Although overall economic conditions are improving in Europe, growth in key countries and sectors for the tropical hardwood sector is subdued and weakening in some cases.

The European Commission currently forecasts GDP growth in the EU to remain level at 1.9% in both 2017 and 2018. However, private consumption, the main growth driver in recent years which expanded at its fastest pace in 10 years in 2016, is set to moderate this year as inflation partly erodes gains in the purchasing power of households.

Investment is expected to expand fairly steadily in the EU but remains hampered by the modest growth outlook. Unemployment continues its downward trend, but it remains high in many European countries. In the euro area, it is expected to fall to 9.4% in 2017 and 8.9% in 2018.

Meanwhile the European market for tropical wood which, after a long period of decline, stabilised at a low level between 2014 and 2016, has generally slowed again this year.

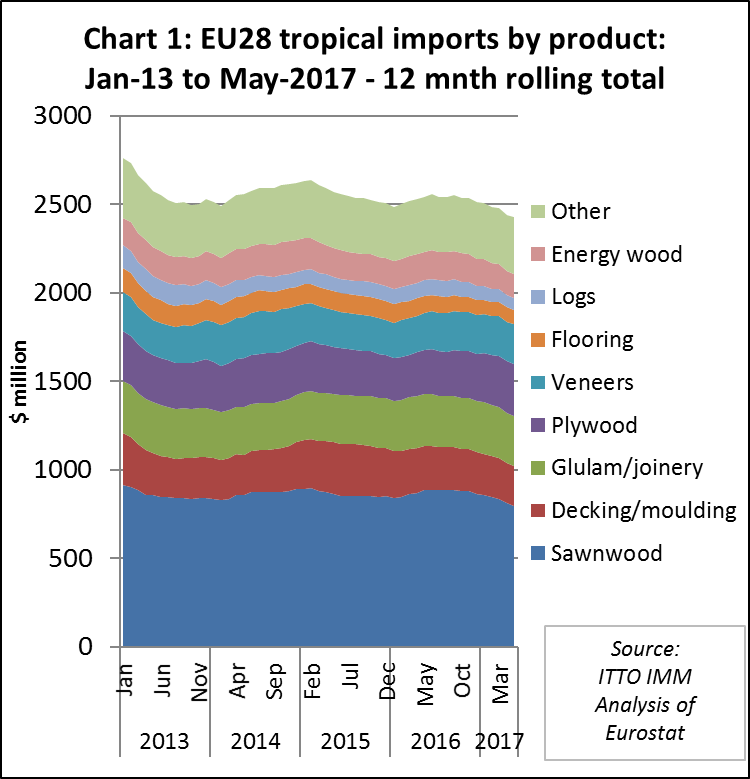

Charts 1 to 4 below show the monthly trend in imports of tropical wood products into the EU to May 2017 using 12 month rolling totals. This is calculated for each month as the total import of the previous 12 months. The data removes short-term fluctuations due to seasonal changes in supply and shipping schedules and provides a clear indication of the underlying trade trend.

Trade value is reported in US dollars, rather than in Euro, to provide a clearer indication of demand from the perspective of exporters into Europe. Because the Euro and other European currencies depreciated sharply against the US dollar between June 2014 and June 2016, the switch to reporting in US dollars has a significant impact on the trade trend.

40-month stasis in dollar value of EU tropical wood imports

While the euro value of tropical wood product imports into the EU increased 20% between mid-2014 and mid-2016, the value reported in US dollars remained almost static. Chart 1 shows the US dollar value of EU imports value of all wood products listed in Chapter 44 of the HS codes sourced from tropical countries. It highlights that the 12-month rolling total remained consistent at around US$2.5 billion for a 40-month period between the middle of 2013 and end of 2016.

Chart 1 also highlights that the US dollar value of EU tropical wood products imports was declining in the first five months of 2017. Much of this decline is attributable to sawn wood, for which the 12-month rolling total fell from US$865 million in December 2016 to US$795 million in May 2017.

This year has seen a significant slowdown in the volume of sawnwood trade between Cameroon and Belgium, which in 2016 overshadowed all other tropical sawnwood trade flows into the EU. In the first five months of 2017, Belgium’s imports of tropical sawnwood were US$88 million, down 22% compared to the same period in 2016.

The tropical sawnwood trade in the Netherlands also declined in the first five months of 2017, by 18% to US$57 million. However, after a very slow start to the year, trade was beginning to pick up in the second quarter. Imports from Malaysia were strengthening during this period, responding to the Dutch government’s decision in January to recognise MTCS certified wood as conformant to national procurement criteria for “sustainable” timber.

