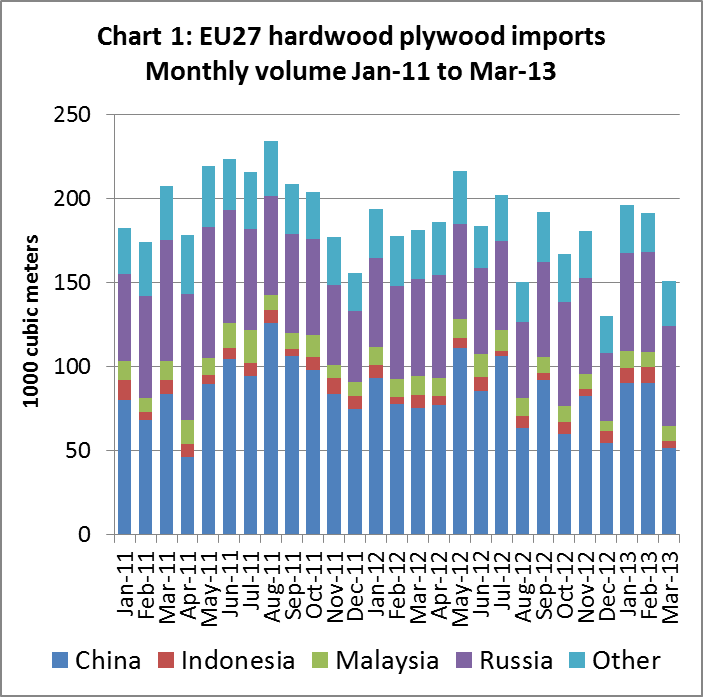

Monthly data for EU27 hardwood plywood imports suggests that European trade in this commodity is coming under pressure from the combined effects of the recent slowdown in European construction and the enforcement of the EU Timber Regulation (EUTR) from 3 March onwards (Chart 1).

The latest data – to the end of March 2013 – is the first to record trade levels immediately before and after the EUTR deadline. The data shows a fall in imports in December 2012 – a much sharper dip than is usual in the run up to the holiday season – followed by a surge in imports in January and February 2013. Then, between the second and third months of the year, imports fell by over 20% to only 150,000 m3 in March 2013. This is significantly lower than normal for the time of year.

Overall the data supports the narrative that European consumption of plywood is weakening with declining construction activity, particularly since the middle of 2012. However EUTR encouraged a surge in imports in the weeks before enforcement, so that stocks built up in excess of market demand. This surge tailed off following introduction of EUTR.

The data shows that there was a particularly large increase in imports from China in January and February 2013, but that imports from this country fell by 40% in March. The main question now is whether the March downturn is indicative of a long term trend or merely short-term indigestion after the rush of imports in the opening weeks of 2013.

There’s some uncertainty over just how long it will take to work through the excess stock of Chinese plywood built up in Europe in advance of EUTR enforcement. In the latest TTJ article on the UK plywood market, one importer claims that “a lot of that stock has gone – I don’t think there is as much as people think there is”. Another added: “there have been stocks, but holes are appearing. Supplies of thin panel in particular are not plentiful”.

Larger Chinese manufacturers adapting quickly to EUTR

It’s still early days, but so far the signs are that the downturn in imports from China may be short lived. The larger Chinese manufacturers are already demonstrating strong capacity to adapt to the new market requirements. The most immediate change may be just a switch in the face veneers used by these manufacturers, away from species perceived in Europe to be “high risk” (such as bintangor or Russian birch), in favour of species perceived to be “low risk” such as dyed poplar or certified meranti or sapele.

Some of the smaller manufacturers in China may well struggle now to compete in the EU market as buyers focus more on those manufacturers that have chain of custody and are geared up to provide the required evidence of legality. These changes are already increasing prices of Chinese plywood products to European buyers.

