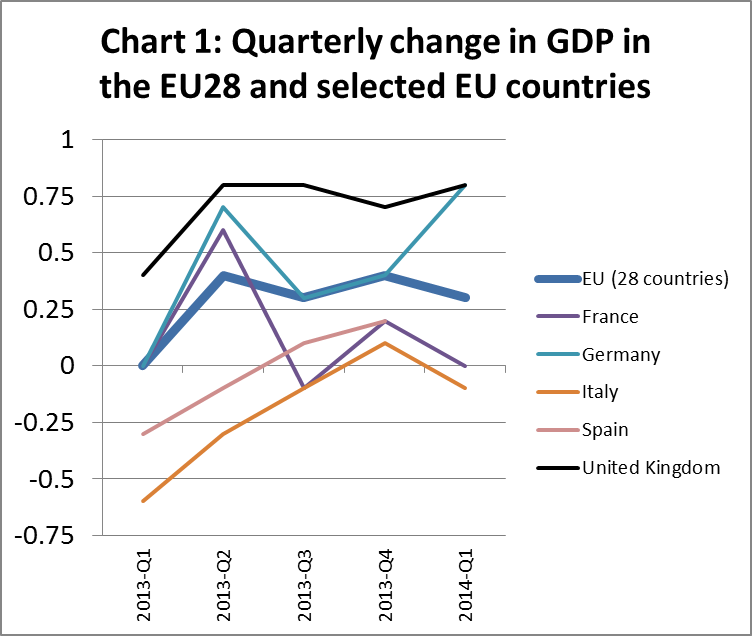

The European economy has climbed out of recession and, after six years of trauma, appears to be on the mend. The countries that required European Union-backed rescues are beginning to exit from them. However the latest GDP figures released on May 15 by Eurostat indicate that the recovery is very slow and tentative (Chart 1).

GDP in the 18-nation euro-zone expanded by just 0.2% in the first quarter of 2014, half the figure economists were projecting. Total EU growth in the first quarter was only a little higher at 0.25%, despite a strong performance by the UK outside the euro-zone where the economy expanded by 0.75%. Germany, as usual, was the leader amongst European countries, posting a gain of 0.8%. After a very long period of economic contraction, Spain’s economy is now growing modestly, expanding 0.4% in the first quarter of 2014.

However, economic conditions in other countries of Southern Europe remain fragile. Italy’s economy shrank by 0.1% in the first three months of 2014, matching the average of the three previous quarters. France’s recovery has faltered. France recorded zero growth in the first quarter of 2014, a big downturn compared to expansion of 0.6% in Q2 2013. Portugal shrank 0.7% in the first quarter of 2014, following positive numbers in the preceding nine months. While figures weren’t available for Greece in Q1, the signs there are not good. Greek GDP dropped 2.5% in the final three months of last year.

Economic growth in the EU is likely to remain very slow this year. The latest forecast from the International Monetary Fund estimates euro-zone GDP will expand a mere 1.2% in 2014, compared with 2.8% for the U.S. With prices barely rising, there is mounting concern that the euro-zone could plunge into debilitating deflation. This would make the debt burden of Europe’s weakest economies even heavier.

Europe has also made little progress in solving its’ significant unemployment problem. The latest euro-zone jobless rate is 11.8%, only marginally better than 12% a year ago. Only limited progress has been made to liberalise over-regulated labour markets which dampen job prospects throughout much of Europe.

There is also conflict between European politicians’ need to encourage further economic integration to resolve the problems of the euro-zone and the increasing disenchantment of many EU citizens with centralised control from Brussels.

