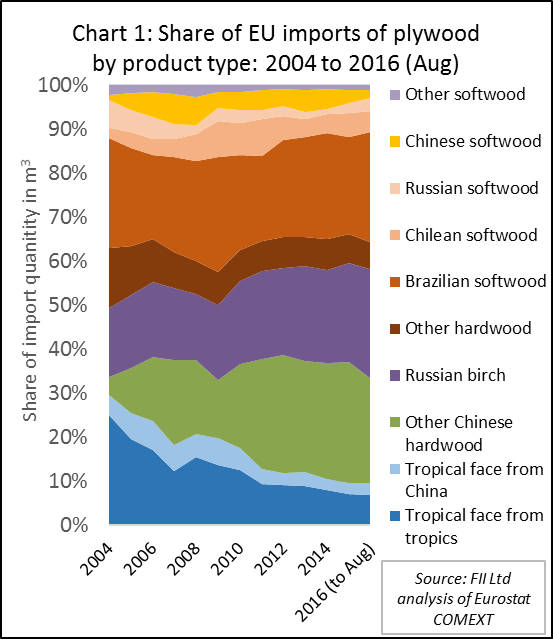

In the last ITTO report on the European plywood market (MIS 16-31 May 2016), it was noted that the share of tropical countries in EU plywood imports fell to an all-time low of less than 8% in 2015. While EU imports of plywood from tropical countries were rising slowly last year, imports from other countries increased more sharply, particularly of mixed hardwood plywood from China and birch plywood from Russia.

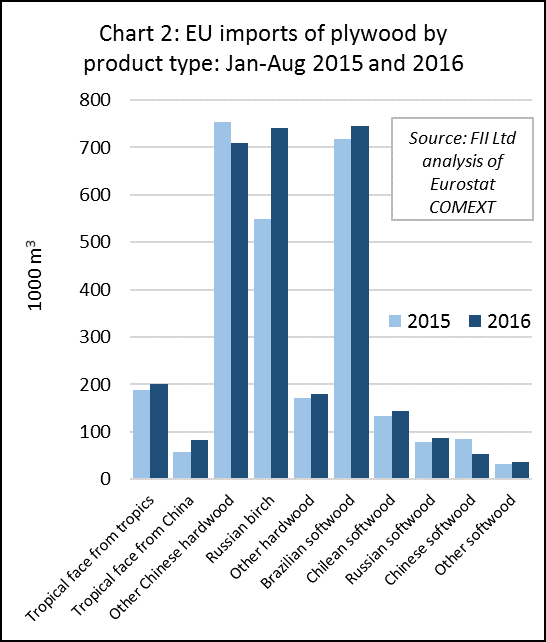

Latest EU import data (to end August) shows that the share of tropical plywood in total EU plywood imports has stabilised at the lower level during 2016. However there has been some shift in the share of other plywood suppliers into the EU. This year Chinese mixed hardwood plywood has lost share in the EU market to Russian birch plywood and various suppliers of softwood plywood, including Brazil, Chile and Russia (Charts 1 and 2).

After falling back 7% to 276000 m3 in 2015, EU imports of hardwood-faced plywood from tropical countries rebounded 7% to 202000 m3 in the first eight months of this year. EU imports of tropical hardwood-faced plywood from China, which increased 5% to 95000 m3 in 2015, have continued to rise rapidly this year, up 30% to more than 82000 m3 by the end of August. However, EU imports of other hardwood-faced plywood from China (including birch plywood, mixed light hardwood, and various other forms of combi plywood) have slowed this year, falling 6% to 709000 m3 in the first eight months.

The changing composition of EU plywood imports from China may be partly related to strong competition from Russian birch plywood, of which EU imports increased by 26% to 741000 m3 in the first 8 months of 2016. Enforcement of EUTR and CE marking requirements may also be encouraging a shift from Chinese mixed light hardwood products to plywood containing more clearly identified species of known origin and technical performance. This same factor is also likely to explain the increase in EU imports of Chinese plywood faced with hardwood species identified as of tropical in origin.

