to heavy congestion from vessels waiting to load and unload. Problems include faulty cranes, the need for dredging due to silt build-up, and mounting labour problems which culminated in a week-long strike by dock workers in December 2013.

Meanwhile, European buyers have increasingly struggled to secure tropical hardwood supplies from Cameroon in the face of strong competition for raw material from buyers elsewhere, notably China and the United States.

Falling French consumption hit imports from Gabon

Chart 2 shows that imports from Gabon during 2013 were impacted both by supply problems and changing consumption patterns in France where much of the wood is consumed. Government harvesting restrictions and other measures contributed to reduced log supply in Gabon during 2013. Meanwhile the French economy and construction activity dipped sharply in the first quarter of 2013 and imports of Gabonese hardwood fell accordingly. However, French market conditions stabilised to some extent from the second quarter of 2013 onwards. EU imports from Gabon were averaging around 40,000m3/month RWE for much of 2013.

EU imports of tropical hardwood from Cote d’Ivoire fell to a low of only 15,000m3/month RWE in the three months to February 2013 as importers grew increasingly concerned about possible EUTR conformance issues. However, imports recovered to an average of 25,000m3/month RWE in the three months to November 2013 as importers grew more confident that the available legal documentation would stand up to EUTR scrutiny. EU imports from Ivory Coast also benefitted from slow recovery in demand for key species like framire and ayous in the UK and Italian markets during the second half of 2013.

Recovery in EU imports from Republic of Congo

Chart 3 shows that EU imports of tropical hardwood products from the Republic of Congo were also recovering from the second quarter of 2013 onward. EU monthly imports from the country which were averaging 10,000m3 at the start of 2013 had risen to 15,000m3 in the three months to November 2013. EU demand for wood from the Republic of Congo has been boosted by limited availability elsewhere and the commitment of larger shippers to supply of FSC certified products.

EU policy measures contribute to sharp rise in imports from Malaysia

EU tropical hardwood imports from Malaysia hit a low of 53,000m3/month RWE at the end of 2012 and remained at this level until September 2013. However, EU imports from Malaysia surged during the autumn months to an average of close to 75,000m3/month RWE. The surge is partly due to improvement in the UK economy and some early signs of life in the Netherlands construction market.

A range of EU policy measures also contributed to the rapid increase in imports from Malaysia at the end of 2013. Loss of Malaysia’s preferential status under the EU’s Generalised Scheme of Preferences (GSP) meant that EU import duties on Malaysian products increased from 3.5% to 7% on 1 January 2014. This encouraged importers to restock in advance of the deadline. Meanwhile the EU Timber Regulation has given Malaysian plywood shippers a competitive boost relative to Chinese manufacturers that have struggled to meet new demands for legal documentation. The EU’s Construction Products Regulation has also benefitted Malaysian shippers of higher quality plywood products able to meet new technical performance standards.

Only limited tropical hardwood imports from Brazil

EU imports of tropical hardwood from South America have fallen dramatically since the start of the recession. EU monthly imports of all tropical hardwood products from Brazil were averaging no more than 20,000m3/month RWE by the end of last year. However Suriname is one South American country that has bucked the trend, with EU imports from the country rising consistently over the last 2 years, albeit from a small base. This is due to recent investment in processing facilities in Suriname combined with a commitment to FSC certification by at least one leading operator which has encouraged greater interest from European buyers, particularly in the Netherlands.

