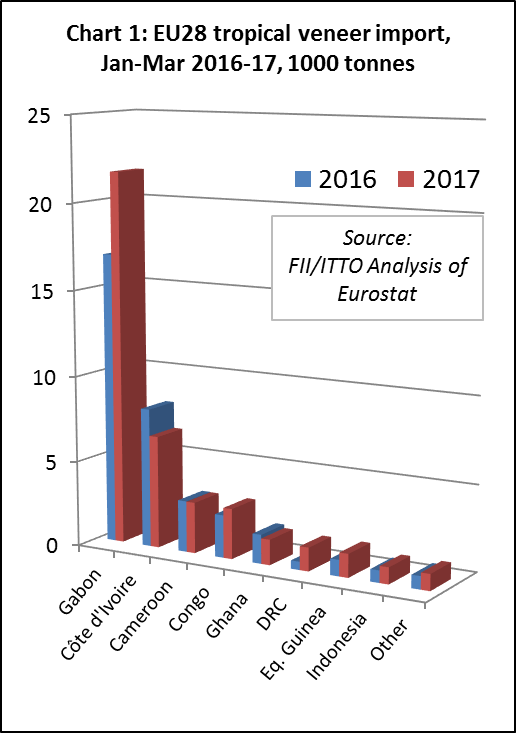

After making gains last year, EU imports of tropical veneer have continued to rise in 2017, hitting 40,000 metric tonnes (MT) in the first quarter, a 15% increase compared to the same period in 2016. As in 2016, most gains were in imports from Gabon, which increased 28% to 21,700 MT in the first quarter of 2017. EU veneer imports also increased from several smaller supplying countries including Congo (+18% to 2,900 MT), DRC (+187% to 1,400 MT) and Equatorial Guinea (+45% to 1,400 MT). However, imports declined from Côte d’Ivoire (-19% to 6,600 MT), Cameroon (-1% to 3,000 MT), and Ghana (-12% to 1,500 MT). (Chart 1).

EU imports of veneer from Gabon consist mainly of rotary okoumé veneer destined for plywood manufacturers in France. The EU market for decorative tropical hardwood veneers is benefitting to some extent from the slow recovery in EU furniture and joinery manufacturing activity. However, the fashion for oak in the EU is as strong as ever, and competition from wood look-alike products such as laminates and luxury vinyl tiles has continued to intensify, as the look and performance of artificial surfaces has progressively improved.

Surge in EU tropical plywood imports in 2017

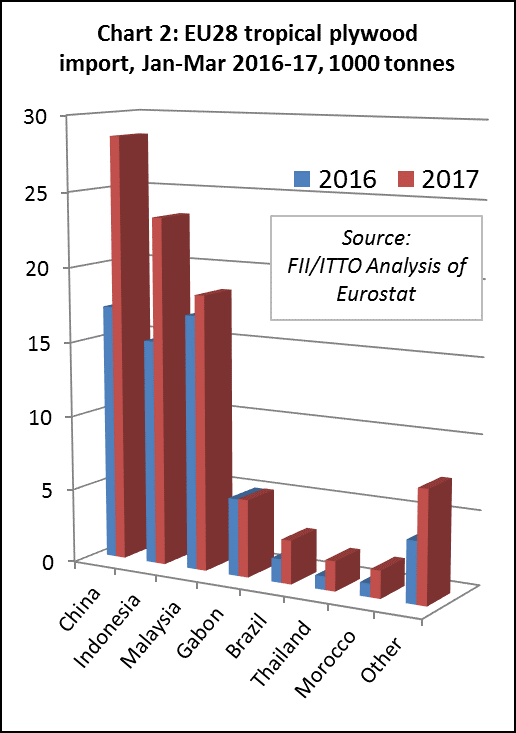

Following a 15% rise during 2016, EU imports of tropical plywood increased a further 45% to 89,900 MT in the first quarter of 2017. Much of the increase comprised plywood faced with tropical hardwood veneers manufactured in China and destined for the UK and Belgium. Imports of this product from China increased 66% to 28,600 MT in the opening 3 months of this year. However, there were also gains in direct EU imports from all the major tropical suppliers during the same period. Imports increased from Indonesia by 54% to 23,400 MT, Malaysia by 8% to 18,500 MT, Brazil by 84% to 2,900 MT, Thailand by 123% to 2,000 MT, and Morocco by 106% to 1,900 MT. Imports from Gabon were stable at 5,200 MT during the period. (Chart 2).

The changing composition of EU plywood imports may be partly related to enforcement of EUTR and CE marking requirements. This is encouraging a shift from Chinese mixed light hardwood products to plywood containing more clearly identified species of known tropical origin and technical performance. It also provides new opportunities for plywood imported directly from tropical countries, particularly Indonesia following issue of the first FLEGT licenses in November 2016.

