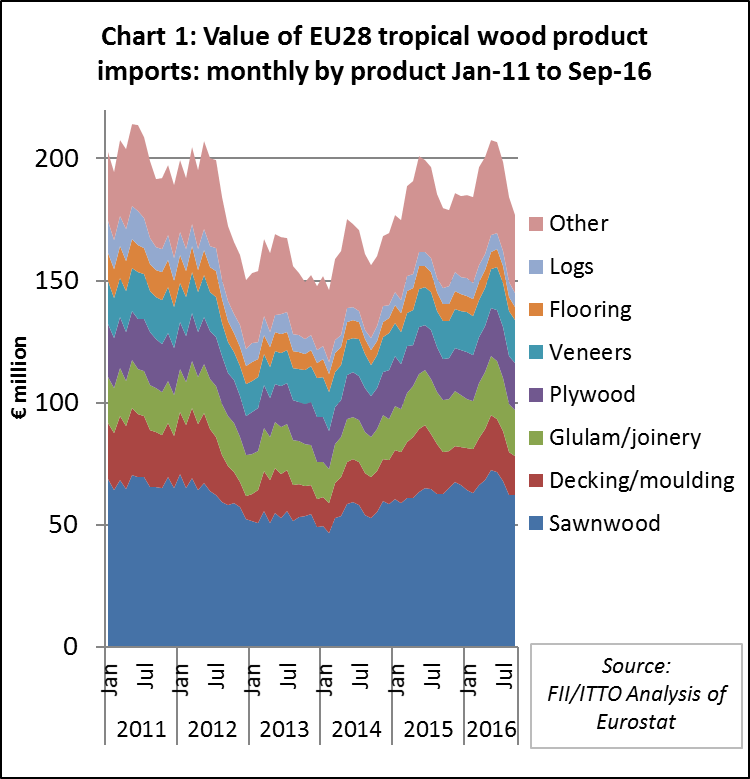

EU imports of tropical timber products increased sharply between January and May this year, but slowed again in the four months to end September 2016 (Chart 1). Nevertheless, the value of EU imports of tropical timber across all product groups in the first 9 months of 2016 was, at €1.741 billion, 2% greater than the same period the previous year. So far EU imports of tropical timber in 2016 have been close to levels last seen in 2011.

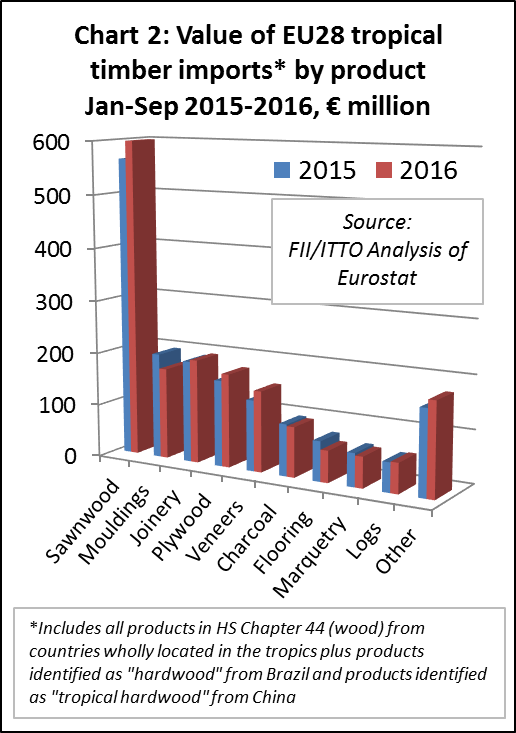

In the first nine months of 2016 there was a rise in the value of EU imports of tropical sawn (+6%), joinery (+2.2%), plywood (+8.5%), veneers (+14%) and logs (+2.6%). These gains offset a decline in the value of EU imports of tropical decking and mouldings (-13.5%), charcoal (-3.2%), flooring (-20.4%) and marquetry (-7%). (Chart 2).

Exchange rates have continued to have a significant impact on EU imports of tropical timber in 2016. The euro-dollar rate, having fallen around 20% in the 12 months prior to April 2015, has remained relatively flat at the lower level ever since. Meanwhile the British pound weakened by around 15% against the dollar following the Brexit vote in June this year and remains stalled at the lower level. This has contributed to price inflation for European importers. The dampening effect of exchange rate has only been partly offset by low freight rates which hit historical lows on many routes in the first half of 2016 in response to over-capacity in shipping and low oil prices.

