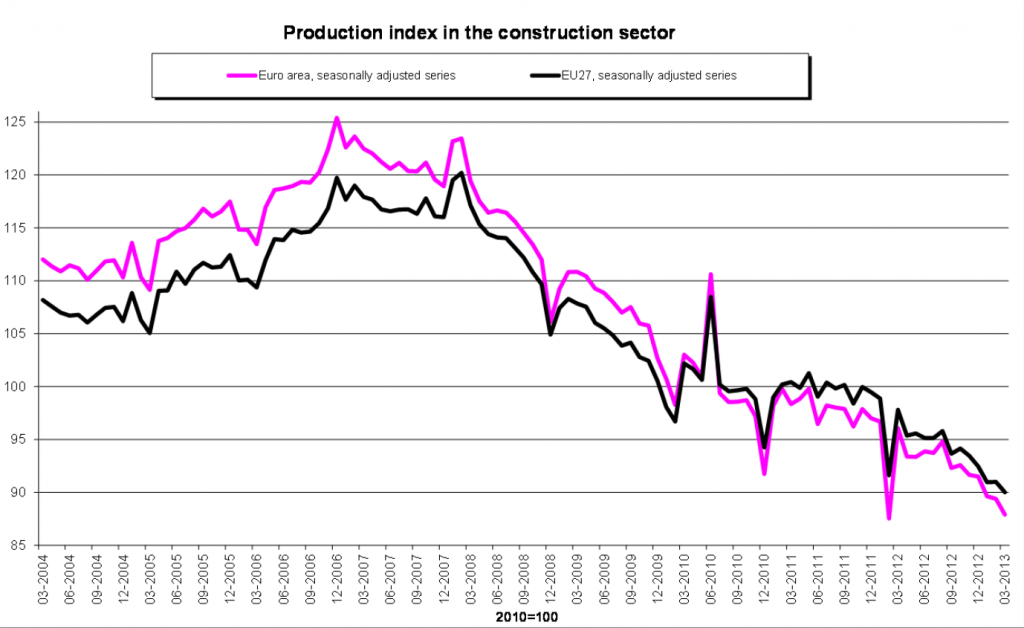

For the last 5 years, the Eurostat construction production index for both the EU27 and euro-area group of countries has fallen consistently, with only an occasional short-lived reversal (see figure 1 below). In the first quarter of this year, EU-27 construction activity reached new lows. The index during the January-March 2013 period was down 5.2% compared to the same quarter in 2012, and down 2.8% compared to the previous quarter.

The downward trend affected building and civil engineering equally. Building activity was down 5% compared to the same quarter in 2012 and down 2.5% compared to the previous quarter. Civil engineering was down 5.3% compared to the same quarter in 2012 and down 3.9% compared to the previous quarter.

Particularly worrying is that the downturn in construction is now almost universal across the continent. Comparing the first quarter of 2013 with the same period in 2012, construction production was down in Czech Republic (-11%), Germany (-3.7%), France (-3.3%), Netherlands (-8.2%), Poland (-15.9%), Portugal (-20.8%), Romania (-3.9%), Slovenia (-24%), Slovakia (-10.9), Sweden (-0.4%), and the UK (-7.4%). These declines are only partly offset by gains in Spain (+2.8%), Latvia (+9.8%), and Hungary (+4.8%).

It’s difficult to find any good news in the European construction data. However, the fact that Spanish construction picked up a little during the quarter is a reminder that even the biggest downturns must at some point reach bottom. And even after five years of almost uninterrupted decline, construction production activity across the EU is still running at 75% of the all-time peak in 2007. EU construction sector annual turnover still totals around €1.5 billion and the sector continues to purchase goods and services to a value of around €1 billion every year.