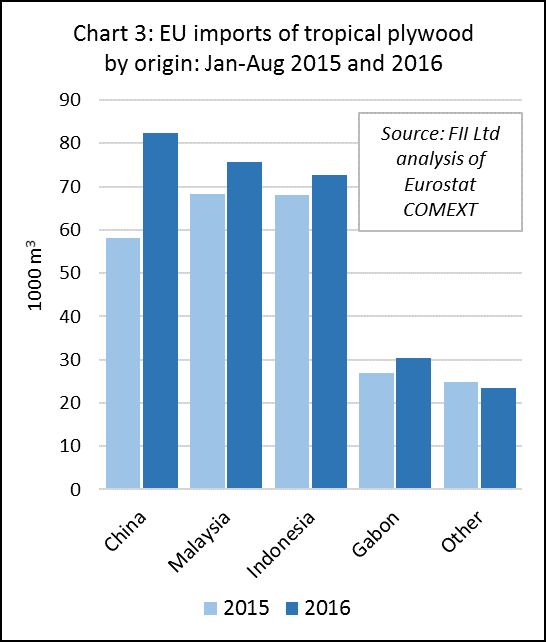

Tropical countries have been supplying more hardwood plywood into the EU this year. In the first eight months of 2016, EU imports increased 11% to 76000 m3 from Malaysia, 7% to 73000 m3 from Indonesia, and 12% to 30000 m3 from Gabon. However, the shifting composition of plywood supplied into Europe from China has meant that country has now emerged as the EU’s largest single supplier of tropical hardwood plywood. This raises questions about the relative competitiveness of plywood manufacturers operating in tropical countries (Chart 3).

UK switches to tropical hardwood plywood manufactured in China

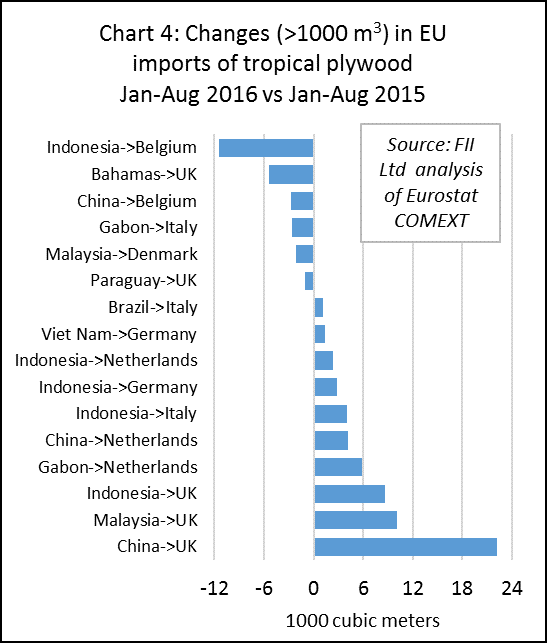

Trends in overall EU imports of plywood are also partly dependent on shifting market conditions and preferences in different parts of the EU (Chart 4). The increase in EU imports of tropical hardwood faced plywood from China this year has been concentrated almost entirely in the UK with a smaller amount destined for the Netherlands.

In recent years, of all EU importing countries, the UK has been most tempted by the low prices and relatively short transit times offered by Chinese plywood suppliers. UK importers have also been under intense pressure to demonstrate conformance to EUTR after the NMO, the UK’s enforcement agency, published a report in February 2015 revealing failures by several UK importers of Chinese plywood to meet regulatory requirements. Specific concerns were raised over the lack of accurate information on species content in Chinese hardwood plywood.

The sharp rise in UK imports of Chinese plywood faced in tropical hardwood may therefore simply be a result of efforts to ensure more accurate identification of species content. It also suggests that a significant proportion of this material is faced with FSC or PEFC certified tropical hardwood, or at least that Chinese manufacturers are now successfully reassuring customers of the legality of their tropical veneer supplies by other means.

Much of the gain in EU plywood imports from Indonesia during 2016 has also been concentrated in the UK, with other gains being made in Germany, the Netherlands, and Italy. These gains have been sufficient to offset a big fall in imports of Indonesian plywood by Belgium. Rising EU imports of Malaysian plywood in 2016 have been mainly destined for the UK, Netherlands and Belgium.

The gain in EU imports of plywood from Gabon in 2016 has all been concentrated in the Netherlands. In fact, 60% of all EU plywood imports from Gabon have been destined for the Netherlands this year. Imports into France and Italy, which historically have been leading markets for African okoume plywood, have declined so far in 2016.

