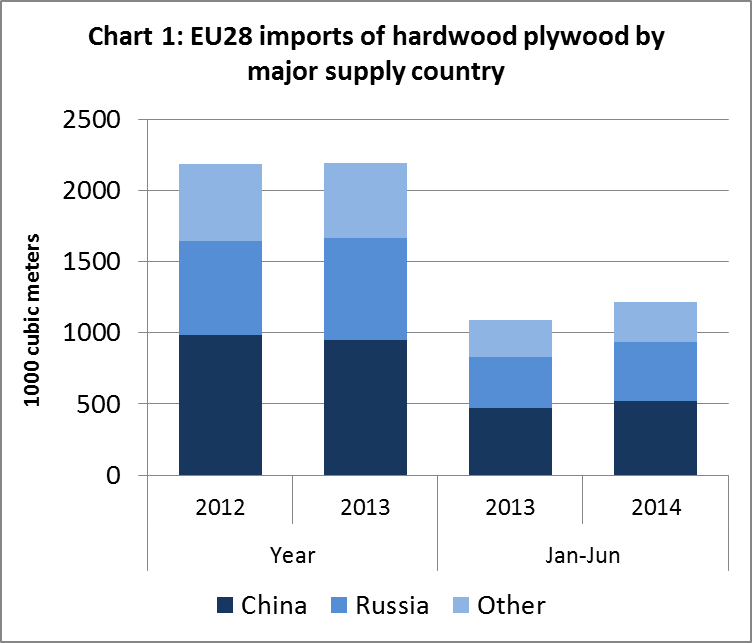

In the first six months of 2014, EU28 imports of hardwood plywood were 1.21 million m3, 12% more than the same period the previous year. This follows stable imports between 2012 and 2013 (Chart 1).

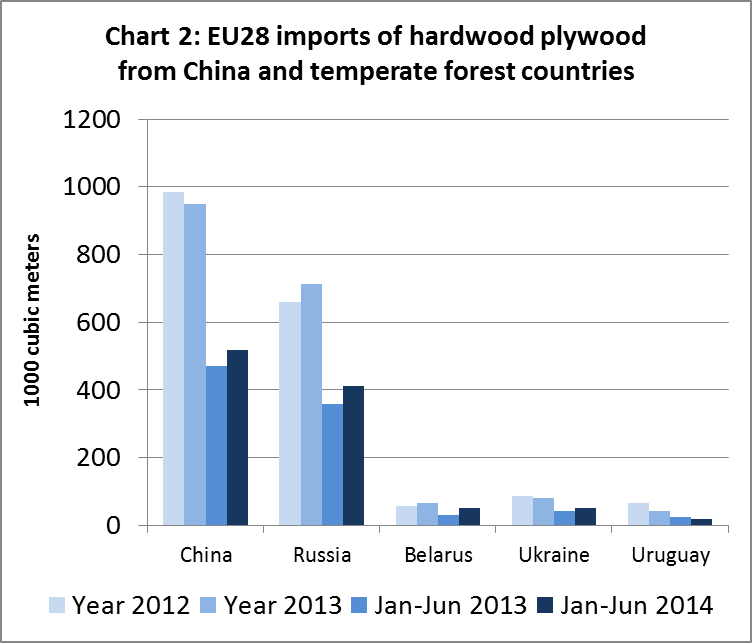

Most of the gains this year have been in imports from China and temperate forest regions. After declining 3.5% between 2012 and 2013, EU imports of hardwood plywood from China increased 11% to 519,000 m3 in the first six months of 2014. Imports from Russia climbed 15% to 412,000 m3 in the first six months of 2014, building on the 8% rise in imports recorded the previous year. Imports in the first six months of 2014 also rose strongly from Belarus and Ukraine. However imports from Uruguay have been declining (Chart 2).

