Latest trade data shows that the rising trend in EU import value of tropical wood products that began in the second half of 2014 levelled off in 2016. The stability in the euro value of tropical wood imports in the second half of 2016 may hide a slight fall in the volume of imports as European currencies weakened on foreign exchange markets during that period (which implies a rise in import prices).

The euro, trading at around $1.15 in June 2016, had fallen to only $1.05 by the end of the year. Even more pronounced is the fall in the British pound, which was trading at $1.50 in June just before the country’s vote to leave the EU before declining to a 30-year low of $1.29 in early July after the result and which now stands at just $1.23.

Nevertheless, the dramatic slowdown in European tropical wood imports forecast for the second half of 2016 in response to currency movements and economic uncertainty in the UK following the Brexit vote failed to materialise. Prospects for the market in 2017 also look reasonably positive.

While the political situation in Europe is still uncertain, the economic recovery is gathering pace, helped by an improving global outlook, low interest rates, a significant fall in the level of unemployment, a weak euro and the end of austerity.

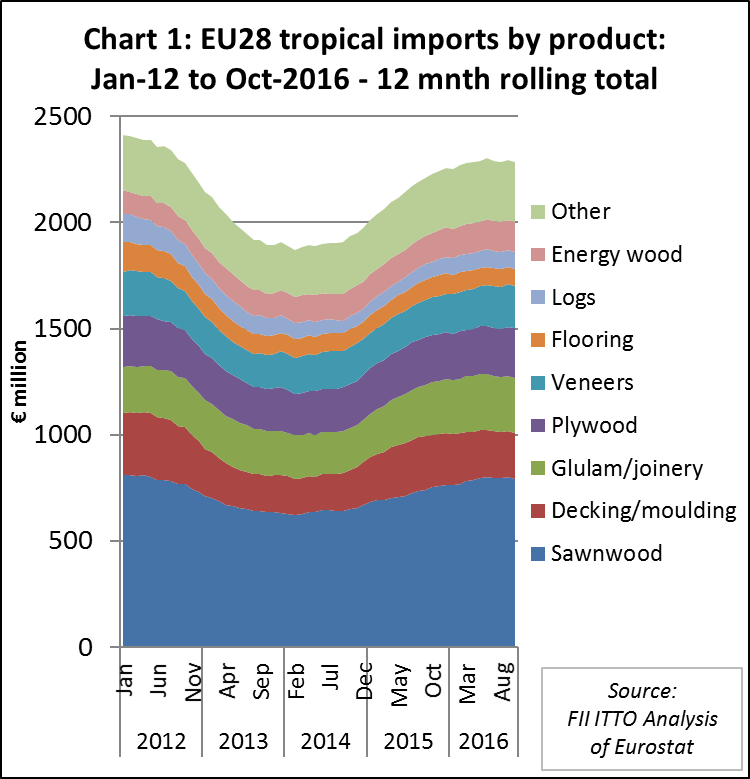

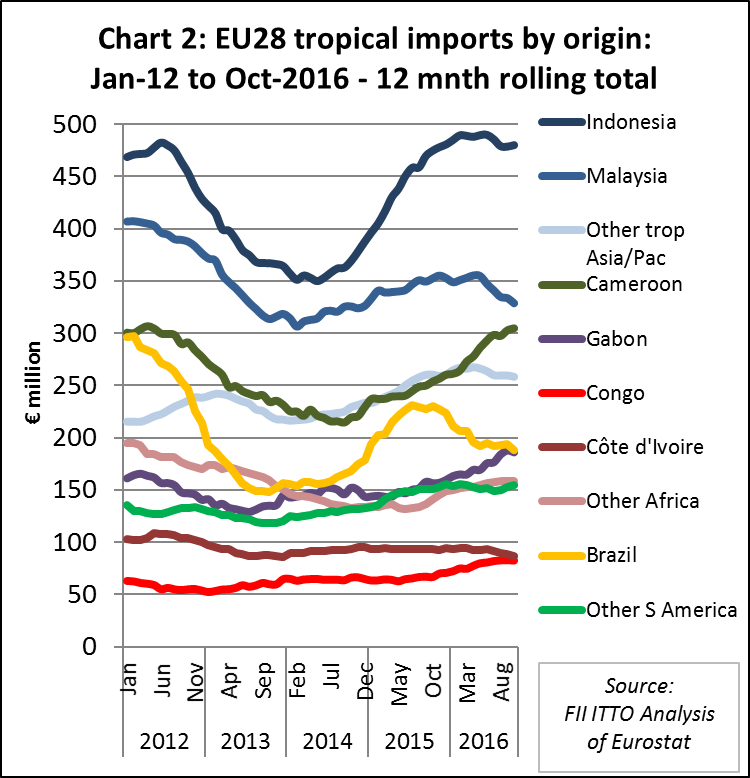

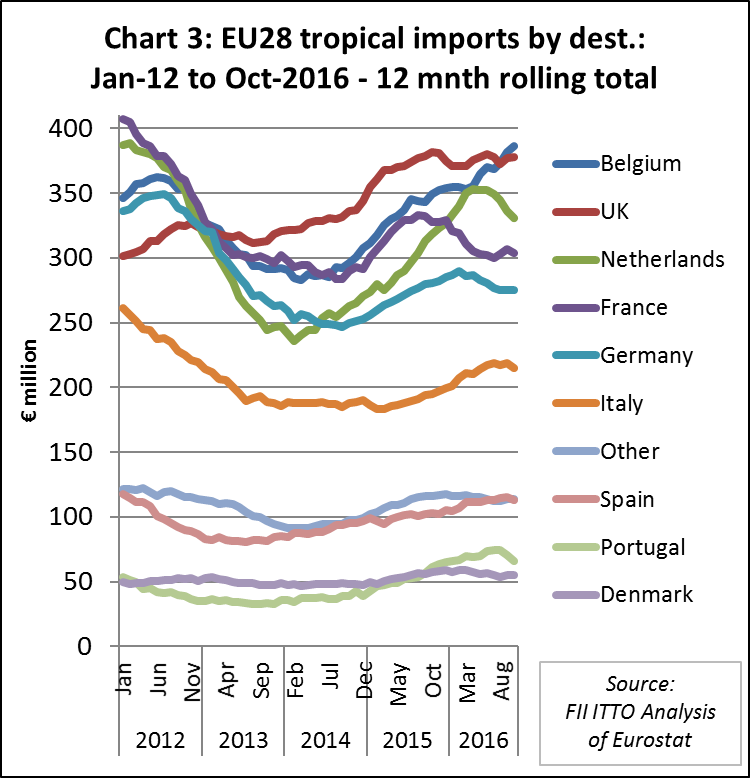

Charts 1 to 3 below show the monthly trend in imports of tropical wood products into the EU to October 2016 using 12 month rolling totals. This is calculated for each month as the total import of the previous 12 months. The data removes short-term fluctuations due to seasonal changes in supply and shipping schedules and provides a clear indication of the underlying trade trend.

