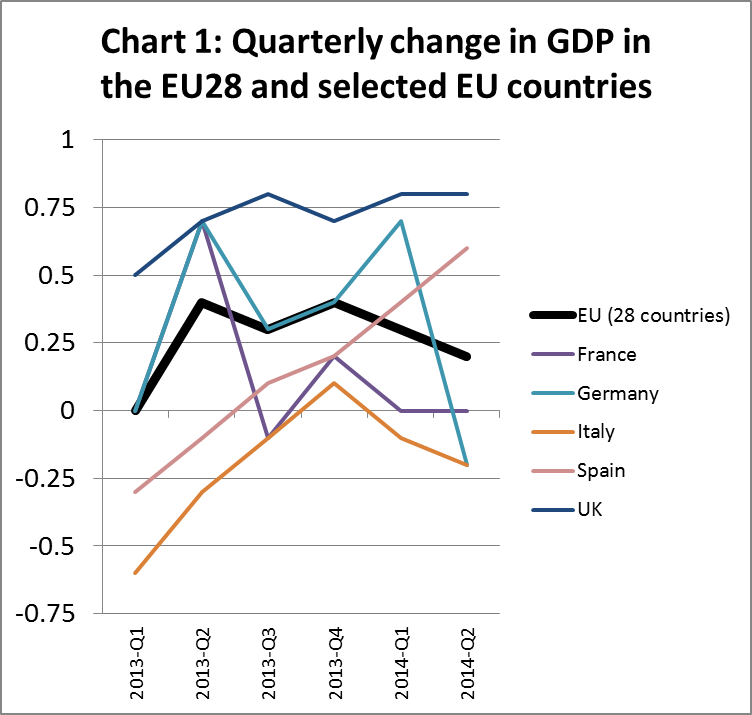

The EU28 group of nations recorded only 0.2% GDP growth in the second quarter of 2014, down from 0.3% in the first quarter (Chart 1). The slowdown was largely due to contraction in Germany, Europe’s biggest economy. After expanding 0.7% in the first quarter of 2014, Germany’s economy slipped 0.2% in the second quarter of the year as foreign trade and investment, particularly in the construction sector, weighed on growth. Meanwhile France recorded zero growth for the second quarter in a row between April and June 2014, while Italy’s economy continued to contract.

Investor and business confidence in central and east Europe has been undermined because of the crisis in Ukraine – straining relations with Russia – raising fears of an even weaker recovery because of the threat of deepening sanctions.

There was better news from Spain where the recovery has continued to gather pace this year, with GDP expanding 0.6% in the first quarter. However, the UK is currently the strongest performer of large European economies, with GDP growth of 0.8% in both the first and second quarters of 2014.

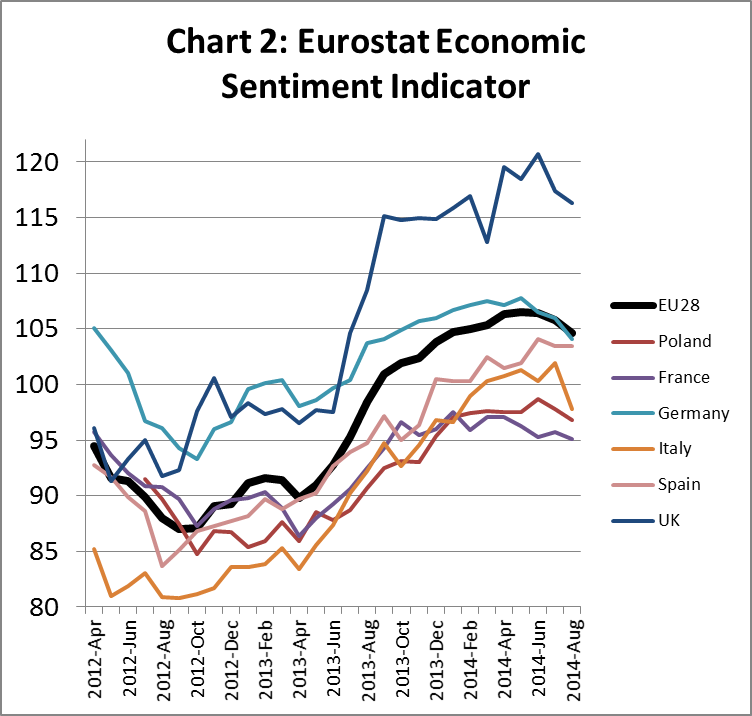

Trends in GDP growth are mirrored in Eurostat’s Economic Confidence Indicator (ECI), a forward-looking index that measures perceptions and expectations in five surveyed sectors (industry, services, retail trade, construction and consumers) in all EU Member States.