Firm European demand for Chinese hardwood plywood

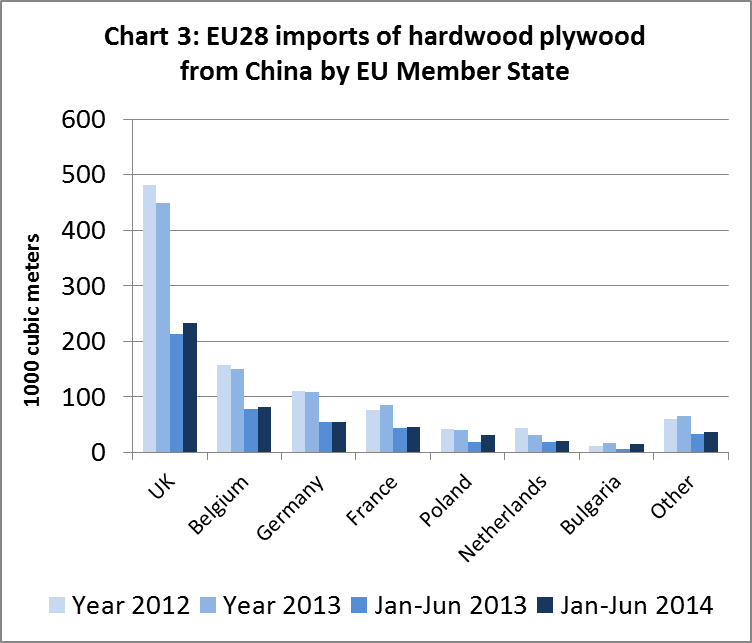

There has been firm demand for Chinese hardwood plywood in Europe this year. Officially reported imports of Chinese hardwood plywood have risen into all the leading EU markets during 2014 with the exception of Germany (Chart 3). Demand has been particularly strong in the large UK market, led primarily by strong recovery in construction and also benefitting from improving sales to the shop-fitting, furniture and packaging sectors. Nevertheless, there remains considerable resistance to increased prices in the highly competitive UK market. This trend has favoured Chinese products which tend to be more competitively priced than South East Asian products. China’s share of the UK market has been rising sharply this year, mainly at the expense of Malaysia.

While UK buyers often seem more inclined to compromise on quality rather than on price, some importers are raising concerns about the quality of Chinese plywood arriving in the country. There are reports, for example, of thin and low quality veneers for plywood products claimed to be compliant with the BS1088 standard for marine plywood.

The apparent decline in imports of Chinese hardwood plywood into Germany may be partly due to emerging signs of weakness in German construction and other continental European countries in the second quarter of 2014. However it also reflects the recent practice by German customs to record some plywood imports from China as LVL thereby pushing them into a higher tax bracket. This issue has been raised with the German customs authorities by the German timber trade association GD Holz. As a result, some Chinese products currently included under LVL in German trade statistics may reclassified and plywood import statistics for 2013 and 2014 amended upwards retrospectively later in 2014.

After a period of tight supply for mixed light hardwood plywood from China in the first quarter of 2014 due to restricted availability of eucalyptus and poplar veneer, the supply situation eased in the second quarter of the year. Delivery times to Europe currently stand at around 4 to 5 weeks.

FOB prices for mixed light hardwood plywood from China were holding steady in the three months before the Chinese New Year, but prices increased in March and April this year to accommodate rising prices for eucalyptus and poplar veneer. Prices have since stabilised at the higher level.

CIF prices for delivery of Chinese plywood to Europe have been less certain due to continuing fluctuations in freight rates. After recovering to $1300 per TEU in early July, the Shanghai-North Europe freight index dipped again to $1,230 at the end of July and then jumped to $1,455 in the first week of August. It remains to be seen whether shipping companies will be able to maintain these higher rates during the autumn months.

