European consumption of real wood flooring (i.e. excluding laminates) remains flat and the role of tropical timber in this sector is declining. This is apparent from combined analysis of Eurostat trade data and the latest market report by the FEP (European Federation of the Parquet Industry) released on 16 June 2017 at the Federation’s annual general meeting in Budapest, Hungary.

Prior to the global financial crises, nearly 20 million m² of the 100 million m2 of real wood flooring manufactured in Europe was faced with tropical hardwood. Another 20 million m² was imported directly from the tropics.

However, in the last decade a host of factors have conspired to drastically reduce the role of tropical wood in this sector, including the shift to engineered flooring products, intense competition from Eastern European and Chinese manufacturers for market share, a progressive switch to oak at the expense of all other hardwoods, a glut in supply of cheaper laminates and non-wood alternatives, the development of new and improved look-alike surfaces, and an increasing focus on legality due diligence and certification.

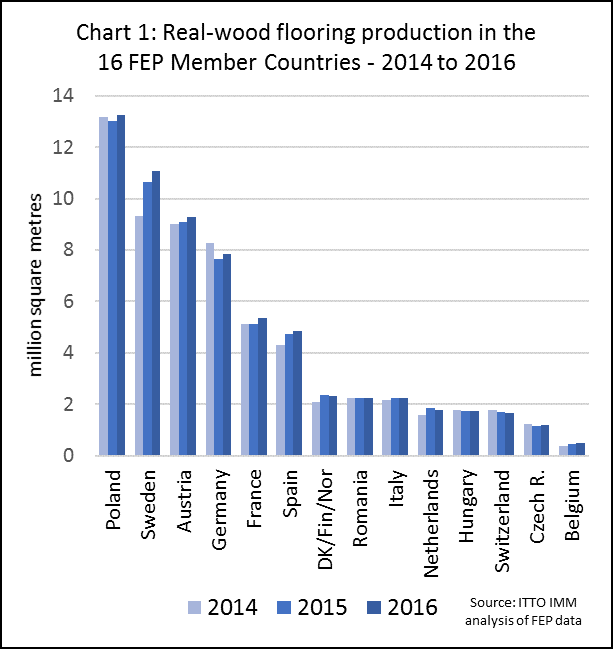

Drawing on information from member companies and affiliated national associations, FEP provides detailed data on real wood consumption and production in 16 European countries covered by the FEP. This data shows that consumption increased 1.7% in 2016 to 77 million m² in the 16 FEP countries, building on a 0.5% gain in 2016. It also shows that production in these countries increased 2.5% to 65.6 million m², with notable gains in Poland, Sweden, Austria, Germany, France and Spain (Chart 1).

According to FEP, in 2016 multilayer parquet floors accounted for 80% of wood floors manufactured in the 16 FEP countries, up from 79% in 2015 (the majority comprising three-layer parquet). Solid wood flooring accounted for 18% of production, down from 19% in 2015, while mosaic accounted for 2%.

