Economic sentiment in Europe improved a little during the second quarter of 2013. Talk of a possible “depression” and euro-collapse has receded into the background. Nevertheless overall economic conditions remain fragile and the construction sector, the major driver of wood demand, is still deep in negative territory.

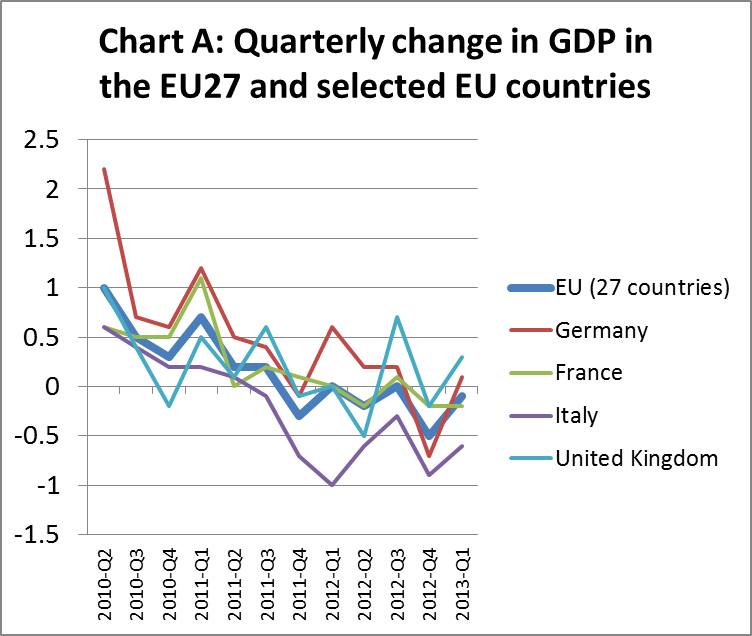

GDP data for the first quarter of 2013 reveals that the EU economy remained static at the depressed level achieved in the last quarter of 2012. Slow growth in Germany and UK during the quarter was offset by continuing decline in France, Italy and other southern European countries. Nevertheless, the European Commission was sufficiently encouraged by the figures to revise upwards their forecast for EU GDP change during 2013 from -0.3% to -0.1%. For 2014, economic activity is now projected to expand by 1.4% in the EU.

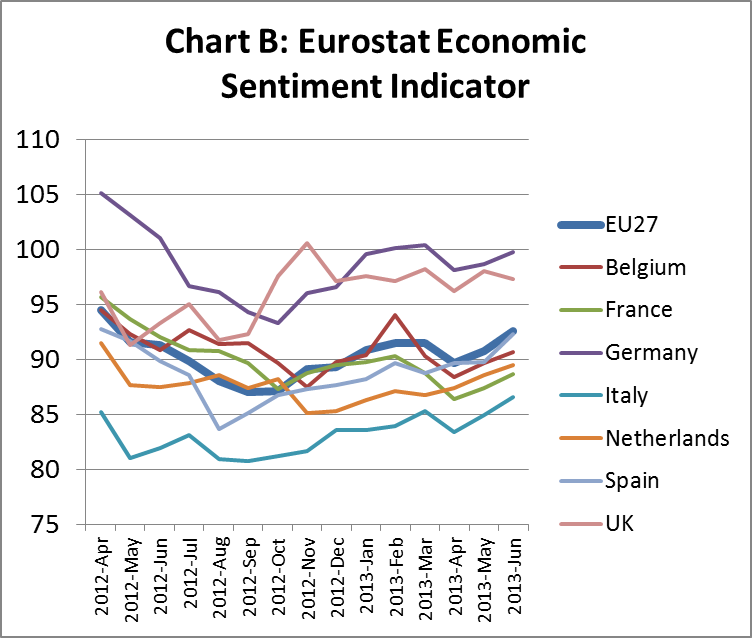

The Economic Sentiment Index (ESI) showed some improvement in the second quarter of 2013 both for the EU as a whole and for many individual EU countries (Chart B). However, the index remains well below 100 in nearly all EU countries. This means that a majority of those surveyed are still not optimistic that market conditions will improve in the short term. Germany and the UK continue to stand out as countries where there is a higher level of confidence about future prospects.