Mixed fortunes for tropical hardwood plywood in Europe

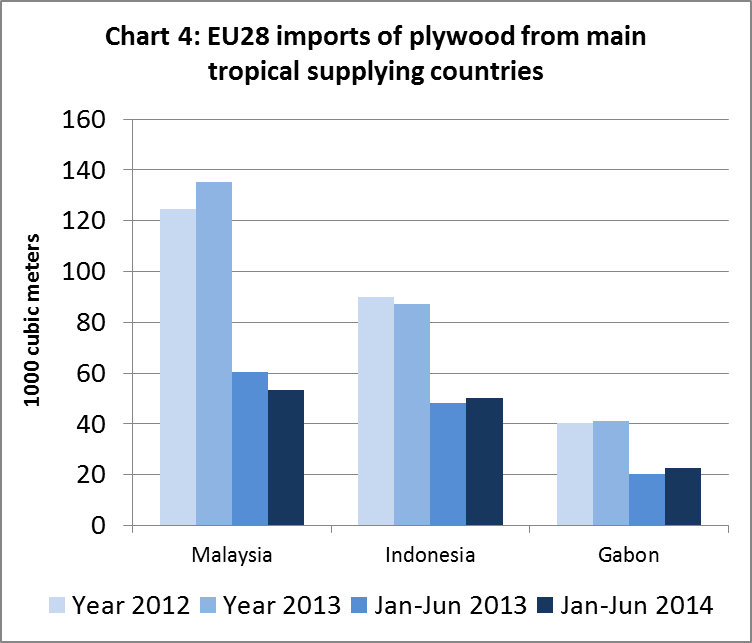

The fortunes of tropical hardwood plywood in the EU market have been mixed in 2014 (Chart 4).

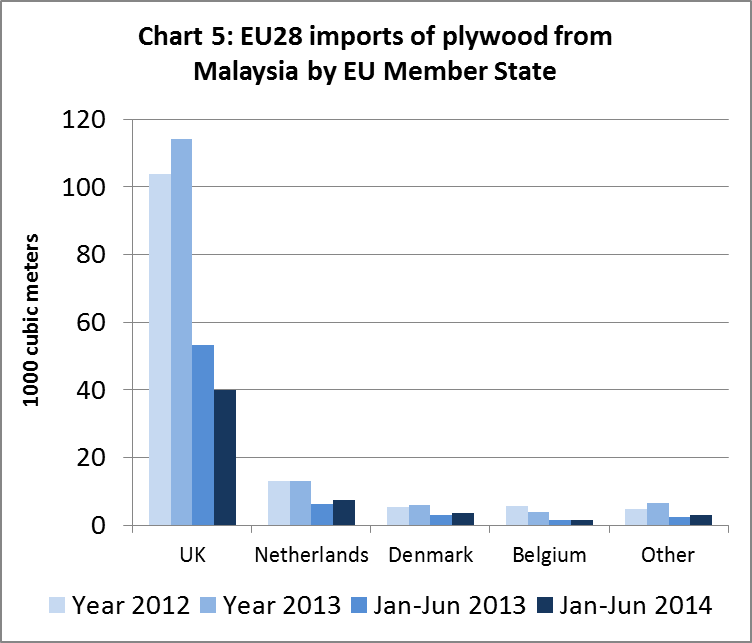

Imports from Malaysia declined 12% to 53,300 m3 in the first 6 months of 2014, a turnaround following a 9% increase in imports from Malaysia the previous year. This is partly explained by rising prices for Malaysian plywood in 2014 due to various factors including: the increase in GSP duties from 3.5% to 7% on 1 January 2014; higher production and freight costs during 2014; and robust sales in other parts of the world, including the US and Middle East. Prices for Malaysian raw plywood on offer to European buyers currently stand at around Indo 96+32%.

Higher prices for Malaysian plywood have particularly reduced demand in the relatively large but price conscious UK market. Imports of Malaysian plywood into the main continental European markets have increased this year (Chart 5).

