After a period of turbulence during the years of the EU recession, the EU plywood market has stabilised and shown signs of recovery in the last 18 months. Supply and prices have also become more consistent and the industry appears to have adjusted well to the new demands of the EUTR.

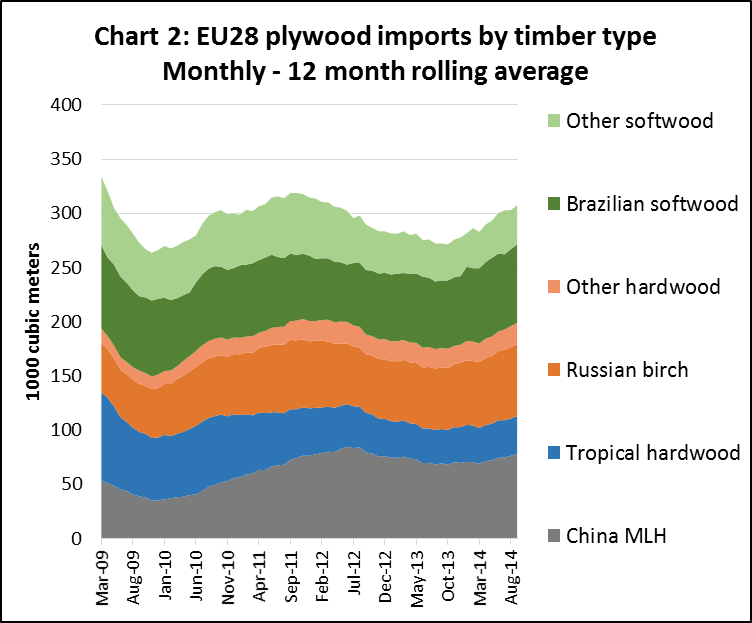

The annual trend in EU plywood imports over the last 6 years is shown in Chart 1. After a dip between 2011 and 2012, imports remained stable at 3.38 million m3 in 2013. EU imports in the first nine months of 2014 were 2.96 million m3, 12% more than the same the previous year (Chart 1).

