According to the latest half-yearly report issued in June 2014 by the Euroconstruct research agency, aggregated construction output for the EU countries fell by 2.7% in real terms in 2013 to the lowest level in 20 years (at constant prices). However, Euroconstruct report that the European construction market hit bottom last year and forecast average growth of 1.8% per year between 2014 and 2016. This new growth rate forecast is 0.2% greater than the previous Euroconstruct forecast in November 2013.

The rate of recovery projected by Euroconstruct is slow given the extent of the decline in construction value in recent years. It implies that output and capacity utilization in the European construction sector as a whole will remain at near-depression levels. High unemployment and debt, low investment, tight credit, and financial fragmentation in the Euro area will continue to dampen demand.

However, even when growth is slow, with total value of nearly €1.3 trillion in 2013, Europe’s construction sector remains globally significant and a very large consumer of wood and other materials.

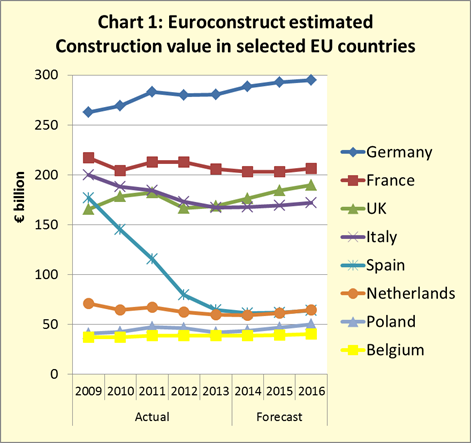

Growth in construction will vary widely between EU countries (Chart 1). The German construction sector has grown consistently over the last five years and is now by far the largest in Europe. The upward trend in German construction is expected to continue between 2014 and 2016. Construction activity in France has been sliding since 2012 but is forecast to hit bottom in 2014 and stabilise in 2015. Construction activity in the UK began to rebound last year and is forecast to continue to recover well between 2014 and 2016. Poland, Ireland, Denmark and Hungary are also among the fast growing construction markets, all with average growth rates expected to exceed 4% per year. In contrast, construction output looks set to remain below 2013 levels in Spain and the Czech Republic.

Much of the growth in European construction will be concentrated in new residential construction, but the gradual recovery should feed through into all sub sectors. New residential construction in total is expected to grow by 3.2% a year between 2014 and 2016. However residential renovation and maintenance (R&M) is expected to grow by only 1.2% a year. This will reduce average growth in total residential construction to 2% a year in real terms.

Although most EU countries are clear of recession, sluggish domestic demand growth and weak public sector finances are likely to dampen non-residential construction for some time. Euroconstruct expect total non-residential construction on average to increase by 1.5% a year between 2014 and 2016 in real terms, an upward revision of 0.3% from the November 2013 forecast. Total civil engineering works is now expected to grow by 1.9% a year between 2014 and 2016 in real terms, compared to 1.5% in the previous forecast. The adjustment is mainly a result of a brighter outlook for new civil engineering.