Slowing EU joinery sector activity

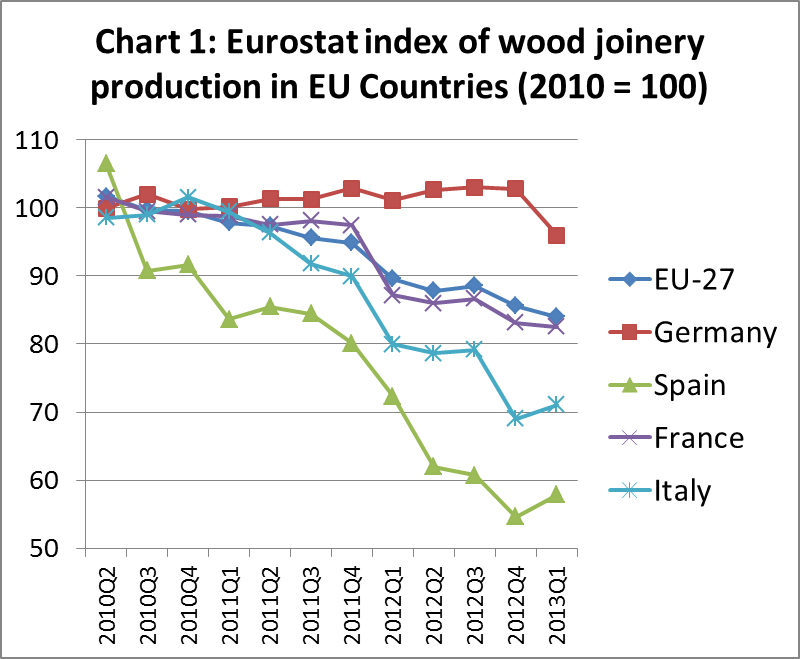

The downward trend in overall construction sector activity is mirrored by a slowdown in EU joinery activity. Except for a very small increase in the third quarter of 2012, the Eurostat seasonally adjusted index of wood joinery activity[1] for the EU27 group countries has declined in every quarter for the last 3 years (Chart 1). Activity in the first quarter of 2012 was only 84% of the level in 2010. After a long period of steep decline, there was a slight improvement in joinery manufacturing activity in both Italy and Spain in the first quarter of 2013. The improvement in Italy is particularly welcome since this country is the EU’s largest manufacturer of windows, alone accounting for nearly one quarter of all wood windows supplied into the EU. However the gains made in Italy were offset by a large decrease in joinery manufacturing activity in Germany, the EU’s largest manufacturer of doors and second largest manufacturer of windows.

[1] Includes joinery products windows, doors, and glulam but excludes flooring and kitchens

Disappointing joinery sales in the UK

In the UK, the British Woodworking Federation (BWF) quarterly survey of members indicates that the joinery sector slowed during the January to March 2013 period. With poor weather conditions thought to be a factor, there is some optimism that sales will improve in the second and third quarters as the summer construction season gains momentum. However, costs associated with rising energy prices, CE Marking and sourcing EUTR compliant timber are beginning to put pressure on manufacturers.

The survey showed that UK joinery sales in the first quarter of 2013 did not increase as much as had been anticipated in the previous survey, with the balance of respondents indicating decreasing sales volumes. In the survey, a balance of 7% of respondents reported a decrease in sales volumes in Q1 2013, whereas in the previous survey 19%, on balance, had predicted that sales volumes would increase in this period. Only 13% of respondents indicated that they have been or will be operating at over 90% capacity. The survey showed that order books for future work still rarely extend beyond 3 months.

More positively, the survey indicated that manufacturers are confident that sales volumes will improve during the next 12 months, with a balance of 24% predicting an increase in this period. There is also growing investment in customer research and e-business as companies seek to improve competitiveness. 70% of respondents said they are planning for a spending increase in product improvement.

European flooring sector faces challenges

Weak market conditions in the European construction and joinery sectors extend to wooden parquet flooring products. The state of the European flooring market was the main topic for discussion at the Board of Directors of the European Federation of the Parquet Industry (FEP) on 24 April 2013. They concluded that, while it is too early too early to give a reliable forecast for the current year, European parquet producers continue to face important challenges and variations at country level in a market yet to show any sign of recovery.

All the large European FEP countries[1], with exception of Germany, showed a declining trend in sales of wooden flooring during the first quarter of 2013. Wood flooring sales declined in 7 of the 12 countries considered by the FEP. Sales were flat in 4 countries, and only in Norway was any growth achieved. With respect to wood flooring markets in individual EU markets during the first quarter of 2013, FEP conclusions were as follows:

- Austria: slight decline in production and consumption due mainly to harsh winter conditions.