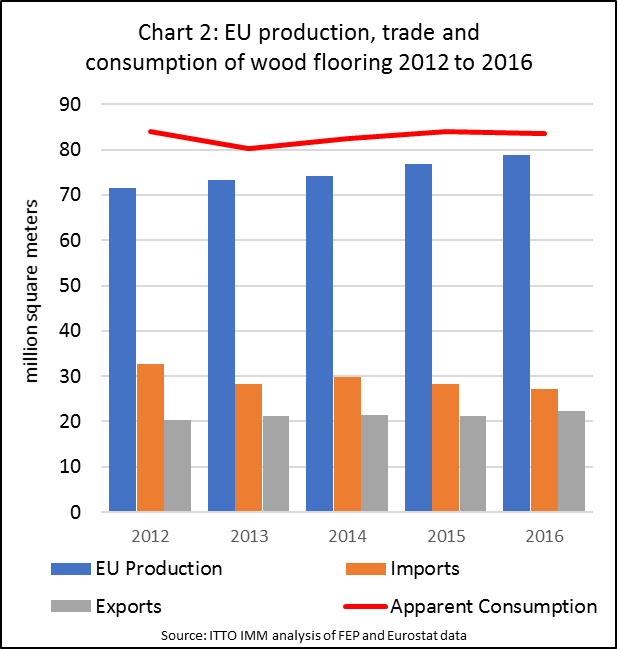

Data in the FEP annual report also indicates that total real-wood flooring production in the EU28 as a whole increased 2.4% from 76.9 million m² in 2015 to 78.7 million m² in 2016. Combining this with Eurostat trade data, which shows a 3.9% decline in imports and a 5.5% rise in exports by the EU in 2016, consumption within the trading block appears to have declined slightly, by 0.5%, during the year (Chart 2).

The combination of FEP and Eurostat data shows that the share of all real-wood flooring supplied into the EU single market by domestic manufacturers was 74.4% in 2016, up from 73.2% in 2015 and from 68.6% in 2012.

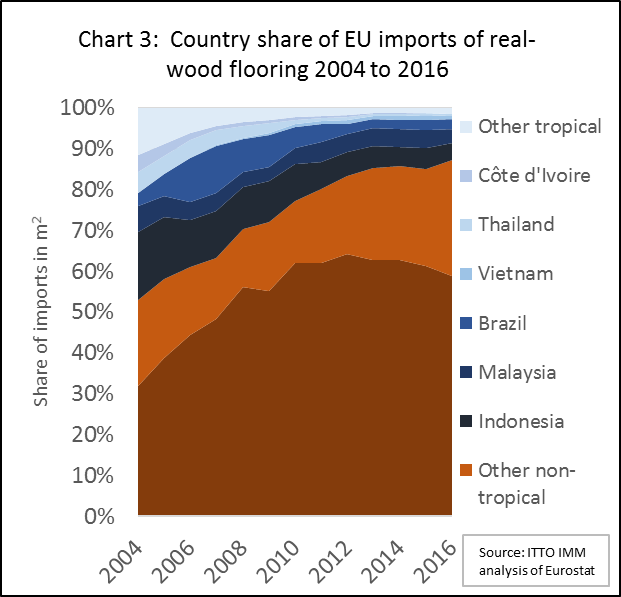

This analysis confirms that external suppliers into the EU continue to lose share in the wood flooring sector. Eurostat data also reveals that, amongst external suppliers to the EU, tropical countries are rapidly losing share to temperate countries. EU28 imports of real wood flooring from the tropics declined 18% to 3.46 million m² in 2016. Imports from China also fell in 2016, by 8% to 15.9 million m². In contrast, imports from Ukraine increased 28% to 3.99 million m², 21% from Switzerland to 1.28 million m² and 25% to 1.2 million m² from Bosnia. The continuous shift away from tropical suppliers of real-wood flooring is made apparent in Chart 3.

