There was only very slow growth in both the EU wood furniture and joinery sectors during 2017. While production and consumption gained momentum in parts of continental Europe, particularly in Eastern Europe, this was offset by a significant slowdown in the UK and stasis in Germany.

Growth in the EU door sector was considerably more buoyant than in the window and furniture sectors in 2017. While wood made up some lost ground against plastics in these sectors, market share was being lost to metal products.

These are the main conclusions to be drawn from analysis of newly released Eurostat PRODCOM data which provides a snapshot of the production and consumption value of wood furniture and joinery products in the EU in 2017.

No growth in wood furniture production in 2017

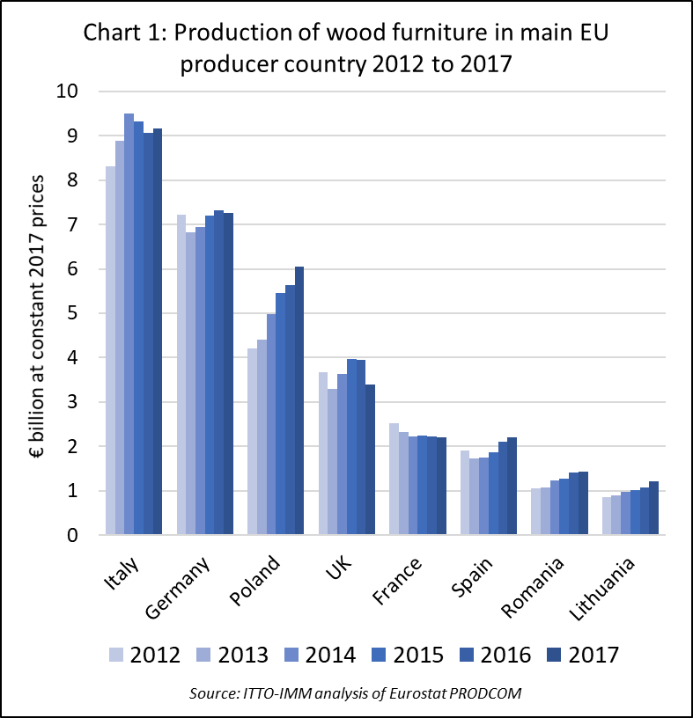

The value of EU wood furniture production was €40.3 billion in 2017, no change from the previous year and still 20% down on the level prevailing before the financial crises in 2008. A slowdown in production in the UK offset gains in Poland, Spain, and Lithuania. Production in Italy and Germany, the two largest manufacturing countries, and in France and Romania was broadly flat in 2017 (Chart 1).

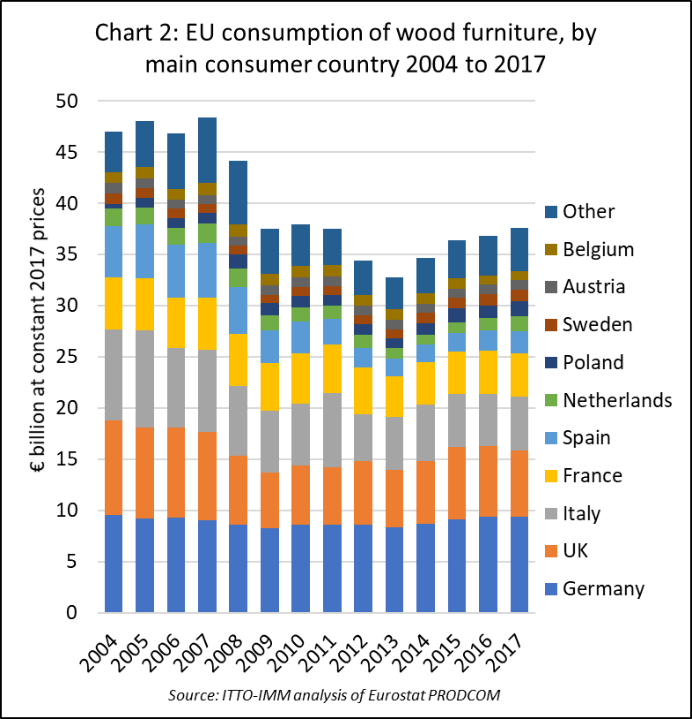

EU consumption of wood furniture was €37.6 billion in 2017, a gain of 2% compared to 2016. During 2017, consumption was stable (at €9.4 billion) in Germany, the largest market, and rising in Italy (+3% to €5.2 billion), France (+1.5% to €4.3 billion), Spain (+7% to €2.2 billion), Netherlands (+30% to €1.5 billion), Poland (+15% to €1.4 billion) and Sweden (+2.5% to €1.1 billion). However, wood furniture consumption fell 6% to €6.5 billion in the UK and 5% to €870 million in Belgium (Chart 2).

