The month of March 2013 is likely to be remembered as a major turning point for the European wood industry. Not only did it mark the introduction of the EU Timber Regulation (EUTR), but it also brought extremely bad economic news. Some newspapers and economists are now talking in terms of a “depression” in Europe. The fragile optimism of the opening weeks of the year has been dashed amid emerging signs that the recession is far from over.

One indicator of the rapid change in sentiment is provided by the Citigroup Eurozone Economic Surprise Index which tries to capture how well the data is coming in relative to economic expectations. At the end of February, the index stood at +70 as most data was exceeding expectations at that time. However the index fell like a stone to -8 by the end of March following a series of very poor numbers on economic growth, employment, manufacturing, industrial production, and retail sales.

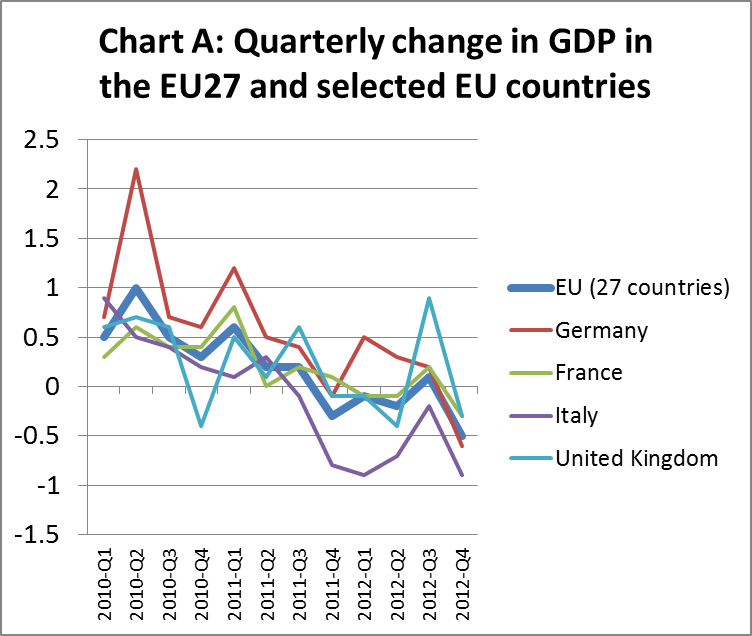

Particularly discouraging was the release of numbers indicating an expectedly sharp decline in GDP in all the major EU economies in the last quarter of 2012 (Chart A). This led the European Commission to report that EU-wide GDP shrank by 0.6% last year. They also forecast that GDP is likely to shrink by a further 0.3% during 2013. Euro-zone GDP is widely expected to have contracted for a sixth consecutive quarter in the first three months of 2013.

IMF forecast 0.3% decline in euro-zone GDP during 2013

The IMF’s twice yearly report on the global economy in April largely agrees with the EC’s analysis, also forecasting 0.3% decline in GDP in the euro-zone in 2013, with France joining Spain and Italy in contracting. Germany’s economy is forecast to grow 0.6% this year. Uncertainty in the euro-zone is spilling over into other European economies. For the UK, the IMF is forecasting growth of just 0.7% in 2013, after saying in January this year that the country’s economy could expect 1% growth. IMF forecasts that Eastern European countries will grow at 2.25% this year, following 1.5% last year.

