The market impact of the EU Timber Regulation (EUTR) has been a major concern for the European timber trade and policy makers. Now that over a year has passed since coming into force, trade interests are raising concerns about inconsistent application across the EU and even within Member States, lack of clear guidance on key elements such as risk assessment, and the need for a greater focus on commercial implications and on evolution of cost-effective mechanisms for compliance, particularly amongst smaller companies that are so important in the timber trade. Equally NGOs are raising concerns about lack of visible progress by some EU Member States to develop enforcement regimes. This in turn has encouraged the European Commission to take measures to ensure that all Member States honour their commitments to implement and enforce EUTR.

In July, the European Timber Trade Federation (ETTF) convened a meeting “to consider perspectives on implementation, enforcement and outcomes of the EUTR on the market”. The meeting was attended by representatives of ETTF member associations from France, Germany, Italy, Netherlands, and the UK. Also attending were Svetla Atanasova of the EC Environment Directorate and Rupert Oliver, Lead Consultant to ITTO’s EC-funded FLEGT VPA Independent Market Monitoring (IMM) project.

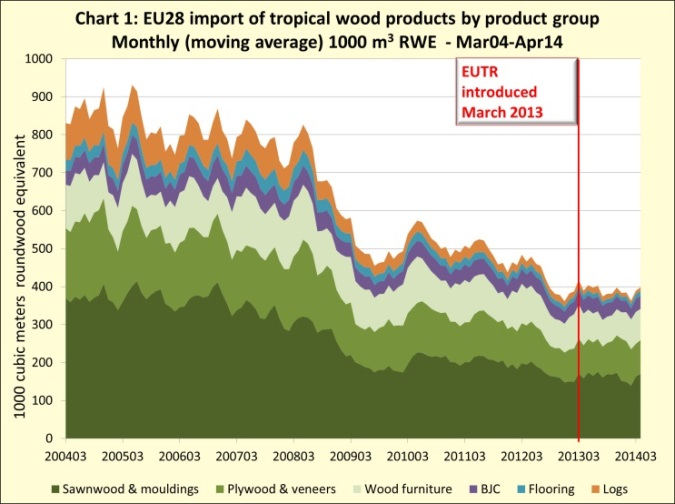

Rupert Oliver delivered a presentation for ITTO IMM on “Do Statistics tell us anything about EUTR implementation and possible impacts?” Drawing on the following sequence of charts (1-4), he considered whether there is any evidence EUTR is contributing to a reduction in EU trade in tropical hardwoods.

Rupert Oliver observed that, when considered over a long timescale, EU trade in tropical hardwoods since introduction of EUTR is more remarkable for its relative stability (at a low level) than for any significant change (Chart 1). This stability might itself be partly due to EUTR which, alongside weak consumption and lack of financial credit, has contributed to greater risk adversity in the trade. There appears to be much less speculative purchasing of tropical hardwood products by European importers than in the past.

Rupert Oliver highlighted recent structural changes in Europe’s tropical hardwood trade. The EU import data combined with anecdotal reports suggests that one effect of EUTR has been to concentrate the trade in the hands in a more limited number of larger operators. European operators are now being much more selective in who they deal with in tropical countries, tending to focus on suppliers with whom they have formed long-term commercial relationships and which have been most co-operative in provision of the detailed information now required to demonstrate negligible risk.

But the structural changes are equally due to long term constraints on supply of tropical hardwood supply to European buyers following reduction in processing capacity in some tropical supply countries and increasing diversion of trade to domestic and emerging markets, notably China. In a sellers’ market, tropical hardwood exporters have more options and have become less inclined to service increasingly demanding European buyers.

