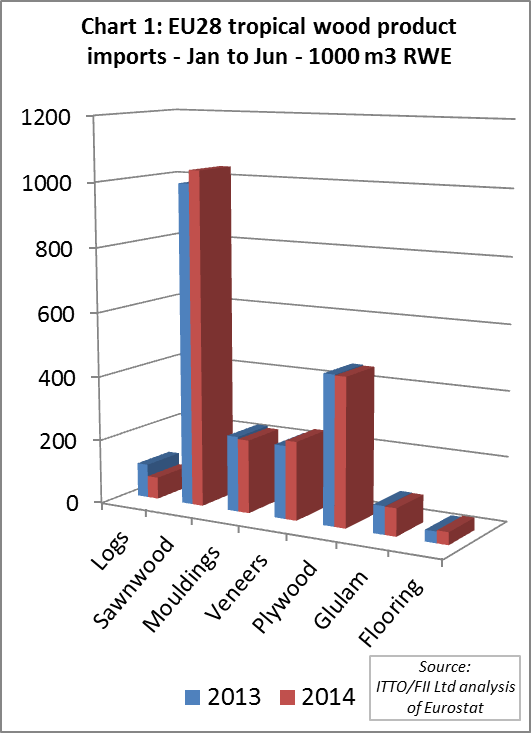

Although there has been some shifting between product groups, total EU imports of tropical hardwood products in the first half of 2014 hardly recovered from the historically low levels recorded in the previous two years.

EU imports of tropical hardwood products in the first half of 2014 were 2.157 million m3 in roundwood equivalent terms, a marginal increase of 1% compared to the same period last year. Imports of tropical hardwood logs, mouldings and decking, plywood and glulam/window scantlings have all fallen this year. These losses have been offset by rising imports of tropical hardwood sawn, veneer and flooring (Chart 1).

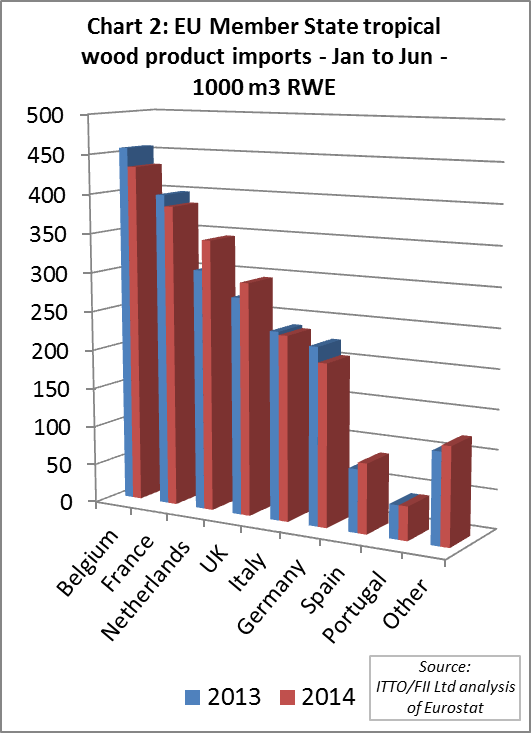

In the first half of 2014, the volume of tropical hardwood imports[1] fell into both Belgium (-5%) and France (-4%), the two largest European destinations for these products (Chart 2). Both markets are currently affected by consolidation of operators in the tropical wood industry and rapidly changing demand trends. After signs of recovery at the end of 2013, both countries also registered a general slowdown in construction activity in the first half of 2014.

In contrast, the volume of tropical hardwood imports increased into the Netherlands (+13%) in the first half of 2014. After a long period of recession, Dutch building activity improved gradually in the second half of 2013 and first half of 2014. Dutch construction still faces challenges including low permit issuance, stricter regulations for housing corporations, and government austerity. However demand for hardwood has benefitted from the temporary VAT reduction on renovation activities implemented since early 2013 which is due to remain in place until the end of 2014.

UK imports of tropical hardwood products were up 7% in the first half of 2014, boosted by good recovery in the construction sector. UK construction activity slowed a little in July but recovered strongly in August. New construction orders continue to rise in the UK, suggesting good market prospects for the rest of the year.

