After showing signs of recovery in the first half of 2014, the market for wood flooring in Europe slowed in the second half of the year. Competition from substitute products continues to intensify. Political tensions and economic slowdown in Russia have undermined export demand. These were the main conclusion of a meeting of the Directors of the European Wood Flooring Federation (FEP) on 30 September 2014.

The FEP market review covers the member countries of the FEP which includes all the main European consuming countries with the exception of the UK. The following summarises wood flooring demand in each FEP member country during the first nine months of 2014:

Austria: The market declined by an estimated 3% compared to the same period last year.

Belgium, Denmark and Norway: the market has remained stable compared to the same period in 2013.

Finland: sales are down by between 5% and 7% mainly due to reduced demand in Russia, the major export market.

France: sales are down between 10% and 12% this year. The trend forecast is also negative. Consumer confidence remains low.

Germany: the positive development of the first 4 to 5 months of 2014 has not continued. Demand in June, July and August was declining. Industry statistics indicate that wood flooring sales in the first 8 months of 2014 are down nearly 2% compared to the same period in 2013.

Italy: wood flooring consumption remains very low, down 20% in 2014 compared to the same period in 2013. Wood is also losing share. Consumption of ceramics has also fallen this year but at a slower rate than for wood flooring. Market expectations are subdued.

Netherlands: slow recovery of the economy offers some potential for future improvement in demand. However the market currently suffers from over-supply as the decline in domestic sales in recent years has not been matched by closure of manufacturing facilities. Producers have been trying to develop export opportunities but face stiff competition, particularly as the economy remains fragile in neighbouring European countries.

Spain: the market is stable but at a very low level. High levels of unemployment continue to severely depress consumer confidence. Spain’s government is due to cut both corporate and income taxes early in 2015 in an attempt to strengthen the economy and bolster the prospects of the ruling centre-right Popular party in elections due next year. This may lift consumption in 2015, at least in the short-term.

Sweden: wood flooring consumption has increased around 3% in 2014. House building is picking up, especially construction of single-family homes.

Switzerland: After significant growth in recent years, the market is now weakening. Demand is falling for both mosaic and 3-strip products. Wood flooring is losing share to luxury vinyl tiles.

Tarkett sales suffer from European and CIS downturn

Many of these same trends are apparent in the latest financial reports of Tarkett, the France-based company which is one of the world’s largest wood-based flooring manufacturers. Tarkett generated net consolidated revenues of €2,516m in 2013, 9.5% up on the previous year and a record for the company. However, the company’s high exposure to the European and CIS markets has meant it has struggled to maintain growth in 2014. Tarkett net sales reached €731.2m in the third quarter of 2014, a reduction of -3.3% compared to the same period in 2013.

Tarkett’s sales have continued to rise slowly in Scandinavia, Central Europe and Middle East as well as in Spain and Italy. However, sales in France have been badly affected by the contraction in public spending and the overall weakness of its economy. This has led to the closure of Tarkett’s Marty wood flooring plant in France, which experienced severe financial difficulties despite industrial, sales and marketing investments made. Tarkett’s sales to Russia and other parts of the CIS have also fallen by around 10% this year.

Tarkett sells close to 500 million square meters of flooring each year, and operates around 30 manufacturing sites around the world including in Western and Eastern Europe, Russia, North America, Brazil, and China. Tarkett’s strategy is to locate production facilities as close as possible to consuming markets so as to minimize transport costs and customs duties and remain competitive with local players. Tarkett are the number one vinyl flooring company worldwide and the leading flooring company in Russia and more generally in the CIS, as well as in a number of major European countries, including France and Sweden. One site in Russia has more than 1000 employees and has the largest production capacity of vinyl flooring in the world.

Wood and laminate flooring accounts for around 10% of Tarkett’s sales. These products are destined primarily for Europe and North American markets, mainly residential renovation projects and, to a lesser extent, commercial applications such as retail, hospitality, offices and indoor sports facilities. In line with broader industry trends, Tarkett has shifted from manufacturing plank to engineered multi-layer wood products.

Most of the wood used by Tarkett comes from Europe. Tarkett has been restructuring its’ European wood business to improve efficiency and reduce costs, for example by transferring manufacturing capacity from Scandinavia to Eastern Europe, which is closer to the source of raw materials and offers lower labour and other costs.

UNILIN shifts flooring manufacturing from Malaysia to Eastern Europe

A recent development at UNILIN highlights the value placed on proximity to the consumer in Europe’s flooring industry. UNILIN is one of Europe’s largest wood and laminate flooring companies manufacturing under the Quick-Step and Pergo brands. Through a multi-million dollar investment, UNILIN has boosted production capacity of engineered wood floors at its’ Magnum Parket plant at Vyskov in the Czech Republic by 59% to produce 1.3 million square meters a year.