Chart 1 shows total EU € import value of all wood products listed in Chapter 44 of the HS codes sourced from tropical countries. Total imports in the 12 months to October 2016 were €2.29 billion, slightly above €2.26 billion recorded for the 12 months of 2015. European imports of tropical veneer, plywood, and energy wood continued to rise slowly between January and October 2016. European imports of tropical sawnwood, LVL and logs, which were rising in the first half of 2016, stabilised at the higher level in the second half of the year. However, imports of tropical decking and mouldings, which increased sharply in 2015, were sliding throughout 2016.

Chart 2 shows how European imports from the major tropical supply countries developed between 2012 and October 2016. After rapid growth in 2015 and the first quarter of 2016, European imports from Indonesia (dominated by decking, doors, plywood and LVL) stabilised at the higher level between April and October 2016. Imports from Malaysia (mainly sawnwood, plywood, doors, and LVL) peaked in May 2016 and fell in the months to October. Imports from Brazil (mainly sawnwood and decking) were also sliding in 2017. However, imports from Cameroon (almost all sawnwood) and Gabon (a mix of sawnwood, veneer and plywood) continued to rise in the year to October.

Chart 3 shows the recent trend in tropical wood imports into the main EU consuming countries. The pace of growth in imports into the UK (which takes mainly doors, plywood and sawnwood) was slowing in the early months of 2016. Contrary to expectations of a sharp downturn, the euro value of UK imports stabilised at the higher level in the months following the Brexit vote in June.

The value of tropical wood imports into Belgium (mainly sawnwood and decking) increased so rapidly in the year to October that the country was on course to overtake the UK as the largest European destination for tropical wood in 2016. This suggests that the trend towards concentration of Europe’s tropical imports in the hands of a few large traders close to main ports continues to intensify – a trend driven partly by logistics and partly by the risk management demands of the EU Timber Regulation.