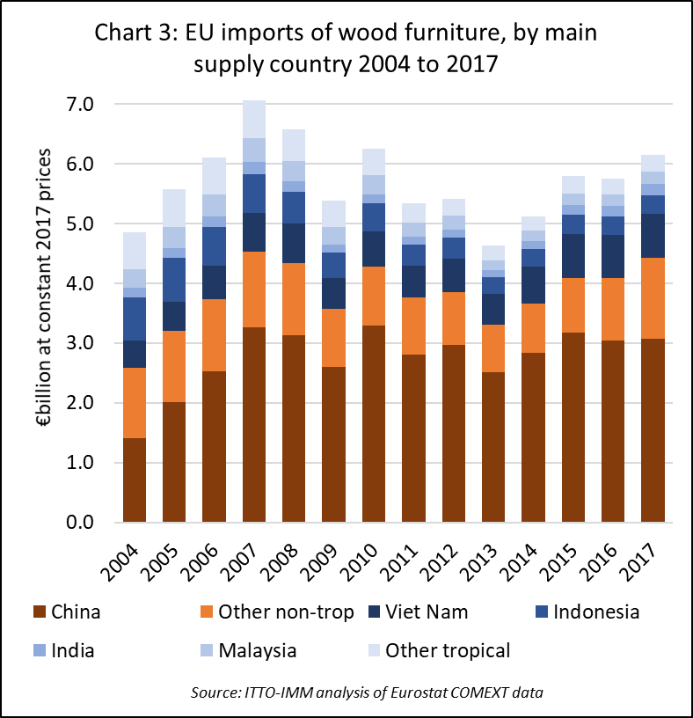

After flatlining in 2016, the value of EU imports of wood furniture from non-EU countries increased 7% to €6.16 billion in 2017. Imports from China, by far the largest external supplier fell 4% in 2016 but recovered 0.7% to 3.08 billion in 2017 (Chart 3).

In recent years China’s competitiveness in the EU wood furniture market has been impeded as prices have risen on the back of growing domestic demand and new laws for pollution control pollution in China. EU furniture importers also continue to question the variable quality of product imported from China and some have struggled to obtain the legality assurances required for EUTR conformance when dealing with complex wood supply chains in China.

The main beneficiaries of rising EU wood furniture imports in 2017 were other European countries including Ukraine, up 67.7% to €133 million, Bosnia, up 14.9% to €218 million, and Serbia, up 13.7% to €127 million.

EU imports of wood furniture from tropical countries increased 3.5% to €1.72 billion in 2017, reversing a 2.5% decline the previous year. Vietnam is the dominant supplier of furniture to the EU, although imports were flat in 2016 and 2017 after rising 40% in the previous two years. Imports from Vietnam decreased 0.7% in 2016 and then increased just 0.5% to €724 million in 2017.

EU imports of wood furniture from Indonesia increased 2% to €309 million in 2017, following a 6% decline the previous year. Imports from Malaysia increased 11% to €180 million, EU imports from Malaysia recovered 10.7% to reach €203 million last year. Imports from Thailand decrease 3.4% to €61 million.

Recent survey work undertaken by the ITT0-IMM in highlights that, to some extent, direct competition between furniture suppliers in the various South East Asian countries is limited by market differentiation.

With the rapid decline of availability of natural forest teak from Myanmar, Indonesia is now best placed to supply a wide range of outdoor furniture products, particularly due to relatively abundant plantation teak supplies. Indonesia’s long woodworking tradition has also meant it has gained a reputation for supply of good quality specialist hand-made furniture, a niche market in the EU where it competes most directly with India.

By contrast, the Vietnamese furniture sector has gained a reputation for supply of large volume mid-range products, both for exteriors and, increasingly, for interior use, and is importing a wide range of wood from around the world to feed this production. The Vietnamese furniture industry is regarded by EU importers as technically more evolved than most other Asian producer countries and increasingly able to supply products to high European quality standards.

Malaysia also supplies high quality products but offers a much smaller range than Vietnam with a heavy focus on rubberwood and other plantation species.

