Drawing on interviews with timber trade associations across the region, the latest newsletter of the European Timber Trade Federation (soon to be published at http://www.ettf.info/ettf_news) shows that the European timber market continues to grow slowly and broadly in line with GDP forecasts of 2.4% in 2018 and 2.3% and 2% in 2019. It also highlights that trade growth is becoming more widespread and resilient in southern European countries, including in Italy, Spain and Greece.

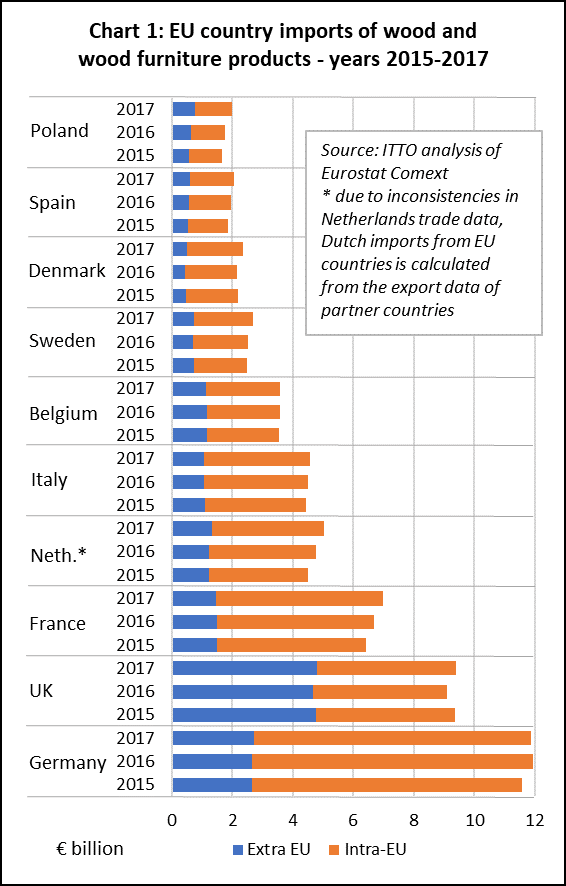

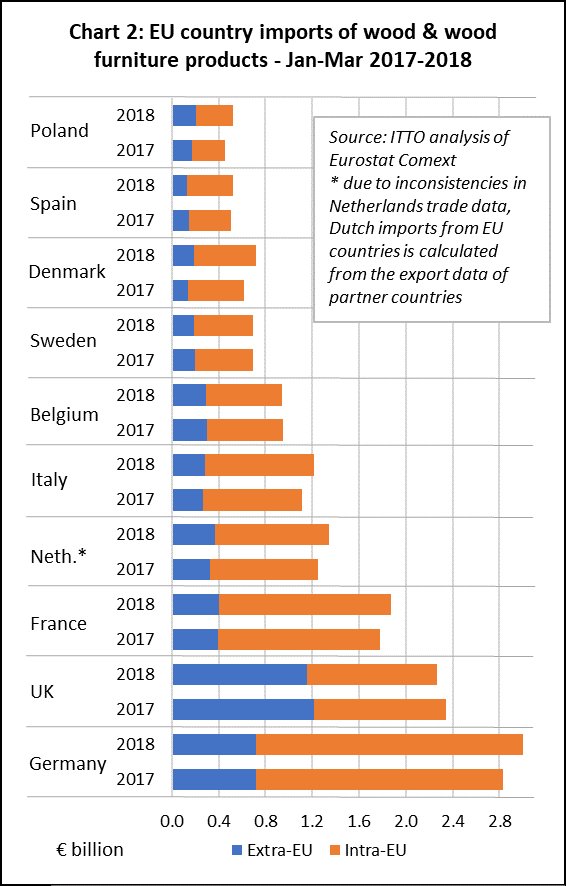

However, growth has lost momentum in the UK, the largest EU importer from outside the region. ITTO’s own analysis of trade data also indicates that much of the recent gain has been in internal EU trade and imports from neighbouring European countries, rather than in imports from the tropics and other regions (Charts 1 and 2).