COFFI: Weak recovery in ECE wood market expected to continue despite downside risks

Overall, the pattern of weak recovery in EU and North American forest products markets following the global financial crisis is continuing in 2016 while the CIS market is declining. Currency volatility and low oil prices have been key determinants of recent forest products trade trends. New market opportunities for forest products are arising from innovative products and policy measures to reduce carbon emissions and encourage moves to a circular economy.

However, there are significant downside risks to the stability of the global economy. The forest products sector also needs to focus more on ensuring the regulatory environment does not create unnecessary barriers to trade and enhances, rather than hinders, the competitiveness of wood relative to other materials.

These were key conclusions of the seventy-fourth session of the ECE Committee on Forests and the Forest Industry (COFFI) held in Geneva, Switzerland, from 18 to 20 October 2016. The session was attended by more than 130 participants including national delegations from 31 countries across the ECE region which includes Europe, the Commonwealth of Independent States (CIS) and North America, together with representatives of UN agencies, the European Commission, trade associations and NGOs. The session was followed by a workshop on 21 October 2016 on measuring the value of forests in a green economy.

Drawing on the UNECE Forest Products Annual Market Review 2015-2016 published to coincide with the meeting, and presentations by regional market experts, COFFI concluded that the general condition of forest products markets in the ECE region remained relatively stable in 2015 and the first half of 2016. European and North American markets experienced moderate consumption growth, benefitting from generally positive economic developments and improvements in the housing and construction industry.

In contrast, deteriorating economic conditions and currencies depreciations primarily accounted for a more than 4% contraction of sawnwood and panels consumption in countries of the Commonwealth of Independent States (CIS).

COFFI highlighted that currency volatility is playing an important role in trade of forest products in the UNECE region. In the United States during 2015, imports of wood products jumped about 10%, while exports declined by about the same ratio due to the strong US dollar. Meanwhile the weakness of the euro and other European countries is contributing to a rise in the EU’s net trade surplus of forest products. In the CIS countries, a weakened rouble is pushing exports to record highs for all major product categories, in many cases more than countering the lack of domestic demand and thus increasing production.

The gap between the pace of economic expansion in the EU and the U.S. is narrowing, as economic activity in the euro area is rising. The wood furniture manufacturing sector in Europe continues to show resilience and is growing, with 84% of furniture consumed in Europe produced domestically. Construction is expanding only slowly across Europe as a whole, but some individual markets are now performing well, notably in Germany, Netherlands, and the UK, while Spain is bouncing back after a particularly deep recession.

COFFI noted that a major factor explaining the diversity of economic performances in the ECE region during 2015 and 2016 is the decline in oil prices, which almost halved. Economic conditions in the CIS countries, several of which are significant oil exporters, have suffered. However, in the EU and other large oil importing countries, lower energy costs have contributed to improved consumer confidence and business profitability.

While COFFI forecast continuing gradual improvement in forest products markets in the ECE region during 2017, several risks clouding the horizon were identified. Geopolitical tensions, which have disrupted trade and undermined confidence in the CIS, have not yet disappeared. The refugee crisis, while providing a short-term boost to economic activity, is creating strains in several European countries. The United Kingdom vote to leave the EU has added a source of uncertainty that is unlikely to dissipate in the immediate future.

COFFI observed that recent trade negotiations within the ECE region, if brought to a satisfactory conclusion, offer potential to further boost international trade in forest products. Canada and the EU have concluded negotiations on the Comprehensive Economic and Trade Agreement (CETA), while the Transatlantic Trade and Investment Partnership (TTIP) – a trade agreement between the EU and the US – is still under negotiation. Both the CETA and TTIP would encourage transatlantic trade particularly in value added forest products.

In 2015, Armenia and Kyrgyzstan officially joined Belarus, Kazakhstan and the Russian Federation in the Eurasian Customs Union, which is designed to reduce barriers to the movement of goods, services, capital and labour, and expected to increase the trade in forest products among these countries.