- Belgium: consumption is stable and production gradually improving.

- Denmark: wood flooring sales are flattening out as construction output is growing again, though at a low rate (+2.2%) and is well below pre-crisis levels. All construction segments are forecast to increase moderately but new residential construction shall remain weak in 2013 due to subdued house price developments.

- Finland: consumption of wood flooring decreased significantly during the quarter, down 10% on the same period in 2012. Rising unemployment in the country is undermining consumer confidence.

- France: the first quarter of 2013 showed a decrease of 15% in wood flooring sales. Growing unemployment is undermining consumer confidence. However solid wood flooring is a little less affected and is performing better than multilayer and manufacturers are adapting accordingly.

- Germany: wood flooring sales in the first quarter of 2013 were flat for most products, with the exception of wide planks which continue to grow. While construction activity slowed at the end of 2012, prospects look better with an increase in building permits.

- Italy: the wood flooring market lost close to 20% in sales in the first quarter of 2013. Political uncertainties have translated into a difficult economic situation. However, market conditions are expected to improve now that a new government has been formed.

- Netherlands: wood flooring consumption contracted by 10% compared to the first quarter of 2012. The negative market trend witnessed at the end of 2012 is continuing. The renovation market is more promising than new build but this is not generating the same volume of flooring sales. Wood flooring production is rising, but over 60% goes to exports and consists predominantly of 2-layer products.

- Norway: the wood flooring market is slowing down but still growing compared to last year. The building sector is flat.

- Spain: wood flooring production is stable at a low level, but sales declined in the first quarter of 2012 by 5 to 10% compared to last year. The shift observed in other countries towards wide planks is also witnessed in Spain. Unemployment remains a major concern with 25% of the population out of job, and a worrying 50% among the younger generation.

- Sweden: wood flooring consumption is slightly down in the first quarter of 2013 compared to the same period in 2012.

- Switzerland: wood flooring sales were stable in the first quarter of 2013. Wide planks are in fashion as elsewhere in Europe. The construction market is picking up after the winter, which is also reflected in the increasing number of building permits.

China increases share of EU wood flooring imports

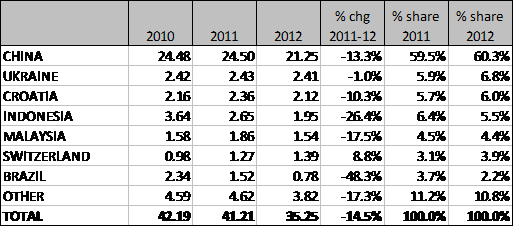

Wood flooring is the only joinery product for which external suppliers have a large share of the EU market. According to preliminary estimates by FEP, production of wood flooring in member countries was around 70 million m2 and consumption was 91 million m2 in 2012. This compares to imports of 35.25 million m2 in 2012 (Table).

Table: EU27 imports of wood flooring 2010-2012 (million m2)

[1] FEP covers all the major European markets with the exception of the UK

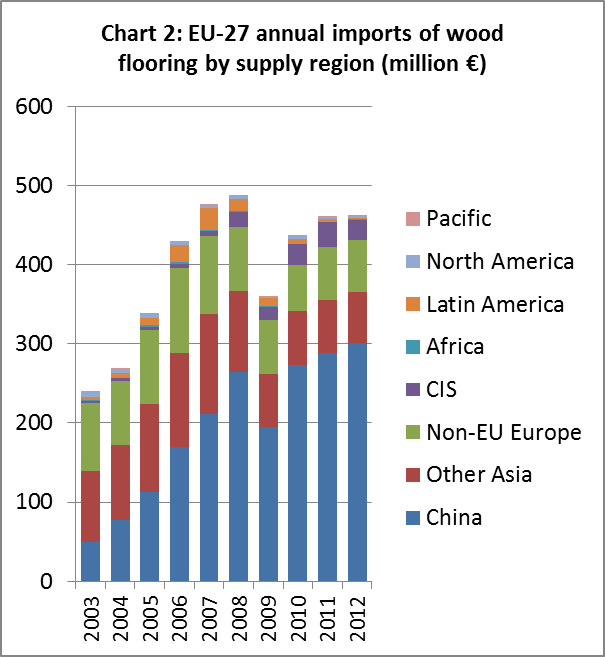

Total EU imports of wood flooring declined 14.5% in volume terms during 2012, however imports held up well in value terms (Chart 2). The total value of wood flooring imports in 2012 was €462 million, a slight gain on €461 million the previous year and not far short of the record level of €487 million in 2008.

