The EU’s FLEGT process has recorded two landmark events in recent weeks. The first ever FLEGT licenses were issued by the Indonesian Licensing Unit on 15 November and the licensed consignments landed in the EU in early December. And after nearly six years of negotiations, Vietnam and the EU agreed in principle to sign a FLEGT Voluntary Partnership Agreement (VPA) and to ratify the agreement as soon as possible in 2017.

The arrival of the first consignment of FLEGT licensed timber from Indonesia followed the EU’s decision in August this year to formally recognise the Indonesia licensing scheme for exports of verified legal timber to the EU, a decision which came into force on 15 November. The relevant amendment to the EU FLEGT regulation acknowledged that Indonesia has fulfilled the requirements of the VPA and is therefore able to export FLEGT-licensed timber and timber products.

According to a statement by the UK Timber Trade Federation (TTF), several association members received goods from the first FLEGT licensed shipment in early December including James Latham, Meyer Timber, Hanson Plywood and MDM Timber. The products arriving included door blanks and marine plywood. The TTF said that “the UK hopes to continue and increase trade in timber products with Indonesia now that FLEGT licenced products are automatically EUTR compliant”.

Any EU operator importing timber products into the EU from Indonesia is now required to submit the FLEGT licence for verification to the FLEGT competent authority of the EU country where the timber will be imported. The FLEGT license will be supplied to the EU importer by the Indonesian exporter and the importer should submit it to the relevant EU competent authority before the timber arrives in the EU.

Full details of the licensing procedures are available from the FLEGT licence information point established by the European Forestry Institute (EFI) with EU funding at:

http://www.euflegt.efi.int/web/flegt-licence/home

A useful step-by-step guide to the new procedures for exporting FLEGT licensed products from Indonesia and importing into the EU, including links to other relevant information sources, has also been produced by The Forest Trust. The guide is available at.

http://www.tft-earth.org/wp-content/uploads/2016/10/FLEGT-Licensing-Information-and-FAQs.pdf

The decision by Vietnam and the EU to sign a VPA, which will eventually lead to a requirement for FLEGT licensing of all timber products imported into the EU from Vietnam, was jointly announced by EU Environment Commissioner Karmenu Vella and Vietnamese Minister of Agriculture and Rural Development Nguyen Xuan Cuong following a meeting on 17 November. This VPA, for which negotiations started in October 2010, will be the EU’s second VPA with an Asian country (after Indonesia).

While the substance of the deal has been agreed, some technical and consistency checks across several hundred pages of text still have to be carried out. The EU and Vietnam hope to sign the VPA in 2017, following a final review by lawyers from both parties. There will then follow a period for technical development and finalisation of the FLEGT licensing procedures in Vietnam, a process which will be overseen by an EU-Vietnam Joint Implementation Committee.

The scope of the agreement covers all export markets and the domestic market in Vietnam. In terms of sources, the agreement covers both imported timber, a major source of raw materials for Vietnam, and all domestic sources in Vietnam, including natural and plantation forests, confiscated timber (under specific conditions), timber from home-gardens, farms and scattered trees, and rubberwood.

The range of timber products included in the scope of the agreement encompasses all major products exported by Vietnam to the EU, particularly the five compulsory timber products as defined in the FLEGT Regulation of 2005 (logs, sawn timber, railway sleepers, plywood and veneer) and also includes a number of other timber products such as wood in chips or particles, parquet flooring, particle board and wooden furniture.

The core of the VPA is the description of the Vietnam Timber Legality Assurance System (VNTLAS), which will ensure that timber products exported from Vietnam to the EU are verified legal according to specified requirements for all stages of the supply chain, from import and harvesting onwards.

EUTR prosecution of Swedish company for Myanmar teak imports

Swedish enforcement officials have prosecuted a trader of Myanmar teak, Almtra Nordic, under the EU Timber Regulation (EUTR) which bans placing wood on the EU market if there is a non-negligible risk of illegal harvest. A Swedish Forest Agency (Skogsstyrelsen) investigation found Almtra Nordic could not demonstrate who harvested timber or where it was cut prior to purchase from its supplier, the state-operated Myanmar Timber Enterprise (MTE). The company has received an injunction preventing it from placing Myanmar teak on the EU market unless it can identify and mitigate the risks of illegality involved – in accordance with EUTR due diligence requirements.