In contrast, imports of tropical hardwood products into Germany were down 9% in the first half of 2014 compared to the same period last year. After two years of robust growth, Germany’s construction sector has been contracting during 2014. Tropical hardwood is struggling to compete against alternative products in several key market segments in Germany including decking, window scantlings, plywood and flooring.

Implementation of a tough EUTR inspection regime in Germany and the government’s decision to confiscate a consignment of African wenge logs due to an alleged breach of the law, may also have played a role to discourage tropical wood imports into Germany this year.

There was a pick-up in demand for tropical hardwood products in Spain and Portugal in the second quarter of 2014, mainly to replenish depleted stocks. However in both countries, as in Italy, there is still very little speculative purchasing in anticipation of any increase in future demand.

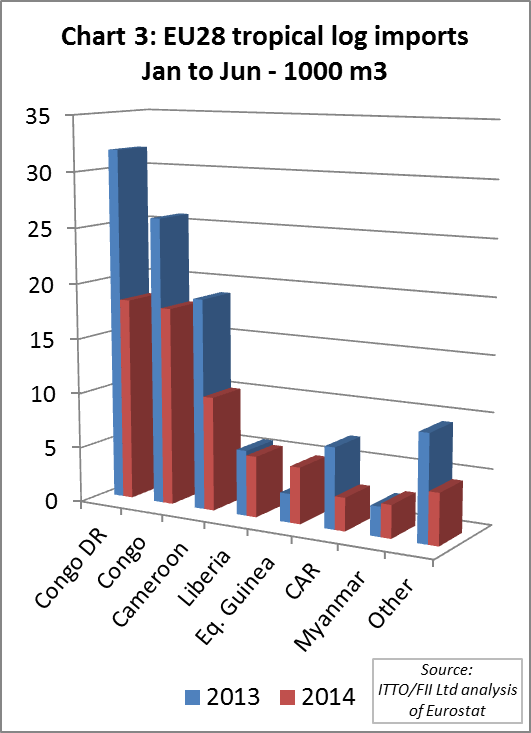

EU tropical hardwood log imports slide even further

EU imports of tropical hardwood logs were 68,000 m3 in the first six months of 2014, 35% less than the same period of 2013 (Chart 3).

Continuing delays in shipment of logs from Douala port has had a significant impact on log exports from Cameroon and Congo this year. The civil war in Central African Republic and EUTR-related concerns over the reliability of legality documentation are other factors impeding EU tropical log imports this year. Lack of availability elsewhere has encouraged an increase in EU log imports from Equatorial Guinea and Liberia during 2014, although the volumes involved are very small.

[1] Refers to total roundwood equivalent volume of logs, sawnwood, mouldings & decking, veneers, plywood and glulam

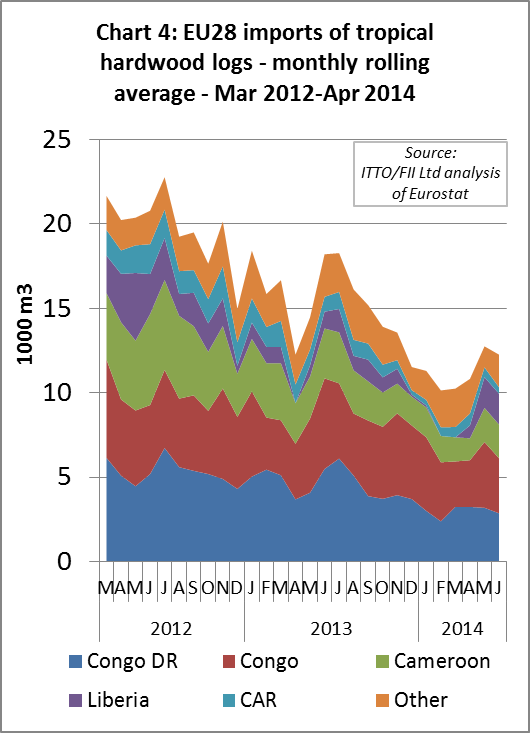

Review of monthly data shows that EU imports of tropical hardwood logs were extremely low in the first quarter of 2014 and increased only a little in April and May. Imports were again showing signs of weakness in June (Chart 4). Since most log imports usually arrive in the first half of the year, the downward trend is expected to continue.