The ECI for the EU as a whole was still over 100 in August – indicating above average economic sentiment. However the ECI was declining between June and August this year. The decline is apparent in all the major EU economies with the exception of Spain. Overall economic sentiment remains strong in the UK, moderate in Germany and Spain, but weak and declining in France, Italy and Poland (Chart 2).

European construction flat at a low level

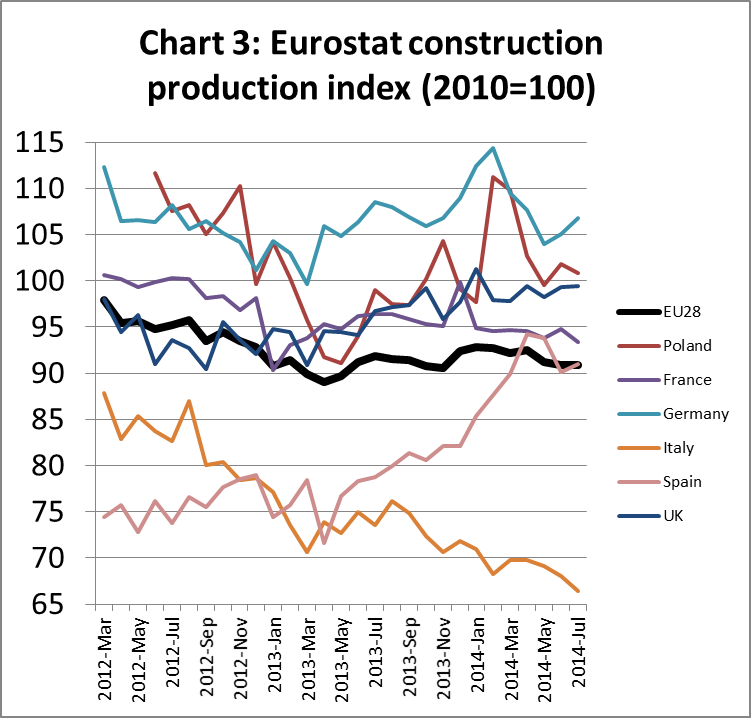

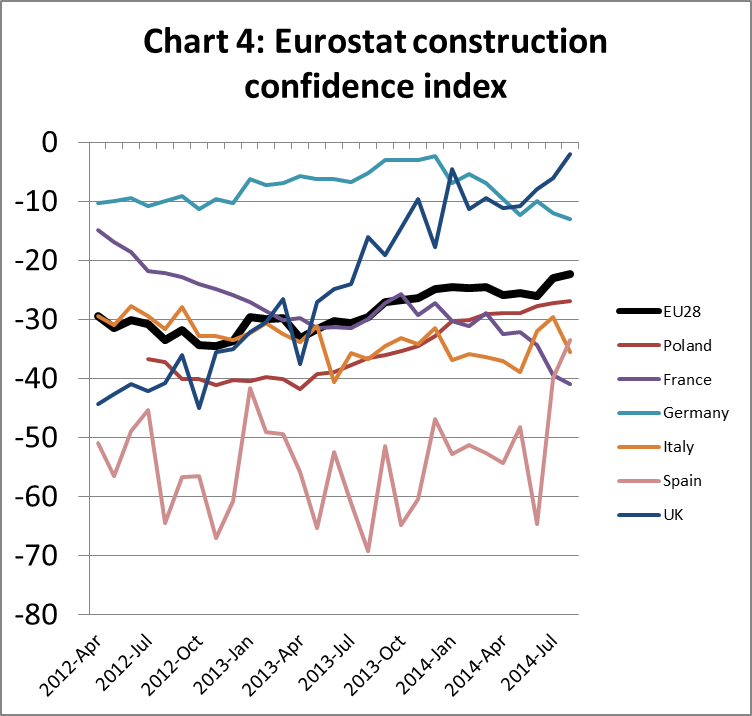

Although overall European construction activity hit bottom in March 2013, it has risen only slowly since then (Chart 3). Activity was strengthening to February this year but has dipped again since April. The Eurostat Construction Confidence Index in the EU is still in negative territory, indicating that many in the industry still expect market conditions to deteriorate rather than to improve in the next 3 months. However the trend in market sentiment is gradually improving (Chart 4).