European real wood flooring production down 1.8% in 2013

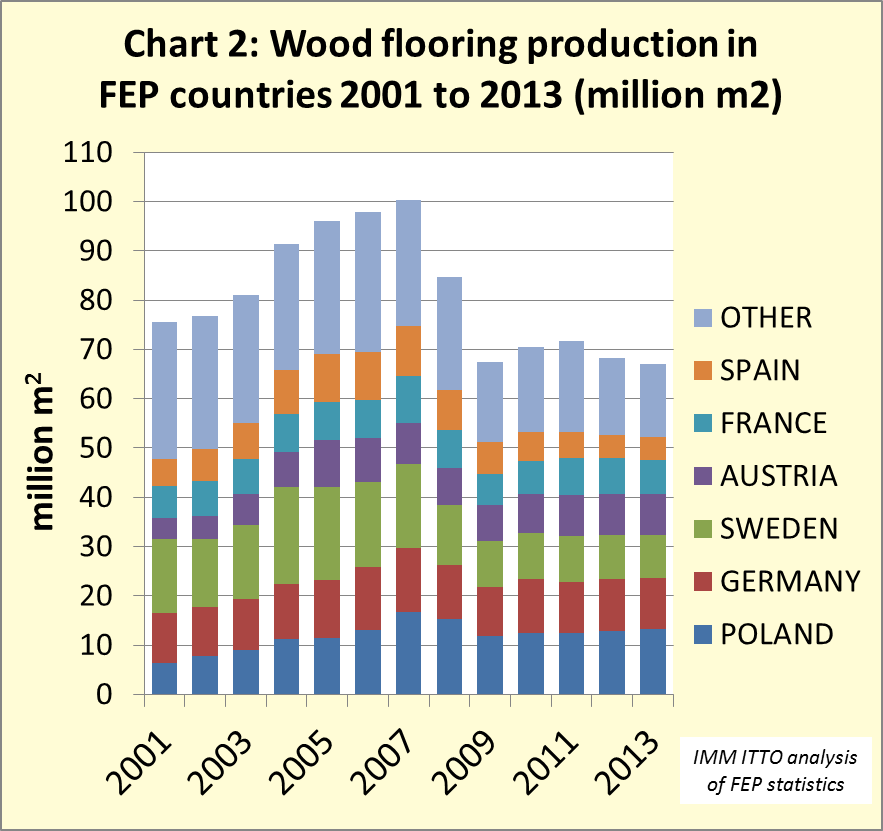

Production of ‘real wood’ flooring[1] in the 17 countries covered by FEP[2], the European wood flooring association, declined by 1.8% to 67.03 million m2 in 2013 (Chart 2). FEP estimate that total production in Europe, including both FEP and non-FEP countries, was just over 77 million m² in 2013. These figures were released by FEP at their annual meeting in Malaga, Spain, in June.

[1] The term ‘real wood’ flooring is used to denote products with a real wood face veneer which are identified specifically as wood flooring in the trade product codes. These products are distinct from laminated flooring which are considered separately in this report.

[2] Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Hungary, Italy, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden and Switzerland.

Production in Poland, Europe’s largest wood flooring manufacturing country, increased 2.5% to 13.28 million m2 in 2013. Poland now accounts for nearly 20% of all production in FEP countries. Production in Germany, the second largest European manufacturing country, remained stable at 10.4 million m2 between 2012 and 2013. However production in Sweden, the third largest manufacturing country, declined 3.3% to 8.78 million m2 in 2013. There was also a 5.8% fall in production in France to 6.9 million m2.

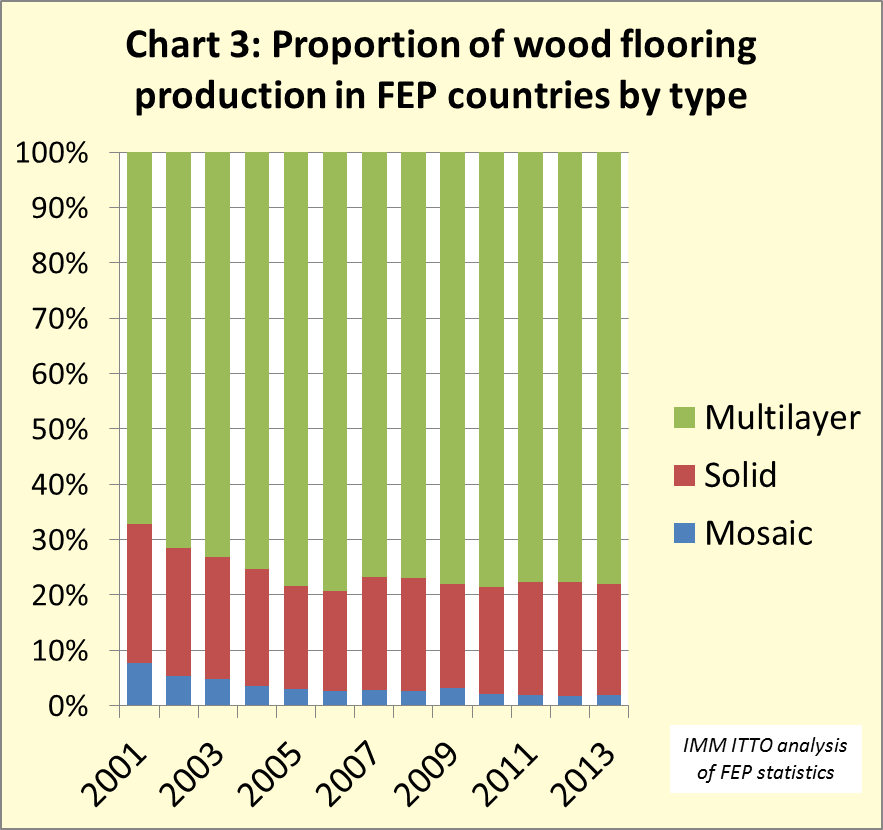

There was no change in the proportion of real wood flooring production by product type between 2012 and 2013 (Chart 3). In both years, multilayer flooring accounted for 78% of production, solid wood for 20% of production and mosaic wood flooring for only 2% of production.