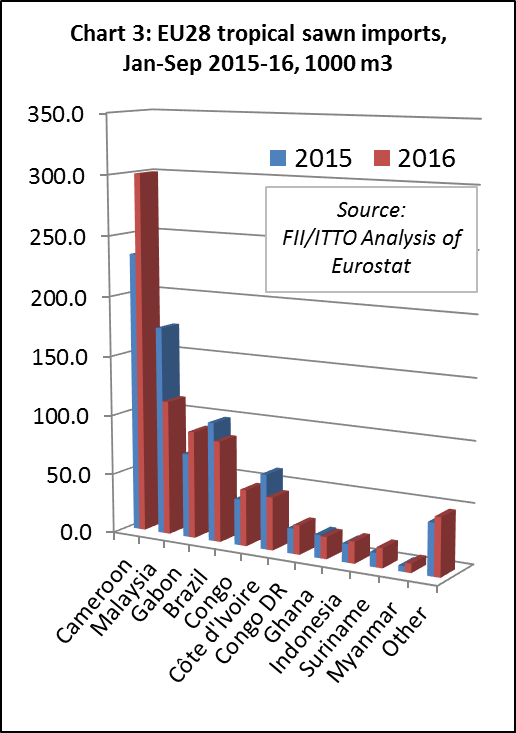

Only marginal increase in EU tropical sawn imports

EU imports of tropical sawn increased by 2% to 810,900 m3 in the first nine months of 2016. Imports from Cameroon, the largest supplier, increased 29% to 300,200 m3. There was also significant growth in imports from Gabon (+27% to 89,700 m3) and Congo (+22% to 47,000m3), a reversal of fortune for both countries which lost share in the EU market in 2015. These gains offset a large fall in imports from Malaysia (-35% to 112,500 m3), Brazil (-15% to 84,600 m3) and Ivory Coast (-29% to 44,000 m3). (Chart 3).

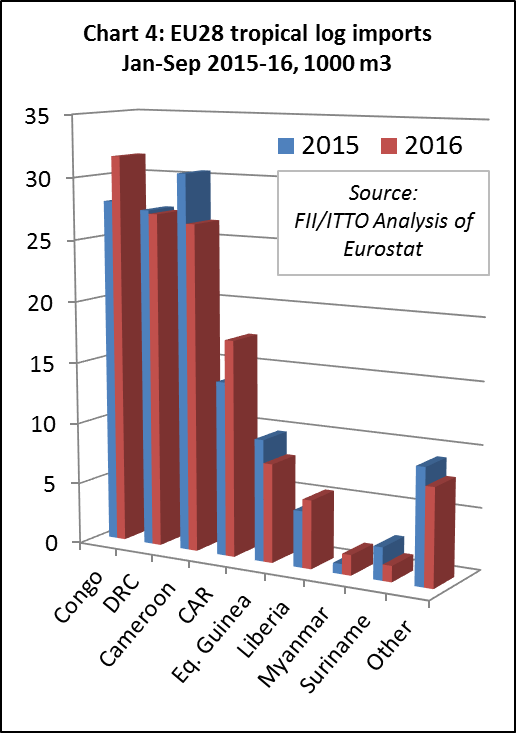

EU imports of tropical logs stable at low level

After recovering a little ground in 2015, EU imports of tropical hardwood logs have remained static in 2016. Imports during the first nine months of 2016 were 127,200 m3, exactly equivalent to the same period the previous year. However, there was a shift in the source of supply. EU imports of tropical logs increased from Congo (+13% to 31,600 m3), Central African Republic (+24% to 17,500 m3), and Liberia (+21% to 5,500 m3). These gains offset declining imports from Cameroon (-13% to 26,500 m3) and Equatorial Guinea (-19% to 8,000 m3). Imports from DRC remained stable at 27,100 m3. (Chart 4).

