Latest reports on European economic and construction sector health and outlook make for almost exclusively positive reading. After the EU economy enjoyed its strongest growth in gross domestic product in a decade in 2017, the overviews and forecasts for the first part of 2018 state that not only has expansion continued to date, it is set to persist through the rest of the year and into 2019.

In the Spring Forecast from the European Commission Directorate General of Economics and Financial Affairs (ECFIN), almost all the EU country summaries are strongly upbeat. The one exception is the UK, with its weaker outlook attributed to a large degree to the political and economic uncertainties surrounding its prospective departure from the EU.

Euroconstruct also stated at its conference in Helsinki in June that European construction was set for continued growth ‘in the next few years’.

“European construction is growing well on the back of low interest rates, good economic growth and pent-up needs,” the organisation stated. “Economic growth is expected to remain solid, unemployment will decrease, exports will grow, interest rates will remain low and the confidence of consumers and business and industry in the future is high.”

It added that increased tax revenues would drive public building and infrastructure projects, and that immigration and the ageing of the population would also likely boost construction.

Against this backdrop, it might be assumed that the tropical sawn hardwood sector would be among those capitalising and growing European sales. Certainly the rest of the EU construction products industry is on a strongly upward curve, even in the UK. Like much of the rest of the sector in northern Europe, business here was severely disrupted by poor weather in the first three months of 2018, but the UK Construction Products Association reports a strong quarter two upturn in sales and rising confidence in the country’s £56 billion industry.

EU tropical import figures mixed

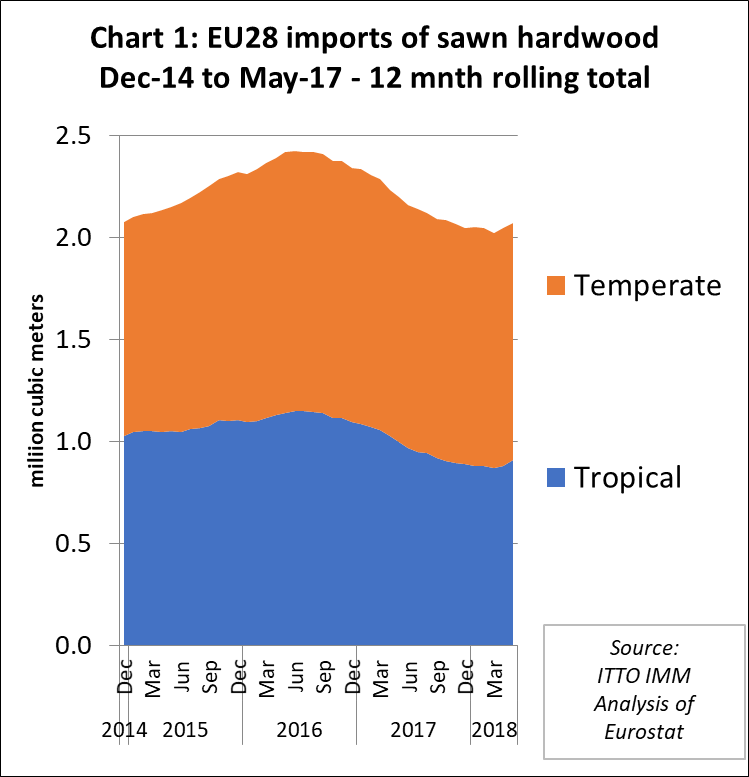

However, the latest figures for the tropical sawn hardwood sector in Europe show a very mixed and fluid picture. In the first quarter of 2018, European imports were down 6% compared to the same period in 2017, continuing a long term trend. However, overall business recovered slightly over the next two months to leave the January to May import figure up 4.4% (Chart 1).