The investment means that UNILIN will no longer need to import engineered wood floors from its production plant in Malaysia to supply the European market. The stated aim of the project is to offer shorter European supply lines and to progress corporate sustainability objectives. UNILIN’s available site capacity in Malaysia will be reoriented to supply markets in Asia, US, Latin America and Australia.

UNILIN claim the shift in production will greatly decrease the company’s carbon footprint. UNILIN also note it is committed to producing 100% PEFC certified product. Most of the wood used for manufacture of UNILIN’s flooring products derives from temperate regions and PEFC certified material is readily available from Europe’s domestic forests.

Slow rise in EU imports of wood flooring during 2014

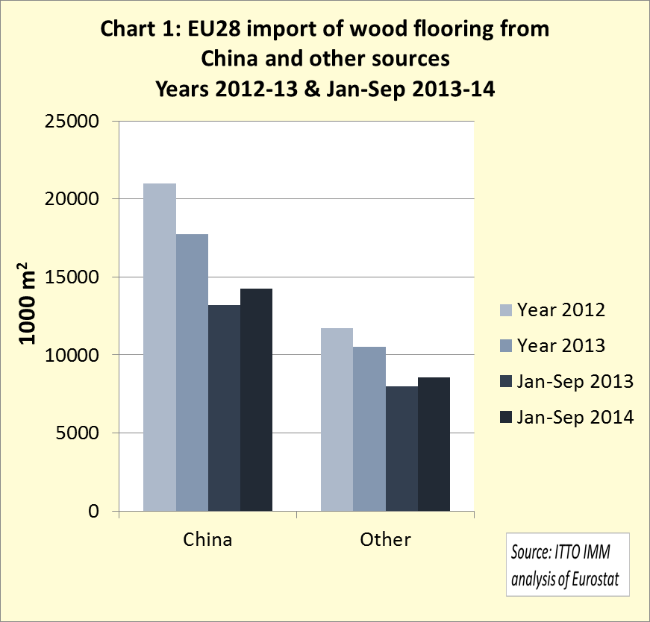

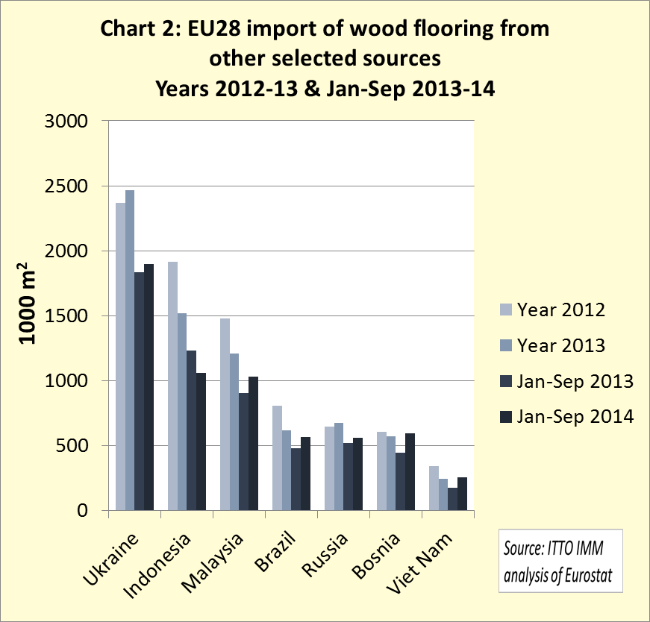

Imports of ‘real wood’ flooring from outside the EU supply around 22% of total consumption throughout the region. After declining in 2013, imports have been rising again this year (Chart 1). In the first nine months of 2014, the EU imported 22.86 million m2 of real wood flooring, 7.8% up on the same period in 2013. Imports from China were 14.26 million m2 in the first nine months of 2014, 8% more than in the same period the previous year. Imports have also risen from Ukraine, Malaysia, Brazil, Russia, Bosnia and Vietnam this year. Imports from Indonesia and Thailand have continued to decline (Chart 2).