While these various external suppliers now play an important role in specific sections of the EU furniture market, the domestic industry remains very dominant. The share of domestic manufacturers in total EU furniture supply declined only slightly between 2013 and 2017. In 2017, domestic manufacturers accounted for 86.7% of the total value of wood furniture supplied into the EU market, down from 87.5% in 2016 and 88.6% five years before.

5% growth in wood door supply to the EU in 2017

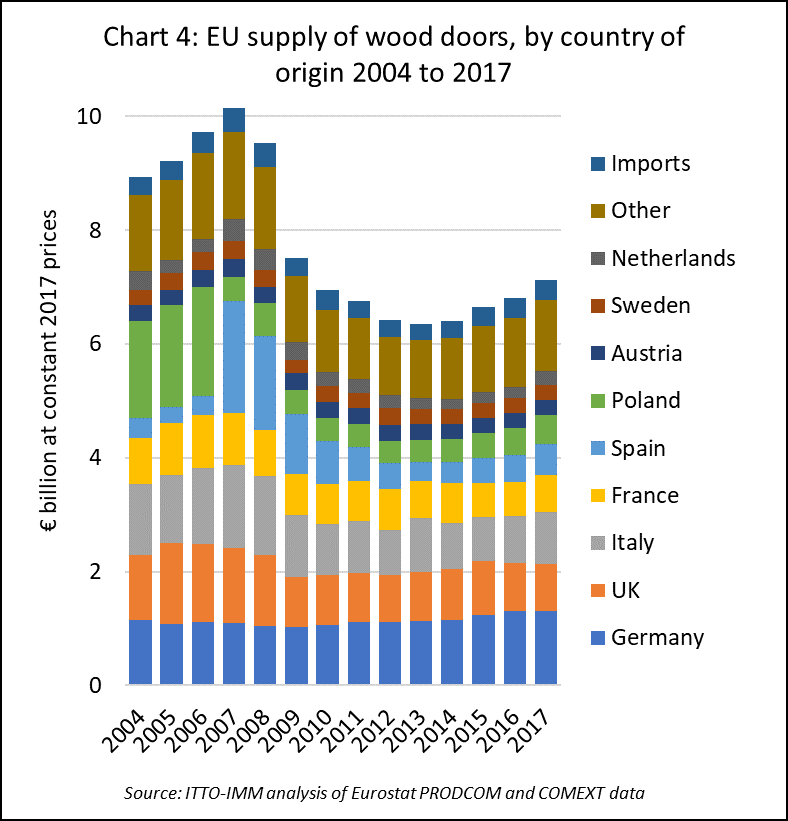

Eurostat PRODCOM data reveals that the total value of wood doors supplied to the EU increased by 5% to €7.12 billion in 2017. Despite the increase, the value of wood doors supplied to the EU in 2017 was still more than 25% down on the level prevailing before the global financial crises (Chart 4).

Most new wood door installations in the EU comprise domestically manufactured products. The EU’s domestic production increased 4.9% to €6.78 billion in 2017. There was significant variation in the performance of the wood door sector in EU countries in 2017.