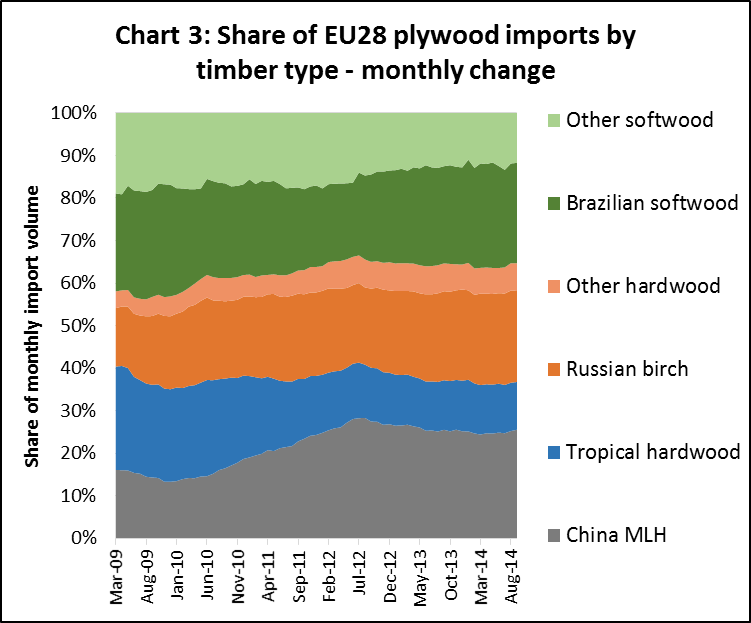

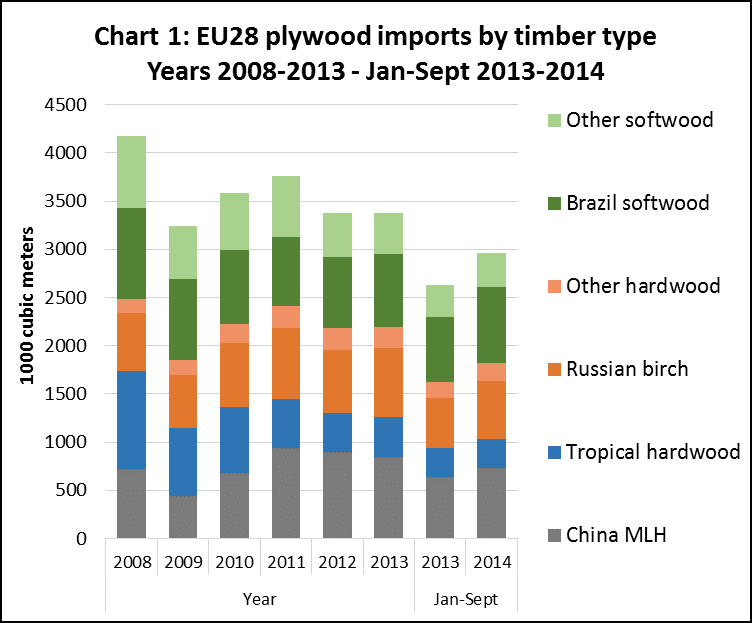

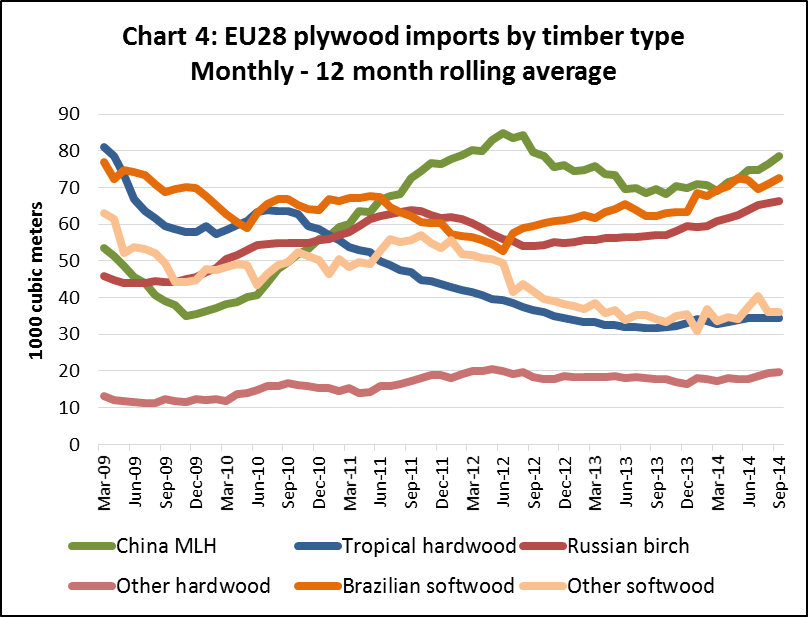

Charts 2 to 4 show the monthly trend in plywood import volume into the EU to September 2014 using 12 month rolling averages. This is calculated for each month as the average monthly import of the previous 12 months. The data removes short-term fluctuations due to seasonal changes in supply and shipping schedules and provides a clear indication of real changes in consumption.

Chart 2 shows that EU plywood imports declined between September 2011 and October 2013 but recovered continuously in the 12 months between September 2013 and September 2014. Chart 3 highlights that the share of different types of plywood in the EU market was quite stable in the period between July 2012 and September 2014. This contrasts with the period of import growth between January 2010 and June 2012 when Chinese Mixed Light Hardwood (MLH) plywood and Russian birch plywood rapidly gained share, primarily at the expense of tropical hardwood plywood and softwood plywood.

EUTR impact

The relative stability in share between different plywood types over the last two years coincides with the timing for introduction of the EU Timber Regulation (EUTR) in March 2013. There was much speculation in advance of this measure that it might impact particularly heavily on the plywood sector.

It was assumed that difficulties of obtaining reliable assurances of legality in the complex supply chains that prevail in China’s plywood sector might lead to a loss of share. Beneficiaries were expected to be domestic suppliers and tropical countries with simpler supply chains and where far-reaching steps were being taken to implement third party certification or legality verification systems.

The fact that EU plywood imports from tropical countries has at least stabilised over the last 2 years may be partly attributable to these efforts in combination with the EUTR. Plywood exported into the EU from Malaysia is mostly certified to the MTCS, imports from Indonesia are certified to the SVLK, while those from Gabon are primarily FSC certified.

At the same time, the EU import data indicates that a significant number of Chinese suppliers have been able to adapt to the new demands of the EUTR – either by switching to locally produced face veneers – such as reconstituted poplar – or by sourcing tropical veneers from certified or otherwise known legal sources.

This assumes that measures by EU countries to implement the regulation have been sufficiently rigorous to change behaviour. Regular contacts with EUTR Competent Authorities and EU trade associations suggest that there have been far-reaching EUTR implementation measures in most of the largest plywood importing countries – particularly in the UK and Germany. Anecdotal reports in the European timber trade press also highlight the growing emphasis on legality verification in the EU plywood sector and the effect this is having on supply chains.