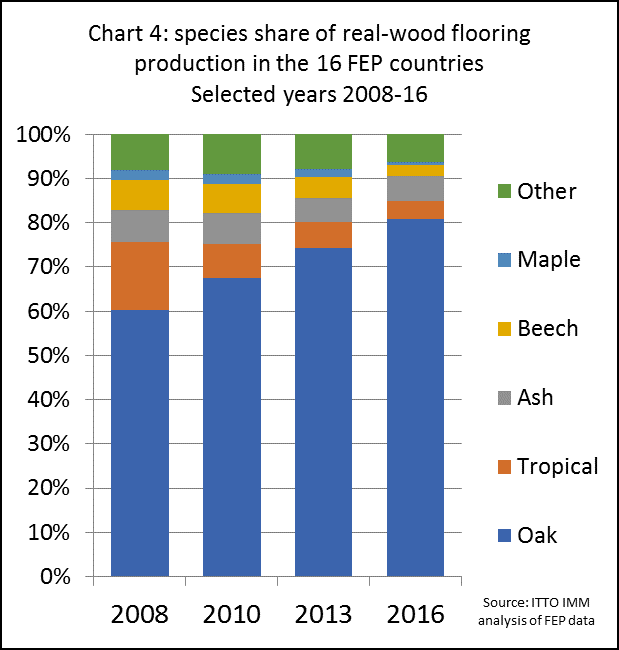

FEP data highlights the increasing reliance on oak in the EU wood flooring sector, a factor which is both a result of, and serves to reinforce, the dominance of domestic suppliers in the EU market. The share of oak surfaces in European real-wood flooring production increased from 77.7% in 2015 to 80.8% in 2016. Meanwhile the share of tropical timber fell from 4.5% to only 4.1%. Beech also fell from 3.8% to 2.5% and maple from 1% to 0.6%. In fact, the only timber other than oak to increase share was ash, rising from 5.6% in 2015 to 5.7% in 2016, mainly because it is regarded as a cheap oak substitute. (Chart 4).

The dominance of oak in flooring and the wider market for interior furnishings is now acknowledged to be a serious problem for the European hardwood sector. FEP observed in their annual report that “the growing shortage of oak as primary raw material source remains a major concern and has to be stressed once again”.

Similarly, the American Hardwood Export Council (AHEC) in their report of the Interzum show in Cologne, Germany, during May noted that “for some importers, oak (mostly from European sources) has increased from 50-60% of their hardwood business to 80% or more in recent years. Most of the hardwood traders AHEC spoke to expressed concern about the unhealthy nature of the situation and would like to see more demand for other species”.

Laminates share of European flooring sector on the rise

Another issue touched on in the FEP report is the challenge for real wood flooring from laminates and non-wood substitutes. The sheer scale of this challenge was made clear from data published in May 2017 for the Annual General Meeting (AGM) of the Federation for European Producers of Laminate Flooring (EPLF).

Laminate flooring composed of HDF with a high resolution printed image and embossed to provide texture has been substituting for hardwood flooring now for well over a decade. However, the surface finishes continue to improve and have become so convincing that, as the FEP comments; “it is becoming increasingly difficult for consumers to differentiate parquet from competitive flooring alternatives with a wood look surface.”

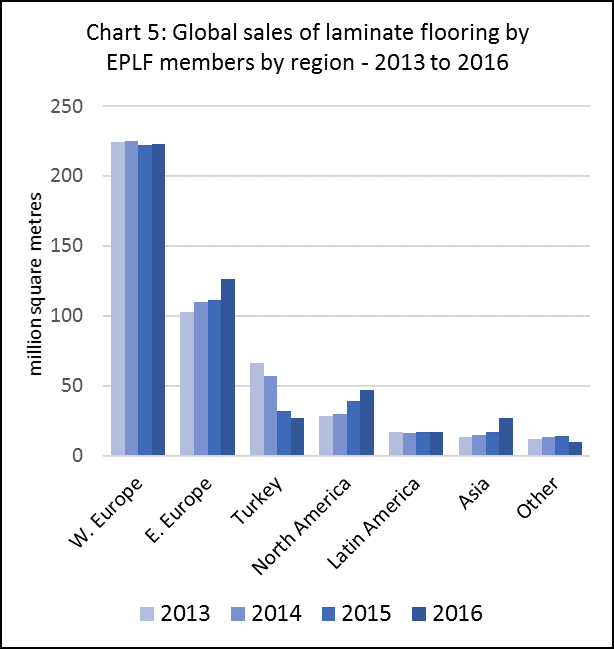

In contrast to the generally static market for real wood flooring, EPLF members reported a 5.5% increase in sales in 2017. Sales by European laminate manufacturers, at 477 million m² last year, now dwarf those of the real wood flooring sector. While EPLF members sales in Western Europe increased by only 0.5% in 2016, to 223 million m2, they increased 14% to 126 million m2 in Eastern Europe, with strong growth in Poland (+11%), Russia (+17%), Ukraine (+20%) and Romania (+27%). (Chart 5).