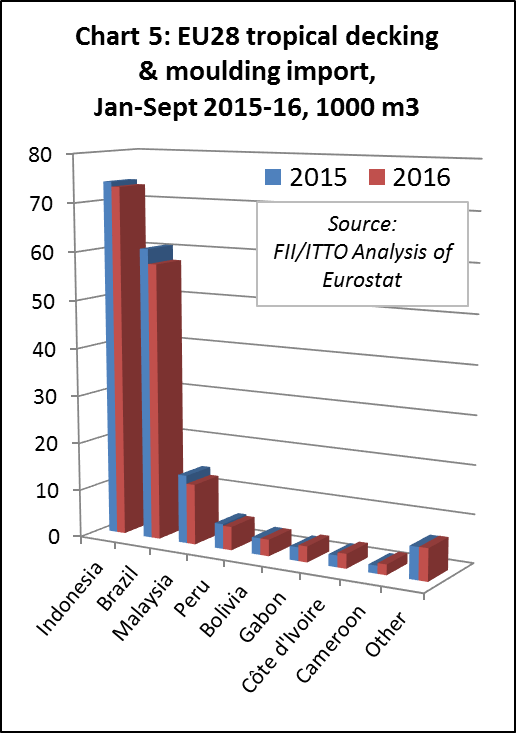

Slide in EU tropical decking imports

EU imports of tropical mouldings (which includes both interior mouldings and exterior decking products) were 166,900 m3 in the first nine months of 2016, 3% less than the same period in 2015. Imports decreased from all the major supply countries including Indonesia (-1% to 73,000 m3), Brazil (-5% to 57,600 m3), Malaysia (-12% to 12,600 m3) and Peru (-6% to 4,900 m3). However, deliveries from several African countries, including Gabon, Cote d’Ivoire and Cameroon, increased from a low base. (Chart 5).

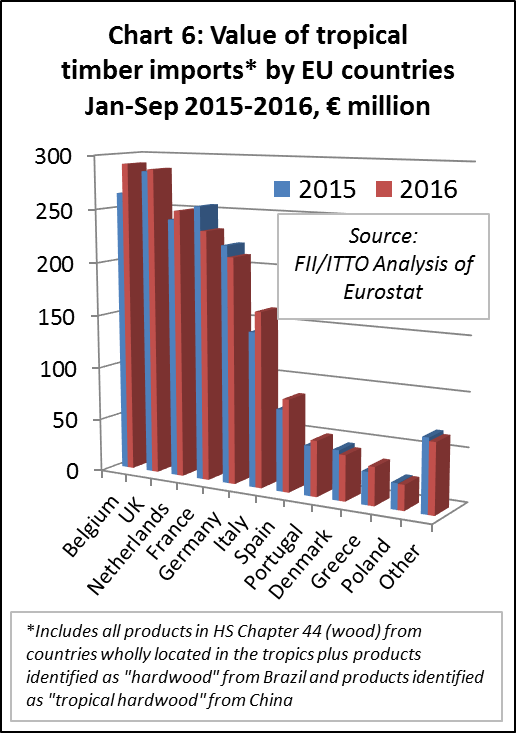

Inconsistent market performance across the EU

A closer look at the individual EU countries reveals that following consistent EU-wide growth in 2015, tropical wood import trends have been more variable this year. (Chart 6).

Strong rise in Belgian imports of tropical timber

Imports of tropical timber have risen strongly into Belgium this year, rising 10.4% to €291.4 million across all product groups during the first nine months. This rapid growth means that Belgium has been the largest importer of tropical timber in the EU so far in 2016, overtaking the UK. Much of the rise in Belgian imports has consisted of sawnwood, notably from Cameroon and Gabon.

The strong rise in Belgian imports is probably indicative more of evolving distribution networks in the wider EU market than of changes in Belgium’s own internal market. The Belgian construction industry and other consuming sectors are relatively small and growing only slowly at present. However, EUTR and other logistical factors continue to concentrate more tropical timber trade in the hands of a few large importers close to the major European ports. Much of the tropical timber imported into Belgium is likely consumed in neighbouring EU countries.

Flatlining UK imports of tropical timber

After strong gains in 2015, imports of tropical timber into the UK have been flat this year, up only 0.7% at €287.2 million in the first 9 months. The UK is importing more tropical hardwood plywood this year, increasingly from China, but there have also been gains in imports from both Indonesia and Malaysia. UK imports of sawnwood from the Congo Republic have also increased in 2016. However, these gains in the UK have been offset by declining imports of flooring from Indonesia and Malaysia, and of sawnwood from Guyana.

More positively, UK importers report that hardwood consumption has remained reasonably buoyant in the UK despite the Brexit vote and rising material costs. The latest Joinery State of Trade Survey by the British Woodworking Federation shows UK joinery sales increased again in the July to September 2016 period, the 10th successive quarter of growth.

Declining tropical imports despite good timber demand in Germany

Deliveries of tropical wood into the German market declined 4.7% to €210.8 million in the first nine months of 2016. This is disappointing at a time when underlying consumption trends in Germany are good and there is pressure on supply of temperate hardwood species, notably oak. The German timber trade federation GD Holz reports strong growth in wood product sales in Germany this year, particularly due to strong demand for new apartments and for renovation projects.

Demand for garden decking and other exterior wood products in Germany has continued to expand in Germany during 2016, but at a slower pace than other sectors such as internal doors and flooring. The German market for tropical decking products suffers from intense competition from wood plastic composites. There has been a particularly sharp drop in German imports of decking from Indonesia this year.