Changing plywood market share

Chart 4 shows how trends in EU plywood import trade have varied very widely between different products types over the last four years. It highlights how tropical hardwood plywood imports fell continuously from June 2010 to June 2013, losing share to Chinese MLH, Russian birch and other temperate hardwood products (particularly from Ukraine, Belarus, and Uruguay) at that time.

EU imports of Chinese MLH plywood rose sharply in the period between November 2009 and June 2012 and then subsided for the next 18 months as the much anticipated recovery in European construction continued to be delayed. The EU rise in imports of Russian birch peaked much earlier, in June 2011, but then subsided more slowly. In the softwood plywood sector, Brazil lost share to other suppliers in the period 2009 to June 2012, but has been regaining share ever since.

Chart 4 also shows that there has been an upward trend in imports in all plywood products types during 2014. The pace of increase in imports this year has been particularly rapid for Chinese MLH, Brazilian softwood and Russian birch plywood.

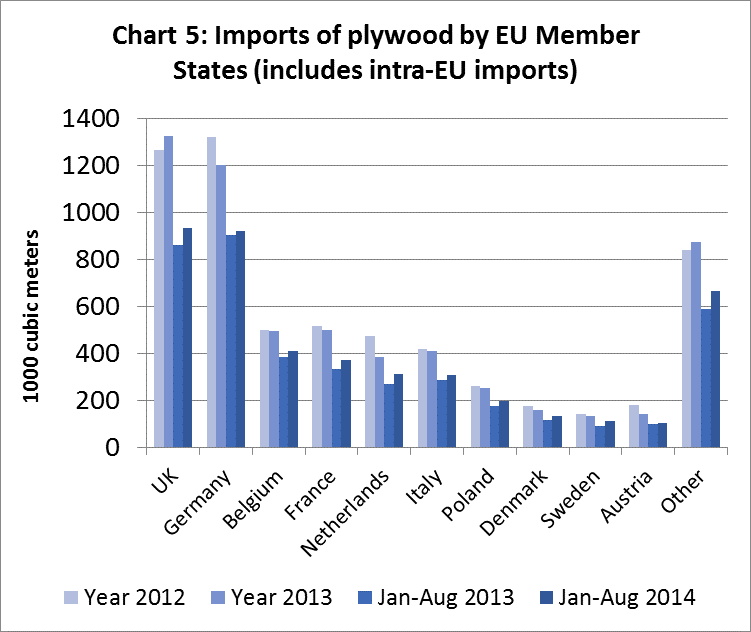

Chart 5 shows that plywood imports have risen into all the main EU markets during 2014, with particularly strong growth in the UK.

Strong UK plywood demand

Rising plywood imports into the UK in 2014 are due both to higher levels of construction activity and to improvements in the supply side. UK importers report that Chinese MLH plywood has been readily available this year at stable prices. Orders in the last quarter of 2014 could be shipped from China within around four weeks. However quality consistency remains an issue for some UK buyers of Chinese plywood. Freight rate volatility has also been a problem again this year. Rates tend to rise at the start of each month and then decline sharply as shipping companies fail to fill available space.

While plywood imports into Germany were strong in the opening months of 2014, the market showed signs of weakness in the second half of the year. This was primarily due to the recent downturn in the Germany economy. Imports have also been hindered by the German customs decision to reclassify much of the plywood imported from China as laminated wood. Technically these two products are distinguished by the direction of grain in alternate veneer layers – in plywood the grain is crossed at right angles whereas in laminated wood it is parallel. Plywood attracts a duty of only 7% while laminated wood attracts a duty of 10%. In the absence of reliable assurances that only products glued crosswise are supplied by Chinese suppliers, some German importers are switching back to alternative products including European birch and softwood plywood.