EU imports of tropical wood flooring continue to decline

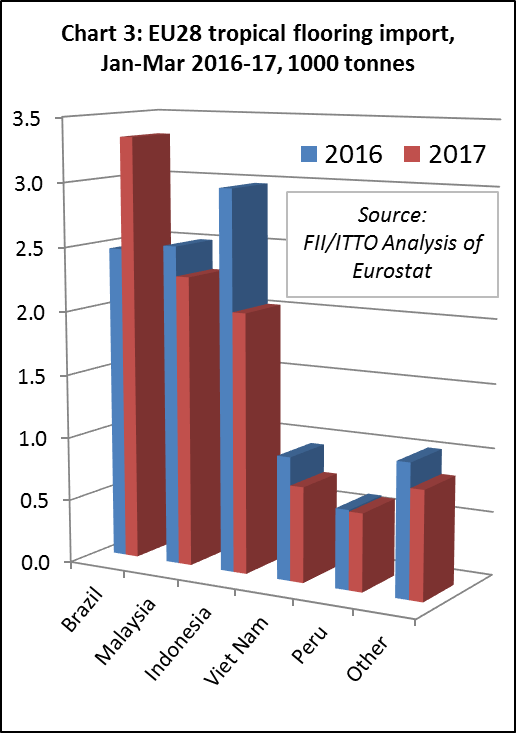

After declining 18% in 2016, EU imports of wood flooring from the tropics fell a further 7% in the first quarter of 2017 to 9,900 MT. While imports from Brazil increased 35% to 3,300 MT in the three- month period, imports declined from all other significant tropical supply countries including Malaysia (-9% to 2,300 MT), Indonesia (-32% to 2,000 MT), Viet Nam (-23% to 700 MT) and Peru (-2% to 600 MT). (Chart 3).

The continuing decline in EU wood flooring imports from the tropics this year forms part of a wider trend of increased dependence on European manufacturers in the EU. EU imports of wood flooring from China – the largest supplier outside the European region – are also declining. After falling 12% to 341,000 MT in 2016, EU wood flooring imports from China declined a further 12% to 82,000 MT in the opening quarter of 2017.

Meanwhile, EU imports wood flooring imports from neighbouring European countries, such as Ukraine and Bosnia, are rising. There are also clear signs of intensifying competition and over-capacity in the EU’s domestic wood flooring sector. Statistics published by the European Parquet Flooring Association FEP show that consumption of real-wood flooring in Europe is rising more slowly than domestic production.

Trade data also reveals a significant rise in internal EU trade – as western European distributors are buying more wood flooring from manufacturers in Eastern Europe. At the same time EU exports of wood flooring have been rising, although the pace of growth is slowing with declining opportunities for market expansion in Russia and the Middle East.

Taken together these trends indicate a very challenging market environment for external suppliers of wood flooring into the EU.

Dip in EU imports of wood doors from the tropics

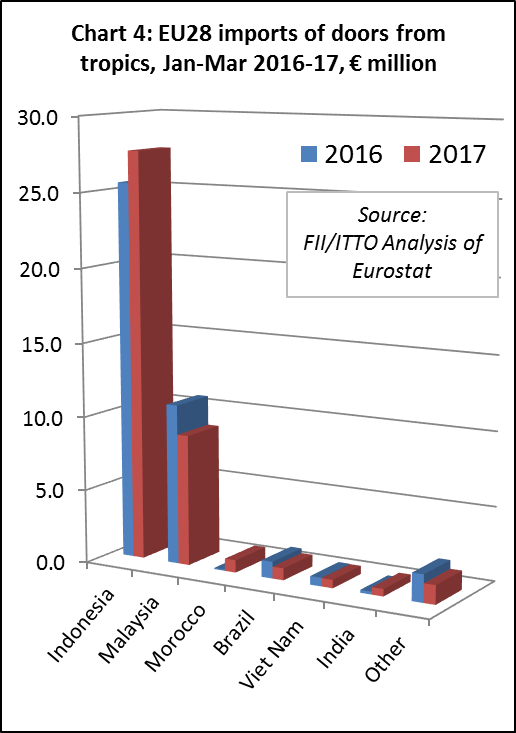

After a 24% increase in 2015, EU imports of wood doors from tropical countries dipped 2% to €167 million in 2016. This slow downward trend continued into the first quarter of 2017 with imports of €40.5 million being 1% less than the same period the previous year.

Much of this trade comprises imports of doors from Indonesia into the UK. Jeldwen, a leading operator in the global market for joinery products, has significant door manufacturing capacity in Indonesia and is also a leading distributor to wholesalers and DIY chains in the UK.

In the first quarter of 2017, EU imports of wood doors from Indonesia increased 8% to €27.6 million. In contrast imports from Malaysia, the only other significant tropical supplier to the EU market, fell 18% to €8.9 million. (Chart 4).

Wood doors purchased in the EU are now rarely made from solid timber and instead are manufactured using veneered panels and finger-jointed timbers. Requirements to comply with higher energy efficiency standards and efforts to provide customers with long-life time guarantees are driving this concerted shift to engineered wood products.