Elsewhere in Europe, the US dollar value of direct imports of tropical sawnwood in the first five months of 2017 declined in the UK (-8% to US$32 million), France (-21% to US$31 million), Italy (-33% to US$29 million), Germany (-2% to US$22 million), and Spain (-17% to US$19 million).

Changing product mix in EU tropical wood trade

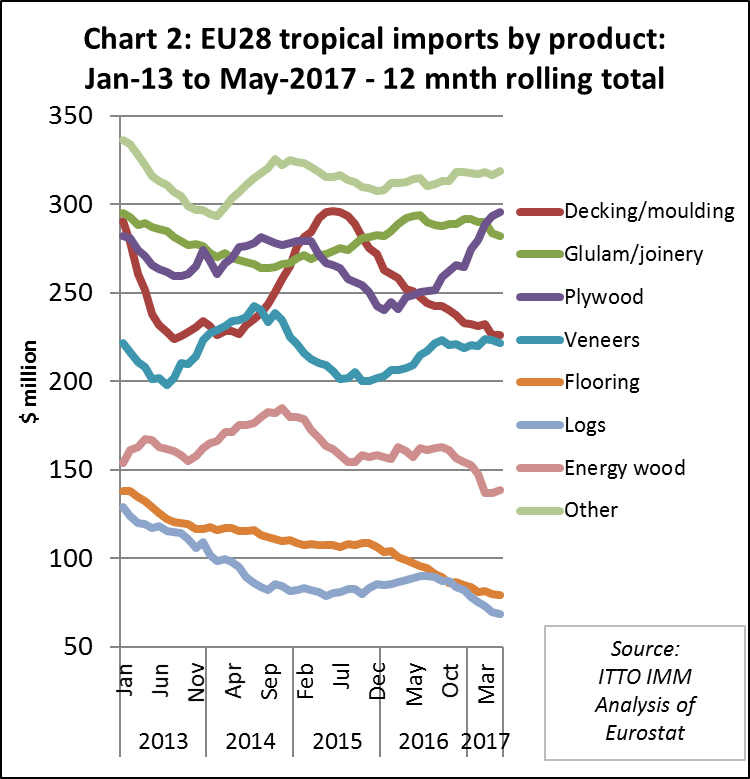

Chart 2 shows the US dollar value trend in EU imports of tropical wood products other than sawnwood. It highlights that, while there has been relative stability in the total value of imports, there is considerable flux in the product mix.

EU imports of tropical decking have been particularly volatile in the last three years, rising sharply in 2015 and declining in 2016 and the first half of 2017. The recent decline is mainly due to intensifying competition from alternatives, notably wood plastic composites and modified temperate wood species.

In contrast, imports of tropical hardwood plywood have been rising rapidly and continuously since the start of 2016. All the gains have been in imports of tropical hardwood plywood from Indonesia and China, with a rising proportion destined for the UK and Belgium.

The EU plywood market has been an early target for EUTR regulatory checks. As a result, Indonesian product is now receiving a boost from the “green lane” through EUTR provided by FLEGT licenses. There is also greater focus on ensuring that plywood imported from China contains only wood material of known species and origin, so that more is now positively identified as faced with tropical hardwood.

EU imports of tropical veneers were rising in 2016, but the pace of increase has slowed in 2017. Roughly half the tropical veneer imported into the EU is rotary okoume veneer from Gabon to supply plywood manufacturers, mainly in France, and the remainder is decorative veneer, mainly from Ivory Coast and Cameroon and mostly destined for Italy. Meanwhile EU imports of other tropical wood products, including energy wood, flooring and logs have been sliding in 2017.

Indonesia increases share in declining EU market

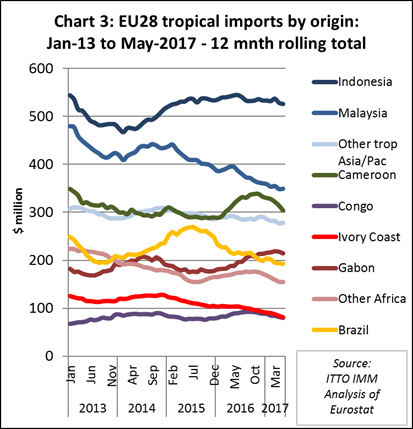

Chart 3 shows how the fortunes of the various tropical supply countries are changing in the EU market. Indonesia has become more firmly established as the leading tropical supply country into the EU this year. While the dollar value of EU imports from Indonesia has remained static since the start of 2016, import value from most other leading supply countries has been declining.