EUTR is tending to reinforce other commercial trends that were already limiting opportunities for smaller manufacturers and encouraging higher prices for Chinese plywood. These include higher quality standards with imposition of the EU’s Construction Products Regulation (CPR) from 1 July 2013 and rising labour and material costs in China itself.

In coming months, China may become slightly less dominant in the EU plywood market. However it’s likely to maintain its position as the largest single supplier.

Chinese plywood prices may now be rising for EU buyers, but they remain highly competitive. For example, European CIF prices for 18 mm C=BB/CC Mixed Light Hardwood plywood from China were around $380/m3 in the last quarter of 2012. Prices for comparable Chinese plywood with an FSC certified sapele face and eucalyptus core now stand at around $420-440/m3. Even these prices are still $100/m3 less than those for 18 mm BB/CC meranti from Malaysia and $150/m3 below prices for Indonesian lauan plywood.

Exporters in other countries wishing to regain market share for tropical hardwood plywood in the EU market need to do more than provide new forms of legality verification at a competitive price. They need to focus at least as much on the considerable quality and technical performance benefits of their products. New opportunities might arise following introduction of the CPR which implies much wider and more effective mandatory enforcement of CE Marking standards, including conformance of structural plywood to the EN13986 standard.

Malaysia sees short-term benefits from EUTR

European importers report that Malaysia has seen some short-term benefit from implementation of EUTR, with demand for PEFC certified BB/CC grades of meranti-faced plywood rising a little in recent months. Some EU buyers appear at least temporarily to have switched away from Chinese hardwood plywood products due to lack of confidence in assurances offered on legal status of hardwoods imported into China. In recent weeks, European importers have been able to source PEFC certified Malaysian hardwood plywood without difficulty, although the switch to Malaysia has meant they are paying significantly higher prices than they used to in China.

Slowdown in imports of Indonesian plywood

Comparatively high prices are currently deterring European buying of Indonesian plywood, despite these products being well known for their quality and now arriving in the EU with V-Legal documents.

It’s notable that EU imports from Indonesia declined from 9800 m3 in February 2013 to 4400 m3 in March 2013. This trend may be driven mainly by weak European consumption, but could also be related to Indonesia’s rolling out of the V-legal system for all exports to the EU during the first quarter of 2013.

According to the German timber trade journal EUWID, most Indonesian plywood imported into the EU was formerly classified under tariff code 44123190 which is subject to a 3.5% import tariff. However more accurate information on species content supplied with the V-legal documents has led to some product being reclassified as 44123110 subject to a higher tariff of 6.5%. The latter tariff applies to plywood faced with various higher value tropical hardwoods including several Asian species such as dark red meranti, light red meranti, and white lauan.

Very slow European market for okoume plywood

Early optimism that EUTR might feed through into improved demand for okoume plywood manufactured in Europe or in Africa has so far been disappointed. Manufacturers of okoume plywood have been trying to force through price increases in Europe in an effort to widen very tight margins. However European demand for okoume plywood remains very weak. There was a brief increase in European buying in the opening months of the year, but this has fallen away again following manufacturers’ price rises introduced from April onwards

Okoume plywood consumption in the main markets of France and the Netherlands has been very slow this year. While there are reports of delivery delays for okoume plywood manufactured in Gabon, low consumption has meant that supply has not been a significant issue for the European trade.

European plywood manufacturers under intense pressure

EUWID report that Europe’s domestic plywood industry has been struggling seriously in the face of mounting costs and the intense competition from overseas suppliers. Key problems have been high roundwood prices and wage costs relative to other parts of the world. With the added pressure of weakening consumption in the European construction sector, profit margins are now being reduced to unsustainable levels. Some suppliers have been forced to file for insolvency, while others have had to postpone or cancel plans for investment in new plant and machinery.

According to EUWID, the problem has been especially difficult in the European poplar plywood sector which added a significant amount of new production capacity just before the economic downturn. For example, one Spanish plywood producer completed two investment projects in Spain and France in mid-2009 which boosted the group’s poplar plywood manufacturing capacity from 60,000 m3 to 210,000 m3. However this came on-stream just as consumption was falling and led to a significant decline in prices and much lower margins across the whole industry.

