The European economy may finally be exiting its longest post-war recession but entering a period of stagnation or very weak growth at best, latest data suggest. The purchasing managers index (PMI) for the euro zone rose to a 15-month high of 48.9 in June. Germany’s PMI rose 0.7 point to 50.9, signalling modest growth. France’s score also rose but remained below 50.

PMI scores of below 50 signal falling business activity, so even June’s improved reading points to a slight drop in euro-zone activity in the second quarter. The PMI suggests that any recovery in coming months will be too weak to halt the rise in unemployment in Europe or to alleviate the region’s public and private debt burdens. However, the PMI also suggests that, following a 0.9% (annualised) fall in euro-zone GDP in the first quarter of 2013, the pace of economic contraction probably slowed in the second quarter. Unemployment across the euro-zone is still at 12.2% and is expected to rise for the rest of this year. The pace of job-cutting accelerated in June, according to the PMI survey, despite the overall improvement in business sentiment.

Other surveys of business sentiment and industrial production have been more upbeat. According to the European Commission, euro-zone consumer confidence rose close to a two-year high in June, though it remained well below its long-term average.

Overall, the signs are that recovery in Germany is trickling down to other large economies in the region including France, Italy and Spain. The hope among many Europeans is that stronger global demand will spur growth in export-sensitive Germany, which accounts for around 30% of euro-zone GDP. That, in turn, may boost exports from its European neighbours and provide an overall boost to business confidence.

But no-one is expecting a rapid turnaround. There are very significant downside risks. Still-worsening joblessness will continue to push up spending on unemployment and other benefits in Spain, France and Italy. Small businesses continue to struggle against high borrowing costs. The lack of spending by businesses and consumers will hamper tax receipts. Without expanding economies, debt burdens will keep on rising as a share of GDP, even if annual budget deficits decline. The region remains very vulnerable to potential shocks, such as an economic slowdown in China which would seriously dent a vital source of export demand for European products.

Meanwhile the euro recently hit six-month highs against a broad basket of currencies. This has been a boon to wood importers, encouraging a slight uptick in purchases to boost depleted stocks. However, the strong euro, if it persists, spells trouble for the region’s exporters. A major concern when European domestic consumption is so weak.

European construction forecasts down again

The downturn in European construction has been deeper and continued for much longer than expected, but it should finally hit bottom during 2013. This was the conclusion of the Euroconstruct network of European construction forecasters at their June 2013 conference. Euroconstruct revised its expectations for the construction market in the 19 member countries[1] in 2013 to a decline of 3% – deeper than the 2.5% decrease it forecast at the end of last year. The outlook for Europe’s construction output in 2014 has also changed, from expected growth of 1% to an increase of just 0.5%. Growth for 2015 of 1.7% is currently forecast.

The strongest forecast declines in construction output in 2014 are expected in Spain (-7.7%) and Portugal (-3.5%), while the largest increases are predicted for Norway (4.6%) and Sweden (3.5%). In terms of sectors, residential construction shows the most promise for a recovery between now and 2015. Output is expected to decline 2.2% this year before returning to 1.1% growth in 2014, increasing to 2.3% in 2015.

But the outlook for non-residential construction and civil engineering is weaker. Non-residential construction is expected to fall 3.3% this year and a further 0.3% in 2014, before recovering to 1% growth in 2015. Civil engineering output is expected to drop 3.5% this year before returning to 0.4% growth in 2014 and 1.4% growth in 2015.

Tropical hardwood imports decline even further in 2013

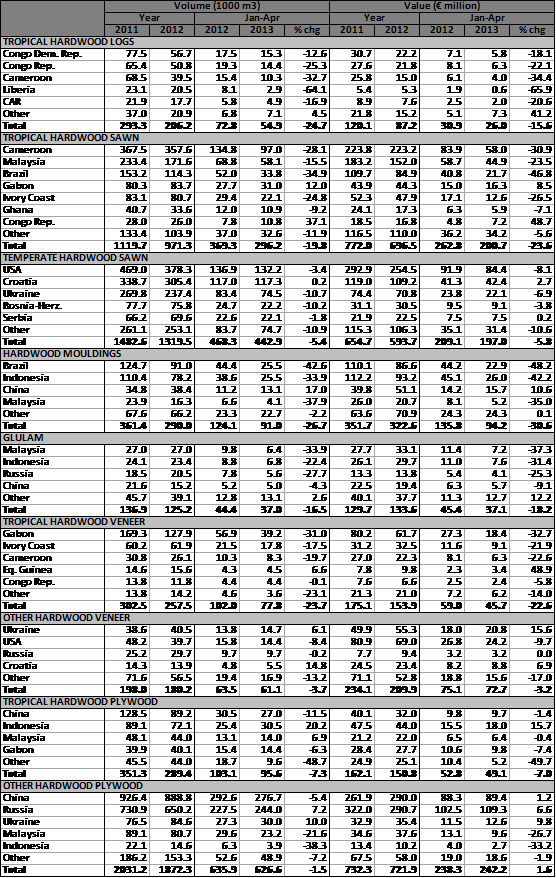

European imports of tropical hardwood products have maintained their downward trajectory this year (see Table). This trend is almost universal, affecting all product groups and all major supply countries. A large part of the explanation lies in broader economic trends which continue to dampen down European consumption. However, lack of lack of supply has also been a factor during 2013. This is due to political and infra-structure problems in parts of central Africa, numerous mill closures, reductions in log harvests, and diversion of logs and lumber to other more buoyant markets elsewhere, notably China.

