The latest EU trade data indicates that the tropical hardwood market started the year very slowly. In the first 2 months of 2014, EU imports of tropical hardwood logs, sawn, mouldings and plywood were all significantly lower even than in 2013, a year when tropical hardwoods were at a record low in the EU.

Unlike previous years, low tropical hardwood imports in early 2014 was driven less by low European consumption than by a range of supply-side and policy issues. EU importers generally report that demand from European manufacturers and end-users is better this year than in 2013. There are indications that the European market for some tropical wood products may have turned a corner in spring 2014 and trade began to improve in March and April.

Several factors explain low EU import volume in the early months of 2014 including:

- lack of availability, particularly as more tropical hardwood is being diverted to alternative markets;

- greater focus on a smaller number of legally verified suppliers since introduction of the EU Timber Regulation;

- higher landed stocks in the EU at the close of 2013 as importers bought in advance of changes to import duties from 1 January 2014 with a change in GSP status for several key suppliers (notably Malaysia and Gabon); and

- closure of important EU tropical hardwood stock holding operations in 2013.

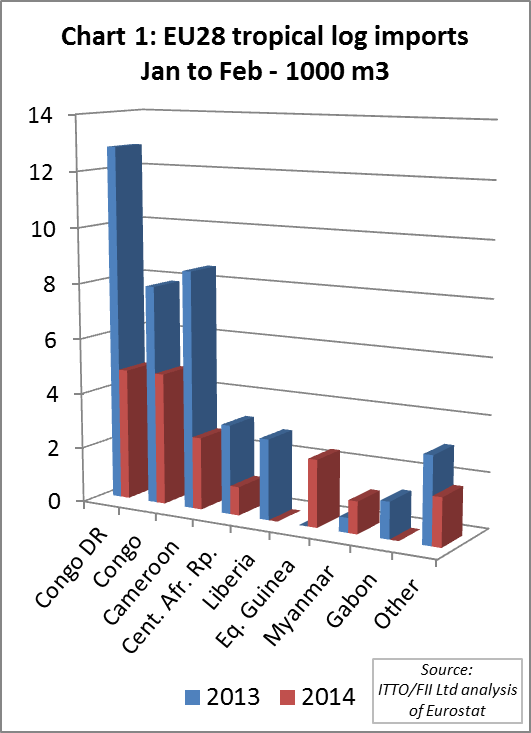

EU tropical log imports down 54% to end February 2014

EU imports of tropical hardwood logs in the first two months of 2014 were 18,454 m3, 54% less than the same period the previous year. Imports declined from all the main African supplying countries (Chart 1).

Amongst smaller suppliers, imports increased from Myanmar in anticipation of the country’s log export ban imposed from April this year. EU imports of logs from Equatorial Guinea only resumed in the second half of last year and were therefore up sharply in January to February 2014 compared to the same period in 2013.

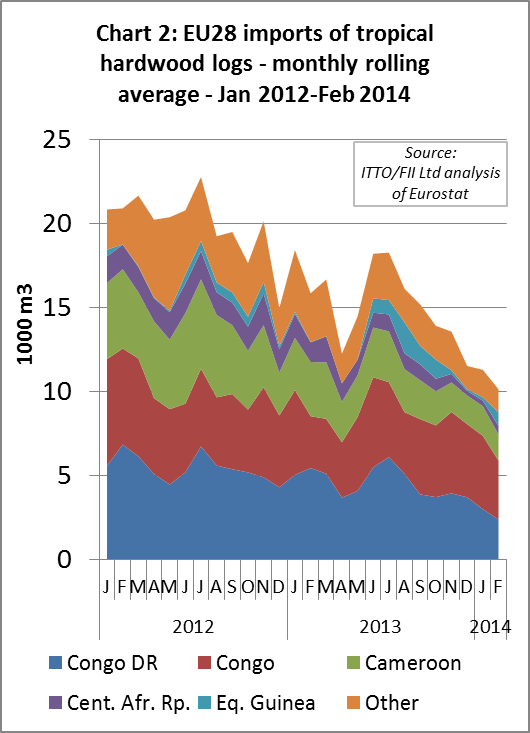

Longer term monthly data shows that after a brief spike in early summer 2013, EU imports of tropical hardwood logs resumed their long term decline between August 2013 and February 2014 (Chart 2)

