A major structural change is underway in the African timber industry as operations are reoriented away from the European market towards Asian markets. This change is driven by factors both on the supply-side, particularly declining availability of timber species of interest to the European market; and on the demand-side as consumption is weakening in Europe at a time when demand in Asia is rising rapidly.

Although this shift has been going on now for over a decade, the full implications were laid bare in March this year with the announcement that the Rougier holding company was to be placed under court-ordered receivership proceedings in France with a view to rolling out extensive restructuring actions.

This event is encouraging a reassessment of the future role of European forest operations in the African region, and of the continuing validity of a business model heavily dependent on the profits anticipated from the sale of third party certified tropical wood products and other eco-system services in “environmentally-aware” markets of richer industrialised nations.

These issues are explored in two recent trade articles, one by Alain Karsenty[1], the research director of CIRAD, the other by Emmanuel Groutel[2], an independent expert on the African timber industry currently affiliated to Caen University in France. These articles refer respectively to the “crises” and “brutal weakening” of European-owned forest and timber operations in Africa in recent years.

These events raise, in the words of M. Groutel, profound questions about “theories of change of all policies and projects currently underway that rely on the link between responsible companies and the European and American market”.

According to M. Karsenty, the bankruptcy filing of Rougier has come as a particular shock to Europe-based tropical forestry professionals because the company, which was founded in Niort in 1923, is “one of the oldest and largest timber companies in Africa” which is present in Cameroon, Congo and, since 2015, in the Central African Republic (CAR) and which owned over 2.3 million hectares and employed 3,000 people, mainly in Africa.

During the on-going restructuring process, Rougier has disengaged from all African operations, except those in Gabon. In a transaction concluded on July 16, 2018, ownership of four Rougier subsidiaries – Société Forestière et Industrielle de la Doumé (SFID), Cambois and Sud Participation in Cameroon and Rougier Sangha-Mbaéré (RSM) in the Central African Republic – was transferred to Sodinaf (Société de distribution nouvelle d’Afrique), a Cameroonian company.

Financial difficulties of Rougier part of a wider problem

M. Karsenty highlights that the financial difficulties of Rougier form part of a wider pattern of failure by European operators in the African tropical wood sector. The Dutch-owned Wijma Cameroon Group sold four of its five forest concessions in Cameroon to a competing company (Vicwood SA, headquartered in Hong Kong) in 2017. The Italian company Cora Wood SA, a well-known plywood manufacturer operating in Gabon, had to sell one of its concessions to a Chinese company to pay off its debts.

M. Karsenty notes that “rumours are rife about possible future disposals of other European companies in Gabon or Congo”.

As M. Karsenty observes, the reasons given by the Rougier management when filing for bankruptcy this year refer to problems that are common to the entire tropical timber export chain in Africa. These include on-going serious problems and delays with shipping out of Douala port in Cameroon and delayed payment of VAT refunds by African governments, partly linked to low oil prices, which created additional financial challenges for operators in the region.

While these problems impact on all operators in the region, they have fallen particularly heavily on European-owned companies because of weak and declining consumption of tropical timber in the European market; the declining availability of African wood species that satisfy the narrow preferences of European buyers; and the particularly low profitability of certified sustainable timber operations which receive little or no market premium for higher operating costs.

Reasons for declining European tropical wood consumption

The reasons for declining consumption of tropical timbers in Europe are now well understood, having been widely reported by ITTO and others. They are also well articulated by participants at recent trade consultations in the UK and France hosted by the FLEGT Independent Market Monitor (IMM), an on-going ITTO project funded by the EC.

The logistical problems of supplying consistent commercial timber volumes from Africa into the European market are compounded by strong EU trends to favour engineered timber products which in turn require just-in-time delivery of wood in standardised grades and dimensions which tropical suppliers are not well placed to provide.

New thermally and chemically modified softwood and temperate hardwoods, together with wood plastic composites, are replacing tropical woods in many exterior applications. African species used in interior applications – like wawa, ayous, and movingui – are being replaced by beech, rubberwood, American tulipwood, MDF and a whole host of non-wood materials.

Meanwhile demand for tropical wood continues to suffer from the long-term effects of negative media campaigns linked to deforestation which the certification movement has not been able entirely to address.