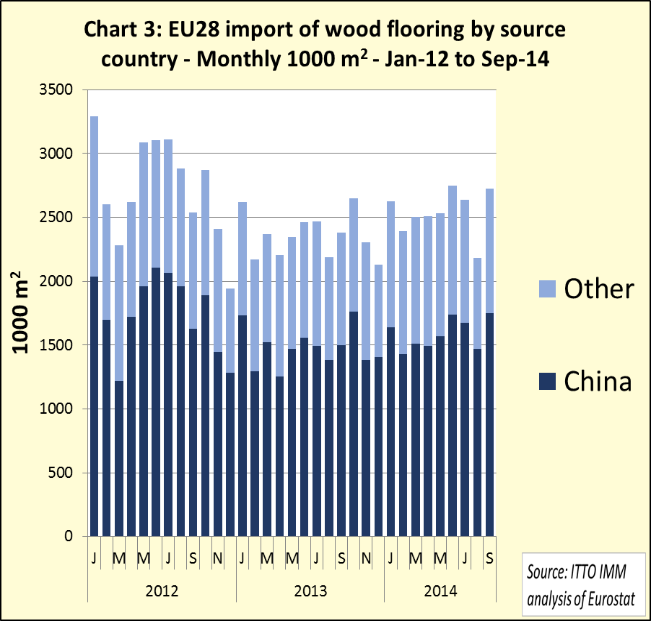

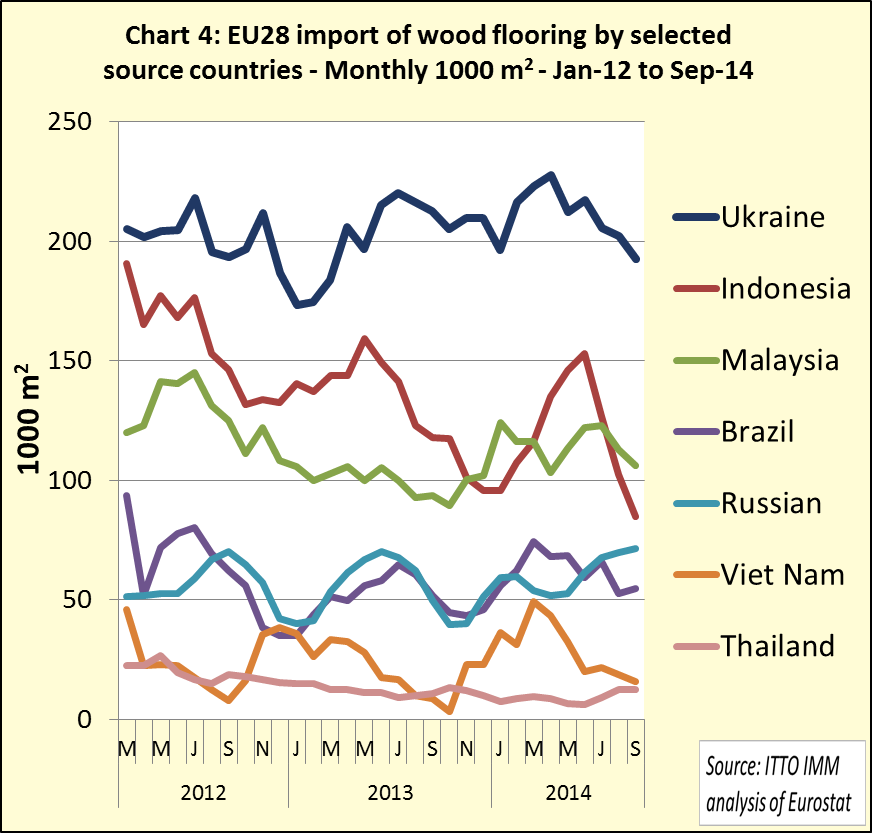

Monthly data indicates a gradual rising trend in EU wood flooring imports from China between the start of 2013 and June 2014 (Chart 3). A sharp fall in imports during August this year was followed by a strong rebound in September. Monthly imports of wood flooring from Ukraine, Malaysia, Brazil, and Russia have been fairly stable over the last 2 years (Chart 4). Imports from Indonesia have been more volatile and generally declining. Imports from Thailand have also been sliding during this period.

Construction growth boosts UK flooring demand

In the absence of a large domestic wood floor manufacturing sector, the UK is a large consumer of imported wood flooring. UK consumption trends in 2014 have been more positive than in other parts of Europe, driven by strong activity in the construction sector and rising consumer confidence.

The latest Construction Trade Survey undertaken by the UK Construction Production Association (CPA) reports that construction activity increased again in the third quarter of 2014, the sixth consecutive rise in activity. Although private housing output slowed, this was offset by growth in all other sectors. Construction firms also reported increases in forward looking indicators such as orders and enquiries suggesting that activity will continue to rise throughout 2015.