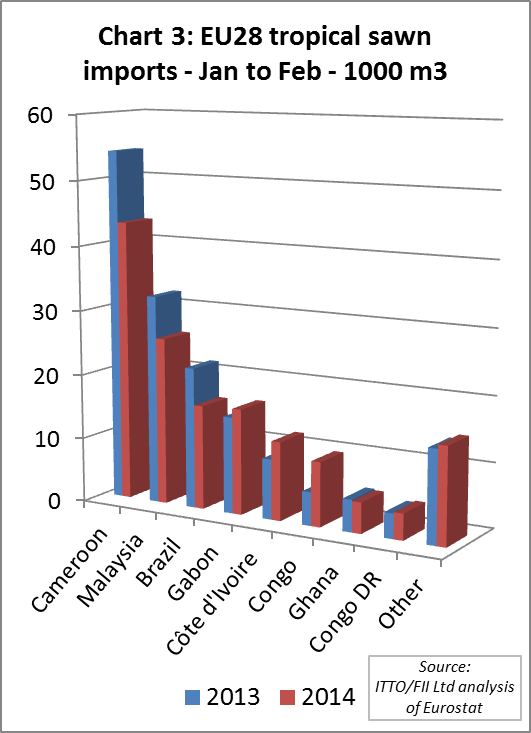

EU imports of sawn tropical hardwood fall sharply

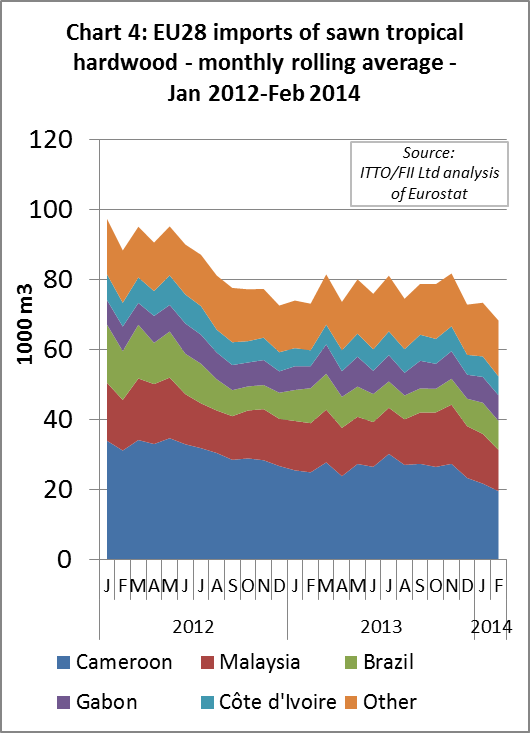

EU imports of tropical sawn hardwood in the first two months of 2014 were 147,326 m3, 8% down on the same period in 2013. Imports fell from all three of the main supply countries including Cameroon, Malaysia and Brazil. However, imports increased from some smaller suppliers, including Gabon, Ivory Coast, and the Republic of Congo (Chart 3). EU imports of tropical sawn hardwood were low but stable for most of 2013, but trended down sharply between November 2013 and February 2014 (Chart 4).

The low level of EU imports from Cameroon in early 2014 is partly due to short-term operational problems at the port of Douala and volumes are likely to rise in the spring as these problems are overcome. However, European buyers are also struggling to obtain sufficient volumes of preferred species such as sapele and sipo as more is now being sold into the Asian and U.S. markets.

EU imports from Brazil started the year 2014 very slowly, mainly due to weak consumption during the winter months in France and Belgium. However, judging from Brazilian export data and comments by EU importers, there has been more European interest in Brazilian sawn hardwood during the spring period, partly owing to on-going supply difficulties for African sapele. Demand for Brazilian sawn hardwood has been particularly robust in the Netherlands this year, and has also improved in France, Portugal and Spain in recent weeks.