Stabilisation of tropical plywood imports

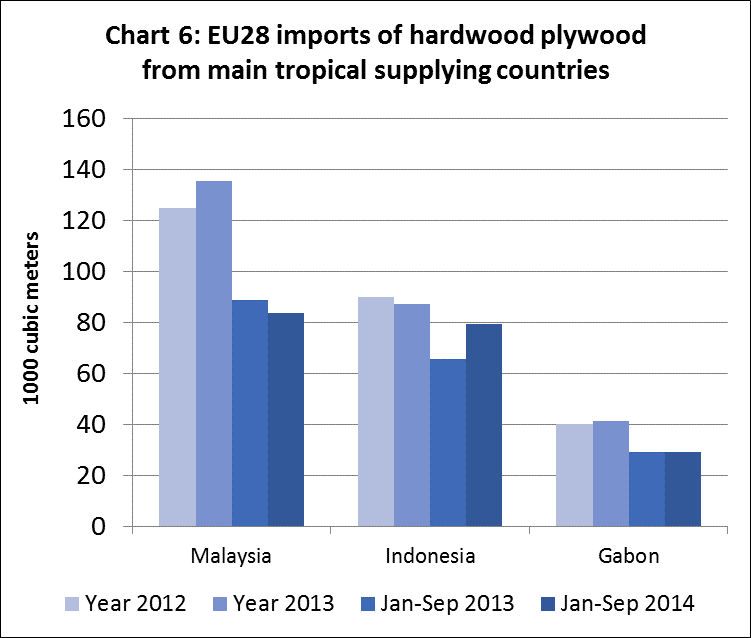

Charts 6 and 7 show how the downward trend in imports of tropical hardwood plywood into the EU has stabilised and even shown slight signs of recovery in 2014. Imports from Malaysia rose sharply at the end of 2013 to beat the increase in GSP duty from 1 January 2014 and fell away sharply in January and February. However they then stabilised at a slightly higher level than the previous year in each of the 7 months from March through to September 2014. For the full January to September 2014 period, EU imports of Malaysian hardwood plywood were 83,600 m3, 6% less than the same period in 2013.

Imports from Indonesia also fell in the first two months of 2014, but then increased between March and August 2014. In total for the first nine months of 2014, EU imports of Indonesian hardwood plywood were 79,500 m3, 22% more than the same period in 2013. European imports from Indonesia have been boosted this year by resumption of regular break bulk services in response to volatile container freight rates. Constraints on log supply and firm demand for Indonesian plywood in Japan and the Middle East mean that prices for Indonesian plywood are still too high for many European importers. However there is consistent demand from that sector of the market willing to pay premium prices for the quality advantages offered by Indonesian product. European importers report that prices for Indonesian plywood have been steady during the second half of 2014, with only slight price increases for specific grades of filmed plywood.

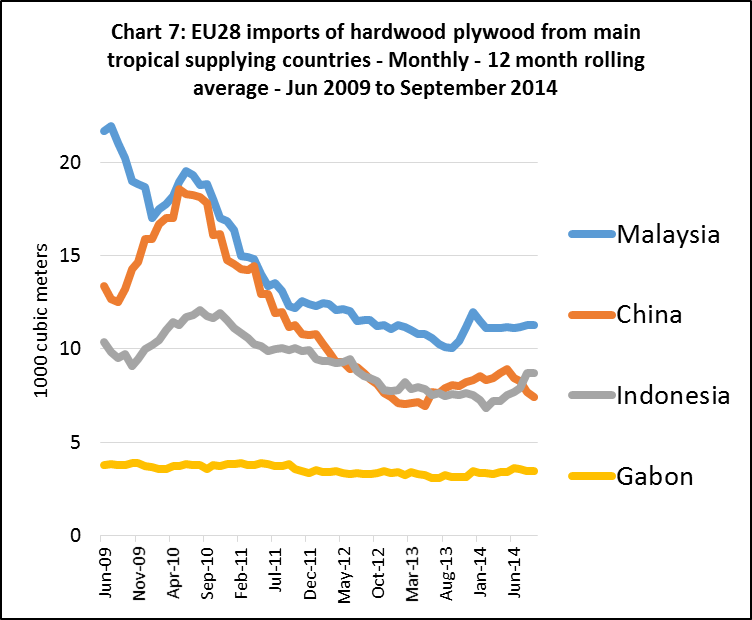

Chart 7 highlights that EU imports of okoume plywood from Gabon have remained low but consistent over the last 3 years. Imports from Gabon are around 3200 m3 to 3400 m3 each month with very little variation during the last 4 years. Total EU imports of plywood from Gabon in the first 9 months of 2014 were 29,000 m3, exactly equivalent to the same period the previous year. Much of this product is believed to be FSC certified and derived from one large European-owned operation in Gabon.

Okoume plywood market challenges

Despite the consistency in supply, Europe’s market for okoume plywood continues to suffer from slow demand. There were early signs of improving construction and economic activity in the first half of 2014 in the two key markets for this product – France and the Netherlands. However, activity and market confidence weakened again in the second half of the year.

Since the change in Gabon’s GSP status on 1 January 2014, plywood imported into the EU from Gabon has attracted a 7% duty. However manufacturers of okoume plywood in Europe have been granted an exemption and pay no duty on okoume veneer imported from Gabon.