This provides context for those concerned about the apparent lack of market growth for Indonesian wood products in the EU since issue of the first FLEGT licenses in November 2016. While total imports from Indonesia are not rising, they are stable in a market which is generally declining and Indonesia is increasing share compared to other tropical supply countries.

The dollar value of EU imports of tropical wood products from Malaysia fell almost continuously in the two years up to March 2017, with a notable decline in Dutch and German imports of sawnwood and UK imports of Malaysian plywood. However, there were some early signs of EU imports of Malaysian products picking up again in April and May this year.

EU imports from Cameroon, mainly sawnwood and mostly imported into Belgium, spiked in the second half of 2016 and subsided rapidly in the first five months of 2017. EU imports from Congo and Gabon have also slowed in 2017 after a strong performance in the second half of 2016. Meanwhile the long-term decline in EU imports from Ivory Coast has continued in 2017. Imports from Brazil have also declined consistently in the last two years.

Rising uncertainty in the UK market

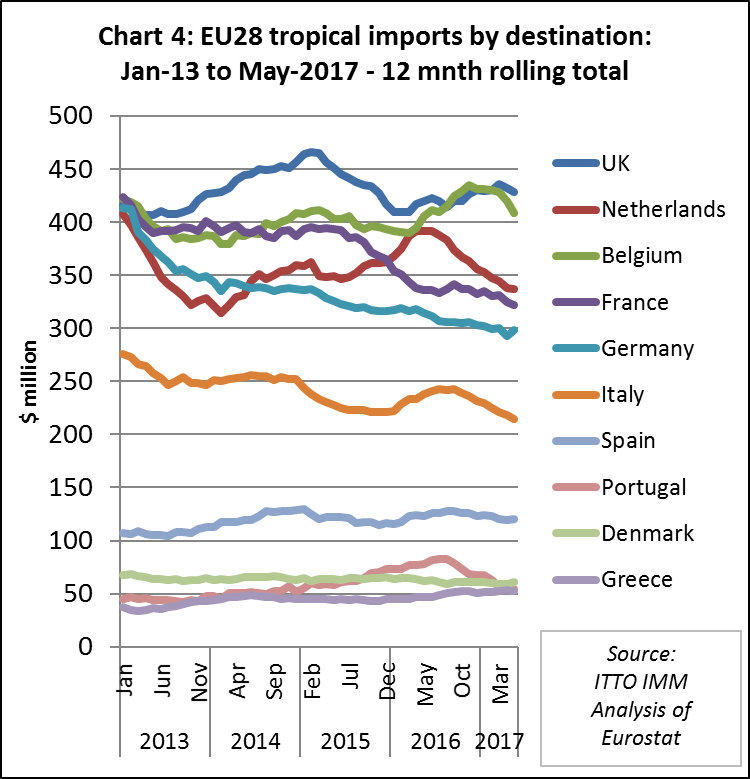

Chart 4 shows that over the last 4 years, the UK has been the largest single destination for tropical wood imports into the EU. The focus on direct imports also underestimates the influence of the UK since a proportion of sawnwood imported by Belgium and the Netherlands from Africa is also sold into the UK after kiln drying on the continent.

The UK market for tropical hardwood remained more resilient than many expected in the second half of 2016, despite the uncertainty caused by the Brexit vote in June 2016 which led a 15% fall in the value of the British pound against the dollar in the third quarter of the year.

However, concerns are now mounting about economic conditions in the UK. The UK economy was the worst performer in the EU in the opening months of 2017 as the Brexit vote at last began to take its toll. With economic growth of just 0.2% in the first three months of this year, the UK was well behind its European neighbours (growth for the whole of the EU was 0.6% in the first quarter).

The latest British Woodworking Federation survey of joinery activity in the U.K. reinforces this picture of subdued demand. The survey reports slowing growth and tightening margins in this sector during the first quarter of 2017. The weakness of the British pound and associated rising inflation are identified as dampening factors. While stair manufacturers had a good quarter, manufacturers of internal and external doors had more mixed results.

Recent business surveys suggest the UK economy picked up some momentum in the second quarter after its slow start to 2017. But with higher inflation weighing on consumer spending, most forecasters expect growth to be lacklustre during the rest of 2017. The snap election called for June 2017, which led unexpectedly to a hung parliament and undermined the authority of the current Conservative government, has only served to increase the uncertainty.

Positive indications in Benelux

Imports of tropical wood products into Belgium and the Netherlands were mirror images of each other in the second half of 2016, rising very rapidly into the former while declining in the latter.