German timber imports rise in 2018 after stalling last year

In 2017, total German imports of wood products (including all those in HS 44 and wood furniture in HS 94) declined 0.7% to €11.88 billion. Germany’s imports from inside the EU fell slightly, by 1.7%, to €9.17 billion in 2017, while imports from outside the region increased 2.6% to €2.71 billion.

Most of the gains in German imports during 2017 were from Russia, Belarus and Ukraine. However, trade also increased 5% with Indonesia, Germany’s largest tropical supplier, to €158 million.

In the first quarter of 2018, German imports were up 6% to €2.28 billion, with nearly all the gains in imports from other EU countries.

According to GD Holz, German sales of lumber and planed timber slowed in the first quarter of 2018, but flooring and building products sales were very robust. From a tropical perspective, a decline in garden and outdoor products sales was a concern in the first quarter, but this trend is likely to have reversed as the weather has improved. Construction is also set for a strong year in Germany.

German importers report some shortages in certain timber categories, including tropical plywood and decking, but with woodworking order books full, traders are expecting further growth in overall demand for timber products.

French trade benefits from rising construction trend

In France, the importers association Le Commerce du Bois reports that trade was buoyed by 2%-plus GDP growth last year and continues to benefit from a rising trend in construction, with housing starts in March at the 427,000 per annum level which compares to 360,000 starts in 2016.

The French timber trade also expects to benefit increasingly from government measures to improve building energy performance and incentivise wood use in construction and from the new €10 million promotional programme, ‘Pour mois, c’est le bois’”.

This campaign is led by the French national wood association France Bois Forêt and supported by other trade and industry bodies. It aims to “increase the volume of wood consumption in France and increase market share for domestic production”.

To date, signs are that the revival in French demand and the promotion campaigns are benefitting mainly European suppliers. The total value of French imports of wood products increased 4.4% to €6.99 billion in 2017. However, imports from inside the EU increased 6.3% to €5.52 billion while imports from outside the EU declined 2.3% to €1.48 billion.

In the first quarter of 2018, French imports increased 5.4% compared to the same period in 2017, with imports from inside the EU rising 6.3% to €1.47 billion and imports from outside the EU up 2.2% to €402 million.

All key sectors expanding in Belgium

In Belgium, the Fedustria association, which since last year has also covered the importing sector, reports that all key sectors enjoyed growth in 2017. The main drivers were higher consumer spending and construction growth of 3.1%. Sales of wood building products and systems were up 5.3%, while sheet materials also performed strongly.

Although Belgian timber sector confidence dipped a little in early 2018, Fedustria is optimistic of boosting market prospects via the latest wave of its wood promotion campaign: “Wood gives oxygen”.

Similar to France, the recent gains in Belgian trade have mainly benefitted other European countries. Belgian wood products imports increased 0.8% to €3.60 billion in 2017. Imports from within the EU increased 3.2% to €2.48 billion while imports from outside the EU declined 4.1% to €1.12 billion.

Belgian imports in the first quarter of 2018 were €950 million, no change from the same period in previous year. Imporst from inside the EU increased 0.7% while imports from outside the EU declined 2.2%.

In the panels sector, Fedustria highlight that the industry faces ever-tighter rules on emissions, adhesives and ‘best available techniques’ application. Consequently, the Belgian association is working with the European Panel Federation to ensure products imported into the EU meet the same high standards and do not compete ‘unfairly’.

Netherlands growth at the highest level for a decade

In the Netherlands, economic growth is at its highest point since 2008, consumer confidence is high, and timber trade turnover is rising. The Netherlands imports of wood products increased 5.3% to €5.03 billion in 2017. Imports increased from inside the EU by 4.7% to €3.7 billion and from outside the EU by 7% to €1.33 billion.

These trends continued in the first quarter of 2018, with imports rising another 7.2% to €1.34 billion compared to the same period in 2017. Imports from inside the EU gained 5.6% to €975 million and from outside the EU the rise was 11.7% to €366 million.