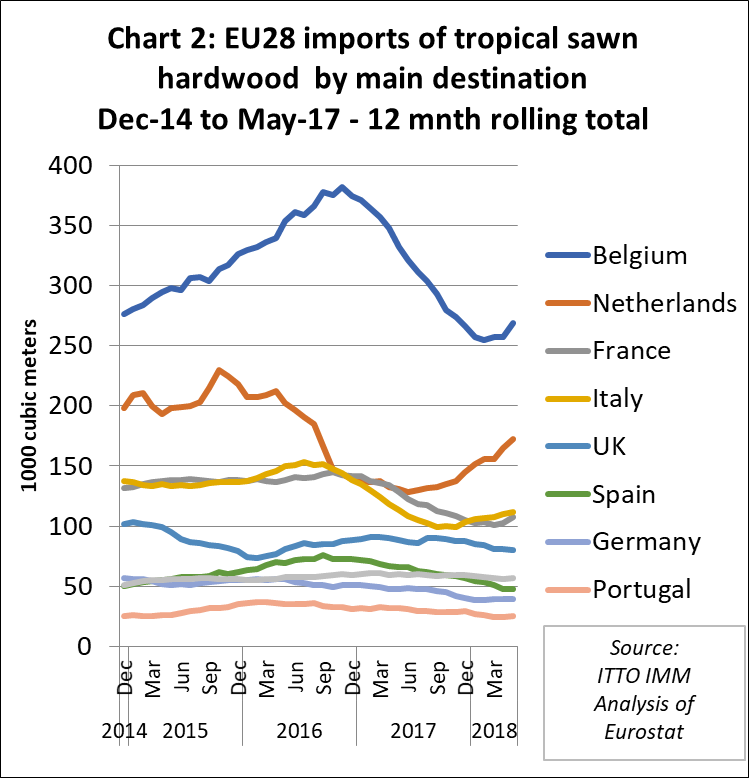

The improvement in EU tropical sawn hardwood imports in the second quarter of 2018 was accounted for mainly by rising trade in the Netherlands and Belgium. There was also a slight uptick in imports by Italy and France. Imports in the other leading tropical timber consuming EU countries was either flat or declining (Chart 2).

Total EU imports of tropical sawn hardwood for January to May 2018 were 405,597 m3, compared to 388,395 m3 for the same period the year before. Belgium’s imports were up 2.1% at 119,354 m3, while the Netherlands’ jumped 45.7% to 88,692m3. France and Italy’s imports were up respectively 5.5% and 19.7% at 49,517m3 and 48,019m3, while Denmark’s rose 23.9% to 8479m3 and Poland’s 47.2% to 4,271 m3.

Of the bigger importers, Spain saw the sharpest contraction, down 31.8% to 18,129m3, while the UK’s imports fell 20.1% to 29,903. Germany’s tropical sawn hardwood trade was down 3.4% to 18,397 m3, Portugal’s 30.3% at 9,623m3, Ireland’s 48.3% at 3,878m3 and Greece’s 3.16% at 3,550m3.