Given that both countries are important centres for distribution of tropical wood to other parts of Europe, these trends are more likely associated with short-term logistical factors favouring transit via ports in Belgium over those in the Netherlands, than with changes in internal demand in the two countries.

In fact, underlying market conditions in each country appear to be reasonably good. There was robust growth in construction output in both the Netherlands and Belgium in 2016, and this trend continued into the first quarter of 2017.

The Belgian economy expanded 0.64% in the first quarter of 2017 compared to the quarter, the highest quarterly growth rate since 2011, driven by an uptick in private consumption. In the Netherlands, a buoyant labour market together with rising wages and house prices and upbeat consumer sentiment are fuelling household spending.

There is also optimism that the Dutch government’s decision to recognise MTCS as “sustainable” will boost prospects for Malaysian timber in the Netherlands in the next few years, particularly as both the government and the Netherlands Timber Trade Association share a commitment to ensure that at least 90% of tropical timber imports derive from sustainable sources by 2020.

French economy boosted by election results

France has been a weakening market for tropical wood in recent times, both due to sluggish economic growth and to substitution by alternative materials, including European timbers and non-wood products.

However, there is now better news on the economic side. France’s economy grew by 0.4% in the first three months of the year, stronger than the 0.3% initially estimated by statisticians. That suggests the economy is moving in the direction indicated by surveys which show business activity growing at the fastest pace for seven years.

French consumer confidence has climbed this year to its highest level for a decade, according to the national statistics agency INSEE. The EC’s sentiment data for France is also at a six-year high and shows improvements across all the sectors it monitors – industry, services, retail, consumer and construction.

Economic sentiment was given another boost by the outcome of the French elections in June, which delivered a new centrist President at the head of a party with an absolute Parliamentary majority. The new government’s election manifesto emphasised the need to reduce the budget deficit and increase confidence in the business environment. The new government now forecasts GDP growth of 1.6% this year and 1.7% in 2018.

However, the new government will have to walk a fine line to deliver on its promises. It is committed both to reducing the budget deficit to below 3% in line with euro-zone rules, and to a big cut in taxes on individuals and businesses of around 11 billion euros next year. To achieve this, it intends to reign in public spending and to liberate France’s rigid labour market laws, measures that will likely meet ferocious opposition from unions and labour groups.

Economic growth in Germany not benefitting tropical suppliers

The German economy got off to a strong start this year, according to official GDP figures released by the German Statistics Institute in May. GDP growth accelerated and was well balanced, with all main categories accelerating. The positive momentum seems to have carried over to the second quarter, with confidence indicators reaching all-time highs and signs of particularly strong growth in the German construction sector.

Some hardwood product sectors are benefitting from this growth. For example, the European wood flooring association FEP reports that parquet sales in the first quarter of the current year remained stable building good performance recorded in 2017.

Despite the underlying strength of the economy, Chart 4 highlights that German imports of tropical wood have been in continuous decline in the last five years. This is a clear indication of the mounting pressure on tropical wood from substitute products in Germany. EUTR regulatory concerns have also deterred German importers concerned about the legality risks associated with buying tropical timbers

Italy lags further behind

Italy is another market where tropical wood imports have been in almost continuous decline in recent times. In this instance, the trend is more readily explained by poor underlying economic conditions.

Italy’s economy is lagging further behind its European peers. Recently released data shows that GDP expanded just 0.2% from the previous quarter in the first quarter of 2017, less than half the 0.5% growth recorded in the Euro area. Private consumption, which was the main driver of growth last year, is gradually weakening, restrained by rising inflation, a stubbornly high unemployment rate and feeble wage increases— a consequence of stagnant productivity.

However there are some more positive signs emerging. According to Euroconstruct, residential renovation and new non-residential buildings are increasing in Italy and only new residential construction is still declining.

Spanish economy improves but tropical wood demand still flat

Imports of tropical wood into Spain have been static overall at a low level in recent years. However, market prospects are beginning to improve. The Spanish economy continues to build momentum as stronger-than-expected dynamics in the first quarter of 2017 have carried over into second. Households are now benefitting from higher real estate prices and robust job creation. The residential housing sector is improving. For the first time since the crisis, there were more housing starts than completions in 2016.

Other leading data points to a better-performing economy in Spain this year, with both the services and manufacturing purchasing managers indices accelerating markedly in April and exports expanding at the fastest pace on record in the first quarter. Spain’s economy is expected to grow 2.7% in 2017.

PDF of this article:

Copyright ITTO 2020 – All rights reserved