Most of the growth in Netherlands imports from outside the EU has comprised wood furniture from China, Indonesia, Vietnam and India, and sawnwood from Russia.

While demand is expanding, the Netherlands Timber Trade Association reports that the trade is experiencing some pressures with stock prices rising and supply constraints for some products. A lack of skilled labour is also curbing construction’s growth capacity and civil works are still not back to pre-recession levels.

Italian imports rising more strongly in 2018

According to the ETTF newsletter, new Fedecomlegno Secretary General Massimo Fiorini takes Italy’s rise in timber imports in 2017 as a key indicator of the sector’s recovery. Overall, Italy’s wood and wood furniture imports increased 1.8% to €4.6 billion in 2017. Imports from within the EU increased 2.3% to €3.53 billion and imports from outside the EU increased by 0.2% to 1.06 billion.

Italy’s imports also picked up pace in the first quarter of 2018, rising 8.9% to €1.22 billion, increasing 9.9% from inside the EU and 5.9% from outside the EU.

One market driver in Italy is an upswing in the property sector since 2017, which resulted in rising imports of sawn timber, wood flooring, and joinery products.

While the signs in Italy are encouraging, the recovery has yet to extend to tropical wood. Imports from the largest suppliers of tropical timber into Italy – Cameroon and Indonesia – fell during 2017. Italian imports from Brazil increased, but this was mainly plantation softwood plywood rather than tropical hardwood.

From within the EU, there was a significant increase in imports from Austria, Italy’s largest external wood supplier, together with Poland and Slovenia.

Much of the recent gain in Italian imports from outside the EU has comprised furniture from China – which may be seen as a negative by Italy’s large and still dominant domestic furniture sector – together with sawnwood from Ukraine and birch plywood from Russia.

Volatility in the UK trade

The UK Timber Trade Federation (TTF) reports that the last two years’ have been volatile due to uncertainties over Brexit and subsequent currency fluctuation. The timber trade had weathered this until now, but into 2018 conditions have worsened, with wood and wood products imports declining 3.2% in the first quarter compared to the same period in 2017. Imports from within the EU fell 1.5% to €1.11 billion while those from outside the EU fell 4.7% to €1.15 billion.

The decline in UK imports from outside the EU this year has been concentrated in plywood and joinery products from China, sawn hardwood from the USA, and pellets from the USA and Canada.

The slowdown in UK imports is attributed partly to poor weather and the collapse of giant contractor Carillion and partly uncertainty surrounding Brexit with the UK moving from the fastest to the slowest growing EU economy.

With the UK due to leave the EU in March 2019, the full impact of Brexit has yet to be felt. The TTF has warned that Brexit could land the UK trade with a ‘£1 billion tax bill’ in non-deferrable VAT on wood imports from the EU. Currently under EU rules, importers can clear goods through customs and pay VAT later, a major cashflow benefit.

However, once the UK leaves the EU VAT area, 20% VAT will have to be paid on goods’ arrival. The TTF is concerned that this will contribute to additional costs for storing at ports and delays due to administering customs checks and documentation. The TTF is therefore urging government to maintain existing EU VAT arrangements.

While from the perspective of the TTF, the extra bureaucracy of doing trade with the EU after Brexit is a clear disadvantage, these issues may create some new opportunities for suppliers outside the EU.

In 2017, the UK imported wood and wood furniture products with a total value of €9.4 billion (US$10.9 billion) of which 49% derived from other EU countries. The UK is already by far the largest EU importer of wood products from outside the region – alone accounting for 25% of all extra-EU imports and 27% of EU tropical imports – and Brexit may increase this tendency to trade with countries outside the EU.

However, these new opportunities need to be balanced against the potential negative impact of Brexit on the overall UK economy.

Rising optimism in Danish trade

According to the Danish Timber Trade Federation, Denmark is enjoying 2% annual GDP growth and its construction sector is optimistic again after several years of crisis. The timber sector is benefitting accordingly with a rise in both import and consumption of wood products, both from within and outside the EU. Prices are also trending upwards in softwood, hardwood and certain panel products.