Continuing recovery in EU imports of tropical veneer

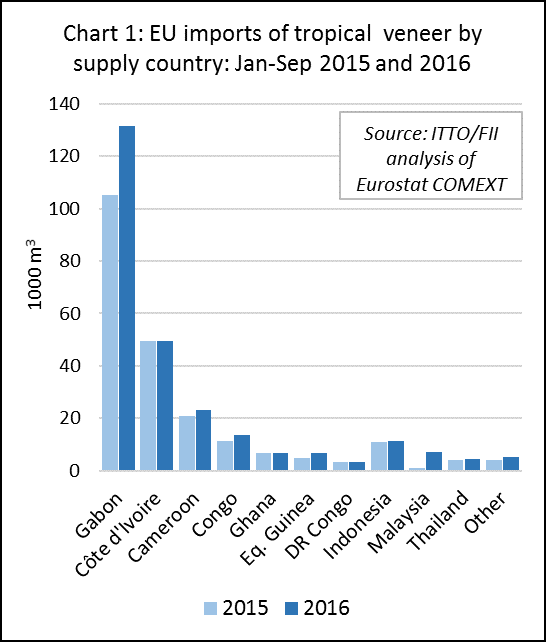

The recovery in EU imports of veneer from tropical countries which began last year has continued into 2016. Imports were 261,600 m3 in the first nine months of 2016, up 18% compared to the same period in 2015. This follows a 9% gain in imports last year. Imports from Gabon, the leading supplier, increased 25% to 131,500 m3 in the nine month period. There were also significant increases in EU veneer imports from Cameroon (+11% to 23,200 m3), Congo (+19% to 13,400 m3), Equatorial Guinea (+32% to 6,600 m3), Malaysia (+500% to 6,900 m3), and Thailand (+11% to 4,400 m3). Imports from Côte d’Ivoire (49,400 m3), Ghana (6,800 m3) and the Democratic Republic of Congo (3,200 m3) were stable compared to the previous year. (Chart 1).

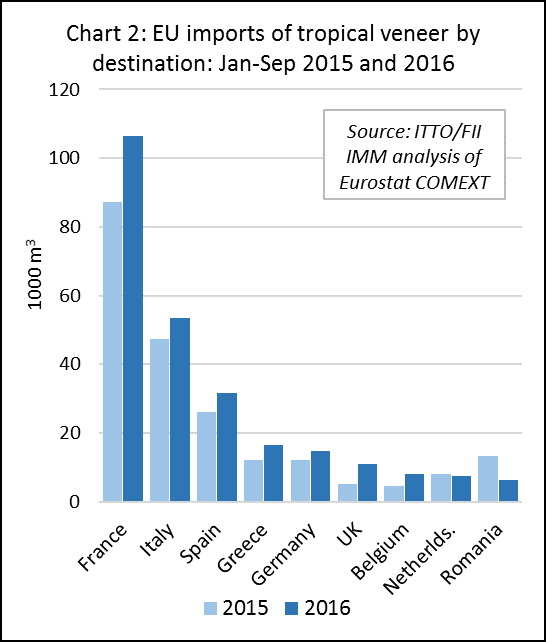

As in 2015, all the largest EU markets for tropical veneer have been importing more this year (Chart 2). During the first nine months of 2016 compared to the same period in 2015, imports increased into France (+22% to 106,500 m3), Italy (+13% to 53,600 m3), Spain (+22% to 31,700 m3), Greece (+36% to 16,500 m3), Germany (+21% to 14,700 m3), the UK (+110% to 11,000 m3) and Belgium (+75% to 8,200 m3). These gains offset a decline in imports by the Netherlands (-5% to 7,600 m3) and Romania (-52% to 6,400 m3).

EU imports of tropical veneer in the last quarter of 2016 may be disrupted by the uncertain environment in Gabon following the presidential election. However, imports are almost certain to exceed 300,000 m3 in 2016 for the second year in row. While still down on levels of well over 400,000 m3 prevailing a decade ago prior to the financial crises, the recent growth is an encouraging sign for a sector which had appeared to be in long-term decline.