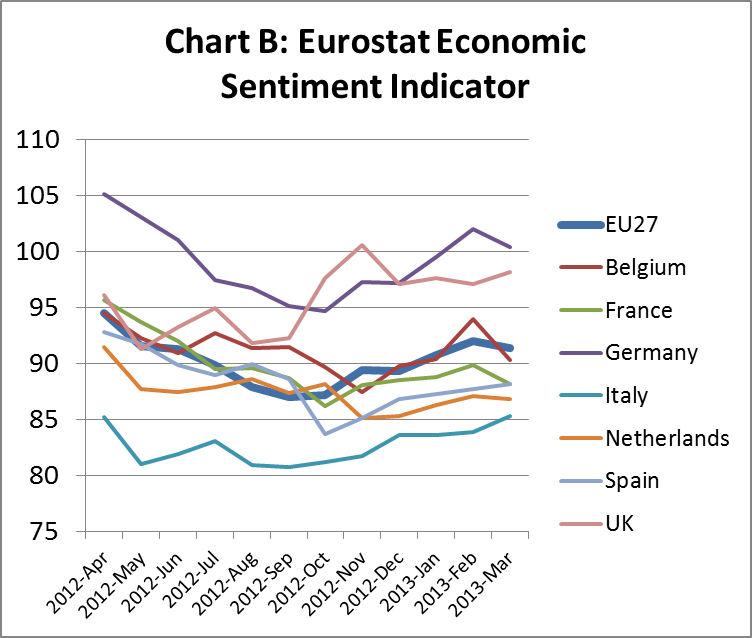

Similarly the Economic Sentiment Indicator (ESI) decreased in March in both the euro area and the EU, putting on hold the slow recovery in sentiment that started in November last year. Sentiment declined by 1.1 points in the euro area and by 0.6 points in the EU (Chart B). The downturn was particularly large in Germany and France, the two leading economies of the euro-zone.

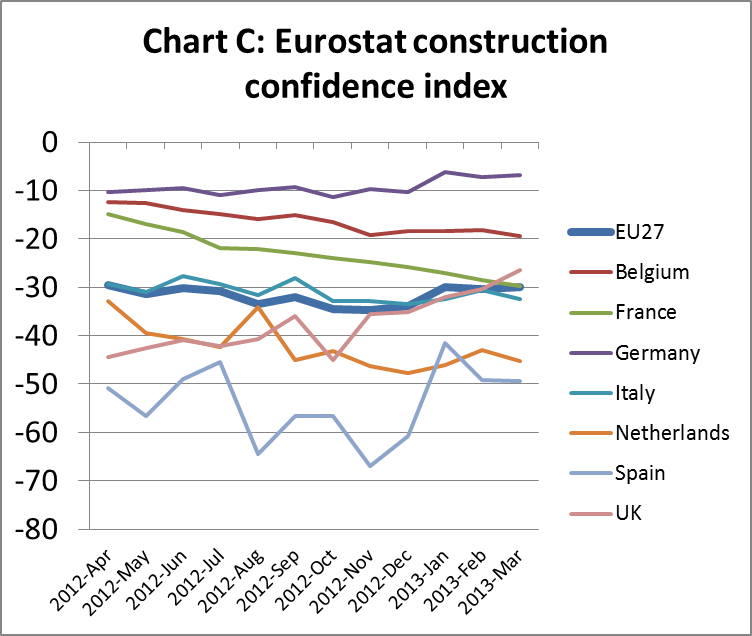

Indicators relating to the construction sector, of most direct relevance to wood consumption, remain very negative. The Construction Confidence Index was flat at -30 during the first 3 months of 2013 (Chart C). This shows that construction professionals are very pessimistic about the likelihood of any upturn any time soon.

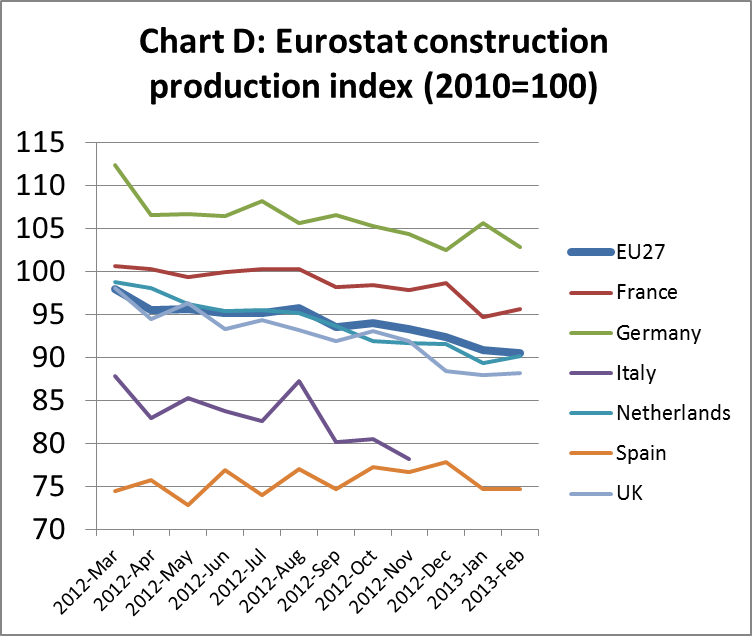

The European Construction Production Index, which measures actual output in the sector, has been declining since the start of the year (Chart D). Construction output across the EU in the first 2 months of 2013 was only 90% of the depressed levels registered in 2010.