In 2017, Denmark imported wood and wood furniture products to a total value of €2.37 billion, nearly 10% more than in 2016. Imports increased 9% to €1.88 billion from other EU countries and 13.5% to €490 million from outside the EU.

Denmark’s imports increased a further 16% in the first quarter of 2018 comparted to the same period in 2017, rising 10% from inside the EU and over 37% from outside the EU.

A large proportion of the increase in Danish imports from outside the EU comprises biomass from Russia and the US, however there was also an increase in wood furniture imports from Vietnam and, to a lesser extent, Indonesia.

Tourist industry puts floor under Greek demand

In Greece, the level of timber trade is still restricted following the financial crises which came to a head in 2010 and led to a 25% reduction in total national GDP and an estimated 85% contraction of the wood sector. In 2017, Greek wood and wood furniture imports declined 2% to €420 million, after a 10% rise the year before.

However, in 2018 investment in construction for the tourist sector, particularly for major hotel developments but also including the small private rental market, is giving the Greek timber industry a modest, but much needed boost, according to HTCA, the Greek timber trade association.

The HTCA acknowledges that building and timber industries have been particularly hard hit in the economic crisis. But domestic and inward investment in tourism related projects is on the increase, and, in line with a wider upturn in the use of timber in construction, these are featuring more wood products and systems than in the past.

This is beginning to have an impact on imports which were €69 million in the first quarter of 2018, nearly 10% more than the same period in 2017, rising 13% from within the EU and 6% from outside the EU. From outside the EU, there has been particularly strong growth in Greek imports of wood furniture from China and plywood from Russia this year.

Russian timber sector in bouyant mood

According to a report in the ETTF Newsletter by Sviatoslav Bychkov, Ilim Timber Managing Director, Marketing and Communications, the Russian timber sector is in buoyant mood and increasing capacity, including in wood-based construction, after a robust performance in 2017.

In 2017 Russia GDP grew 1.5%, successfully taking the country out of economic recession. The woodworking industries were part of this success, contributing 1.9% to GDP, with the sawmill sector achieving 2.2% growth and its further expansion reflected in a 60.7% increase in production and processing equipment imports.

Saw log production rose 4% to reach 79 million m3, while exports contracted 1.5% to 11 million m3, with the bulk going to China. Meanwhile market prices for Russian sawn softwood exports grew an average of 10% in Asia, Europe and the Middle East and North Africa (MENA), driven by a number of factors, including demand on the domestic market.

China overall accounted for 58% of sawn timber and 95% of log exports from Russia in 2017. The former percentage represented 21% volume growth to a total of 15.5 million m3.

Reflecting the migration to processed timber exports, Manzhouli, the major land port for Russian timber exports to China, achieved a record high volume of sawn timber handled, at 8 million m3 and saw a record low volume throughput of saw logs at 3.8 million m3. In 2017, Russian exporters also started to explore railway connections to China’s Sichuan province using container block trains.

At the same time the reorientation of lumber exports away from CIS and MENA markets continued, resulting in these accounting for just 20% of the total.

In this buoyant market, all major Russian producers reported that they were increasing production volumes, adding shifts and also modernizing technology. Capital investment was estimated to have increased sawn goods capacity by 600,000m3 in 2017, with a further 500,000m3 forecast for 2018.

Due to demand, sawmillers in the North West region started to experience some saw log shortages, while Siberia reported record high harvest volumes.

Further reflecting production growth, a number of mills in Siberia and eastern regions have started fuel pellet production to manage by-products output, increasing overall industry capacity by 31%.

Annual plywood production, primarily birch, has been stable at 3.7 million m3 for three years, with 50% exported, mainly to the US, UK and rest of the EU, but an estimated 200,000m3 of new capacity is forecast to be added this year.

FSC certification has grown to cover 48.3 million hectares of Russian commercial forest. Russia now accounts for 25% of the FSC certified forest area worldwide.

