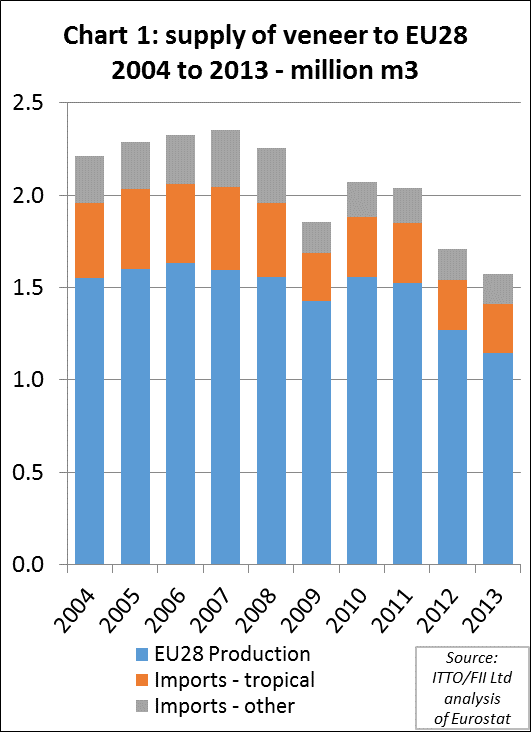

The latest Eurostat data shows that the EU market for veneers has suffered severely in recent years. The supply of veneers to the EU fell 33% between 2007 and 2013 due to the combined effects of economic crises, the decline of domestic plywood manufacturing capacity and competitive pressure from a wide variety of substitute wood and non-wood materials (Chart 1).

While EU imports of tropical hardwood veneer fell only 1% last year to 266,000 m3, this level was more than 40% less than in 2007. EU imports of veneers from temperate regions declined 5.2% in 2013 to 163,000 m3 in 2013 but were down 46% compared to 2007.

In 2013, EU veneer production fell a further 10% to 1.14 million m3 in 2013 and was 28% less than in 2007. At 104,000 m3, production in Germany during 2013 was 13% down on the previous year and only one quarter of the level in 2007. Italy produced 202,000 m3 of veneer in 2013, 26% less than the previous year and only around half of the level of 5 years before.

These losses have been only partly offset by rising veneer production in Estonia and Lithuania, which turned out 96000 m3 and 86000 m3 respectively in 2013. Both countries produced only a relatively small quantity of veneer five years previously.

EU tropical hardwood veneer imports up 8%

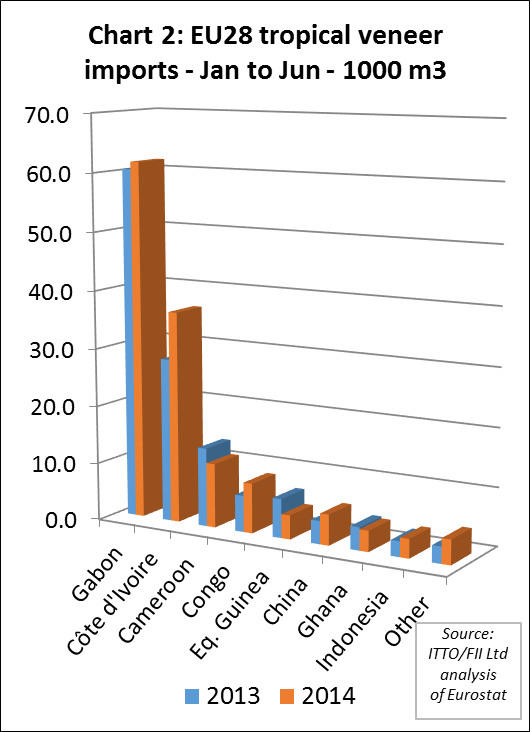

However, the EU veneer market has shown signs of recovery this year. EU imports of tropical hardwood veneer were 138,400 m3 in the first six months of 2014, 8% more than the same period last year (Chart 2). This year there has been particularly strong growth in EU veneer imports from Ivory Coast (+29% to 36,500 m3) and the Congo Republic (+37% to 8,600 m3).

EU imports of tropical hardwood veneer from the Gabon, still the largest single supplier, were up 2.1% at 61,700 m3 in the first six months of 2014. This is despite the temporary imposition of a 7% import duty on EU veneer imports from Gabon on 1 January 2014 following a change in the country’s GSP status. The rise is indicative of slightly better demand for okoume plywood in Europe during 2014 driven by improved construction activity, particularly in Netherlands, Belgium and Spain, and by rising boat-building in Italy.