Patchy and uneven growth in ECE hardwood consumption

On sawn hardwoods, COFFI concluded that production in the ECE region increased by 1.8% to 40.7 million m3 in 2015, rising in all three subregions (Europe, North America and CIS). Consumption of sawn hardwood in the ECE region also increased to 35.6 million m3 in 2015, a 0.9% rise compared to 2014 and the fourth consecutive year of increase. Falling consumption in Europe and the CIS in 2015 was offset by rising consumption in North America.

COFFI observed that European consumption of sawn hardwood decreased 2.8% to 12.2 million m3 in 2015, mainly due to a significant decline in Turkish consumption. Consumption in EU28 countries increased by 0.8% in 2015, to 9.5 million m3, benefiting from (albeit slow) growth in key sectors of the EU economy, including construction and furniture.

There has been little change in European hardwood fashion trends which remain heavily oriented towards the “oak look”. For example, oak is now used in over 70% of wood flooring manufactured in Europe while the share of tropical woods continues to decline and other temperate species account for only a small share. Such is the strength of demand for oak in Europe, that supplies are becoming restricted and prices have been rising sharply this year.

According to COFFI, sawn hardwood consumption in the CIS subregion fell 25.9% to 1.46 million m3 in 2015 following a 3.6% fall the year before. However, hardwood production in the CIS increased 2.3% to 3.4 million m3, with exports taking up the slack. The weakness of the rouble encouraged a 50.5% increase in sawn hardwood exports by the Russian Federation to 1.4 million m3. The Russian Federation exported 1.2 million m3 to China in 2015, 49% more than in 2014 and by far the highest level ever recorded.

COFFI estimate that North American sawn hardwood consumption increased 5.7% to 22.0 million m3 in 2015, with domestic sales in North America benefiting from rising new homes construction in the US. However, there are signs of slowing consumption in some sectors, notably pallets, flooring and board roads during 2016.

Obstacles and opportunities for wood in the ECE region

The COFFI meeting included two panel discussions, the first led by the private sector and considering the “opportunities for and barriers to forest products from the perspective of the private sector”, the second involving researchers, engineers and designers on “wood construction in the ECE region”.

The first panel discussion highlighted the obstacle to market development presented by industry fragmentation, which tends to increase costs and reduce investment in marketing and research and development. It emphasised the strong need to improve coordination and communication among different forest products subsectors. Although progress is being made to enhance consumers trust in wood as a material, there remains an urgent need for more and better promotion.

There was also a call for a more streamlined and science-based regulatory environment which enhanced, rather than hindered, the competitive position of forest products relative to other materials. Specifically, there was a call for legislation that works for small and medium-sized enterprises, as well as legislation that is coordinated and harmonised between countries (lack of consistent application of EU Timber Regulation was highlighted as a problem). There needs to be greater recognition that the rising tide of regulation across a whole range of issues (such as FLEGT, chemicals, health and safety, data protection, waste management) tends to favour larger operators.

There is also a need to create a level playing field for wood in relation to other materials by internalising external costs. If the ecological footprint of products is better reflected in the price of the final product, wood will become highly competitive. This could be achieved on the product side (e.g. carbon tax) or at the level of the production (e.g. payment for ecosystem services). Similarly, laws requiring legal origin of wood materials could equally well be applied to non-wood materials such as oil, coal and minerals.

There are also significant opportunities to improve yield and reduce waste in the forest products sector, if only sufficient resources are targeted on R&D. However, development is still impeded by the inherent conservatism in the industry, the small size of most companies and relative lack of technical knowledge.

Government has an important role to play in fostering a regulatory and trading environment that facilitates innovation. However, this shouldn’t involve direct grants for government- favoured champions on technologies, rather efforts to remove barriers by enhancing skills and education, encourage competition and provide space for “creative destruction”.

The panel discussion on wood in construction in the ECE region also highlighted significant obstacles to increasing wood’s market share and included recommendations to overcome them. Panellists highlighted the continuing need to enhance the education of architects and engineers on the physical and design properties and use of wood; harmonize and update regulations, products standards, building and fire safety codes; improve communication with insurers and financiers about actual risks and cost effectiveness; adopt lifecycle analysis of buildings including embodied emissions; promote increased public funding for wood construction; and to set up a taskforce to engage with the construction sector to promote wood construction.

PDF of this article:

Copyright ITTO 2020 – All rights reserved