Weak EU imports of Malaysian sawn hardwood in the opening months of 2013 follow stronger imports at the end of 2013 when there was a rush to buy in advance of an increase in European import duties. EU imports of sawn hardwood from Malaysia and other Asian countries have also been negatively affected by high and volatile freight rates during 2014. Availability of Malaysian sawn hardwood was also quite restricted in the early months of 2014.

However the supply situation for Malaysian sawn hardwood has now improved significantly so that standard European dimensions can be shipped at short notice. Better European consumption combined with improved supply and availability of robust MTCC/PEFC certification procedures, plus shortages of alternatives, suggest better future prospects for Malaysian wood in the EU market during 2014.

EU decking market starts slow but gaining momentum

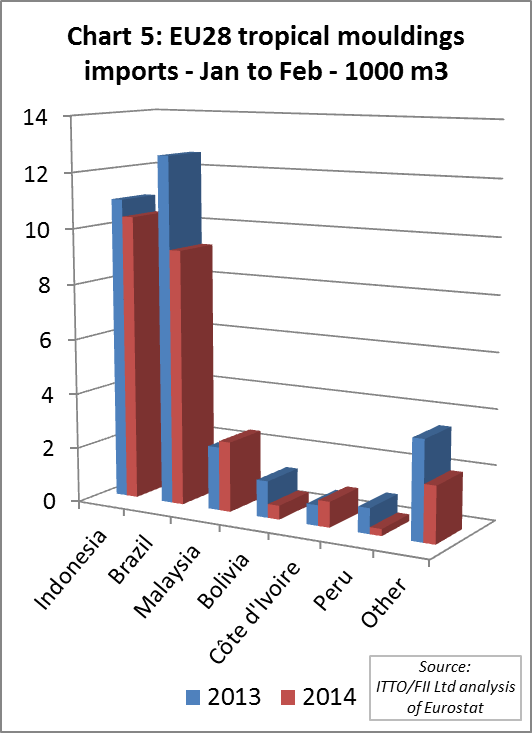

EU imports of mouldings (including decking profiles) were 25,860 m3 in the first two months of 2014, 20% less than the same period in 2013. Imports fell from Indonesia and Brazil, but were higher from Malaysia (Chart 5). European imports of tropical hardwood decking were low during the winter months when importers were concerned about the persistence of unsold stocks from the previous year on the EU market and uncertain about future demand in 2014.

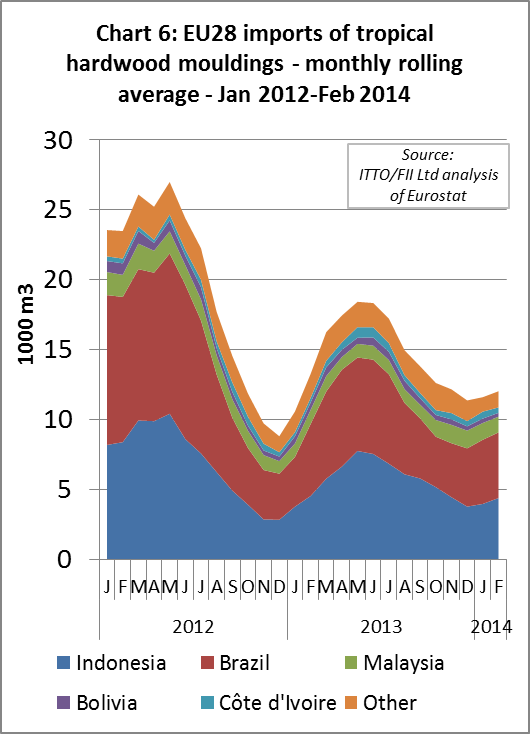

However, closer analysis of monthly trends indicates an upward turn in EU trade in mouldings and decking during February 2014 (Chart 6). Imports are also likely to have increased again in March and April with the relatively early arrival of good spring weather in north-western Europe and rising consumer confidence.