European panels sector creates challenges for tropical wood

Of the wide range of panel products used in Europe, only plywood is sourced in any volume from outside the region. For this reason, the wood panels sector in Europe is mainly of interest to tropical countries for the important role it has played to drive development of tropical wood substitutes. In addition to the competition to hardwood flooring from HDF-based laminate flooring referred to in the previous section, OSB is an important competitor for construction plywood while MDF has taken a rising share of the EU interior decorative mouldings market, often replacing lighter tropical hardwoods such as wawa/ayous.

The EU panels sector also remains a key source of innovation in the international forest products sector and continues to extend applications into new areas, often at the expense of tropical wood products. For example, a new process launched in 2011 to acetylate MDF has created a product that can be used for exterior applications, with a 50-year guarantee above ground and 25 years in ground, which now competes directly with tropical hardwood products in exterior applications.

A less direct impact of the European panels sector on the tropical wood trade, but perhaps just as important, is the central role it plays to promote the wider sustainability agenda in European market. As a product based on wood fibre either from certified forests in Europe or from off-cuts and other waste material, Europe’s panel manufacturers have had a strong incentive to promote the FSC and PEFC labels. They have also been at the heart of European policy initiatives to improve waste efficiency and promote the circular economy and cascaded use of wood.

All these various themes were featured at the European Panel Federation (EPF) AGM held in Porto, Portugal, on 29/30 June 2017. The EPF is one of the more influential wood industry associations in Europe. The organisation represents members in 25 countries including the manufacturers of particleboard, MDF, OSB, hardboard, softboard and plywood. The industry has an annual turnover of about 22 billion Euros, employs over 100,000 people directly and includes more than 5,000 enterprises in Europe.

In a review of the industry delivered to the event, the EPF Managing Director reported that production in European wood-based panels continued to recover slowly from the downturn following the global financial crises. Total production increased by 1.8% in 2016, to 55.6 million m³, still well below the level in excess of 70 million m³ recorded in 2008 before the global financial crises.

Production increased in 2016 across all the main product categories including particleboard (+0.8% to 30.2 million m³), MDF (+2.0% to 12 million m³), OSB (+6.9% to 5.4 million m³), softboard (+4% to 4.6 million m³), and plywood (+2.5% to 2.9 million m³). The only panel for which production did not increase in 2016 was hardboard which declined 5.6% to 0.5 million m³.

At the AGM, members of the EPF endorsed priority areas for future action to strengthen the market for European panels and secure the future of the association:

- E1 Compulsory – to seek EU legislation that endorses the E1 standard for formaldehyde emissions as the minimum requirement for panels placed on the EU market (E1 adhesives are required to have less than 0.75 formaldehyde parts per million).

- New Standard – to lead a project to define a single low formaldehyde emission standard to arrest the proliferation of different limit levels around the world and to facilitate trade.

- Image – to profile the wood-based panels industry as a leader in Europe’s drive towards a circular economy and resource efficiency, especially focusing on the Cascade Use of Wood and its benefits.

- Construction – to increase the use of wood-based panels in construction, thereby growing the market whilst helping to mitigate climate change due to wood’s carbon storage qualities.

- Africa – to share European experience of the production, certification and marketing of wood-based panels with the leaders of this growing market, thereby becoming a future reference point.

- Communications – to develop a new communications model, including a new website, to bring EPF’s messages and activities to members, internal and external stakeholders, and to the general public.

- Certification – to add the voice of EPF members to the call for wood to come from certified and sustainable sources, with no associated unnecessary bureaucracy and cost.

- Biomass – existing industries to be safeguarded via a level playing field, free from market distortions, allowing the EU’s Circular Economy and Renewable Energy Directive to work in harmony.