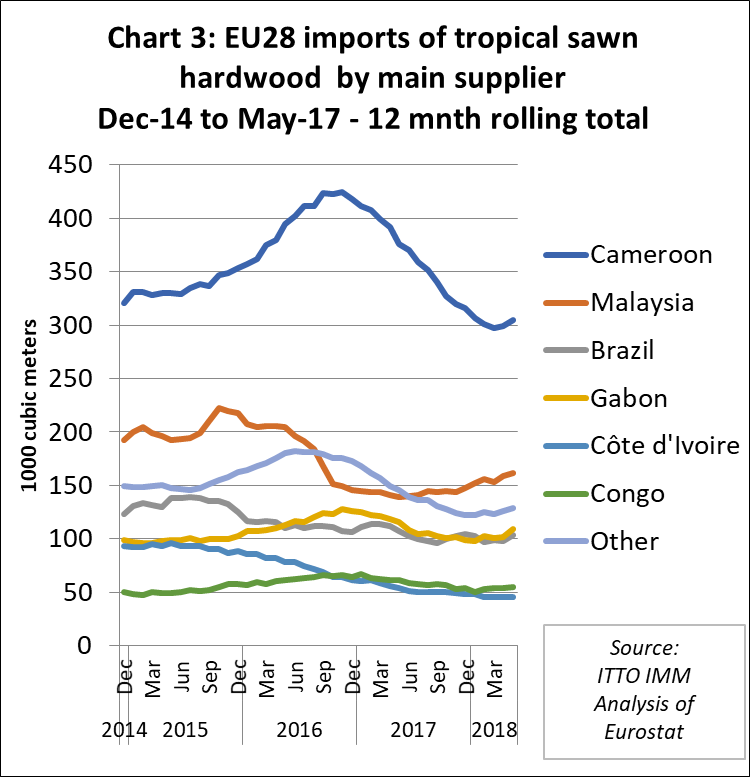

There was also divergence in the EU fortunes of various tropical suppliers. EU imports of sawn hardwood from Malaysia progressively increased in the first five months of 2018. Imports from Cameroon declined in the first three months of 2018 before recovering a little ground in April and May. Imports from Gabon, Brazil and Congo remained static at a relatively low level in the first five months of 2018. Imports from Cote d’Ivoire continued to slide between January and May this year (Chart 3).

Comparing the January to May period in 2018 with the same period in 2017, EU imports of sawn hardwood fell from Cameroon by 8.3% to 124,853, from Brazil by 1.6% to 48,939m3, from Côte d’Ivoire by 12.8% to 17,593m3, from Suriname by 25.2% to 2,690m3 and from Madagascar by 20.6% to 2,915m3.

In contrast, in the first five months of 2018, EU sawn hardwood imports increased from Malaysia by 21.4% to 78,305m3, from Gabon by 23.2% to 53,167m3, from Congo by 6% to 22,973m3 and from Myanmar by 45.5% to 4,932m3.

EU importers face rising competition for supplies

EU timber traders cited a number of factors shaping tropical import trends. These included intensifying competition for material from Chinese and other Asian buyers, which was driving up prices for tropical and temperate hardwood alike, as well as resulting in short supply in some species.

But logistical problems, the ‘deterrent effect’ of the EUTR in the tropical market on both suppliers and buyers, as one importer described it, and ever intensifying competition from rival products, including temperate hardwoods, modified timber and wood composites, also had an influence.

The restructuring of the African operations of the French-based Rougier Group, one of the EU’s key tropical producers and importers, was also felt to have impacted the market. And some companies also believe there is an underlying long term ‘slow but discernible’ decline in the EU tropical trade, although this is not a view shared by everyone.

Interestingly, however, the EU temperate sawn hardwood market has also been experiencing its own challenges, notably supply constraints, price inflation and most recently allegations of illegality and breaches of the EUTR in one of the best selling species, European oak.

Backlogs grow at Douala Port

One factor in the contraction in Cameroon’s EU exports, which started in 2016, cited by a number of EU importers, was the continuing deterioration of operations at the port of Douala, the key timber trade export hub for much of central and west Africa. The government has now appointed a commission to investigate the ‘failed operations’ at the facility. But importers don’t expect rapid improvement to the rate of throughput and reductions in backlogs at the port any time soon.

“It’s a combination of poor management, old and unreliable equipment and silting up of access channels, which means that larger, deep-draft vessels can’t dock,” said an continental EU importer. “Some shippers are exploring the possibility of using the new, Chinese-funded, deep-water port at Kribi, but this still has teething problems, and the only other real alternative is Pointe Noire in the Republic of Congo.”

According to latest reports the backlog of timber for shipment to China alone at Douala has now reached 60,000m3.

As mentioned, the disruption to supply from Rougier’s Cameroonian operations while the company has been under protective receivership is also thought to have hit the country’s overall export figures.

Rougier has now finalised the sale of its businesses SFID, Cambois and Sud Participation in Cameroon and RSM in the Central African Republic to Cameroon-based consortium Sodinaf. The latter was chosen as the buyer, said Rougier in its July 19 statement, “for the quality of its project, which will help ensure the sustainability of the activities sold”.