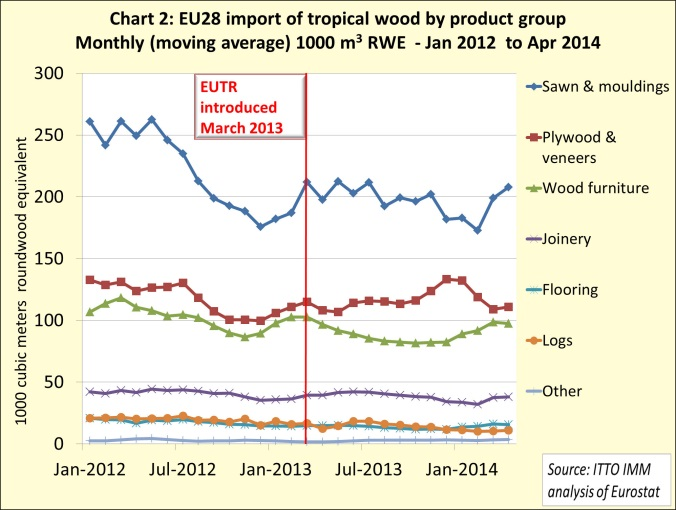

Rupert Oliver noted that, when looking at short-term fluctuations in EU hardwood imports since enforcement of the EUTR, the identifiable trends are most readily explained by other commercial factors than by EUTR.

For example, a notable recent trend in EU sawn tropical hardwood imports is the downward slide that began in August 2013 and reached a low in February 2014 (Chart 2). This was due to the combined effects of: low availability of the commercially most popular African species such as sapele; infra-structure problems at Douala port, which greatly reduced exports from Cameroon; overstocking in the European garden decking sector, which particularly reduced exports from Indonesia; and the sharp dip in imports from Malaysia in early 2014 after an increase in EU import taxes following the change in Malaysia’s GSP status.

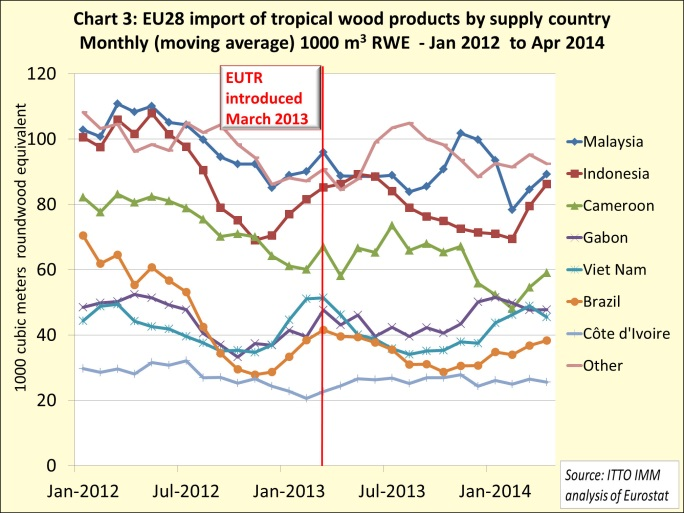

Since February this year, there has been a small rebound in sawn tropical hardwood imports in to the EU with an easing in the tight supply situation in Africa and with improved consumption in many European markets including France, Belgium, Netherlands, Germany and the UK. All these trends are apparent from analysis of monthly EU tropical hardwood imports by source of supply (Chart 3).

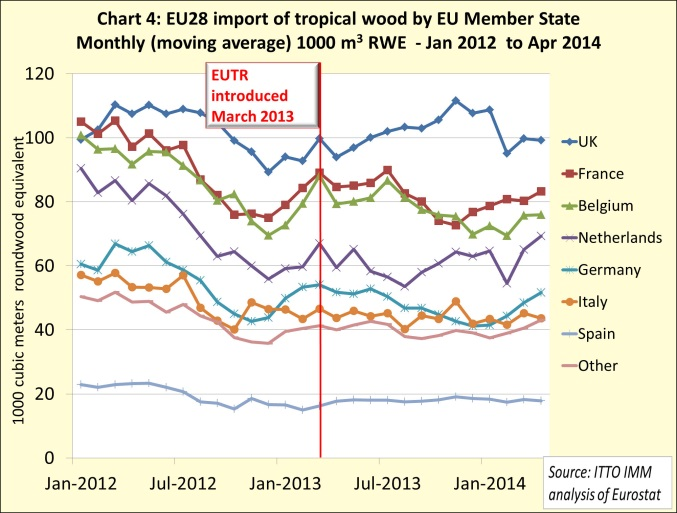

Rupert Oliver also considered whether there is any evidence of shifting in the direction of imports of tropical wood from EU countries with strong sanctions regimes to those with weaker regimes. He concluded that there are no strong signals so far from analysis of timber trade statistics.

Again alterations in the destination of imports into the EU are more readily explained by changes in consumption than by differences in EUTR regimes (Chart 4). Imports of tropical hardwood products into the UK increased consistently throughout 2013, even after implementation of EUTR and despite the UK having one of the most active EUTR regimes. Meanwhile tropical hardwood imports into France, which is only now introducing a regime for EUTR enforcement, were declining last year.