Rougier sales rise in France but decline in emerging markets

Rougier, the France-based tropical timber company, reports €111.8 million in revenues in the year to 30 September 2016, down 8.7% compared to the same period in 2016. Third-quarter revenues came to €33.3 million, contracting 7.2% from the previous year.

The Rougier Afrique International branch’s sales for the third quarter were down 9.5% from the previous year. Business over the quarter was affected primarily by the weak level of sales from Cameroon, faced with the slowdown in demand from the main emerging countries, as well as the significant disruption in Gabon in September following the presidential elections.

In contrast to the international division, Rougier’s import and distribution division in France achieved 4.7% sales growth for the third quarter. This progress has been supported by the diversification in terms of the products offered and customers served in a French market that is gradually improving.

The contraction in the value of Rougier’s sales was concentrated in sawn timber and derivatives which declined 16.1% in the third quarter, primarily due to the drop in prices for certain timber species and intense competition from other suppliers. Log sales, buoyed by the upturn in exports from Cameroon, showed an improved trend for the third quarter, with year-on-year sales growth of 4.9%. Sales of plywood and derivatives, up 8.3% in the third quarter, continue to see strong growth, driven by robust demand in Europe.

However, Rougier note that the regional breakdown of sales remains volatile. The changes over the first nine months of the year take into account the significant slowdown for certain emerging markets in Asia, the Middle East and North Africa. Sales have also been affected by intense competition on American markets. However, Rougier’s sales are progressing in Sub-Saharan Africa, as well as Europe, benefiting from the range of certified products offered by the Group.

At the end of this year, Rougier is embarking on a strategic realignment plan for its operations in Africa. This plan is focused on developing higher value-added production activities, reorganizing industrial resources and starting up the first production operations in the Central African Republic in the first half of 2017. It is being supported by a major cost reduction program in all the Group’s subsidiaries.

Danzer: innovation critical to hardwood competitiveness

There are significant opportunities to increase yield and reduce material costs in the international hardwood industry, but these are being squandered due to high levels of conservatism and a widespread lack of capacity and willingness to innovate. There’s also a need to work towards a smarter regulatory environment, driven more by sound scientific data and less by the concerns of narrow lobby groups, to encourage innovation, improve competitiveness and stimulate trade.

These were key messages in an intervention by Mr. Hans-Joachim Danzer, Chief Executive Officer of Danzer Holding AG, at the ECE Committee on Forests and the Forest Industry (COFFI) held in Geneva, Switzerland in October 2016. Mr Danzer delivered a presentation as part of a panel discussion on “opportunities for and barriers to forest products from the perspective of the private sector”.

Mr Danzer offered these views from the perspective of a company which is the largest producer of decorative sliced wood worldwide and amongst the largest producers of sawn hardwood in Africa and North America. Now head-quartered in Dornbirn, Austria, Danzer has operations in the US, Canada, France, Germany, Czech Republic, and the Republic of Congo.

Danzer operations extend to management of 1.2 million hectares of forest concessions in Africa, all of which are now FSC certified; annual wood raw material consumption of 500000 m3; delivery of 210 hardwood species into 83 countries; and sales of euro 254 million in 2015. The company employs 2500 people of 40 different nationalities.

Mr Danzer noted that in many ways his company’s large scale operations are not typical in the hardwood sector. He emphasised that the sector is characterised by a very high level of fragmentation, with much production for local markets using outdated equipment, and huge numbers of players, often with limited skills, at every stage from harvesting through primary processing, trade, manufacturing and distribution. This in turn contributes to high costs of acquiring raw material and high levels of wastage throughout the supply chain.

The Danzer group has invested heavily to overcome these obstacles, developing innovative processing practices to improve yield within its own operations, while also promoting a similar approach in the wider industry. The company has been very successful in the first aim but so far less successful in encouraging wider uptake.

For example, CT scanning technology is now in daily routine use in Danzer’s U.S. operations. CT scans draw on computer-processed combinations of many X-ray images taken from different angles to produce cross-sectional images of the logs so that processing can be customised to optimize yield. On the assumption that reduced wood wastage would be of mutual benefit to the whole industry, the Danzer group has made the technology readily available via an internet portal and smartphone app. However there has been very little uptake so far.