At the same time the company said it intended to “continue to be a major player within its industry” and would focus on developing its other more ‘geographically aligned’ African operations, notably in Gabon, “in better conditions”.

But, while the situation is now seemingly resolved, some EU importers feel there may be continuing implications for trade with the Cameroonian operations.

“With those ex-Rougier businesses now in Cameroonian rather than French ownership, they may well take a different market view and approach,” said an importer, who also questioned whether the new owners would renew the FSC-certification which Rougier let lapse under receivership.

Concentration of EU African import trade

The combination of these factors, with intensifying competition from Chinese buyers and the administrative time and cost burden of EUTR compliance is reported by companies in some EU countries to be leading to further concentration of the African importing sector.

“We’re seeing operators on the periphery of the trade, previously importing smaller quantities now and again, coming to us instead,” said an importer.

Supply issues are also applying further upward pressure on African prices. One company said both sapele and sipo/utile were being quoted €50 to €60 per m3 more for quarter one delivery 2019, an increase of around 10% on current prices. And another importer forecast a further 5-7% increase in sapele by the year-end.

Iroko and framire/idigbo prices were also reported to have firmed, with supply of the former improving, but the latter becoming increasingly difficult to source.

“Overall African supply is tight, and drying specialists in the UK and the Netherlands in particular are finding it difficult to get enough hardwood to put through their kilns,” said an EU importer.

“It’s very much a sellers’ market. Our African suppliers have full order books and are very bullish. They can pick and choose their customers and often they’re also choosing Chinese buyers because they both pay a good price and don’t require the legality and sustainability verification we do.”

Competitive Asian market

While both Indonesia and Malaysia increased their EU exports of sawn hardwood in the first five months of 2018, EU importers reported tight supply due to competition from Asian buyers and continuing wet weather affecting harvest and transit.

Lead times for Malaysian keruing and meranti were extended and prices firming, with the strength of the ringgit against the dollar said to be adding to price pressure, while suspension of some suppliers’ certificates has affected PEFC-certified supply.

Indonesian bangkirai prices are also already up this year, and importers say more increases are in the pipeline, with quotes up 20-30% for end-of-year deliveries. One company also said that the premium on FSC-certified material over FLEGT-licensed had increased.

Whether FLEGT-licensing is assisting imports from Indonesia is unclear. One importer said they were highlighting it in their customer documentation, but others were doubtful.

“It still needs more communication and education in the market place,” said one company. “It’s not sufficiently understood or valued by our customers, and awareness decreases the further you go down the supply chain. Brand recognition is nowhere near the levels for FSC or PEFC.”

EU importers discouraged from importing Myanmar teak

Given continuing controversy in the EU over whether Myanmar teak can be traded in compliance with EUTR requirements, importers questioned by ITTO were surprised by EU import statistics showing a 46% increase in sawn hardwood trade with Myanmar in the first five months of this year. The statistics indicate that much of the rise in trade was destined for Italy, Belgium, Germany, and the Netherlands.

NGOs such as the Environmental Investigation Agency claim that it is not possible, under the existing regulatory framework in Myanmar, for EU importers to gather information sufficient to ensure a negligible risk of teak being from an illegal source in line with EUTR requirements.

As things stand, this position is effectively endorsed by the Competent Authorities (CAs) responsible for enforcement of EUTR at national level in the EU, at least with respect to claims of legality drawing only on Myanmar’s regulatory documents and procedures.

At their meeting in November 2017, the European Commission’s Expert Group on the EUTR and FLEGT Regulation which provides a forum for member state CAs, reviewed a statement issued by the Ministry of Natural Resources and Environmental Conservation (MONREC) in Myanmar regarding improvements in traceability and transparency. The Expert Group agreed that this still falls short of what is needed to demonstrate the origin of the timber and so ensure full due diligence from an EU perspective.

A Myanmar delegation recently met with EU officials, trade bodies, NGOs and CAs, but the outcome was reported to be ‘status quo’ with the CA’s assessment of risk on Myanmar imports unchanged.