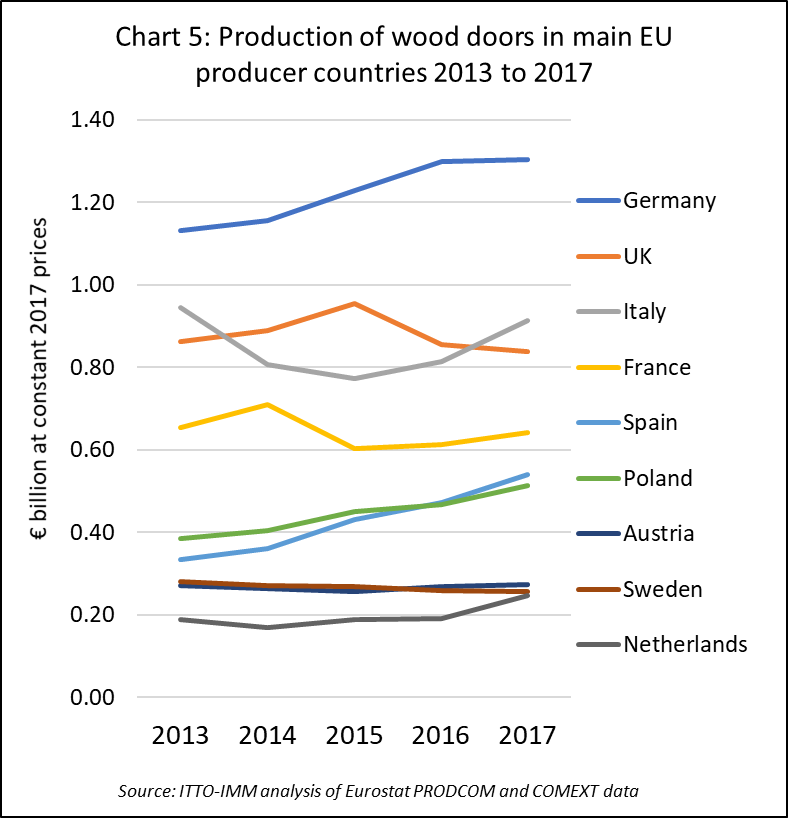

Production in Germany, the largest wood door manufacturing country, was stable at €1.30 billion during the year while production in the UK continued to slide, by 2% to €840 million. However, production increased sharply in Italy (rising 12% to €910 million), France (rising 5% to €640 million), Spain (rising 14% to €540 million), Poland (rising 10% to €510 million) and the Netherlands (rising 30% to €250 million) (Chart 5).

Wood door imports into the EU increased by just 0.3% to €341 million in 2017. Imports accounted for 4.8% of the total euro value of wood door supply to the EU in 2017, down from 5.0% the previous year.

Most of the gains in EU door imports in 2017 were from other temperate countries including Norway (+7% to €16 million), South Africa (+16% to €12 million), Bosnia (+29% to €7 million) and Ukraine (+50% to €7 million). Imports from UAE, becoming more important as a wood processing hub, increased from negligible levels to €5.4 million. However, imports from China, the largest external supplier, fell 2% to €111 million in 2017.

The total value of EU imports of wood doors from the tropics fell 6% to €159 million in 2017. This was mainly due to a decline in imports from Malaysia (-9% to €38 million) and Brazil (-19% to €13 million). The value EU wood door imports from Indonesia also fell, but by only 3.8% to €102 million in 2017.

The European wood door industry is now dominated by products manufactured using engineered timber driven by requirements to comply with higher energy efficiency standards and efforts to provide customers with more stable products and long-life time guarantees.

Another key trend is towards composite doors with a steel-reinforced uPVC outer frame with an inner frame combining hardwood and other insulation material. These new products are designed to combine strength, security, durability, high energy efficiency, with a strong aesthetic.

There may be a place for tropical hardwoods in the design of these products with manufacturers looking to combine high quality, consistent performance, regular availability, and good environmental credentials with a competitive price.

EU market for wood windows rises only 0.7% in 2017

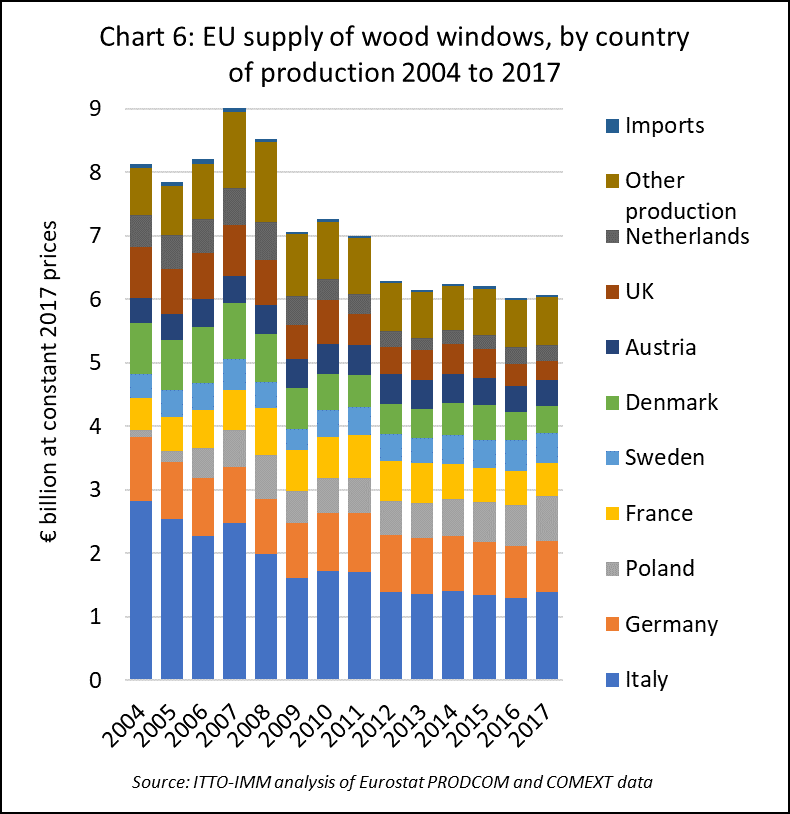

There was little growth in the market for wood windows in the EU in 2017. The total value of wood windows supplied to the EU increased only 0.7% to €6.07 billion in 2017 following a 2.8% decline the previous year (Chart 6).