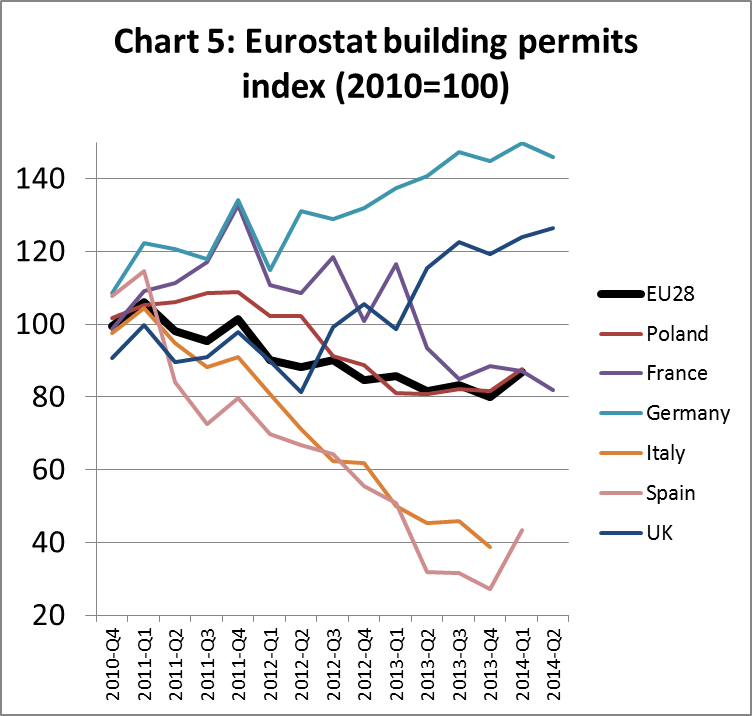

The latest EU-wide data for building permits shows that these were declining until the last quarter of 2013 but experienced an upturn in the first quarter of 2014 (Chart 5).

Rapid improvement in UK construction

Construction industry trends in 2014 have varied widely between EU countries. The UK stands out this year as a country where construction is recovering very rapidly. The UK Construction Products Association (CPA) Summer Forecasts suggest that total construction output will grow by 4.7% in 2014 and a further 4.8% in 2015. Furthermore, this expansion should continue with total construction output forecast to rise 22.2% over the next five years. In the 12 months of end of June this year, UK housing starts were nearly 138000, 22% up on the previous year and the highest level of house building since 2007. Private housing starts are now expected to grow 18% during 2014 and 10% in 2015.

Commercial construction in the UK has also seen a significant resurgence in 2014. This is mainly due to big ticket projects in London, although there are now also signs of improving activity in other parts of the country. The CPA expects commercial offices output in the UK to grow 10% in 2014 and 8% in 2015.

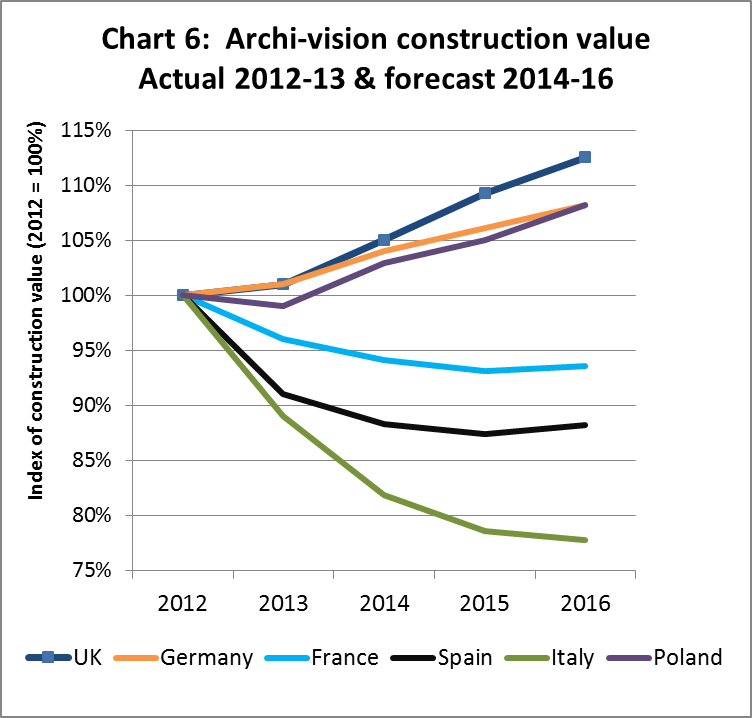

The CPA’s forecasts are slightly more optimistic than those of the 2nd quarter Archi-vision survey of 1600 architects across Europe. For the UK, Arch-Vision predict 4% growth of the UK construction market in 2014 with this rate of growth continuing in 2015 (+4%) and slowing to +3% in 2016 (Chart 6).

Slowdown in German and Polish construction in 2nd Quarter

Construction activity in Germany and Poland has been relatively robust compared to other European countries in recent years. However seasonally-adjusted activity in both countries fell away dramatically in the second quarter of 2014. This seems to be primarily the result of the mild winter which meant that many projects were brought forward into the first quarter. There are indications that construction activity in both countries will recover in the second half of 2014.