The Citigroup Eurozone Economic Surprise Index fell very sharply between the end of February and end of May. This index tries to capture how well the data is coming in relative to economic expectations. At the end of February 2013, the index stood at +70 as most data was exceeding expectations at that time. However the index fell like a stone to -53.2 at the end of May 2013. This was due to publication of a relentless series of very poor numbers across the euro-zone on economic growth, employment, manufacturing, industrial production, and retail sales. The CESI improved a little in June 2013. However the index has yet to establish a meaningful upward trend.

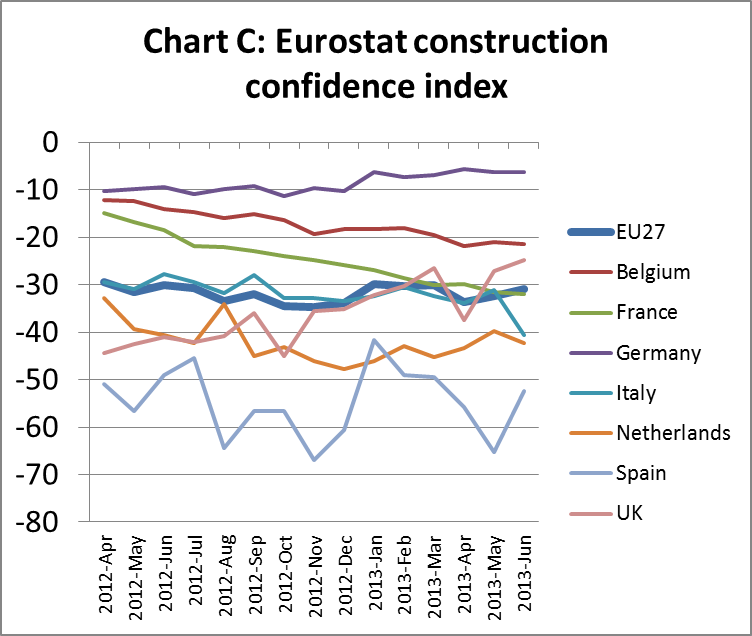

Indicators relating to the construction sector, of most direct relevance to wood consumption, remain very negative. The Construction Confidence Index was flat at -30 during the first 6 months of 2013 (Chart C). This shows that construction professionals are very pessimistic about the likelihood of an upturn any time soon.

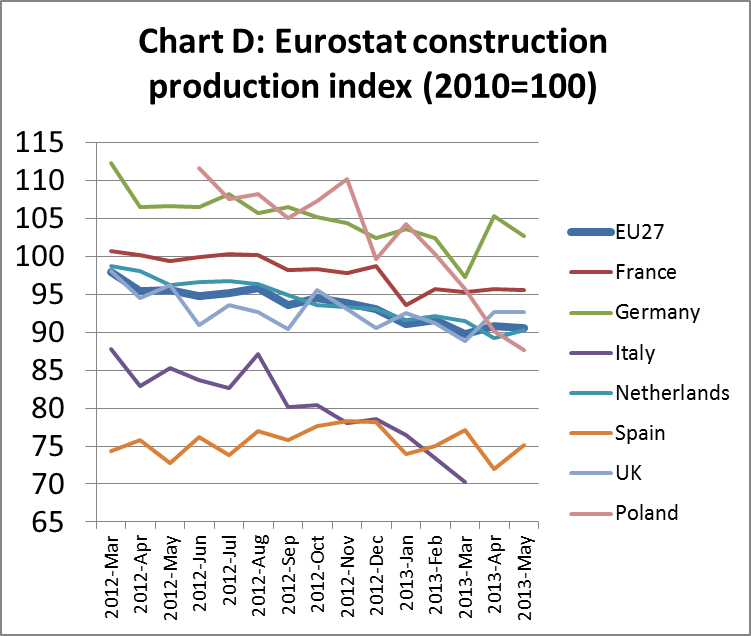

The European Construction Production Index, which measures actual output in the sector, declined continuously between 2010 and March 2013 and remained flat at a low level in April and May 2013 (Chart D). Construction output across the EU in the first 5 months of 2013 was only 90% of the depressed levels registered in 2010.