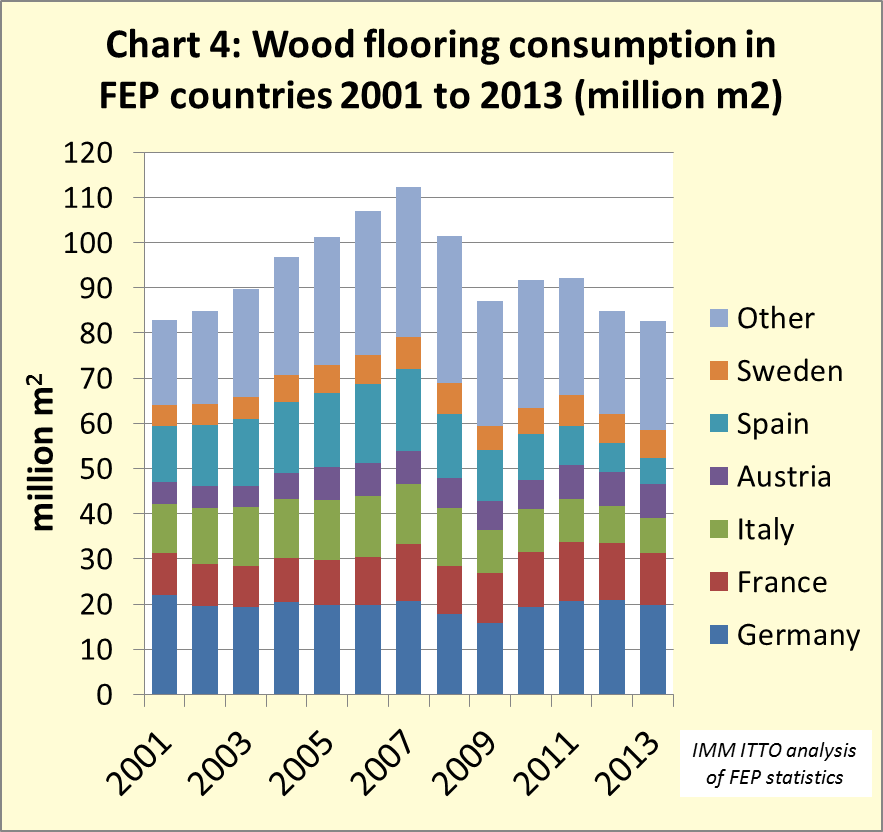

Consumption of real wood flooring in FEP countries declined 2.6% to 82.68 million m² in 2013 (Chart 4). Consumption in all the leading European markets was falling last year. Consumption was down 6% to 19.8 million m2 in Germany, down 7% to 11.6 million m2 in France, and down 5% to 7.8 million m2 in Italy. However these losses were partially offset by rising consumption in Austria, Denmark, Finland, Norway, Switzerland, and Romania.

Consumption of real wood flooring per inhabitant throughout the FEP area fell slightly from 0.22 m² in 2012 to 0.21 m² in 2013. Per capita consumption is now highest in Switzerland (0.79 m²), followed by Austria (0.77 m²) and Sweden (0.65 m²). In contrast, per capita consumption was no more than 0.05 m² in Netherlands and Hungary.

