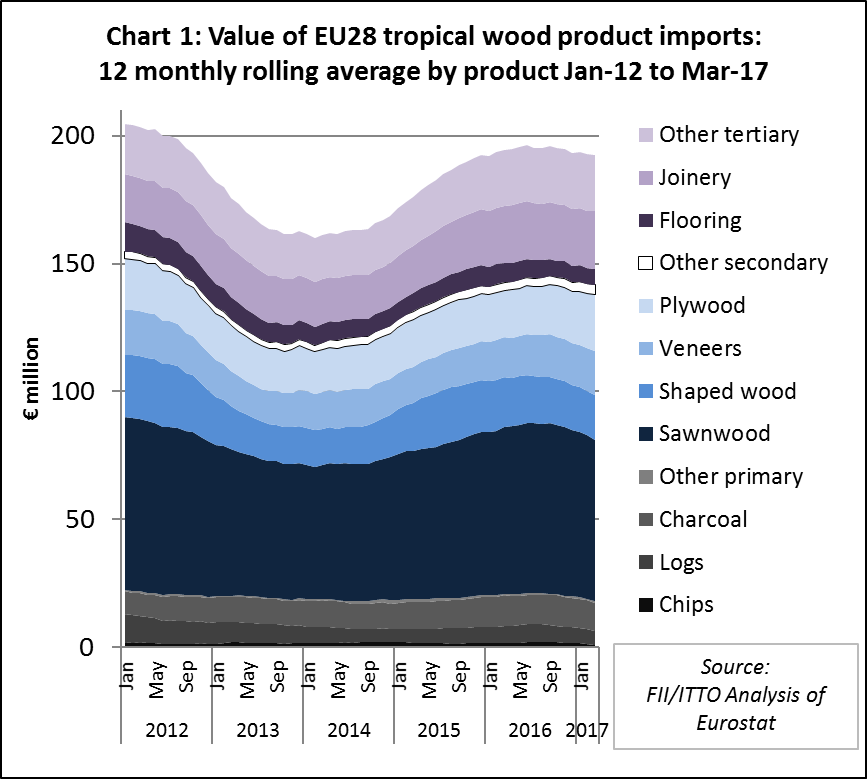

The slowdown in EU imports of tropical timber products registered in the second half of 2016 continued into the first quarter of 2017. Twelve monthly rolling average imports, which peaked at just below €196 million in June 2016, had slipped to €193 million by March 2017. Most of the rise and subsequent slowdown in EU tropical imports in the 24 months prior to 2017 was driven by sawn wood. Imports of other product groups remained relatively more stable during this period (Chart 1).