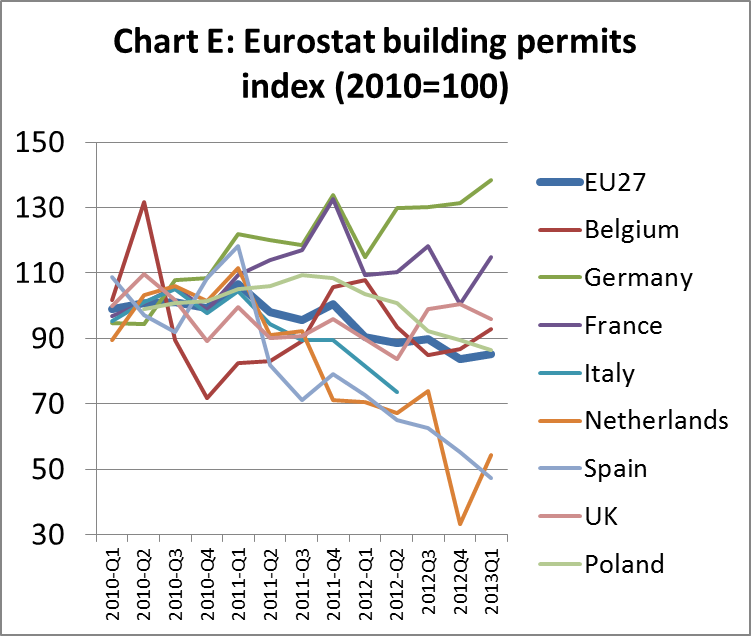

The latest data for the EU Building Permits Index shows there was a very sharp fall in the number of construction permits issued across the EU in the last quarter of 2012 and that permits remained at a low level in the first quarter of 2013 (Chart E). This strongly reinforces the view that construction activity is likely to be even weaker during 2013 than in the previous year. Building permits remain at historically very low levels in Spain, Netherlands, and Italy and have declined sharply in Poland. However, building permits have remained robust in Germany and recovered slightly in France during the first quarter of 2013.

European parquet flooring consumption weakens once more

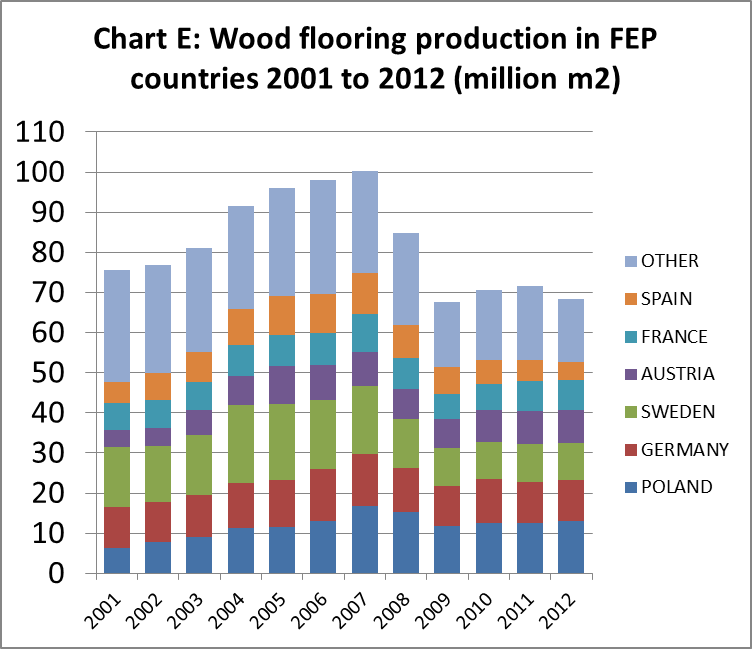

At their annual meeting in June, the Federation of the European Parquet Industry (FEP) reported that wood flooring production in FEP member countries declined in 2012 by 4.7% to 68.3 million m2 (Chart F). This reversal meant that production in 2012 was no more than in 2009 at the height of the global financial crises. Production increased a little in Poland, Germany and Austria last year, but weakened in Sweden, France, Spain and Italy.