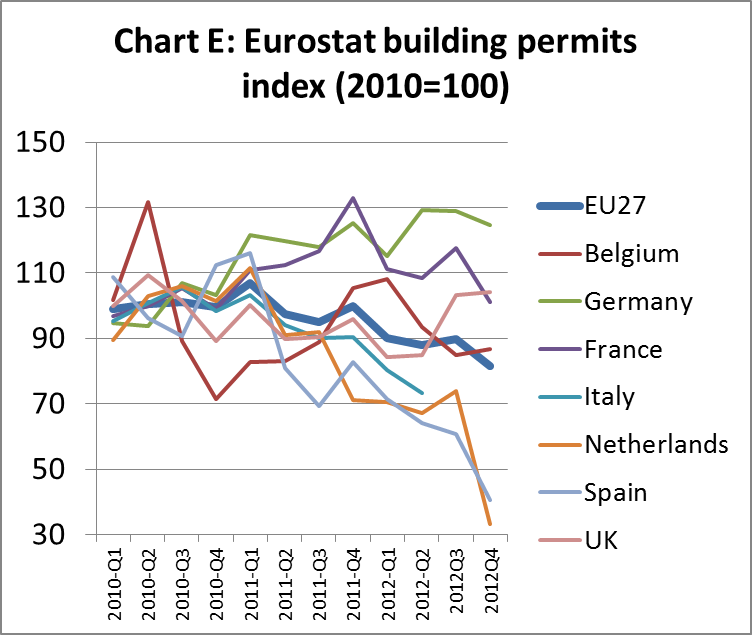

The latest data for the EU Building Permits Index shows there was a very sharp fall in the number of construction permits issued across the EU in the last quarter of 2012 (Chart E). This strongly reinforces the view that construction activity is likely to be even weaker during 2013 than in the previous year.

Rising political discontent has been both a consequence and a cause of the uncertain economic situation. The problem is particularly pronounced in Italy which has been unable to form a government since the parliamentary election at the end of February. No single party managed to secure sufficient seats to form a government. And one party, Beppe Grillo’s Five-Star movement which won 26% of the vote, has made clear that is has no intention of forming a coalition with any prospective partner. The situation is unlikely to be resolved without another election. Meanwhile essential measures needed to reduce the huge debt mountain and improve competitiveness in the euro-zone’s third largest economy have been put on hold.

To make matters worse, euro-zone leaders seriously mishandled the debt crises in Cyprus. Although Cyprus is a tiny economy and the amount of money involved almost totally irrelevant to the wider euro-zone, European leaders managed to reignite fears of a euro breakup, create uncertainty over the safety of retail bank deposits all over Europe, and make it look like Germany is bullying the people of southern Europe.