Supply of wood windows to the EU is overwhelmingly dominated by domestic production which increased 0.7% to €6.07 billion in 2017. Imports from outside the EU accounted for only 0.5% of total EU wood window supply in 2017.

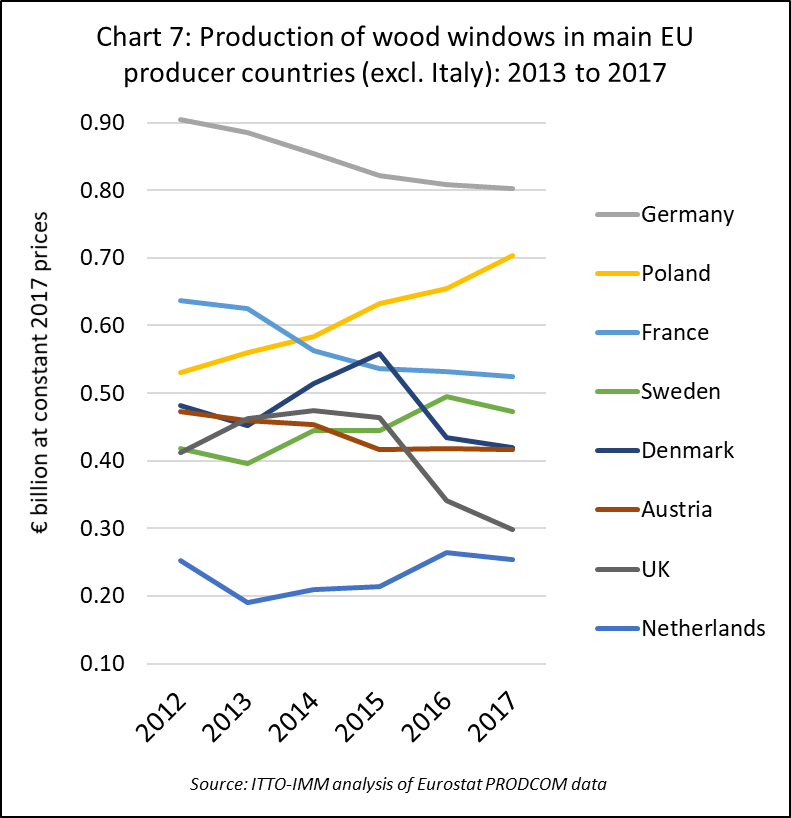

Italy has maintained its position as the largest window manufacturer in the EU, with production rising around 7.2% to €1.39 billion in 2017. Production in Poland continued to rise during the year, by 7% to €704 billion. In contrast, wood window production in most large western European markets declined in 2017, including Germany (-1% to €802 million), France (-1% to €525 million), Sweden (-5% to €420 million), UK (-12% to €299 million) and the Netherlands (-4% to €254 million) (Chart 7).

Imports of wood windows from outside the EU fell by 5.3% in 2017 to €31.4 million, continuing the downward trend of the previous year. EU imports of wood windows derive mainly from neighbouring European countries, including Norway, Bosnia and Switzerland.

Only a very limited, and highly variable, quantity of wood windows is imported into the EU from tropical countries. The value of EU imports of wood windows from tropical countries fell 32% to €3.17 million in 2017. Typically, 50% to 70% of wood windows imported in the EU from the tropics each year derive from the Philippines and are destined for France and Belgium.

While tropical countries are not significantly engaged in the EU market for finished windows, this sector is of interest as a source of demand for tropical wood material. From this perspective, a notable trend in the EU window sector – as in the door sector – is towards use of engineered wood in place of solid timber. This is particularly true of larger manufacturers producing fully-factory finished units that buy engineered timber by the container load.

Increased use of engineered wood is closely associated with efforts by window manufacturers to meet rising technical and environmental standards, provide customers with long lifetime performance guarantees and recover market share from other materials.