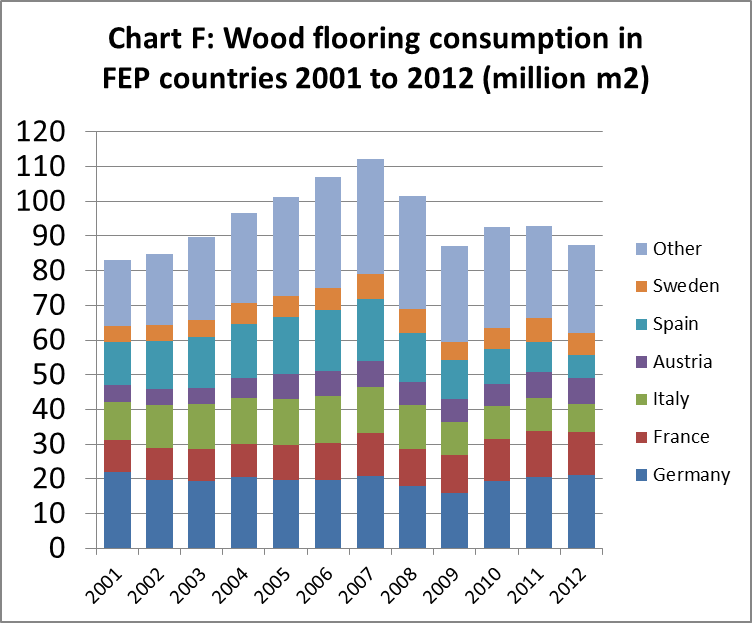

Consumption in FEP member countries followed a similar trend, declining 5.9% to 87.5 million m2 during 2012 (Chart F). Again this was a turnaround after two years of recovery in 2010 and 2011 and consumption in 2012 barely exceeded that of 2009. German and Austrian consumption continued to recover in 2012, but consumption fell sharply into Spain and Italy and also weakened in France, Scandinavia and Switzerland.

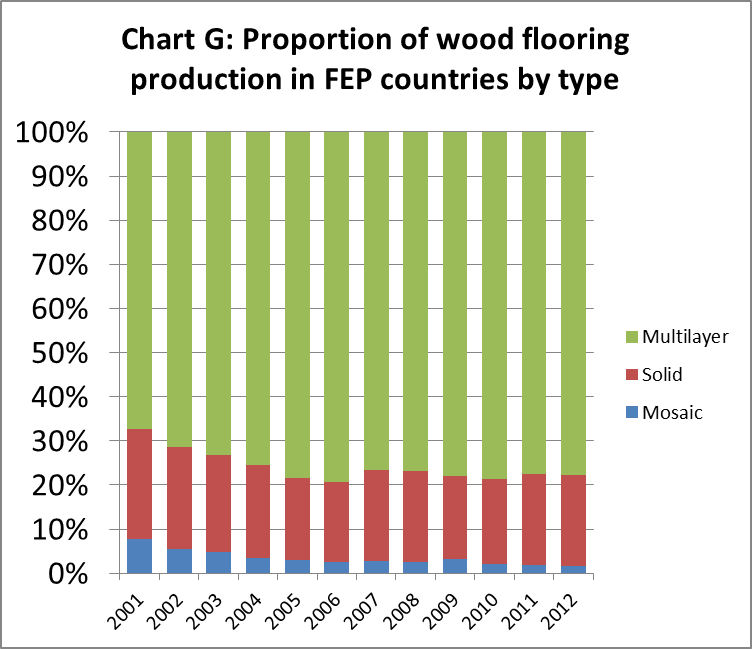

There was little change in the proportion of wood flooring output by product type between 2011 and 2012 (Chart G). Multi-layer flooring continued to dominate, accounting for 78% of the volume of all wood flooring manufactured in FEP member countries during 2012. Solid wood flooring accounted for 21% of production volume and mosaic flooring for 2% in 2012.

The most obvious trend in species usage during 2012 was a further increase in oak’s dominance, mainly at the expense of tropical hardwood. In 2012, oak accounted for 70% of all flooring production in FEP member countries, up from 58% in 2008. In the last five years, share of tropical wood has declined from 15% to 6%. Over the same period, share of temperate species other than oak has fallen from 28% to 24%. These include ash, beech, pine, and maple in descending order of importance.

The increasing domination of oak is explained by a combination of: consumer preference for a species perceived to be characterful and “high quality”; the development of a wide range of new staining and other treatment techniques that have hugely increased the range of looks that can be achieved with oak; wide availability from domestic and North America sources; rising prices and declining availability of tropical hardwoods; and environmental campaigns targeting tropical hardwoods.