Strong rebound in UK tropical hardwood imports

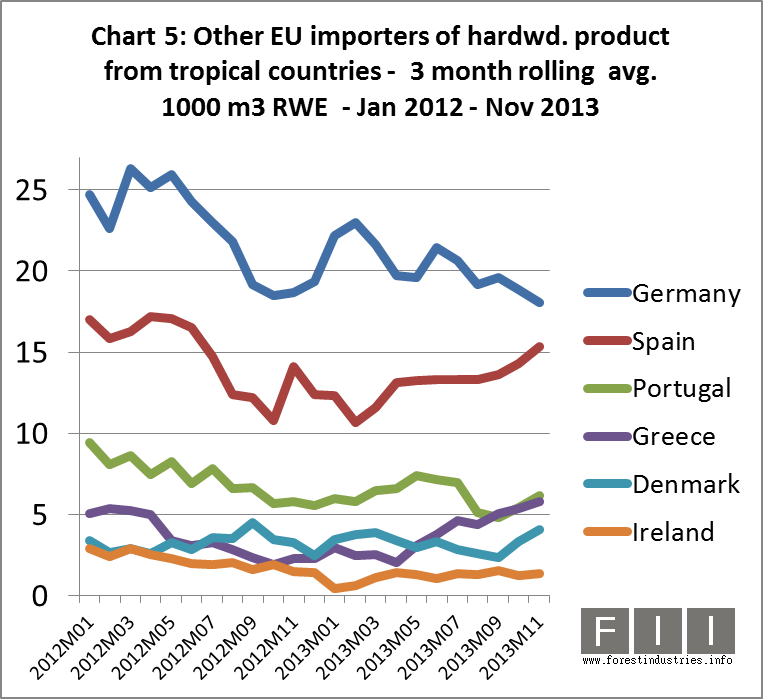

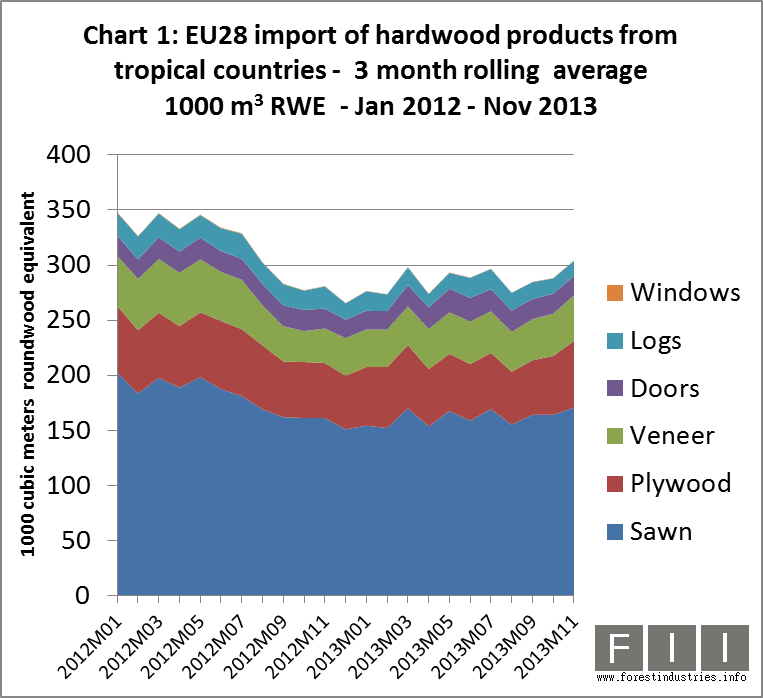

Charts 4 and 5 show how imports of tropical hardwood into the main EU markets have progressed over the last two years. Imports fell sharply throughout the EU during the prolonged winter in late 2012 and early 2013 when European construction activity reached an all-time low. Since then market conditions have diverged widely between countries.

Imports into the UK have rebounded so strongly that, by the end of 2013, the country had emerged as the largest single EU importer of tropical hardwood products. Imports into France recovered well until August 2013 but then fell sharply in the autumn months. Imports into Belgium spiked in March 2013, but then declined progressively throughout the rest of the year. The closure of DLH’s stock-holding operation in Belgium during 2013 may well have been a factor in this decline. After a long period of recession, the Dutch market and several Southern European markets including Italy, Spain and Greece, were showing signs of recovery at the end of 2013.

Imports into Portugal continued to decline throughout 2013, very much in line with construction sector activity in the country which was weakening last year. There are also indications that joinery manufacturers in Portugal are shifting away from tropical hardwoods in favour of temperate species. The same trend is apparent in Germany, the largest single consumer of wood products in the EU, where tropical wood imports were low and declining during 2013.

Lacklustre demand expected in 2014

There is unlikely to be any significant upturn in EU tropical hardwood trade in 2014. The continued sluggish pace of economic and construction activity and the low level of supply are likely to act as a significant brake on trade. The latest European Commission forecast is for 1.4% GDP growth across the EU during 2014, only a slight improvement on the 0% growth projected for 2013. Euroconstruct, an independent research agency, is forecasting growth in European construction output of no more than 0.9% in 2014 and 1.8% in 2015.

Meanwhile, delivery times into the EU for key tropical hardwood products remain very lengthy. Delivery times for wood species from the Congo region are now up to 6 months. Delivery of standard specifications of sawn wawa from Ghana and sawn meranti from Malaysia are up to three months.

Strong demand for African sapele sawn wood is driving price rises to levels that European importers often find difficult to pass on to their customers. Importers report that FOB prices for FAS AD 52mm sapele lumber in standard lengths and widths now stand at between €650/m3 and €680/m3, up from closer to €600 in mid-2013. These prices are not far short of those for sipo which have remained more stable at around €700/m3 fob for non FSC-certified goods and up to €770/m3 for FSC certified.

Prices for other key African wood species in the European market have been relatively more stable than those for sapele, but where there is movement it tends to be upwards. The FOB price for FAS AD 52 mm iroko sawn wood increased by around €30/m3 in 2013 and now stands at around €650-700/m3 fob for air dried and €750-800/m3 for kiln dried. The FOB price for framire sawn wood is in the region of €500/m3 fob. Wawa No. 1 c+s is selling for around €350/m3 fob. Prices for Khaya sawn wood have been firming on the back of good US demand.

At this time of year, European importers would normally be stocking up large volumes of tropical hardwood decking profiles in preparation for the spring garden season. However, orders so far this year have been quite limited with many importers adopting a wait-and-see approach until there is clearer information about the volume of stocks left over from last season. Weak consumption in 2013 has meant there is a stock overhang. Uncertainty has also been created by several high-profile closures of distribution operations in Belgium and Netherlands.

However, there are some more positive indications emerging from the decking sector. Unlike last year, the winter so far in 2014 has been warm and mild which is encouraging a few merchants to consider earlier deliveries this year. This trend is being boosted by more competitive pricing for bangkirai decking profiles. Prices for delivery standard+better bangkirai into Northern Europe currently stand at around $1500/m3, down from prices of up to $1800/m3 a couple of years ago. Bangkirai decking can also still be obtained within around five weeks. However both prices and delivery times could increase quite quickly if demand does pick up.

PDF of this article:

Copyright ITTO 2020 – All rights reserved