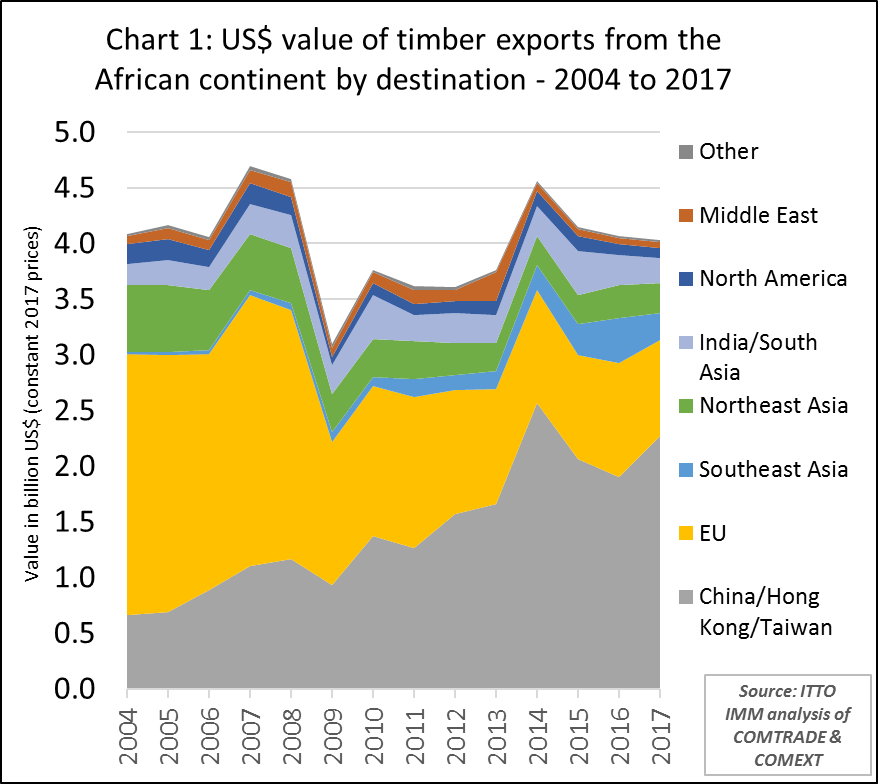

As demand for African timber has weakened in Europe, it has continued to strengthen in Asia. Trade data analysed by IMM shows that the share of China in total African timber exports more than doubled from 25% in 2008 to 57% in 2017. The share of the EU in African exports fell from 49% to 21% in the same period. (Chart 1).

European operators’ African transferred to Asian operators

According to M. Karsenty, “European dealers, formerly essential in the African timber industry, are gradually giving up their assets to Asian investors. Malaysian operators have been present in Central Africa since the mid-1990s. Chinese companies have entered the industry since the 2000s and, more recently, Indian investors, including the multinational Olam, have made their mark in Gabon and Congo”.

The process of transferring European-owned industry assets in Africa to Asian firms has been on-going now for some time, but there is a feeling that the withdrawal of Rougier, a company with such long and deep links to Africa, may mark a turning point.

The share of African timber exports to Europe increased slightly in 2015 and 2016, due both to a slight uptick in European consumption and a big fall in exports to China (mainly due to bursting of the speculative bubble in rosewood). However, Europe’s share of African exports slumped again in 2017 and appears to be falling fast in 2018.

The on-going trade dispute between China and the United States might strengthen these trends. On 2nd August, the Trump Administration announced a new round of tariffs on $200 billion in Chinese goods, due to be implemented from 1st October. In retaliation, the Chinese government announced that if the US goes ahead, it will impose a wide-ranging package of sanctions on imports of US products, including a 25% tariff on American hardwood.

Such measures are likely to enhance China’s demand for hardwood products from other regions, including Africa. And as around 50% of all American hardwood exports are currently destined for China, it’s also likely to encourage US hardwood exporters to focus more heavily on the European market, further increasing competition for tropical timber.

Declining availability of African timbers of most interest to European buyers

In addition to these global issues, forestry trends in Africa are reducing availability of timber species of most interest to the European market. M. Karsenty notes that European operators in African have traditionally focused on a limited range of profitable species: okoumé in Gabon; ayous, sapelli and azobé in Cameroon; sapelli in northern Congo and okoumé in southern Congo; sapelli in CAR; a few precious species such as wenge and afrormosia in DRC.

Europe’s traditional focus on this handful of species means that gradually they have become commercially depleted – although not necessarily endangered. According to M. Karsenty, “the problem is economic: the volumes remaining at the second rotation (legally, 25 to 30 years between two rotations) are generally insufficient to support industrial utilisation and to satisfy market demand”.

M. Karsenty notes that this problem is well illustrated by Rougier which purchased a concession in CAR just over the border from its main factory in Cameroon as a direct consequence of the decline in available volumes of sapelli and ayous in eastern Cameroon, a region that has been repeatedly exploited (both by industry and small artisanal operators) for several decades.

Similarly, observes M. Karsenty, Wijma’s abandonment of several concessions in Cameroon is also linked to the sharp drop in the volume of azobé at the end of the first rotation. Although there are other species that could be harvested in these forests during the second and subsequent rotations, they are either insufficiently abundant to replace traditional species, or their selling price is too low to cover the costs of harvesting, transport, and processing.