Increased focus on energy efficiency means that triple-glazed insulating window units with very low U-factors are now more common than double-glazed units in Europe. These units demand thicker, more stable and durable profiles that in practice can only be delivered at scale using engineered wood products.

The quality and engineering of wood windows has undergone a revolution in the EU in recent years so that manufacturers are now able to deliver products with many of the benefits previously reserved only for the best quality tropical hardwood frames using softwoods and temperate hardwoods.

Factory-finished timber windows are given a specialist spray-coated paint finish for even and durable coverage which might only need redoing once a decade. The lifespan of factory-finished engineered softwood frames is now claimed to be about 60 years, while thermally or chemically modified temperate woods can achieve around 80 years.

Nevertheless, smaller independent joiners producing bespoke products in low volumes still tend to rely on solid timber purchased from importers and merchants to manufacture window frames. Tropical woods such as meranti, sapele and iroko continue to supply a high-end niche in this market sector, competing directly and often successfully with oak, Siberian larch, and western red cedar.

The apparent stasis in EU production of wood windows during 2017, a year when overall construction activity in the region is estimated by Euroconstruct to have risen by 3.5%, implies some loss of market share.

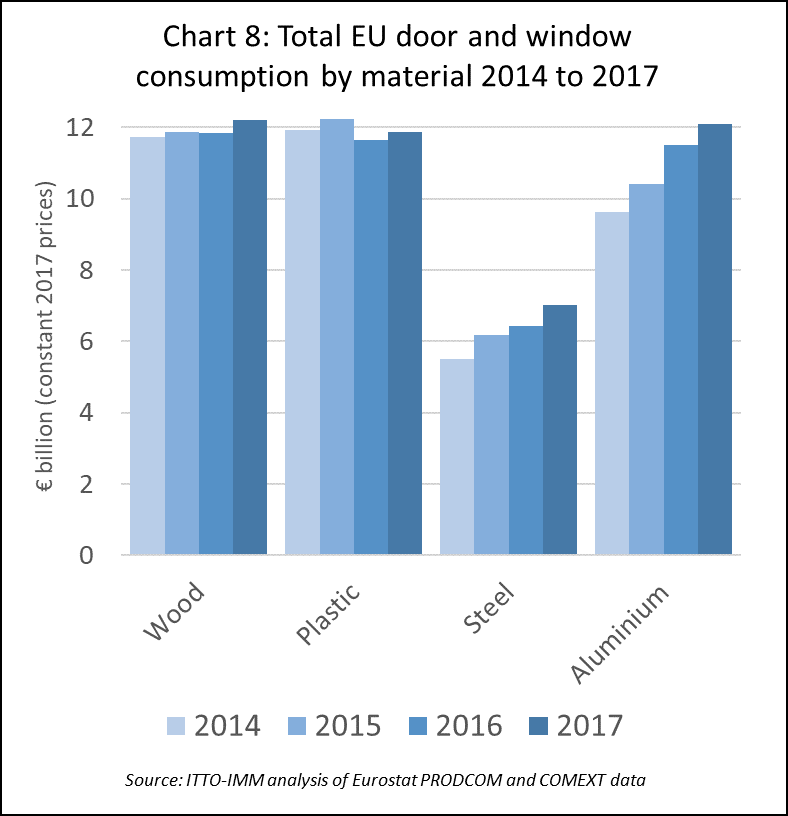

The Eurostat PRODCOM data provides evidence for this showing that between 2014 and 2017 total EU consumption value for doors and windows increased 26% in aluminium and 28% in steel. The consumption value for wood increased only 4% during this period, while consumption of plastic stagnated (Chart 8).

Overall the share of wood in the total value of EU door and window consumption fell from 30% to 28% between 2014 and 2017, while the share of aluminium increased from 25% to 28%, steel increased from 14% to 16%, and plastic decreased from 31% to 27%.

This highlights that while wood may be making gains in relation to plastic products in the EU market for windows and doors, it is losing share to metal products.

Aluminium is becoming a particularly prominent competitor. Aluminium has always remained the default windows product in the commercial market but over the last 5 years the material has enjoyed considerable resurgence within the residential window and door market.

An important driver behind this has been aluminium bi-fold and sliding doors as consumers demand greater space and light within living areas. Another factor is the demand for lower maintenance and greater strength in light weight frames for high energy efficiency double and triple glazed units.

PDF of this article:

Copyright ITTO 2020 – All rights reserved