Even with this advantage, there is little sign of an upturn in market demand for European produced okoume plywood. Producers continue to report very low profitability but are struggling to push through price increases in the current market. The simple fact is that Europe’s few remaining tropical hardwood plywood manufacturers are uncompetitive relative to overseas suppliers.

Slight rise in tropical hardwood plywood imports from China

Chart 7 shows that EU imports of Chinese plywood faced with tropical hardwood were rising between April 2013 and May 2014. This seems to contradict anecdotal reports suggesting that imposition of the EUTR from March 2013 had encouraged a partial switch away from tropical hardwood face veneers in plywood supplied into the EU from China. It’s likely that many EU importers had already made the switch away from tropical hardwood in Chinese plywood in advance of the March 2013 deadline. It’s also possible that Chinese manufacturers were being successful in sourcing sufficient volumes of legally verified tropical face veneers to service their European clients. However, the slow rising trend in EU imports of tropical hardwood plywood had reversed again by June 2014.

Russian birch plywood readily available

In the first nine months of 2014, EU imports of Russian birch plywood were 604,000 m3, 16% more than the same period in 2013. Demand has been particularly good in the UK. Supplies have also been readily available. In the last quarter 2014, lead times between ordering and delivery into the EU were no more than around 4 weeks on average. There is particularly good availability of filmed plywood grades as domestic demand for this product in Russia was weakening towards the end of the year with the early onset of winter. Prospects for supply in 2015 are also good with no shortages of log supplies and the colder conditions now prevailing in Russia expected to allow an early start to the harvesting season.

EU domestic plywood production

The EU does not have a large domestic plywood sector, mainly because it lacks supplies of large diameter logs required for plywood manufacture, and production has declined in recent years. Nevertheless the domestic industry is still an important competitor for imported plywood.

Latest Eurostat data shows that EU plywood production was 3.81 million m3 in 2013, down from 4.16 million m3 in 2012 and a high of 4.55 million m3 in 2007. Each year domestic production contributes between 50% and 55% of the volume of plywood supplied to the EU, a proportion that hardly changed during the decade to 2013.

Most large EU plywood manufacturers are based in Sweden and Finland and use softwood and birch. There are a range of smaller plywood manufacturers in southern parts of the continent utilising temperate species such as poplar and beech.

Delayed recovery in European construction

Future prospects for plywood market growth in Europe are likely to be dampened by only slow recovery in the European construction sector. The latest forecast issued by the research organisation Euroconstruct at their November 2014 Conference suggests a slower return to growth than forecast at their June 2014 Conference.

Euroconstruct note that after seven years of deep crisis, during which the market lost 21% in volume, 2014 is expected to be the first year of recovery in European construction output. However growth this year is not expected to exceed 1%, rising to 2.1% in 2015 and 2.2% in the following two-year period.

The recovery has been gaining momentum in the UK and other northern European countries outside the Eurozone. Eastern European economies have also returned to robust growth after a sharp slowdown in 2012-2013. However in the Eurozone in Western Europe, Italy remains in recession while economic problems are also mounting in other countries. Output, wages and prices are stagnating and levels of unemployment are at record highs after four years of general austerity measures.

Overall economic growth is expected to remain weak, particularly as the credit market is still very tight and the public accounts correction is still underway. Concerns over the risk of deflation in the Eurozone are also mounting.

According to Euroconstruct’s new estimates, all three main segments within the construction market are expected to grow slowly in the short-to-medium term. The residential sector is still suffering. This is especially true of new construction which, after a further 4% reduction last year, is only expected to grow 0.1% in 2014. However, in the medium term this sector is expected to be the main engine for recovery. Growth in residential construction across Europe is expected to average around 4% per year during the period 2015 to 2017. During this period new non-residential construction is forecast to grow by only 2% per year. Civil engineering is expected to grow on average 2.5% per year over the next three years. Renovation was more stable than other sectors during the recession and levels of activity in this sector should at least be maintained.

Construction activity is expected to grow most rapidly in Eastern Europe over the next three years, partly driven by increased spending of EU project funds on infra-structure. Construction activity in France, Italy and Spain has shown no increase in 2014. Growth in Germany is also slowing and there are even concerns that German construction activity could start to decline within the next two years. In contrast, the UK is set for very strong growth. UK residential construction is booming again (+16% new investment in 2014) and non-residential construction is expected to be boosted by strong demand for commercial, industrial and educational building. New civil engineering works are also expected to grow in the UK (+4.5% forecast in the two-year period 2015-2016).

PDF of this article:

Copyright ITTO 2020 – All rights reserved