The European plywood market faces a combination of buoyant demand, mounting competition for product from other leading consumer countries, plus persistent supply delays and constraints among key producers, notably tropical suppliers.

In fact, tropical suppliers actually saw their exports to Europe fall in the first quarter of 2018. The overall result of these factors has been rising prices, increasing caution about forward buying and, if not shortages, longer lead times and difficulties, as one importers said, ‘in planning ahead and obtaining the right volumes at the right time’.

Concerns have also been raised in the industry once more about mis-marking of Chinese plywood imports in terms of timber species mix and recommended application labelling. This has been voiced particularly by the UK Timber Trade Federation (TTF), which has consequently issued new product performance and content checking protocols for its members.

Boost from European construction

The key driver of European plywood demand has been the continuing buoyant state of construction across most of the EU. This is underpinned, according to market monitor and analyst Euroconstruct, by generally robust wider economic performance, low interest rates, migratory flows, particularly into urban centres, and the latent demand that has built up due to the building investment backlog since the economic crisis.

The latest Euroconstruct report, published on June 11 and charting building sector development in its network of 19 European countries describes their current construction growth as “exceptional”. It adjusts its estimate for 2017 expansion of the industry, forecast in November last year at 3.5%, to 3.9%. This gives the industry turnover of €1.52 trillion, comprising 49% new build and 51% renovation, repair and refurbishment. It also predicts, with building levels still 20% off their 2007 market peak, that there is more growth to come through 2018 (2.4%) into 2019 (1.9%).

“Never before have all Euroconstruct countries’ building industries grown for two years in a row,” states the report.

Fastest 2018 construction expansion is expected in Hungary, forecast at a rate of 24.6%, Ireland 11.1% and Poland 9.9%, with the worst performance in a ‘barely positive’ UK market, where poorer economic performance is expected to keep growth down to just 0.1%.

Having said that, the UK will remain the third biggest construction market in Europe, with a value of €210.9 billion, after Germany (€332 billion) and France (€216 billion), but ahead of Italy (€169.4 billion).

New residential construction has recently been the main engine of European construction growth, increasing last year by 10%. That rate, says Euroconstruct, will halve in 2018, but civil engineering will take over as the key market driver, expanding 5%.

This, said one importer, will be positive for plywood demand, as will growth in renovation, which, Euroconstruct says, will ‘continue for a long time and on average exceed and be more stable than growth in new construction’.

Solid plywood demand , rising prices

Against this background, European plywood importers variously describe demand ranging from ‘stable and sound ’ and ‘at a good level’, to ‘strong and strengthening’.

Most companies said sales were solid across the range, although Malaysian generally and Indonesian marine plywood were highlighted as being particularly sought after.

At the same time, all importers had issues with supply in different degrees.

“There have been delays from everywhere, for various reasons,” said one leading continental operator. “Overall supply is short, making it difficult to plan,” confirmed a UK company. “Mills are also often running very late.”

The problems with Indonesian and Malaysian supply are largely attributed by European importers to the long and severe wet season and its impact on harvesting and log transport, with mills consequently running short of logs.

The weather and raw material supply situation has since improved, but a report in the European trade press early April said that in some regions ‘logging roads are still muddy and log hauling is difficult’, adding that it could take a further month before the situation returned to normal.

Plywood prices for both Malaysia and Indonesia in the EU are reported to have increased by 30% in the last six months.

Until recently, supply from Brazil was described by European importers as ‘no better or worse than usual’, but the recent nationwide truckers strike over high fuel prices is expected to cause continuing delays in delivery of raw material to mills and finished product to port.

President Temer ultimately made concessions to the strikers and industrial action was called off end of May, but the country was left with a significant backlog of undelivered cargo and the action is now expected to dent GDP.

Increased competition from US buyers for Malaysian and Indonesian product is also said to be impacting availability and price in Europe.

“Traditionally, US buyers have sourced Asian hardwood plywood imports most heavily from China [worth $1.12 billion last year], but their requirements are now such that they’ve been exploring other sources, including Indonesia and Malaysia,” said a European importer/distributor.