European plywood imports fall 10% in 2012

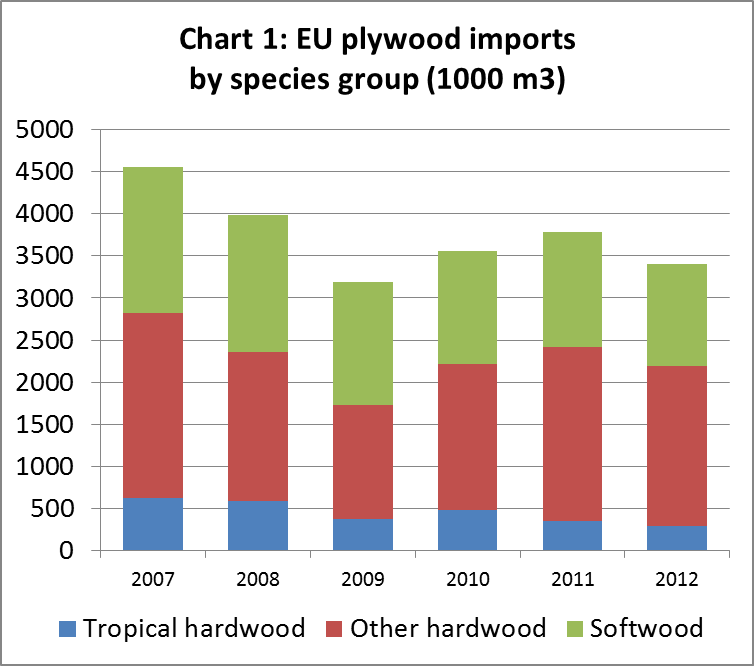

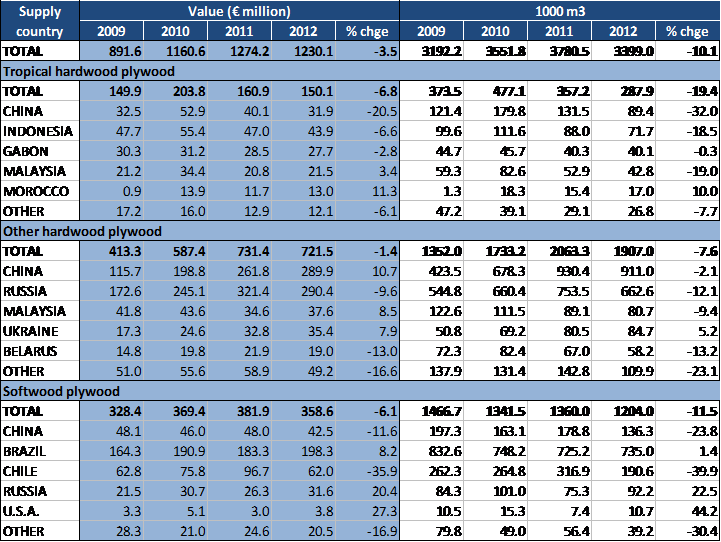

EU imports of plywood were 3.4 million m3 with value of €1.23 billion in 2012, down 10% and 3.5% respectively compared to the previous year (Table 1 and Chart 1). Imports of products identified as “tropical hardwood” fell by 19% to 288,000 m3, continuing a long term decline. Imports of “other hardwood” plywood fell by 7.6% to 1.91 million m3. Imports of softwood plywood fell 11.5% to 1.2 million m3.

EU-27 imports of plywood 2009 to 2012

Categorisation of EU import data into “tropical” and “other” hardwood needs to be treated with caution. One of the weaknesses of the international harmonised system (HS) of product codes is that it defines “tropical wood” as containing any one of a specified list of tropical species. Unfortunately the list doesn’t cover the full range of tropical woods and has not moved with the times. It omits several tropical species that have become commercially significant only quite recently. A particularly significant omission is bintangor, probably the leading tropical wood in Chinese plywood exports.

Most, if not all, bintangor plywood imported into the EU is likely to be identified as “other hardwood” in the EU statistics. It is widely known that an increasing volume of EU imports of plywood from China is “Mixed Light Hardwood” (MLH) manufactured from plantation grown eucalyptus and poplar rather than tropical hardwood veneer. However, there’s no way of knowing how far the process of substitution has proceeded. Therefore the recent decline in EU imports of tropical plywood and rise in imports of non-tropical hardwoods may be overstated.

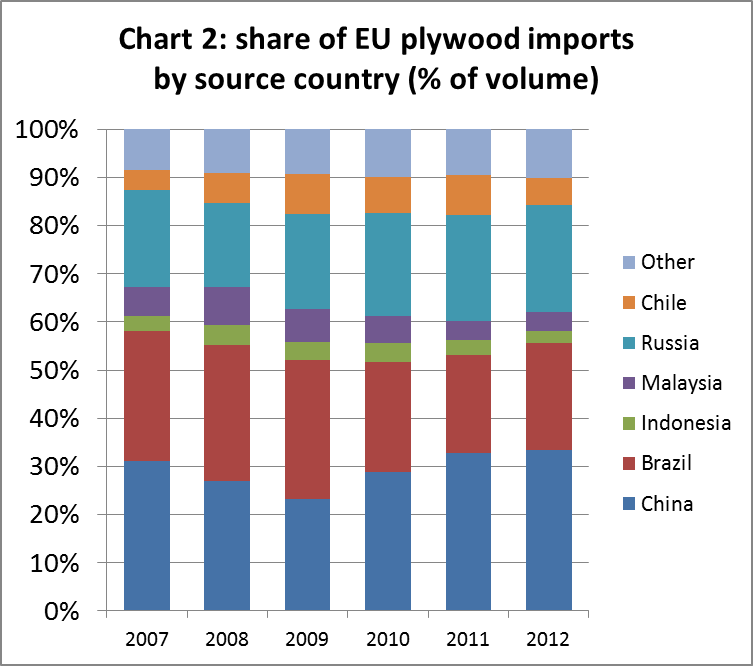

China contributes one third of EU plywood imports

Once again China was the leading external supplier of plywood to the EU during 2012, contributing 33% of all imports (Chart 2). While import volume from China declined 8% in 2012 to 114 million m3, this was in line with the overall fall in the market. China’s share of total imports in 2012 was the same as the previous year and up from 23% in 2009.