European laminated flooring sector suffering from over-capacity and competition

Europe’s laminated flooring sector, while still dominant in global terms, has been struggling during the global financial crises. In addition to declining consumption, the sector has come under intense competitive pressure from manufacturers in other parts of the world, particularly China.

The laminate flooring sector is also suffering from overcapacity which has put considerable pressure on prices. While consumers benefit from very low prices, retailers now need to shift huge volumes in order to profit from sales of laminate flooring. As a result distributors are looking for higher margin products. At present there’s growing interest in Luxury Vinyl Tiles (LVT) which are increasingly viewed as offering a better combination of quality, value and margin.

The European laminate flooring industry is responding, partly through down-sizing, partly through development of new higher value product lines, and partly through marketing efforts emphasising the specific performance and environmental benefits of laminate flooring. The laminate market has become split between the low-end product selling for less than €10 per square meter and the upscale product that offers bevelled edges, handscraping, wire brushing and exotic designs priced in excess of €20 per square meter.

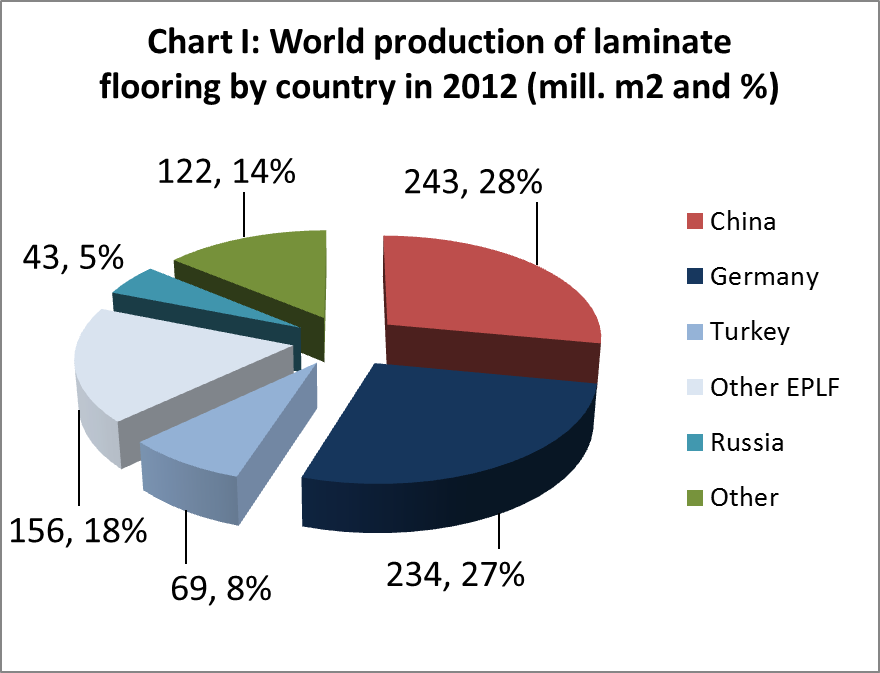

At their annual meeting in June 2013, the Association of European Producers of Laminate Flooring (EPLF) discussed the global laminate market noting that, in their estimation, China recently overtook Germany as the largest single manufacturer of laminate flooring in the world. EPLF estimate that of total global production of around 870 million m2 in 2012, China contributed 243 million m3 (28%) and Germany 234 million m2 (27%). However taken together, the 22 member companies of the EPLF (all located in Europe including Turkey) accounted for 460 million m2 in 2012, 53% of global production (Chart I).

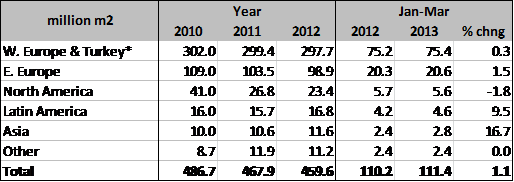

EPLF data shows that sales of laminated flooring by EPLF members fell sharply during 2011 and 2012 (Table). During these years, low and declining sales in Europe and North America were only been partially offset by increased sales to Turkey, Latin America, Asia and Russia.