Flatlining EU imports of wood furniture from the tropics

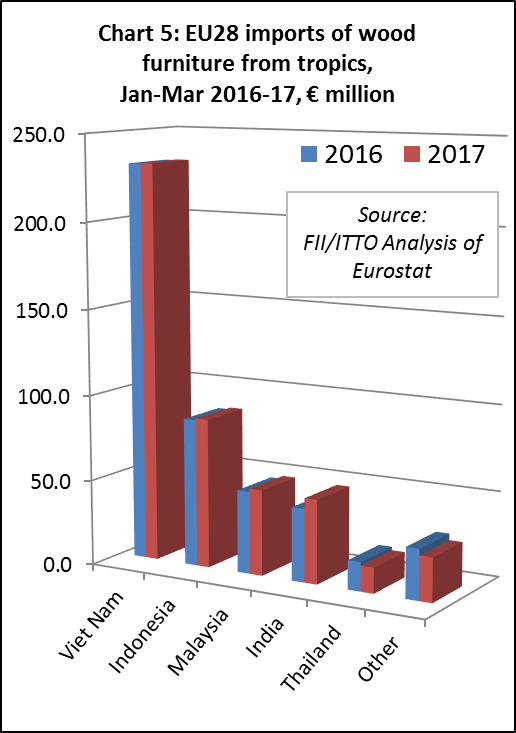

The EU imported wood furniture with total value of €459.1 million from tropical countries in the first three months of 2017, 1% more than the same period in 2016. This follows a 1.3% fall in EU imports to €1.64 billion in 2016.

EU imports of wood furniture from Vietnam, by far the largest tropical supplier, were static at €232.3 million in the first quarter of 2017. Imports increased slightly from Indonesia (+1% to €87.3 million) and Malaysia (+4% to €50.0 million) during the same period. There was a much larger 14% increase in imports from India to €48.9 million. Imports declined 12% from Thailand to €14.9 million (Chart 5).

The lack of any significant upturn in EU imports of wood furniture from Indonesia in the first quarter of 2017, immediately following issue of the first FLEGT licenses, will disappoint Indonesian manufacturers, particularly when considered against the rise in imports from India which is not engaged in the VPA process and has no ready access to certified wood material. This suggests that there is still much work to be done both to increase awareness of FLEGT licensing and ensure more rigorous implementation of EU Timber Regulation in the EU furniture sector.

More positively for the FLEGT programme, the competitiveness of Indonesia in supply of wood furniture to the EU seems to have improved in relation to China. The value of EU imports from China fell 2.3% to €766.1 million in the first quarter of 2017. This follows a 3.7% fall in EU imports from China to €3.04 billion in 2016.

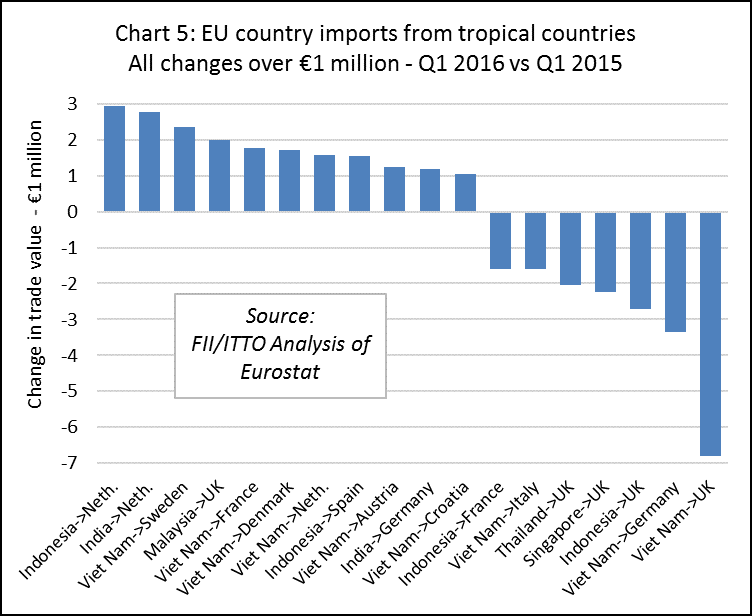

Closer analysis of the trade data reveals a lot of flux in EU imports of wood furniture from tropical countries at national level during 2017. Imports of wood furniture from Viet Nam have fallen sharply into the UK and Germany this year, whereas Sweden, France, Denmark and the Netherlands have all imported more from Viet Nam. Imports from Indonesia have risen into the Netherlands and Spain this year, but fallen into the UK and France. The rise in EU furniture imports from India this year is mainly concentrated in the Netherlands and Germany (Chart 5).

EU demand for wood furniture from tropical countries also needs to be considered in the light of wider consumption and production trends. As in other sectors, there are clear signs that while demand for wood furniture in the EU is rising, competition is also intensifying. EU manufacturers, particularly in Eastern Europe, are producing more at a time when domestic consumption is growing only slowly and exports to other parts of the world are weakening. Wood furniture suppliers in the tropics face significant competition from domestic manufacturers and manufacturers in Eastern European countries outside the EU, as well as in China.

PDF of this article:

Copyright ITTO 2020 – All rights reserved