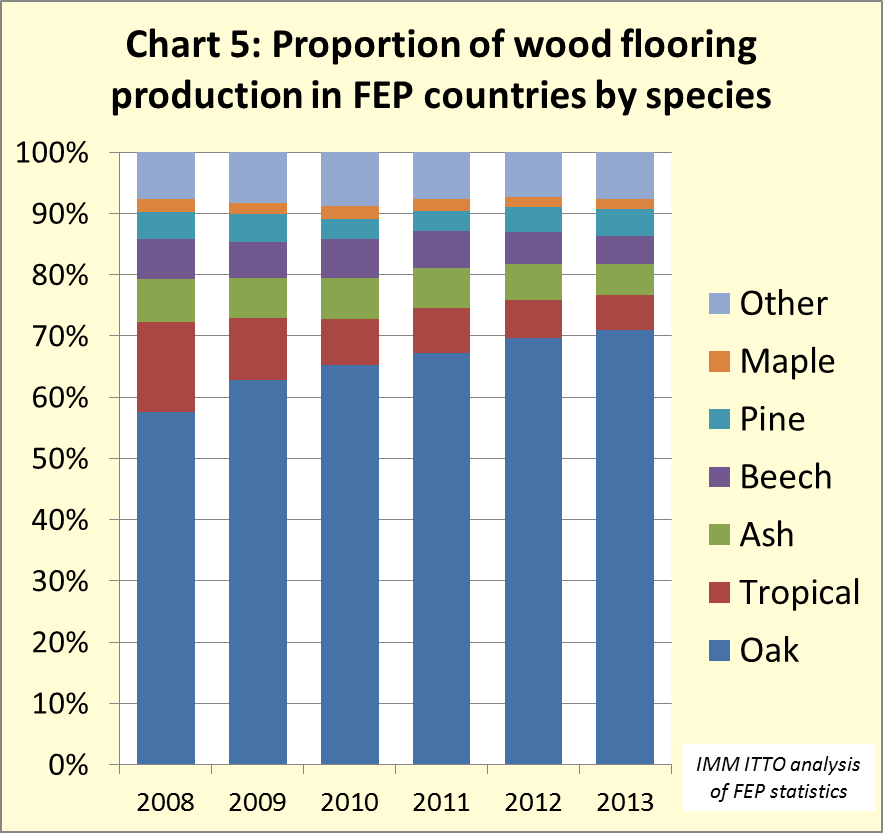

The dominance of oak in European real wood flooring production continued to rise last year, while tropical wood lost more ground (Chart 5). In 2013, oak accounted for 70.9% of wood flooring production in FEP countries, up from 69.6% in 2012. The share of tropical wood fell from 6.2% to 5.8% last year. The share of ash (5.1%), beech (4.6%) and maple (1.6%) were all slightly lower in 2013 than in the previous year. However, the share of pine increased from 4.1% in 2012 to 4.4% in 2013.

At their June meeting, members of FEP reported that the outlook for real wood flooring in Europe has improved in 2014 after nearly seven years of lingering economic and financial crisis. The positive trends that have emerged in northern Europe at last seem to be filtering through into southern Europe which was traditionally a large market for wood flooring. However, members of FEP expressed concern about continuing lack of access to credit following the financial crises, particularly amongst small and medium-sized companies that dominate the wood flooring sector.

Slowdown in rate of increase in EU wood flooring exports

EU exports of real wood flooring have been rising in recent years as European manufacturers focused on diversifying overseas markets in the face of weak domestic demand. In 2013, around 25% of all real wood flooring manufactured in the EU was exported to non-EU countries. However the pace of increase in exports slowed in the first four months of 2014 with a slowdown in economic growth and political problems in several major external markets.