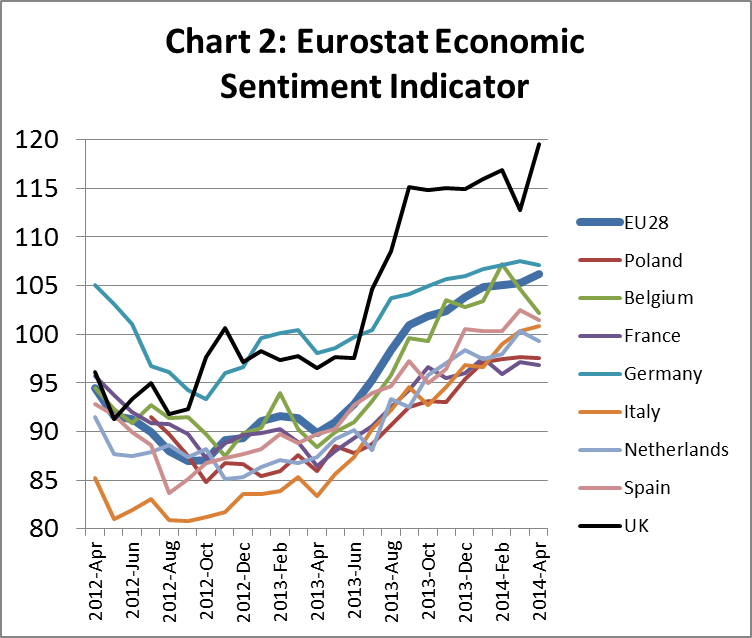

More positively, economic sentiment in Europe has continued to rise sharply in recent months (Chart 2). The rise is apparent across the EU but is particularly dramatic in the UK and Germany. Improvement in this indicator implies that both consumer and investor confidence will continue to rise during the European summer.

EU construction static at a low level in 2014

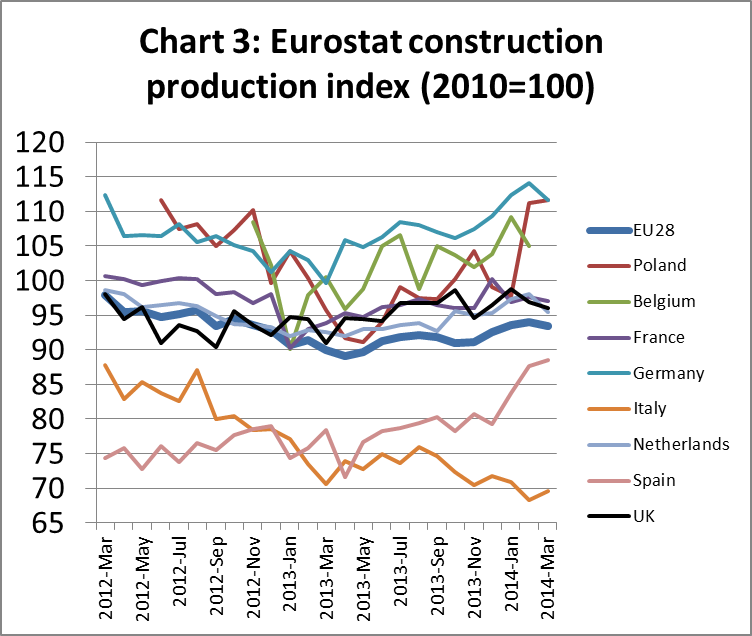

Europe’s construction sector is by far the most important driver of timber demand in the region. Recovery in this sector has been even weaker than in the overall economy. There has been only a slow and faltering increase in the Eurostat construction production index since it hit an all-time low in March 2013 (Chart 3).

Construction production in Germany, Poland, and Belgium has strengthened significantly in 2014. Construction production has also improved significantly in Spain this year, although from a very low level. Smaller gains have been made in the UK and the Netherlands. However construction production has been flat in France and continues to fall in Italy.