However, the rise in import value into Belgium between April and October 2016 was mirrored by a sharp decline in imports into Netherlands during the same period, so these trends may simply reflect temporary shifts in internal EU distribution channels between the ports of Rotterdam and Antwerp.

Meanwhile, direct imports of tropical wood into France (mainly sawnwood, decking and veneer) and Germany (mainly decking and sawnwood) were sliding in the opening months of 2016 but stabilised between July and October. The recovery in tropical wood imports by Italy (mainly sawnwood and veneer), Spain (mainly sawnwood and veneer) and Portugal (mainly sawnwood, logs and chips) in the first half of 2016 lost some momentum in the second half of the year.

Improving economic prospects in Europe

While there are significant downside risks in 2017, particularly with key national elections due to be held in Germany, France and the Netherlands, prospects for the European market seem promising. Economic surveys show that manufacturing activity and economic sentiment in the EU increased to their highest levels since 2011 in the closing months of last year. By the end of 2016, unemployment in the 19-nation euro zone had fallen to its lowest point in more than seven years: 9.8% according to Eurostat compared to over 20% a year earlier.

The big question in Europe this year is whether fragile economic growth and unprecedented central-bank stimulus will be overtaken by populist politics which could threaten the future of both the euro and the European single market.

But while Europe’s political calendar in 2017 certainly creates uncertainty, it might also offer opportunities. In a recent interview for CNBC, Francesco Garzarelli, co-head of global macro and markets research at Goldman Sachs noted that a potential right-wing president in France could lead to a stronger reform agenda in Europe. “If France were to change gear and become more inclined to move forward into reforming its economy I think that will force the likes of Italy, Portugal, Greece to do the same,” Garzarelli said.

In fact, more economic analysts now seem inclined to give Europe the benefit of the doubt and are suggesting that growth will exceed expectations. According to a research team led by Anais Boussie, writing in the Credit Suisse European Economics note on 9 January, “The euro area is set to deliver an upside growth surprise this year. Market expectations for growth are too low, in our view. Growth should strengthen on the back of stronger global trade and a pick-up in construction activity. It should remain supported by consumer spending, for which the fundamentals are improving,”

The Credit Suisse team forecast that GDP in the euro-zone will rise by a sturdy 2.0% in 2017, growth that will be underpinned by consumer spending. Instead of being fuelled by things like low oil prices, Credit Suisse reckon consumer spending will grow thanks to improving fundamentals like labour demand. They also note that “construction investment has contributed positively to growth for the past six quarters, and appears to be accelerating”.

Credit Suisse are confident that “the risk of deflation in the euro area has largely disappeared and headline inflation is set to rise sharply in the first half of 2017 as the strong dampening effect from past oil price declines fades away.” They also expect that the European Central Bank will be “dull” (a positive trait after a few too many “interesting” years) – quantitative easing will continue to provide greater liquidity at least until the end of the year while the base interest rate is likely to remain unchanged.

UK economy defies expectations in 2016 but likely to slow in 2017

Outside the euro-zone (but still a member of the EU for at least another 2 years), the UK economy defied expectations in 2016 as Britons decided to keep calm and carry on spending following the Brexit vote. Growth showed surprising resilience in the face of recession fears, with warnings from the Bank of England ahead of the EU referendum proving unfounded. Indeed, the UK Office for National Statistics said the economy grew by 0.5 per cent between July and September 2016, the three months after the referendum.

The UK economy remained buoyant in the last quarter of the year. The Markit/CIPS UK Manufacturers Purchasing Managers Index for December rose to 56.1, the strongest reading since June 2014, and up from 53.6 in November. A reading above 50 indicates expansion in the sector, with the month’s figure driven up by orders from home and abroad. The figures put the UK on course to be the fastest growing economy in the G7 group of leading nations in 2016.

However, this resilience is not expected to last. The British pound’s plunge in value last year may see growth falter in 2017. Surging prices due to the weaker currency are widely forecast to bring an end to the consumer spending spree that has helped prop-up growth since the EU referendum.

The UK’s Office for Budget Responsibility (OBR) estimates the economy will take a hit of almost £60 billion over the coming five years as a result of the Brexit vote. The OBR has slashed UK growth forecasts and is predicting higher than previously expected borrowing. To boost short term growth, the UK government is pinning its hopes on a big increase in public spending on infrastructure in a package of measures unveiled in August last year worth more than £170 billion and on historically low interest base rate of only 0.25%.

PDF of this article:

Copyright ITTO 2020 – All rights reserved