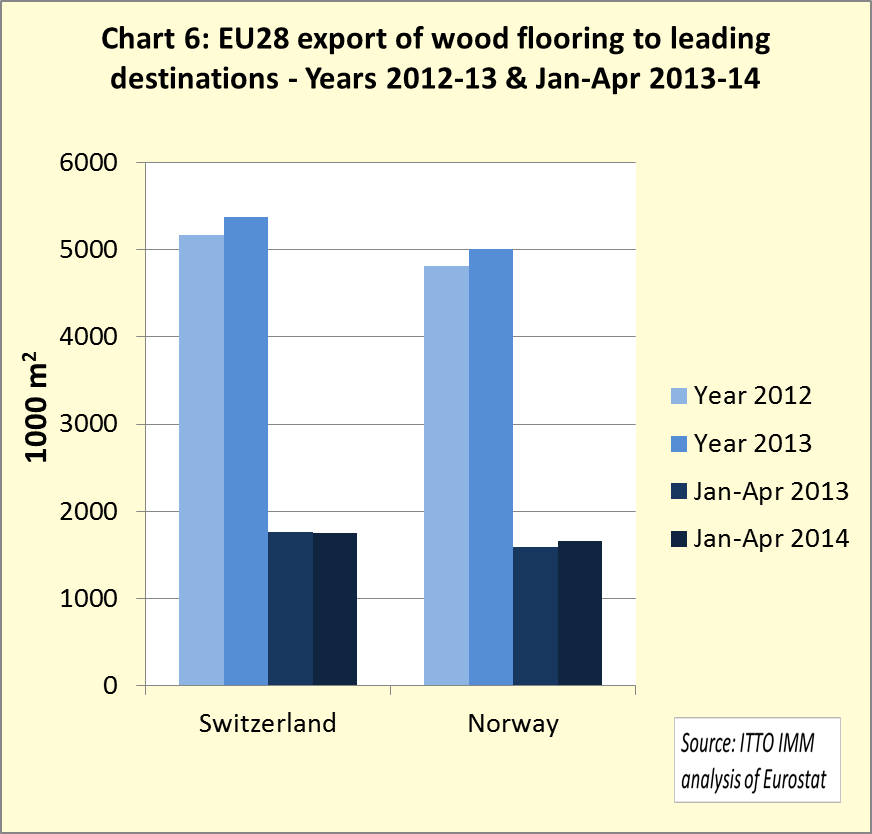

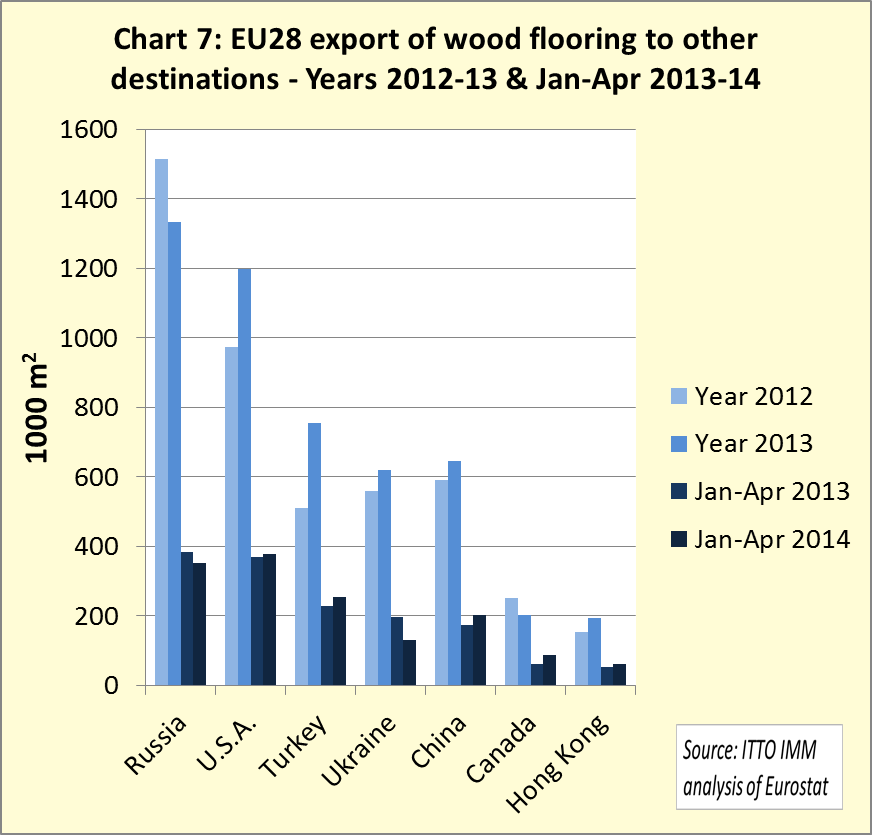

Total EU exports of wood flooring increased 4.7% to 17.78 million m2 between 2012 and 2013. There was growth in exports to Switzerland and Norway, by far the largest export destinations (Chart 6). However there was also significant growth in exports to USA, Turkey, Ukraine, China and Hong Kong in 2013 (Chart 7).

Between January and April 2014, the EU exported 5.64 million m2 of wood flooring, 1.3% more than the same period in 2013. This year exports have continued to rise strongly to Norway, Turkey, China and Hong Kong. However the rate of export growth has slowed to the USA, while exports to Switzerland and Ukraine have been declining in 2014. Exports to Russia began to decline in 2013 and this trend has continued in 2014.