Slow increase in construction expected from 2015

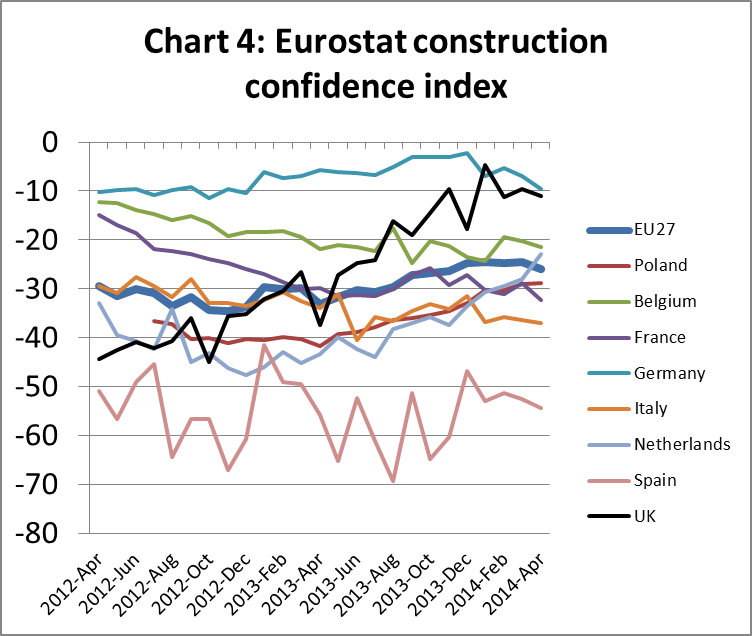

Various indicators of future construction activity suggest that the overall EU market will remain static at a low level in 2014. There is potential for a slow but sustained recovery to start next year, led by the UK and Germany and spreading into Belgium, Netherlands and Poland.

There was gradual improvement in Eurostat’s EU-wide construction confidence index (CCI) between March 2013 and March 2014 (Chart 4). However the CCI declined slightly in April 2014 and remains firmly in negative territory. This means that a balance of those surveyed still believe order books and employment in construction will continue to decline in the following 3 months.

The German CCI remains high relative to other EU countries but weakened a little in the opening months of 2014. The UK CCI, which increased sharply over the winter months, has now flattened out at a higher level. The Belgium CCI has also remained static in recent months but is at least higher than in most other EU countries. Confidence in the Netherlands construction sector has improved significantly over the last 12 months after hitting a very deep low at the start of 2013. Construction confidence in France, Italy and Spain remains at a low level.

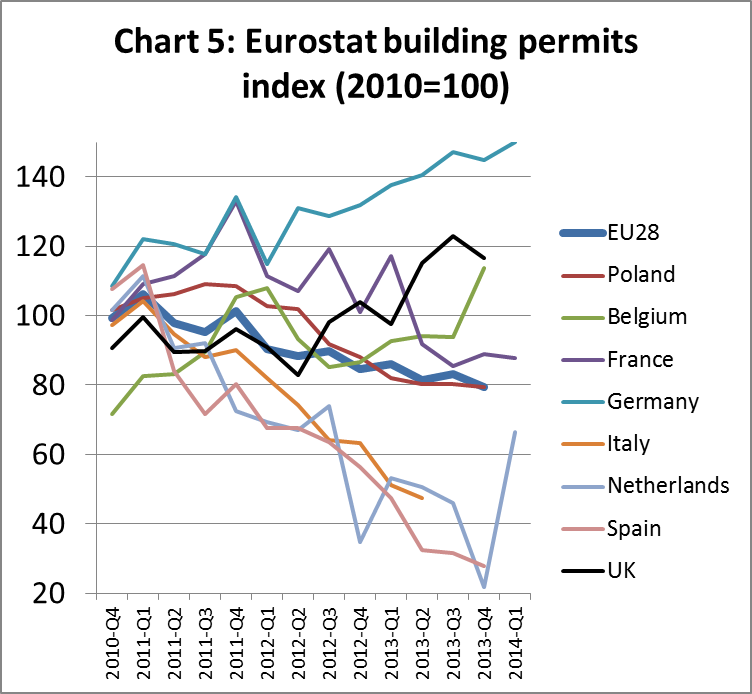

The latest EU-wide building permits data, for the last quarter of 2013, is not encouraging from the perspective of future construction activity (Chart 5). The numbers of building permits issued across the continent continued to decline throughout last year. While there was a rise in permits issued in Germany, the UK and Belgium, this was offset by declining permits in Italy, Spain, France, the Netherlands and Poland.

First quarter 2014 data for building permits from those few countries that have reported so far is more encouraging. Building permits issued in Germany have continued to rise this year, while there has also been a sharp rebound in building permits issued in the Netherlands.