The 2nd quarter Archi-vision survey shows that architects’ order books and turnover development in both Germany and Poland were positive in the second quarter of 2014, suggesting plenty of new building projects in the pipeline. Archi-vision forecast continued slow growth in construction activity in both countries between 2014 and 2016 (Chart 6)

Construction activity in Spain has been regaining strength since the start of 2013. The Archi-vision survey indicates two positive quarters for Spanish construction in a row in the first half of 2014 as more architects report increasing order books. Residential building permits have also been rising in Spain this year for the first time since the recession. However, government austerity is still a major constraint in Spain and building permits for non-residential construction have fallen again this year. Arch-Vision forecast that Spanish construction activity will decline 3% in 2014 and a further 1% in 2015, but will recover by 1% in 2016 (Chart 6).

Depressed construction in Italy

Construction activity in Italy remains depressed. The construction production index for Italy continued to decline to July 2014 and is now only 65% of the level of 2010 (Chart 3). The latest data for Italian building permits shows these falling sharply during 2013. The Archi-vision survey shows that, after several bad quarters in 2013, Italian architects experienced another big drop in order book and turnover development in the second quarter of 2014. The confidence indicator for Italian construction is stable, but at a low level (Chart 4). Therefore the outlook for the next twelve months is not promising. Archi-Vision predict that the Italian construction market will fall by 8% in 2014 and a further 4% in 2015. The decline might then level off in 2016.

Construction activity in France declined sharply at the end of 2014 and confidence in the sector remains low. The Archi-vision survey indicated a sharp fall in architect’s order books in the fourth quarter of 2013. The Construction Confidence Indicator for France has continued to fall this year (Chart 4). However, other indicators suggest the market may be close to bottom. French building permits for residential buildings showed a negative trend for the whole of 2013, but stabilised in the first two quarters of 2014. Building permits for non-residential construction registered a slight increase. Archi-Vision forecast that French construction activity will decrease in 2014 (-2%) and 2015 (-1%), but will stabilise from 2016 onwards.

Slow improvement in Dutch and Belgian construction

There are signs of improving construction activity in the Netherlands. The Archi-vision survey indicates that order books and turnover for architects in the country increased in the second quarter of 2014, the third consecutive quarter of growth. Other indicators suggest gradual improvement in both residential and non-residential construction in the Netherlands. This positive development is partly driven by a temporary reduction in VAT on rebuilding, renovation and repair, a measure now due to end on 1 July 2015. Archi-vision predict a small increase in Netherlands construction activity in 2014 (+1%), gradually strengthening in 2015 (+2%) and 2016 (+3%).

In Belgium, the Archi-vision survey also indicates a gradual improvement in construction sentiment and activity since mid-2013. Belgian building permits are rising slowly, mainly due to growth in the residential sector. Archi-vision forecasts consistent 2% per annum growth in Belgian construction during the period 2014 to 2016.