“Whether US anti-dumping and countervailing duties on Chinese hardwood products, activated in December, will heighten this trend remains to be seen.”

China plywood trade slowed by environmental controls

Meanwhile Chinese plywood supply is reported by EU importers continuing to be disrupted by tough new national environmental controls, which are forcing mills to interrupt production to upgrade or replace emission and waste treatment technology. Here prices are reported to have risen 10% in the last six months.

“Inspectors have been visiting our Chinese supplier mills now for months, and we’ve seen regular stoppages as they improve their systems,” said one importer/distributor. “And recently there were more in Linyi and Pizhou.”

“Stoppages also increased in Qingdao as part of the authorities moves to improve the local environment for June’s Shanghai Cooperation Organisation meeting,” said another leading EU importer.

Some European traders maintain that one reason for the pollution crackdown is to rationalise and concentrate the plywood industry, forcing smaller producers to close.

One European importer/distributor, however, insisted this was not the prime objective. “We visit regularly and are convinced it’s motivated by a genuine desire to reduce the industry’s environmental footprint and help meet climate change targets,” he said. Importers added that they generally back China’s action as underpinning its overall environmental credibility.

As for the situation with Russian hardwood plywood supplies to the EU, an importer summed it up as ‘more or less OK’. “But there have been some issues with a lack of trucking capacity,” he said.

Total EU plywood imports up 5% in first quarter

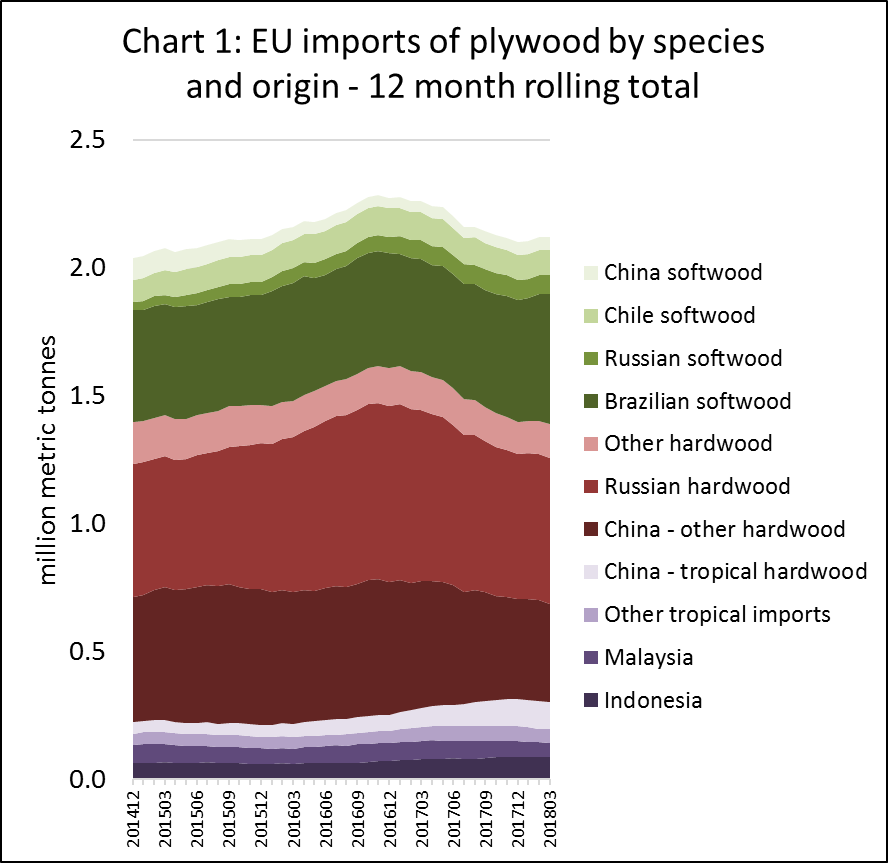

Analysis of latest trade figures for plywood supply to the EU tally with importers’ comments. Total EU plywood imports have picked up a little this year, hitting 686,000 m3 in the first quarter, nearly 5% more than the same period in 2017. However, supply constraints have meant that imports are still well below levels prevailing two years ago in 2016. (Chart 1).