Until the matter is resolved, several timber trade bodies, including Le Commerce du Bois in France and the UK TTF, are advising members not to import Myanmar teak.

UK tropical downturn

UK hardwood companies attributed the particularly sharp fall in their imports of tropical sawn hardwood to a number of factors. These included the situation in Douala and disruption in supply from Rougier, a major supplier to the country. They reported too that, after heavy buying in 2017, there was an excess of stock on the ground. General economic uncertainty in the market was additionally leading to customers buying just in time and little and often.

Some importers thought too that sales of tropical hardwood were in long term decline due to a combination of aversion to perceived illegality risk and increased consumer acceptance of other products. The UK is a particularly strong market for modified timber, notably Accoya, thermo-treated timber and wood composites, which are reported to be increasing in choice and quality. One importer recently told the UK’s TTJ magazine that they saw all these products as “part of the armoury of a modern timber products and service provider”.

Competition from temperate hardwoods was also cited as a factor in tropical timber sales trends by EU importers, although as highlighted above, this sector is not without its own issues.

Prices across the range of temperate species are said to be firm thanks to demand levels in the EU and competition from Asian, again notably Chinese buyers, who have been taking growing quantities of logs as well as sawn timber.

At the European Oak Conference in London in March, the European Organisation of Sawmill Industries (EOS) stated that in seven years Europe’s oak lumber exports to China are up 34%, while log exports have risen 244%. This had led to demands in France in particular for some form of controls on log exports.

The recent imposition of phytosanitary restrictions on US hardwood logs by China was expected by some to alleviate demand pressure in the market. However, one importer thought that it might lead to Chinese buyers sourcing more US hardwood lumber instead.

European oak export controls

Adding price inflationary and demand pressure in the European oak market are export and transit controls on oak logs and green lumber in Croatia, ostensibly to curb the spread of oak lace beetle (Corythucha arcuata).

At the European Oak Conference a representative of the Croatian Oak Cluster said the controls might be relaxed this summer, but according to the EOS there is no news to date. The latest is that Croatian authorities have informed the European Commission Standing Committee on Plant, Animals, Food and Feed (PAFF) that their course of action would be decided in July following consideration of a new report into the effectiveness of measures to control spread of the beetle.

The ten-year ban on unprocessed timber exports from Ukraine has also impacted on EU oak processors and has been challenged by the EU authorities.

Now, following an investigation by ENGO Earthsight, there is also added concern that lumber from Ukrainian mills entering EU supply chains may have derived from illegally felled trees, including oak.

Earthsight alleges that Ukrainian rules allowing felling of diseased trees have been illicitly used to harvest healthy forest. The subsequent timber, some of it stamped FSC-certified, was then finding its way, despite EUTR due diligence, into neighbouring EU countries, notably Poland and Romania. The NGO said corruption in Ukrainian authorities was facilitating the trade.

On July 18 Ukrainian prime minister Volodymyr Groysman, seemingly in response to the Earthsight exposé, said he was initiating a crackdown on illegal timber and appealed to the EU to provide information on imports of timber from his country. But in the meantime an importer said his company was “interrogating all European oak imports much more closely”.

Turning back to tropical timber, the International Tropical Timber Technical Association (ATIBT) says that its Fair & Precious brand-based marketing initiative to promote tropical timber internationally was continuing to roll out.

Speaking at the EU FLEGT Independent Market Monitor Trade Consultation in Nantes in June, the organisation said the Fair&Precious brand was open to companies across the tropical timber supply chain which committed to source material legally and sustainably, and to submit to third party audit of their procurement practice.

ATIBT also said it would be considering where the FLEGT VPA initiative and FLEGT licensed timber might fit in the Fair&Precious sourcing criteria.

Meanwhile the 2018 conference of the Sustainable Tropical Timber Coalition, the industry alliance dedicated to increasing sustainably sourced tropical timber sales in Europe, has the theme of using data and market intelligence to drive market share. It takes place in Paris on October 25 (www.europeansttc.com).

PDF of this article:

Copyright ITTO 2020 – All rights reserved