European wood joinery production continues to decline

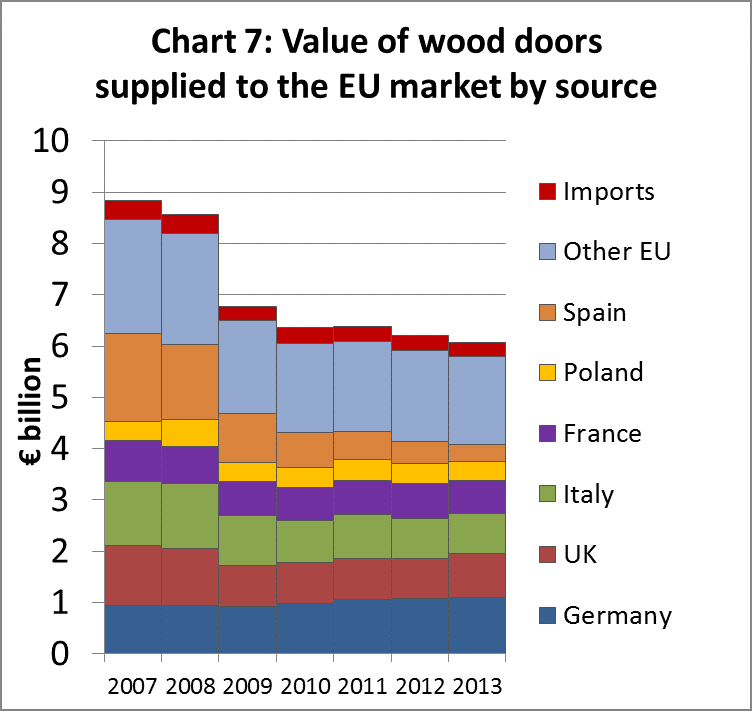

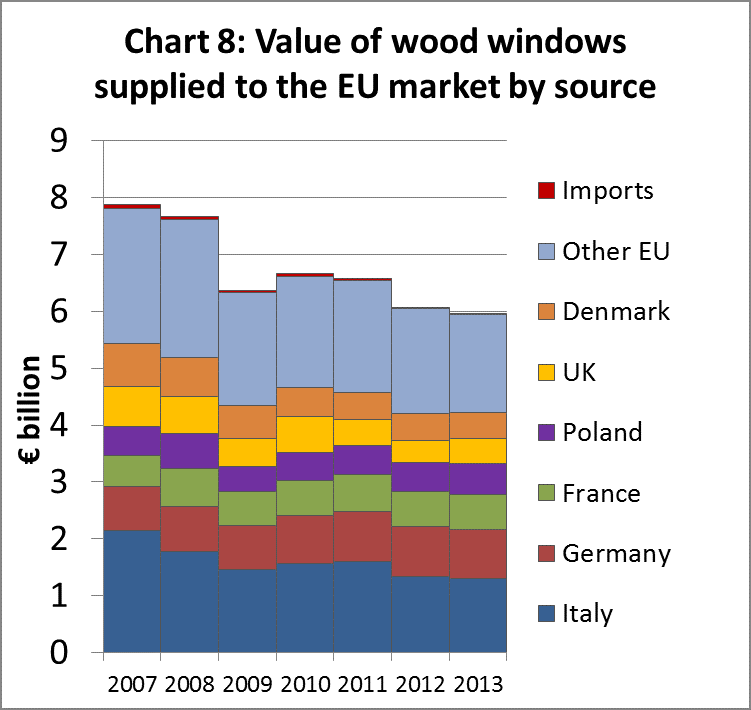

According to newly-published Eurostat data, the total value of EU production of wooden doors and windows declined in 2013. EU imports of both commodities fell even more sharply. Domestic producers increased their already hugely dominant position in these market segments.

EU wooden door production was €5.79 billion in 2013, down 2.1% compared to the previous year (Chart 7). Wooden door production increased in all three of the largest manufacturing countries: Germany (+2.6% to €1110m), the UK (+6.9% to €840m) and Italy (+2.2% to €780m). However this was offset by a sharp fall in production in France (-7.3% to €640m) and Spain (-25.2% to €330m). Production in Poland remained static at €380m.

EU wood window production fell 1.76% from €6.07 billion in 2012 to €5.96 in 2013 (Chart 8). The decline was mainly due to a 3.2% fall in production in Italy, the largest wood window manufacturing country, from €1340m in 2012 to €1300m in 2013. Production in Denmark also continued a long-term downward trend, falling a further 4.7% to €440m in 2013. Production in Germany and France remained stable, respectively €870m and €610m in both 2012 and 2013. However production increased in Poland (+7.1% to €550m) and the UK (+14% to €450m) during 2013.

The downward trend in EU production of wood windows and doors is partly the result of the decline in overall construction activity. This has been particularly pronounced in the new build sector with the result that renovation and refurbishment activity is now a much more important driver of demand. Around 60% of all windows manufactured in Europe are now utilized in the renovation sector and only 40% in the new build sector.

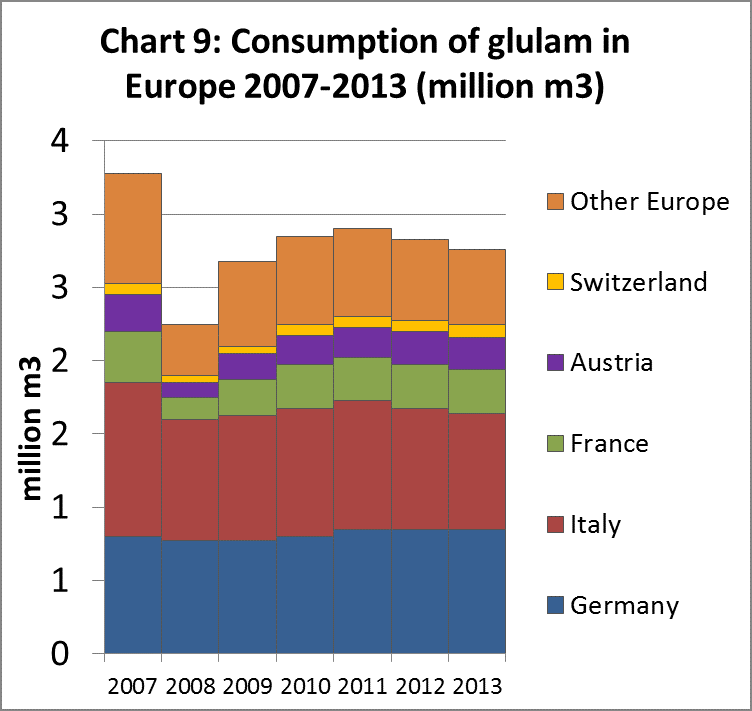

European production and consumption of glulam, used in large dimensions for structural applications and smaller dimensions for windows, also declined in 2013 (Chart 9). Consumption declined 4% in Italy to 790,000 m3 and 2% in Austria to 220,000 m3. However consumption was stable in Germany and France in 2013 at around 830,000 m3 and 300,000 m3 respectively.