EU veneer imports show signs of revival

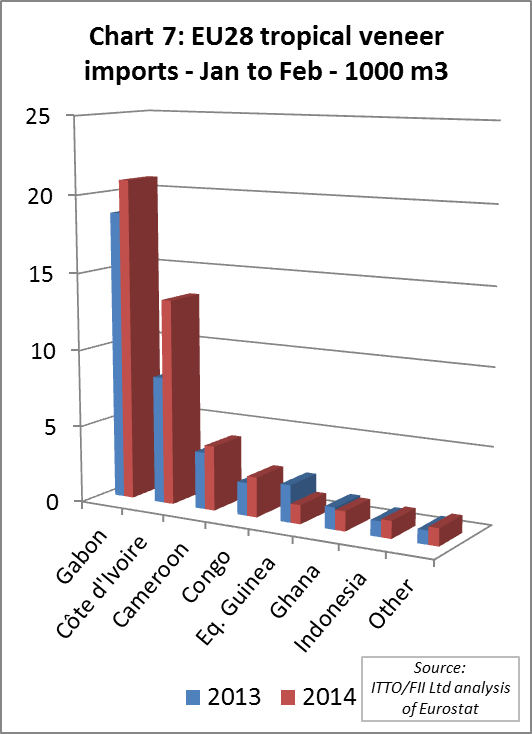

EU imports of tropical hardwood veneer in the opening two months of 2014 were 45,746 m3, 19% more than the same period in 2013. Imports from Ivory Coast were over 60% higher in January to February 2014 than they were during the same period in 2013. Imports also increased from Gabon, Cameroon and the Republic of Congo (Chart 7).

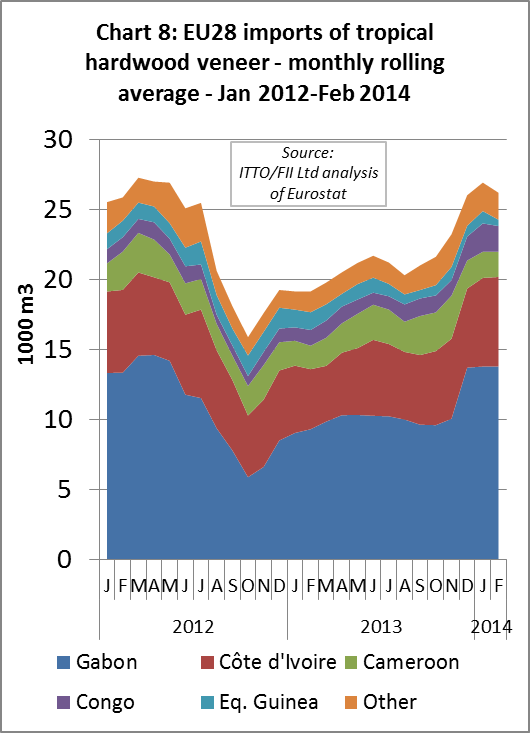

Analysis of the monthly data shows that EU imports of tropical hardwood veneer have been strengthening consistently since the end of 2012, with particularly strong growth in imports from Gabon (Chart 8).

The upward veneer trade trend is partly a result of Gabon’s restrictions on log exports which has led to EU manufacturers importing veneer instead. Nevertheless, the recent rise imports from a wider a range of African countries is an encouraging sign that the European market is improving and buyers are being encouraged to source higher value tropical products.