Risk of Africa’s over-dependence on commodities

M. Karsenty also highlights the dangers of African operators remaining too dependent on exports of commodities such as logs, standard size lumber and rotary cut veneers rather than further processed products. He suggests that “to sell commodities is to be condemned to remain a ‘price taker’, dependent on international timber prices and the changing preferences of international buyers”.

Overseas buyers of timber will always tend to focus on the limited range of species and grades that meet their own production standards and agendas for market development. They often have little or no long-term stake in any specific supply country or region and will turn to alternatives – and play different suppliers off one another – when it suits them.

African suppliers of timber commodities face intense competition from Asian woods, and increasingly from modified temperate hardwoods and plantation timbers, even non-wood products, when prices of African woods are perceived to be too high.

Some African countries have now placed tight restrictions on log exports, particularly of the most commercially valuable species, to boost domestic wood processing. However, analysis by IMM shows that the rise in African exports to Asia has been accompanied by an overall shift away from exports of value-added products at a region-wide level.

According to IMM, the share of logs in total African timber exports increased from 41% in 2008 to 55% in 2017. During the same period, the share of higher-value products such as plywood, joinery products and mouldings – which has never been high – fell from 5.4% to 2.7% (Chart 2).

Asian operators better placed than European operators in Africa

M. Karsenty observes that Asian operators in Africa have been better able to overcome recent market challenges than their European counter-parts because they have significant capital and the markets in which they operate accept qualities sometimes lower than those demanded by European buyers which allows them to exploit a wider range of species.

Asian companies are under much less market pressure to demonstrate the legal and sustainable origin of their products. According to M. Karsenty, “apart from the Olam company, which bought a large concession already certified in north Congo in 2011 from a Danish company, no Asian-owned operator has yet sought to obtain the FSC label for its African concessions”.

The business model pioneered by European operators for their African concessions seems to be unravelling. This model was built on the foundation of forest management plans developed in the 1990s and extended by a period of rapid uptake of FSC certification in the period 2005 to 2010.

The success of this model depends heavily on the market rewards to be derived from a clear commitment to sustainable forestry and social welfare standards. These rewards should derive for the combination of greater market access and prices for timber products, the anticipated development of new markets for eco-system services, notably carbon capture, and enhanced confidence of shareholders and other financial backers.

As M. Karsenty notes, “while certified woods are sold at a higher price in some sensitive markets, a good proportion of labelled timber is sold at current prices in the southern and eastern markets of Europe, the Middle East and Asia. And in this case, investment in certification is not profitable”.

Presentations at the FSC Dialogue meeting held in conjunction with the Gabon Wood Show in June also highlighted the continuing failure of this business model to deliver adequate financial returns. It was noted here that the total area of FSC certified had declined in the last two years from 5.5 million hectares to 4.85 million hectares.

The representative of one European-owned FSC certified operation in Africa said that “we have reached breakeven point after several years of negative performance – but sustainable tropical forest management models are still economically not attractive enough to motivate traditional investors to finance new developments.”

This company representative said that while efforts are being made to monetise carbon credits of certified forest operations, the returns on this and other ecosystem services are very low and timber sales still account for 90% of revenue. Furthermore, the large majority of this derives from their investments in plantation timber which from a financial perspective (although not from an environmental perspective) performs better than FSC certified natural forest.

Too early to dismiss “certified sustainable” business model

While this business model based on certification of natural forest has been losing ground in Africa over the last decade – and the problems at Rougier have turned a spotlight on its viability in the current market environment – the long-term potential for this model should not be dismissed out of hand.

To some extent the recent failures of European operations in Africa are due to economic conditions and policy failures that may yet be reversed. The timing of the rapid uptake of FSC certification – which occurred just as the global financial crises began to bite and which had a much larger effect markets in Europe and the US than in Asia – was particularly unfortunate for European operators in Africa.

The financial crises also distracted policy attention from efforts to develop markets from eco-system services and contributed to a general failure on the part of industrialised nations to back up their environmental commitments with funds.

More recently there have been some signs of recovery in total wood consumption in the EU market, buoyed by rising interest amongst architects and designers of wood’s environmental credentials.

All imports into the EU are now subject to the EUTR and while this law does not give FSC and PEFC certified wood a “green lane” through the due diligence requirements, it does state that certification is an appropriate tool for risk mitigation.

Both FSC and PEFC have also taken steps to ensure that their requirements for legal conformance and chain of custody of standards are fully aligned to EUTR. Consistent implementation of EUTR, and equivalent laws in other consuming countries, should eventually give certified products more of an edge over uncertified products in these markets.

Progress is slow but prospects for eco-system services are also improving. Capacity for REDD+ is being gradually built up, boosted by the strong endorsement of this approach in the 2015 Paris Agreement.

Global carbon markets are also set to expand, notably following the announcement by China in December last year that it is launching the world’s largest cap-and-trade carbon market. This market, expected to be operating by 2020, is likely to allow use of forest carbon offsets, although the rules for this are still unclear.