The EU suspended the GSP tariff specifically for okoume veneer from Gabon on 24 June 2014 and backdated the measure to 1 January 2014. Removal of the tariff came after concerns were raised by okoume plywood manufacturers based in France, mainly in the Poitou-Charentes region, that it would lead to the collapse of the French industry with potential loss of 1,500 jobs. The 0% tariff on okoume veneer from Gabon is now expected to apply at least until the next GSP review on 31 December 2018.

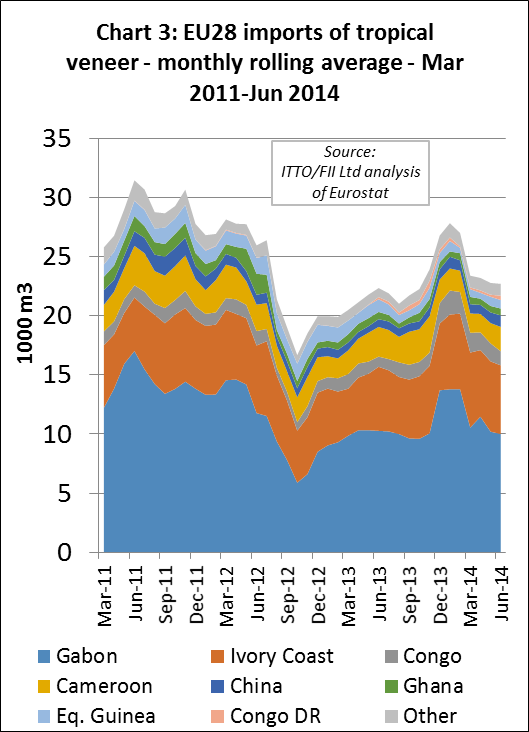

EU imports of tropical veneer were particularly high in the first 2 months of 2014, with a large spike in imports from Gabon during that period (Chart 3). In the second quarter of the year, imports slowed from Gabon but continued at a relatively high level from Ivory Coast.

Imports of tropical hardwood veneer into France fell 1.6% to 52,800 m3 in the first half of 2014 and Italian imports fell 6.8% to 27,200 m3 during this period. However imports into Spain increased for the first time since the start of the economic crises, rising nearly 30% to 21,600 m3. Tropical hardwood veneer imports also increased into Germany (+8% to 9500 m3), Belgium (+60% to 9300 m3), and Romania (+83% to 5000 m3) in the first six months of 2014.

EU imports of temperate hardwood veneer were also rising in the first 6 months of 2014, at 86,300 m3 up 9% on the same period in 2014. After several very slow years, European imports of American hardwood veneers have been rising this year, particularly into Germany, Spain, Italy and Portugal. These gains have offset falling exports to several smaller markets for American hardwood veneer including the UK and France.

Better demand for European veneer products

The German trade journal EUWID reports slightly improved demand for veneer produced in Europe during the second quarter of 2014. Central European veneer mills were reporting rising orders for interior remodelling projects, notably in export markets in the Middle East, United States and India. There was also improved demand for large volume commodity grades used by the European furniture and board industries. This was partly due to decreased availability of veneer from the Ukraine during 2014 owing both to the difficult political climate and concerns about the quality of legality assurances in the light of the EU Timber Regulation (EUTR).

EUWID note that orders to process tropical timber in European mills are continuing to decline in the face of falling imports of tropical hardwood logs into the EU. The EU imported only 68,000 m3 of tropical hardwood logs in the first six months of 2014, 35% less than the same period of 2013. Orders for beech veneer are also declining as the wood is still out of fashion and the market remains firmly focused on oak.

EC emphasise commitment to enforce EU Timber Regulation

In an article in the European Timber Trade Federation (ETTF) newsletter, the EU Environment Commissioner Janez Potocnik re-emphasised the Europe’s strong commitment to the EUTR and determination to ensure effective enforcement across the continent.

Mr Potocnik observes that while EUTR has been fully applicable since March 2013, a scoreboard, recently published by the European Commission, shows significant outstanding compliance gaps. While all but one Member State have designated competent authorities to coordinate enforcement of the Regulation, nine Member States have as of yet not adopted rules on applicable penalties for infringement. And 11 are not ready to check whether operators and monitoring organisations fulfil their obligations.

While Mr Potocnik recognises “the political, budgetary and organisational difficulties EU Member States face in implementing new legislation”, he also suggests that “they have had sufficient time to prepare for full implementation of the EUTR and the Commission has provided ample support through information and coordination meetings to take stock of progress, discuss implementation challenges, and share best practice”.