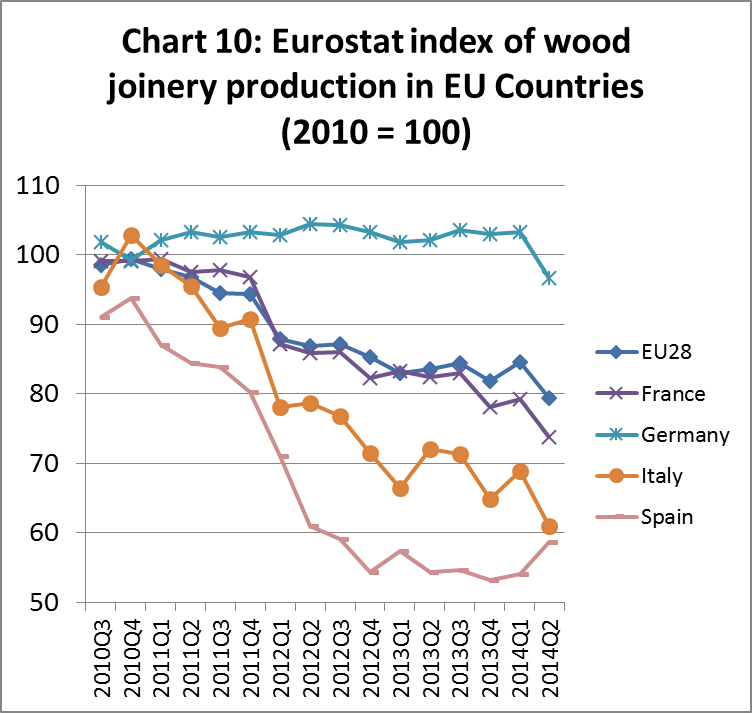

The Eurostat index of joinery production in EU countries (which excludes flooring but includes doors, windows and glulam) shows that production increased slightly in the first quarter of 2014 but then fell away sharply in the second quarter (Chart 10). An upturn in joinery production in Spain and the UK in the second quarter of this year was insufficient to offset a downturn in Germany, France and Italy.

Energy efficiency helps drive joinery sector demand

In addition to underlying economic growth, future development of the construction sector is heavily dependent on legislation to improve energy efficiency of the existing building stock in European countries. Various new measures are expected to encourage more rapid growth in the window and doors sector than in the overall construction sector.

In December 2012, the EU published a new Energy Efficiency Directive requiring Member States to implement most of its provisions by 5 June 2014. The Directive establishes a common framework of measures for promotion of energy efficiency to ensure the achievement of the EU’s 2020 20% headline target on energy efficiency and to pave the way for further energy efficiency improvements beyond that date.

All EU-28 countries are now required to use energy more efficiently at all stages of the energy chain – from the transformation of energy and its distribution to its final consumption. Most countries have identified improvements in existing building stock as one of the most cost-effective ways to meet the Directive. They are therefore introducing building regulations with tighter energy efficiency requirements for windows and doors.

EU Member States are also obliged under the Directive to renovate at least 3% of buildings owned and occupied by the central governments starting from 1 January 2014. They must also include energy efficiency considerations in public procurement so as to purchase energy efficient buildings and products.

Given wood’s strong natural insulation qualities and recent improvements in wood manufacturing technology, the wood window and door sector is well placed to exploit these new opportunities. However, competition is intense and other material sectors are gearing up research and development and marketing activities. The wood industry in Europe faces a particularly strong challenge from the PVC sector which accounts for at least two thirds of the windows market in many EU Member States. Aluminium windows also account for a comparatively large share of the market, particularly in Spain, Portugal and Italy, partly explained by relatively low price for these windows.

A recent report by independent market analysts Ceresana forecasts a consistent rise in demand for window and door units across the EU until 2020 driven by a gradual improvement in construction activity and a significant rise in refurbishment. Solid wood windows are anticipated to lose market share, both to PVC and to wood/aluminium composite windows. However, wood (mainly veneer and laminate doors) is expected to continue to dominate the interior door market and to maintain share (currently around one third) of the external door market.