Yacht industry calls for co-operation with Myanmar on teak

According to a report in the ETTF newsletter, an international alliance of yacht sector and associated organisations has cautioned against a ban on trade in Myanmar teak. Instead it urges industry, governments and NGOs to support the country’s efforts to reform forest management and improve legality assurance.

The Large Yacht Cluster (LYC) comprises shipyards, teak importers and suppliers, national and international trade bodies and NGOs. Its core aim is a ‘sustainable teak value chain’. The organisation says teak is prized in yacht making, not just for aesthetics, but also its durability and anti-slip characteristics and the fact that it does not warp, attract insects, or absorb moisture.

At the same time the cluster says it is “fully aware of the fragile status of teak and the consequences of unlawful traded timber”.

However, it warns that banning trade in the timber will only promote exports to less environmentally concerned markets, reduce support for Myanmar to strengthen environmental controls and undermine its ability to tackle illegality.

The cluster says the requirements on legality assurance of the EU Timber Regulation, US Lacey Act and Australian Illegal Logging Prohibition Regulation are promoted in the industry, as well as ‘certification references such as FSC and PEFC’.

But it also urges greater international harmonisation of market legality requirements ‘to ensure a global approach, a level playing field and harmonised enforcement’.

It additionally backs development of alternative materials to partly spare teak and is working on guidelines for using less teak per vessel to reduce pressure on stock.

The core appeals in the position paper are for: international support for Myanmar’s efforts to create a sustainable teak value chain; endorsement of this stance from national and international institutions and trade bodies; support for education of the yacht industry on teak issues; national enforcement agencies to work collaboratively – ‘taking a constructive approach and refraining from unconstructive and unequal measures and penalties against those that do their utmost’.

Regular news on EUTR developments

Much timber trade policy discussion in the EU now focuses heavily on developments in the EU Timber Regulation (EUTR) which, given its scope covering nearly all timber products and importing companies in the EU, is having a significant effect to influence purchasing decisions, particularly in relation to tropical timber products.

The latest European Timber Trade Federation newsletter (soon to be published at http://www.ettf.info/ettf_news) includes details of the European timber trade’s views on the implementation and enforcement of EUTR.

Information on the latest EUTR developments is also provided in a regular briefing note issued by UNEP-WCMC in its capacity as a consultant to the European Commission and based on information provided by the Member States Competent Authorities (CAs).

Drawing on a survey of 20 CAs in the second half of 2017, the latest UNEP-WCMC briefing provides details of EUTR compliance checks performed and penalties imposed to enforce EUTR implementation. The respondents reported conducting checks on more than 467 domestic operators, 388 importing operators, 300 traders dealing with domestic timber, 177 traders dealing with imported timber and three monitoring organisations, over the period June-November 2017.

The report also includes a summary of the latest FLEGT/EUTR Expert Group meeting in Brussels during April where it notes that “some Member States reported substantiated concerns regarding companies placing timber from high-risk countries on the EU market, including from Myanmar and Brazil. The conclusion of the EUTR Expert Group meeting of 20 September 2017 was reiterated and it is still not possible for operators to demonstrate compliance with EUTR due diligence obligations as regards timber imports from Myanmar”.

According to WCMC-UNEP, the FLEGT/EUTR Expert Group meeting in April also included a presentation on a TAIEX mission to Ukraine which reported that “a substantial corruption risk can be found in every supply chain and is widespread throughout the country, however there was not enough public information available to convince EU operators of the risks”.

Eurostat data compiled by ITTO shows that in 2017 the EU imported EUTR regulated products with a total value of €950 million from Ukraine, which compares to €554 million in 2013 when the EUTR was first introduced, a 72% increase. EU timber imports from Ukraine comprise a wide range of products, led by sawn hardwood and softwood and veneers, mainly destined for Poland, Germany, Romania, Hungary and Italy.

Links to the UNEP-WCMC briefing notes together with other EC information on the EUTR are available at http://ec.europa.eu/environment/forests/timber_regulation.htm#products.

PDF of this article:

Copyright ITTO 2020 – All rights reserved