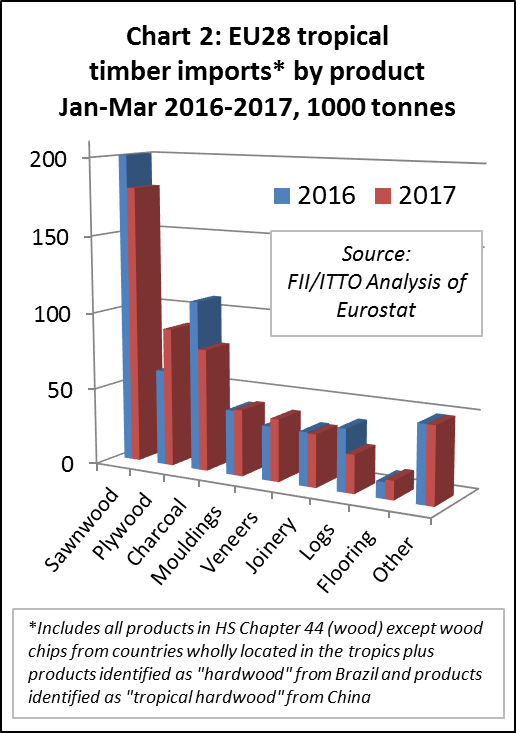

In the first quarter of 2017 compared to the same period in 2016, total EU imports of tropical timber products (all those listed in HS Chapter 44) declined 5% to 553,000 metric tonnes (MT). There was a 10% decline in EU imports of tropical sawn to 180,000 MT, a 28% decline in imports of tropical charcoal to 79,000 MT, and a 39% fall in imports of tropical logs to 25,000 MT. These losses were partially offset by a 45% rise in imports of tropical plywood to 90,000 MT, a 2% rise in imports of tropical mouldings (including decking) to 43,000 MT, a 15% rise in imports of tropical veneers to 40,000 MT, and a 16% rise in imports of tropical flooring to 12,000 MT (Chart 2).

Slowdown in imports recorded in nearly all EU markets

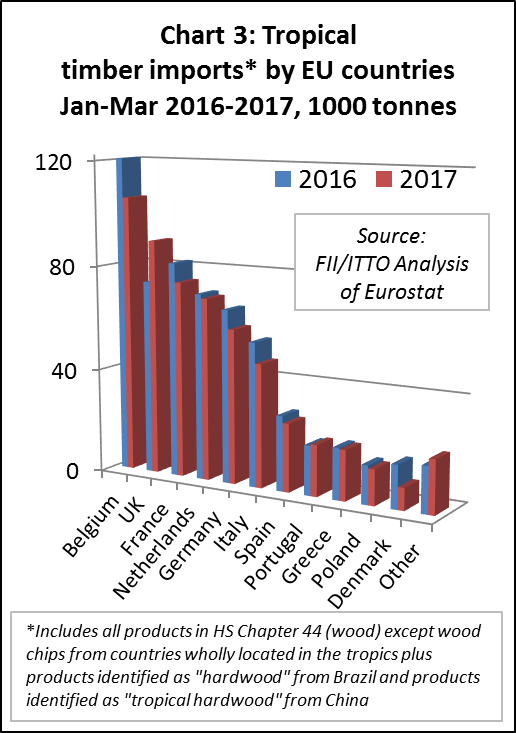

After rising strongly in 2016, imports of tropical timber products in Belgium declined 12% to 106,000 MT in the first quarter of 2017. Imports of tropical timber products into France, Germany and Italy, which have been slipping in recent years, also had a slow start to 2017. In the first quarter, imports declined 8% to 75,000 MT into France, 11% to 59,000 MT into Germany and 14% to 47,000 MT into Italy. After showing signs of recovery last year, imports of tropical timber products into the Netherlands and Spain weakened again in the first quarter of 2017. During the period, imports fell 2% to 70,000 MT into the Netherlands and 9% to 26,000 MT into Spain. (Chart 3).

The UK was the only large EU market for tropical timber products registering an increase in imports in the first quarter of 2017. UK imports increased 21% to 90,000 MT during the period, although a significant part of this gain was due to a rise in imports of tropical-hardwood-faced plywood from China rather than an increase in direct imports from the tropics.

10% decline in EU imports of tropical sawn wood.