China is by far the largest external supplier of wood flooring to the EU. In 2012, the EU imported 21.25 million m2 of wood flooring with a value of €301 million from China. While the volume of wood flooring imports from China fell by 13% in 2012, the value actually increased by 4.3%. China’s share of overall EU wood flooring imports has been rising in recent years, from around 51% of volume in 2009 to over 60% in 2012. China’s share of import value increased from 54% to 65% during the same period.

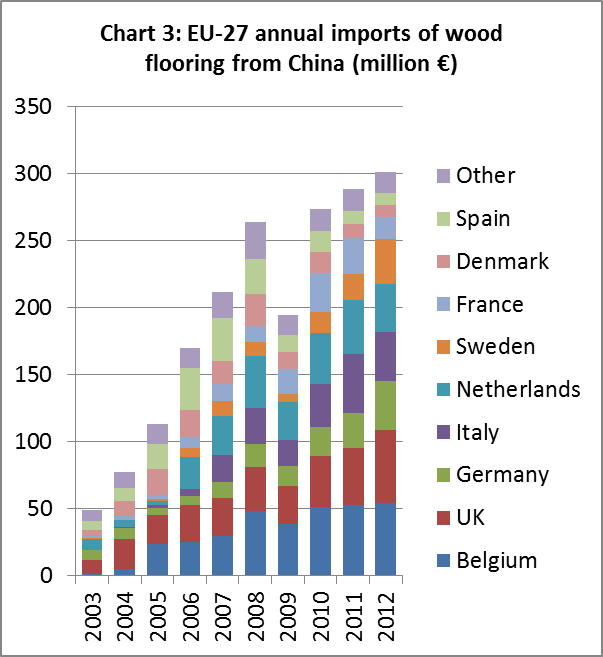

Most Chinese wood flooring is imported into the EU through Belgium, UK, Germany, Italy, Netherlands, and Sweden (Chart 3). A significant proportion is likely to be re-exported from some of these countries (notably Belgium, Netherlands and Sweden). The value of Chinese wood flooring imports increased last year into Belgium (+4% to €54.5 million), UK (+27% to €54.1 million), Germany (+39% to €36.8 million), and Sweden (+81% to €34.2 million). However, import value declined into Italy (-17% to €36.2), Netherlands (-12% to €35.7 million) and France (-42% to €15.9 million).