During the first quarter of 2013, overall global sales by EPLF members stabilised at the lower level achieved in 2012. This year sales have continued to decline in Germany, France, the UK, the Netherlands, Spain, Austria, and the USA. However rising sales in Sweden, Italy, Latin America and Asia have been just sufficient to offset weak markets elsewhere.

Table: Global sales of laminate flooring by EPLF Members

In 2012, for the first time, EPLF members also provided sales figures by product thickness. Around 45% of all EPLF laminate flooring sales were products with a thickness of less than 7.5mm, around 45% were 8mm to 9mm thick and the remaining 10% had thickness in excess of 10 mm. Products 8mm to 9mm thick are the biggest sellers in Eastern Europe and Turkey. In Western Europe, and Germany in particular, customers prefer products which are thinner than 7.5mm.

European laminate producers complain about Chinese competitors in Russia

Competition in the laminate flooring market is intense in all regions. However, EPLF expressed particular concern about competition from Chinese manufacturers in Russia in a press statement issued after their June meeting: “It is with some concern that the EPLF is seeing the Russian laminate flooring market being flooded with mass produced Chinese goods, which also do not meet high European standards. There is a risk that these products will damage the reputation of laminate flooring amongst Russian customers. The EPLF has therefore decided to initiate a quality campaign to raise awareness of the high-quality products of European manufacturers and to distance itself from inferior cheap products”.

The statement goes on to claim that European laminate flooring products “are environmentally-friendly, high-tech products, manufactured in a sustainable manner. In other words, they are gentle on resources and socially responsible. European quality is synonymous with long-lasting floors, innovative products for enhanced interior comfort, leading design for versatility and individuality, good value for money and, importantly, ecologically-sound products which guarantee safety for customers and their families”.

Mounting challenge from “Luxury Vinyl Tiles”

Laminate flooring is under intensifying competitive pressure from LVT. Made primarily from polyvinyl chloride resins and plasticizers, LVT is being heavily promoted as a versatile, relatively low cost but nevertheless “luxury” product. LVT manufacturers and retailers claim it offers good cleaning and maintenance, easy installation, good acoustics and high levels of durability. It’s also claimed that new decorative films for LVT take advantage of higher-resolution ‘HD’ printing and other technologies to produce increasingly realistic wood, stone and tile looks covering a myriad of designs and textures.

In countering the threat from LVT, the wood laminates industry is placing considerable emphasis on the relative environmental benefits of a wood-based flooring product. European laminates manufacturers now make far-reaching claims that products are made exclusively from either wood sourced from sustainably managed domestic forests, or recycled material from the timber industry. Even the decorative finishes are being printed on certified paper with a high proportion of recycled material and natural water-based inks. They are using eco-friendly resins as binder and increasing use of recycled paper to make packaging. They claim that laminate flooring manufactured in Europe is low-emission and far outperforms legal limits for formaldehyde and VOCs (volatile organic compounds).

To back these claims, European laminate manufacturers are investing in Environmental Product Declarations (EPDs). Most laminate flooring manufactured by EPLF members now comes with an EPD prepared in line with the ISO14025 standard for “Environmental labels and declarations”.

Laminate design trends

The “wood look” remains very dominant in the laminate flooring sector comprising perhaps 80% of all sales. Amongst wood types, the laminates sector follows the “real wood” sector so far as oak is the preferred look.

According to EPLF “Oak is always popular with designers. No other laminate flooring decor offers as many different possibilities as this expressive domestic timber that has been a dominant mainstream player over the last few years – and will continue to be so. Natural, light shades, very rustic textures, subtly altered vintage looks – oak offers an impressive range of possible designs”.

However, the laminates sector is also trying to differentiate itself from the “real wood” sector by emphasising its ability to offer a huge variety of “experimental timber looks”. Increasingly radical designs are being promoted which combine the grain of different wood species with unusual and bold colours and other decorative features. The laminates sector is exploiting its ability to offer a much wider range of board lengths and widths at competitive prices than for the real wood product.

There’s also much emphasis in the sector on improving the texture and feel of laminate flooring to produce a more “authentic” look. This is of increasing concern to modern architects and consumers and one factor that continues to give real wood a genuine competitive edge.

PDF of this article:

Copyright ITTO 2020 – All rights reserved