The signing of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) in October 2016 also promises a significant expansion of demand for carbon offsets from the aviation industry.

Bolstering market awareness of benefits of sustainable tropical forestry

More concerted actions are also now being taken by African operators and certification advocates to bolster market awareness of the benefits of these systems. FSC representatives at the Gabon Dialogue particularly emphasised the work they are doing to raise consumer awareness of the role of certification in promoting progress in line with the UN Sustainable Development Goals.

The message being sent out is that “certified tropical timber products come preloaded with rural development and environmental conservation values”. FSC were confident that this message is gaining traction, benefitting from the links to the FSC brand which has gained widespread consumer recognition in western markets.

Other agencies are now working to promote this message. With wide-ranging support from major players in the tropical wood industry, ATIBT launched a new joint marketing initiative to develop the Fair & Precious brand in 2017. Companies that carry the brand are required to sign up to 10 environmental and social values and to demonstrate progress through commitment to FSC or PEFC certification.

With support from the Dutch government, the European Sustainable Tropical Timber Coalition (STTC) is also raising awareness of the economic, social and environmental benefits of certified tropical forest operations. STTC is working to expand the European market for certified tropical forest products by developing pan-industry partnerships, promotion of lesser known tropical species, and provision of technical advice.

This work is beginning to show results. This was highlighted in a presentation by a representative of SNCF, the French national rail network, to the Racewood conference held alongside the Gabon Wood Show in June. The French railways need more than 12000 m3 of wood every year. Until recently tropical timbers were not used because of preconceived ideas about delayed deliveries and the risk of illegal and unsustainable harvesting.

However, partly encouraged by mounting concerns about the environmental and health impacts of creosote-coated softwood alternatives, SNBG have reconsidered their use of tropical timber. They have developed an action plan to expand application of certified tropical hardwoods in collaboration with a wide range of actors – including ATIBT, the French timber association LCB, FSC, PEFC, and WWF, together with big distributors such as Alstom, Bombadier, Nestle, Saint Gobain.

SNBG have been particularly encouraged by whole-life costing exercise which has indicated that, due to the exceptional technical properties of azobe, when all costs associated with supply, installation, maintenance, disposal, and replacement are taken into account, the tropical timber performs very well against alternatives such as creosote treated softwood and concrete.

Lower cost certification options

While these initiatives on the demand side are essential to the long-term future of the certified sustainable tropical timber business model, the recent experience of European operators in Africa also highlights the importance of ensuring the costs of certification do not create an insurmountable barrier to profitability.

To a significant extent, the certification challenges faced by operators in Africa are symptomatic of the reliance on only one international system – the FSC – and the slow evolution of regional capacity for certification.

Speaking to the Racewood conference in June, Jean-Paul Grandjean of PPEFC II, an initiative of COMIFAC to encourage development of certification capacity in the Congo region, explained the many measures been taken to actively support forest operators to maintain their certificates, through training, building of certification institutions and networks, and scientific research.

However, M. Grandjean also observed that a specific barrier to FSC certification in Africa was raised in 2014 with passage of Motion 45 of the FSC General Assembly on Intact Forest Landscapes (IFL).

This led to greatly tightened FSC requirements for any forest identified as an IFL, for example that low-impact/small scale forest management and non-timber forest products must be prioritised in unallocated IFL areas, first access must be provided to local communities, and alternative models for forest management/conservation (for example for ecosystem services) must be developed within IFLs.

While the FSC requirements for IFL may appear desirable in principle, their implementation would always be extremely challenging in the business environment prevailing in the Congo region – with only limited returns to be gained from eco-system services, declining availability of the most commercially valuable species, very patchy and highly inconsistent international demand for certified wood, and lack of institutional capacity to certify large numbers of community forests.

In the light of these developments, the emergence of a new certification framework in Africa that is directly responsive to regional conditions and prioritises regional institutional capacity is a positive development.

Earlier this year, the first certificate covering an area of 600,000 hectares was awarded by PAFC Gabon, a certification system endorsed by the international PEFC in 2014 after 5 years of development. The PAFC Gabon standards are derived from ITTO principles and adapted specifically to the national context.

A similar PAFC process is also now underway in Congo, where it is supported by the Ministry of Forest Economy with financial assistance from the African Development Bank. A protocol agreement was signed between PAFC and the international PEFC in 2014, and the PAFC Congo was formally constituted as an independent agency in 2017.

[1]http://www.willagri.com/2018/06/28/la-crise-de-la-filiere-europeenne-du-bois-tropical-en-afrique-centrale/

[2]https://www.researchgate.net/publication/323665892_Quid_du_futur_des_concessions_forestieres_africaines_dans_le_Bassin_du_Congo

PDF of this article:

Copyright ITTO 2020 – All rights reserved