Minor recovery in EU imports of sawn tropical hardwood

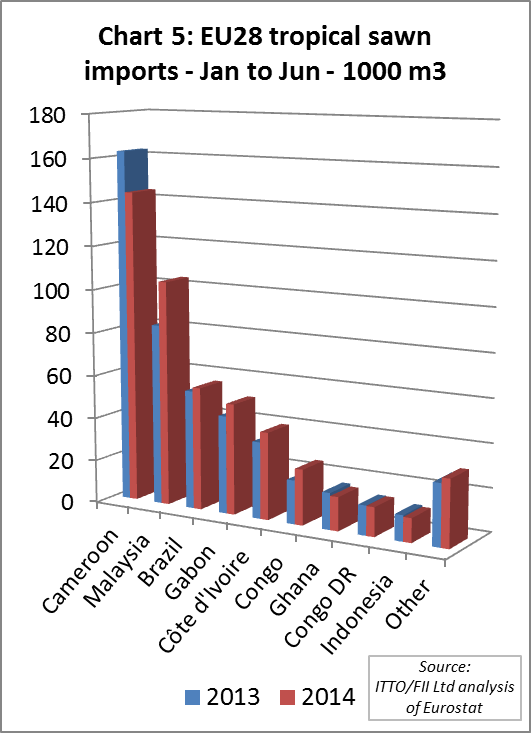

EU imports of sawn tropical hardwood were 493,000 m3 in the first half of 2014, 4% more than the same period in 2013. Imports from Cameroon fell 11% to 144,000 m3 (Chart 5). However, this decline was offset by rising imports from Malaysia (+24% to 104,000 m3), Brazil (+3% to 57,000 m3), Gabon (+13% to 51,000 m3), Ivory Coast (+14% to 40,000 m3) and the Republic of Congo (+27% to 26,000 m3).

Exports from the main port of Douala in Cameroon have been disrupted by logistical problems this year. There also continues to be significant competition for African sawn hardwood supplies from Asian and North American buyers.

Large European-owned companies in Gabon have been actively expanding sales of sawn hardwood in Europe in 2014, building on a strategy of certification and diversification of the range of timber species and products on offer.

Much of the gain in EU imports of sawn hardwood from Malaysia during 2014 has been destined for the Netherlands, indicative of improved construction activity in that country this year. Suppliers in Malaysia have also been better able than those in Africa and Brazil to supply product at short notice, particularly certified product which is increasingly required in the Netherlands,.

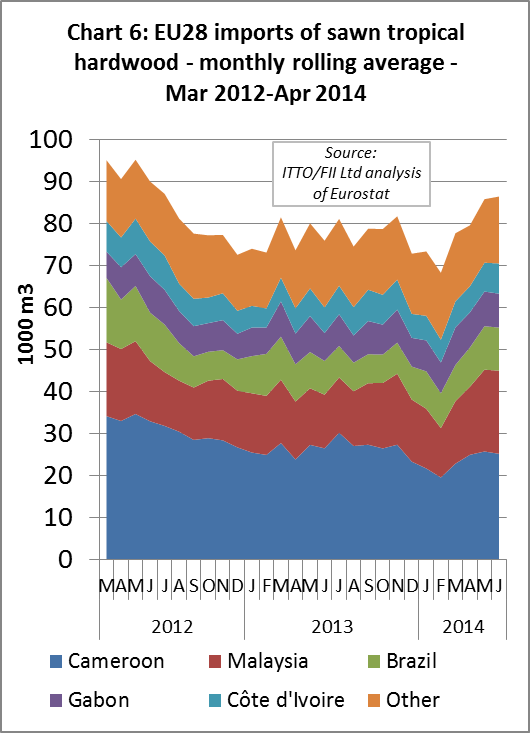

After a slow start to the year, EU imports of sawn hardwood increased strongly between March and June (Chart 6). However by July, trade was slowing again as consumption had not kept pace with imports and European stocks had begun to build. The hiatus in activity may be short-lived with most forecasts indicating relatively stable European buying and consumption of sawn tropical hardwood for the rest of the year.

According to European importers, tight supplies and better demand led to rising export prices for several species of African sawn wood, including framire, iroko and sipo, in the second quarter of the year. Prices for sapele and wawa sawn lumber have remained stable at the higher levels achieved in April.