EU imports of plywood from Brazil fell 2% to 751,000 m3 in 2012. Brazil’s share of total imports was 22% last year, a slight gain on the previous year, but still well down on 2009 when share reached 29%. The vast majority of plywood imported into the EU from Brazil now consists of elliotis pine plywood from plantations in southern Brazil. Very little tropical hardwood plywood is now being exported from Brazil.

Imports from other traditional suppliers of tropical hardwood plywood to the EU also declined again in 2012. Imports from Malaysia were 134,000 m3, down 13% compared to the previous year. Imports from Indonesia were only 89,000 m3, down 22% compared to 2011.

Due to weak consumption and the low prices most European importers are now willing to pay for plywood products, manufacturers in Malaysia and Indonesia have been reorienting exports to other sales markets, notably Japan, South Korea, the U.S., and the Middle East.

Another factor was the closure of the Sumalindo mill in East Kalimantan, Indonesia, during August 2012 due to high production costs. This reduced availability of Indonesian plywood, particularly larger 5X10 ft panels. This led European importers to increase purchases of substitute products from Russia and China.

EU imports from Russia declined 9% to 756,000 m3 in 2012. Russia’s share of all EU imports remained level at 22% between 2011 and 2012. Russia’s share has increased slightly from 20% in 2009. The vast majority of EU imports from Russia now consist of birch plywood. Russian filmed birch plywood is an important competitor for Chinese filmed plywood in Europe. This product has also made inroads into traditional markets for some tropical hardwood products, particularly in continental Europe.

UK plywood imports nearly at pre-recession levels in 2012

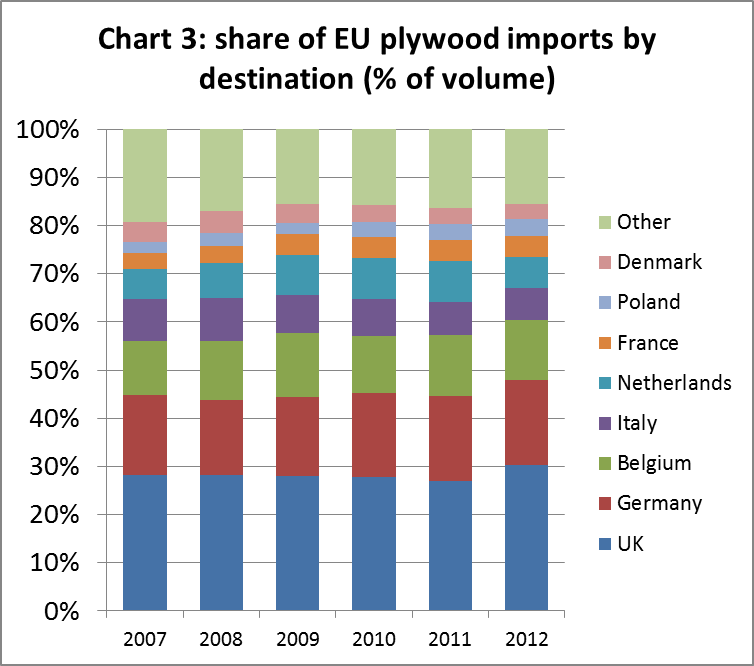

Plywood is mainly destined for the UK, Germany and Belgium which together account for around 60% of all plywood imported into the EU from outside the region (Chart 3). Imports by the UK were 1.03 million m3 in 2012, 1.4% up compared to the previous year and not far short of pre-recession levels. However imports into Germany declined 10% to 602,000 m3 in 2012, while imports into Belgium fell 12% to 419,000 m3. There were also significant declines in plywood imports into some of the smaller markets including Italy (-13% to 229,000 m3), Netherlands (-32% to 219,000 m3) and France (-8% to 146,000).