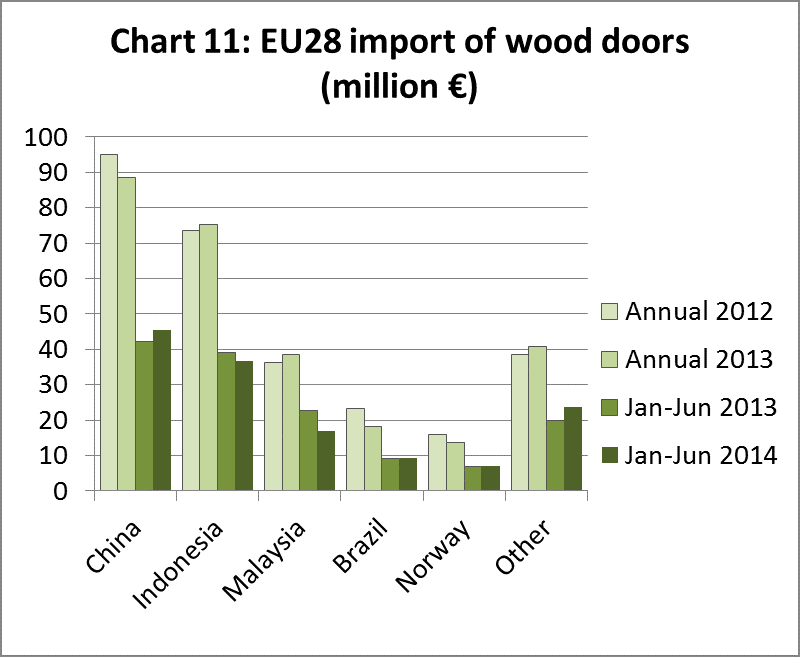

No change in EU imports of wood doors in 2014

Imports of wood doors into the EU were valued at €139m in the first 6 months of 2014, exactly equivalent to the same period the previous year (Chart 11). Imports from China increased 7.6% to €45.6m, but these gains were offset by declining imports from Indonesia (-5.8% to €36.8m) and Malaysia (-25.6% to €16.8m). Imports of wood doors from Brazil remained stable at €9.2m during the period. Imports currently account for around 4.5% of the total value of EU wooden door consumption, down from 5% in 2010.

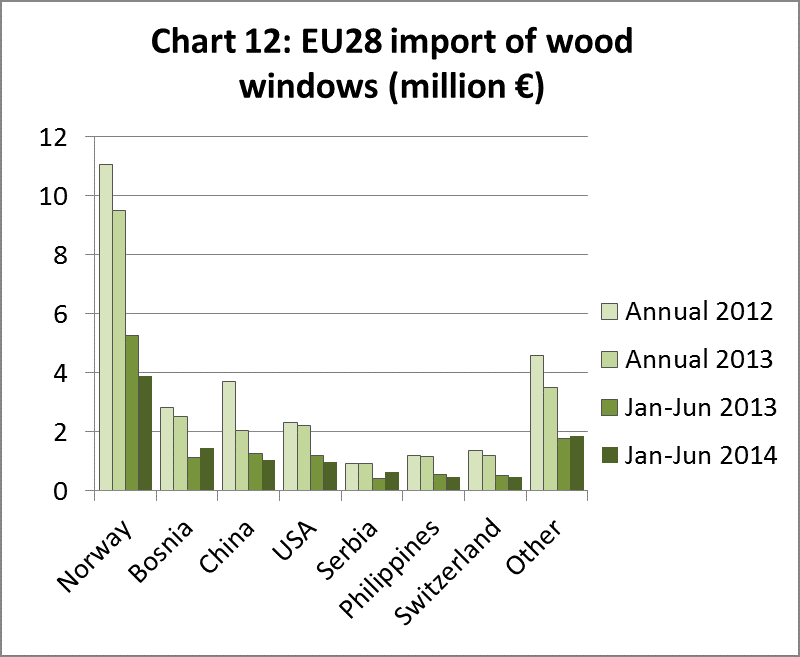

EU imports of wood windows continue to decline

The EU market for wood windows is very heavily dominated by domestic producers. Imports currently account for only 0.4% of the total value of EU wooden window consumption, down from 0.8% in 2007. Most wood windows imported into the EU derive from other European countries, notably Norway and Bosnia. In the first 6 months of 2014, imports fell from most of the leading supply countries including Norway, China, the USA, Philippines, and Switzerland. However there was a slight increase in imports from Bosnia and Serbia (Chart 12).