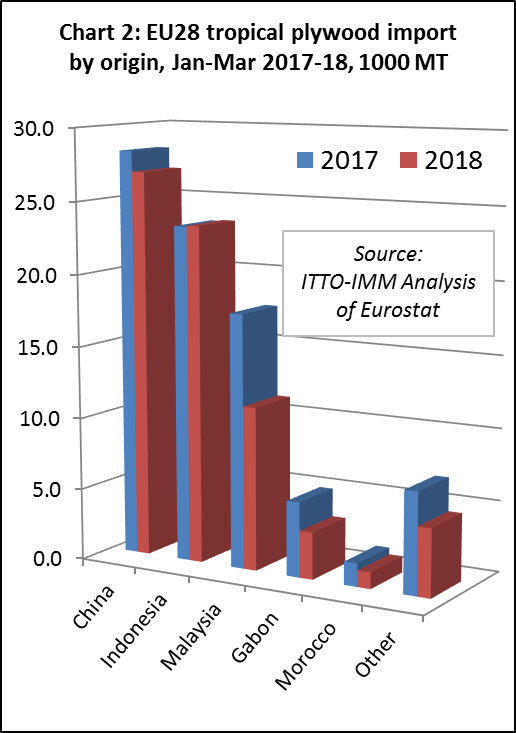

Lack of supply has been a significant drag on EU imports of tropical hardwood plywood this year. Imports from all the EU’s leading tropical suppliers except Indonesia declined in the first quarter of 2018 (Chart 2).

The volume of EU plywood imports from Indonesia increased only slightly, by 0.3% to 23,000 tonnes, in the first quarter of 2018. However, import value from Indonesia fell 10.9% to €23.9 million during the period.

In the first quarter of 2018, EU imports of tropical hardwood plywood from China contracted 16.5% by value to €16.5 million and 5% in volume to 26,900 tonnes, and Malaysia’s were down 40% to €8.4 million and 36% to 11,350 tonnes.

Imports from Gabon were 37% lower by value at €4.6 million and 37.5% by volume to 3,250 tonnes, and from Morocco down 29% by both value and volume to €1.9 million and 1,137 tonnes.

Together with other sources, this meant total first quarter EU tropical plywood imports were 23% lower by value at €61.9 million and 15% by volume to 74,029 tonnes.

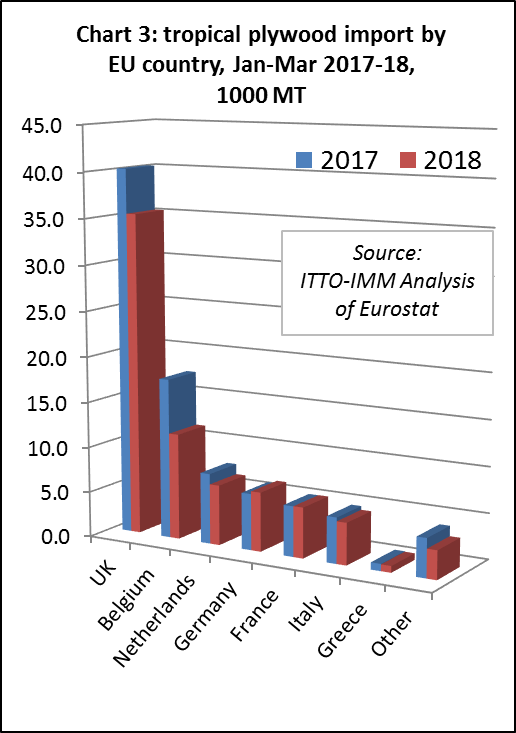

By individual EU country, in the first quarter of 2018, imports of tropical plywood declined in the UK by 12% to 35,331 tonnes, Belgium by 34% to 11,630 tonnes, Netherlands by 15% to 6,601 tonnes, Italy by 8% to 4,592 tonnes and Greece by 7% to 723 tonnes.