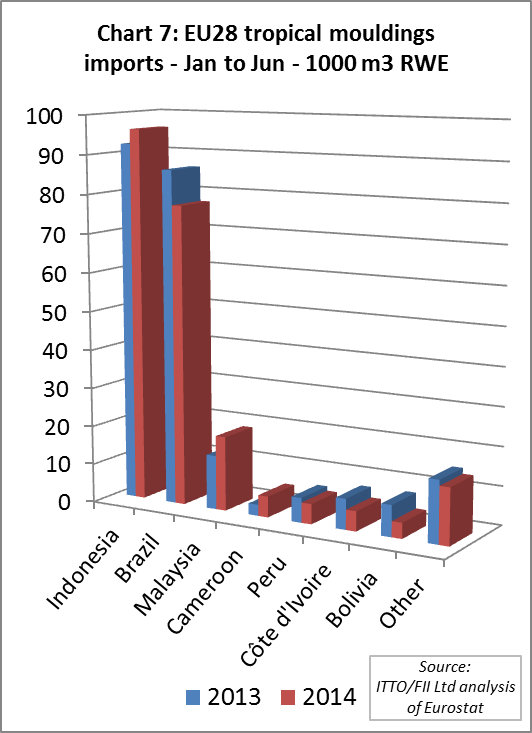

Better EU demand for Asian decking in 2014

European demand for Indonesian bangkirai decking has been better overall during 2014 compared to the previous year, although the total volume is still low by historical standards. Total EU imports of mouldings and decking from Indonesia in the first half of 2014 were 96,000 m3, 4% more than the same period in 2013 (Chart 7). EU imports of moulding and decking from Malaysia also increased 37% to 19,000 m3 in the first 6 months of 2014 compared to the same period in 2013.

However European imports of Brazilian decking products have continued to subside this year. Imports of Brazilian moulding and decking in the first 6 months of 2014 were 77,000 m3, 10% less than the same period in 2013. This may be partly due to currency fluctuations, the euro having depreciated more than 10% against the Brazilian real since the start of the year.

Brazilian decking products have also been the target of a Greenpeace campaign in Europe in 2014. Several large European retailers have discontinued sales of ipe decking following allegations that legal documentation does not meet EUTR requirements.

Asian decking has been more competitively priced than Brazilian products in Europe this year. Indonesian bangkirai decking has also reclaimed share from alternative temperate wood products during 2014. However, all wood decking products now face significant competitive pressure in European markets from wood-plastic composites.

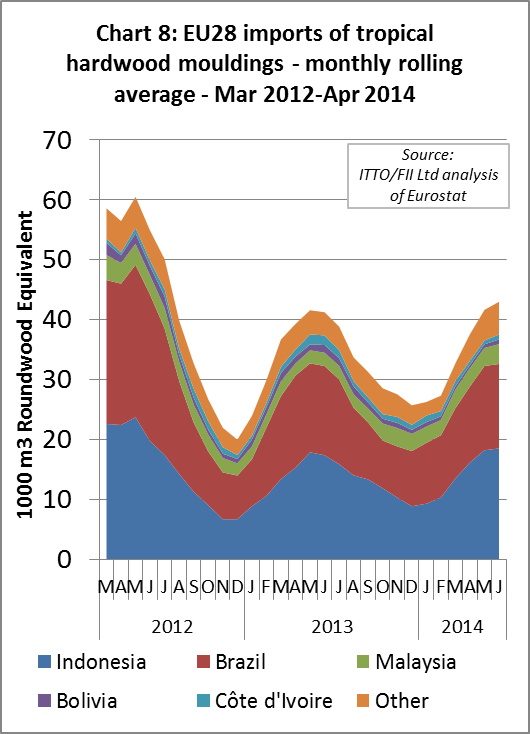

Monthly data reveals the usual steep rise in EU imports of moulding and decking products during the second quarter, levelling off in June (Chart 8). Anecdotal reports indicate that as the summer season progressed, the pace of new orders for decking tailed off rapidly in July and August this year. Those orders placed were limited to small volumes of specific sizes to fill gaps in stocks.

Significant new orders are not now expected before November at the earliest. Depending on importers assessment of the stock situation and still uncertain forecasts of demand next year, most new orders of decking for next season may be delayed until January.

PDF of this article:

Copyright ITTO 2020 – All rights reserved