EU construction value forecast to fall 1% to €820 billion in 2014

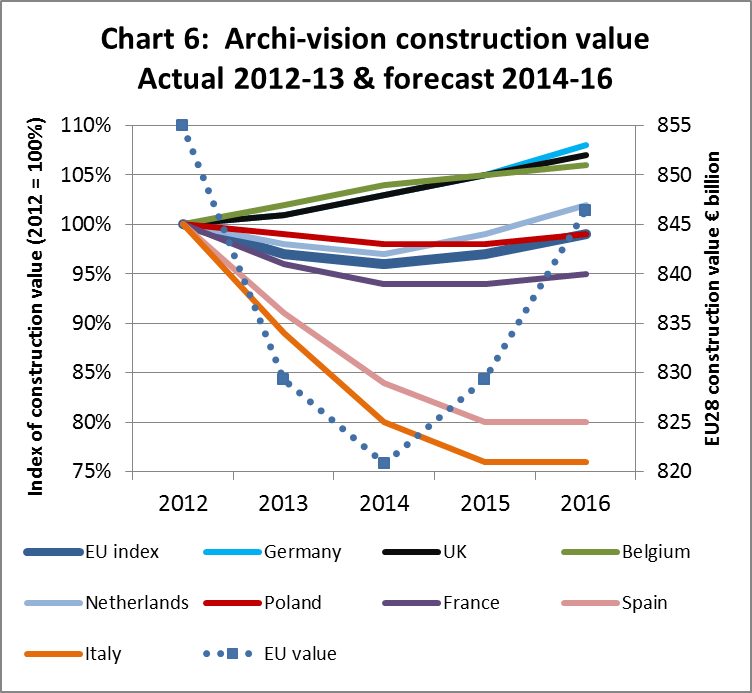

The independent research organisation “Archi-vision” estimates that total European construction value will fall from €830 billion in 2013 to €820 billion this year (Chart 6). However, construction value is expected to rebound to €830 billion in 2015 and €845 billion in 2016. These forecasts draw on Archi-vision’s quarterly survey of 1600 architects across the EU combined with analysis of other European construction industry data.

Archi-vision forecast that construction value will rise at around 2% per year in the UK, Germany, Netherlands and Belgium between 2014 and 2016. Construction value is expected to remain static in France and Poland during this period. Construction value is expected to continue to fall in Italy and Spain during 2014 and 2015 before stabilising at a low level in 2016.

Slight improvement in EU joinery production in first quarter of 2014

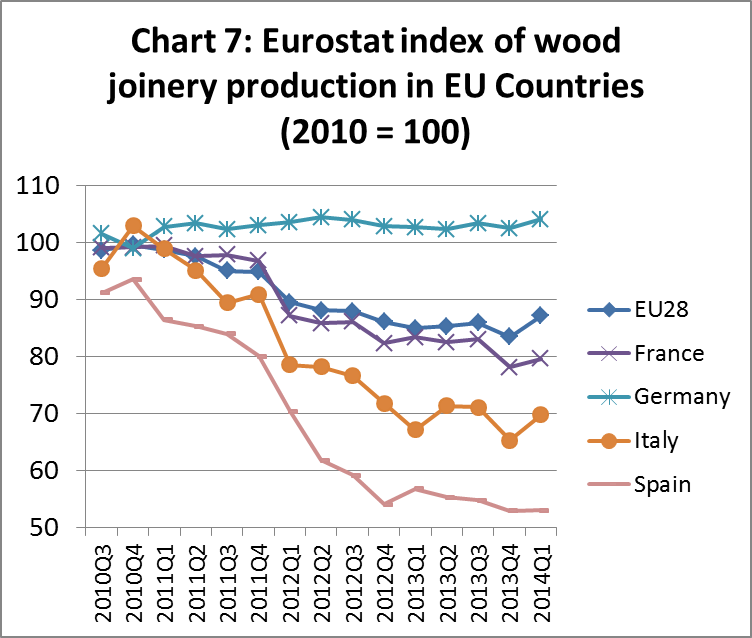

Overall joinery activity in the EU was static at a low level in the first nine months of 2013 and then fell sharply in the last quarter. However, activity picked up a little in the first quarter of 2014 (Chart 7). In line with forecasts for the European economy and construction industry as a whole, joinery activity across the region is expected to recover only slowly during 2014. Of all European countries, only Germany has maintained comparatively high levels of joinery activity over the last two years. Recovery in the EU joinery sector is expected to be led by continued good levels of activity in Germany and a relatively strong rise in the UK.

UK construction recovery now stronger and broader

The UK Construction Products Association (CPA)’s latest forecasts highlight that the recovery in UK construction is becoming stronger and broader. Rapid increases in private house building, together with growth in the infrastructure and commercial sectors, will drive activity. CPA forecast 4.5% growth in 2014 and a further rise of 4.8% in 2015.