Drawing on the results of regular surveys and analysis of longer term demand trends, the CPA forecasts that the UK construction sector will grow 4.8% in 2014 and 5.3% in 2015. Sectors particularly relevant to the flooring industry are expected to perform very well. Private housing starts are expected to grow 18% in 2014 and 10% in 2015. The private housing sector’s rapid growth since early 2013 has been sustained by consistent levels of demand, the general UK economy’s return to health and government policies. For example, the UK government’s “Help to Buy” scheme allows private buyers to secure a mortgage with just a 5% deposit.

The private commercial sector, the largest component of UK construction, is set to increase 3.7% in 2014 and 6.1% in 2015. This sector is expected to benefit from a pickup in consumer spending and business investment and drive growth in each year up to 2018. The CPA expects new offices construction will expand by 10% in 2014 and 8% in 2015, followed by 7% in 2016. The retail sector remains exposed to the long-term trend away from the high street to internet shopping, and previous peak output levels are unlikely before 2018. Nevertheless, new large developments should still support growth in the retail sector of 8% from 2015.

Austerity in the previous three years has meant that public sector construction has severely hindered overall construction recovery. However the low point of public sector investment in construction seems to have passed. Increased funding for schools and hospitals is expected to lead to public sector construction growth averaging 2.6% per year between 2015 and 2018.

Growth in UK flooring demand slower than other economic sectors

A new report by Verdict, an independent market research company, also highlights that prospects are improving in the UK floor coverings market. Verdict note that UK consumers are more confident about their finances, housing transactions are growing quickly and pent-up demand is being released.

However, Verdict also caution that the rate of growth in the flooring sector will likely be much slower than in other areas of the UK economy. Verdict predict that the UK floor coverings market will increase by just 1.7% as homeowners prioritise other sectors due to floor coverings’ more hardwearing nature. Verdict forecast that from 2014 to 2019, total demand for floor coverings in the UK will grow by 15.1%.

Verdict suggest that a large share of this growth in demand will be in kitchen floors and will involve a wide mix of materials. This is partly because more homeowners will want to develop a room which they had deferred during the downturn. It is also because of life-style changes in the UK. The kitchen has become the hub of today’s home, the place where the family gathers and spends more time in each day. There is a move to “open plan living” in which different functional zones in the home are defined not by walls but by different surface materials including tiles, laminates, carpets and real wood flooring.

Another trend identified by Verdict in UK flooring and furnishing sales is a significant shift from traditional retail outlets to on-line retailers. However, rather than seeing this as a threat, forward-looking retailers are exploiting the trend. According to Gillian Drakeford, UK country manager of IKEA, the furniture giant now views online as a compliment to stores. “Customers are visiting the store and using the layouts to get ideas but perhaps going home and placing the order online. Going online is not killing the stores – it makes us more accessible, which grows the brand” she says.

IKEA’s sales figures suggest that the strategy is working. Overall UK sales of IKEA jumped by 11% to £1.4bn in the year to 31 August and footfall at IKEA stores is also increasing, rising by 5%. During the same period, IKEA UK’s online sales increased by a quarter and now make up 10% of sales.

UK Flooring Show highlights challenge to wood

Signs of mounting confidence in the UK’s flooring sector were apparent at the 52nd edition of The Flooring Show, the UK’s longest-established and only national flooring event held in Harrogate from 21-23 September. After a few years of marking time, largely due to overall economic conditions, this year’s show reported significant growth. Over 150 exhibiting brands were present covering some 3,500 square metres of exhibition space across four halls, up from 120 brands and 3,000 square metres respectively in 2013.

While the increase in numbers is encouraging for the flooring sector generally, the composition of exhibitors and show publicity highlighted the mounting challenge to wood from substitute materials. Wood products manufacturers and suppliers were in a minority at the show while there was a very strong showing from manufacturers of carpets and tiles. A major exhibit on carpets was provided by the Wool Marketing Board. The “Trends Hub” displaying “cutting-edge flooring materials and designs” was supported by British Ceramic Tile and Interface, a leading carpet tile manufacturer.

A large proportion of wood-based flooring on display consisted of laminated products. Exhibitors were showing a wide range of new laminate flooring designs “inspired by natural wood”, with a strong focus on oak, worn wood and distressed patterns.

The range of new flooring products based on reconstituted wood-fibre also continues to expand. UK-based Interfloor was exhibiting the Nadura range, manufactured by Meister in Germany, which it claimed is a “completely new category of flooring made using wood powder technology”. The range replicates slate, sandstone, metallic and wood effects and is designed to be hard wearing, with a lifetime residential warranty, slip resistant and easy to clean.

Suppliers of real wood flooring were represented at the show by Mohawk, a global player that offers hardwood flooring alongside a wide variety of other floor types, and BGP Trading, a leading Italian company in the wooden flooring market. BGP were exhibiting their top luxury “100% Made in Italy” collection of engineered hardwood flooring products. There was a strong focus on oak in this collection, although the company can also supply high end engineered products faced with tropical species including teak, doussie and iroko.