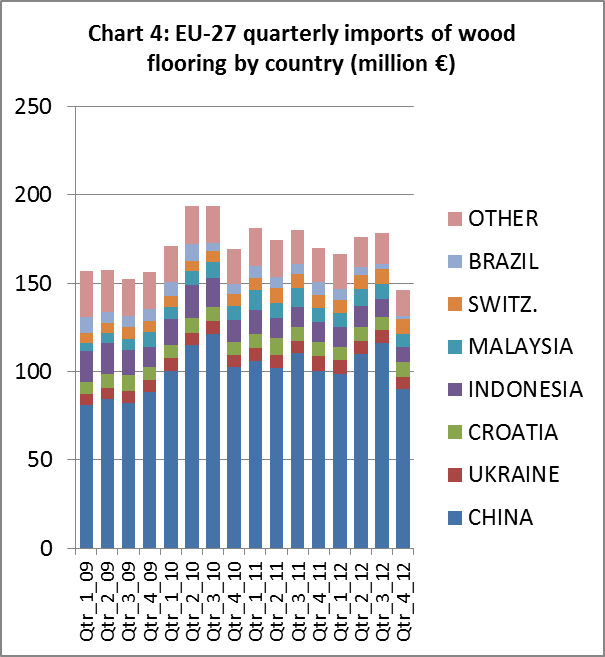

Quarterly data reveals that EU27 wood flooring imports fell sharply in the last quarter of 2012, with a particularly large decline in imports from China (Chart 4). This is probably due to the mounting economic uncertainty in Europe and the sharp decline in construction activity during the winter months. It’s also possible that the imminent imposition of the EU Timber Regulation (EUTR) discouraged purchasing of Chinese wood flooring due to the complex supply chain and difficulties of securing legality documentation. However, the impact of EUTR will only really become apparent with publication of 2013 trade data.

EU wood door imports resilient despite construction downturn

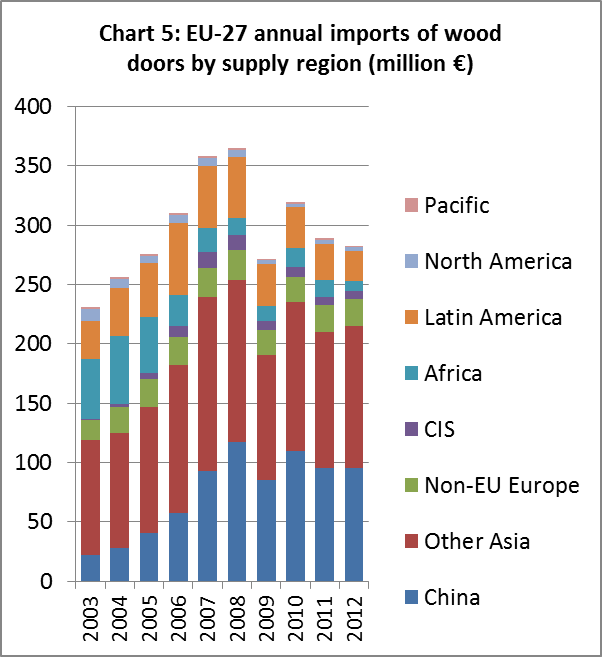

Unlike wood floors, most wood doors consumed in the EU are also manufactured in the EU. In 2011 only 4.6% of the total €6.3 billion of wood doors installed in the region derived from outside the EU.

Nevertheless, the market for wood doors in the EU is large and even a small share generates a lot of income. The total value of EU wood door imports in 2012 was €283 million, a 2.3% decline compared to the previous year (Chart 5). While imports are well below the level of 2008 when they peaked at €364 million, imports have remained reasonably resilient during the last three years despite slowing construction activity. During this period, China has remained the largest single supplier and maintained a share of around 33% of all EU wood door imports.

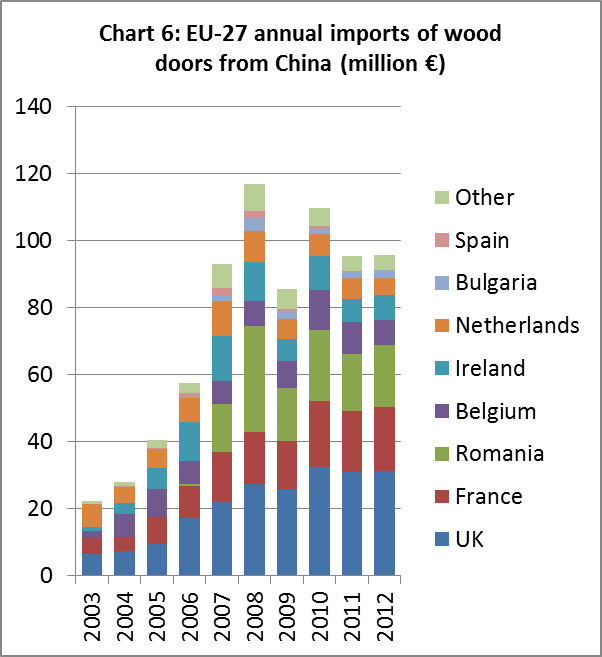

Most Chinese wood doors imported into the EU are destined for the UK, France, Romania, Belgium, Ireland, and the Netherlands (Chart 6). The value of Chinese wood door imports increased last year into the UK (+1% to €31.2 million), France (+4% to €19.1 million), Romania (+11% to €18.6 million), and Ireland (+2% to €7.2 million). However, import value declined into Belgium (-20% to €7.6 million) and the Netherlands (-15% to €5.2 million).