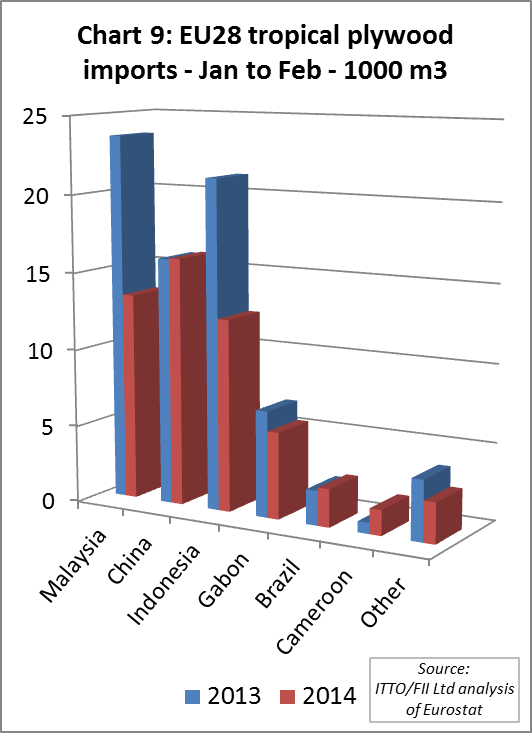

Downturn in EU imports of Malaysian plywood

EU imports of tropical hardwood plywood in the first 2 months of 2014 were 54,088 m3, 27% down on the same period the previous year. The opening months of 2014 were marked by a particularly big downturn in imports from Malaysia and Indonesia (Chart 9). European trade with both countries has been severely disrupted by volatile freight rates in 2014.

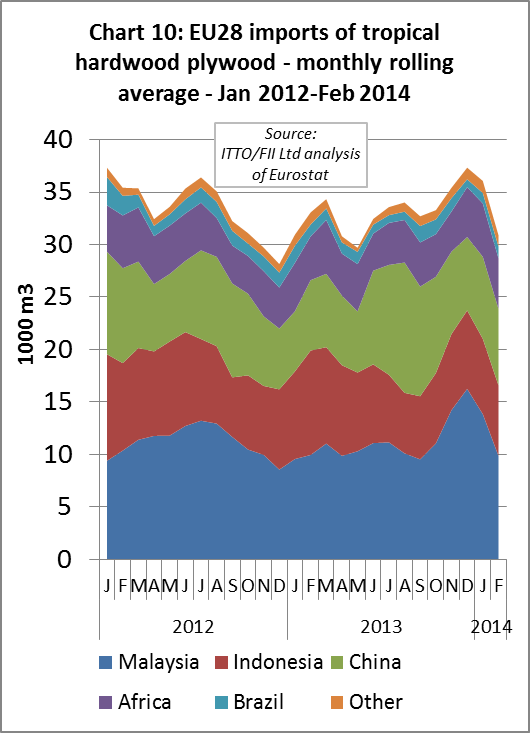

Slow EU trade in Malaysian plywood was also partly due to a rise in EU import duties with the change in Malaysia’s GSP status on 1 January 2014. This is clear from monthly data which shows a sharp spike in EU imports from Malaysia in November 2013 followed by consistent decline over the next 3 months (Chart 10).

While EU imports of Indonesian plywood were weak to end February 2014, demand has been rising since March. European trade in Indonesian plywood has been boosted by stronger construction sector activity, particularly in Germany and the UK, and also by rising prices and restricted availability of Russian birch plywood which has been a significant competitor in recent years.

EU imports of tropical hardwood plywood from China in the first two months of 2014 were at the same relatively low level as in 2013. EU imports from China are now much more heavily focused on Mixed Light Hardwood (MLH) products comprising eucalyptus and poplar. EU imports of MLH plywood in the first two months of 2014 were 143,196 m3, 13% less than the same period in 2013. However EU imports of this commodity in the early months of last year were inflated as importers built stocks in advance of EUTR enforcement in March 2013. Indications are that EU demand for Chinese MLH plywood has been increasing in 2014 and is better than last year.

Chinese MLH products bearing the Q-Mark issued by BM TRADA are becoming particularly popular in Europe and are taking market share from Malaysian tropical hardwood plywood and Russian birch plywood. The Q-Mark provides for CE-Marking of Chinese plywood and gives an assurance that the product is fit for purpose. Some Chinese manufacturers are now providing products that are both Q-Marked and FSC or PEFC certified for the European market.

PDF of this article:

Copyright ITTO 2020 – All rights reserved