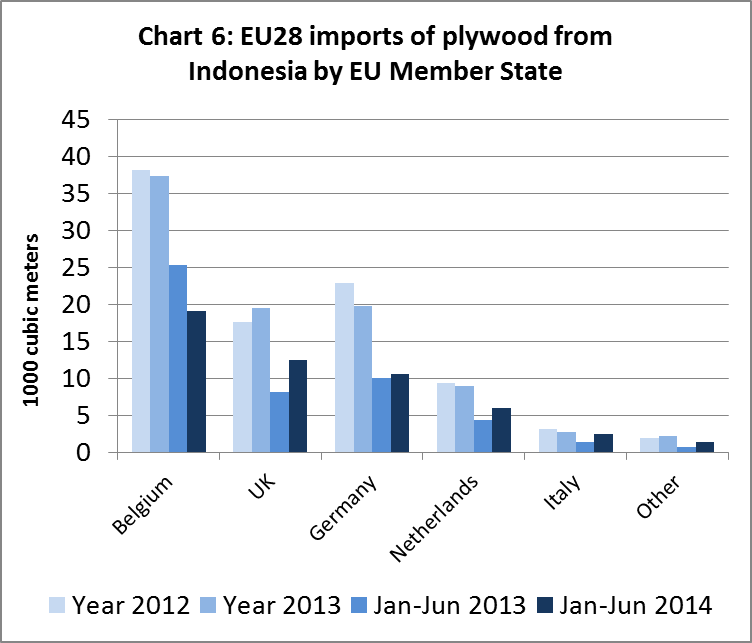

Imports of hardwood plywood from Indonesia were up 5% in the first six months of 2014 following a decline in imports the previous year. Imports into Belgium declined by 25% but this was offset by rising imports into the UK, Germany, Netherlands, and Italy (Chart 6).

Like Malaysian products, Indonesian plywood prices have been rising this year and currently stand at around Indo ’96 +40% for raw plywood. Much of the gain in prices is due to rising log costs in Indonesia and higher freight rates, both for break bulk and container shipment. However Indonesian plywood continues to benefit in the EU market from relatively high prices for competing Russian and European birch plywood. Break-bulk shipments of Indonesian plywood to Europe are now occurring around once every two to three months and are heavily subscribed.

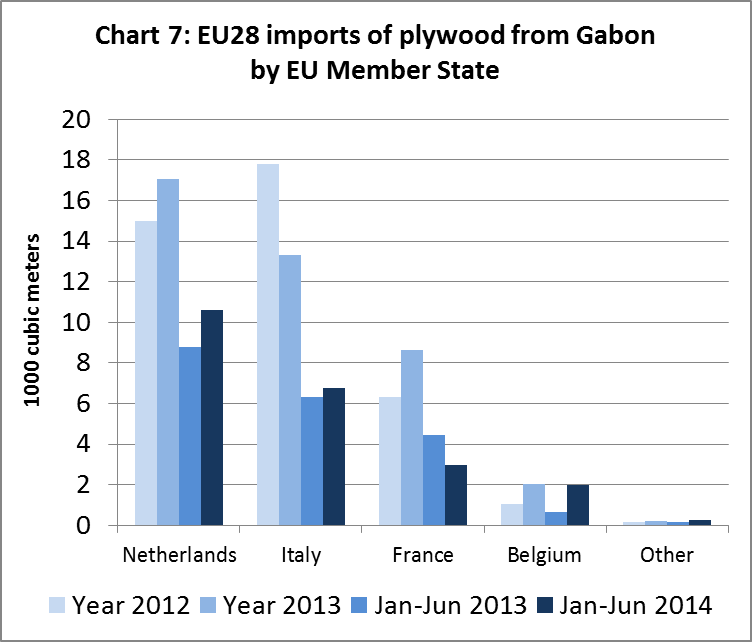

EU plywood imports from Gabon are low but rising

EU imports of hardwood plywood from Gabon were 10% higher in the first six months of 2014 compared to the same period the previous year. Imports into France declined, but this was offset by rising imports into Netherlands, Italy and Belgium (Chart 7). This is despite the change in Gabon’s GSP status which led to imposition of a 7% tariff on EU imports of hardwood plywood from Gabon at the start of 2014. Imports this year have also been disrupted by occasional strikes by customs officials at Libreville port in Gabon.

Both EU manufacturers and importers report better demand for okoume plywood in 2014 than in the previous year. This is driven by improved construction activity in the opening months of 2014 in Netherlands and Belgium and, more recently, by rising boat-building in Italy.

However European consumption of okoume plywood is still very low by historical standards. Much of the existing demand is for FSC certified products. Apart from increases due to the imposition of higher export tariffs, prices for okoume plywood imported from Gabon have remained stable during the first half of 2014.