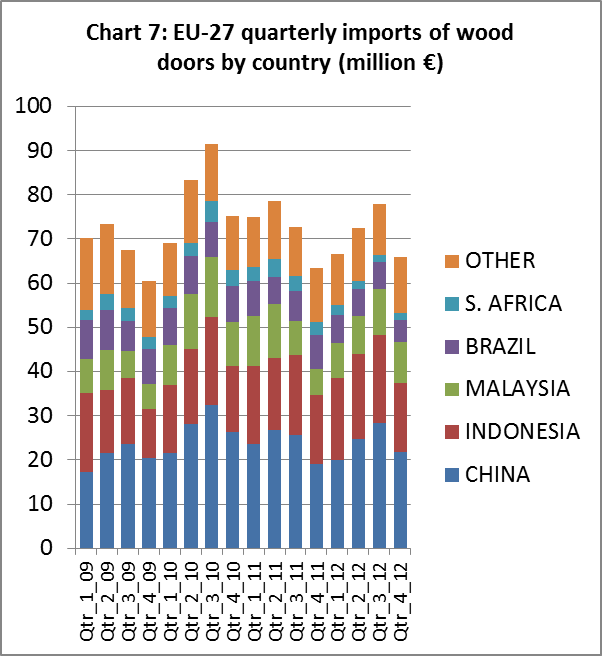

As in the wood flooring sector, there was a sharp fall in the value of EU imports of wood doors in the last quarter of 2012 (Chart 7). The biggest fall was in imports from China (down 23% compared to the previous quarter), although imports also declined from Indonesia (-14%) and Malaysia (-13%). It’s unclear whether this is the start of a long term trend or a short-term response to slow construction sector activity in Europe last winter.

EU glulam imports from China down 14% in 2012

Europe is the world’s largest market for glulam, accounting for close to 60% of all global consumption. Europe currently consumes around 3 million m3 of glulam of which only around 125,000 m3 was imported in 2012, mainly from Malaysia, Indonesia and China.

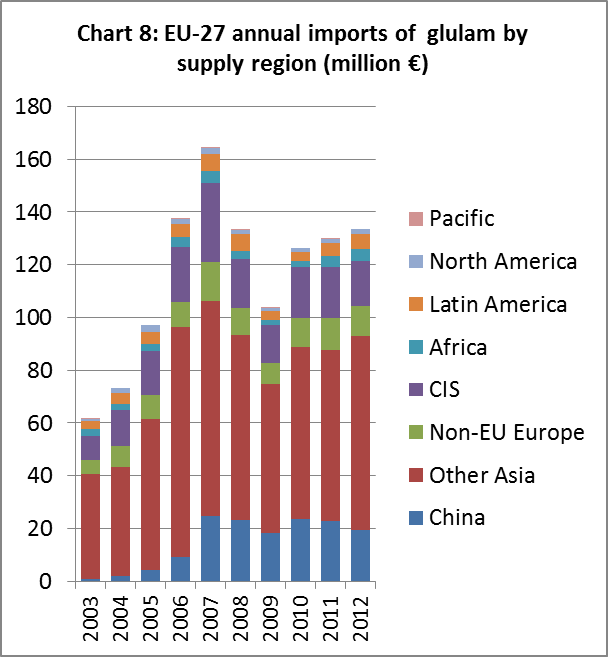

While volumes are small, imported glulam products have high unit value, averaging around €1000 per cubic meter. EU imports of glulam in 2012 were valued at €134 million, up 3% from €130 million in 2011 (Chart 8). In 2012, imports from the largest external supplier, Malaysia, were valued at €33 million, a 19% increase compared to the previous year. Imports from Indonesia also increased in 2012, by 13% to €30 million. However, imports from China declined by 14% to €19 million.