Consequently, Mr Potocnik says the Commission will intensify efforts to ensure uniform, stringent application throughout the EU. “We have already identified concrete implementation challenges and weaknesses and are working on a reinforced compliance strategy. The Commission intends to follow a dual approach. This would combine compliance promotion – through active support to Member States encountering implementation difficulties – and pursuing infringements through legal procedures”.

The EC intends to ensure that guidance documents are regularly updated and to strengthen bilateral dialogues with countries and communication between Competent Authorities on enforcement- related issues.

The EC has started requesting information from Member States about their EUTR implementation. National authorities concerned have 10 weeks to reply to the Commission’s enquiry.

In latest news, the French parliament finally passed enacting regulations for the EUTR on September 11, 18 months after the EUTR became law at EU level. The French regulations lay out sanctions and fines for non- compliance, including failure to exercise due diligence. France’s Competent Authority, the Agriculture Department, says its’ first EUTR checks of ‘operator’ companies are expected toward the year-end.

ITTO backs proposal for new EUTR supplier law database

Under the EUTR, companies which first place timber on the EU market (‘operators’), must ensure the material is compliant with the laws of the country of origin. There is considerable concern in the EU timber trade that this can involve a significant administrative and research burden, particularly for small to medium sized businesses. Many may not have the resources or knowledge to do it effectively and subsequently risk breaching the EUTR.

Heads of European Timber Trade Federations from UK, Netherlands, Germany, Italy and France discussed the issue at the ETTF summer meeting in Brussels and called for some form of central legality guidance that could be continuously updated by relevant stakeholders in Europe and its supplier countries.

ETTF secretary general André de Boer explored the issue further in an article in the UK’s TTJ magazine. “It would be more efficient and cost effective if this information could be found in one place,” he said. “If we had a constantly updated online data resource, Europe’s EUTR Competent Authorities could also make use of it, and ensure all stakeholders based their risk analysis on the same information. It would be good for the industry and reinforce the capabilities of the EUTR to eradicate illegal timber.”

Mr de Boer subsequently held talks with ITTO on moving the ETTF proposal forward. It has now been incorporated into ITTO’s 2015-16 Biennial Work Program (BWP), which will soon be circulated to ITTO members for consideration, prior to the fiftieth International Tropical Timber Council session in November.

“The ITTO’s Trade Advisory Group (TAG) was already developing a related proposal for web-based country profiles to contain relevant producer country forest sector and timber trade information,” said ITTO Assistant Director of Trade and Industry Steve Johnson. He added that the ITTO had been receiving increasing requests for such [legality] information, and “hoped the TAG proposal would find donor support”.

UK and Dutch imports overwhelmingly legal and sustainable

The UK TTF’s latest annual report on ‘Responsible Sourcing of Timber in the UK’ shows that 92% of members’ timber purchases in 2013 were negligible or managed risk of illegality. The remaining 8.4% is assessed risk, of which 7.3% is low risk, 0.8% is medium and 0.3% is high. The proportion of purchases of FSC or PEFC certified rose to 90.7%.

Meanwhile in the Netherlands, head of the Netherlands Timber Trade Association, Paul van den Heuvel, has announced that the latest biannual reports from members, independently audited by Probos, showed that 86% of the 1.9 million m3 of timber they imported and traded in 2013 was “demonstrably sustainable’, that is from forest certified under the PEFC or FSC schemes. It had previously set a goal of 85% by 2015. By material and product 96% of the 1,005,222 m³ of softwood imported into the Netherlands was certified sustainable; 83% of the 591,771 m³ of plywood and 55% of the 285,199 m³ of hardwood.

Commenting in the latest ETTF Newsletter, Mr van den Heuvel said that his members, who account for 70% of Dutch timber imports, would continue to drive up their proportion of sustainable timber. They would also push for the wider Netherlands market to make sustainable the norm through their alliance with buyers, specifiers, government and other stakeholders in the country’s Green Deal initiative. This is an industry-wide project for ‘stimulating sustainable forest management and certified timber’ that to date has 27 signatories, including government departments, business associations from along the supply chain, and trade unions.

Mr van den Heuvel also said that a few years ago, the NTTA asked the Dutch government to consider a lower VAT rate on sustainably produced timber to stimulate an increase in specification and consumption. Mr van den Heuvel noted that “with an effective Green Goods Agreement and lower VAT rate there would be no reason for importers and consumers not to choose sustainably produced (tropical) timber. At the time the VAT cut was rejected, but we continue to push for it and so should all involved in the sector.”

PDF of this article:

Copyright ITTO 2020 – All rights reserved