In another example, Danzer has developed a light-weight board that can be manufactured from veneer waste. The product is extremely strong (with E-modulus value exceeding 6000 N/mm²) for its weight (less than 350 kg/m³). The Danzer group approached numerous potential partners and customers and although all were impressed with the idea, none have yet been encouraged to develop as a commercial product.

One of the Danzer group’s most successful innovations has been to develop a veneer slicer capable of slicing wooden lamellas of less than 2.5 mm thickness for engineered flooring products with almost no loss of raw material. These machines replace traditional saws, which waste up to 50% of wood material as sawdust. In this case the machines are proprietary and patent protected, but they provide a clear demonstration of the opportunities to improve yield and thereby significantly reduce procurement costs with sufficient investment in research and development.

On the question of how to encourage more innovation in the hardwood sector, Mr Danzer said that ultimately the initiative must lie with the private sector. However, regulators can contribute by putting in place a regulatory environment that encourages a “bottom-up process of creative destruction”. In such an environment, innovative companies will succeed while those that do not innovate will fail. Government authorities should seek to avoid the creation of perverse incentives, through poorly targeted subsidies or research grants and marketing support for government preferred technologies.

According to Mr Danzer, governments should aim to develop clear rules for international trade and place greater emphasis on negotiating and implementing free trade agreements by reviving and finalizing the Doha Round. He also called on the EU and partner governments to speed up the FLEGT process and to grow the number of VPAs, while ensuring consistent implementation of existing demand-side measures like EUTR. However, he also observed that there needs to be greater recognition that excessive regulation tends to favour large companies and that compliance is relatively more costly for small businesses.

Mr Danzer noted that there should be greater concern in regulation for relative competitiveness of wood compared to other materials. “Regulators should require equivalent standards of legality to be imposed on oil, ores, and coal as on timber products. There should be greater emphasis on scientific analysis of problems and solutions, and on incorporation of externalities into acquisition costs by accounting for carbon, energy, and water, and adding these costs via taxes”.

Mr Danzer made a plea for markets to be kept open to timber products from developing countries. He noted that entry barriers to hardwood production are low and the hardwood sector is therefore well placed to contribute to development goals. If tropical timber products are valued in trade and thereby help to support the local population, there is a greater incentive to maintain the forests.

Mr Danzer concluded “If trade restrictions are to be imposed, it is better to target agricultural products produced on former timberland. At present, all palm oil, soy bean, coffee, … from illegally clear-cut timberland can enter western markets without any regulation”.

Downgrading of European construction sector growth forecasts

The European construction market is passing through a period of uncertainty because of the weak economic outlook both in the EU and wider global economy and political events including the UK’s decision to leave the European Union and upcoming elections in France, Germany and the Netherlands. These issues were highlighted at the 82nd Euroconstruct conference hosted by ITeC (Institut de Tecnologia de la Construcció de Catalunya), in Barcelona during November.

As usual, Euroconstruct issued their forecast of construction output in Europe at the conference, updating their forecast from the previous conference held in June. The new forecast is for only 2% growth in 2016, six tenths of a point less than the previous estimate.

In issuing the new forecast, Euroconstruct noted that “Brexit has not yet caused a direct disaster on the European economy, but it has indeed lowered the mid-term expectations, combined with a long list of other factors including China slowing down, Germany slowing down, uncertainty in the US, European banks still not out of trouble, and interest rates likely to increase”.

Euroconstruct observed that expectations for 2017 are not encouraging. European construction output is forecast to increase 2.1% next year, at a rate only slightly faster than the economy as whole (GDP in the region is expected to grow only around 1.4% next year).

Euroconstruct note that “there is an interesting window of opportunity created by a combination of cheap credit and a more favourable perception of building as an investment shelter. However, this opportunity may be ephemeral, and not a driver for the longer term”.