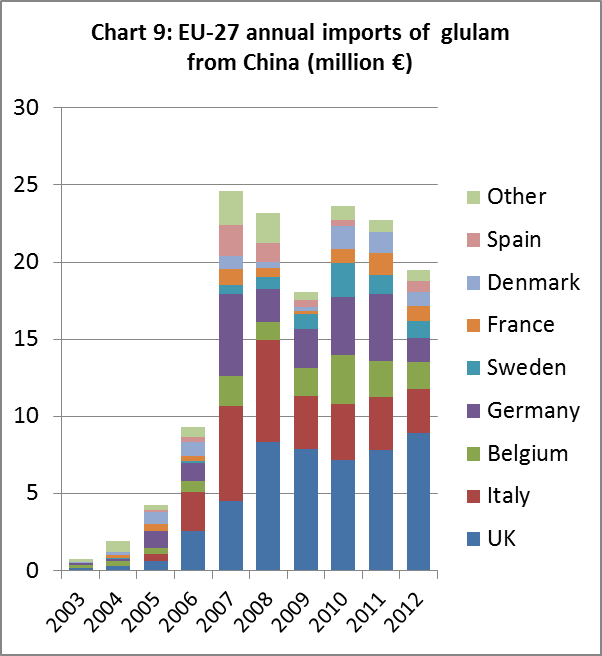

Most Chinese glulam imported into the EU is destined for the UK, with smaller volumes destined for Italy, Belgium and Germany (Chart 9). The value of Chinese glulam imports increased last year into the UK (+14% to €8.9 million). However, imports fell into Italy (-16% to €2.9 million), Belgium (-27% to €1.7 million), and Germany (-64% to €1.6 million).

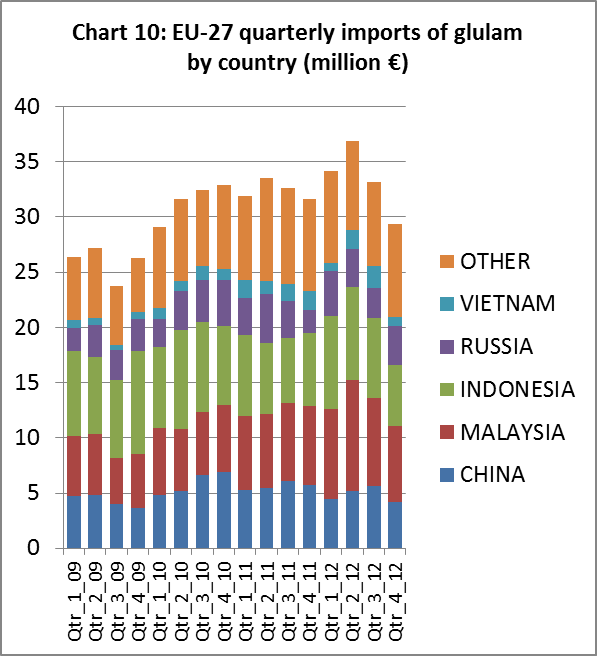

Quarterly data reveals that EU imports of glulam rose strongly in the first six months of 2012 but then declined sharply in the second half of the year (Chart 10).

EU wood window imports fall to negligible levels

Manufacturers outside the EU play a very minor and declining role in the EU wood windows sector. Imports accounted for only 0.5% of the €6.6 billion of wood products installed in the EU in 2011, down from 0.8% in 2007. External suppliers struggle in a sector where success depends on commitment to an increasingly complex range of EU quality and environmental standards, ability to meet tight construction schedules, and regular contact with a large and generally fragmented network of building contractors.