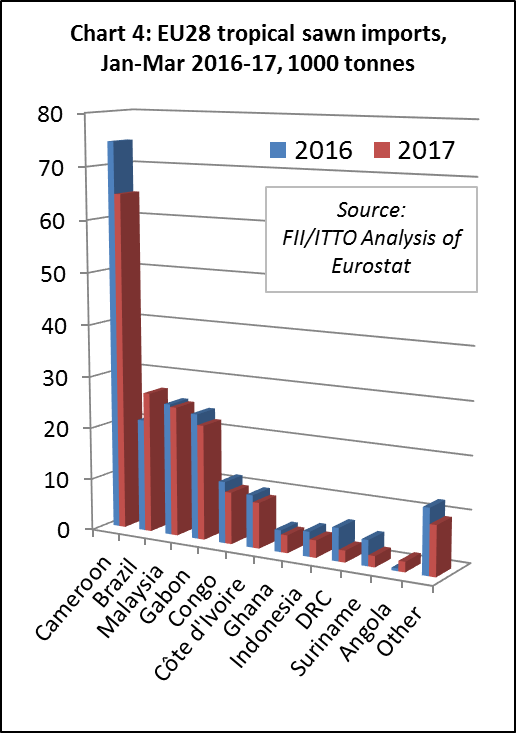

EU imports of tropical sawn wood decreased by 10% to 180,000 MT in the first quarter of 2017. After a significant rise in trade with Cameroon last year, EU imports of tropical sawn wood from the central African country declined 13% to 64,700 MT in the first three months of 2017. Imports also fell from Malaysia (down 2% to 24,900 MT), Gabon (down 8% to 22,100 MT), Congo (down 16% to 9,900 MT), Côte d’Ivoire (down 13% to 8,800 MT), Ghana (down 18% to 3,400 MT), DRC (down 64% to 2,200 MT) and Suriname (down 57% to 2,100 MT). However, after a decline in 2016, EU imports of tropical sawn wood from Brazil increased 25% to 27,000 MT in the first quarter of 2017. Imports from Angola, which were negligible in 2016, increased to 2,000 MT during the period (Chart 4).

In the first quarter of 2017, tropical sawn hardwood imports declined 15% to 62,100 MT into Belgium, 14% to 20,900 tonnes into France, 37% to 14,600 tonnes into Italy, 21% to 10,400 MT into Spain, and 9% to 7,100 MT into Germany. These losses were partially offset by a 10% rise to 14,600 MT into the UK and a 33% rise to 8,100 MT into Portugal.

EU imports of tropical logs resume downward trend

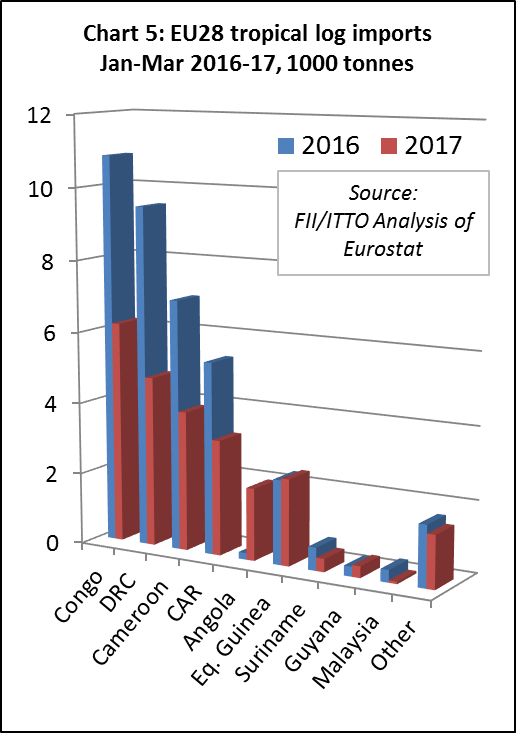

After a brief recovery in 2015 and stasis in 2016, the downward trend in EU imports of tropical logs resumed in the first quarter of 2017. Imports were only 24,700 MT, 35% less than the same period in 2016. EU imports of tropical logs decreased from all the leading suppliers including Congo (down 43% to 6,200 MT), DRC (down 50% to 4,750 MT), Cameroon (down 44% to 3,900 MT) and CAR (down 40% to 3,200 MT). Imports from Equatorial Guinea were level during the period at 2,400 MT and imports from Angola increased from negligible levels to 2,000 MT. (Chart 5).

Most of the decline in EU imports of tropical logs in the first quarter of 2017 was concentrated in France, Belgium and Italy. Imports of tropical logs into Portugal were stable during the period.

Stability in EU tropical decking imports

EU imports of tropical mouldings (which includes both interior mouldings and exterior decking products) increased 2% to 43,000 MT in the first quarter of 2017. A 9% rise in imports from Brazil to 15,300 MT was sufficient to offset a 3% decline in imports from Indonesia to 18,700 MT, and a 39% decline in imports from Malaysia to 2,100 MT. (Chart 6).