Following lobbying by associations representing European plywood manufacturers, the EU has reduced the tariff on imports of okoume veneer under product code 4408393010 from 7% to 0%. The tariff reduction was announced in European Council Regulation No 722/2014 of 24 June 2014 and backdated to 1 January 2014. This reverses the increase imposed at the start of the year due to the change in Gabon’s GSP status. The reduction does not apply to plywood imported from Gabon which continues to be subject to the 7% tariff. Gabon industry representatives have expressed concern that this measure favours EU-based over Gabon-based manufacturers.

UK demand boost EU imports of softwood plywood

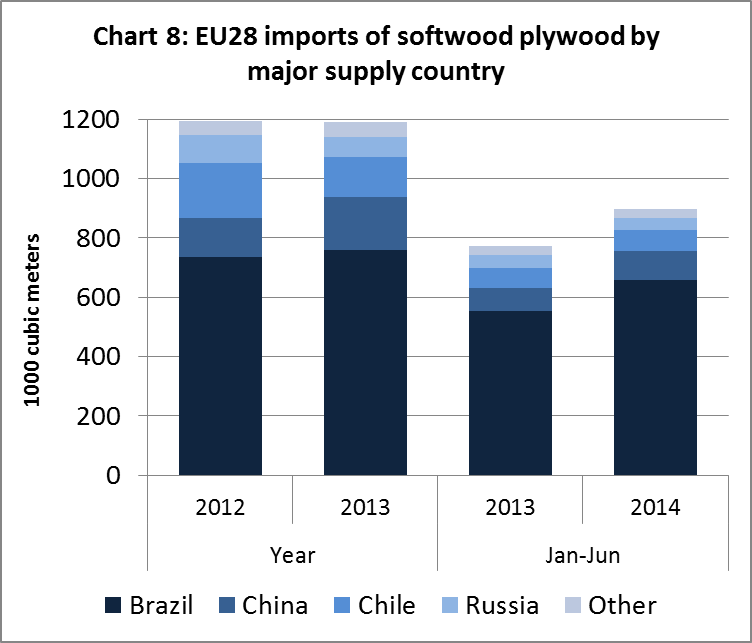

In the first six months of 2014, EU28 imports of softwood plywood were 898,000 m3, 17% more than the same period the previous year (Chart 8). Imports from Brazil increased 19% to 657,000 m3 in the first half of 2014. There was also a 26% rise in imports from China to 97,400 m3, and a 5% increase from Chile to 72,300 m3.

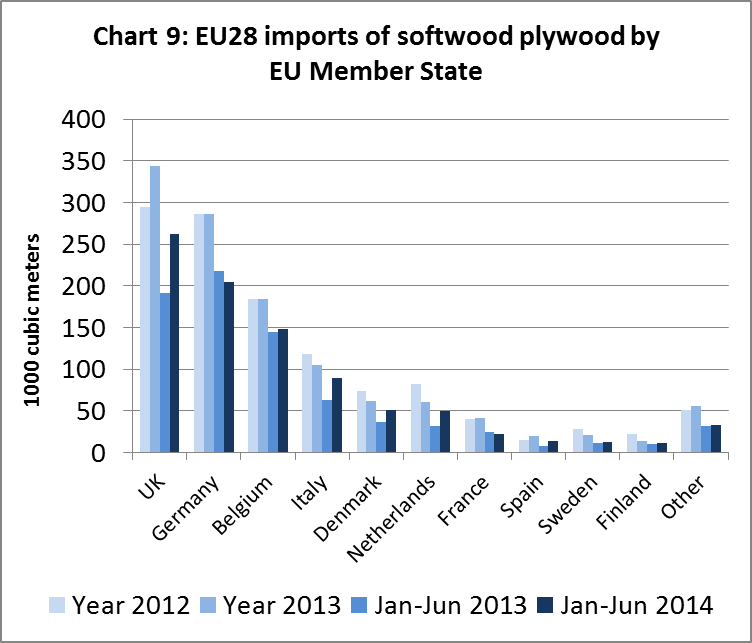

Much of the gain in imports was due to improving market conditions in the UK. However imports also increased into Belgium, Italy, Denmark and the Netherlands in the first half of 2014. Imports into Germany and France have been weaker this year (Chart 9).