Partial recovery in EU wood flooring imports from China

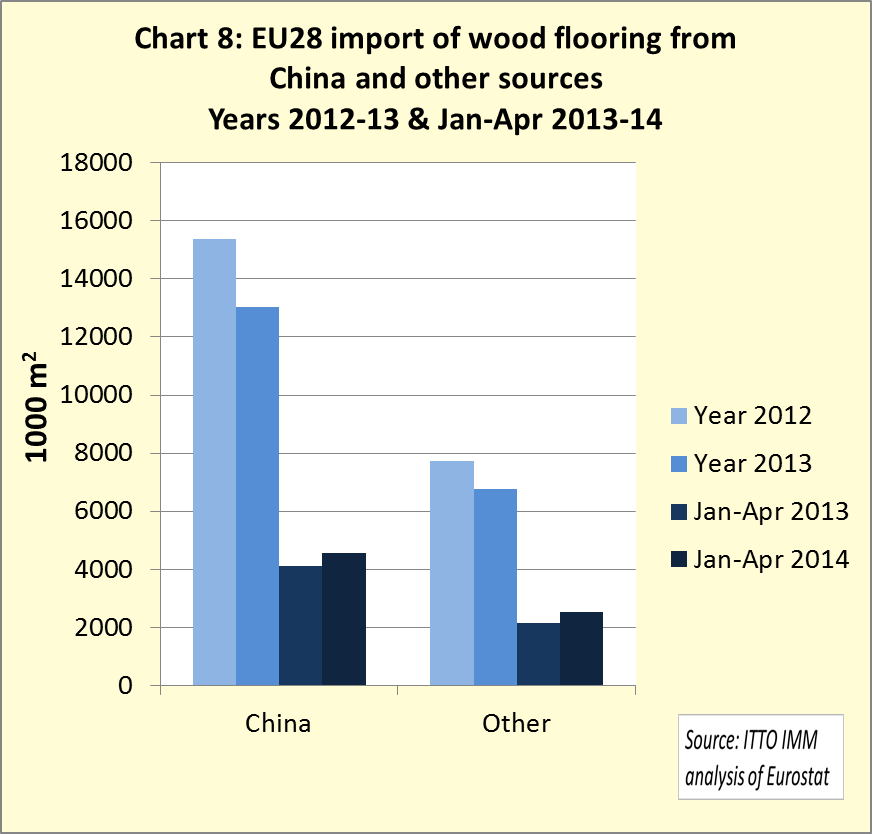

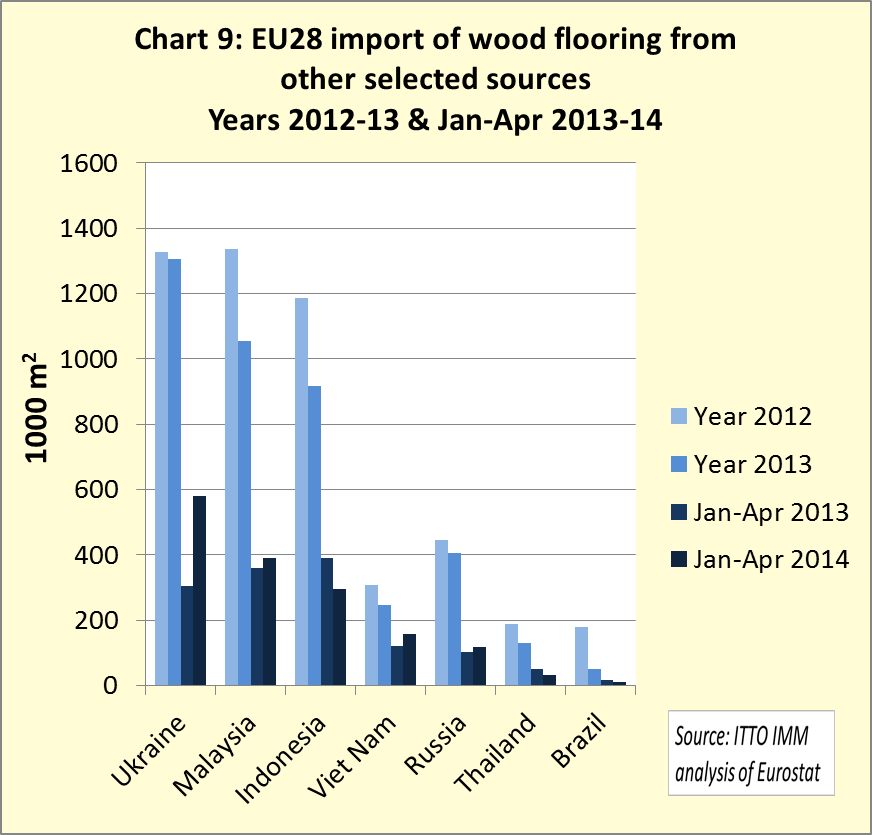

Imports of ‘real wood’ flooring from outside the EU supply around 22% of total consumption throughout the region. EU imports of real wood flooring declined 14% from 23.1 million m2 in 2012 to 19.8 million m2 in 2013. Imports from China, by far the largest external supplier, fell 15% from 15.4 million m2 in 2012 to 13.0 million m2 in 2013 (Chart 8). This was due to the combined effects of very slow construction activity and consumer demand in Europe, competition from Europe’s domestic manufacturers and alternative flooring products, rising costs in overseas manufacturing locations, and diversion of supply to more dynamic emerging markets.