Dutch switching to engineered wood

Imports of tropical timber products into the Netherlands increased 3.4% to €250.1 million in the first 9 months of this year. A sharp fall in Dutch imports of sawnwood from Malaysia was offset by rising imports of LVL from both Malaysia and Indonesia. This may be indicative of a further shift towards engineered wood in the Dutch windows sector, although the Netherlands also imported more sawnwood from Cameroon and the Congo Republic in the first nine months of 2016.

Imports of tropical plywood have been rising into the Netherlands this year, particularly of okoume plywood from Gabon and tropical hardwood plywood manufactured in China. Dutch consumption of tropical hardwood is buoyed by continuing robust growth in the construction sector. Euroconstruct estimate that the value of Dutch construction activity will increase 5.5% this year following 7.5% growth in 2015.

Another fall in French imports of tropical timber

French imports of tropical timber products have declined again in 2016. The value of imports of all tropical timber products into France fell 8.7% to €233.1 million in the first nine months of the year. A large decline in imports of sawnwood, decking and flooring from Brazil and of decking from Peru and Indonesia, was only partly offset by a rise in imports of sawnwood from Cameroon and veneer from Gabon. The latter was most likely rotary veneer to supply the French plywood manufacturing industry.

There are some positive signs that the French economy is improving in 2016. After several years of decline, housing construction in France began to rise in 2015 and this trend has continued in 2016.

Non-residential construction activity in France decreased slightly in 2015 but has recovered a little ground in 2016. The French government also has various programs in place that aim to increase the proportion of wood used in construction from current very low levels, although these are targeted primarily at expanding markets for domestically produced timber.

Rising demand for French oak logs, both for domestic processing and from China and other export markets, led to a 40% increase in price for this commodity between 2012 and 2015, and the rising trend has continued in 2016. Overall these trends may provide better market opportunities for external suppliers of wood products into France in the future.

Italy imports more tropical timber despite economic problems

Imports of tropical timber products into Italy have made gains in 2016 despite the country’s continuing economic problems. The value of imports of all tropical timber products into Italy increased 13% to €163.3 million in the first nine months of the year. This year there has been a rise in the value of Italy’s imports of sawnwood from Cameroon and Myanmar, veneer from Ivory Coast and plywood from Indonesia.

The rise in Italy’s tropical timber imports in 2016 is an encouraging trend in a country which remains in economic crisis. Domestic demand is poor, manufacturing capacity has reduced significantly in recent years and even the once buoyant export industries of wooden doors, kitchen cabinets and furniture are facing increasing competition and lower demand. Some of the gains in Italy’s tropical wood imports this year are being made at the expense of temperate hardwoods, such as American tulipwood which competes with lighter tropical woods in the mouldings sector. Some larger Italian importers are also offsetting weak local markets by expanding sales elsewhere in the EU.

Rising tropical timber imports by Spain and Portugal

The value of tropical timber product imports into Spain and Portugal both made gains in the first nine months of 2016, although for different reasons. Imports into Spain increased 13% to €86 million with nearly all the gain due to rising imports of sawnwood from Cameroon, mainly comprising ayous, iroko, sapele and tali. Sawnwood from Cameroon now constitutes nearly one quarter of the value of all imports of tropical timber into Spain as imports of other products such as Brazilian decking and veneer and African tropical logs have declined to negligible levels.

Imports of tropical timber products into Portugal increased 12% to €51.7 million in the first nine months of 2016, but in this case most of the gain comprised hardwood chips from Brazil. Economic conditions in Portugal remain very challenging and this is reflected in continued weakness in Portugal’s market for tropical sawn timber. Portuguese imports of this commodity, sourced primarily from Cameroon, Brazil and the Congo Republic, have been very slow throughout 2016.

Rising Portuguese imports of hardwood chips is one outcome of Portugal’s National Energy Strategy which seeks to ensure that over 30% of national energy consumption derives from renewable resources by 2020. A significant subsidy for biomass power production is now provided by the Portuguese government. The assumption is that the biomass should derive primarily from domestic forest resources. However, demand for biomass seems to outstripping domestic supply and Portuguese energy suppliers are therefore turning more to imported wood fibre, including from Brazil.

Note that for this analysis and in the absence of better data, all hardwood products imported into the EU from Brazil are classified as “tropical”. While this is appropriate for products like decking and veneers, it may be less appropriate for chips which are more likely to derive from eucalyptus plantations than from natural tropical forests.

PDF of this article:

Copyright ITTO 2020 – All rights reserved