A large proportion of softwood plywood imported into the EU each year arrives in the first quarter as importers rush to benefit from the annual duty free quota of 650,000 m3. This year there was a particularly strong surge in imports in January, but imports slowed dramatically in February and only recovered a little ground in the March to June period.

While consumption of softwood plywood has been good in the UK this year, disappointing construction activity in the spring months in other European markets has weakened demand elsewhere. European importers have been resistant to the higher prices asked by Brazilian exporters following rapid appreciation of the real exchange against the dollar in the first four months of this year. Brazilian exporters have also faced higher log, energy and wage costs this year.

In previous years, Brazilian suppliers have reduced sales prices for softwood plywood in Europe by an amount equivalent to the 7% duty rate once the duty-free quota is used up. However this year they have had little incentive to reduce prices to European buyers at a time of robust demand in North America.

Variable prospects for EU plywood market

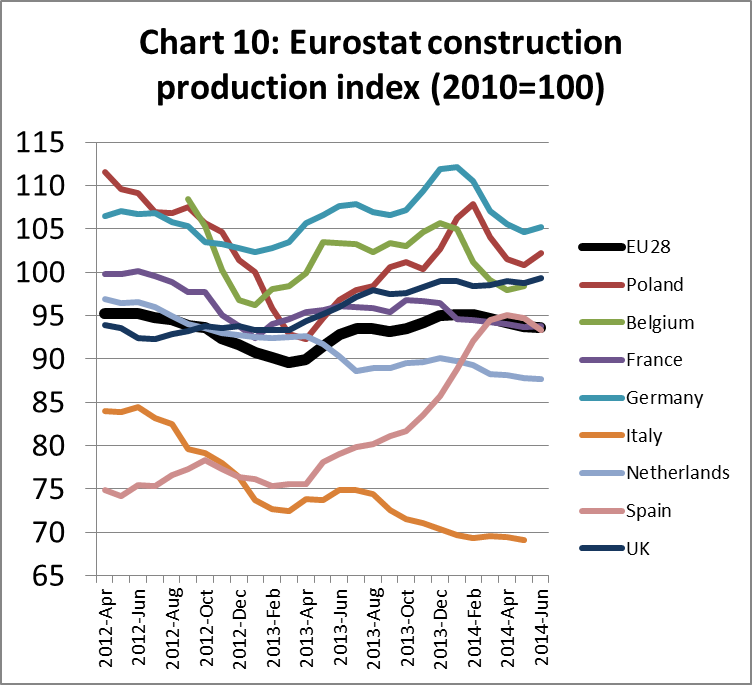

While market conditions for plywood in Europe have improved in 2014, recent construction data and other economic indices suggest future prospects remain variable and uncertain. The EU Construction Production Index, having made gains between March 2013 and January 2014, lost ground in the months to June 2014. The slowdown was particularly evident in Germany but also affected Poland, Belgium and Spain (Chart 10).

There are also emerging signs that the recovery in the broader euro-zone economy may be stalling. The euro-zone recorded zero GDP growth in the second quarter of 2014. It had been expected to grow, if barely, but was dragged down by worse than expected GDP data from Germany and France. Germany’s economy contracted by 0.2% as both its export industry and domestic construction sector struggled. France registered a second straight quarter of zero growth.

However prospects remain good in the UK. In August, the UK Construction Products Association (CPA) revised its forecast for construction output growth this year to 4.7%, up from 4.5% forecast in April. The CPA growth forecast for next year is 4.8%. Growth is expected to be fuelled by rapid expansion in private housing starts and commercial offices. CPA expects private housing starts to grow 18.0% in 2014 and 10.0% in 2015, while commercial offices output are forecast to grow 10.0% in 2014 and 8.0% in 2015. Overall levels of UK construction activity will likely match their 2007 peak in 2017.

PDF of this article:

Copyright ITTO 2020 – All rights reserved