According to CPA, UK private housing starts are set to rise 18.0% in 2014 and 10.0% in 2015, before falling to 5.0% in 2016 and 2017. The current rise is assisted by a ‘Help to Buy’ scheme, which is subsidising mortgage provision, in addition to a strengthening UK economy.

Growth in private housing should lead also to increases in public housing. UK planning consent now usually requires provision of some public housing as part of large-scale private developments. CPA forecasts that public housing starts will rise 8.0% in 2014 and 5.0% in 2015.

The UK’s private housing repair, maintenance and improvement sub-sector is forecast to rise 3.5% in 2014 and a further 4.0% in 2015. The CPA note that such growth is well below potential given considerable demand for energy efficiency measures in the UK’s existing housing stock. Poor implementation and lack of decent incentives has led to only poor uptake of the UK government’s “Green Deal” and ECO schemes designed to increase work in this area.

Commercial offices construction remains one of the largest single components of UK construction and is expected to increase 7.0% in 2014 and 10.0% in 2015, although most growth will be concentrated in London. Rising consumer confidence and pent-up demand for refurbishment mean that activity in the UK retail sub-sector should increase 4.0% in 2014 and 8.0% in 2015. Public sector construction is forecast to marginally rise 0.7% in 2014 and 2.3% in 2015 as schools and hospitals projects finally get underway after long delays during the period of austerity.

Downturn in EU imports of joinery products

With the exception of flooring products, imports contribute only a small proportion of total EU consumption of joinery products. In terms of value, only around 4.5% of doors and glulam, and around 0.5% of wood windows installed in the EU are imported from outside the region. This is indicative of the very strong commercial benefits from proximity to the consumer in the joinery sector and the essential need for detailed knowledge of national construction markets.

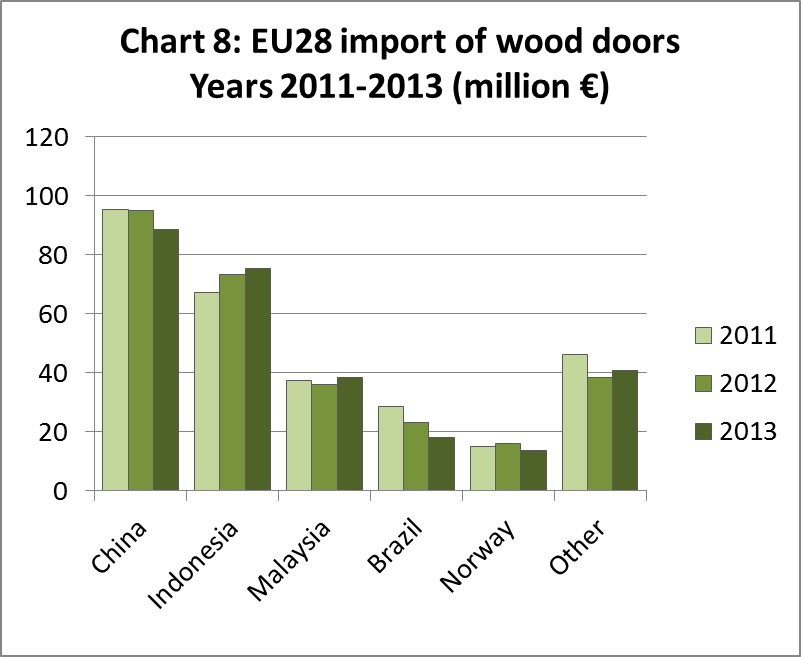

The EU imported wooden doors with total value of €275 million in 2013, 2.8% less than the previous year (Chart 8). The value of wooden door imports from China, the largest non-EU supplier, fell 6.8% to €88.5 million in 2013. However imports increased from Indonesia and Malaysia – the second and third largest non-EU suppliers. Imports from Indonesia rose 2.6% to €75.4 million in 2013. Imports from Malaysia were up 6.3% at €38 million.