Sliding tropical hardwood imports into Germany during the second half of 2013 might be partly explained by the uncertainties created by EUTR enforcement action taken against wenge log imports from DRC in August 2013. Tropical hardwood imports into Germany have improved again in 2014, although this is due less to recovery in imports of African products than of Asian products, notably bangkirai decking and Indonesian plywood.

It is perhaps unsurprising that trade flows have yet to show significant change as a direct response to EUTR given the current status of enforcement regimes. Reports from national associations and the EC at the ETTF meeting highlighted that there are still significant gaps in enforcement but that action is now being taken to rectify this.

EC puts member states on notice to toughen up EUTR enforcement

Svetla Atanasova reported that the EC Environment Director General Karl Falkenberg sent out a letter to all member states in April putting them on notice to toughen up on the EUTR or face sanctions. It asked them to detail their implementation of the Regulation to date within a month. It quizzed them on enacting legislation and sanctions, and whether due diligence checks on affected companies have been started by their national competent authorities. If these had not begun, governments were told to make sure they do.

The majority of EU countries replied the letter and reported that they have taken implementation measures. The EC prepared a summary table of the status of implementation across the EU (now published at http://ec.europa.eu/environment/forests/pdf/scoreboard.pdf).

Responses to the letter indicated that 17 of the 28 EU Member States have already fulfilled the three main obligations of EUTR – that is to establish EUTR Competent Authorities, to implement sanctions, and to start checks on operators. The countries fulfilling all these obligations are: Austria, Belgium, Bulgaria, Czech Republic, Cyprus, Denmark, Estonia, Finland, Germany, Slovakia, Ireland, Lithuania, Netherlands, Portugal, Slovakia, Sweden, and the UK.

A further eight countries are in the process of fulfilling all the obligations –France, Greece, Italy, Latvia, Luxembourg , Malta, Slovenia, and Romania. At this stage, only three countries have not begun to fulfil one or more of the obligations: Croatia, Poland and Hungary. Judging from the EC’s summary table, Hungary seems to be particularly lagging behind.

Svetla Atanasova said the EC would take enforcement actions against any Member States which fell short of their EUTR obligations. She noted that an EUTR enforcement group, comprising officials from member states, has been registered and is due to meet for the second time in September. The EUTR will also be taken up by a task force, including EC representatives, which will work with countries to increase implementation efficiency.

Regular EUTR checks in the UK

Further insights into the status of EUTR enforcement at national level were provided by trade representatives at the ETTF meeting in July. Anand Punja of the UK TTF reported that enforcement action in the UK is already well advanced with regular checks underway of UK importers. The NMO, the UK’s EUTR competent authority, has required a number of operators to alter their due diligence procedures, the main concern being a failure to adequately assess the credibility of documents received from suppliers. There have been no prosecutions to date but the trade is not being complacent. The NMO has stated that it has concentrated so far on building capacity and improving understanding of the issues before attempting to make a legal case.

Overall there is a good working relationship between the UK trade and NMO, the latter having focused so far on helping firms to comply with the legislation. However the TTF has specific concerns. The NMO is targeting firms on the basis of its’ own analysis of risk associated with individual products, species and countries. In the TTF’s view, targeting should be based on evidence of corporate due diligence. The current regime leads to too much emphasis on high profile companies that are already taking far-reaching steps, and not enough on less visible companies.

Active EUTR enforcement in the Netherlands

Paul van den Heuvel of the Dutch VVNH noted that EUTR enforcement is active in the Netherlands, although resources are spread thin given that the Dutch Competent Authority has identified 5000 operators placing timber on the market. Although checks are underway, the Dutch Competent Authority has been unwilling to divulge details of any issues that may have been identified.

As far as VVNH is aware based on information from members, few problems have yet emerged and the existing comprehensive due diligence procedures of Dutch firms are working well. Drawing on EC guidance and with input from the auditing firm NEPCon, VVNH has adapted its existing procurement requirements for members into a new “Timber Checker” system to ensure full compliance to EUTR.

French EUTR regulation expected in September

Eric Boilley of the French association Le Commerce du Bois (LCB) noted that, after several delays, the French regulation establishing the EUTR enforcement regime in France is now expected to be passed September. The first checks on operators are expected to occur soon after. The sanctions regime will be extremely onerous, with fines of €150,000 just for failure to implement adequate due diligence.