Imports slowed during every quarter of 2012

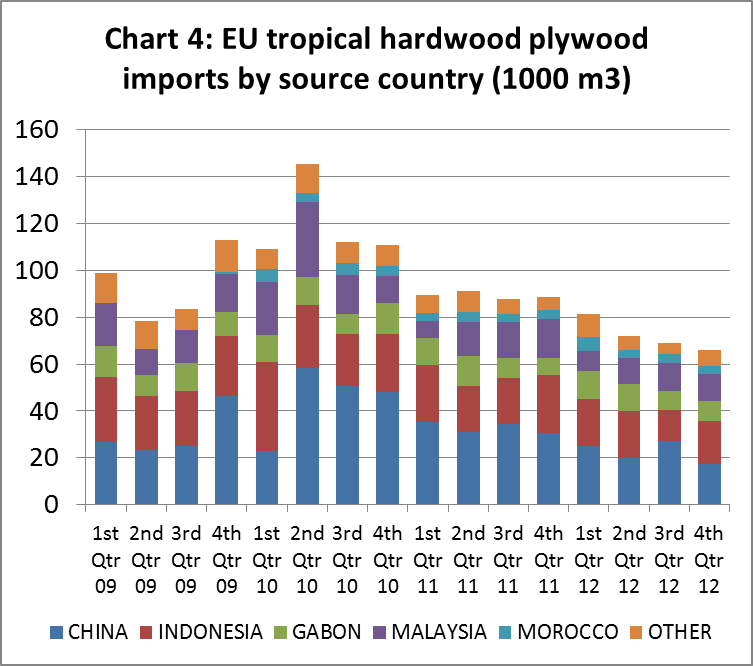

The quarterly data indicates that EU imports of tropical hardwood plywood have fallen steeply and fairly consistently since a spike in imports in the second quarter of 2010 (this spike was due to a big surge in imports to the UK, probably due to short-term demand in advance of the 2012 Olympic Games). Imports of tropical hardwood plywood in the last quarter of 2012 fell to only 66,000 m3.

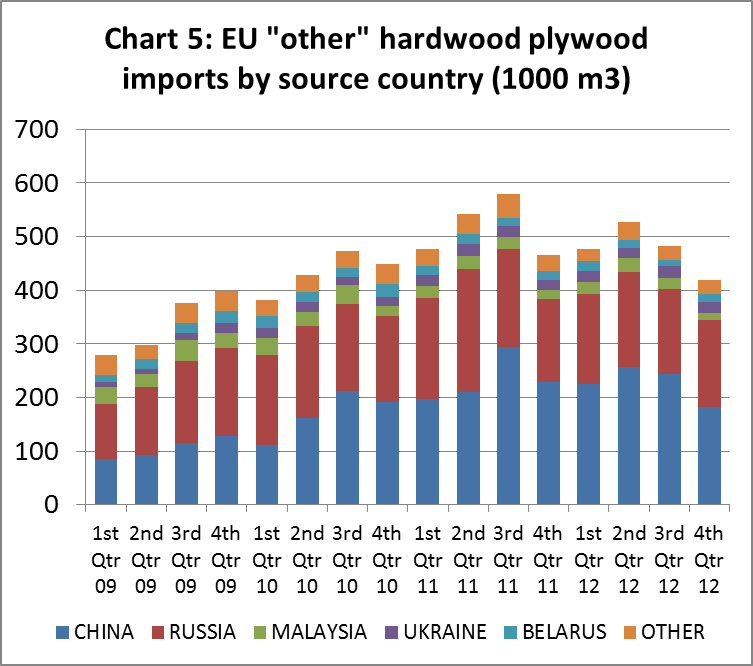

In contrast, EU imports of “other” hardwood plywood increased for 9 months starting in October 2011 to reach 530,000 m3 in the second quarter of 2012. However EU imports of this commodity then fell away sharply to only 420,000 m3 in the last quarter of the year.

This last trend appears to contradict anecdotal reports which suggested that some EU importers responded to introduction of the EUTR by building stocks in advance of enforcement from 3 March 2013. This trend was most widely reported in the UK. However import data actually indicates a very sharp fall in UK imports of “other” hardwood plywood from 215,000 m3 in the third quarter to 146,000 m3 in the last quarter of the year. UK imports during the fourth quarter of 2012 were also much less than the 172,000 m3 imported in the same quarter of 2011.