Europe’s okoume plywood market has also suffered badly from the long-drawn out failure of the French producer Plysorol. Various investors had shown an interest in the company, according to EUWID primarily in order to take control of Plysorol’s concessions in Gabon. After these efforts failed, the company eventually went into liquidation in September 2012. Since then the company’s remaining stocks have been sold off at a series of auctions, the latest in May, undermining demand for other suppliers’ products.

Russian birch plywood prices rising on the back of US demand

In recent years, Russian birch plywood has been an important competitor for tropical and Chinese hardwood plywood, notably as filmed-faced product which has a very wide range of applications. Current European demand for birch plywood is steady at similar levels to last year. Russian producers are pushing prices higher, partly to offset rising raw material costs, but also due to increased demand in the United States. This follows U.S. imposition of anti-dumping duties on Chinese plywood. European delivery times for Russian birch plywood are now becoming more extended – stretching to 6 weeks – in response to rising demand in other global markets.

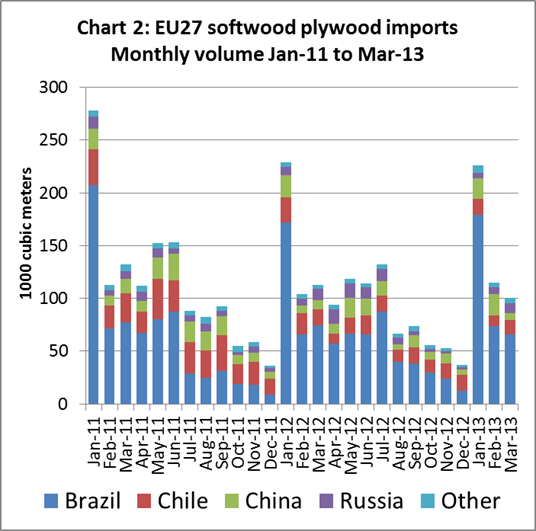

Softwood plywood

EU imports of softwood plywood during the opening months of 2013 followed a slightly different pattern to the previous year (Chart 2). EUTR may have been partly responsible.

This year the usual January surge in imports on opening of the EU’s annual quota was at the same level as in 2011. Total imports in February 2013 were also at a similar level to February 2012, but with a larger volume from China offsetting a decline from Chile. In March, after enforcement of EUTR, imports fell away quite significantly, notably from China and Brazil.

By the end of March 2012, total softwood plywood imports into the EU for the year had reached 441,000 m3. Around two thirds of the 650,000 m3 duty-free quota was already accounted for. Of total imports during the first quarter of 2013, 72% was from Brazil, 9% from Chile, 11% from China and 5% from Russia.

European consumption of softwood plywood is currently slow. Brazilian exporters of elliotis pine plywood have been raising prices in response to tight log supply and good plywood demand in the United States and Caribbean. However sales prices in Europe have been declining as importers are struggling to sell on landed stocks. The usual seasonal increase in demand in April and May has been much slower than in previous years.

Decline in European production of composite panels

European production of wood panels other than plywood has also been hit by the downturn in construction and furniture consumption. EUWID, drawing on preliminary data from the European Panel Federation, reports that European output of particleboard, MDF/HDF and OSB fell by 5% to 43.1m m³ last year.

European particleboard production declined 5% to 28.5m m³ in 2012. Particleboard production has now fallen 32% from the peak level of 37.8m m³ in 2007. Around 66% of the particleboard produced last year was used in furniture production, 23% in construction and 11% in other applications.

MDF/HDF production declined 6% to 11m m³ last year after growing slightly in 2010 and 2011. OSB output was down 2.3% compared to the previous year to stand at 3.6m m³.

PDF of this article:

Copyright ITTO 2020 – All rights reserved