Imports of tropical decking increased into France, were stable into Germany and Belgium, but declined into the Netherlands and UK in the first quarter of 2017.

Rising EU imports of tropical glulam

EU imports of tropical glulam, mainly laminated window scantlings, increased 14% to 15,600 MT in the first quarter of 2017. Imports increased from both the leading suppliers, rising 7% to 6,100 MT from Indonesia and 20% to 5,900 MT from Malaysia. (Chart 6).

In the first quarter of 2017 EU imports of tropical glulam increased into all the main EU markets for this commodity, including the Netherlands, Belgium and Germany.

Note that EU import data for the first quarter of 2017 for tropical veneer, plywood, flooring, and wood furniture will be included in the next market report.

Slow recovery in EU construction forecast to continue

Recovery of the European economy is boosting construction output, although the overall growth rate is forecast to remain slow in the next 2 years. These are the main conclusions of the 83rd Euroconstruct Conference hosted in Amsterdam on 8-9 June 2017.

Euroconstruct reported that European construction output expanded by 2.5% in 2016, half a percentage point higher than forecast at the previous Euroconstruct Conference held in Barcelona in November 2016. Euroconstruct now expect the volume of construction output to increase by 2.9% this year and by 2.4% in 2018, both above the previous projections in Barcelona (+2.1% in 2017 and +2.2% in 2018).

The upgraded forecast reflects an economic upswing stronger than expected half a year ago, greatly improved consumer confidence and the continuing loose monetary policy. Overall construction output is expected to increase by 8% in 2016-2018 compared to the 6.5% forecast in Barcelona. Thereafter growth is expected to moderate in 2019 (+2%), slightly below the Barcelona figure (+2.1%).

GDP growth of 1.5% to 2.0% per annum in the period 2017-2019 is projected for the 19 Euroconstruct countries. According to Euroconstruct, the European economy is set to follow a moderate growth path, stimulated by still relatively low oil prices, the weaker euro exchange rate and the Euopean Central Bank’s stimulus policy (quantitative easing).

In most European countries, domestic consumer demand is increasing, stimulated by declining unemployment. Investment has started to pick up, particularly since households and companies can still secure inexpensive financing, and foreign demand is developing favourably.

However, the pace of recovery remains relatively moderate due to the sluggish implementation of economic reforms as well as long-standing weak growth trends. In general, the European economic growth potential is lower than it was before the financial crisis, due to the population ageing and declining productivity growth.

Euroconstruct estimate that residential construction in Europe expanded by 5% in 2016. In the coming years growth in this market segment is projected to become less strong, expanding by 3.7% in 2017, 2.3% in 2018 and 1.7% in 2019. At present, output in the sector is boosted by demographic trends, increasing household income and low mortgage rates.

New residential construction expanded by 8.8% in 2016, and growth this year will also remain very strong (+6.8%). However, a significant slowdown in new residential construction is expected in 2018 and 2019. Growth in residential renovation and maintenance has been slower but is expected to remain consistent at about 1.5% per year.

Non-residential construction is forecast to grow only modestly in the coming years; by 2.3% in 2017, 1.8% in 2018 and 1.2% in 2019. Despite the positive impulse from the growth of consumer demand and relatively high corporate profits, expansion in this sector is hindered in many countries by lack of external financing and the poor financial situation of public authorities. Subsectors where public financing is particularly important – such educational building – is generally lagging other sectors.

Output in civil engineering, after contracting 1.8% in 2016, is forecast to increase by 2% this year and by 3.6% in both 2018 and 2019. Much growth in civil engineering will be concentrated in Eastern Europe, largely due to a new round of EU structural funds.

Construction activity in most European countries is growing consistently at around 2% per year during the 2017-19 period. However, activity is forecast to grow much more rapidly in a few countries, notably Hungary (14.9%), Ireland (7.7%), Poland (5.5%), Czech Republic (4.3%) and Portugal (4.1%).

PDF of this article:

Copyright ITTO 2020 – All rights reserved