European laminates producers report on new-season fashion trends

According to the Association of European Producers of Laminate Flooring (EPLF), manufacturers are responding to three big European furnishing trends in preparation for the 2015 laminate flooring season. These trends are identified as “Shabby Chic”, “Vintage” and “Scandinavian Style”. EPLF suggest these trends will dominate at Domotex 2015, Europe’s leading flooring show to be held in Hanover 17 to 20 January.

EPLF note that originality, clarity of style and naturalness are in demand in interior design in Europe. Members of EPLF are using advanced printing and finishing techniques to exploit these trends. More defined printing with a strong three-dimensional effect aims to provide “true-to-nature” grain patterns, “a more authentic look and touch” and “more vibrant colours”. However, the wood effects in laminate this year will be “presented in an overall calmer and more reserved way than in previous years” and “cracks and knots on the surface are rather less pronounced”.

EPLF suggest that oak decors continue to dominate the international range of laminates. However, other premium and natural design wood decors such as wych elm, ash, spruce, larch, walnut and pine are increasingly finding favour amongst buyers. With regard to colour, wood effects currently have a tendency towards the lighter natural tones: greige, light beige, cream, warm light grey shades, or even matt white.

EPLF also state that the current trend for open space living is driving demand for the “wood flooring look”, particularly for extra-long and extra-wide plank formats which create the impression of generously-sized rooms. The variety of colours and textures of authentic wood decors can be used to good effect to divide up space. European manufacturers are also exploiting modern interest in mixed materials by combining the classic wood look with stone finish decors in a single laminated product.

Laminate flooring manufacturers are also increasing the range of applications for their products through development of an increasingly wide range of surface types. These include moisture-repellent surfaces for use in kitchens and bathrooms and highly non-slip surfaces for use in entrance and work areas.

European legal judgement sets precedent for CE-Marking

A recent judgement by the European Court of Justice (ECJ) has dealt a blow to Germany’s continuing insistence on application of national standards for construction products, including flooring, in breach of EU rules for free flow of goods throughout the continent.

On 16 October, the ECJ ruled that through the use of what are known as Bauregellisten (Building Rules lists), the Federal Republic of Germany had impeded market access for construction products already carrying CE conformity marking. The action was brought against Germany by the European Commission.

The ECJ judgement refers only to a limited range of construction products covered by certain harmonised European standards (hEN) – in this case doors, gates and thermal insulation products. However, it sets a precedent for resolution of numerous similar complaints from manufacturers and importers relating to German treatment of a wide range of construction products covered by other harmonised standards.

The European flooring industry has taken a very close interest in the judgement. Associations like the EPLF have long argued that Germany has created a barrier to internal EU trade by insisting that CE-Marked flooring products must also meet national technical approvals and the Ü mark of conformity managed by the Deutsches Institut für Bautechnik (DIBt).

In practice, all wood flooring products placed on the EU market are already required to meet stringent performance and environmental requirements. CE-Marking in accordance to the hEN14342 standard for wood flooring has been mandatory throughout the EU since July 2013 when the Construction Products Regulation (CPR) replaced the Construction Products Directive (CPD).

The hEN14342 standard covers the following flooring products: solid wood flooring; engineered wood flooring; multi-layer engineered wood flooring; bamboo flooring; and engineered bamboo flooring. The standard includes minimum requirements for moisture content, reaction to fire, pentachlorophenol content, formaldehyde emissions, breaking strength, slipperiness, thermal conductivity and biological durability.

The exact procedures (the so-called Attestation of Conformance or “AoC” level) to demonstrate conformance to the various hEN standards varies. In most instances it requires the services of a “European Notified Body” which is a third-party body recognised as competent to carry out the conformity assessment tasks laid down in the standard.

Wood flooring is defined as AoC-level 4 in hEN 14342. This means that a manufacturer must have documented conformity to an internal production control system and must perform an initial type testing. Manufacturers requiring CE Marking at AoC-level 4 must contact a European Notified Body which will then test a sample of the product and issue a test report and (if a positive outcome) award a certificate. Having signed the EC “Declaration of Conformity”, the manufacturer may then affix the “CE Mark” to product

The judgement against Germany should reinforce the general principle that conformance to CE Marking based on harmonised European standards such as hEN14342 should ensure free access to all EU Markets. Although individual Member States are mandated to establish national performance and environmental standards for construction products, this is only on condition that national standards do not impede the free movement of CE-Marked products.

PDF of this article:

Copyright ITTO 2020 – All rights reserved