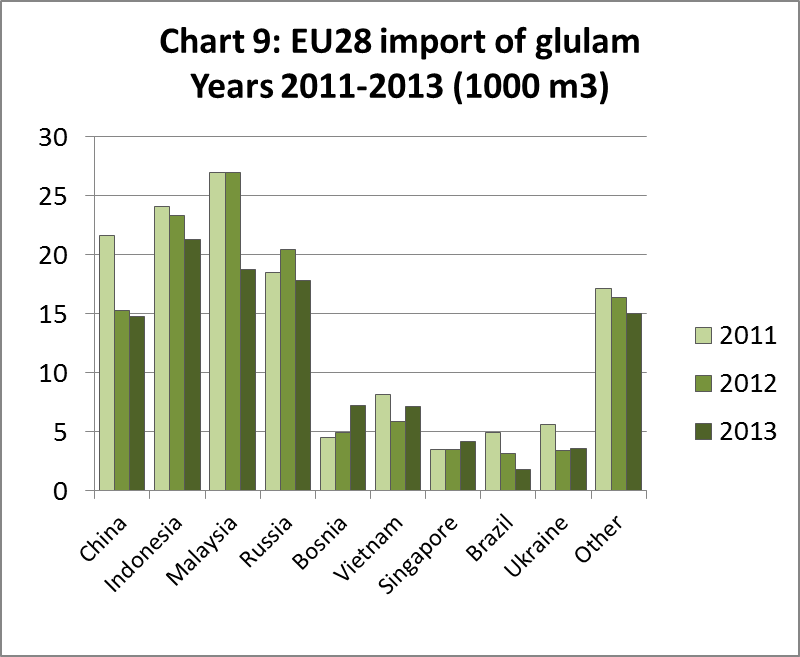

The EU imported 111,700 m3 of glulam in 2013, 9.5% less than the same period in 2012 (Chart 9). During 2013 there was a significant fall in imports from Malaysia, Indonesia and Russia, the three largest external suppliers of glulam to the EU. Imports from China, the fourth largest external supplier were at a similar level to the previous year. Imports of glulam from Vietnam increased slightly. The European glulam market is currently suffering from saturation, with too much production chasing limited demand.

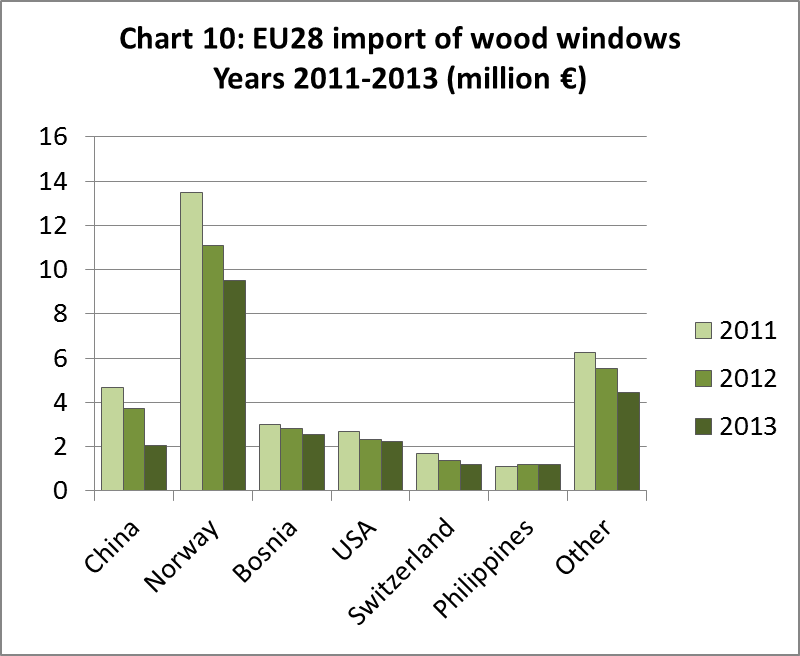

EU imports of wood windows were €23.1 million in 2013, 17.6% less than the previous year (Chart 10). Most of these imports derive from other European countries, notably Norway, Bosnia and Switzerland. Imports from China, the largest supplier outside Europe, were only €2.1 million in 2013, 45% less than the previous year.