However EU imports of real wood flooring have been rising again this year. Between January and April 2014, the EU imported 7.1 million m2 of real wood flooring, 13.2% up on the same period in 2013. Imports from China were 4.6 million m2 in the first four months of 2014, 11% more than in the same period the previous year. Imports have also risen from Ukraine, Malaysia, Vietnam and Russia this year. Imports from Indonesia and Thailand have continued to decline (Chart 9).

European laminate flooring manufacturers report slow sales recovery

Europe’s laminate flooring sector, while still dominant in global terms, came under considerable pressure during the global financial crises. Declining consumption combined with overcapacity and overseas competition, particularly from China, led to a sharp fall in prices. This meant that retailers had to shift huge volumes of laminate flooring in order to profit from sales. As a result distributors have been turning to higher margin products such as Luxury Vinyl Tiles (LVT) which are seen to offer a better combination of quality, value and margin.

The European laminate flooring industry has responded partly through down-sizing and partly through development of new higher value product lines. It has also focused marketing efforts on the specific performance and environmental benefits of laminate flooring and on the quality credentials of European manufacturers.

Partly as a result of these efforts, Europe’s laminate flooring market has become increasingly diversified. Low end products are still available at retail prices of less than €10 per m2. These contrast with upscale products offering some combination of long-life guarantee, bevelled edges, handscraping, wire brushing and exotic designs which might be priced in excess of €25 per m2.

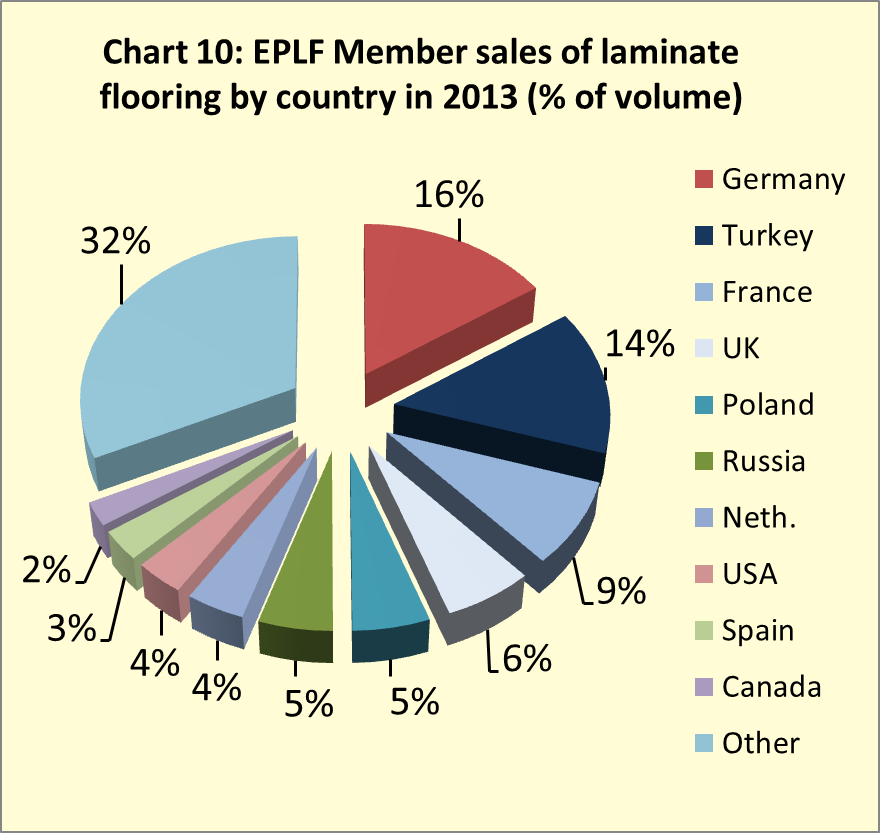

The industry’s marketing effort has been co-ordinated by the Association of European Producers of Laminate Flooring (EPLF) which this year incorporated the slogan “Quality and Innovation made in Europe” into the association logo. EPLF’s members currently consist of 21 manufacturers from 11 European countries. The EPLF manufacturers supply approximately 55% of the global laminate flooring market and over 80% of the European market. Germany is hugely dominant in the sector in Europe, accounting for around 50% of production by EPLF members in 2013. The second largest producer amongst EPLF members is Turkey accounting for 15% of production.