More significant for longer term prospects will be rising public demand, particularly for housing, a trend which Euroconstruct expects to continue. Euroconstruct forecasts that construction sector output will grow between 2.1% and 2.2% in both 2018 and 2019. Although the pace of growth is slow, it is expected to be consistent. If the forecast becomes a reality, the European construction sector will reach 2019 with uninterrupted growth for six years in a row. This would put the output level at only 3% below the 1995-2015 average.

Considering individual sectors, Euroconstruct forecast that residential construction will have grown 3.9% in 2016 – mainly because of improving performance in France, Germany and the UK, together with a range of smaller European countries and encouraged by low interest rates. However, credit is unlikely to remain so favourable and therefore Euroconstruct forecast that the pace of growth in residential construction will fall to around 2% in 2018 and 2019.

Euroconstruct observe that the recovery of non-residential construction is still at a very early stage in Europe. Therefore, the present downgrade in the economic outlook comes at a very inconvenient time, cooling the already weak demand for industrial and other business assets. Euroconstruct does not expect rapid changes, forecasting growth in non-residential construction of only 1.5% for 2016-2017 and 1.8% for 2018-2019.

Office construction is expected to perform somewhat above these averages, since it is rebounding from a period of significant contraction. However industrial and storage construction are expected to perform below the non-residential average. Activity in Europe’s civil engineering sector is believed to have declined in 2016, by around 1%, a hangover from Europe’s continuing high levels of public sector debt.

There are also significant variations between European countries. The increase in construction activity in 2016 has come mostly from Germany. Construction output in Germany increased 2.5% to €297 billion this year, reinforcing the country’s position as by far the largest construction sector in Europe. However, the German pull on European construction is expected to fade with output due to fall by 0.6 per cent in 2019 after growth of just 0.2 per cent in 2018 and 1.5 per cent in 2017.

The UK is currently Europe’s second largest construction market, with Euroconstruct estimating output of €223 billion in 2016. However, growth projections for the UK have been slashed. Euroconstruct figures now point to a decline both this year and in 2017, with output falling by 0.2 per cent each year. This is not only a consequence of the EU referendum, but also a wider slowdown reported in the industry. Output fell 1.1 per cent in Q3 quarter on quarter, according to the Office for National Statistics, marking the second consecutive fall following a 0.1 per cent decline in Q2.

Slowing in the German and UK construction sectors will leave France, currently the third largest European construction market with output of €204.33 billion in 2016, as the main generator of growth over the next three years. After three years of decline between 2013 and 2015, construction output in France is estimated to have increased 2.4% in 2016, and is forecast to accelerate to 3.6% in 2017, and to remain high at around 3% per year in 2018 and 2019.

The recovery in Spain is also expected to continue, with construction output estimated to have grown 2.1% in 2016 and forecast to grow by over 3% each year between 2017 and 2019. However, Euroconstruct forecasts for Spain have been revised down since June, with wrangling over the formation of a new government continuing to hit public funding and deficit reduction targets.

Construction output in Italy turned a corner in 2016 according to Euroconstruct, rising by around 1.9% this year and building on an increase of 0.8% in 2015 after several years of significant decline. Growth is expected to continue at a rate of around 2% per year between 2017 and 2019.

According to Euroconstruct, the construction sector in several smaller EU markets should grow rapidly over the next three years, most notably Ireland. November’s forecasts show growth in Ireland of 12.5% this year, followed by 8.5% in 2017, 7.1% in 2018 and 9.2% in 2019. This makes Ireland comfortably the fastest growing market by 2019, with only the Czech Republic (8.3%) and Hungary (7.1 per cent) approaching that level.

In addition to Europe, the Euroconstruct conference considered the wider global economic environment. Antonio Maura of Cresme, the Italian-based construction research company, suggested that global economic growth is likely to slow over coming years and noted that the construction sector globally is currently under-performing compared to other industrial sectors. He predicted construction sector growth of only 1.5% worldwide this year, the slowest pace since 2009 and much lower than global GDP growth forecast of 2.5% in 2016. He added that sector growth would remain weak in the next two years, and would only start to grow significantly faster than GDP from 2019. The acceleration would be led, he said, by the recovery of major emerging markets and advances in developing countries.

PDF of this article:

Copyright ITTO 2020 – All rights reserved