- Federations – EPF to maintain and increase its profile towards EU and national institutions working with members, related wood-working industry federations and NGOs.

- Safe Finances – to achieve all of the above within a balanced budget, ensuring the member contributions and additional income cover expenses.

Acetylated wood strives to gain European market foothold

The latest financial report of Accsys Technologies plc suggests that acetylated wood, often cited as a competitor to tropical wood in high exposure applications, is making slow headway in the European market. The Dutch-based modified wood producer recorded an 18% sales volume increase in the year ended March 31, 2017, but also a loss before tax of €4.4m (2016: €0.5m loss).

The 18% sales growth of Accoya acetylated wood saw volumes increase to 39,790 m3 in the year, with a 31% rise in the second half of the period. Sales by Medite of Tricoya panels increased by 32% to 5,806 m3 last year.

Given the level of ambition for the accoya and tricoya products, these volumes are still quite restricted. Accsys claims that the potential market for Accoya and Tricoya exceeds 2.6 million m3 annually – a very large figure which implies the company has ambitions to capture a large share of the existing European market for timber in external applications and to expand into other regions.

Accsys observes that “Accoya captures the market share in those applications which require rot, insect and water resistance, i.e. primarily outdoor products. The Group is focused on the higher-value end of these applications, where the dual qualities of durability and dimensional stability offered by Accoya are most highly valued.” Target applications for Accoya include windows, doors, decking and cladding and for Tricoya include facades and cladding, soffits and eaves, exterior joinery, wet interiors, door skins, flooring, signage and marine uses.

The company is now moving forward with a programme of expansion, including a project which, in phase 1, will increase Accoya production capacity in the Netherlands to 60,000 m3 by the end of 2017 and, in phase 2, by an additional 20,000 m3 in subsequent years. Finance has also been secured to build a new Tricoya chip acetylation plant in Hull, the UK, which will greatly increase supply of material for Tricoya panels. The plant will have an initial capacity of 30,000 metric tonnes and is expected to be operational in the first half of 2019.

ATIBT planning one-stop tropical wood website

The ATIBT (International Tropical Timber Technical Association) is building a one-stop website giving performance and other use and specification data for tropical timber species.

The organisation, which has won support for the initiative as a project of the Sustainable Tropical Timber Coalition (STTC), says the goal is to make it easier for the trade to sell tropical hardwood, and for end users and specifiers to select the right material for the job. The aim is also to broaden application of tropical wood by increasing market confidence in using it in more areas and more ambitious projects.

The present lack of such a site, said ATIBT in its STTC proposal, risks misapplication of tropical material and damage to its reputation.

‘With no centralised information base, each timber trader and processor provides their own marketing message, with the result that sales staff and customers may be misled,” said ATIBT Managing Director Benoît Jobbé-Duval. “This can lead to misspecification, resulting in timber staining and failure and customers subsequently choosing other materials.”

ATIBT has asked national European trade federations to back the site, to support translation and provide ‘catalogues’ of popular species in their market. Most have agreed.

The site is modelled on www.boistropicaux.org, which is operated by French trade association Le Commerce du Bois.

“It will also be further adjusted to each national context, taking into account specific technical standards, and listing distributors,” said Mr Jobbé-Duval.

The site will incorporate pictures of species and applications, underpinned with technical specification data from the Tropix database of French-based agricultural research organisation CIRAD.

The new facility will also provide links to complementary online sources, including the joint ETTF/ATIBT www.timbertradeportal.com legality assurance and business link website, which is sponsored by ITTO, and the species specification guide at www.houtdatabase.nl .

“Our objectives are also to strengthen ATIBT’s working relationships with other European associations, and to communicate our role in areas such as promoting use of legal and sustainable tropical timber and encouraging application of lesser known species,” said Mr Jobbé-Duval.

The new site should be complete, ready for adaptation by national federations, by July.

PDF of this article:

Copyright ITTO 2020 – All rights reserved