LCB has been requiring mandatory due diligence procedures for its members already for seven years so is hopeful that the new sanctions regime will not cause immediate disruption. LCB has also formed a close working relationship with both the French Ministry of Agriculture, which will act as the EUTR Competent Authority, and with WWF which advises LCB on risk assessment and the status of legal documentation in supplying countries.

Italian enforcement measures barely begun

Davide Paradiso and Domenico Corradetti of Italian Federlegno Arredo noted that EUTR enforcement measures have barely begun in Italy and that all the work to date to inform industry and prepare for EUTR has been carried out by the association. This is a vast task given the numbers of mainly smaller operators in Italy. There are estimated to be up to 10000 operators in the paper sector, 6000 in the importing sector, and 8000 forest enterprises. It was also noted that, due to the absence of sanctions in Italy, enterprises are not strongly motivated to improve due diligence procedures.

Despite these constraints, Federlegno has made significant progress to develop a practical system for EUTR conformance for member companies. The system is known as LEGNOK which sets out standard procedures for risk assessment in line with EUTR. Companies can upload all their own risk assessments of suppliers on to an on-line database to reduce duplication of effort and to allow review by a Wood Information Centre located in the Italian office of TRAFFIC, the international NGO established to monitor trade in wildlife. The Wood Information Centre provides an independent view of the credibility of legality information and makes recommendations to the importer.

Bureaucratic approach to EUTR in Germany

Nils Olaf Petersen of GD Holz noted that the Federal Office for Agriculture and Food (BLE) which acts as the EUTR Competent Authority in Germany has undertaken checks of timber importers since July last year. Around 60 companies have been checked so far and the procedures have been strict, more so than audits of financial accounts. The BLE has adopted a bureaucratic approach, assessing first whether the operator has a due diligence system in place, second whether the operator has adequately described the system in company documents, and third whether it is being implemented effectively. The latter step involves operators being required to show specific examples of risk assessments and demonstrating a clear rationale for acceptance of legal documents. There have penalties imposed, including a severe penalty on an importer of wenge logs from the Democratic Republic of Congo.

BLE has reported that of those companies so far visited, 25% were identified as not undertaking due diligence as required under EUTR. BLE state that the main problem is that while nearly all companies are collecting documents they are not then taking sufficient time to consider their credibility and authenticity. The BLE has emphasised that the regulatory approach will be progressively tightened and more companies will be sanctioned in the future if they do not demonstrate more diligent checks on documents received from suppliers.

BLE is also working closely with the Thünen Centre of Competence on the Origin of Timber which brings together expertise of the three Thünen Institutes of Wood Research, Forest Genetics, and International Forestry and Forest Economics, responsible for wood identification, proof of origin, certification and timber trade structures. The Centre is extremely busy, not only with enquiries from the BLE, but also from Competent Authorities in the UK and a few other EU Member States, NGOs seeking to identify illegal imports, and from trading companies wishing protect themselves from regulatory action.

ETTF call for definitive central guidance on supplier legal documents

ETTF ended their July meeting with a call for definitive central guidance on the legal documents provided by overseas suppliers. Competent Authorities are clearly keen to ensure that importers do not take legal documents at face value and instead scrutinise their validity.

It was noted that the NGO Greenpeace’s latest claims that legality documentation from Brazil fell short of EUTR requirements also highlighted the importance of this issue. In the absence of clear independent advice, several large European importers have discontinued all purchases of Brazilian ipe on the strength of the Greenpeace campaign.

Given that very few timber importing companies have the resources or skills at their disposal to undertake detailed scrutiny of the legal situation in each country and the validity of every document supplied with consignments, there is an essential need to rationalise the approach and provide more support. Otherwise more tropical wood may well be excluded at the merest hint of controversy simply for lack of better information.

Andre de Boer, ETTF’s Secretary General, concluded by stating that a detailed proposal would be prepared, for possible funding as an ITTO project, to develop a central public on-line database which would provide access to detailed information on applicable legislation in all timber supplying countries. He emphasised that the aim would be to provide well-structured comprehensive information and not to judge the quality of legislation or documents. Forming judgements would remain the obligation of the EU operator, as required by the EUTR.

PDF of this article:

Copyright ITTO 2020 – All rights reserved