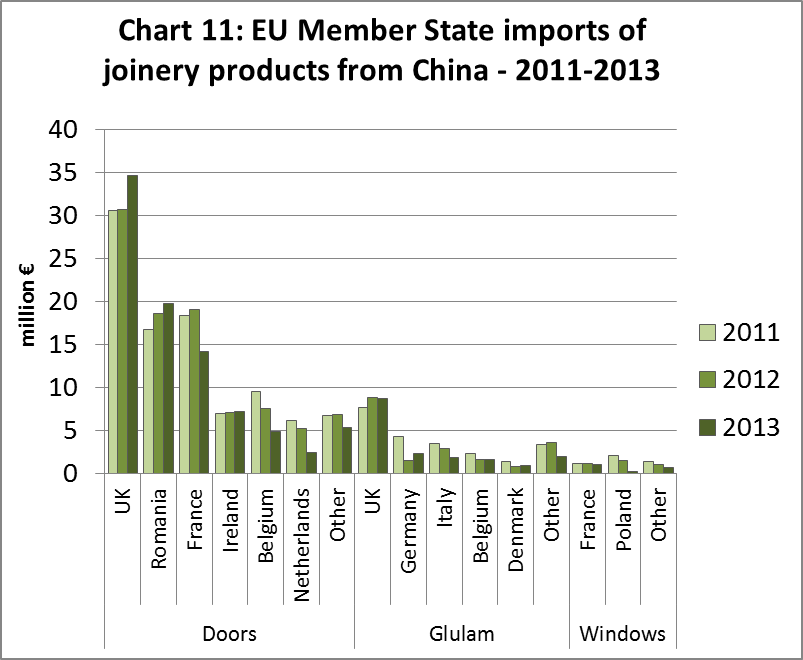

Chart 7 provides more detail of recent trends in EU markets for joinery products imported from China. Imports of wooden doors from China increased into the UK, Ireland and Romania during 2013, but declined into France, Belgium and the Netherlands. German and Danish imports of Chinese glulam increased during 2013, but this was insufficient to offset declining imports into UK, Italy, and Belgium. EU imports of wooden windows from China have been mainly destined for France and Poland, both markets which weakened significantly in 2013.

European flooring industry reports continuing challenges

Discussions at the spring meeting of the European wood flooring manufacturers association FEP indicate that the industry continues to face major challenges. There are some signs of improving demand in a few countries and of a more stable situation in others. However the market remains very difficult in Southern Europe. Lack of consumer confidence, the weak European construction sector as well as an ever increasing competition are daily challenges for the European wood flooring industry.

FEP country representatives reported as follows:

- Austria: a small increase of around 1% is forecast in consumption in the first quarter of 2014 compared to Q1 2013. There is increasing competition for wood flooring from Luxury Vinyl Tiles (VLT).

- Belgium: the wood flooring market has stabilised. Although total construction output fell 1.3% in 2013, there was improvement in non-residential construction, both new build (+2.2%) and renovation (+1%).

- Denmark: parquet sales were static at a low level in the first quarter of 2014, but the market is expected to grow by a few percentage points during the whole of the year.

- Finland: parquet consumption is expected to remain stable during 2014 with total sales of around 1 million m2.

- France: the year 2014 started badly with parquet sales down an estimated 8% to 10% in the first quarter of 2014 compared to the same period in 2013. Consumer confidence is still lacking. Traditional retailers no longer regard wood flooring as a priority product. Competition with other flooring types is becoming even more intense.

- Germany: Despite the good economic situation in Germany, the parquet market remains static with zero growth expected this year and intense competition from other products. As in the past, wider boards are becoming increasingly popular. DIY stores are moving towards new products such as LVT.

- Italy: parquet consumption is estimated to have decreased by 10% in the first quarter of 2014 compared to the same period in 2013. Conditions are very uncertain with a lot of new competitors on the market.

- Netherlands: After a very poor year in 2012, the market stabilised in 2013. First quarter sales in 2014 were the same as in the first quarter of 2013.

- Norway: sales increased by around 2% in the first quarter of 2014 compared to the same period in 2013. Imports of building materials into Norway increased by 18% in the first 3 months of 2014, an indication of an active market.

- Spain: parquet sales in the first quarter of 2014 were down 5% compared to the same period of last year. However, there is a slow rise in optimism as some macroeconomic indicators are recovering.

- Sweden: parquet consumption was up around 2% in the first quarter of 2014 compared to the same period in 2013. The housing sector is starting to recover.

- Switzerland: a very mild winter meant that parquet sales in the first quarter of 2014 were 5% higher than the same period in 2013. Wood flooring remains popular and the market mood is good.

PDF of this article:

Copyright ITTO 2020 – All rights reserved