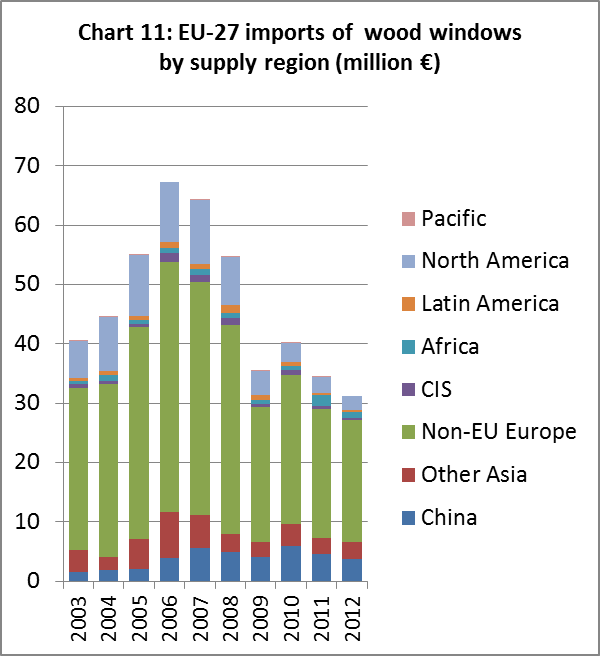

EU wood window import value fell again last year, from €34 million in 2011 to €31 million in 2012 (Chart 11). Most wood windows imported into the EU derive from other non-EU European countries, notably Norway and Croatia.

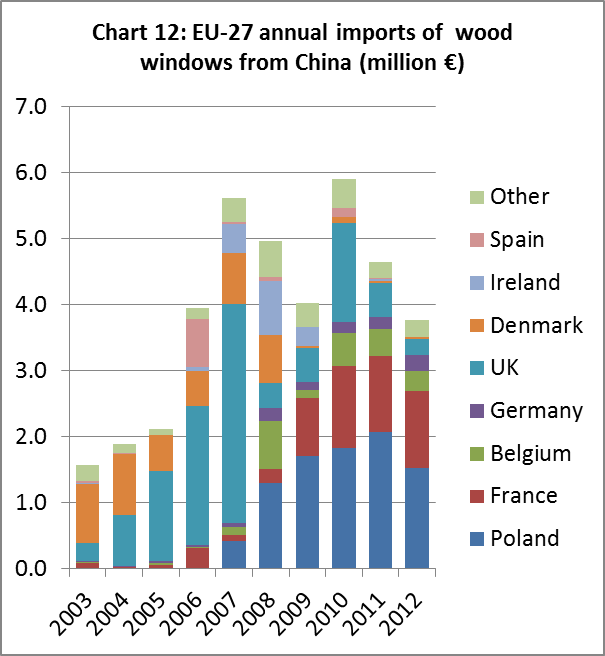

Wood window import value from China in 2012 was €3.8 million, down from €4.7 million the previous year. Most wood windows imported into the EU from China are now destined for Poland and France (Chart 12). The UK, the largest market before 2008, now imports hardly any windows from China.

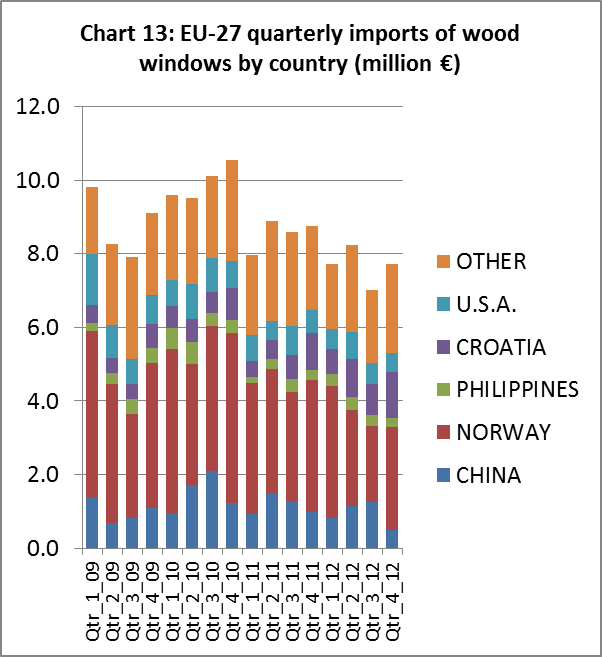

Quarterly data indicates that EU wood window imports strengthened at the end of last year (Chart 13). However this was due to increased imports from Norway and Croatia. Imports from China fell sharply in the last quarter of 2012.

PDF of this article:

Copyright ITTO 2020 – All rights reserved