Another contributing factor may have been enforcement of the EUTR from 3rd March 2012 which has placed new demands on EU importers to seek evidence from all suppliers that there is negligible risk of any wood being derived from an illegal source. This is increasing procurement focus on the relatively limited number of exporters offering certified and independently verified tropical wood. It is too early to assess the full impact of this measure, but it may be significant that total EU import of tropical logs, sawn, veneer and plywood was around 12% higher in the January-February 2013 period (281000m3), immediately before EUTR enforcement, than in the March-April 2013 period (243000m3). In previous years, EU imports of tropical wood in the first four months of the year tend to be distributed more evenly.

During the first four months of 2013, EU27 imports of tropical hardwood logs were only 55,000 m3, 25% less than the same period in 2012. Imports fell without exception from all the main supply countries, including Congo DR, Congo Republic, Cameroon and Liberia. Due to strong Asian demand for logs and tightening controls on log exports by African countries, prices have been high relative to sawn lumber offering little incentive to European buyers to import logs. Europe’s formerly large plywood manufacturing sector based on tropical logs appears to be fading fast.

EU imports of sawn tropical hardwood were 296,000 m3 in the first 4 months of 2013, 20% less than in 2012. After falling below 1 million m3 for the first time in 2012, EU imports of sawn tropical hardwood are unlikely to exceed 900,000m3 in 2013. Imports slowed considerably from Cameroon, Malaysia, Brazil and Ivory Coast during the four month period, but increased from Gabon.

[1] Euroconstruct Member Countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Hungary, Ireland, Italy, Netherlands, Norway, Poland, Portugal, Slovakia, Spain, Sweden, Switzerland, UK

EU27 imports of hardwood products by leading country, years 2011-2012, Jan-April 2012-2013

In recent years, declining EU imports of sawn tropical lumber have been partially offset by rising imports of hardwood mouldings and glulam from developing countries. However sales of these commodities into the EU have also been hard hit by the continuing recession. During the January to April period, total imports of hardwood mouldings and glulam fell 27% and 17% respectively. There were large falls in imports of these commodities from Malaysia, Indonesia and Brazil. However, there was a 17% rise in EU imports of hardwood mouldings from China to 13000m3.

EU imports of tropical hardwood veneer were down 24% at 78,000 m3 in the first 4 months of 2013, with imports well down from Gabon, Ivory Coast, and Cameroon. During the same period, EU imports of plywood faced with tropical hardwood declined 7%. However, in this instance, the decline was mainly attributable to China and Gabon, while Indonesia and Malaysia regained some market share in the first 4 months of 2013.

Losing share to European and other temperate hardwoods

In addition to loss of volume, the data indicates that tropical hardwood is losing share of the EU’s declining market. The downturn in EU imports of hardwood sawn, plywood and veneer during 2012 and the first four months of 2013 was more pronounced for tropical wood than it was for non-tropical wood.

Data just released by the European Organization of Sawmillers (EOS) also shows that production of sawn hardwood in EOS member countries[1] was rising in 2012 at a time when European imports of this commodity were falling. According to EOS, European sawn hardwood production increased 8.2% to 6.22 million m3 in 2012. Production increased strongly in Romania, with other lesser gains in Austria, Belgium, France and Italy. EOS forecast a further increase in production in 2013, but at a slower rate of 1.2%. This suggests that imported hardwood has been losing market share relative to domestically harvested wood.

Despite production growth in 2012, Europe’s hardwood sawmilling sector still faces major challenges. Exports of hardwood logs to countries outside Europe are impacting on the sector, especially in France, Belgium and Germany. Production in 2012 was 20% less than peak levels of 7.7 million m3 in 2006 and 2007. Seven hardwood processing businesses with a combined cutting capacity of 300,000 m3 per year were forced to close or file for insolvency in Germany and France between 2011 and June 2013. Nearly 200,000 m3 of this capacity was a single Germany-based beech sawmill. In a highly competitive market, these sawmills were unable to cover rising log costs by increasing the price of lumber. However these closures in central Europe are being partially offset by rising production capacity in Eastern Europe, notably in Romania.

Oak further consolidates flooring sector dominance

According to the Federation of European Parquet Industry (FEP), wood flooring production in the 17 FEP countries[2] declined 4.7% to 68.3 million m2 in 2012. This compares to peak levels of over 100 million m2 in 2007. Production increased in Austria, Belgium, Germany and Poland during 2012. However these gains were offset by big losses in several areas including Hungary, Italy, Spain, Scandinavia, and Switzerland.

In 2012 oak accounted for close to 70% of all flooring produced by FEP Members, up from 67% in 2011. During the same period, production of tropical wood flooring fell from 7.4% to 6.2%. Since 2008, oak’s share has risen from 58% and tropical wood’s share has fallen from 14.7%. Ash and beech accounted for 6.5% and 6.1% respectively of flooring production in 2012 and share of these species has remained stable over the last 5 years. Maple and cherry are still out of fashion in Europe and accounted for only 2% and 1% of flooring production in 2012 respectively.

[1] EOS member countries: Austria, Belgium, Denmark, Finland, France, Germany, Italy, Latvia, Norway, Romania, Sweden, Switzerland, UK

[2] FEP member countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Hungary, Italy, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden, and Switzerland

PDF of this article:

Copyright ITTO 2020 – All rights reserved