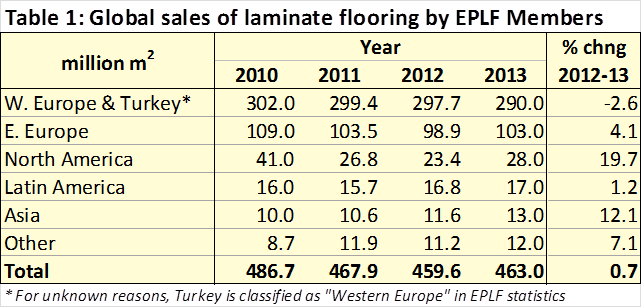

According to the latest EPLF annual report, the European market for laminate flooring has stabilised and is just beginning to show signs of recovery. Sales of laminate flooring by EPLF member companies increased 0.7% from 460m m² in 2012 to 463m m² in 2013. Although sales declined in Western Europe and Turkey in 2013, there were gains in other regional markets (see table).

Sales of laminate flooring in Germany, the largest single European market for laminate flooring, fell from 76 million m² in 2012 to 72 million m² in 2013. Sales in Turkey, the second largest market, declined from 66 million m² in 2012 to 65 million m² in 2013. France also saw a slight decline from 40 million m² in 2012 to 39m m² in 2013. Sales to the UK were stable at 29 million m² in 2012 and 2013.

EPLF member sales increased in Eastern Europe in 2013. Poland was the largest market for laminate flooring in the region, with sales rising from 24 million m² in 2012 to 25 million m² in 2013. Sales also increased in Russia, Romania and Ukraine last year.

As recently as 2011, North America experienced a dramatic slump in sales of laminate flooring due to the challenging economic situation in the USA. Sales dropped from 41 million m² in 2010 to 27 million m² in 2011 and then to only 23 million m² in 2012. In 2013, North American sales picked up once more, rising to 28 million m². Sales in the USA increased from 12 million m² in 2012 to 16 million m² in 2013. Sales in Canada remained stable at 11 million m² in both 2012 and 2013.

Tough competition from Asia’s domestic manufacturers has meant that sales of European laminate flooring to the region have been limited to date. European sales are focused on higher value premium products. European sales throughout Asia increased from 11.6 million m² in 2012 to 13 million m² in 2013. European sales of laminate flooring in China, including Hong Kong, increased from 3 million m² in 2012 to 4 million m² in 2013. The volume is very small compared with the overall size of the Chinese market which is believed to consume in excess of 250 million m² of laminate flooring each year.

Challenges to European laminate flooring in Turkey and Russia

EPLF members report a slight upward trend in total European sales of laminate flooring in the first half of 2014. However political issues are now creating concerns about future prospects in Turkey and Russia which have been key growth markets for laminate flooring in recent years.

Sales of European laminate flooring in Turkey weakened in the first half of this year. This was partly driven by a big fall in the value of the lira-euro exchange rate. However it may also be a consequence of Turkey’s decision in December 2013 to start anti-dumping procedures against German laminate flooring producers. The decision follows complaints by Turkish flooring producers that German manufacturers have been selling at below production cost in Turkey. German manufacturers have responded that their costs are lower than Turkish competitors because they have more efficient raw material supply chains. The Turkish government is still investigating and has yet to publish a final decision.

EPLF members also report challenges in the Russian market this year. Apart from the potential political fall-out from recent events in Ukraine, European laminate flooring manufacturers allege widespread counterfeiting of their products in the Russian market. EPLF claim that in Russia “the high proportion of inferior-quality and incorrectly-declared goods imported from Asia makes things difficult for EPLF manufacturers as it tends to cause lasting damage to the image of laminate flooring”. To counter this threat, EPLF has established a “Russia task force” to work directly with Russian trade associations and retailers to raise awareness of quality standards and put in place procedures for brand protection.

European laminate flooring follows fashion for oak and rusticity

EPLF report that “rusticity” remains the key theme in current laminate flooring ranges in Europe. The rustic “used look” appears in several varieties of products, from construction timber styles with imitation cement traces, to flooring that feels brushed, planed or freshly sanded. Ultra-modern synchro-pore printing now enables more authentic transfer of a wide variety of structures, from fine veins and pores to deep, distinctive knots. There is still a strong preference for larger and wider sized boards.

Oak continues to dominate wood decors with its wide-ranging decorative potential, from white-washed to smoked. However floors with the appearance of delicately-grained ash, walnut or elm, or rich softwoods such as spruce and larch, are also rapidly gaining in popularity.

A considerable amount of laminate wood decor no longer appears in its “natural” version, but rather with a discreet white or grey haze. Dark colours have seen a slight decline, with the new floors of European laminate manufacturers instead presenting a varied spectrum of natural grey and beige tones. This follows a trend that originated in the wider field of interior decoration.

PDF of this article:

Copyright ITTO 2020 – All rights reserved