Much of the decline in UK trade of “other” hardwood plywood between the third and fourth quarters of 2012 was due to imports from China, which fell from 146,000 m3 to 84,000 m3 during this period. It seems likely that many UK importers of Chinese plywood had already taken steps to build stocks well before the March 2013 EUTR deadline.

The sharp decline in UK imports in the last quarter of 2012 also needs to be viewed in the light of a significant slowdown in construction activity and the publication of poor construction forecasts at that time.

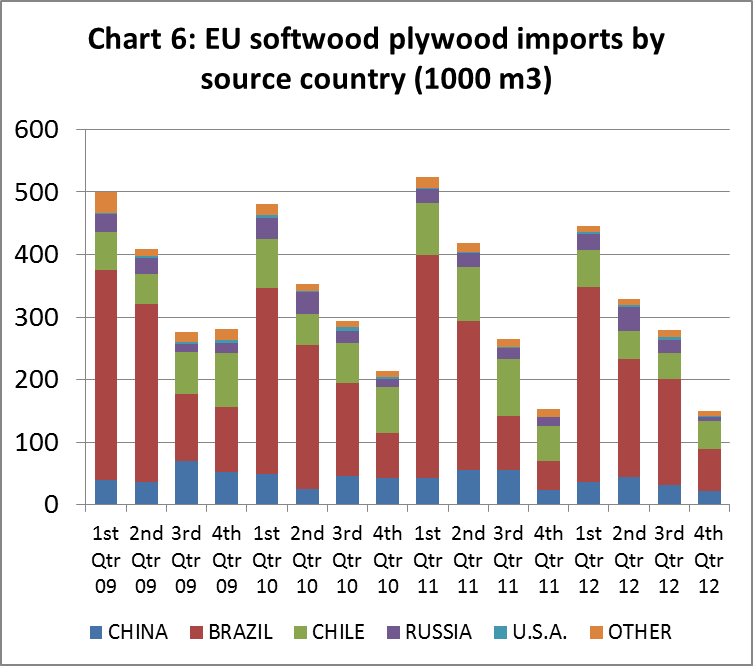

Quarterly data for EU imports of softwood plywood bears the imprint of the import quota imposed on this commodity (Chart 6). The EU allows duty free imports of 650,000m3 of softwood plywood every year, imposing a 10% duty on all imports above that amount. The inevitable result is that softwood imports are strongly concentrated in the first half of the year as importers rush to beat the duty. During 2012, low consumption in the EU meant that the duty-free quota was filled more slowly than during the previous 2 years. Imports also fell steeply to only 150,000 m3 in the last three months of 2012, the lowest quarterly figure for many years.

The extent to which the EUTR and current construction industry downturn will impact on the future EU plywood market will only become fully apparent with publication of more import data in 2013. It will be particularly interesting to observe whether there was any short-term spike in imports in January and February 2013 due to last-minute efforts by importers to build stocks in advance of the March 2013 deadline.

Slow start to the year for Chinese plywood in Europe

In April 2013, anecdotal reports from market participants indicate that European landed stocks of plywood are high relative to demand. Stocks are being consumed only slowly. In the current uncertain economic environment, most importers are now holding back on making new plywood purchases.

European traders suggest that demand for Chinese plywood was particularly slow throughout the first quarter of 2013 due to limited construction activity and weak demand from the packaging sector.

Due to concern about EUTR legal liabilities, importers have become extremely wary of buying replacement volumes of both MLH plywood and poplar/bintangor plywood from China. At present, buyers in the UK, Belgium and the Netherlands are focusing on Chinese plywood composed of eucalyptus or poplar cores and certified tropical wood surface veneers. German buyers are now concentrating mainly on film coated poplar plywood from China.

Prices for Chinese plywood on offer to European importers have also been rising this year. This is partly due to a significant narrowing in the supply base. European importers are now buying from a restricted range of exporters regarded as best able to provide legality assurances. It’s also partly because those exporters are pushing for higher prices in order to cover the extra costs of EUTR documentation and the higher costs of securing legally verified logs and veneers.

There was also a significant freight rate increase on the China-Europe route in March this year. Rates for a 40 foot container increased from below $2000 to over $2500 during the month and are widely expected to continue to rise.