Recovery in EU glulam imports in 2014

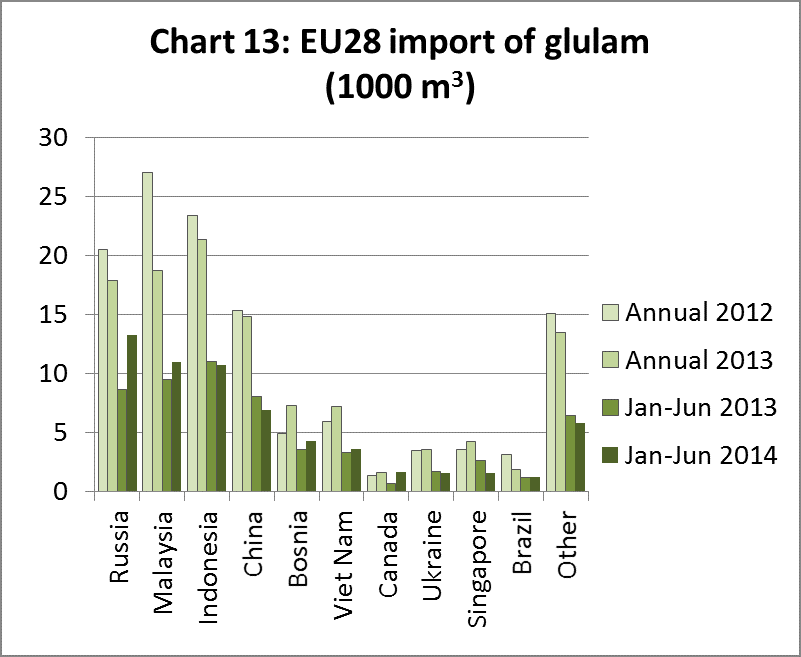

The EU imported 61,400m3 of glulam products in the first half of 2014, 9% more than the same period in 2013. Imports from Russia increased 54% to 13,300 m3 in the first six months of this year (Chart 13). As a result Russia has overtaken Malaysia to become the largest external supplier of glulam to the EU this year. However there was also a 16% increase imports from Malaysia to 11,000 m3 this year. Meanwhile imports declined 2% to 10,700 m3 from Indonesia and 14% to 6,900 m3 from China.

Imports of glulam account for around 5% of total EU consumption of this commodity. Much of the imported glulam consists of dimension product for window manufacturing. Glulam imports from Russia and China are primarily pine and larch. Imports from Malaysia and Indonesia consist of meranti.

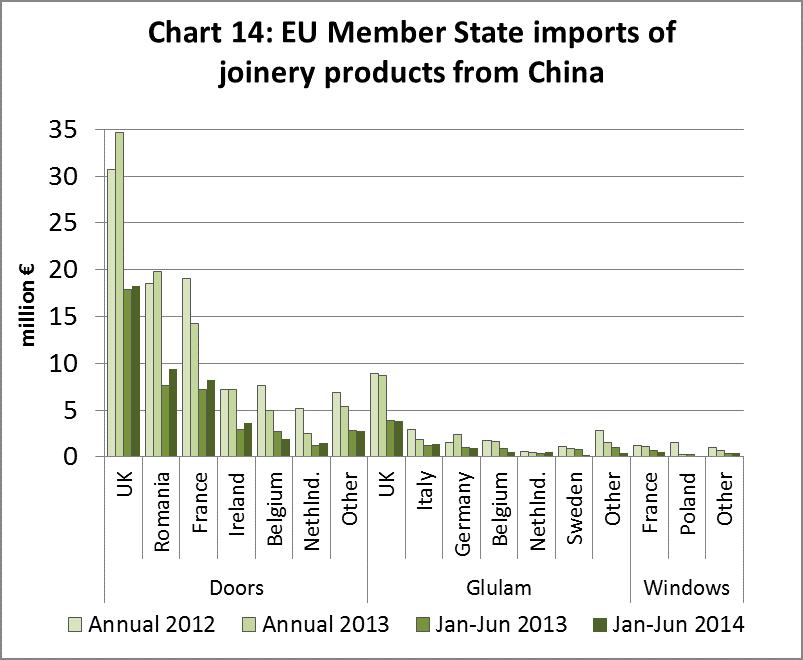

EU28 imports of joinery products (excluding flooring) from China had a value of €54.5 million in the first 6 months of 2014, 3% more than the same period the previous year. This partially reverses the 9% decrease (to €108m) in EU28 imports of Chinese joinery products between 2012 and 2013.

Chart 14 summarises EU imports of joinery products from China by product group and EU Member State. Doors make up the bulk of EU joinery trade with China, with total value of €88.5 million in 2013. The EU and Romania are the main European markets for China’s wooden doors and both countries have been importing rising quantities over the last 2 years. Imports of Chinese wooden doors by France, the third largest market, declined between 2012 and 2013, but have increased again this year.

The UK is the only EU country importing significant quantities of glulam products from China, with value of around €8.7 million in both 2012 and 2013. UK imports of Chinese glulam products were €3.8 million in the first 6 months of 2014, 1.6% less than the same period in 2013.

EU imports of finished wood windows from China are negligible and declining. EU imports of this commodity fell from €3.7 million in 2012 to €2.1 million in 2013. In the first half of 2013, EU imports of Chinese wood windows were only €1 million, mainly destined for France and Poland.

PDF of this article:

Copyright ITTO 2020 – All rights reserved