In contrast, German imports increased 5% to 6,480 tonnes and French imports were up 32% to 5,530 tonnes in the first quarter of 2018. (Chart 3).

EU first quarter imports of ‘other’ (i.e. non-tropical) hardwood plywood from Russia, China, Ukraine, Belarus, Bosnia Herzegovina, Uruguay and Brazil and other suppliers were 276,042 tonnes, a 2% gain against 269,471 in the first quarter of 2017.

Softwood imports, primarily from Brazil, Russia, Chile, China, South Africa, Uruguay, Canada and Norway, were 335,590 m3 in the first quarter of 2018, 13% more than the same period in 2017.

Plywood importers views of FLEGT licensing

Asked about FLEGT licensed Indonesian plywood, importers interviewed for this market report said it had not had significant impact on their purchasing or sales.

One commented that this was related to lack of supply from Indonesia generally. Another said that they had recently seen an upturn in demand for marine ply from Indonesia. “But that’s been due primarily to the excellent quality from our suppliers,” he said.

Importers also cited customer’s preference for FSC and PEFC certification, with FLEGT licensing regarded as a ‘bonus form of legality verification’. “We still don’t believe that enough is known about FLEGT licensing or the wider FLEGT Voluntary Partnership Agreement initiative in the marketplace, particularly in terms of its’ on the ground impacts in the supplier country,” said an importer.

“We still need more communication on FLEGT generally, with awareness greater among our customers of Indonesia’s long-established SVLK timber legality assurance system, which became the TLAS of its FLEGT VPA, than FLEGT itself. Certainly, little is known of the sustainability aspects of FLEGT licensing.”

UK TTF Managing Director David Hopkins took up the themes of awareness and market impact of FLEGT licensing at the recent FLEGT Independent Market Monitoring Trade Consultation in Nantes, France at the end of May. He urged the EU industry to press their national governments to accept a FLEGT licence as evidence of full compliance with their timber purchasing policy, which currently only those of the UK and Luxembourg do.

“We actively promote the fact to the market that the UK government accepts a FLEGT licence as ‘Category A’ proof of legality and sustainability on a level with what we regard as branded certification businesses, FSC and PEFC,” he said.

The UK TTF has also taken steps to ensure Chinese plywood satisfies standards claimed in documentation and labelling. After a year-long review of the market, it has now established a new ‘plywood framework’ within its compulsory Responsible Purchasing Policy.

This demands that UK TTF members ensure third-party testing of glue bonds and obtain all relevant paperwork on suppliers’ factory production controls. The TTF stipulates too that all packs should be marked with product technical class and timber species used. It has also started a market education programme to tackle ‘ignorance about plywood classes and their application’.

Cautious optimism about future EU plywood demand

Looking to the future, despite recent supply issues and price hikes, EU importers say that they remain cautiously optimistic to upbeat about prospects for the rest of the year.

Demand in coming months was variously predicted to be ‘stable’ to ‘robust’ and customers are reported to be broadly accepting the reasons for price rises. “When they see it’s across the market and effectively out of our hands, they pay the increase,” said one company.

Supply from Asia is also expected to improve as the dry season improves raw materials flows and Chinese mills complete implementation of the new environmental rules.

There is also some positive news from France’s Rougier Group, whose African operations entered creditor protection earlier this year.

Speaking at the Carrefour International du Bois exhibition at the end of May, Romain Rougier said that, while the Group is exploring various options for its troubled Cameroon operations, it is determined to stay in Africa in the form of its successful and growing Gabon business, which includes its 37,000m3 per year plywood mill.

Underscoring this commitment, Rougier used the French show to launch Mokalam, a new range of thermally modified cladding from Gabon based on okoumé and fraké, with plans to add further species.

PDF of this article:

Copyright ITTO 2020 – All rights reserved