Speculation about future of the European trade in Chinese plywood

While European buying from China has slowed considerably in 2013, there is very little clarity yet on the extent to which EUTR might impact on EU imports from China longer term. China has become so important in the European market for hardwood plywood, while availability from other sources has declined, that it’s not easy to identify alternatives. One UK importer recently quoted by the UK Timber Trades Journal (TTJ) notes: “there is no EUTR-compliant source of supply that could pick up that amount of slack”.

It’s also not yet certain that EU importers will need to source large volumes of replacement product. European construction industry data suggests the market overall is moving into a phase of reduced consumption. EU importers also report that Chinese suppliers are very actively exploring opportunities to develop procedures and change supply chains to help ensure EUTR compliance.

Stronger market incentives to go down this route are already emerging and may well strengthen. Anecdotal reports suggest that Chinese mills capable of delivering FSC certified plywood have seen a noticeable increase in demand this year. The limited capacity of FSC certified mills in China is already taken up for several months in advance. For example, TTJ reports that one Chinese mill recently finalised an order for regular monthly shipments of FSC certified plywood to the UK to December 2013.

EU importers suggest that Chinese mills are also making further changes to the hardwood species used for face veneers in response to EUTR. For example, some are considering replacing tropical hardwood with imported European hardwoods such as beech or with dyed red poplar.

The prices of all these alternatives are likely to be significantly higher than prices for uncertified Chinese poplar/bintangor and MLH plywood. However, Chinese plywood prices were so low in the past, and the supply of obvious substitutes is now limited, that there may well be scope to maintain higher prices in the EU for legally-verified Chinese products.

The extent to which Chinese exporters are encouraged down this route will depend partly on the effectiveness of EUTR enforcement. It will also depend heavily on the growth of alternative markets outside the EU, particularly within China itself, and the extent to which these will demand equivalent assurances of legality.

One complicating factor is the process on-going in the U.S. to consider imposition of anti-dumping duties on Chinese plywood in that market. If the duties are imposed, it might lessen Chinese manufacturers’ commitment to the U.S. market which, due to the Lacey Act, is one of the few additional sources of strong global demand for legally verified timber products. On the other hand, it might increase the relative importance of the EU market, and therefore of EUTR compliance, to Chinese plywood manufacturers.

So the proposed U.S. anti-dumping duty is another area of uncertainty that could work either way depending on the product profile and market orientation of the individual manufacturer.

No upturn in direct imports of tropical plywood

In advance of EUTR, there was speculation that direct EU imports of hardwood plywood from tropical countries might increase as a result of EUTR. This is due to shorter and less complex supply chains for these products compared to plywood manufactured in China.

It is very early days, but at present there is no evidence that South East Asian suppliers are benefitting from the regulation. European demand for plywood from South East Asia has remained very weak since the start of the year. Sales volumes are generally regarded as even lower than the same period in 2012. Much European buying in the region is now focused on speciality products and demand for standard BB/CC grades is particularly weak.

Replacement prices for both Malaysian meranti and Indonesian lauan plywood have remained generally stable in recent months. Importers say they are unable to pass on any price rises in the current market environment. However exporters complain about log shortages and rising prices for logs and other materials. In this environment there seems little prospect of any significant increase in European demand in the next several months.

In contrast to South East Asian plywood, African and the remaining European-based manufacturers of okoume plywood report that European orders have picked up well during 2013. This is a potentially significant turn-around for a product that lost a lot of market share during the recession. Several major Europe-based producers have closed in recent years. In addition to low consumption, this trend was encouraged by Gabon’s log export ban in May 2010 which led to decreased availability of raw material to European manufacturers. European mills, mostly in France, now mainly depend on imports of okoume veneer from Gabon.

This year’s increase in European demand for okoume plywood from remaining manufacturers is partly due to the withdrawal of other producers from the market. EUTR is also driving stronger demand for FSC certified okoume plywood. As a result prices for okoume plywood have been firming during 2013 and FSC certified product is achieving a premium of 5-10% compared to uncertified product.

Robust imports of softwood plywood in 2013

According to the German trade journal, 50% of the EU 650,000 m3 annual quota for softwood plywood had been used by 20 March 2013. EU imports of softwood plywood were 185,000 m3 in January, 90,000 m3 in February, and 40,000 m3 in the first half of March. Imports to that date this year were marginally higher than the same period in 2012, but lower than in 2011. With imports from other sources so low this year, early signs are that softwood plywood may be taking a larger share of the European market this year.

PDF of this article:

Copyright ITTO 2020 – All rights reserved